Under Armour Inc. PDF

Preview Under Armour Inc.

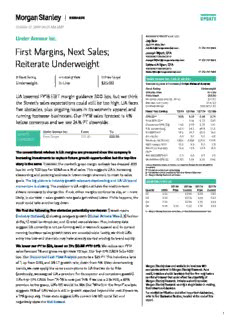

October 27, 2016 04:01 AM GMT UUnnddeerr AArrmmoouurr IInncc.. MORGAN STANLEY & CO. LLC Jay Sole EQUITY ANALYST First Margins, Next Sales; [email protected] +1 212 761-5866 Joseph Wyatt, CFA RESEARCH ASSOCIATE Reiterate Underweight [email protected] +1 212 761-4206 Edward A Ryan, CFA RESEARCH ASSOCIATE [email protected] +1 212 761-4384 Stock Rating Industry View Price Target Under Armour Inc. ( UA.N, UA US ) Underweight In-Line $25.00 Branded Apparel & Footwear / United States of America Stock Rating Underweight Industry View In-Line UA lowered FY18 EBIT margin guidance 300 bps, but we think Price target $25.00 Shr price, close (Oct 26, 2016) $31.81 the Street's sales expectations could still be too high. UA faces Mkt cap, curr (mm) $14,165 52-Week Range $50.38-31.81 five obstacles, plus ongoing issues in its women's apparel and FFiissccaall YYeeaarr EEnnddiinngg 1122//1155 1122//1166ee 1122//1177ee 1122//1188ee running footwear businesses. Our FY18 sales forecast is 4% EPS ($)** 0.53 0.59 0.68 0.79 below consensus and we see 24% PT downside. Prior EPS ($)** - 0.56 0.72 0.93 Consensus EPS ($)§ 1.04 0.59 0.78 1.01 P/E, consensus§ 40.0 54.2 40.9 31.5 Under Armour Inc. From: To: WHAT'S EV/EBITDA** 18.6 24.7 20.5 16.8 Price Target $31.00 $25.00 Div yld (%) 0.0 0.0 0.0 0.0 CHANGED? Revenue, net ($mm) 3,963 4,926 6,018 7,169 EBIT margin (%)** 10.3 8.9 8.3 7.9 Return on avg eqty 15.4 14.9 14.9 14.9 The conventional wisdom is UA margins are pressured since the company is (%)** increasing investments to capture future growth opportunities but the top-line Net debt/EBITDA** 0.5 0.8 0.9 0.8 ModelWare EPS ($) (0.33) 0.48 0.55 0.66 story is the same. However, the market's gross margin outlook has dropped 200 Unless otherwise noted, all metrics are based on Morgan Stanley ModelWare bps vs. only 100 bps for SG&A as a % of sales. This suggests UA is increasing framework ** = Based on consensus methodology discounting and pursuing business in lower-margin channels to meet its sales § = Consensus data is provided by Thomson Reuters Estimates e = Morgan Stanley Research estimates goals. The big picture is industry growth rates are decelerating and UA US brand QUARTERLY EPS ($) momentum is slowing. The problem is UA might not have the medium-term 22001166ee 22001166ee 22001177ee 22001177ee drivers necessary to change this. If not, either margins continue to slip, or – more QQuuaarrtteerr 22001155 PPrriioorr CCuurrrreenntt PPrriioorr CCuurrrreenntt Q1 0.03 - 0.04a 0.04 0.03 likely, in our view – sales growth rate goals get revised lower. If this happens, the Q2 0.03 - 0.01a 0.04 0.03 stock could take another leg down. Q3 0.23 - 0.29a 0.30 0.34 Q4 0.24 0.26 0.25 0.34 0.29 We find the following five obstacles potentially worrisome: 1) weak macro e = Morgan Stanley Research estimates, a = Actual Company reported data (Industry Outlook); 2) slowing category growth (Global Athletic Wear); 3) fashion shifts; 4) retail bankruptcies; and 5) retail consolidation. Plus, industry data suggest UA currently is not performing well in women's apparel and its current running footwear sales growth rates are unsustainable. Lastly, we think UA's entry into low-end channels may have already started eroding its brand equity. We lower our PT to $25, based on 37x $0.68 FY17 EPS: We reduce our FY17 sales forecast 1% and gross margin view 70 bps. Our 5-yr EPS CAGR falls 400 bps. Our Discounted Cash Flow Analysis points to a $25 PT. This includes a beta of 1, up from 0.95, and 3% LT growth rate, down from 4%. Given deteriorating Morgan Stanley does and seeks to do business with trends, we now apply the same assumptions to UA that we do to Nike companies covered in Morgan Stanley Research. As a (previously, we assigned UA a premium for its superior and consistent growth). result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of UA's 4-yr EPS CAGR from '14-'18 is now just 14%. If we use a 2.5x PEG, a 67% Morgan Stanley Research. Investors should consider premium to the group, UA's P/E would be 36x. Our "What's in the Price?" analysis Morgan Stanley Research as only a single factor in making their investment decision. suggests 76% of UA's value is still in growth expected beyond the next 3 years vs. For analyst certification and other important disclosures, a 17% group avg. These stats suggest UA's current 45x P/E could fall and refer to the Disclosure Section, located at the end of this negatively skew the Risk Reward. report. 1 RRiisskk RReewwaarrdd AA UUSS aappppaarreell iinndduussttrryy sslloowwddoowwnn aanndd ffaalllliinngg AASSPPss tthhrreeaatteenn UUAA''ss pprreemmiiuumm vvaalluuaattiioonn Investment Thesis UA is a growth story, but the US athletic apparel environment is slowing and UA ASPs are falling. US apparel is roughly 2/3rds of UA's sales mix. These issues are most acute in women's apparel. UA's running footwear strategy is a second concern. Sales are growing solidly, but ASPs are fading. UA competes on brand image and innovation, rarely on price. This trend change is a concern because it suggests a fundamental shift in the UA story. We see an unfavorable risk/reward. The stock has maintained a premium multiple Source: Thomson Reuter,s Morgan Stanley Research despite downward EPS revisions. However, if PPrriiccee TTaarrggeett $$2255 the market questions the UA growth story, Derived from our DCF analysis, which uses a 9.2% cost of equity and a the P/E could fall significantly. Our FY18 EPS 3% LT growth rate. The cost of equity is based on the current market estimate is 8% below consensus. risk free rate, expected market return, and 1.0 beta. The growth rate is based on our bullish global athletic wear view. The P/E we use is Key Value Drivers backed-into from this analysis. Sales – UA has six main sales drivers: men’s, women’s, and youth athletic apparel, athletic BBuullll $$4455 footwear, international markets, and 6600xx BBuullll CCaassee FFYY1177ee EEPPSS $$00..7755 connected fitness. Spicy Curry. The market sees UA becoming the world's No. 1 athletic brand. EBIT UA primarily uses a wholesale distribution margins expand above 10%. UA's connected fitness strategy works. Sales CAGR model, but also has robust company-owned is 22% and EPS CAGR is 25%. square footage and online growth potential. BBaassee $$2255 Gross margin – UA is a premium-priced 3377xx BBaassee CCaassee FFYY1177ee EEPPSS $$00..6688 brand. Gross margin is affected by labor and Growth questioned. UA progresses internationally, but a US women's apparel input cost changes, inventory management, as sales slowdown and concerns about LT footwear potential cause P/E slippage. well as product and channel mix shifts. Sales/EPS CAGRs are 21%/20%. SG&A – Marketing, new stores/websites, R&D and personnel drive SG&A growth. BBeeaarr $$1155 2255xx BBeeaarr CCaassee FFYY1177ee EEPPSS $$00..6622 Risks to Achieving Price Target De-cleated. UA fails to sustain secondary category momentum and a heavy SG&A burden squeezes margins. The sales CAGR drops to 18% and the EPS North American athletic apparel industry CAGR falls to 12%. The P/E contracts. momentum could accelerate and the Under Exhibit 1: Key value drivers: Our inputs and the impact on scenario values Armour brand could gain traction internationally faster than we expect. • Bull45.00 3.00 4.00 Major supply chain, SAP implementation, 4.00 Curr. 5.00 and connected fitness investments deliver Price 32.89 4.00 benefits faster than expected. Target 25.00 -3.00 -1.00 Foreign currency exchange rate volatility -2.00 -1.00 Bear15.00 could either help or hurt UA. -3.00 Domestic Int'l EBIT margin Connected Sentiment Mismanagement of ESG issues could activewear activewear Fitness sales sales damage UA's image and hurt valuation. Source: Company data, Morgan Stanley Research 2 The big picture is industry growth rates are decelerating and UA US brand momentum is slowing Nevertheless, the core of our Underweight thesis is unchanged We believe the Under Armour brand is more mature than the Street realizes and growth will slow faster than expected. Our conviction in this call has increased post UA's 3Q EPS report. The one difference is we now see UA's sales and EPS growth rates decelerating faster than previously thought and this is causing us to reduce our price target 19%, to $25. Our FY18 sales forecast is 4% below consensus The market mistakenly, in our view, interprets UA's lowered EBIT guidance as a sign that the cost of doing business in increasing The conventional wisdom is UA margins are pressured since the company is increasing investments to capture future growth opportunities and the top-line story is unchanged. If this were true, we believe UA would have announced a big ramp in SG&A spending. This did not happen though. The market's SG&A dollar growth forecast is mostly unchanged. It's the gross margin outlook which has had a larger move. In our model, UA's 3-year SG&A dollar CAGR remains 24%. Our new FY18 gross margin forecast is 95 bps below our previous view. UA actually cut 3Q SG&A dollars relative to expectations, which is more surprising given it was an Olympic quarter. The gross margin decline suggests UA has had to increase discounting and pursue business in lower- margin channels to meet its sales goals. From this we conclude UA's brand momentum is slowing. It appears the company has been forced to pick between accepting slower sales growth or attempting to maintain sales growth rates by lowering prices and, by extension, margins. A little of both has happened, but the bigger impact has been on margins, masking some of the sales weakness. North America sales growth and margins have slowed (Exhibit 2). UA North America sales growth, based on new company guidance, is slowing from 27% in 2014 to 16% in FY17. We believe the slowdown is most concentrated in UA's North America wholesale apparel business, where we estimate the implied growth rate will slip to 11% in FY17 from 25% (Exhibit 3), even with the entry into Kohl's, which is likely good for 500-800 bps of NA wholesale apparel growth. On the margin side, UA's North America margins have dropped to 10% from 13%. 3 Exhibit 2: UA's North America sales growth rate and EBIT margin is Exhibit 3: …and we think the issue is most acute in the wholesale slipping... apparel business UA North America sales growth UA North America wholesale apparel sales growth 30% 30% UA North America sales EBIT % 25% 25% 25% 20% 20% 20% 15% 15% 11% 11% 10% 10% 5% 5% 0% 0% 2014A 2015A 2016E 2017E 2014A 2015A 2016E 2017E Source: Company data, Morgan Stanley Research estimates Source: Morgan Stanley Research estimates We see four reasons why it may be difficult for UA to regain sales momentum over the medium term First, the macro outlook is not changing and, second, fashion trends are working against UA. Many retailers believe the slow apparel & footwear growth environment of the last couple years is "the new normal." We agree (please see Branded Apparel & Footwear Industry Outlook: Video & Note | Spooky (23 Oct 2016) and Global Athletic Wear: Still More Work To Do (13 Sep 2016)). Second, Under Armour is a performance brand that makes performance products at a time when consumers are gravitating to lifestyle/pure fashion products. Retailers are placing inventory bets as if this trend will last for at least another year. This is a problem for UA because it will take it a long time to migrate its brand image to the point where consumers accept it as a fashion brand. Third, UA's plan to accelerate footwear sales to offset declining apparel sales growth rates might not be as successful as hoped. As we have often said, we do not believe Under Armour has developed a strong running footwear business. In fact, ASPs have fallen 25% over the past 3+ years, to $53 (Exhibit 4), well below the average price of a Nike or other premium brand running shoes. Granted our ASP data is based on an incomplete sample of UA's distribution, but based on channel checks and conversations with retailers, we believe it to be directionally accurate. Despite its premium athletic wear image, as far as running footwear is concerned Under Armour is a mid-tier brand, which limits its future growth potential. We believe UA has driven running footwear growth largely by lowering its prices, a strategy that may be unsustainable. It has not yet been able to consistently sell running footwear products in premium channels such as Foot Locker or Finish Line. Nor has it been able to develop a consistent platform, such as Air Max by Nike or Boost by Adidas. We believe many UA heritage Speedform style sales are slowing and to date the Spine has not delivered consistent performance. Plus, UA appears not to have the fashion assortment to compete with Adidas Originals or other fashion players. Lastly, the bar is very high. To meet even our below consensus sales forecast, our analysis suggests UA must grow its US wholesale running footwear business at a 27% 2-year CAGR vs. 23% in FY16e. 4 Exhibit 4: UA running footwear ASPs have fallen 25% over the past 3+ years UA Running Footwear ASPs (12mo rolling) $75 $70 $65 $60 $55 $50 Source: SSI data Unfortunately, the bar is even higher for UA's basketball business. To meet our below consensus sales forecast, we think UA must grow its US wholesale basketball footwear business at a 51% 2-year CAGR vs. 114% in FY16e (Exhibit 5). While Steph Curry is a superstar, we believe sales of his signature products have slowed since last summer's NBA Finals. Perhaps this week's launch of the Curry 3 reignites momentum. However, if it doesn't, we think it will be even harder for UA to meet its footwear objectives. The increasingly aggressive tactics that Nike has taken to slow Under Armour's basketball share gains could have significant impact.. For example, Foot Locker and Finish Line recently reduced prices of Curry 2.5 footwear from $135 to $99.99. Then just days later, some versions of Nike's Kyrie Irving 2 styles moved from $119 to $99.99. We don't believe it was a coincidence. Exhibit 5: The bar is high for UA's running and footwear businesses in the US wholesale channel Morgan Stanley Assumptions 2014 2015 2016e 2017e 2018e Total sales 32% 28% 24% 22% 19% North America 27% 24% 19% 16% 13% N.Am w/s 27% 25% 16% 16% 12% N.Am w/s footwear 39% 52% 42% 35% 22% Running 65% 57% 23% 35% 20% Basketball 58% 271% 114% 69% 35% Cleats 21% 14% 22% 15% 10% Other 20% 25% 49% 5% 13% Source: Company data, Morgan Stanley Research estimates Fourth, UA is investing in its company, but the payoff from these initiatives should take years to develop. UA is spending significant sums to install SAP, construct its new headquarters, add premium retail stores, build out its merchandising teams, create a big data connected fitness platform, and improve the business in other ways. While these all sound like good ideas, they are all long-term projects. Please also see: 3Q Review 5 Our 5-yr EPS CAGR is now 16% Discounted Cash Flow Analysis Relative value analysis Valuation vs. peers Financial Model Where we could be wrong Under Armour remains a strong brand with outstanding management. The company's founder and CEO, Kevin Plank, is one of the most highly successful entrepreneurs of his generation and has found solutions for many business challenges over the past two decades. A key risk is management may be able to drive much stronger international growth rates than we forecast. We model a 40% 4-yr sales CAGR, but UA is starting off a small, $750M base in FY16e. If UA can enter many markets at once, the growth rate could be much bigger and offset weakness in other areas. We also believe UA's Steph Curry business could become much bigger than we currently project. At the same time, macro and fashion are unpredictable over a multi-year forecast period and could trend back in UA's favor. What could drive the stock toward our $15 bear case? Three phenomena suggest Under Armour may have moved too fast in its pursuit of sales growth, potentially making future growth harder to attain The first two are footwear and apparel ASP declines. It may surprise some to learn UA apparel ASPs have dropped 7% over the last 2 years, including 5% this year (Exhibit 6). ASP declines, whether they are in footwear or apparel, could be a sign that a brand is losing pricing power. Strong brands maintain their ability to command a premium price. We note the industry has been weak, too, but UA apparel and footwear price points have fallen farther than the industry average. The apparel ASP trend may be impacted by a mix shift to kids and lower-end channels, but if true, that isn't a positive either, in our view, for reasons we will explain shortly. 6 Exhibit 6: UA apparel ASPs have dropped 7% over the last 2 years, including 5% this year UA Apparel ASPs (12mo rolling) $31 $30 $29 $28 $27 Source: SSIData The third sign is UA's mix shift to kids. This is typically viewed as a positive by bulls, who believe UA has cultivated strong brand loyalty among kids who will be UA customers for life. This "annuity" is the source of cash that UA can leverage to grow its business globally. UA has shifted its mix to kids. In apparel, 24% of sales are to kids, up from 19% in 2013 (Exhibit 8) vs. an industry average of 19%. In footwear, it is 33%, up from 23% (Exhibit 7) vs. an industry average of 15%. Both industry averages have crept up slightly over the past 4 years, but generally speaking have stayed consistent. The risk is by over-indexing to kids, consumers broadly start to define Under Armour as a kids brand. If this happens, adults won't want it. The industry rule of thumb has typically been no more than 20% of a brand's mix should come from kids. Perhaps this explains some of the weakness in women's apparel. Exhibit 7: UA's footwear gender mix has shifted to 33% kids from 23% Exhibit 8: UA's apparel gender mix has shifted to 24% kids from 19% in in 2013 2013 Footwear gender sales mix Mens Womens Kids Apparel gender sales mix Mens Womens Kids 70% 60% 60% 50% 50% 40% 40% 30% 30% 20% 20% 10% 10% 0% 0% Sept '13 Sept '14 Sept '15 Sept '16 Sept '13 Sept '14 Sept '15 Sept '16 Source: SSIData Source: SSIData Some of these phenomena overlap and it is hard to disaggregate causes from effects, but all are potentially symptomatic of the same issue. Another sign we could point out is UA's entry into lower-end channels without properly segmenting the product assortment. UA has become very dependent on lower-end channels for US growth. Examples of these channels are outlet stores, off-price retail, and low-end department stores like Bon-Ton. There is nothing "wrong" with any of these channels. Bulls argue 7 that Nike plays in most of these channels, so Under Armour should be there, too. However, Nike offers a wider variety of products in different channels. UA is still building these capabilities, yet it has pursued growth in a wide range of channels anyway. The unintended consequence may be that it has made high-end customers look for other brands. Just as adults don't want to wear a kids brand, high-end consumers don't want to buy premium-priced products available in lower-tier channels since it doesn't offer the same social benefits. There are many possible explanations, but the key fact in our view is Under Armour's ROIC is decreasing. The company's ROIC is likely 15% in FY16 and moving lower, down from 31% in FY13 (Exhibit 9). Exhibit 9: The company's ROIC is likely 15% in FY16 and moving lower, down from 31% in FY13 UA ROIC 35% 30% 25% 20% 15% 10% 5% 0% 2013A 2014A 2015A 2016E 2017E 2018E Source: Company data, Morgan Stanley Research estimates Taking a step back, Under Armour's brand strategy seems increasingly risky. On one hand the company tries to elevate the brand by opening up very expensive flagship stores and starting high-end sportswear lines at Barneys New York. On the other hand, it allows its brand to be sold at deep discounts and enters retailers like Bon-Ton, a retailer Nike and Adidas do very little business with. This seems risky to us. The only real asset UA or any competitor has is its brand. If the brand equity erodes, it will be almost impossible to get back and growth will be increasingly hard to come by. Looking longer-term, competition is likely going to get much tougher Nike and Adidas are also investing heavily in their businesses. Supply chain innovation is coming in the athletic apparel and footwear industry. Under Armour said it believes that a "monumental shift" is taking place. However, UA also said it believes these changes will be "leveling the playing field." We respectfully disagree. Nike and Adidas are investing in new technologies and developing unique relationships, many of which will be either patented or proprietary. They are working to develop major advantages in the areas of speed, automation, and customization. While noticeable changes aren't likely this year or next, real change could come soon after. Our guess is Nike and Adidas may be three years ahead of every other competitor, including Under Armour, right now. Lastly, UA's most differentiated strategy, connected fitness, may not be working out as intended. UA has an intriguing strategy to harness the power of big data in order to 8 learn more about consumers and athletes, which will ultimately help sell more shirts and shoes. The issue is it doesn’t seem like the strategy is working fully. Wearables as a category has not yet delivered the growth rates some expected. More importantly, UA's connected fitness sales are slowing. It expanded only 40% y/y vs. 73% last quarter and 119% in 1Q (Exhibit 10). The 3Q result was below our expectation. UA said it has 190M registered users, but didn't say how many monthly active users it has. The key signal will be if UA takes a write-down for the roughly $710M it spent acquiring its connected fitness apps. Exhibit 10: UA's connected fitness sales are slowing Connected fitness sales growth 250% 221% 221% 200% 150% 119% 100% 73% 40% 50% 0% 3Q15A 4Q15A 1Q16A 2Q16A 3Q16A Source: Company data, Morgan Stanley Research We see more ways the stock can grind lower than move higher What causes the stock to rebound, or to take another leg down? For the stock to start working, we believe the sales trend has to inflect upwards. With the stock still trading at over 50x FY16 EPS, it is far too early for "value" buyers to step in, we think. In the medium term, perhaps UA has more door growth potential then we are currently model and this can be a source of upside surprise in the numbers. Other factors potentially driving upside could be the Curry 3, Under Armour Sportswear, some other unanticipated new product launch. We doubt some new product emerges which changes UA's trend. Of course, macro could always get better. We really don't see that many positive catalysts out there which can change the trend. If UA sales growth rates continue to slow, however, we think the multiple could fall further. As stated above, the bar is still high for UA. The company is guiding to low 20s percent sales growth in FY17 and FY18. We think this stock will move on sales. Even after this quarter, because sales guidance didn't change, some bulls still believe that the story is intact and that it will just take UA a little longer to get to the expected long- term EBIT margin. To dissuade these investors, sales growth has to slow in our view. 9 3Q Review UA delivered 3Q EPS of $0.29, 4c above consensus, but guidance was very weak and the stock dropped 13% Sales growth of 22% exceeded the Street's 20.7% expectations, but gross margin fell 100 bps below forecasts due to higher than anticipated liquidations, promotions, and unfavorable FX (Exhibit 14). Lower than expected SG&A spending of 20.1% growth vs consensus' expectation of 25.1%, due to lower incentive compensation and shift of marketing spend into the 4th from 3rd quarter added 5c. Inventory control has improved, growing only 12%, producing a forward sales to inventory spread of 8.2% from -7.7% in 2Q. UA maintained FY16 guidance, but guided 4Q below consensus. UA reaffirmed FY16 revenue of $4.925B vs. the consensus $4.94B view (Exhibit 15). It also reaffirmed an operating income outlook range of $440-445M vs. consensus' $419M. For 4Q, UA gave sales growth guidance of+20% vs. the Street's +22%; said gross margin would be "flat” vs. Street's +20 bps view; and EBIT dollars would be in the $186-191M range vs. the Street's $205M. Updated 2018 guidance maintained the $7.5B revenue outlook, but lowered EBIT $ ~27%. The company acknowledged increased difficulty in the North American wholesale channel, noting the recent bankruptcies of The Sports Authority, Sports Chalet, and Golfsmith. However, the momentum UA is seeing in its footwear business and international expansion helps maintain the company's $7.5B outlook. More importantly UA reduced its $800M 2018 EBIT guidance (implying a 34% CAGR from 2016's guidance) to a "mid-teens" expectation. UA expects gross margin to be flat over the next two years as it deals with unfavorable product (footwear is lower margin) and channel (international distributors, North American mid-tier, and family channel stores are lower margin) mix offset by improving leverage and input costs. However, SG&A deleverage as UA invests in people, global infrastructure, and systems to maintain its desired pace of growth. The stock fell 13% on the day vs. a roughly flat S&P 500 move. The stock was flat to positive on a decent earnings print, but the subsequent 8-k filing which included the updated 2018 guidance caused the stock to drop as far as 16% in the pre-market. This new outlook shows UA's difficulties in maintaining growth in this environment, and we interpret the market's initial reaction as a disapproval of the growth at any cost mind set. This re-basing of expectations highlights our concerns around the trajectory of profitability and potential erosion of brand equity. We revised down our FY16, FY17 and FY18 EPS estimates We move our FY16 estimate to $0.59 from $0.57. We roll forward UA's 5c 3Q beat vs our $0.24 3Q estimate, but we adjusted our 4Q16 EPS to $0.25 from $0.27. We now 4Q forecast revenue growth of 20% from 22% and gross margins flat from +100 bps prior. Our SG&A growth also dips slightly to meet updated full year SG&A growth guidance of 26%. Overall our FY16 sales forecast remains unchanged at $4.93B, in-line with guidance. 10

Description: