Wired USA - June 2022 PDF

Preview Wired USA - June 2022

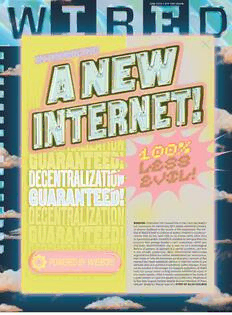

JUNE2O22 OFF THE CHAIN We’ve been in millions of homes. Now we’re at your fi ngertips. As the #1 most installed fi re safety brand in North America*, Kidde is continuously innovating to give homeowners more power to protect their homes and families. Our new line of smart home safety products helps defend against smoke, carbon monoxide, indoor air quality issues, water leaks and freezes. Plus, the devices use the Kidde HomeSafe™ feature to connect with the Kidde app for instant notifi cations, even when you’re not at home. It’s a smarter approach to home safety. Visit us at Kidde.com/SaferHomeToday In partnership with CONTENTS PHOTOGRAPH BY MEIKO TAKECHI ARQUILLOS 3O.O6 P. 7 6 Features Fast, Cheap, and Out of Control p.46 Paradise at the p.60 The End of p.68 Your Brain Is Crypto Arcade Alcohol the Platform Shein has become one of Glamorous influencers Monitoring neural patterns. cover story The Web3 movement wants are blending science and Detecting seizures. Tracking the largest fast-fashion to liberate us from Big Tech superstition to help people sleep states. A startup companies on the planet and exploitative capitalism— “change their relationship called NextSense is building and a staple in Zoomer and to do it using only the to drinking.” Did I miss out earbuds that can eavesdrop blockchain, game theory, and by getting sober the old- on the mind—even if closets. But critics code. What could possibly fashioned way? scientists are still figuring R O worry that the Chinese AYL go wrong? by Virginia Heffernan out what the data means. Y T company’s incredibly by Gilad Edelman by Steven Levy M A BY low prices might come G N YLI at an unacceptable cost. T P S O by Vauhini Vara R P 0 0 3 Branded content provided by Buzz DIARY OF AN ENTREPRENEUR Even by the standards of startups in the technology obsessed Middle East, the growth of Buy Now Pay Later (BNPL) provider Tamara has exceeded all expectations. Launched in September 2020 in Riyadh, Saudi Arabia, by serial entrepreneur Abdulmajeed Alsukhan and partners Turki Bin Zarah and Abdulmohsen Albabtain, after just four months Tamara closed $6 million of funding in the largest seed round in the country’s history. In April the startup topped that in style by raising no less than $110 million in a record-breaking Series A round led by global payments provider Checkout.com. Like many ecommerce companies around the world, Tamara is benefitting from the massive rise in online consumer spending that has taken place during the pandemic. Its BNPL solution allows consumers to pay for products in installments, without incurring any interest charges. The company’s revenues come from fees paid by merchants, who have fallen over themselves to partner with Tamara and offer their customers an innovative and intuitive way to buy big-ticket items, both online and in-store. Co-founder Abdulmajeed says that the pandemic is not the only reason for Tamara’s rapid growth rate or its appeal to global investors. Authorities are also giving local startups all the support they need to roll out innovative services to Saudi Arabia’s young, aspirational and tech-savvy population. In Tamara’s case, the company was the first BNPL firm to be enrolled in the Saudi Central Bank’s sandbox program, where fintechs are given free rein to turn bright Branded content provided by Buzz “ For me as an entrepreneur and for Tamara as a company, raising money is not the objective. Our objective is to deliver the best “ products, delight our customers, and change the world. Abdulmajeed Alsukhan For consumers, Tamara’s CEO and co-founder of Tamara mobile app is a compelling alternative to credit cards and cash ideas into licensed businesses. What is the secret to loved by their customers. But new “The government knows that you Tamara’s success? fintech brands are building a people- can’t expect major innovations We help people budget for their first culture from the beginning. from incumbent companies, so purchases. Sometimes people have Tamara is at the forefront of this it is empowering tech startups events coming up or products they trend. We are determined to make like Tamara,” Abdulmajeed says. want to buy that require a higher that change in the financial industry. budget. They can use Tamara Flush with cash and buoyed by to split that cost into smaller How does BNPL empower supportive regulations, Tamara payments. We are a trustworthy merchants? is expanding rapidly across the financial partner for our customers. Tamara enables consumers to entire Gulf region and beyond. purchase a higher ticket value. The “The market is incredibly receptive, We are not a credit card company. ticket size of an item bought using but BNPL is still a nascent We don’t make money if customers Tamara is 80% higher than any other phenomenon,” Abdulmajeed says. are late – in fact, we lose money. The payment method. We also allow “There is huge room for growth.” way we make money is to integrate people to buy more of their favorite with merchants so that we are one brands. Our merchants are seeing an of the options at checkout. When increase in completed online sales you buy an item from one of our and a huge increase in their top lines. TAMARA IN NUMBERS merchant partners, you see Tamara alongside the global payment brands. How is the startup culture in Saudi Arabia developing? Why do you think Saudis have Five years ago, no-one in Saudi adopted BNPL so enthusiastically? Arabia really knew what a startup was. Banks and other service providers Now we are seeing multiple venture used to take their customers capital funds across the region. The for granted. Service quality was change that has happened here has low, without innovation or new been tremendous. There is a new products that matched daily needs. wave of startups in the country. There is no better time than now Now the country is at an inflection to start something. This is one of point. Saudi Arabia and the Gulf the missions of Tamara. We want region in general has one of the to show people in the region that highest rates of penetration and they too can develop successful, growth in BNPL. Traditional financial innovative businesses. Stories service providers like banks are not like ours will inspire them. CONTENTS 30.06 p.20 On the Cover p.22 p.30 Illustration by Start Posts Patrick Savile p.24 Documenting the Petunia Carnage We wanted to present this p.11 There Is No Photograph by Klaus Pichler p.34 Q&A: Bill Gates Is So month’s big story about Culture War Over This Pandemic Web3 by connecting today’s by Virginia Heffernan p.26 The Last Cell The acerbic optimist thinks crypto evangelists to earlier Tower in Mariupol anxious people (like me) should generations of digital utopians. get a grip and move on. So we asked London-based p.16 The Root of All by Matt Burgess by Steven Levy artist Patrick Savile to imagine Internet Evil a somewhat retro, gleaming by Paul Ford p.28 Cloud Support: p.38 Dreams of a Y E N pop-up ad in the metaverse—a Can Social Media Be Black Futurist HIT W statement of Web3’s boldest, Redeemed? AM p.20 Growing Meals for In a new sci-fi story collection, N, S most truly appealing HI Future Martians by Meghan O’Gieblyn singer, actor, and now writer H S promises—and leave plenty of Janelle Monáe updates Afro- EP S O room for the fine print. by Amit Katwala futurism for our dystopian age. É, J N Gear by Mary Retta HÉ C S A M p.22 The New O H T Spreadsheet Revolution p.88 Six-Word OP: T p.30 Health Sci-Fi OM R by Clive Thompson and Fitness SE F Very Short Stories WI K Essentials by wired readers LOC C 0 0 6 Free Financial Tools Wealth Management RANTS AND RAVES 3O.O6 Readers share their cultural convictions and righteous indignation. RE: “I’M THE OPERATOR” person charged. But in a dark irony, problem space, of unknown her attorneys’ strategy attacks shape and depth. —JP LeBreton I was a manager in Uber’s self- Herzberg as well as Uber and reads (@vectorpoem), via Twitter driving group at the time of the like a full bingo card of victim blam- incident. The company stressed ing. This is the perfect ironic mirror RE: “CASTE AWAY” “not having a culture of blame” for how the story, in appropriately after the fatality. This rang hollow, focusing on Vasquez as a victim, I come from the same Indian given that the people espousing also (unwittingly, I think) uses lan- state as Siddhant and speak the it were likely most at fault. I never guage and framing that makes the same Indian language, so I under- imagined that “no blame” would primary victim—Herzberg—a key stand quite well how dalits are morph into “no consequence” for contributor to her own death. —Joe treated. My father came from executives. We as a society are Lindsey (@joelindsey), via Twitter an underprivileged rural fam- willing to take away four to eight ily. Dr. Ambedkar took a chance years of life from the most vul- In 2020, as part of a systems engi- on him when he was just a broke nerable person in the situation. Is neering masters program, I eval- kid in search of higher education that justice? Maybe. But to say that uated how “trust in autonomy” and a better life. That act of kind- not a single executive should’ve played a role in the Uber incident. ness by Dr. Ambedkar 70 years ago been removed over this incident I found no indication that engi- changed the entire trajectory of certainly doesn’t seem right. neers were designing with trust our family for generations to come. —Former Uber manager in mind, and I came to the con- —Santosh Kulkarni, via email clusion that the operator over- There’s a troubling theme in this trusted the system. Humans are by My heart goes out to Siddhant. story that subtly perpetuates a nature prone to fatigue and distrac- As an Indian immigrant to the US, false narrative about the crash: tion; indeed, this is the very prob- I know the caste system and its that Elaine Herzberg was partly to lem that self-driving is supposed to pernicious role in Indian society blame for her own death. Smiley ameliorate. The idea that an oper- all too well. Growing up in a doesn’t connect the dots for the ator can now somehow compen- Brahmin family, I’ve benefited reader—that a person experienc- sate for the very behavior we are immensely from this system. In ing homelessness, needing a place trying to address through technol- some ways, it is the Hindu equiva- to charge a phone, in an environ- ogy remains an unacknowledged lent of the born-a-sinner idea ment that gave, at best, mixed sig- and glaring contradiction. I fear in some strands of Christian- nals on whether it was OK to cross Miss Vasquez may be just another ity. I do wonder how many of there, did exactly that. It’s deeply scapegoat for a society unwilling the “higher-caste” Indian immi- wrong that Vasquez is the only to address its deeper issues. grants who complain about —Stephen Bell, via email racial discrimination in the US RE: “I'M THE OPERATOR” turn around and discriminate The industry’s framing is that against dalit Indian immigrants. “Read this brilliant piece autonomous vehicles “make fewer The caste system needs to be mistakes” than humans, but the smashed to smithereens, but far truth is that they make classes of too many people in power bene- and tell me we don't need mistakes that humans never would. fit from its perpetuation. —Kumar It is a new and entirely separate Vemaganti, via email more EQ in tech.” A Z AI R A DY SI S A C —Mahmood Hikmet (@MoodyHikmet), via Twitter GET MORE WIRED BY H All wired stories can be found online, but only subscribers AP R get unlimited access. If you are already a print subscriber, G O T you can authenticate your account at wired.com/register. HO P 0 0 8