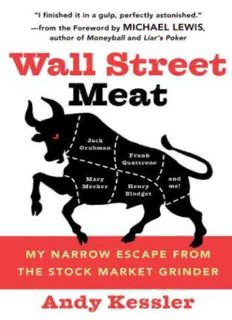

Wall Street Meat: My Narrow Escape from the Stock Market Grinder PDF

Preview Wall Street Meat: My Narrow Escape from the Stock Market Grinder

My Narrow Escape from the Stock Market Grinder ANDY KESSLER For Nancy and the Boys Contents Foreword by Michael Lewis v Introduction 1 CHAPTER 1 Right 51% of the Time 5 CHAPTER 2 Piranhas 19 CHAPTER 3 You’re in the Entertainment Business 41 CHAPTER 4 Bull Run 50 CHAPTER 5 Time to Get Serious 70 CHAPTER 6 Wheeling and Dealing at Morgan 88 CHAPTER 7 Up, then Tanked 114 CHAPTER 8 Kicking Off the ’90s 121 CHAPTER 9 Something about Mary 132 CHAPTER 10 Netscape IPO 165 CHAPTER 11 Quacking Ducks 172 CHAPTER 12 Price Targets as a Marketing Tool 181 CHAPTER 13 Synthetic Goldman Sachs 195 CHAPTER 14 The Ax Syndrome 209 CHAPTER 15 Spitzer Fixer 219 Afterword 233 Index 247 About the Author Credits Cover Copyright About the Publisher Foreword by Michael Lewis J ack Grubman, Frank Quattrone, Mary Meeker, and Henry Blodget, were Wall Street’s best-known promoters of the Internet- telecom boom. A few years ago, they were spoken of in a single breath, and in flattering tones, but those times now feel as ancient as Mesopotamia. For more than a year, New York Attorney General Eliot Spitzer has made as good a political living off the three men as has ever been made on Wall Street. All three are meeting grisly ends. Spitzer rooted out and publicized a few of Blodget’s old emails, in a way that anyone who followed Blodget’s career knew badly distorted the man’s motives and character. Now Blodget is the subject of a NASD probe that may lead to a life- time ban from the securities industry and a multimillion-dollar fine. Grubman, the Caliban of Wall Street, has been fined $15 mil- lion and banished not merely from the securities industry but Foreword from New York City’s private kindergartens, too. And while Quattrone was charged in March 2003 with obstructing a probe of Credit Suisse First Boston, he faces the threat of penalties even worse than Grubman’s. Meeker is the exception. She has not been fined, banned, or even asked by her employer, Morgan Stanley, to take a paid vacation. Spitzer seems to have abandoned whatever interest he had in ruining her career, or in singling out Morgan Stanley for its role in the boom. And Morgan Stanley’s executives have clearly decided to stick by their most famous analyst. In early April, at the Mor- gan Stanley annual meeting, shareholder advocate Evelyn Y. Davis, a character made to order for some Hollywood screen- writer, used Meeker as a club to beat Morgan Stanley Chief Executive Officer Phil Purcell. Davis pointed out that “a lot of people lost money because of her. She should be fired.” But while Purcell wilted beneath other blows from the 73-year-old Davis, he stood right up to her on the subject of Meeker. “We have a very different view of the contribution Mary made,” he replied. “She was a pioneer on the Internet. We value her research.” It’s a curious situation, and it becomes a great deal more curious when you read this deliciously naughty book, Wall Street Meat. Andy Kessler is a fellow I’ve known for some time, but I had no idea he was writing a book. One dark day the thing just showed up on my desk, and I breathed a heavy sigh—another goddamn friend had gone and written another goddamn book, and I was going to have to at least pretend to read the goddamn thing. vi Foreword To slake my conscience, I picked it up and read a few pages. My heart sank. It wasn’t bad enough to put down and lie about having read it. I read a few more pages . . . and a few more. I finished it in a gulp, perfectly astonished. Kessler, a former Wall Street technology analyst, worked with Grubman at Paine Webber Group Inc. and Meeker and Quattrone at Morgan Stanley. He finally quit in the 1990s to make a fortune putting money where his mouth was, actually investing in technology companies. He was right there, on the inside. He knew exactly how the Wall Street machine worked. Having made his fortune, he now seems to feel free to say what he wants about his former firms and old colleagues. What he has to say will not particularly please them, but that is nei- ther here nor there. It will interest the rest of us. Wall Street Meat shows what the essential problem of Wall Street research was—as most people now know—that it ceased to serve investors and began to serve investment bankers. Investors no longer paid the investment banks well enough so that they could afford to produce honest research, and so the investment banks figured out how to use their research to help the corporations that paid them far better. And the invest- ment bank that forged this dubious new model was . . . Morgan Stanley. When Kessler quit Paine Webber to join Morgan Stanley, he only moved about a hundred yards down the street. But in that little distance, he traveled from an old and dying Wall Street to a new and thriving one. At Morgan Stanley, Kessler learned that he would be paid not by the brokers but by the bankers—and that the banker who would make the most difference to him was Quattrone. vii Foreword Quattrone soon would leave Morgan Stanley, first for Deutsche Bank and then for Credit Suisse First Boston, but not before he found and created an analyst who, in Kessler’s view, was a) desperate to be one of the boys, b) free of useful investment ideas, and c) willing to define her job as the pleas- ing of corporations that issued securities rather than investors who bought them. That analyst was Meeker. To Kessler, it seems clear that Meeker was particularly sus- ceptible to her investment bankers because she had nothing interesting to say to her investors. There are a lot of theories to explain why Spitzer let Meeker be. One is that it doesn’t pay for a politician to beat up women in public. Another is that Morgan Stanley’s tech people some- how erased most of their old emails, and so Spitzer was unable to humiliate the firm with its own watercooler chat. (CSFB, which was far less central than Morgan Stanley to the Internet boom, wound up coughing up 10 times more email to Spitzer’s office.) Or perhaps Spitzer found nothing to suggest that in promoting the likes of Women.com Networks Inc. and Home- Grocer.com, Meeker ever had anything other than investors’ interests at heart. Regardless of which theory you believe, Kessler makes one thing clear: Morgan Stanley, and Meeker, knew no other way of doing business. In his view, Morgan Stanley, having no tradition of pleasing investors, and no ability to do so, designed its investment bank without the investor in mind. Meeker and her bosses didn’t know enough to have a guilty conscience when they sold out investors to please corporations. In a game like this, that’s a huge advantage. viii

Description: