Trusts & Estates 1991: Vol 130 Index PDF

Preview Trusts & Estates 1991: Vol 130 Index

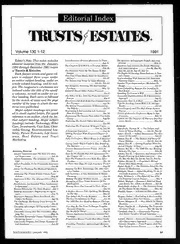

|Dr ebane)@esl aeba lel=y- TRUSTS ;E STATES. Volume 130 1-12 1991 Editor’s Note: This index includes Considerations Of Asset Allocation In Trust ... The Question Of Copyright: Pitfalls And Pots editorial material from the January Of Gold Questions And Answers On Estate Planning 1991 through December 1991 issues And Administration Jan 39, Mar 65, of Trusts & ESTATES. May 52, Jul 50, Sep 53, Nov 54 Each feature article and guest col- The Rights Of Nursing Home Patients: A Plan- umn is indexed three ways: under Does Your Client Really Need An Investment IIE nsncncssrsininteteettiiaintptieanstunasetl Jul 28 PIDs raicceininascsiih dictegeaneanaaaaaaiaal Oct 62 Scattershooting With Selected Life Insurance an author subject heading, under an The Dollars And Sense Of Value-Shifting PE UI ciniscnicinssasninsccintistinctinintitd May 12 article subject heading, and by sub- cl Oct 51, Nov 42 Smaller Trust Organizations: Marketers By ject. The magazine’s columnists are Due Diligence: Assessing The Survivorship Design Pic siccttnitasiandanieanniatcnatateiinsahiiel May 22 Some Compelling Reasons For Investing In indexed under the title of the specif- Editorial Board Offers Future Forecasts ......... Real Estate ic columns, as well as under an au- Standing To Contest A Will thor heading. Each entry is followed The Effect Of Sec. 2701 On Preferred Interest Successful Implementation Of A Quantitative SPITE <tacesdesindsissecssialph linnbapheoicannnteniotaasdiaiaaniee Mar 8 NT ictsniiecsintnnpebivinsnnetaieciaasiaiian Sep 21 by the month of issue and the page Environmental Risk Reduction Considerations Succession Plan Is A Must 5 number of the issue in which the ma- DN I issn isncedschieninilnesbickaanians Apr 24 Tips On Funding Trusts With U.S. Savings terial was published. The Ethical Considerations Of Representing PINE cisccciecitesineycnininiiniatienmnaininenamanaciadil Jul 45 ee I centri chsesnaiiencsicanniitcanenseeneail Jul 18 Trust Property And The Real Estate Auction Major subject headings are print- Evaluating A Survivorship Life Insurance PUTIN sinsininsiticininniemadtinilitinanninitansganineinl Apr 48 ed in small capital letters. For quick PD ENP IID vcs vnisnes secsnsccescisentiosasaced Jan 35 TrusTS & ESTATES Conference Meets In San reference to an author, check the Au- Examining The Factors That Affect Charitable Francisco thor subject heading. Major subject Giving Update On The Taxation Of Discount And Pre- | LA headings include: Technology, Elder Care, Investments, Case Law, Char- AUTHORS itable Giving, Environmental Lia- Abendroth, Thomas W. — The Dollars And A Financial Education Sense Of Value-Shifting Oct 51, Nov 42 bility, Future Forecasts, Life Insur- Getting Familiar With Proposed Chapter 14 Acker, Alan S. — Added Dimensions: The Allo- ance, Real Estate and Trust ick ccsacascicakcacksnectecsanccusmaeamareienn Aug 48 cation Of The GST Marketing. Gifts To Children: Whose Money Is It Anyway? Adams, Roy M. — The Dollars And Sense Of Value-Shifting Oct 51, Nov 42 Giving Credit Where Credit Is Due: Breaking Adams, Roy M. — Getting Familiar With Pro- IE IG siren assencseicnsnsniseciscinbintiotacs Sep 43 posed Chapter 14 Regs ...............0000000 Aug 48 A Grantor Retained Income Trusts - Fish Or Adams, Roy M. — The 1990 Tax Act: Reading ARTICLES, FEATURE eg ERT Mar 18 BORNE BIO ENG ci seinnnsascascrrcsvenssossansin Feb 20 Abusive Guardians And The Need For Judi- How Do We Handle Buy-Sell Agreements Un- Adams, Roy M. — Questions And Answers On cial Supervision PCIE OME sis siccssvarixascassisionnsonvesess Mar 38 Estate Planning And Administration Added Dimensions: The Allocation Of The How The Prudent Investor Rule May Affect 39, Mar 65, May 52, Jul 50, Sep 53, Nov 54 PI cass usntensicariemntiameshisaumsionaeinin Dec 15 Allison, Miriam M. — Proprietary Mutual Added Flexibility To An Irrevocable Insurance Is There New Hope For Life Insurance Trusts? Funds Meet Many Needs...........:0+..++0+++ Oct 32 I issciaais cepinemssactencudeansionchmaasannsecinioned Jan 28 Bartel, Keith P. — The Dilemma Posed By The Advice On Planning For Medicaid Qualifica- Estate Of MacDonald May 44 ware Update Bettigole, Bruce — Added Flexibility To An Ir- Analyzing The Trends Within Private Foun- Life Insurance: A New Dimension In Estate revocable Insurance Trust ...............+++ Jan 28 NIE insta inrsscscnssntiaibecuticnesepdbepsionbicnie’ Aug 38 Planning Blatt, William S. — The Effect Of Sec. 2701 Awareness Is Key: The Attorney-Client Privi- Making The Most Of Farm Assets......... Apr 44 On Preferred Interest Freezes ..............- Mar 8 Managing A Trust Team: Realities Of The Billion, Michael -— Boatmen’s National Bank Marketplace and Smith: Sec. 2504(c) In Review .....Apr 56 Missing Heirs: Put YourselfI n Their Shoes..... Bredenbeck, Arthur H. — The Dilemma Posed Beware Fiduciaries The Toxic Bequest ...Dec 8 By The Estate Of MacDonald May 44 Bidding Auctioneers: Negotiating An Agree- A Modern Divorce Tale: Splitting The Blanket Brachtl, Susan — A Financial Education Bae FR I as ess ssinctsnrensronscns , New Attack On Family Business Brogan, James — Evaluating A Survivorship 2504(c) In Review The New Certification In Trust Life Insurance Plan For Clients.......... Jan 35 The Challenge: Marketing Trust Services In The 1990 Tax Act: Reading Between The Lips Brown, Margaret W. — New Attack On Family ME IIR: di scscisccsiisischenasmapnnescasnnessioinnienan Oct 43 I nciiccsicessnacisnneeniiieeteniotanaiainnians Mar 48 Changing Advantages Of Charitable Contri- Now May Be The Time To Donate Tangible Bruce, Charles M. — Exploring The Protection NII xsdsincasinvmisihickinacksacctacccescovmestnnsced Aug 10 Personal Property OfA ssets Trusts .....................Nov 32, Dec 39 Charitable Giving And The Generation-Skip- Orne Ward Or TRG? asscnncasscescossessesssseos Sep 10 Campbell, Alan D. — Community Property Passive-Aggressive Investment: Limited Part- Charitable Remainder Trusts: Planning And WI cciidwiieascaiscansssacessiistinsincoaicss eae NE TB vs iiises ec cinscsarstntarincvinnel Dec 45 Proprietary Mutual Funds Meet Many Needs . Cardell, Daniel — Successful Implementation Community Property And Estate Taxation Of Of A Quantitative Approach Life Insurance Clemens, Douglas — Trust Property And The Real Estate Auction Process ............... Apr 48 TRUSTS & ESTATES / JANUARY 1992 57 Crough, Maureen — Environmental Risk Re- Oestreich, Nathan — Changing Advantages Can Beat It duction Considerations For Trustees ..Apr 24 Of Charitable Contributions............... Aug 10 Dagbjartsson, Eggert — Passive-Aggressive In- Ottinger, William — Managing A Trust Team: vestment: Limited Partnerships .......... Sep 27 Realities Of The Marketplace ELDER CARE Danford, Dan — Smaller Trust Organizations: Owens, Rodney — Scattershooting With Select- Abusive Guardians And The Need For Judi- Marketers By Design ed Life Insurance Planning Topics ....May 12 cial Supervision Donaldson, John E. — The Ethical Considera- Prince, Russ A. — Beneficiaries Are Satisfied Advice On Planning For Medicaid Qualifica- tions Of Representing The Elderly Jul 18 When Involvement Is Generated Aug 55 DuCanto, Joseph N. — Gifts To Children: Prince, Russ A. — Exploring The Family Of- The Ethical Considerations Of Representing Whose Money Is It Anyway? ............+ Sep 32 fice Advantage The Elderly ... Jul 18 DuCanto, Joseph N. — A Modern Divorce Rodenbush, C. Tim — Missing Heirs: Put The Rights Of Nursing Home Patient Tale: Splitting The Blanket In The ’90s......... YourselfI n Their Shoes ...........::c00:0000++ Dec 53 ner’s Guide Rosenfeld, Jeffrey P. — Examining The Fac- Eastland, Stacy — New Attack On Family tors That Affect Charitable Giving ESTATE PLANNING TECHNIQUES RI TORREOER ATT EM ar 48 Charitable Remainder Trusts: Planning And English, David M. — The Rights Of Nursing RN TIE isisasicavinncresncisnseiccasetied Dec 45 Home Patients: A Planner’s Guide Exploring The Protection Of Assets Trusts ...... Fisher, Robert W. — Charitable Remainder Trusts: Planning And Designing Issues ........ ing The Survivorship Purchase Fowler, Kenneth J. — Is There New Hope For Sennett, David S. — Tips On Funding Trusts The Megatrust™: An Ideal Family Wealth Life Insurance Trusts? .............0s00000+ Aug 50 With U.S. Savings Bonds................00-+- Jul 45 Preservation Tool Nov 20 Freedman, Ellis — The Question Of Copyright: Spahn, Thomas E. — Awareness Is Key: The Pitfalls And Pots Of Gold Attorney-Client Privilege Feb 55 Frey, Frank — The Challenge: Marketing Sterling, Robert L. — Does Your Client Really FUTURE FORECASTS Trust Services In The 908 .........00000000+ Oct 43 Need An Investment Advisor?.............. Oct 62 Advice On Representing Both Husband And Frolik, Lawrence A. — Abusive Guardians Thiessen, Linwood — Some Compelling Rea- sons For Investing In Real Estate ....... Apr 10 Thompson, Mark — Passive-Aggressive Invest- Furmanski, Richard R. — Update On The Tax- ment: Limited Partnerships ............... Sep 27 ation Of Discount And Premium Bonds ........ Venable, Carol — Changing Advantages Of Charitable Contributions................... Aug 10 Economic Outlook Looks Glum .. Jan 22 Gamble, E. James — How Do We Handle Buy- Warchall, James F. — Environmental Risk Re- Enhanced Client Services Are Key. To Sur- Sell Agreements Under Chapter 14? ..Mar 38 duction Considerations For Trustees ..Apr 24 Glenn, Cynthia D. — Standing To Contest A Welch, Lyman W. — How The Prudent In- vestor Rule May Affect Trustees .......... Dec 15 nation Against The Dead Gray, Stephen — Exploring The Protection Of White, M.L. — A Financial Education .Jan 23 Personal Trust To Be Leading Money Maker .. Assets Trusts Nov 32, Dec 39 Williamson, James — Changing Advantages Gross, Leon J. — The New Certification In Of Charitabie Contributions................ Aug 10 Bs cascssaksaneckni Ganbpinssessakasehanesenahseaniis Jan 23 Wilshinsky, Harold L. — Life Insurance: A Halperin, Alan — Giving Credit Where Credit New Dimension In Estate Planning ...Jun 10 Is Due: Breaking The Barriers. ............ Sep 43 Hartmann, Richard L. — Succession Plan Is A Cc Case Law Hellige, James R. — Charitable Giving And Boatmen’s National Bank And Smith: Sec. GENERATION-SKIPPING TAX The Generation-Skipping Tax............ May 34 2504(c) In Review ....Apr 56 Added Dimensions: The Allocation Of The Herpe, David — The Dollars And Sense Of The Dilemma Posed By The Estate Of MacDon- Value-Shifting Oct 51, Nov 42 Charitable Giving And The Generation-Skip- Herpe, David — Getting Familiar With Pro- ME PIE cicchacinnists tinisntakindictinSnbsheschvcvcconed May 34 posed Chapter 14 Regs .........cscssesse00e Aug 48 CERTIFICATION OF TRUST OFFICERS Herpe, David — The 1990 Tax Act: Reading The New Certification In Trust Jan 23 I BRO TING TAI ess scccncsesssssccnssasceneas Feb 20 A Financial Education Jan 25 INVESTMENTS Herst, Michael A. — Update On The Taxation Cae Wart Gi TRG? oiniccsccsssccvssonssscccsseces Sep 10 Of Discount And Premium Bonds......May 50 CHARITABLE GIVING Passive-Aggressive Investment: Limited Part- Jaskiewicz, Stanley — Bidding Auctioneers: Analyzing The Trends Within Private Founda- MI scccicxcissncsnccnisonericeanastneapcannaaned Sep 27 Negotiating An Agreement iiaaah euasiaeed Aug 38 Successful Implementation Of A Quantitative Johnson, Barry W. — Examining The Factors Changing Advantages Of Charitable Contribu- Approach That Affect Charitable Giving IN oscil tarctai Cotsbecuscncbansnkeatacashonnniiend Aug 10 Jones, John — Charitable Remainder Trusts: Examining The Factors That Affect Charitable Planning And Designing Issues .......... Dec 45 Law & LIFE INSURANCE Kvittem-Barr, Barbara — Update On The Now May Be The Time To Donate Tangible Advisers must exercise caution when a client Taxation Of Discount And Premium Bonds.. PAPO FIT asics snesccincsnenssercees Aug 24 considers change of insured option....Mar 69 An analysis of the life insurance rebating pro- Ledbetter, David O. — Beware Fiduciaries COMMENTARY cess: Is it helpful or harmful to clients in the The Toxic Bequest Another Verse In The Litany Of Changes....... PRINS icaieaeccassnnconinptsiniecenctanceobinel Sep 56 Lochray, Paul J. — Now May Be The Time To Banking on Joint Last Survivor policies can Donate Tangible Personal Property....Aug 24 As America Ages, A Demand Growe........ Jul 4 pay off for both the insurer and the policy- Luria, Edward M. — Exploring The Protection Charities Blossom In A Slow Economy ..Aug 4 IS TIER ivicessicsnsssinsicnsad Nov 3,Dec 39 Financial Software: Covering The Bases......... Marsh, Paul E. — Making The Most Of Farm J Dec 57 ia cascincinn carn sacigioghenscssandicesiobunciaoncied Apr 44 IRS Letter Ruling 9110016, part ofa contro- McDonald, James S. — Considerations OfA s- versy, zeroes in on policies which benefit set Allocation In Trust ............::.s0s00000 Apr 51 Life Insurance Is An Effective Tool For The i eeeCR E Jun 72 Meckstroth, Alicia L. — Analyzing The Trends Diligent Planner Majority of all U.S. insurers are not at risk... Within Private Foundations ............... Aug 38 Litigation’s Wicked Ways Can Be Hazardous. Mezzullo, Louis — Advice On Planning For The middle-aging of America precipitates an Medicaid Qualification increase in estate planning and saving Milam, Edward E. — Is There New Hope For Life Insurance Trusts? ............:0000000+++ Aug 50 Miller, James — Successful Implementation Of A Quantitative Approach Real Estate Can Be The Key To Diversifica- Moore, Malcolm A. — Grantor Retained In- tion And Risk Reduction come Trusts - Fish Or Fowl?............... Mar 18 Split dollar insurance: why it can be an excel- Newlin, Charles F. — Standing To Contest A lent alternative for estate planning....Jan 45 Dec 35 Why The Game Plan Changes And How You When promises do not match performance, TRUSTS & ESTATES / JANUARY 1992 who is to be held liable? ....................-+. Jul 58 Environmental Risk-Reduction Considerations Disposing PR No csciieetsincinsscenesseeninticeacid Apr 24 LIFE INSURANCE Making The Most Of Farm Assets......... Apr 44 Added Flexibility To An Irrevocable Insurance Some Compelling Reasons For Investing In Real Estate of a Coin Community Property And Estate Taxation Of Trust Property And The Real Estate Auction Life Insurance Ps terecnscdisracseteccctasketncsertedetsactiottl Apr 48 (O|( elad) le la) Due Diligence: Assessing The Survivorship Purchase ...May 22 Evaluating A Survivorship Life Insurance T I II sss cscensncitcvetesnxinensisnes Jan 35 Tax REFORM — AN INTRODUCTION Is There New Hope For Life Insurance Trusts? The 1990 Tax Act: Reading Between The Lips Life Insurance: A New Dimension In Estate Planning Tax REFORM — AN IN-DEPTH ANALYSIS Scattershooting With Selected Life Insurance The Effect of Sec. 2701 On Preferred Interest PINT TID a cosereeisiscexsersecceisinen May 12 PIII sini cntcchsidinanpiniraiebaseinacedeaavictiente Mar 8 Succession Plan Is A Must May 27 Grantor Retained Income Trusts - Fish Or Call on America’s Oldest & Largest Rare Coin Dealer. M How Do We Handle Buy-Sell Agreements Un- MISCELLANEOUS PI BI isin tisistaiaecaessscnsnienicne Mar 38 (@o)alelUlatiarepelele) mae)an-lelacie)ahs Awareness Is Key: The Attorney-Client Privi- New Attack On Family Business.......... Mar 48 for 50 years; b 55 ele(aar-heil e nae) sadleehmeleiegielai TECHNOLOGY for cash, for trust officers, Keeping Up With Technology: The 1991 Soft- executors, fiduciaries Bidding Auctioneers: Negotiating An Agree- ware Update for many generations ment Jun 71 Software Listing Addendum Considerations Of Asset Allocation In Trust ... TRENDS & DEVELOPMENTS Call or write for the new bro- AICPA Rallies For Simplification chure describing our services. Association Welcomes Small Vendors....Nov 6 Does Your Clieni Really Need An Investment Avoiding Temptation And Saving Ny ocischahw iiscicctegnieelcestadecnentane sonnet 62 Bank Reforms: Risky Business? ............ May 6 The Dollars And Sense Of Value-Shifting Banks Strong In Equity Returns............. Apr 6 Oct 51,Nov 42 Building A Better IRA Boomers’ Financial Climate Changes ....Jun 8 123 West 57th Street, Boomers Warm To Financial Planning..Aug 8 New York, NY. 10019 Getting Familiar With Proposed Chapter 14 Charitable Giving Benefits Donor And Donee Tel: (212) 582-2580 NR isiciacisjhinsarninesaschsnbicastionnnciatiplopiaal Aug 48 GP0])( a In ®t ohV, 0 6) 14 Gifts To Children: Whose Money Is It Anyway? Conference Focuses On Independents.....Jul 6 .. Sep 32 EPA Regulations Provoke Controversy ..Oct 6 References on request Giving Credit Where Credit Is Due: Breaking A Generation Of Savers................:.ss0000 Jan 6 TN MIN ssi csessnsicinnsscedniaienaateusiaibinig Sep 43 Growth Continues — At A Snail’s Pace .Aug 6 Missing Heirs: Put YourselfI n Their Shoes..... Insurance Professionals Change Hats....Dec 6 Keeping It In The Family A Modern Divorce Tale: Splitting The Blanket Making Mutual Funds Advantageous Abroad i SP A scckoninisnincasnrseiabninenscensbcnanseniel Mar 57 The Question Of Copyright: Pitfalls And Pots MDA Branches Out: Senior Citizens’ Crusade PROTECT YOUR CLIENT! Of Gold Feb 73 sssinis suunaladtinsianseebaceaielibbaeiphagshaniccahsnasmiuedsaiinwala Mar 6 PROTECT YOURSELF! Tips On Funding Trusts With U.S. Savings New Tax Programs Announced. ..Feb 8 Bonds... A New Twist On Life Insurance .. Options For Long-Term Care R Outlook Good For LTC Marketers ........ When your client needs help to remain Update On The Taxation Of Discount And Pre- Planners Advise Early Start, Customization .. safely in her home, you want to know that SNP casi thiiaccnnncschrcsontaninxeaiecsed May 50 Dec 6 the person going into that home has been Planners Change To Stay Competitive ..Apr 6 screened and will be closely supervised. Q Plan With Caution: Long Term Care.....May 6 Anything less jeopardizes your client. QUESTIONS AND ANSWERS ON ESTATE PLAN- Poll Shows Interest In Care Insurance ..Feb 6 NING AND ADMINISTRATION Responsibility Is Redefined In Illinois, private duty homecare is not Answers to readers’ questions.............. Jan 3 Standards Give Planners Direction regulated. There are no mandated standards Mar 65, May 52, Jul 50, Sep 53, Nov 54 Succession Plan Survey Reveals Owner Hesi- of quality or service. a cinntichsisinhcaitnitinttiinbeistcnnbiineasiesiaatinninniaainiinial Nov 6 P Concerned Care has such standards and is PHILANTHROPY accredited by the Joint Commission on Charitable Giving And The Generation-Skip- Accreditation of Healthcare Organizations Ns scsixcisshcsdbiansianseiesieotasiseanpieees May 34 (JCAHO)—the same people who accredit ce Advantage hospitals. This is your assurance of the Jun 68 highest quality. Trust LiIABiLity AND LITIGATION PHILANTHROPY & ESTATE PLANNING Beware Fiduciaries The Toxic Bequest ...Dec 8 We serve the entire Chicago metro area with Categories, ceilings and contributions: A How The Prudent Investor Rule May Affect live-ins, homemakers, and skilled nursing breakdown of deductibility PUI ssaiidschetcendssicincthnsensnahaiaticedinione Dec 15 through our four locations. Charity’s share of a donor’s estate gets whit- Providing Protection Against Legal Malprac- Choose the security of high standards. tled down Nov 56 The IRS gives a “triple-whammy” to donors of Standing To Contest A Will Dec 35 (708) 966-8700 ON III osc cnictcesasnastscssnsinaeces Jul 54 Make the most of charitable donations by TRUST MARKETING med making sure they are tax-deductible..May 58 The Challenge: Marketing Trust Services In are, Inc. Pooled funds simply can’t lead lives of quiet SP Be tiiscnnanaicoesacanesseeevsahscoumsantounaesatyeiel Oct 43 depreciation Managing A Trust Team: Realities Of The The Home Nursing Service What hath Congress wrought? Part 1 ..Jan 42 FINI is cicnnsssnsinisniinesisatendsiipritiacesiasonel Oct 10 What hath Congress wrought? Part 2 ..Feb 77 Proprietary Mutual Funds Meet Many Needs . CHICAGO AREA LOCATIONS Oct 32 © Skokie ® St. Charles R Smaller Trust Organizations: Marketers By ® Des Plaines © Homewood REAL ESTATE Design Oct 47 TRUSTS & ESTATES / JANUARY 1992