Table Of ContentNEWS P72 i. | ANALYSIS P24

The Budget Why railways fee |

that blew the areontrack \aie on inequality fi”

budget for recovery SMNESA REVIEWS P39

NON Wi

MAKE IT, KEEP IT, SPEND IT 13 MARCH 2020 | ISSUE 990 | £4.50

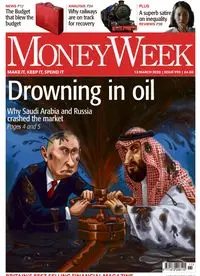

Drowning tn oil

Why Saudi Arabia and Russia

crashed the market

Pages 4 and 5

‘as

\ .

=

‘

it

§

a UIMIN TN i?

771472206115

BRITAIN’S BEST-SELLING FINANCIAL MAGAZINE MONEYWEEK.COM

SCOTTISH MORTGAGE INVESTMENT TRUST

t

AGE

SCOTTISH MORTG

ENTERED THE

FTSE 100 INDEX IN

MARCH 2017.

WHO SAID THE SKY HAD

TO BE THE LIMIT?

Business’s ability to exhibit exponential growth lies at the heart of the Scottish Mortgage Investment Trust.

Our portfolio consists of around 80 of what we believe are the most exciting companies in the world today. Our vision

is long term and we invest with no limits on geographical or sector exposure.

We like companies that can deploy innovative technologies that threaten industry incumbents and disrupt sectors

as diverse as healthcare, energy, retail, automotive and advertising.

Over the last five years the Scottish Mortgage Investment Trust has delivered a total return of 143.1% compared

to 106.9% for the sector*. And Scottish Mortgage is low-cost with an ongoing charges figure of just 0.37%".

Standardised past performance to 31 December*

2015 2016 2017 2018 2019

Scottish Mortgage 13.3% 16.5% 411% 4.6% 24.8% Money

AIC Global Sector’ 9.1% 23.5% 26.4% 1.8% 24.5% ii

AWeighted average. 019

Global Growth

Scottish Mortgage

Past performance is not a guide to future returns.

Please remember that changing stock market conditions and currency exchange rates

will affect the value of the investment in the fund and any income from it. Investors may

not get back the amount invested.

For a blue sky approach call 0800 917 2112 or visit us at www.scottishmortgageit.com

A Key Information Document is available by contacting us. Long-term investment partners

BAILLIE GIFFORD

*Source: Morningstar, share price, total return as at 31.12.19. **Ongoing charges as at 31.03.19 calculated in accordance with AIC recommendations. Details of other costs

can be found in the Key Information Document. Your call may be recorded for training or monitoring purposes. Issued and approved by Baillie Gifford & Co Limited, whose

registered address is at Calton Square, 1 Greenside Row, Edinburgh, EH1 3AN, United Kingdom. Baillie Gifford & Co Limited is the authorised Alternative Investment Fund

Manager and Company Secretary of the Company. Baillie Gifford & Co Limited is authorised and regulated by the Financial Conduct Authority (FCA). The investment

trusts managed by Baillie Gifford & Co Limited are listed UK companies and are not authorised and regulated by the Financial Conduct Authority.

Cover illustration: Hname Here. Photos: Rex Features; Getty Images

13 March 2020 | Issue 990

The arrival of

coronavirus in

China at the

beginning of the

year represented an

immediate supply

shock to the global economy

(the Chinese stopped producing

and exporting). That created its

own demand shock (they weren’t

buying either — and the rest of

us started to get nervous as the

virus spread). This was unusual

enough — you don’t often get

demand and supply shocks at

once. But it’s got a lot weirder

since. First another supply-shock

bomb appeared in the form of

the new oil wars (see page 4).

And then, another whopping demand

shock (a positive one this time) turned up

in the form of massive monetary and fiscal

stimulus in the UK.

On Wednesday, the Bank of England

cut interest rates by 0.5% and took various

measures to make sure credit keeps

flowing (see pages 8 and 12 for more).

The rate cut is more grandstanding than

anything else — and comes with all the

usual downsides (bad news for savers and

terrible news for pension funds). Cheaper

money is also clearly not going to do much

to overcome the virus itself, or indeed to

persuade consumers to nip to the shops

(see page 18 for more on retailers’ woes).

However, the other measures make

sense. The key thing is cash. Keeping

companies alive (making stuff, providing

services and maintaining employment) is

about making sure that they have more

MONEYWEEK

Britain’s best-selling financial magazine

From the editor-in-chief...

Outgoing Bank of England governor Mark Carney

“Once introduced, ‘temporary’ or ‘exceptional’

spending is very hard to roll bac

cash coming in than going out — making

loans easier to give and to get is all part

of that. So was this emergency bout of

monetary policy necessary? Probably —to

send the usual “whatever it takes” message

to nervous markets if nothing else. Was it

ever going to be sufficient to keep us out of

recession alone? Absolutely not.

This brings us to the Budget.

On Wednesday, the chancellor, Rishi

Sunak, announced an extraordinary

package for the support of UK businesses.

We look at some of the measures on

page 12 (see moneyweek.com for more

analysis), but the real point of them is the

same as that of the monetary stimulus —

to help firms keep the show on the road

until what Sunak keeps telling us are

“exceptional circumstances” ease up.

The problem is that it doesn’t come

cheap. We stopped being able to add up

the total of Sunak’s promises

about half an hour into his

Budget. That is not a good

thing — the long-term effects of

overspending are rarely good.

Sunak might be right that these

are exceptional circumstances.

But, as all ex-chancellors

know, once introduced, even

exceptional or “temporary”

spending is very hard to roll

back. The same goes for

ex-governors of the Bank of

England and loose monetary

policy: they all know that cutting

is rather easier than raising rates.

How do you invest into these

exceptional circumstances? With

some difficulty. On page 24 we

look at the possibilities in the new age of

rail. On page 23, David looks at how some

of the big trusts I know a lot of you hold

(as I do) have held up over the last week.

Personal Assets, which we have long held

in anticipation of a new financial crisis,

has done exactly as it should have and

protected our capital. Phew. On page 16

John looks at the investment trusts that are

currently trading on very large discounts.

Some probably should be. Others might

be making their way into buy territory. Be

ready! Finally, in these increasingly tricky

times you need a reliable yield — so turn to

page 30 where Max has some interesting

ideas for you.

Cok A)

w

Lowy Merryn Somerset Webb

[email protected]

Loser of the week

Anthony Levandowski, the

former head of Uber’s

self-driving efforts, has

declared bankruptcy

after being ordered to

pay $179m in

damages related to

his alleged theft of

trade secrets from

Google, says Patrick

McGee in the Financial

Times. Levandowski

(pictured), one of the founders and key engineers

Good week for:

says The Metro. However,

in Google self-driving project Waymo, left Google

in 2016. Shortly after this he co-founded Otto, an

“autonomous trucking company”, alongside

Lior Ron. It was later bought by Uber for $680m.

Waymo sued soon after, accusing Levandowski of

“absconding trade secrets”. He was fired by Uber

in 2017 when he refused to testify. The lawsuit

was settled in 2018, but Levandowski was found

Bad week for:

Hedge fund manager Philip Falcone and his Harbinger Offshore fund’s

assets have been frozen after he failed to pay millions in legal fees

following a high-stakes litigation against US regulators, says Ortenca

Aliaj in the Financial Times. With an estimated net worth of $1bn,

Falcone has defaulted on his debts and sold some of the underlying

collateral, which included art works by Pablo Picasso and Andy Warhol.

liable for $127m. Whether Uber pays for the fines

“is subject to an ongoing dispute”, but the

company said the resolution of the matter “could

result in a possible loss of up to $64m or more”.

Ron, who remains an Uber employee, settled with It bodes ill for this year’s postponed Coachella festival, which was to

Google for $9.7m earlier this year.

moneyweek.com

The South By Southwest arts festival, which was to be held this week in

Austin, Texas, has been cancelled due to concerns about Covid-19.

, Last year it brought in $356m for the local economy, says The Guardian.

3

Maisie, a wire-haired dachshund, was awarded “Best in Show” at Crufts in

Birmingham. She won her owner, Kim McCalmont, “a modest” £150 in cash,

“the prestige... can earn them extra profits

through advertising and sponsorship”. A “Best of Breed” winner can

also “rake in up to £250,000 in stud fees”, adds the Birmingham Mail.

An appeals court in San Francisco, California, has ruled that Led

Zeppelin did not steal the opening riff to one of their most famous

songs, Stairway To Heaven. In 2014, US band Spirit accused the

British rock icons of ripping off their song, Taurus, which had been

released three years earlier in 1968. Led Zeppelin would have faced

paying millions had they lost. In the time since the case first went to

court, the song is estimated to have grossed $3.4m.

2 feature headline acts such as Travis Scott (pictured), in California next

6 month. Pulling such a high-profile event “could leave a $1bn hole”.

—

13 March 2020 MoneyYWeek

Will an oil price war spark a global crisis?

Alex Rankine

Markets editor

“Now comes the oil shock,” says The

Wall Street Journal. A “game of chicken

between Riyadh and Moscow” has sent

oil prices plunging and produced the worst

day for many equity indices since 2008

(see page 5). Major oil producers led by

the Saudis and the Russians, a grouping

known as “Opec+”, have been cooperating

to limit output and support crude prices

since 2016. The Covid-19 demand slump

saw Opec propose a new 1.5 million

barrels per day (bpd) cut. That plan was

rejected by Moscow, which has grown

critical of an approach that it says only

props up prices for US shale producers.

A nasty break-up

Rather than compromise, Riyadh

retaliated. The Saudis slashed prices

over the weekend in an all-out attempt

to steal market share. The resulting

“price war” could see the global market

saturated with oil. Caroline Bain of

Capital Economics predicts a “huge”

global surplus of 3.2 million bpd in the

second quarter.

The dramatic dissolution of the Opec+

alliance saw crude prices plunge by the

most since the 1991 Gulf War on Monday.

Brent crude fell 24% and is down almost

50% this year to trade at around $35

per barrel. US benchmark West Texas

Intermediate had its second-worst day

on record, losing 24.6%. Oil companies

account for 10% of the UK equity market.

The FTSE 100 had its worst day since the

financial crisis on Monday, plunging 7.7%.

The International Energy Agency

forecasts that demand will fall by 90,000

bpd this year, the first annual decline since

2009, says Andy Critchlow in The Daily

Telegraph. Industry veterans fret that the

“high-stakes game of roulette” between

Moscow and Riyadh could see oil “tumble

below $20” per barrel. The Saudis do not

seem well-placed to win a price war: they

need prices at $80 a barrel to balance their

budget. Russia, with a more diversified

economy, says it only needs $40.

The downsides of cheap oil

This high-stakes strategy is typical of

Crown Prince Mohammed bin Salman,

Saudi Arabia’s de facto leader, writes Julian

Lee on Bloomberg. The prince wants to

“drive oil prices down so far and so fast

that Russia realises it made a terrible

mistake”, but that is unlikely to work. As

with the prince’s bloody intervention in

\

1’s diversified economy only needs an

oil price of $40 a barrel to balance its budget

Yemen, a supposedly short decisive blow

could turn into a protracted conflict that

does damage to all sides. The prince is “a

risk taker... prone to impulsive decisions”,

Greg Brew of Southern Methodist

University told The New York Times.

Yet why is cheaper oil bad news?

Historically, lower prices have been seen

as a “net positive for global demand” as

they boost consumer purchasing power

and lower costs for businesses, says

Jennifer McKeown of Capital Economics.

Yet with coronavirus causing lockdowns

and sowing fear, consumers are unlikely

to rush out to spend, Oil-producing

companies and nations are in for a serious

budget squeeze. “What’s more, the price

crash could put severe financial stress on

the corporate bond market.” (See below.)

Is the corporate credit bubble about to meet its pin?

The bill for America’s energy

boom could now be due. Shale

energy firms have borrowed

billions of dollars over the past

decade to finance the

exploration and drilling of

thousands of wells, says Ryan

Dezember in The Wall Street

Journal. In a world of ultra-low

interest rates investors were

delighted to snap up the higher

yields on offer.

Moody’s Investors Service

reports that North American

oil and gas firms have $200bn

in debt maturing over the next

four years. And now slumping

oil prices are sending jitters

through the bond market. On

Monday energy bonds issued

by smaller operators traded so

low that the market seemed to

have concluded they were

“already out of money”.

13 March 2020

= Oil and gas drillers are

ls starting to struggle” 4

Around 12% of the $936bn of

debt issued by US oil and gas

firms are trading at distressed

levels, notes Joe Rennison in

the Financial Times: their yield

is more than 10% above that of

US Treasuries.

This story is bigger than

US energy, says Alexandra

Scaggs in Barron’s. Energy

bonds make up about 11% of

the US high yield debt market.

Energy sector ructions have

prompted investors to pull a

net $9.3bn from junk bond

funds over the last two weeks.

That is driving up borrowing

costs for all junk bond issuers.

The spread of financial

contagion to the wider high-

yield bond market looks

“inevitable”, said Deutsche

Bank in a note.

Firms grappling with record

levels of corporate debt could

now be hit by falling earnings

caused by Covid-19 on the one

hand and rising borrowing

costs as bond markets take

fright on the other. The OECD

notes that BBB-rated bonds,

one notch away from junk,

made up 52% of all new

investment-grade bond

finance worldwide over the

past three years, says Philip

Aldrick in The Times. Junk

bonds comprise another

quarter of corporate debt.

What’s more, the International

Monetary Fund said late last

year that the money owed by

companies unable to cover

interest payments with profits

could hit 40% of the total in

eight major economies if there

is adownturn half as bad as

the financial crisis.

In short, concludes Aldrick,

we could be in trouble. US

economist Hyman Minsky

argued that a fall in one set of

asset prices can actlikea

domino that knocks over “the

whole debt-funded capitalist

edifice”. Corporate debt could

prove the “first domino.”

moneyweek.com

©Getty Images

©iStockphotos

Get set for the

next euro crisis

Italy suspended mortgage

payments for households and

small firms as the country

entered a coronavirus lockdown

this week. Meanwhile, on

Monday the spread between

Italian and German ten-year

debt (the gap between the

yields on each) went above 2%

for the first time since mid-2019.

That suggests that the

current sovereign bond rally is

not completely indiscriminate,

with investors reassessing the

risks of lending to Europe’s

second most-indebted nation.

The Italian economy now looks

set to contract sharply in the

first and second quarter.

In the world of sovereign

debt risk, Italy is “the elephant

inthe room”, says Hung Tran in

the Financial Times. The

country is almost certainly

heading for its fourth recession

since the global financial crisis.

That will push government

debt above $2.5trn, equivalent

to an utterly unsustainable

135% of GDP. An outright

crisis is unlikely so long as

interest rates remain low. But

the riskis “rising” and it

represents an “existential threat

to the eurozone”.

Europe's leaders have yet to

get a grip, says Peter Goodman

in The New York Times. With

recession looming, French and

Italian politicians this week

called for a coordinated fiscal

response to Covid-19, but debt-

averse northern governments

will be hesitant to get on board.

History suggests it takes a

real crisis to get consensus in

Europe. With Italy locked down

that day may not be far away.

Markets

From panic to hysteria

The stockmarket has passed

from “panic mode into pure

hysteria”, Ayush Ansal of

Crimson Black Capital told

Simon English in the Evening

Standard. Battered by the

spread of coronavirus and the

tumbling oil price, Monday

was the worst day for many

global markets since the 2008

financial crisis.

Losses on Wall Street were

so severe that trading was

halted for 15 minutes on a

day when America’s S&P

500 index plunged 7.6%.

The 30-company Dow Jones

Industrial Average saw a

similarly dramatic collapse.

Italy’s FTSE MIB index lost

nearly 10%. The FTSE 100

and pan-European Stoxx 600

indices both officially entered

bear markets, defined as a 20%

drop from the most recent high.

Australia’s market fell by 7.4%.

Money flooded into safe

havens. Gold briefly rallied

above $1,700 per ounce for

the first time in seven years.

The yield on five-year UK

government bonds fell below

zero for the first time on

record, and that on US 30-year

Treasuries slipped below 1%.

Last Friday marked the 11th

anniversary of the day that

the S&P 500 index bottomed

out at 666 before starting its

long bull run. In a suitably

satanic twist, ten-year Treasury

yields marked the anniversary

by falling to 0.666%, notes

Bloomberg’s John Authers.

——_-.

Piazza del Duomo, Milan: Italy has taken a big hit from Covid-19

Prepare for recession

Crashing stockmarkets and

emergency interest-rate cuts

make it feel like 2008 all over

again, says Neil Shearing of

Capital Economics. Yet today’s

world is quite different.

The 2008 crash was a

financial shock followed

by “an extremely slow

recovery as households and

financial institutions repaired

their balance sheets”. The

coronavirus crisis may provide

a “sharp shock” this quarter

as factories are closed and

cities locked down, with a brief

but nasty recession perfectly

possible. But activity should

rebound quickly “provided

that the virus fades”. Even

more emergency central bank

money will only further juice a

recovery when it arrives.

Emergency rate cuts have

yet to have much impact,

notes Jeremy Warner in The

Daily Telegraph. Action by

the US Federal Reserve, which

delivered a 0.5% rate cut last

week, has failed to calm the

waters; indeed it seems “to

have added to the alarm”. Black

Monday 2020 will go down in

history as the moment when

a “decade of denial finally

ended”, says Larry Elliott in

The Guardian. Perpetually

low rates have long masked

the “underlying fragility of the

global economy”. The era when

asset prices could rocket ever

upwards ona “giant wave of

debt” may finally be at an end.

Two things are needed for

this turmoil to end, says The

Economist. First, “evidence

that virus infection rates” are

peaking. Second, stocks must

become cheap enough to tempt

“bottom-fishing investors”. We

are still a long way from either.

What oil's plunge means for investors

The collapse in the oil price has wrought

havoc on the share prices of oil companies

everywhere - with double-digit drops in

the share prices of FTSE 100 stalwarts BP

and Royal Dutch Shell, and the spreads on

US shale oil companies debt exploding

higher (see page 4). So what does it mean

for your portfolio?

The first question is: will the oil price

stay here, or perhaps fall further? This

depends on several factors, none of which

look especially promising for oil bulls. On

the demand side, coronavirus will have a

huge impact. The International Energy

Agency reckons that global oil demand

will fall this year for the first time since

2009. On the supply side, Saudi Arabia

and Russia have flung the taps open, with

Saudi upping the stakes even further mid-

week, by saying it aims to pump 13 million

barrels a day—a record level. The hope

might be to put US shale producers out of

business, but that will take time, especially

if the US steps in to defend the sector. So

moneyweek.com

in the short-to-medium term, it does look

as though low prices are here to stay.

But what does this mean for oil

producers? It’s certainly not good news,

but on the other hand, oil producers were

already being shunned by global markets.

Asa proportion of the S&P 500 for

example, the energy sector has never

before been this lowly valued. Part of that

is scepticism over shale producers ever

making any money (quite possibly

justified) but some of itis arguably down

to over-optimism on how rapidly we'll

replace fossil fuels with less polluting

resources. So oil companies were

dropping from low valuations.

The outlook for US shale producers

looks too uncertain for our liking. But the

oil majors look more interesting. As

Rupert Hargreaves notes on Motley Fool,

BP (LSE: BP) has a healthy balance sheet

with low borrowing and plenty of scope

for cutting spending if necessary. The

majors have also demonstrated in past

crises (such as the 2014 slump in the oil

price) that maintaining their dividends is

of utmost importance. With BP currently

yielding more than 9%, that looks worth

betting on. Shell (LSE: RDSB) has a higher

breakeven cost of production but it’s also

viewed as unlikely to cut its dividend.

Meanwhile, a slump in the oil price is

unequivocally good for some sectors and

countries — cheap petrol is good news for

consumers and it’s very good news for the

beleaguered travel industry in general.

The difficulty is that low oil prices are

unlikely to benefit the latter immediately —

it’s still not clear just how badly damaged

airlines and cruise companies will be by

the slump. If you are feeling very brave

you might want to consider a small dip

into cruise giant Carnival (LSE: CCL). It’s

currently yielding more than 9% — we

wouldn't bet on that being paid out, but

given that the US government has been

making noises about assisting the travel

industry, it might be worth a bet.

13 March 2020 =MonevWeek

6

Shares

MoneyWeek's comprehensive guide to this week's share tips

Three to buy

Admiral

The Times

This motor-insurance business

has operations in the UK,

Europe and the United States

and also owns the

Confused.com price-comparison

website. Admiral prides

itself on its strong culture,

happy workforce and steady

management. These priorities

have yielded results: a 10%

jump in 2019 pre-tax profit

compares favourably with

falling earnings at rivals Direct

Line and Hastings and enabled

Admiral to raise the full-year

Three to sell

dividend by 11%. The stock is a

long-term buy. 2,238p

Ocado

The Sunday Telegraph

The online grocery specialist’s

critics say it is loss-making

and overvalued, but fans insist

it will profit from the future

of retail. Ocado’s proprietary

technology is much in demand

in the UK and overseas,

which is why it is valued like

an international technology

business rather than a mere

supermarket. The proportion

of British consumers who buy

groceries online has doubled

over the past decade and today

sits at 30%. Globally, online

grocery sales are set to grow

by 15% a year through 2024.

Ocado offers compelling

growth prospects. 1,122p

<

js

Moneysupermarket.com

Shares

Shares in this price comparison

website surged last month on

the back of an encouraging

full-year trading update. The

“indiscriminate sell-off” in

the UK market has seen the

price return to earth. But

this is a firm with little direct

exposure to the coronavirus

fallout: house-bound people

can still shop online for energy

providers and insurance. This

seems an opportunity to buy

into a healthy business at its

pre-rally price. 313p

The Restaurant Group

The Sunday Times

Coronavirus-related disruption

to cinema scheduling is the last

thing that management at this

struggling restaurant portfolio

needed. The shares have halved

since it announced the £559m

takeover of Wagamama in

2018. “Tired” legacy brands

such as Chiquito and Frankie

& Benny’s have been hit by

falling demand at retail and

leisure parks. Wagamama itself

is performing well, but until

the firm finds a way to ditch

its “fading” brands and pay

...and the rest

down debt the shares are best

avoided. 87p

Capital & Counties

Investors Chronicle

This West End-focused

property developer’s portfolio

consists of a mixture of retail,

food and beverage, office

and residential property.

Approximately 95% of

CapCo’s holdings are in

London’s Covent Garden,

where property values fell 1.4%

in 2019. A conservative loan-

to-value ratio of 16% means

> the balance sheet is solid,

but that is outweighed by the

fact that half of group assets

are let out to retailers. “In an

environment where retail rents

are in decline” there is little

upside in prospect. A lack of

dividend growth is a final bear

point. Sell. 196p

HSBC

Investors Chronicle

HSBC is trying to redeploy

capital from underperforming

developed markets towards

higher-growth regions in Asia

and Mexico. This “painful”

process will mean 35,000 job

losses, but should save billions

annually. The trouble is that

with the Covid-19 outbreak

slashing global growth

estimates and provoking

emergency interest-rate cuts the

outlook for interest margins

and shareholder returns has

taken a big hit. Sell. 555p

The Daily Telegraph

Slumping markets are creating

buying opportunities. We

suggest that bargain hunters

take a look at foreign-exchange

firm Equals, cruise liner

Carnival, Jet2 owner Dart

Group, easyJet, WH Smith,

Whitbread, InterContinental

Hotels and Legal & General

(39.75p; 2,33 5p; 1,18 6p;

1,074. 5p; 1,948p; 3,758p;

4,253.5p; 264p). A share-price

slide at energy and healthcare

distribution specialist DCC is

a reminder that rich valuations

are vulnerable in a market

slump. There is still no reason

to jump in (5,554p).

Investors Chronicle

Premium food producer

Cranswick has been

capitalising on pork shortages

A German view

The market meltdown has given investors the opportunity to pick

up first-rate German technology stocks on the cheap, says

Christof Schtrmann in WirtschaftsWoche. One to consider is

Secunet Security Networks, a cybersecurity outfit. It protects

sectors including carmakers and energy suppliers in addition to

key public infrastructure such as border controls. Sales have

jumped from €91m in 2015 to €227m last year; earnings per share

jumped by 94% over the same period. The structural growth

outlook is compelling: as the global economy digitises, the need

for cybersecurity will rocket. The market is expected to grow

sixfold between 2011 and 2025.

MoneYWeek = 13 March 2020

in China to boost its exports

and the dividend has increased

for 29 consecutive years. Buy

(3,352p). Rising gold prices

mean that prospects are

brightening at African miner

Hummingbird Resources (23p).

Shares

Mid Wynd International

Investment Trust, which

focuses on high-quality

businesses with “fortress

balance sheets”, offers a

diversified way to bet on

a global market recovery

(579p). Investment trust Law

Debenture boasts defensive

qualities, low charges and a

good long-term record —

buy (610p).

The Times

Shares in Legal & General

look cheap and the group has

growth opportunities from

infrastructure investment. There

isalsoa “juicy” 7% dividend

yield (249. 5p). Struggling

industrials conglomerate

General Electric’s “mammoth

turnaround” won’t be made

any easier by disruption from

Covid-19. Avoid ($10).

Defying the slowing Indian economy and jittery global

stockmarkets, the State Bank of India’s credit-card company is

going public, say Benjamin Parkin and Henny Sender in the

Financial Times. SBI Cards plans to raise Rs103.5bn ($1.4bn).

Last week's four-day share sale was more than 20 times

oversubscribed. Investors appear to be taking a long-term view

and are counting on India’s second-largest card issuer to “ride a

wave of newly financially literate Indians taking out cards for the

first time”. The firm’s sales have jumped by over 40% a year

since 2017. There is ample scope for further growth. India had

two credit cards per 100 people in 2017; China, 42.

moneyweek.com

@ Boeing's shares have lost

30% in a month, double the

S&P 500’s slide, says Robert

Cyran on Breakingviews. The

company faces a war on two

different fronts. The Federal

Aviation Authority’s rejection

of Boeing’s assurances about

wiring will further delay the

737 Max’s return to the sky.

And the Covid-19 virus means

that people and firms are

“cutting back on travel”, so

airlines will “cut orders or

payments”. With Boeing

burning through $2.7bn in

cash last quarter and with

debt over $27bn, no wonder

new CEO Dave Calhoun has

admitted that “the company’s

problems are “worse than

he imagined”.

@ Twitter CEO Jack Dorsey

(pictured) is claiming “victory”

after an agreement between

the social network, activist

fund Elliott Management

Corporation and private-

equity group Silver Lake

ensured that he will remain

CEO “for now”, says Casey

Newton in The Verge. Silver

Lake will put $1bn into the

company, enabling Twitter to

launch a $2bn share buyback,

in return for Twitter giving up

three seats on the board.

But Dorsey has been given

“aggressive new goals”, such

as “growing its user base by

at least 20% this year”.

And Silver Lake is likely to

push for Twitter to be taken

private. “The barbarians

once at the gate are nowin

the boardroom.”

@ Premier Oil's shareholders

may be fuming after the stock

fell by 60% on Monday, but

this collapse was “merited”,

says Jim Armitage in the

Evening Standard. Despite

grappling with almost £2bn

of debt, Premier recently

persuaded its stakeholders to

let it issue $500m in new

shares to buy “a bunch of

ageing oil and gas fields”.

But thanks to a “legal monkey

wrench” from hedge fund

ARCM and the drop in the

oil price, the rights issue

is “surely dead”. The board

now needs to “work outa

major restructure” - and

that “won't be pretty” for the

company’s for shareholders.

moneyweek.com

Shares

Aramco's appeal dwindles

The Saudi oil behemoth has lost a fifth of its value since it peaked last

December. It still looks unattractive, says Matthew Partridge

©Getty Images

The Saudi oil giant Aramco is to slash the cost of

a barrel of oil by up to $8, reports Benoit Faucon

and Summer Said in The Wall Street Journal.

At the same time the company is prepared to

increase its output to its maximum capacity of

13 million barrels a day if needed.

The move - which comes after a “long-

standing partnership” between some of the

world’s largest oil producers, including Saudi

Arabia and Russia, “splintered” at the end of last

week — has helped send oil prices down by more

than 20% toa four year low of $33 a barrel (see

page 4).

Aramco’s move is partially prompted by

“tensions” between the Saudi government

and the Russians, says the Financial Times. In

particular, the Saudis complain that the Russian

government has been “shirking” its share of

existing supply curbs intended to compensate

for the reduction in global demand prompted

by the coronavirus outbreak. Some experts

believe that the latest move is part of a “game of

brinkmanship” intended to “lure producers back

round the negotiating table”. However, another

motivation is to hit US shale producers, who had

indirectly benefited from the stabilised prices.

No longer defying gravity

Whatever the reasons for the latest move, the fall

in oil prices has been disastrous for Aramco’s

share price, which has “largely defied gravity”

since part of the company was listed on the Saudi

exchange last December, says Filipe Pacheco on

Bloomberg. Not only did the shares surge by

20% in the aftermath of the flotation late last

year, despite a lack of demand from foreigners,

but they remained above the initial price, “even

as the coronavirus led to a slump in crude”.

However, the latest fall means that more than

$400bn of Aramco’s market value has vanished.

It was worth$2trn at the peak.

In theory, Aramco’s minority shareholders are

ee

protected by “inducements such as guaranteed

J

The group is ready to produce

13 million barrels per day

dividends” for five years, says Liam Denning

on Bloomberg. The stock is now yielding 5%.

Yet the average yield of the big five Western

majors has jumped from 5.5% to 8.6% since

Aramco listed. What’s more, its free cash flow,

which finances the dividend, was expected to

dwindle before the latest oil-price fall. There’s no

guarantee that oil prices will bounce back, so the

yield isn’t high enough to justify the risk.

Given that it will take at least six months for

shale producers to cut back production, the price

of crude oil could remain at $35 a barrel for

some time, says George Hay for Breakingviews.

Under this scenario, Aramco “would be worth

barely half” its current $1.5trn market cap. Still,

at least shareholders wouldn’t be suffering alone,

since the Saudi government, which still controls

virtually all Aramco’s shares, “requires an oil

price of $83 a barrel to balance its budget”. The

resulting deficit will make it harder for Crown

Prince Mohammed bin Salman to “pursue his

Vision 2030 scheme to overhaul the economy”.

Tesco checks out of Thailand

Tesco shares escaped the

dramatic falls suffered by the

rest of the FTSE 100 this week,

say John Reed and Jonathan

Eley in the Financial Times.

That's because it agreed to sell

its southeast Asian operations

to Thai conglomerate Charoen

Pokphand for $10.6bn in cash.

This will produce a “lavish”

special dividend of £2.5bn; the

remainder will be used to

eliminate Tesco’s pension

deficit. The deal, the biggest in

Thailand's history, sees Tesco

return its 2,000 stores in

Thailand and 74 in Malaysia to

CP Group, who sold its Lotus

supermarket group to Tesco for

$180m during the Asian crisis.

There’s no doubt that the

owner of CP Group “has got his

hands ona fine business”, says

Ben Marlow in The Daily

Telegraph. Of all Tesco’s

attempts at expansion

overseas, Thailand “was far

and away the biggest success”.

What's more, the sale not only

represents a U-Turn from

Tesco's plans to add another

750 stores in Thailand, but it

also leaves Tesco “focused

almost entirely on the UK”,

where growth is “elusive”.

Nonsense, say Clara Ferreira

Marques and Nisha Gopalan

on Bloomberg. Not only did

the Asian business amount to

a “modest 9% of Tesco’s total

revenue in the first half of

last year”, but it also “needed

investment” at atime

when Thailand's economy

is “flatlining”.

Tesco also achieved a high

price of 12.5 times earnings.

The only concern is that Thai

regulators may block the deal

because it allows CP Group to

grab “too much of the market”,

so Tesco’s shareholders

shouldn't celebrate “until

they get delivery”.

13 March 2020 MoneyYWeek

Virus wreaks global havoc

Italy is in lockdown and Britain is preparing for the worst. But Is ie being done? Emily Hohler reports

The coronavirus continues to spread,

prompting “lockdown” across Italy and

“emergency measures worldwide”, says

Jessie Yeung on CNN. According to official

figures, Covid-19 has infected around

113,000 people, resulting in more than

4,000 deaths. The majority of cases are in

mainland China, but the infection rate there

has slowed, while it “wreaks havoc” in the

West. On Monday, Italy’s prime minister,

Giuseppe Conte, announced “sweeping

quarantine measures” for the entire

population of 60 million: “blanket travel

restrictions, a ban on all public events, the

closure of schools and public spaces”. So far,

Italy has 9,172 cases and 463 deaths, the

most of any country outside China.

More testing is key

Italy is copying China’s “draconian

methods”, the “gold standard for how

to contain the disease”, says Jeremy

Warner in The Daily Telegraph. Britain,

Germany and France will probably soon

follow suit. “Similarly unconventional

methods” are needed to limit wider

economic damage. For Italy, already

“crippled by the banking and sovereign-

debt crisis of 2010-2012”, these measures

are going to be particularly important.

Any economic contraction will have

“serious consequences for the rest of

Europe”. Italy’s government has asked

that eurozone stability pact rules limiting

the size of deficits are temporarily lifted

and, since this is a global emergency,

the request will be hard to refuse. The

European Central Bank will also come

under “intense pressure” to renew its

monetisation of Italian sovereign debt.

A “fully fledged transfer union, with each

state guaranteeing the debts of others”,

could move a “step closer” as a result.

As for Britain, we have been “preparing

for the next crisis ever since the last one”

and our banks now have “mountains

of capital”, says Tim Wallace in The

Daily Telegraph. But nobody anticipated

Covid-19, which is a “real economy

shock”, with a likely “hunkering down”

and people “working and spending less”.

Its arrival happens to coincide with

Rishi Sunak’s first Budget (see page 12)

and the goal is likely to be to give a “short-

term boost to the economy to ensure

businesses can weather the storm” (see

below).

The number of cases in the UK rose

by 54 to 373 on Tuesday and a sixth

patient has died. News that junior health

minister Nadine Dorries has tested

positive increases the pressure to “tighten”

access to Parliament as authorities “ramp

up” preparations in anticipations of the

epidemic’s peak within a few weeks,

says the Financial Times. The NHS is to

increase the tests it is processing to 10,000

daily, a move that should help patients

Donald Trump: intensely

relaxed in his Katrina moment

seek treatment and self-quarantine more

quickly — “the bedrock of an effective

medical response”.

Testing is key, agrees The Economist

and the inability or unwillingness to test

may explain why in countries outside

China or South Korea, where testing rates

are much lower, the mortality rate appears

to be up to five times higher. In the US,

where cases leapt by almost 50% within

24 hours to 1,030 on Tuesday night, only

1,700 people had been tested as of 8 March,

says Martin Farrer in The Guardian.

Covid-19 has become a highly politicised

issue there, with critics calling it President

Trump’s Katrina moment. Democrats

have criticised him for “reacting slowly”,

contradicting expert advice and “spreading

misinformation”, says Michael Tesler in The

Washington Post. Trump counters that the

media and Democrats are “exaggerating

health risks” to damage his chances of

re-election. Unless the virus is contained by

election day, it probably will.

Bank deploys its bazooka against Covid-19

The Bank has more in the arsenal &

13 March 2020

In central-banking circles, the

package of measures unveiled

by the Bank of England on

Wednesday is called a “big

bazooka”, says Philip Aldrick in

The Times. To “bridge the

economy” over Covid-19 and

shore up confidence, the Bank

has cut interest rates by 0.5

percentage points, back toa

record low of 0.25%;

announced a £100bn cheap

funding scheme for banks to

support small businesses and

cut the countercyclical capital

buffer so much that “lenders

will be able to pump an extra

£200bn of credit into the

economy”. The Bank’s

Prudential Regulation

Authority also sent astern

5 warning to banks not to

increase bonuses or dividends

in response to its policy

actions, notes Paul Dales in

Capital Economics.

Gratifyingly, lessons learned

from the previous crisis are

being applied, says Mark

Bathgate in The Spectator. The

Bank and the Treasury — unlike

in 2007 - are co-ordinating

policy,and the Bank is wise to be

taking advantage of a “decade

of rebuilding bank balance

sheets” to raise the availability

of lending. It “materially”

reduces the “risk of a credit

shock to the economy”.

The Bank's “willingness to be

seen to be doing something is

understandable”, says AJ Bell,

but if the global economy tips

into a recession, despite 12

years of “extraordinarily loose

policy”, where will central

banks turn next? If markets

head south along with the

economy, claims that these

were “just emergency

measures” will look “pretty

threadbare. Trying to solve a

debt crisis by encouraging more

borrowing... has perhaps kept

the plates spinning for a bit

longer, but it has not provided a

sustainable base for the real

economy or financial markets”.

Well, at least the bazooka

“has not emptied the Bank’s

arsenal”, says Aldrick.

Bank boss Mark Carney has

previously suggested that there

is room for a further £120bn of

quantitative easing; interest

rates can be lowered to 0.1%.

moneyweek.com

ASK YO

THIS TONE

WOULD YOU LEND

YOU MONEY?

Why would you lend you money? Because you have character, determination,

you know where you’re going. You don’t just define success by the money

you have in the bank, but also by how much further you can go.

We like your view of you. Maybe you should talk to us about that loan.

6 Investec

Private Banking

Search: Redefining Success Call: +44 (0) 207 597 3540

YOUR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.

Minimum eligibility criteria and terms and conditions apply.

IC {

10

Politics & economics

Joe Biden poised for victory

The septuagenarian stages a surprising turnaround. Matthew Partridge reports

Following a “string of

commanding primary

victories”, Joe Biden,

77, the candidate for the

Democratic nomination

for US president, appears

poised to complete “one

of the most striking

turnarounds in recent

campaign memory”,

finding himself “in a

dominant position only

ten days after the first

state victory of his three

presidential runs”, say

Matt Flegenheimer and

Katie Glueck in The New

York Times. Having

won in the south, in

the northeast and in the midwest, as well in large

states and small ones, the former vice-president’s

position is so strong that any collapse “would

probably require a political U-turn as sharp as the

one that precipitated his rise”.

a

Fa

2)

E

5

oo)

6

Sanders wins the argument

The strength of Biden’s coalition and his “lopsided”

victories have prompted many Democrats to declare

the primary race over and call for Bernie Sanders,

Biden’s remaining opponent, to drop out, says Jim

Newell on Slate. Some have even suggested that the

party should “shut this primary down” and cancel

the remaining debates. If so, this would be a big

mistake. Although Biden’s victory is almost assured,

Sanders still has a lot of support among younger

voters and Latinos. Given that both blocs are

“integral” to victory in November, giving Sanders

a little time to make his own decision would be

something that they “will remember”.

Sanders’ supporters won’t come away empty

handed, as they have won the argument on many

issues, says Richard Wolffe in The Guardian. On

the key issue of health, for example, Sanders has

moved Biden further to the left on a publicly funded

Biden: they think it’s all over... it probably soon will be

healthcare option “than

he and Barack Obama

had ever supported

in office or on the

campaign trail in two

elections”. Indeed, if

the current coronavirus

crisis continues, the idea

of “widely available

public healthcare” may

well end up attracting

“overwhelming

support across the

political spectrum”.

Cometh the hour...

While the outcome

of the Democratic

primaries “is no

longer in much doubt”, the national contest is

only starting to hot up, says Edward Luce in

the Financial Times. Donald Trump and his

supporters have started flinging slurs about Biden’s

“mental health”, claiming that he “doesn’t know

where he is or what he’s doing”. This despite the

fact that there is no evidence Biden is suffering

from “anything other than ageing combined with

a life-long stutter”. Biden has responded in kind,

ridiculing Trump’s hyperbole.

As well as “incoming fire” from Trump and

his supporters, who claim Biden is “bumbling

and past his prime”, he may also face further

attempts by Republican senators to investigate his

son’s dealings in Ukraine, says Stephen Collinson

on CNN. Still, Biden is betting that the political

demands of the moment with respect to the

coronavirus outbreak might finally be lining up

for a “competent Washington veteran” with the

“lind of empathy that the current president lacks”.

At the risk of antagonising Sanders’ supporters,

he is moving his campaign onto a “presidential

footing” with speeches about the “gravity of the

moment”. He appears to believe he could “benefit

from a case of cometh the hour, cometh the man”.

Who will suffer from the oil glut?

Saudi ene:

Abdula.

OGetty Images

yin Salman Al Saud

Saudi Arabia’s decision to raise

oil production and sell it at

sharply discounted prices ata

time of declining oil demand “has

sent shock waves” through the

oil and stock markets, says Karen

Young in The Washington Post.

The price fall will hit Middle

Eastern countries that rely on

crude exports particularly hard.

Most Gulf nations have tried to

MonevWeek = 13 March 2020

end their dependence on oil, but

they have few alternative sources

of revenue. And the price falls

coincide with the Covid-19 crisis,

which “has seized business and

tourism activity globally”,

creating “a simultaneous

demand and supply shock”.

The oil-price collapse may

have “set a timebomb

underneath the economy” of

Saudi Arabia’s neighbours, but

ironically its old enemy Iran will

be less affected, says the

Financial Times. lran has bitterly

criticised the Saudi decision, but

Iranian production is already

severely constrained by US

sanctions, meaning the price war

is “less consequential” than it

would otherwise have been. Iran

analysts estimate that oil

shipments last year “probably

amounted to only a few

hundreds of thousands of

dollars, mostly to China”.

Oil producers across the

region will hope for a deal that

sends prices higher, but they

may be in for along wait, says

Clifford Krauss in The New York

Times. Saudi Arabia has the

lowest production costs of any

oil producer, meaning it can

operate profitably at low prices,

at least for a while. And Russia,

which Saudi claims undermined

the previous Opec agreement by

producing too much, can afford

to sit it out too. The “sudden

upheaval” in oil will claim victims

around the world, but who will

suffer most may yet “take

months to assess”.

Betting on

politics

Joe Biden’s triumph (see

left), combined with

Donald Trump’s

controversial handling of

the coronavirus

outbreak, have seen both

punters and bookies start

to edge away from the

incumbent US president.

The implied chances of

Trump’s re-election have

fallen from around 60% a

few weeks ago to

essentially being at even

money (50%). With

£18.3m matched, Betfair

has him at 1.99 (50.2%) to

be the next president,

while Ladbrokes has him

at 10/11 (52.3%).

While the state-by-

state markets aren't very

liquid at the moment,

they also seem to be

predicting a close

outcome in the electoral

college. Smarkets

currently has Trump as

favourite in several swing

states, putting him at

1.36 (73.5%) to win Ohio,

1.37 (73%) to win North

Carolina and 1.71 (58.4%)

to win Florida. It also put

the Democratic

candidate as favourite to

regain several rustbelt

states that voted for

Trump in 2016, putting

them at 1.49 (67.1%) in

Michigan, 1.67 (59.8%)

to win Pennsylvania

and 1.74 (57.4%) to

win Wisconsin.

It's always hard to

predict what will happen

in eight months’ time,

but I've always been

sceptical that Trump

could ever be re-elected

given his consistently

low approval ratings.

I suggest you take

Ladbrokes’ 2/7 (77.8%) on

the Democrats winning

Minnesota. The last time

this state voted

Republican in a presiden-

tial election was during

the Nixon landslide of

1972, with Hillary Clinton

comfortably defeating

Trump in 2016. The last

head-to-head poll, which

was taken back in

October, showed Biden

with a double-digit lead.

moneyweek.com