Table Of Content/?7-09t/fD57

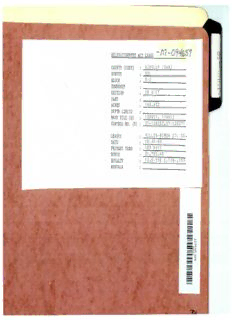

RELINQUISHMENT• ACT LEASE -

COUNTY (CODE) WINKLER (248 )

SURVEY PSL

BLOCK 8- 2

TOWNSHIP

SECTION 1 6 & 1 7

PART

ACRES 140 . 432

DEPTH LIMITS

BASE FILE (S) 139012 , 139013

CONTROL NO. ( S) 07-1 28262 , 07- 128271

LESSEE HILLIN-S I MON OIL CO .

DATE 10-30- 90

PRIMARY TERM 180 DAYS

BONUS $1, 755 . 40

ROYALTY 12 . 5-1 5% ( . 125- . 15)

RENTALS

CONTENTS OF

\Ar D r I .::> ~\L-\~ rE.~ .:>- ,\

t. ea:,tL., 7-li-91

l.

,,

~ .

2. M~o

~,s

3 • :5 of ,t ~ .

,,

~.

4 • Obli

-..

>:t:f~L , ""'ol'l ,tv /vl·tBo Ure(.,......, ft.11.v~,'v"r-1 .S ()(.1

8'

s ~-n

~ . {-tr<, fvv,..,..,_ /-ldl,-> "'1C>V '/'1 ~ •

3 ~.

-----

l. ~ -

<t1-.

~-· --------- ---- - ---r=~------ --------

GLO-S-08- (1-81)

HILLIN - SIMON OIL CO.

OPERATING ACCOUNT

DELUXE FORM WVC-3 V-2

DATE DESCRIPTION AMOUNT

.

....

.,

• •

•••3- 19- 91 Filing fe:e fer relinquishment act lease covering ir.te"'est in

•• • •l

Sect.ior.s 16 and 17 Block B-2 PSL Survey, Wi nkle:r. County Tx

KS06

• •

• . f1/

•• .

•

'

r::~EQVC~

l

• ... f (9 AM 2 0 91

V·2 ENERGY RESOURCES

-·

HILLIN - SIMON OIL CO. DETACH AND RETAIN THIS STATEMENT

THE ATTACHED CHECK S lN PAYMENT 0,- ITEMS DESCRIBitO BELOW

OPERATING ACCOUNT IF NOT CORRE ~ PLEASE NOTIFY U!l PROMPTLY NO RECEIPT DESIRED

DELUXE FORM WVC..!J V-2

DATE DESCRIPTION AMOUNT

v

•

·.·.· : 3- 19-91 Proces~.inq fee for relinquishment a.ct lease covering intere~t i

' Sections 16 & 17 Block B- ? PSL Survev

• •• KS06 Winkler Cuunty, Texas i;~:~:'

'

:::;{11

. . J

MAR 2 0 91

••

•

.. : Iu

I ENERGY RESOURCt:S

•- •-•- --• -• -• --•

• • • • • ••

• • • • • • ••• •

•

Mineral Classified Land

Lease Consideration Comparison

...

County \.Vr/\ \.. \er

Area s ..' " '"'•'7 !.11:. 8-.). PrL '5...>7

Lease Total

M. F. Acres Date Term Bonus B/ Ac Rent a 1 Comparison

1"10· '13J

New II.) '?> .'"\ 5'1 I0-30 '\D I<{ D uo.~) 3 510 .<iC 1>;)~ - I,J,) - I::. /o

.i't lo5", I G.

M- cp,5c:..O ~~~~ /o,JI. 3 -·l-~l ('/~ ~)~ srt/tl7'1 ~ 'h - _}(l....,t !;),)-- 1 ~ "/o

I\4~J f( IQa\~ 0~ •t..:~ "-l"r")-1

v ,V\ • 1 ~ I S" C

Remarks:

e-;~fotl .J.d

1-<. Q ( •

Considerati~-

Recommended ("'0.~ 3-27-.9

Not Recommended

-------

.

.J

.

~45507

. .

PAID-UP

OIL AND GAS LEASE

THIS AGREEMENT, made by and entered into this 30th day of October

1990, by and between t he state of Texas, acting by and through its agents,

Amon G. Carter Foundat ion the address of which is P. 0. Box 1036, Ft. Worth,

Texas 76101, herein referred to as owner of the Soil, whether one or more,

individually and as agent for the state of Texas, as Lessor, and Hillin-Simon

Oil Company, P.O. Box 1552, Midland, Texas 79702, hereinafter called Lessee:

Jft ooo cc;C7/ 1 'f/o O o EJ~".S (, /

1. GRANTING CLAUSE. Lessor, in consideration of dollar amounts

shown below and ot her good and valuable consideration, of the royalties

herein provided, of the agreements, covenants, stipulations and conditions

herein contained, and hereby agreed to be paid, observed and performed by

lessee hereby demises, grants, leases and lets unto Lessee, for the sole and

only purpose of drilling for, operating, producing and selling oil and/or gas

only, the following described land in Winkler County, Texas to-wit:

That certain 1,123.457 acres of land as set out in Exhibit "2" attached

hereto and made a part hereof,

containing 1,123.457 acres, more or less. The total bonus consider at i on paid

represents a bonus of $25.00 per acre, on 140.432 acres, and the bonus

.....~. onsideration for this lease being paid as follows:

....

• . •

.. .. To the State of Texas: One thousand seven hundred fifty- f ive and

40/100 Dollars ($1,755.40)

..• ..

....

To Owner of the Soil: One thousand seven hundred fifty- f i ve and

.. .•

40/100 Dollars ($1,755.40)

..

• •

Total Bonus Consideration: Three thousand five hundred ten and

. .• . 80/100 Dollars ($3,510.80)

• • • •

• •

2. TERM. Subject to the other provisions in this lease, this lease

shall be for a term of One hundred eighty (180) days (herein called "primary

term") and as long thereafter as oil and gas, or either of them is produced

in paying quantities and sold from said land. As used in this lease the t erm

"produced in paying quantities," means that the receipts to Lessee less all

royalties paid or to be paid from the sale or other authorized commercial use

of the substances(s) covered exceed out-of- pocket expenses of operation for

the six months last past.

being produced and sold from

then ipso facto terminate as to both parties, unless on or

Lessee shall pay or tender to the Owner of the Soil or to

or its successors (which shall

depository regardless of changes i n the ownership of said amount

specified below: In addition, Lessee shall pay to the C issioner of the

General Land Office of the State of Texas, at Austin, exas, a like sum on

or before said date. Payments under this paragraph all operate as a rental

and shall cover the privilege of deferring the duction of oi l andjor gas

in paying quantities and the sale of same un · one year from said date and

payments under this paragraph shall be in e following amounts :

To the Owner of t he Soil=----~~---------------

To the State of Texas:

----r..:::__ __________

Tot al Rental: _ ____ ~~----------

In a like manner and like payment or tender on or before

1989, the production nd sale of oil andjor gas in paying quantities may be

further deferred r a successive period of one (1) year during t he primar y

term. If oil for gas is not being produced and sold in paying quantities

from said nd, this lease shall then ipso facto termi nate as to bot h

parties, nless on or before such date Lessee shall pay and tender to Lessor

the ounts mentioned above and likewise shall pay or tender t o the

of the General Land Of fice of the State of Texas a like sum.

1

tQ exist, susp

or for any reason fail or efore due

date, Lessee shall not be such payments

or tenders of rental unti days after the owner of the Soil shall

deliver to roper recordable instrument naming another bank as agent

4. PRODUCTION ROYALTIES. When oil andjor gas flows from the

wellbore or production is obtained, whether saved or marketed or not, Lessee

agrees to pay or cause to be paid one-half (1/2) to the Commissioner of the

General Land Office of the State of Texas, at Austin, Texas, and one-half

(1/2) to the owner of the soil:

(a) OIL. As a royalty on oil, which is defined as including all

hydrocarbons produced or flowing in a liquid form at the mouth of the well

and also all condensate, distillate, or other liquid hydrocarbons recovered

from oil or gas run through a separator or other equipment, as hereinafter

provided, that part as shown in Exhibit "1" of the gross production or the

market value thereof, at the option of the Owner of the Soil or the

Commissioner of the General Land Office, such value to be determined by 1)

the highest posted price, plus premium, if any, offered or paid for oil,

condensate, distillate, or other liquid hydrocarbons, respectively, of a like

type and gravity in the general area where produced and when run, or 2) the

qighest market price thereof offered or paid in the general area where

·:··~roduced and when run, 3) the gross proceeds of the sale thereof, whichever

••• .is greater. Lessee agrees that before any gas produced from the leased

···"premises is sold, used or processed in a plant, it will be run free of cost

• to the parties entitled to royal ties through an adequate oil and gas

.···~eparator of conventional type or other equipment at least as efficient so

···~hat all liquid hydrocarbons recoverable from the gas by such means will be

.··.~ecovered. The requirement that such gas be run through a separator or other

• • • e• qu10 pment may be wa10 ved 10 n wr1I t10 ng by the royalty owners upon such terms and

•. •.• •c .o nditions as they prescribe.

• •

(b) NON-PROCESSED GAS. As a royalty on gas (including flared or

escaped gas), which is defined as all hydrocarbons and gaseous substances not

defined as oil in subparagraph (a) above, produced or flowing from any well

on said land (except as provided herein with respect to gas processed in a

plant for the extraction of gasoline, liquid hydrocarbons or other products)

that part as shown in Exhibit 11111 of the gross production or the market value

thereof, at the option of the Owner of the Soil or the Commissioner of the

General Land Office, such value to be based on the highest market price paid

or offered for gas of comparable quality in the general area where produced

and when run, or the gross price paid or offered to the producer, whichever

is greater; provided that the maximum pressure base in measuring the gas

under this lease contract shall not at any time exceed 14. 65 pounds per

s~1aYP inch absolute, and the standard base temperature shall be sixty (60)

degr ees Fahrenheit, correction to be made for pressure according to Boyle's

Law, and for specific gravity according to tests made by the Balance Method

or by the most approved method of testing being used by the industry at the

time of testing.

(c) PROCESSED GAS. As a royalty on any gas processed in a gasoline

plant or other plant for the recovery of gasoline or other liquid

hydrocarbons, that part as shown in Exhibit 111" of the residue gas and the

liquid hydrocarbons extracted or the market value thereof, at the option of

the Owners of the Soil or the Commissioner of the General Land Office. All

royalties due herein shall be based on one hundred percent (100%) of the

total plant production of residue gas attributable to gas produced from this

lease, and on fifty percent (50%) or that percent accruing to Lessee,

whichever is greater, of the total plant production of liquid hydrocarbons

attri butable to the gas produced from this lease; provided that if liquid

hydrocarbons are recovered from gas processed in a plant in which Lessee (or

its parent, subsidiary or affiliate) owns an interest, then the percentage

applicable to liquid hydrocarbons shall be fifty percent (50%) or the highest

percent accruing to a third party processing gas through such plant under a

processing agreement negotiated at arms• length (or if there is no such third

party, the highest percent then being specified in processing agreements or

contracts in the industry), whichever is greater. The respective royalties

on residue gas and on liquid hydrocarbons shall be determined by 1) the

2

highest market price paid or offered for any gas (or liquid hydrocarbons) of

comparable quality in the general area, or 2) the gross price paid or offered

for such residue gas (or the weighted average gross selling price for the

respective grades of liquid hydrocarbons, F.O.B. at the plant in which said

gas is processed), whichever is greater.

(d) OTHER PRODUCTS. As a royalty on carbon black, sulphur or any

other products produced or manufactured from gas (excepting liquid

hydrocarbons) whether said gas be "casinghead," "dry" or any other gas, by

fractionating, burning or any other processing that part as shown in Exhibit

"1" of the gross production of such products, or the market value thereof at

the option of the Owner of the Soil or the Commissioner of the General Land

Office, such market value to be determined as follows: 1) on the basis of the

highest market price of each product for the same month in which such product

is produced, or 2) on the basis of the average gross sale price of each

product for the same month in which such product is sold, whichever is

greater.

(e) ACCURATE METERING. Lessee agrees to use the most advanced

methods of production facilities and metering equipment employed by the

industry to measure accurately all oil and gas produced from the leased

premises. The Owner of the Soil, his agents/ representatives shall have the

..... upon request, to witness all tests of meters and to inspect and

~ight,

• examine all meters, meter readings and meter charts. If the Owner of the

·:::~oil, in his opinion, is not satisfied with the accuracy of the measuring

• devices or meters, he may, at his own expense, install and operate check

••• to verify the accuracy of Lessee's meters. Lessee agrees to install

~eters

• ••• ~nd maintain tamper-proof locks or seals on all valves that bypass or divert

from gas meters or other measuring devices. In the event it becomes

··. ~as

•• flecessary to bypass or divert gas from a metering or measuring device, Lessee

• agrees to notify promptly the owner of the soil as to the time, date and

. .

: •. • "J;eason for such bypass.

5. MINIMUM ROYALTY. During any year beginning with the date of the

end of the primary term of this lease, if this lease is maintained by

production, the royalties paid hereunder in no event shall be less than an

amount equal to One Thousand Two Hundred and no/ 100 Dollars ($1,200.00);

otherwise, there shall be due and payable on or before the last day of the

month succeeding the date of the end of the primary term a sum equal to One

Thousand Two Hundred and No/100 Dollars ($1,200. 00) less the amount of

royalties paid during the preceding year.

6. ROYALTY IN KIND. Notwithstanding any other provision in this

l ease, at any time or from time to time, the Owner of the Soil or the

CoNmissioner of the General Land Office may, at the option of either, upon

not le::.s than sixty (60) days notice to the holder of the lease, require that

the payment of any royalties accruing to such royalty owner under this lease

be made in kind. Should the Owner of the Soil elect to take his portion of

the oil and gas produced and saved from said leased premises, then the Owner

of the Soil as Agent for the State of Texas may, subject to the approval by

the Commissioner of the General Land Office, include in any contract he makes

for the sale of his part of the oil and gas produced and saved from said

leased premises the Stat e of Texas' interest in the gross production of oil

and gas produced from said leased premises as the interest is above set out

in Paragraph 4. Provided, further, that under the terms of such contract,

the State of Texas shall receive no less for its oil and gas than the amount

received by the Owner of the Soil and no less than t he same proportionate

amount received by the Lessee, and provided further that any such contract

for the sale of the State' s interest in the gross production of the oil and

gas produced from the leased premises shall not be effective until such

contract has been approved by the Commissioner of the General Land Office.

I f Lessee, in accordance with the provisions of Paragraph 4 above, commits

the gas produced from the leased premises to a purchaser for i nterstate

transmission or use, or otherwise dedicates the gas to interstate commerce,

Lessee shall, in any such contract or other dedication of the gas, protect

the rights of the Owner of the Soil and General Land Office to take royalty

gas in kind by predicating and conditioning the commitment upon FERC or other

appropriate regulatory agency approval and authorization of their in kind

royalty rights.

3

399 90

1/Q~

rMl

7. NO DEDUCTIONS. Lessee agrees that all royalties accruing under

this lease (including those paid in kind) shall be without deduction for the

cost of producing, gathering, storing, separating, treating, dehydrating,

compressing, processing, transporting, and otherwise making the oil, gas and

other products hereunder ready for sale or use. Lessee agrees to compute and

pay royalties on the gross value received, including any reimbursements for

severance taxes and production related costs.

8. PLANT FUEL, RECYCLED GAS AND FREE GAS. No royalty shall be

payable on any gas as may represent this lease's proportionate share of any

fuel used to process gas produced hereunder in any processing plant.

Notwithstanding any other provisions of this lease, and subject to the

written consent of the Owner of the Soil and the Commissioner of the General

Land Office, Lessee may recycle gas for gas lift purposes on the leased

premises or for injection into any oil or gas producing formation underlying

the leased premises after the liquid hydrocarbons contained in the gas have

been removed; no royalties shall be payable on the recycled gas until it is

produced and sold or used by Lessee in a manner which entitles the royalty

owners to a royalty under this lease. Owner of the Soil at his risk and

expense may use gas for ranching, agricultural (including but not limited to

farming and irrigation) and household purposes from any gas well on the

•••••~ remises free of payment to Lessee, provided he pays the Commissioner of the

• ~eneral Land Office on or before the 15th day of each and every month one

···:·Ralf (1/2 ) of the total market value of the royalty payable under Exhibit "1"

·: at the well or wells from which the gas is t aken and used by the Owner of

.•.•.•. ~ he Soil of all gas so taken and used during the previous calendar month .

•

•• • 9. ROYALTY PAYMENTS AND REPORTS. All royalties which are required

• • • .(o be paid to the Owner of the Soil and the Commissioner of the General Land

• Office under this lease shall be due and payable in the following manner:

on oil is due and must be received by the Owner of the Soil and the

:·.·~oyalty

• ~eneral Land Office on or before the 5th day of the second month succeeding

the month of production, and royalty on gas i s due and must be received in

the General Land Office and by the Owner of the Soil on or before the 15th

day of the second month succeeding the month of production, accompanied by

the affidavit of the owner, manager or other authorized agent, completed in

the form and manner prescribed by the General Land Office and showing the

gross amount and disposition of all oil and gas produced and the market value

of the oil and gas, together with a copy of all documents, records or reports

confirming the gross production, disposition and market value including gas

meter readings, pipeline receipts, gas line receipts and other checks or

memoranda of amount produced and put into pipelines, tanks or pools and gas

lines or gas storage, and any other reports or records which the General Land

Office may require to verify the gross production, disposition and market

value. A copy of all contracts under which gas is sold or processed and all

subsequent agreements and amendments to such contracts shall be delivered to

the Owner of the Soil and shall be filed with the General Land Office within

thirty (30) days after entering into or making such contracts, agreements or

amendments. Each royalty payment shall be accompanied by a check stub,

schedule, summary or other r emittance advice showing by the assigned General

Land Office lease number the amount of royalty bei ng paid on each lease. If

Lessee pays its royalty on or before thirty ( 3 0) days after the royalty

payment was due, then Lessee owes a penalty of 5% of the royalty or $25.00,

whichever is greater. A royalty payment which is over thirty (30) days late

shall accrue a penalty of 10% of the royalty due or $25.00, whichever is

greater. In addition to a penalty, royalties shall accrue interest at a

rate of 12% per year; such interest will begin accruing when the royalty is

sixty (60) days overdue. Affidavits and supporting documents which are not

filed when due shall incur a penalty in an amount set by the General Land

Office administrative rule which is effective on the date when the affidavits

or supporting documents were due. The Lessee shall bear all responsibility

for paying or causing royalties to be paid in the manner prescribed in this

paragraph. Payment of the delinquency penalty shall in no way operate to

prohibit the State' s right of forfeiture as provided by law nor act to

postpone the date on which royalties were originally due. The above penalty

provisions shall not apply in cases of title dispute as to the State's

portion of the royalty or to that portion of the royalty in dispute as to

fair market value. Penalties due under this paragraph are subject to change

in order to conform to any future penalty statutes. In the event of an

4

Description:individually and as agent for the state of Texas, as Lessor, and Hillin-Simon Hill in-Simon Oil Company, dated 30th day of October,. 1990. A royalty