Table Of ContentoRT

The Gazette of Gudia

er —ags— TEI

PART Sect 3 Subsection)

‘atten 3 ti

PUBLISHED BY AUTHORITY

ad fee, Ha, ST a, 2004/6, 1925

[NEW DELI, WEDNESDAY, JANUARY 2 MOUWAGILA 8, 1705

afr atte ae art

(afra feat)

ae

ve fees, 26 ae, 2004

: 294 sied-2008 )/2002—2007

ara, 1270 8) a Te ge afta Pata ale sana AAR, 2002 2007 AT 2.1

Ser ofa, fader Te (Reva ale PAH) SIP, 1902 (1992 weet 22)

Bl erates Oa emt with ar weber ee gy obec wena GT ter ote nema a

amg & aft (ga ge) avfovea 2002-2007 2A Pierre weer aA &

05)

ve 105

4, Prats st orem iS sad @ ah (GE GH) wee 202-2007 Sa

v(m) a aed @ (arma Ae waa RePeei) oh ade SHC eT wee ra

“Pts at ira a og A A (GH TH) ies, 2on2-2007 TH aE 1, S

sferees & argue wel] Geurel a ores Sere erTaTTe @ aiot-g ay wtaheT

citar anda gor ae a snp 3 ele gm A Te, vege ve AM aR AY

Ba aiftarker de argurats & oy so eet ae ane FaPImheap a Be aga

Freharst aA aa WTA RT & a Weitere ott aT |

anda wrarerat # Big wetia Fre wa, wee woot ator ah ae alta

goat atta res odie sonal 3 Rhy Refer wee al eee are ae

referer att at aA pe Ran ag

Gm) FRR omalen wee oy ane & |

(@) hah ewe snare ae omeame & ste

Go) ah ah wed Bar aoe Te a st FT EY

o .

TmowerorneiapemacRonsY —__east 0,

urea suine TATE SQ woe, forte as aan AT aTEM 3, a Fey

ares anal aah Bq etn aioe aay ado wes | anedla arr ay we AE

ot gfe wel wears Re et oar eel ol gg ae fom ue alt ockee,

sais 3 er often) Mists ae (Bru aero Rank awe 1 te

Qiong arn anene MIM ew fa hu oh ramet ae eT ga arate

Rite BR ae ude feet TEM gen STAT ae ar STMT AR weg Tete

ied ARETE B aTRTA adh acre ages & ene aT “eo TT

803 Fe vor seifta Tet andy See a ee a Bae oe aT

swt Reha swat ae | :

Secame-6 aR we Be GARE AH on ue aL AG al il suo ar TET

Sela geht) Toy Awe oe ota ora an Areata a & Aa

aft arg Sees ESTERT rer, ae sieaT dake VAT A Ten sue STE.

afta dare we orges Bape TAA a a |

fafa ate arena uel one Sot (ga ga) ere, 2002 2007 a vg

19 viii - 9 F Aide Rall ot gate agE Rrdet 3 unre ate AAW

Diidey & arora A ya trae - 6 ue ofefted eat Bye A seeh | sell, Ae

ag See wi Agee w ay al Sara arma ftenlee) Eger Pars, aM ale

sper Ra ven Be

2, Paka ote sine =F 3 £8 (eu Ge) Teh 2002-2007 sR

oid — 11-3 Pepa aati Pe SIME =

Sane ate ame Wong Tare FT HA ayse Sar fy oH aE

ese ey acihat fi at Ang eee GT, Sala BT, AT a A TTT

(ahem) aide, ese (1996 th 29) BH arr - 6 Al wt TT (2) aw ards (a) B

acer ame CR BHT Pree) ee Soe ARON ae FT A ee

Sora he re ye THE Sha era PF wo a ay wT eT NS

Treat A at amie Fa orem val 8, Preity raed we wate wa

gia a rh Rat ang Qu aA awe aA >

Fe) wha & fay too mide ob ate, ava A ap 25 Mee TI RS any wy EL

9) M8 oak aed ae la) oor Tea are me aes oa eT A TT

eG Pie A a coerce TET aaheD Pag ay eh Gara aes oT

seer oe ate ff AE wl 2

ay oat aw ARRCRAPTEET Boge cee A A megy avai A hE ae

naa, orga ate ame or Ba yw ge wr mvc A Bao a AE oT

1 ck fag te HP

jyg—ere3g9) 2a ower: aT

2 Raney Sag ee WRIA we Rea og oT

‘wowia | ore ate [oe Fae Te (ai Vadae et!

7 larrenies Tqaigee oa 7

ta roarine [wee 7

3. [7iossi00 [Re 4

a” "Triessato Wide, aan Rien, eee |

athe orgs

& | riosz00 | oT ga wate Red ae

ftw Be

cy 77081100 aria Sa ae

Hu ARaad Bi wets

71081200 weit Rat ta

fae ae

8 71081300 anata Fas]

faftert & ana

&| revago00 |e ae matt | Rad Fe]

H Fas adie

18 [ameneo [aia Cietn tien |qer [anda ad ae

hires) ae fale di allt

fame arene toilet

afte Rew,

je arr fea ' _|

"1 92040000 «(HIS ocor & GfaRen mfdaiia | yaw va aly yok freer

| ar rea (were fr am mer al Pr oe

fam, yare ar Ba tins [iarae & ayn ao

| ate eco grisice) | tio sno certs) RARE

42,.91985 ae

sfipgaai io dio ato

! i s:(3) fate 2.8 2002

: |? | Fae artery

L anh é yen a ad &

‘ sen wadags stir!

jor ofafaes, 1950 31

uiauial a ser FT

wife aaTeRRT

weet erga of ore

' ae m8 |

1M SZETTR OF INDIA. EXTRAORDINARY. Base Se 3

4. Prat aie Sra on Sah (Ga we) tteren zeus 2007 F onyqll 4

Aare 71 nee onli Rem sien 4, fore ache ET Fer

si(Creay/9 02 fate 270.197 ow vidRe aera aE Sef} (97-02 Te

att. ag97 erPre & ot ger amr a B

5 Ratt ote onan act & ord Fat Ga ye ace, 20uz07 a sage! &

MTL 46 TT TTL A es FO (ay

vais orga aH th eal 3 daa arate afk ae PRE AA weed ata Al

pe Star ger sir ay dan at ane are oh ei Bl gt le 31

SRE AF HHT Beat lar" erm ah gene eB

6. ete ate orem wa 3 ord A (ea atta, 200-07 & anaes 87

sa arp ule oP Prmgay states Prat

{terme 2 (IO ~ 4a wed en aren oR Ea whet

Tama ae Fae Gace OF aRAT For eT

(iy AEE 5 (Ne) - Ra A are ST Daa dag Og aa wh wT

Be Fear eat ot a Bae A RRR A ea ee eal ob Fog rae eT ST

Samah ar

fi) Te wa tame Serge ade acd is) Saft aly Saga

RAHN sre wa ae Ta cei, econ arr aT His) Ym. a0,n00 areitt

Seok 8 & arm Br BNET wr co MiG aL aT Age SL onde arent,

Soqoes Sear FET TNR Ga ya eten oTRST MTT sxsw ATT!

as afi sip AWS wer Re seed BT ETT TT PAE AACA a

ata wert ae arebsEeT ai-cat bho: ere eT

Wj team 3 A - Arafat at ee an ta 8 eh ama a, ere

Ua ons eae BY Rigas ate @ mE aT soa OT TAAL Hal dale A oh

Bex A waa,

Lat te

gd dutta Hon fire Tal

Ls, ovsart90re-317¢ 7 03/4 11

Saanfis, abies, fra ome steaks ar aha

(erin 359) sr TT TET

! MINISTRY OF COMMERCE AND INDUSTRY

: Grparisient of Commerce)

NOTIFICATION

[Nev Delhi, te 2h Juans 2004

‘No, 294(RE-2003)/2002—2007

5.0. 12%8)-— In exercise of pawers conferred by Section 5 of the.

“Fordigh Trade (Development and Regulation) Act, 1992 (No.22

of 1992) read with paragraph 2. of the Export.aid Import

Policy - 2002.07, as amernied from time to time; the Central

Government hereby amends the ITC (H8) Classification of

Export and impoit Items 2902-07 as under:

1. Condition 6 of Chapter I A (General Notes to import Policy)

- of the ITC (HS) Classifications of Export and Import items 2002-

2007shall be amended ta read as under: i

. “Import of all the products as.pet_Appendix IIT to

Schedule I of the ITC (HS) Classifications of Export and Import

Items, 1997-2002, shall be subject™to compliance of the

mandatory Indian Quality Standards as mentioned in column 2

of the said Annexare, which are also applicable to domestic

goods. For'compliance of this requirement, all manufactures/

exporters of these products to India, shall be required 10

register thenisclves with Bureau of Indian Standards(I#5}

Alternatively ; certification of the products under

mandatory quality Indian standards will be permitted under

the BIS Product Certification Scheme for Indian importers

provided all the following conditions are met:

a) Items are required for captive consumption, and

}) Items are required on.continuvus basis, and

¢) _ Ttemp are procured from pre-identified sources.

298 Grfei-®

A “Te GAZETTE OF NDA: EXTEAORDINARY. Pevsit—Sm560)

‘The Indian Importers woilld have to apply to BIS for

seeking a licence for ‘each of the notified product he intends

to import. BIS would record the application after satisfying ..

jteclé that all the above conditions are met and that the

applicant importer has installed the test facilities. Based on

the recording of application, the Custome can clear the

consignment, which will be tested by the BIS and a licence

issued if the product conforms to the refevant Indian

standard, The importer would use the material only after

grant of licence for the first lot so imported and for the

subsequent imports, after testing the product for conformance

lo Indian Standard,

The conditions of Paragraph 6 above shall not be

applicable on imports of gifts where the recipient of a gift is @

charitable, religious or an educational institution registered

tauer a law relating to the registration of socicties or trusts or

otherwise approved by the Central or 2 State Government and |

the gilt sought to ke imported has been exempted from |

payment of customs daty

by the Ministry of Finance.

Not withstanding anything contained in the Appendix IIE

to the Schedule 1 of TPC (HS) Classifications. of Export and

Import Ttems, 2002-2007, import of cylinders and import of

valves/valve fittings will be exempted from the conditions at

paragraph 6 above, However, this exemplicn shall be

applicable only on Such cylinders, import uf which has been

approved by Chief Controller of Explosives, Nagpur”

2 Condition 11 of Chapter’ A (General Notes ta Impon

Policy) of the IFC (HS) Classifications of Export and Import

iterns 2102-2007 shall be amended to read as follows

““maport of textile and textile articles is permitted subject

to the condition that they shall not contain any of the hazardous

dyes whose handling, production, cerriage or use is probibited

‘el

[omy as360) Seg OTH; TT

by the Government of India ‘under the provisions uf clause (d)

of subsection (2) of section 6 of the Environment (Protection)

Act, 1986, (29 of 1986) read with the relevant rule(s) framed

theicunder, For this purpose, the import consignments shall

accompany. a preshipment certificate from thé notified agencies.

In cases where such certificates are not available,“ the

consignment will be cleared after testing of the same from the

notified agencies based on the following parameters:

a) Af least 25% of samples are drawn for testing instead of

100%, ’

“ b} While drawing the samples, it will be enoured by

&

Customs that majority samples are drawn from

consignments originating from.countrics where there is

‘no légal prohibition on the use of harmful hazardous

Dyes.

The test report will be valid for « period of six months

+ in cases where the textilé/textite articles of the same

specification/quality are impirted and the importer,

supplier and the country of origin are the same.”

After amendment the following entries would read as

under:-

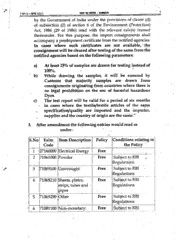

IS.Nof Exim, [item Description| Policy (Conditions relating to

|_| Cade | i the Policy

1 [27160000 [Blectrical Energy | Free

2 \r1061000 (Powder Free Subject to RB

i i Regulations

172069100. Unwrought Free, Subject to RBI

1 | Regulations,

4 (71069210 (Sheets, plates, | Free Subject to RBI

Istrips, tubes and -! Regutations.

[pEpes 7 a

5. 471069290 |Other Free [Subject to RBT

Regulations.

6 (71081100 [Nop-monetar Free. [Subject to RBI

{TYR GAZETTHO INDIA EXTRAORDINARY.

Bears 3

[Powder

1 Widéi200 Gther unwrought | Free

ltorms

BS [P1087300 (Giher semi- “|” Free

| Imanufactured

! liorms Monetary

4 (tsscoo jother Free

| 10 [28369300 wT Bree”

jPosittoning,

‘System (DGPS)

Positioning

‘System (GPS)

Revives;

‘Arms (fur ‘Restricted!

|example, Spring,

[Air or Gas Guns

land stats,

fruncheons),

lexcluding those

lol heading, 9307

[Regulations. :

Subject lo RBE

Regulations.

Subject to RIT

IRegulations.

Subject to RBI

[Regulations.

i

|

import of Air Gand!

[Air Pistol will be free

lsubject tothe

condition that the

lrequirements specified

lm the MITA,

INotification No. 5.0.)

{607 (E) dated 12.9.1986|

land Notification No.

5.0, 831 (EK) dated!

28.2002 are fulfilled

land also that the

[purchaser f aser of 1

hese lems shall’

coblainy requisite user +

fives front the |

competent authority

under the’ provisions

of the existing Arius

Acct, 1959.

(mae 5c) Stee OTT.

4.

Intport Licensing Note No. (1) of CKapter 71 to the Schedule

~ [of ITC (HS) Classification of Fxporl and Import items,

2002-07 incorporating Public Notice No. 51 (#N)/97-02

dated 27.10.1997 and Public Notice No, 54(PN}/97-02 daled

* 4.11.1997, stands deleted.

Import “Licensing Note_No.(2)_of Chapter 48 w the

Schedule ~ I of [TC (HS) Classification of Expurt_and

Import items, 2002-07; The sentence “A declaration about

the total quantity and value of the ieweprint imported &

consumed during the first half of each licensing year shall

be submitted to the Registrar of Newspapers for India by

31" October of each year.” stands deleted.

Import Licensing Noted to Chapter 87 of ITC (HS)

Classification of Export and Import Items 2002-07 will be

amended as follows :

() Paragraph 2(1)(4) : “The import of new

vehicles shall be permitted through «the

Customs Port at Nhava Sheva, Kotkata,

Chennai, ICD - Tughlakabad and Delhi Air

Cargo.”

(i) Paragraph 3(1) (a): “Individuals coming to

India for permanent settlement after two vears

continuous stay abroad provided the car has

been in the possession of the individual for a

period of minimum one year abroad.”

(iii) A new Paragraph will be added as follows :

(6) Import of new vehicles having a CIF value

of $ 40,000 by individuals / companies and

fiems under the EPCG Scheme will be exempt

from the conditions at Sl. No. (2)(11}{0) above.

298 SEfoy-

“THE GAZETTE OF NDIA: EXTRAOROINARY Past Sen 58)

However, at the time of Customs clearance, a

Type Approval Certificate from the country of

origin shall be furnished. This ‘Type Approval

shall stipulate that the vehicle to be imported

complies with ECE Regulations and shall be

from an Internationally Accredited

Organization / Agency. ”

Gv) Paragraph 3q1) : “The following shall be

deleted “all such imports, exept by the

physically handicapped persons, shail not

involve any foreign exchange remittance {rom

India directly or indirectly,”

‘This issues in public interest.

IF No. nL93/1¢0NL3 LAM 3ePe=T,

LL. MANSINGH, Director Gena of Foueign Trade: & Exoffciy Adal. Soe,