World horticultural trade & U.S. export opportunities / United States Department of Agriculture, Foreign Agricultural Service. PDF

Preview World horticultural trade & U.S. export opportunities / United States Department of Agriculture, Foreign Agricultural Service.

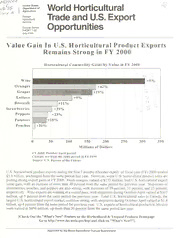

Historic, Archive Document Do not assume content reflects current scientific knowledge, policies, or practices. j-/D9£° 0 ' / „ United States World Horticultural \)(p 1 • Department of 5 Agriculture ■^y 3 J Trade and U.S. Export Foreign Agricultural Service Opportunities Circular Series FHORT 7-00 July 2000 Value Gain In U.S. Horticultural Product Exports Remains Strong in FY 2000 Horticultural Commodity Gains by Value in FY 2000 W ine Oranges Grapes Lettuce Broccoli Strawberries Peppers Potatoes Peaches 0 50 100 150 200 250 300 350 Millions of Dollars FY 2000: October-April period Changes are from the same period in FY 1999 Source: U.S. Bureau of the Census U.S. horticultural product exports during the first 7 months (October-April) of fiscal year (FY) 2000 totaled $5.9 billion, unchanged from the same period last year. However, some U.S. horticultural product sales are posting strong export gains in F Y 2000. Fresh oranges, valued at $ 173 million, lead U.S. horticultural export value gain, with an increase of more than 40 percent from the same period the previous year. Shipments of strawberries, peaches, and peppers are also strong, with increases of 39 percent, 31 percent, and 23 percent, respectively. Wine exports are running at a record pace, with shipments during October-April valued at $307 million, up 5 percent from the same period the previous year. Total U.S. horticultural sales to Canada, the largest U.S. horticultural export market, continue strong, with shipments during October-April valued at $1.8 billion, up 4 percent from the same period the previous year. U.S. exports of horticultural products to Mexico were valued at $494 million, up more than 30 percent from the same period last year. [Check Out the "What's New" Feature on the Horticultural & Tropical Products Homepage Go to http://www.fas.usda.gov/htp/ and click on "What's New?") Approved by the World Agricultural Outlook Board/USDA For further information, contact: U.S. Department of Agriculture Foreign Agricultural service Horticultural and Tropical Products Division 1400 Independence Ave., S.W. AG Box 1049 Washington, DC 20250-1049 Telephone: 202-720-6590 Fax: 202-720-3799 http://www.fas.usda.gov/htp Frank Tarrant, Director Robert B. Tisch, Deputy Director for Marketing Brian Grunenfelaer,Deputy Director for Analysis ANALYSIS Nancy Hirschhom 202-720-2974 Situation & outlook supervisor, publication editor, export forecast coordinator, briefing paper coordinator, key development coordinator Lisa Anderson 202-720-5028 Tree nuts, avocados, tropical fruit, nursery products, Canada snapback, NAFTA quarterly report, circular team Frank Hokana 202-720-0875 Coffee, sugar, trade questions on cocoa & spices Bob Knapp 202-720-4620 Canned deciduous fruit, kiwifruit, special projects Shari Kosco 202-720-9792 Table grapes/grape juice, wine/brandy, circular team Emanuel McNeil 202-720-2083 Fresh & processed vegetables (excl. potatoes), cut flowers Debra A. Pumphrey 202-720-8899 Fresh and processed citrus, essential oils, U.S. tea trade & information technology coordinator Karina Ramos 202-720-6877 Dried fruit, berries, beer/hops, melons, circular team & homepage coordinator Sam Rosa 202-720-6086 Fresh deciduous fruit, trade issues database coordinator, apple juice, olives, mushrooms Christine Sloop 202-690-2702 SPS/food safety/quality issues coordinator, biotechnology issues, bilateral technical & policy issues Janise Zygmont 202-720-1176 Organics (analysis & marketing) MARKETING Steve Shnitzler 202-720-8495 Apricots, avocados, ginseng, pomegranates, bartlett pears, ginseng Ted Goldammer 202-720-8498 Citrus, potatoes (marketing & analysis), hops Sonia Jimenez 202-720-0898 Fresh deciduous fruit Kristin Kezar 202-690-0556 Tart cherries, honey (marketing), canned fruit, papaya, watermelon Elizabeth Mello 202-720-9903 Vegetables, berries Ingrid Mohn 202-720-5330 Tree nuts Elias Orozco 202-720-6791 EMO/Cochran Coordinator, HTP Homepage & honey (analysis) Kelly Strzelecki 202-690-1341 Dried fruit, kiwifruit Yvette Wedderbum 202-720-0911 Wine, brandy, credit programs, grape juice, table grapes Bomersheim July 2000 2 World Horticultural Trade & U.S. Export Opportunities Table of Contents PAGE FEATURE ARTICLES: World Raisin Situation & Outlook. 5 Processed Tomato Products Situation and Outlook in Selected Countries. 11 WORLD TRADE SITUATION AND POLICY UPDATES: Australia Opens Market to U.S. Pacific Northwest Cherries. 19 Taiwan Lifts Excessive Pesticide Sampling of Washington State Apples Effective June 18th. 19 Korea’s Market is Ripe for U.S. Wine Exports. 19 New Zealand Wine Production and Exports To Continue Rapid Expansion . 20 Argentine Citrus To Be Allowed into the United States. 20 USDA Establishes Quarantine Zone for Plum Pox. 21 EPA Proposes Revoking Methyl Parathion Tolerances. 21 FAS Report on the EU Fruit and Vegetable Regime 2000 . 21 Mexico Lifts Quarantine on California Plums. 22 History of the WTO Sanitary and Phytosanitary Agreement.22 ORGANIC UPDATES: Organic Trade Association Receives Export Promotion Funds .24 Japan Introduces New Organic Standards. 24 Danish Eye Organic Export Opportunities . 24 EXPORT NEWS AND OPPORTUNITIES: GSM-102: No Activity Since Last Publication. 25 Supplier Credit Guarantees Available to Developed/Mature Markets: Taiwan . 26 STATISTICS: Raisins: Production, Supply, and Distribution. 8 U.S. Exports of Raisins . 9 U.S. Imports of Raisins . 10 Production of Processing Tomatoes in Selected Countries. 14 Canned Tomatoes: Production, Supply, and Distribution in Selected Countries . 15 Tomato Paste: Production, Supply, and Distribution in Selected Countries. 16 U.S. Exports: Canned Tomatoes, Ketchup, Tomato Paste and Sauce. 17 U.S. Imports: Canned Tomatoes, Ketchup, Tomato Paste and Sauce. 18 FY 2000 GSM-102 Coverage. 28 FY 2000 Supplier Credit Guarantee Coverage . 29 Top United States Horticultural Product Exports By Value and Volume. 30 Top United States Horticultural Product Imports By Value and Volume. 31 Selected Horticultural Crop Prices Received by U.S. Growers. 32 U.S. Horticultural Product and Market Export Summaries . 33 U.S. Exports of Selected Horticultural Products Summary . 34 By Country of Destination. 36 U.S. Imports of Selected Horticultural Products Summary. 42 By Country of Origin. 44 July 2000 3 World Horticultural Trade & U.S. Export Opportunities To access FAS Attache Reports online, please reference the following Internet address: http ://www. fas .usda. go v/scripts w/attacherep/default. asp Search through the country and market reports prepared by FAS attaches covering over 20 horticultural and tropical product commodities and nearly 130 countries. Search by keyword, including country and commodity. Cocoa and Honey Reporting Coverage Discontinued Beginning with the June, 2000, Tropical Products: World Markets and Trade Circular and the November, 2000, Sugar: World Markets and Trade Circular, commodity and country analysis and statistical tables for cocoa and honey will be discontinued. This decision was necessitated due to declining Foreign Agricultural Service budget resources and the need to more strategically target remaining resources in support of the agency's primary mission to facilitate the expansion of export opportunities for U.S.-produced agricultural commodities. The Horticultural and Tropical Products Division (HTP) expects to continue to receive voluntary reporting on cocoa and honey production and trade from an abbreviated number of countries and these will continue to be posted on the FAS and HTP Home Pages upon receipt. What’s New on the Homepage? The Horticultural & Tropical Products Division has introduced an enhanced feature on its homepage designed to bring the latest information to the public as efficiently as possible. The site will contain information on policy and technical developments affecting trade in horticultural commodities, as well as selected reports submitted by FAS overseas offices and special reports prepared by the division. The information will typically remain on the site for approximately one month, before being archived. For further information on this new feature, please contact Nancy Hirschhom (202) 720-2974. Go to http://www.fas.usda.gov/htp/ and click on "What's New?" Export Summary U.S. exports of horticultural products to all countries in April totaled $820 million, up slightly from the same month a year earlier. Seven of the 15 product categories registered value increases. Categories with the most significant increases in April were citrus (up $22.6 million or 48 percent) and hops (up $2.6 million or 42 percent). The categories with the most significant decreases were fruit and vegetable juices (down $15.3 million or 20 percent) and tree nuts (down $9.9 million or 15 percent). For FY 2000 to date (October- April), the total value of U.S. horticultural exports was $5.9 billion, slightly down from the same period in FY 1999. July 2000 4 World Horticultural Trade & U.S. Export Opportunities World Raisin Situation and Outlook Raisin production in selected countries is expected to fall in 1999/2000, for the second consecutive year. Smaller raisin crops in Chile, South Africa, Greece, Turkey and Mexico in 1999/2000 will lead to a 4 percent decline in world raisin production. Only Australia and the United States are expected to post increases in raisin production during 1999/2000. As a result of the smaller raisin crop, exports for selected countries are expected to be down 8 percent to 365,000 tons in 1999/2000. Australia is the only country that estimates a significant increase in exports. Australia’s raisin exports are forecast to rise 87 percent to 10,000 tons, still far below the average level of raisin exports. Southern Hemisphere Australia The 1999/2000 (March 2000 - February 2001) raisin crop is expected to rise by 48 percent to 32,500 tons. Recent developments in production techniques, such as trellis drying, are driving this increase in production. At the same time, winemakers, which had been purchasing sultana grapes for the production of certain types of wine, have greatly reduced their intake of sultana varieties. This alone is expected to increase the supply of raisins by 4,000 to 5,000 tons. Despite this increase, raisin production is still not expected to reach the record level achieved in 1997/98. Raisin production in 1998/99 was changed from 20,700 tons to 22,000 tons in line with revised industry estimates. Unfavorable weather during 1998/99 led to a 43 percent decline in production compared to 1997/98. Exports during 1999/2000 are expected to reach 10,000 tons, up 87 percent from 1998/99 as a result of the larger than expected raisin crop. Raisin exports fell in 1998/99 by 63 percent to 5,337 tons due to a sharp reduction in production. The major export markets in 1998/99 were Canada, Germany, New Zealand, the United Kingdom and Japan. Raisin imports increased 11 percent in 1998/99 to 12,714 tons, but with greater production expected in 1999/2000, raisin imports are forecast to decline by 10 percent to 11,500 tons. Turkey continues to be the largest supplier of raisins in Australia, with 55 percent of the market. Chile Raisin production is forecast down 14 percent to 31,000 tons in 1999/2000 (January 2000 - December 2000) as a result of a significant decline in export prices due to weak export demand. Weak demand has also caused prices for discarded grapes, which are dried for raisins, to fall in 2000 from an average of U.S. $0.20 per kg to U.S. $0.10 per kg. July 2000 5 World Horticultural Trade & U.S. Export Opportunities During 1998/99, raisin production was significantly higher than initially estimated and 29 percent above the previous year. Raisin production had been expected to decline in 1998/99 due to smaller table grape production and increased competition by the wine and juice concentrate industries for grapes discarded by the fresh fruit industry. However, there was less competition from the wine industry in light of increasing production by newly planted vineyards dedicated to wine grapes. Higher raisin prices together with a strong export demand also had a positive effect on total raisin production during 1998/99. Exports are expected to fall by 17 percent to 27,000 tons in 1999/2000 due to a decline in raisin production. Over 90 percent of Chile’s raisin production is exported. The largest destinations for Chile’s raisins are the United States, Mexico, Brazil, Peru and Colombia. Chile does not import raisins. South Africa Raisin production is forecast to decline by 11 percent in 1999/2000 (January 2000 - December 2000) as a result of poor weather conditions during the fruit drying period. Production is expected to reach 36,000 tons in 1999/2000 compared to 40,438 tons in 1998/99. Exports during 1999/2000 are expected to increase slightly to about 26,500 tons. The European Union is South Africa’s major export destination point for agricultural products, including dried fruit. South Africa’s major markets duringl998/99 were the United Kingdom, the Netherlands, Germany, Canada, France and Japan. Under the EU-South African Free Trade Agreement, South African dried fruit will soon be subject to preferential tariff quotas in the European market. However these products will not have duty free entry that other South African products will eventually enjoy. Northern Hemisphere Greece The 1999/2000 raisin crop (September 1999 - August 2000) has been revised downwards to 22,500 tons, a 20 percent decline from the previous year. Hot and dry conditions during the growing period combined with wet weather during the fruit drying period negatively affected the quality and output of the 1999/2000 raisin crop. Raisin production in 1998/99 has also been revised down to 28,000 tons and was of good quality. Raisin exports are expected to fall from 24,000 tons in 1998/99 to 22,000 tons in 1999/2000. Greece’s official trade data reports that in 2000, raisin exports to Australia have increased sharply. During 1998/99 major markets for Greece’s raisins were Germany, the Netherlands, the United Kingdom, France, Poland and Canada. July 2000 6 World Horticultural Trade & U.S. Export Opportunities Turkey Raisin production during 1999/2000 (September 1999 - August 2000) remains unchanged from the earlier forecast of 190,000 tons. After two consecutive years of excellent crops and record highs, raisin production is thus expected to fall by 24 percent during 1999/2000 compared to the previous year. Crop disease and hail in some producing areas resulted in smaller and lower quality raisins. Exports during 1998/99 are expected to be up slightly from 186,700 tons to 190,000 tons, despite the small crop. Between September 1999 and April 2000, the largest destinations for Turkey’s raisins were to the United Kingdom, Germany, the Netherlands and Italy. Imports are expected fall from 3,131 tons in 1997/98 to 3,000 tons in 1998/99, a 4 percent decline. The import duty for raisins in 2000 is 57.3 percent of the CIF value on raisin imports. United States Raisin production in 1999/2000 has been revised up from 267,183 tons to 297,557 tons, up 18 percent from the previous year. Exports are estimated to fall 23 percent in 1999/2000 to reach 85,000 tons as a result of strong domestic demand and low stock levels. Year to date (August 1999 - April 2000) raisin exports are 60,000 tons. Major markets for U.S. raisins include Japan, the United Kingdom, Canada, Sweden and Denmark. Imports are also estimated to fall from a high of 24,750 tons in 1998/99 to 18,000 tons in 1999/2000, as a result of the larger raisin crop. For the 2000/01 marketing year (August 2000-July 2001), the Raisin Administrative Committee (RAC) has received a budget ceiling of $2.07 million to market California raisins under the Market Access Program (MAP). MAP funding is allocated for the same markets targeted in 1999/2000 and include China, Hong Kong, Japan, Malaysia, Philippines, Scandinavia (Denmark, Finland, Norway, and Sweden), Singapore, Taiwan, and the United Kingdom. The RAC’s primary objectives in these markets are to increase consumer and trade awareness of the quality of California raisins, and to show the product’s versatility in baking and cooking. (The FAS Attache Report search engine contains reports on the Dried Fruit industries for 6 countries, including Australia, Chile and South Africa. For information on production and trade, contact Karina Ramos at 202-720-0897. For information on marketing contact Kelly Strzelecki at 202-690-1341.) July 2000 7 World Horticultural Trade & U.S. Export Opportunities RAISINS: PRODUCTION, SUPPLY, AND DISTRIBUTION (METRIC TONS) Marketing Years 1996/97 - 1999/2000 Country/ Marketing Beginning Domestic Year 1/ Stocks Production Imports Exports Consumption 2/ Ending Stocks NORTHERN HEMISPHERE Greece 1996/1997 1,930 33,000 500 28,500 3,000 3,930 1997/1998 3,930 38,000 2,000 37,000 4,000 2,930 1998/1999 2,930 28,000 4,000 24,000 4,500 6,430 1999/2000 6,430 22,500 3,500 22,000 5,000 5,430 Turkey 1996/1997 22,872 200,000 8,2% 163,895 52,000 15,273 1997/1998 15,273 240,000 3,090 192,770 37,000 28,593 1998/1999 28,593 250,000 3,131 186,700 30,000 65,024 1999/2000 65,024 190,000 3,000 190,000 30,000 38,024 Mexico 1996/1997 0 16,000 8,000 10,000 14,000 0 1997/1998 0 18,000 6,130 7,265 16,865 0 1998/1999 0 22,000 4,474 13,142 13,332 0 1999/2000 0 15,000 3,500 5,000 13,500 0 United States 1996/1997 123,373 282,588 11,684 117,816 209,889 89,940 1997/1998 89,940 388,729 11,194 120,614 222,976 146,273 1998/1999 146,273 251,290 24,750 110,688 213,415 98,210 1999/2000 98,210 297,557 18,000 85,000 229,767 99,000 Total Northern Hemisphere 1996/1997 148,175 531,588 28,480 320,211 278,889 109,143 1997/1998 109,143 684,729 22,414 357,649 280,841 177,7% 1998/1999 177,7% 551,290 36,355 334,530 261,247 169,664 1999/2000 169,664 525,057 28,000 302,000 278,267 142,454 SOUTHERN HEMISPHERE Australia 19%/1997 17,720 24,750 8,518 15,029 31,959 4,000 1997/1998 4,000 38,500 11,481 14,485 32,196 7,300 1998/1999 7,300 22,000 12,714 5,337 33,377 3,300 1999/2000 3,300 32,500 11,500 10,000 32,500 4,800 Chile 1996/1997 1,820 33,000 0 28,279 3,500 3,041 1997/1998 3,041 27,820 0 27,017 3,500 344 1998/1999 344 36,000 0 32,563 3,500 281 1999/2000 281 31,000 0 27,000 3,500 781 South Africa; Republic of 1996/1997 15,588 38,889 0 30,183 13,988 10,306 1997/1998 10,306 27,063 0 20,200 11,425 5,744 1998/1999 5,744 40,358 0 26,400 12,600 7,102 1999/2000 7,102 36,000 0 26,500 12,500 4,102 Total Southern Hemisphere 1996/1997 35,128 %,639 8,518 73,491 49,447 17,347 1997/1998 17,347 93,383 11,481 61,702 47,121 13,388 1998/1999 13,388 98,358 12,714 64,300 49,477 10,683 1999/2000 10,683 99,500 11,500 63,500 48,500 9,683 Grand Total 1996/1997 183,303 628,227 36,998 393,702 328,336 126,490 1997/1998 126,490 778,112 33,895 419,351 327,962 191,184 1998/1999 191,184 649,648 49,069 398,830 310,724 180,347 1999/2000 180,347 624,557 39,500 365,500 326,767 152,137 1/ Northern Hemisphere marieeting years begin August 1, and Septentier 1 in Turkey. Marketing years for Southern Hemisphere raisins, (which are harvested early in the second ofthe split years shown) begin Jan. 1. and March 1 in Australia 2/ Domestic consunption figures include raisins used for feed and distillation purposes. 3/ inpons include cunants. U.S. production datahavebeen converted to apacked weight basis in orderto align themwith the other supply and distribution statistics. July 2000 8 World Horticultural Trade & U.S. Export Opportunities