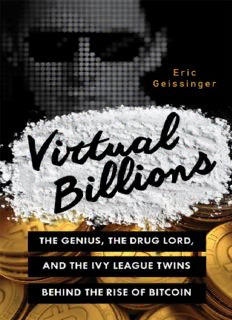

Virtual Billions: The Genius, the Drug Lord, and the Ivy League Twins behind the Rise of Bitcoin PDF

Preview Virtual Billions: The Genius, the Drug Lord, and the Ivy League Twins behind the Rise of Bitcoin

Published 2016 by Prometheus Books Virtual Billions: The Genius, the Drug Lord, and the Ivy League Twins behind the Rise of Bitcoin. Copyright © 2016 by Eric Geissinger. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, digital, electronic, mechanical, photocopying, recording, or otherwise, or conveyed via the Internet or a website without prior written permission of the publisher, except in the case of brief quotations embodied in critical articles and reviews. Cover image © Shutterstock Cover design by Nicole Sommer-Lecht Trademarked names appear throughout this book. Prometheus Books recognizes all registered trademarks, trademarks, and service marks mentioned in the text. Every attempt has been made to trace accurate ownership of copyrighted material in this book. Errors and omissions will be corrected in subsequent editions, provided that notification is sent to the publisher. Inquiries should be addressed to Prometheus Books 59 John Glenn Drive Amherst, New York 14228 VOICE: 716–691–0133 FAX: 716–691–0137 WWW.PROMETHEUSBOOKS.COM 20 19 18 17 16 5 4 3 2 1 The Library of Congress has cataloged the printed edition as follows: Names: Geissinger, Eric, 1968- Title: Virtual billions : the genius, the drug lord, and the ivy league twins behind the rise of bitcoin / Eric Geissinger. Description: Amherst, NY : Prometheus Books, 2016. | Includes index. Identifiers: LCCN 2016007396 (print) | LCCN 2016012216 (ebook) | ISBN 9781633881440 (hardback) | ISBN 9781633881457 (eBook) Subjects: LCSH: Electronic funds transfers. | Bitcoin. | Electronic commerce--History. | BISAC: BIOGRAPHY & AUTOBIOGRAPHY / Business. | BUSINESS & ECONOMICS E-Commerce General (see also COMPUTERS Electronic Commerce). | BUSINESS & ECONOMICS Money & Monetary Policy. Classification: LCC HG1710 .G45 2016 (print) | LCC HG1710 (ebook) | DDC 332.1/78--dc23 LC record available at http://lccn.loc.gov/2016007396 Printed in the United States of America I made a mistake in presuming that the self-interests of organizations, specifically banks and others, were such as that they were best capable of protecting their own shareholders and their equity in the firms. —Alan Greenspan, October 24, 2008, to Congress It's a bubble. It has to have intrinsic value. You have to really stretch your imagination to infer what the intrinsic value of Bitcoin is. I haven't been able to do it. Maybe somebody else can. —Alan Greenspan, December 4, 2013, in an interview with Bloomberg Introduction: Spending Symbols and Buying Potatoes Chapter 1: Satoshi Nakamoto: What He Invented Chapter 2: Satoshi Nakamoto: How Bitcoin Works Chapter 3: Satoshi Nakamoto: A Rocket-Powered Launch Chapter 4: Ross Ulbricht: Into the Dark Chapter 5: Ross Ulbricht: The Rise and Fall of Silk Road Chapter 6: The Winklevoss Twins: Born on Third Base, Hit a Double Chapter 7: The Winklevoss Twins: The Fog of Success Conclusion: Incremental Progress Acknowledgments Notes Index Note: According to general but not yet unanimous online agreement, Bitcoin (singular, capital B) is the name of the currency, the network supporting the currency, and the payment system in general. A single bitcoin or collection of bitcoins (referring to units of the currency) uses the lower case. For example, “I sure love Bitcoin, and I bought ten bitcoins yesterday.” On January 1, 2010, all the bitcoins in the world could be had for less than a cent. By July 1, 2013, they were worth nine billion dollars. Growth at this rate is historically unprecedented: Bitcoin easily outpaced Facebook, Twitter, Microsoft, and every other technology company in its rush to a multibillion- dollar capitalization. Back in 1997, the New York Times called a similar technology boom the “Internet Gold Rush,”1 as companies monetized information, sold online advertising, and made their storefronts virtual. It was slow going at first: “Digital miners are meeting with spotty success,”2 the paper reported, with most of the big money made by companies selling internet access and hardware (primarily routers and cables). This soon changed. Once the internet's backbone had been built, a bonanza followed, and companies achieved Fortune 500 valuations in a three-year period of explosive, unrealistic growth. What became known as the dot.bomb bubble popped in 2001, and the Internet Gold Rush ended; sober businessmen moved in. Bitcoin isn't the electronic equivalent of a dollar, transformed into bits and bytes and transmitted over the internet; it's more of a financial subsystem, an alternate payment stream, which soon ushered in a new wave of investment—a silver rush. It's hard to understand the extent of Bitcoin's growth without turning to the only comparable real-world parallel, the transformation of a bland series of rolling hills next to a modest mountain in Nevada—the uninhabited land3 worth pennies a few years before—into a blasted landscape pockmarked with burrows and smoke, unsteady cabins and open latrines, with desperate miners striking claims and digging and fighting over square feet of turf that gleamed with the possibility of buried riches. The 1859 discovery of the Comstock lode set off a frenzy of activity: it represented one of the largest silver discoveries in the history of mankind and signaled the end of the more famous, but played-out, California Gold Rush (1849–1855). Soon so much silver was being pulled out the Comstock mines that prices dropped worldwide and governments considered demonetizing silver currency, as it no longer had significant independent value. The Comstock Lode's social and political effects were far reaching: acting as a magnet, it deformed settlement patterns across the West, spurred Nevada into an abrupt and early statehood, drew fortune-seekers from around the globe, and caused booms in cities as distant as San Francisco and Los Angeles. Miners swarmed the landscape, cleared forests, constructed bridges, and tunneled through mountains. The lode rewarded industry and meted out heartbreak in unequal measure.4 James Finney,5 one of the original discoverers of the so-called “Gold Hill” strike, was an unsophisticated man who sold his share in the claim (worth tens of millions) for an old horse and a bottle of rot-gut whiskey. This sounds uncomfortably close to a folk legend, but it's certainly true none of the early miners on the scene, who should have profited most with the least work, did well for themselves—stories of heavy drinking, insanity, and suicide were common. Compared to the fate of many others, Finney's fate was a relatively light sentence for stumbling across one of the great buried fortunes in the history of the world. The Comstock Lode was a global event. Most people didn't feel the effect of the mining strike directly, beyond a diluted bump in national prosperity, but for some it meant uprooting themselves and changing everything they had ever done and leaving behind everyone they had ever known. Mining had a reality you could sink your hands into, in fact it was required: separating silver from lumps of quartz or shovelfuls of sticky blue mud was a messy job. When it was over, and the lode was played out, something tangible had been produced, and refined, and was in use throughout the world: 192 million ounces of 99.7 percent pure silver. You could point to it and say, Look, that's what the fuss was all about. Something beautiful and real had been created from one of the ugliest and most sordid celebrations of greed the human race had ever enthusiastically indulged. Yet at its height, Bitcoin's net worth surpassed, in adjusted dollars, the aggregate total of Nevada's Comstock Lode over any five-year period. Bitcoin wouldn't have captured the fancy of so many tech-savvy early adopters if it had been built on an unstable or poorly designed code base, or thrived despite wary journalists telling readers as early as 2011 that Bitcoin was nothing more or less than a “bubble,” liable to pop at any moment.6 Bitcoin succeeded without a single well-known entrepreneur adopting it within the first two years of its existence. Bitcoin flourished despite lack of institutional support of any kind, its value unstable, though trending ever-upward. Bitcoin's relentless advance, despite a complete lack of traditional financial backing, was either a fantastic coincidence or the rational consequence of the law of supply and demand (combined with perfect timing). Looking back on it, Bitcoin's rapid expansion occurred in a void, without resistant pressure. A need existed, an opportunity as yet untapped and largely unforeseen, and when Bitcoin was invented and distributed it filled the empty space effortlessly, making little noise as there was little opposition. No businesses were impacted and pushed out of the way, and nobody gave the strange startup currency much attention at all—until it was too late to stop its onrushing growth. By 2014, dire tales of an impending Bitcoin collapse, still regularly published, began to fade into the background. Businesses all over the world were signing up to accept the currency. Conservative investors started pouring money into Bitcoin startups. In January 2014, the Sacramento Kings of the National Basketball Association became the first professional team to accept Bitcoin for ticket and merchandise sales.7 Bitcoin had attained a tenuous though stable level of respect in the financial community, and when it's possible to buy groceries in Birmingham, Alabama, using bitcoins, without anyone batting an eye8…it's safe to say Bitcoin's moving quickly toward mainstream acceptance. When confronted by something as miraculous and weird as Bitcoin's explosive five-year growth, it's hard to avoid the fundamental question: How on earth did this happen? When I'm at a dinner party, surrounded by people desperate to know more about Bitcoin—which, now that I think about it, doesn't occur as often as it should— there's always somebody who interrupts my description of the currency and pooh-poohs the entire Bitcoin concept because, quite obviously, “Bitcoins aren't real.” They're nothing more than electrical impulses flying around the internet, sensitive to magnetic fields and stymied by broken wires or overheated hard drives or misrouted signals. It's crazy to base a currency on a delicate computer network, which might suffer a catastrophic collapse at any moment. Surely

Description: