The Tax Adviser 2012: Vol 43 Index PDF

Preview The Tax Adviser 2012: Vol 43 Index

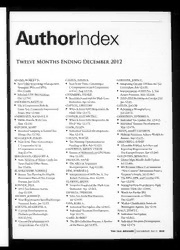

Author|ndex TWELVE MONTHS ENDING DECEMBER 2012 ADAMS, ROBERT D. CASTEN, DAVID B. GARDNER, JOHN C. ® New LB&I Knowledge Management ® Now Is the Time: Converting a ® Integrating Circular 230 Into the Tax Strategies: IPGs and IPNs. C Corporation to an $ Corporation Curriculum. Feb 12:133. Oct 12:668. or LLC. Aug 12:534. Interpretations of SSTS No. 1, Tax Schedule UTP: IRS Findings. CHAMBERS, VALRIE Return Positions. May 12:318. Oct 12:700. ® Securities Fraud and the Theft-Loss 2010-2011 Revisions to Circular 230. ANDERSON, KEVIN D. Deduction. Apr 1 Jan 12:42. ®@ The S Corporation Built-In CLIFTON, GREGORY GATLIN, JACOB Gains Tax: Commonly Encountered ® When Is Form 8283 Required to Be ® Releasing a Wrongful Levy. Issues. Mar 12:166. Filed? Mar 12:172. Jul 12:472. ANDREOZZI, RANDALL P. CONNER, ELIZABETH C. GERSHMAN, EDWARD A. ® FBAR: Handle With Care. ® When Is Form 8283 Required to Be © Individual Tax Update. Dec 12:812. May 12:330. Filed? Mar 12:172. ® Individual Taxation Developments. BATCHER, MARY COOK, ELLEN Mar 12:174. ® Statistical Sampling in Federal Tax ® Individual Taxation Developments. GREEN, MARY CATHRYN Filings. Oct 12:702. Mar 12:174. ® Helping Associates Achieve Work/Life BEAUSEJOUR, DAVID COUNTS, WAYNE Balance. Sep 12:622. ® Now Is the Time: Converting a ® Tax Planning Opportunities for GREENWELL, DAVID C Corporation to an Funding an IRA. Feb 12:123. ® Allowable Political Activities and S Corporation or LLC. COZEWITH, MINDY TYSON Reporting Requirements for Aug 12:534. ® Impact of Millennials on CPA Firms. Tax-Exempt Entities. Apr 12:260. BERGMANN, GREGORY A. Mar 12:192. GOLDSTEIN, BENSON S. ® State Taxation of Trusts: Credit for DROUGAS, ANNE ® Global High-Wealth Audit Update. Taxes Paid to Other States. ® The ABCs of Acquisitive Jul 12:466. Sep 12:616. Reorganizations. Aug 12:548. ® IRS Revenue Officer Can Summons BLANKENSHIP, VORRIS J. EIDE, BARBARA J. “Non-Content” Information From a ® Retiree Tax Planning for Eligible ® Interpretationso f SSTS No. 1, Tax Taxpayer’s Emails. Jul 12:467. Retirement Plans of Tax-Exempt Return Positions. May 12:318. ® The RPO, OPR, and Circular 230. Entities. Jan 12:24. ELZWEIG, BRIAN Apr 12:258. 3ONNER, PAUI © Securities Fraud and the Theft-Loss ® Setting Up Firm Procedures to Fight ® 2012 Tax Software Survey. Deduction. Apr 1 Identity Theft. Oct 12:696. Aug 12:524. ESPARZA, THERESA ® Watch for Further IRS BROPHY, JOSEPH D. ® Sales Tax Audit Best Practices. Pronouncements on ITINs. ® New Reporting for Specified Foreign Jul 12:458. Oct 12:697. Financial Assets. Jan 12:55. FAVA, KARL L. ® Worker Classification Issues on BURTON, HUGHLENE A. ® Individual Tax Update. Dec 12:812. Washington Agenda. Jan 12:50. ® Current Developments in ® Individual Taxation Developments. HAGY, JANET C. Partners and Partnerships. Mar 12:174. ® Individual Tax Update. Feb 12:114. GARD, ROBERT Dec 12:812. ® Current Developments in S ® The IRS Collection Process: A Review ® Individual Taxation Developments. Corporations. Oct 12:676. of the Basics. Jul 12:472. Mar 12:174. TAX ADVISER | DECEMBER 2012 859 Author|index ® Reporting Dilemma: Personal NASH, CLAIRE Y. Use of Rental Properties. ® Section 530 Relief for Worker May 12:326. Classification Controversies. HARRINGTON, STEVI Jun 12:380. ® The ABCs of Acquisitive NELLEN, ANNETTE Reorganizations. Aug 12:548. ® Individual Tax Update. HARTMANN, WENDY E. Dec 12:812. ® Community Property Rules and ® Individual Taxation Developments. Registered Domestic Partners. Mar 12:174. Apr 12:244. NEWMAN, DENNIS HENDRIX, JANNET E. ® Individual Tax Update. ® How to Start a Firm. Jun 12:408. LAUFER, DOUGLAS M. Dec 12:812. HIBSCHWEILER, ARLENE M. ® When Is Form 8283 Required to Be ® Individual Taxation Developments. ® FBAR: Handle With Care. Filed? Mar 12:172. Mar 12:174. May 12:330. LYNCH, MICHAEL F. NEWMAN, TERI E. ® Timing Considerations of Discharging ® Now Is the Time: Converting a ® Individual Tax Update. Dec 12:812. Taxes in a Chapter 7 Bankruptcy. C Corporation to an S Corporation or ® Individual Taxation Developments. Feb 12:104. LLC. Aug 12:534. Mar 12:174. HOFF, DAVID MAAS, WILLIAM E NG, STEPHEN ®@ What Can One Line Do for You? ® Integrating Circular 230 Into the Tax ® Investors’ Dilemma on Purchasing Sep 12:625. Curriculum. Feb 12:133. Distressed Obligations. Sep 12:608. HORN, JONATHAN ® 2010-2011 Revisions to Circular 230. NOGA, TRACY J. ® Individual Tax Update. Dec 12:812. Jan 12:42. ® Opportunities for Incorporating ® Individual Taxation Developments. McGOWAN, JOHN R. International Tax Law Into All Levels Mar 12:174. ® EITC Due-Diligence Requirements: of the Tax Curriculum. May 12:342. JENSEN, JENNIFER IRS Ramps Up Enforcement and ORBACH, KENNETH N. ® The Evolution of Sales Tax Nexus Education Efforts. Jan 12:34. ® Santa Clara Valley Housing Group: Expansion Laws. Apr 12:252. McNAMARA, LAWRENCE H., JR. An S Corporation Abusive Tax Shelter. ® Sales Tax Audit Best Practices. ® Reporting Trust and Estate Sep 12:610. Jul 12:458. Distributions to Foreign Beneficiaries PADDOCK, DAVID A. JOHNSON, ERIC L. (Part 1). Dec 12:800. ® Community Property Rules and ® State Taxation of Trusts: Credit for MATTSON, ANDREW M. Registered Domestic Partners. Taxes Paid to Other States. ® FATCA Adds Layer of Complexity, Apr 12:244. Sep 12:616. Penalty Exposure to Offshore Asset PARFIRYEVA, ALESIA KARLINSKY, STEWART S. Reporting. Apr 12:263. ® Sales Tax Audit Best Practices. © Current Developments in MAY, BRUCE E. Jul 12:458. S Corporations. Oct 12:676. ® Interpretations of SSTS No. 1, Tax PASMANIK, PHILIPT . KASTANTIN, JOSEPH Return Positions. May 12:318. ® FATCA’s Withholding Requirements e Integrating Circular 2, 30 Into the Tax MAY, DIANE R. for Foreign Financial Institutions. Curriculum. Feb 12:133. ® Interpretations of SSTS No. 1, Tax Jun 12:400. ® 2010-2011 Revisions to Circular 230. Return Positions. May 12:318. PETRONCHAK, KATHY Jan 12:42. MEDINA, JOSEPH ® Large Business and International KELLEY, ANN GALLIGAN ® Deducting Employee MBA Expenses. Examination Process Changes. ® A Powerful Learning Tool: Lessons Jul 12:454. Jan 12:56. From an Exam Reflection Assignment. MOISE, ROBERT PEVARNIK, THOMAS R. Nov 12:766. @ Where’s My Canceled Check? © Compensation and Benefits Update: KOSSMAN, SETH Jul 12:470. Retirement Plans and Executive ® A Trust Fund Recovery Penalty Primer. MOORE, DANIEL T. Compensation. Nov 12:746. Oct 12:698. ® Individual Tax Update. Dec 12:812. PICK, SUSAN LAGARDE, STEPHEN ® Individual Taxation Developments. © Get the Most Out of Overpayments © Compensation and Benefits Update: Mar 12:174. Applied to the Following Year’s Implementing the New Health Plan MOORE, MICHAEL L. Return. Jul 12:468. Laws (Part Il). Dec 12:830. ® Advising Nonresidents and Recent RANSOME, JUSTIN P. © Deducting Employee MBA Expenses. U.S. Residents on Estate Tax Issues. ® Recent Developments in Estate Jul 12:454. Nov 12:738. Planning: Part I. Sep 12:600. 860 THE TAX ADVISER | DECEMBER 2( & ® Recent Developments in Estate SHAFFER, RAYMOND J. YUSKEWICH, J. MATTHEW Planning: Part II. Oct 12:688. ® Tax Planning Opportunities for © Cost-Basis Reporting, the New ® Transfers to Skip Trusts in 2010: Not Funding an IRA. Feb 12:123. Schedule D, and Form 8949. Necessarily Free From GST Tax. SMUCKER, DAVID K. Apr 12:26S. Apr 12:240. ® Pension Rescue and the Fair Market ZOLLARS, EDWARD K. RO, HOWARD Value of a Permanent Life Insurance ® Transferring Client Data Securely. ® A Road Map of Tax Consequences of Policy. Dec 12:824. Dec 12:842. Modifying Debt. Jun 12:390. SNOW, DANNY ROBERTSON, BRYAN P. © Equitable Ownership and Mortgage Campus to Clients © Computing the Includible Portion for Interest Deductions. Jan 12:54. NELLEN, ANNETTE (Editor) Graduated GRATs. Aug 12:530. SONNIER, BLAISE M. ® The ABCs of Acquisitive ROTZ, WENDY ® Circular 230: Its Day-to-Day Impact Reorganizations. Aug 12:548. ® Statistical Sampling in Federal Tax on Tax Practices. Feb 12:130. ® Integrating Circular 230 Filings. Oct 12:702. ® Circular 230, Section 10.21, and SSTS Into the Tax Curriculum. RUBIN, KENNETH L. No. 6: Standards Relating to Taxpayer Feb 12:133. ® Individual Tax Update. Dec 12:812. Errors and Omissions. Aug 12:544. Opportunities for Incorporating ® Individual Taxation Developments. STOUT, DAVID E. International Tax Law Into All Mar 12:174. ® Tax Planning Opportunities for Levels of the Tax Curriculum. SALZMAN, MARTHA L. Funding.an IRA. Feb 12:123. May 12:342. ® Timing Considerations of Discharging THURBER, KATHRYN A Powerful Learning Tool: Lessons [axes in a Chapter 7 Bankruptcy. ® The Evolution of Sales Tax Nexus From an Exam Reflection Assignment. Feb 12:104. Expansion Laws. Apr 12:252. Nov 12:766. SCHADEWALD, MICHAEL S. VEGA, AMY M. © Apportionment Using Market-Based ® Individual Tax Update. Case Study Sourcing Rules: A State-by-State Dec 12:812. ELLENTUCK, ALBERT B. (Editor) Review. Nov 12:756. ® Individual Taxation Developments. ® Jan 12:59. SCHAEFER, MICHAEL V. Mar 12:174. Feb 12:137. ® When Is Form 8283 Required to Be WALKER, DEBORAH Mar 12:194. Filed? Mar 12:172. © Compensation and Benefits Update: Apr 12:268. SCHAFER, FRANCES Implementing the New Health Plan May 12:346. ® Recent Developments in Estate Laws (Part II). Dec 12:830. Jun 12:412. Planning: Part I. Sep 12:600. © Compensation and Benefits Update: Jul 12:476. ® Recent Developments in Estate Retirement Plans and Executive Aug 12:553. Planning: Part II. Oct 12:688. Compensation. Nov 12:746. Sep 12:628. ® Transfers to Skip Trusts in 2010: Not WALSTRA, RICHARD Oct 12:705. Necessarily Free From GST Tax. ® The ABCs of Acquisitive Nov 12:770. Apr 12:240. Reorganizations. Aug 12:548. Dec 12:850. SCHNEE, EDWARD J. WASHINGTON, JAMES R., Ill ® Taxing the Transfer of Debts Between ® Tax and Financial Planning DC Currents Debtors and Creditors. Jul 12:446. in 2012: Betting on the House? GOLDSTEIN, BENSON S. SCHNEID, JOSEPH W. Dec 12:846. ® Global High-Wealth Audit Update. © Due Diligence Update. May 12:340. WASHINGTON, KEMBERLEYJ . Jul 12:466. SCHREIBER, GERARD H., JR. ® Tax and Financial Planning ® IRS Revenue Officer Can Summons ® Tax Practice Quality Control. in 2012: Betting on the House? “Non-Content” Information From a Nov 12:762. Dec 12:846. Taxpayer’s Emails. Jul 12:467. SCHULMAN, MICHAEL DAVID WHITTALL, ROB © The RPO, OPR, and Circular 230. ® Assisting the Newly Widowler|ed. ® U.S. LLCs for U.K. Tax Purposes. Apr 12:258. Mar 12:188. Oct 12:684. ® Setting Up Firm Procedures SEAGO, W. EUGENE WILLIAMS, JIMMY J. to Fight Identity Theft. ® Taxing the Transfer of Debts Between ® Key Planning Considerations for Cash Oct 12:696. Debtors and Creditors. Jul 12:446. Flow in Retirement. Jun 12:406. ® Watch for Further IRS SEETHARAMAN, ANANTH YESNOWITZ, JAMIE Pronouncements on ITINs. ® EITC Due-Diligence Requirements: ® The Mobile Workforce Bill: Oct 12:697. IRS Ramps Up Enforcement and Addressing “Road Warrior” ® Worker Classification Issues on Education Efforts. Jan 12:34. Compliance. Dec 12:838. Washington Agenda. Jan 12:50. THE TAX ADVISER |D ECEMBER 2012 861 Author|ndex CPA News Notes O’CONNELL, FRANK J., JR. (Editor) NEVIUS, ALISTAIR M. © Sep 12:570. ® Jan 12:4. SMITH, ANNETTE B. (Editor) Feb 12:72. ® Jul 12:428. Tax Research Mar 12:148. VAN LEUVEN, MARY (Editor) Techniques Apr 12:206. ® Jun 12:362. May 12:282. WONG, ALAN (Editor) Jun 12:360. © Oct 12:646. By Robert L. Gardner, Ph.D Jul 12:424. Dave N. Stewart, CPA, Ph.D Aug 12:490. Tax Practice & Procedures Ronald G. Worsham, Jr., CPA, Ph.D Sep 12:566. CHAMBERS, VALRIE (Editor) Oct 12:642. ® Jan 12:54. Nov 12:718. Apr 12:260. Dec 12:782. Jul 12:468. Tax Researcn Oct 12:698. TecHNiques Personal Financial Planning SARENSKI, THEODORE J. (Editor) Tax Practice Management ® Assisting the Newly Widowler]ed. HOLUB, STEVEN F. (Editor) Mar 12:188. and PARKER, KENNETH M. (Editor) Key Planning Considerations ® Helping Associates Achieve Work/Life for Cash Flow in Retirement. Balance. Sep 12:622. Jun 12:406. ® How to Start a Firm. Jun 12:408. ® Tax and Financial Planning in ® Impact of Millennials on CPA Firms. 2012: Bettingo n the House? Mar 12:192. No. 061074 Regular $73.75 Dec 12:846. ® Transferring Client Data Securely. ® What Can One Line Do for You? Dec 12:842. AICPA Member $59.00 Sep 12:625. Tax Practice Responsibilities 1 specific examples of how State & Local Taxes PURCELL, THOMAS J., II (Editor) effectively researcn both tax YESNOWITZ, JAMIE C. (Editor) ® Circular 230: Its Day-to-Day Impact mptiance and tax planning ® The Mobile Workforce Bill: on Tax Practices. Feb 12:130. engagements !n this new eignti Addressing “Road Warrior” ® Circular 230, Section 40.21, and SSTS editi+o n. r cE mpl. oying n a93 syst+ emaattiicc Compliance. Dec 12:838. No. 6: Standards Relating to Taxpayer ® State Taxation of Trusts: Credit for Errors and Omissions. Aug 12:544. combined with guidance on Taxes Paid to Other States. ® Due Diligence Update. May 12:340. atest avaiiabdie tools and Sep 12:616. Tax Practice Quality Control. urces, Tax Research Nov 12:762. Techniques helps sharpen your Tax Clinic k nt ay t ALMERAS, JON (Editor) Tax Trends @ Mar 12:152. BEAVERS, JAMES . t the fact ANDERSON, KEVIN D. (Editor) © Jan 12:66. @ May 12:288. Feb 12:142. e Ask expert que f BAKALE, ANTHONY S. (Editor) Mar 12:198. © Seaforr ctheh r ight authority ® Aug 12:494. Apr 12:274. COOK, MARK G. (Editor) May 12:354. e Re € quest Jun 12:418. - f cate y ciusion COZEWITH, MINDY TYSON (Editor Jul 12:481. and FOX, SEAN (Editor) Aug 12:558. A case study illustrates the @ Apr 12:212. Sep 12:633. various working papers that go DELL, MICHAEL (Editor) Oct 12:710. nto a client file @ Jan 12:8. Nov 12:774. FAIRBANKS, GREG A. (Editor) Dec 12:855S. ®@ Feb 12:76. cpa2biz.com KOPPEL, MICHAEL (Editor) s ® Dec 12:786. 888.777.7077 Subjectindex TWELVE MONTHS ENDING DECEMBER 2012 ACCOUNTING MetuHops & Periops Extension of time to file. Reasonable compensation. Oct 12:648. Apr 12:212. Related taxpayers. Nov 12:723. See “Tax Accounting.” Gain recognition agreement. Sec. 338 election. Apr 12:215, Jun 12:364. May 12:290, Jul 12:428. BANKRUPTCY & INSOLVENCY Insolvency. Aug 12:494. Sec. 382. Jan 12:8, Feb 12:80. NUBIG. Feb 12:76. Stock basis reporting. May 12:288. Cancellation of debt income, insolvency NUBIL. Feb 12:76. Worthless debts. Feb 12:84. exclusion. Dec 12:786. Short tax year of acquired corporation. Worthless securities. Feb 12:83. Chapter 7. Feb 12:104. Apr 12:212. Worthless stock deduction. May 12:291. Discharge of income tax. Feb 12:106. Single-member limited liability company. Fraud. Feb 12:110. Apr 12:213. Crepits AGAINST TAX Liens. Feb. 12:106. TS Statute of limitation. Feb. 12:108. CorroraTIONS & SHAREHOLDERS Alternative simplified credit. Apr 12:216. Amortization of intangibles. Child care credit. Nov 12:734. CHARITABLE CONTRIBUTIONS Jul 12:428. Child tax credit. Mar 12:174, Booster clubs. Mar 12:178. Anti-churning rules. Jul 12:428. Nov 12:734. Conservation easements. Jun 12:418. Basis. Apr 12:215. Credit for coverage under a qualified ( ontemporaneous documentation. Built-in losses. Jan 12:8. health plan. Mar 12:176. Dec 12:787. Buy-sell agreements. Jan 12:59. Education tax credits. Mar 12:175. Form 8283. Mar 12:172. Check-the-box regulations. Feb 12:83. EITC due diligence. May 12:340. Fundraising. Mar 12:178. Consolidated returns. Apr 12:215. Energy-efficient commercial building Noncash contributions. Mar 12:172. Controlled group. Nov 12:722. deduction. Aug 12:497. Pub. 78. Mar 12:178. Converting C corporation to an First-time homebuyer credit. Substantiation. Mar 12:183, S corporation or LLC. Aug 12:534. Mar 12:175. Dec 12:788. Deemed asset sale election. May 12:290. Green buildings. Aug 12:497. Volunteer expenses. Mar 12:177. Disguised dividends. Oct 12:648. Low-income community businesses. Double taxation. Oct 12:665. Feb 12:74. CONSOLIDATED RETURNS Hot stock rules. Feb 12:78. New markets tax credit. Feb 12:74, Insolvency. May 12:290. Sep 12:570. Bausch & Lomb doctrine: Apr 12:214. Intercompany transactions. Apr 12:215. Nonbusiness energy credit. Mar 12:175. Cancellation of indebtedness. Matching principle. Nov 12:723. Qualified research expenses. Aug 12:494. Modification of debt instrument. Apr 12:216. C reorganization, upstream, Apr 12:213. Feb 12:83. Passthrough entities. May 12:292. Deferred intercompany gain. Ownership changes. Feb 12:76. R&E expenditures. Feb 12:85. Jun 12:362. Patronage dividends. Nov 12:722. Rehabilitation credit. Dec. 12:855. THE TAX ADVISER DECEMBER 2012 863 Subjectindex Credits Against Tax, cont'd Plan distributions. Jan 12:24. Foreign beneficiaries. Profit sharing plans. Nov 12:747. Dec 12:800. Research credit. Feb 12:86, Apr 12:216, Qualified domestic relations orders Form 706. Dec 12:783. May 12:292, Aug 12:498, (QDROs). Jan 12:24, Nov 12:749. Formula clauses. Sep 12:602. Nov 12:723. Qualified plans. Mar 12:152. Gifts, present interest in. Nov 12:726. Qualifying longevity annuity contracts. Gift tax. Apr 12:219, Sep 12:600, Residential energy-efficient property Nov 12:747. Oct 12:690, Nov 12:725. Retirement plans. Jan 12:24. Graduated retained interests. Jan 12:7, credit. Mar 12:175. Sustainability. Aug 12:497. Rollovers. Nov 12:750. Aug 12:530, Oct 12:693. Tax withheid on wages. Mar 12:175. Sec. 83 election, substantial risk of Graduated grantor-retained annuity Veterans’ work opportunity credits. forfeiture. Nov 12:754. trusts. Aug 12:530. Apr 12:207. Success-based fees. Jan 12:19. Graegin loans. Jan 12:67. “Top hat” plans. Jan 12:24. Grantor-retained interests. Jan 12:7. DEPRECIATION Transit fare smart cards. Aug 12:491. Generation-skipping tax. Apr 12:240. Listed transactions. Jan 12:7. Artwork. Aug 12:501. EMPLOYMENT TAXES Transfers in 2010. Apr 12:240. Automobile depreciation limits. Inflation adjustments. Sep 12:607. May 12:284. Family member exceptions. Jan 12:6. Information reporting. Cost segregation. Aug 12:505. Inflation adjustments. Mar 12:184. Dec 12:800. Purchase-price allocations. Aug 12:505. Payroll tax cut extension. May 12:285. Investment advisory fees. Sep 12:604. Rental real property. Oct 12:648. Religious exceptions. Jan 12:6. Knight decision. May 12:294, Sec. 530. Jun 12:380. Sep 12:604. Supplemental unemployment Marital deduction clause. Oct 12:650. Emptovet Benefits & PENSIONS compensation benefits. Nov 12:774. Nonresident aliens. Dec 12:801. Annuities. Mar 12:153. Tips. Sep 12:567. Notice of right of withdrawal. Bankruptcy, retirement plan assets. Treatment of disregarded entities. Feb 12:92. jan 12:24. Jan 12:5. Ordering rules. Jun 12:361. Community property. Jan 12:24. Trust Fund Recovery Penalty. Portability election. May 12:284, Deferred compensation. Jan 12:24. Oct 12:698. Sep 12:568, Oct 12:688, Eligible exempt entity plans. Jan 12:24. Voluntary classification settlement Dec 12:783. Employee plan qualification. Jan 12:9. program. Feb 12:90, Mar 12:184. Sec. 2036 regulations. Aug 12:530. Employee stock ownership plans. Worker classification. Mar 12:184, Skip trusts. Apr 12:240. May 12:346. Jun 12:380. Substitution power over life insurance Employer-sponsored group health plans. policy. Oct 12:694. Dec 12:830. Estates, Trusts & Girts Transfers to trusts. Sep 12:600. ERISA. Nov 12:747. Trusts, deduction for administrative Exempt organization plans. Jan 12:24. Annual gift tax exclusion. Nov 12:725. costs. May 12:294. Flexible spending arrangements. Appraisals. Apr 12:217. Trusts, generation-skipping transfer tax. Aug 12:490, Dec 12:833. Charitable deductions. Sep 12:602. Sep 12:600. 401(k) plans. Nov 12:746. Claims against estate. Apr 12:274, Valuation, estate. Apr 12:219, Governmental plans. Nov 12:750. Oct 12:694. Oct 12:689. Health plan cost reporting. Mar 12:149. CLAT annuity payments. Sep 12:606. Valuation of claims. Apr 12:274. Health plan premium tax credit. Clawback of gift tax exemption. Withholding. Dec 12:800. Dec 12:834. Dec 12:847. Highly compensated employees. Crummey powers. Feb 12:92. Excise TAXES Mar 12:153. Estate administrative expenses. IRS, determination letter program. Jan 12:66, May 12:294. Medical device excise tax. Jul 12:431. Nov 12:748. Estate planning for non-U.S. citizens. Treatment of disregarded entities. Medical loss ratio rebates. Apr 12:219. Jan 12:5. Dec 12:832. Estate tax. Apr 12:217, Oct 12:650. Nonqualified plans. Mar 12:154. Reform. Sep 12:600. Exempt ORGANIZATIONS Patient Protection and Affordable Care Family limited partnerships. Act. Dec 12:830. Oct 12:688. Disclosure of tax-exemption Performance-based compensation. FATCA. Dec 12:800. determinations. May 12:285. Nov 12:755. Fiduciary fees. Sep 12:605. Online search tool. May 12:284. 864 THE TAX ADVISER DECEMBER 2012 Political organizations. Apr 12:260. Sec. 199. May 12:295. IC-DISCs. Aug 12:509, Oct 12:651, Reporting requirements. Apr 12:260. Standard mileage rates. Feb 12:72, 682. Sec. 527 organizations. Apr 12:260. Mar 12:177. Immigration and Customs Enforcement. Success-based fees. Jan 12:19, Jul 12:438. Expenses & DEDUCTIONS Dec 12:788. India, R&D incentives. Aug 12:501. Tangible property costs. Mar 12:150. Information reporting. Jan 12:55, Acquisition indebtedness. May 12:300. Telecommunications services. Apr 12:263, Jul 12:438. Bad debt. Nov 12:727. Jan 12:10. Interest on deposits. Jul 12:426. Bonus accruals. Jan 12:5, Apr 12:224. Theft loss deductions. Apr 12:262. Liens and levies. Jul 12:442. Business deductions. Trade or business expenses. Mark-to-market rules. Oct 12:659. Dec 12:789. Dec 12:814. Nonresident aliens. Nov 12:738. Capital expenditure. May 12:297. Wages paid. Mar 12:177. Offshore voluntary disclosure initiatives. Capitalization. Sep 12:573. Mar 12:149, May 12:330, Sep Capitalization of acquisition costs. FOREIGN INCOME & TAXPAYERS 12:567. Dec 12:788. Partnerships. Jul 12:434. Capital loss. Nov 12:727. Canada, R&D incentives. Aug 12:500. Passive foreign investment company. Caregiver expenses. Mar 12:180. CFC upfront payments. Jul 12:425. Jul 12:433, Aug 12:510, Oct 12:658. Controlled substances. Mar 12:180. China, R&D incentives. Aug 12:500. Qualified electing fund. Oct 12:658. Cost-segregation studies. Sep 12:574. Consolidated group. Apr 12:225. Resident alien capital gains. Aug 12:510. Domestic production activities Controlled foreign corporations. Mar Sandwich structure. Mar 12:155. deduction. Jan 12:10, May 12:295. 12:155, Jul 12:439, Oct 12:653. Specified foreign financial assets. Education expenses. Jul 12:454. Corporate reorganization. Apr 12:225. Jan 12:55. Equitable ownership and mortgage Dual consolidated losses. Feb 12:93. Subpart F. Jul 12:439. interest deductions. Jan 12:54. Estate taxes. Nov 12:738. Tax treaties. Nov 12:739. Executive compensation. Jun 12:364. Expatriated entities. Aug 12:491. U.K., R&D incentives. Aug 12:500. Exercising stock options. Feb 12:142. Foreign Account Tax Compliance Act U.K. taxation of U.S. LLCs. Oct 12:684. Golden parachutes. Jun 12:364. (FATCA). Apr 12:263, May 12:331, U.K. unit trusts. Aug 12:510. Idle assets. Mar 12:178. Jun 12:400, Sep 12:580, U.S. residents. Nov 12:738. LEED certification costs. Sep 12:573. Dec 12:800. Voluntary disclosure programs. Local lodging. Jul 12:426. Model intergovernmental agreement. Mar 12:149, May 12:330, MBA expenses. Jul 12:454. Nov 12:728. Sep 12:567. Meals and entertainment. FBAR. Jan 12:55, May 12:330. Withholding. Jun 12:400. Dec 12:789. Foreign asset reporting rules. Sep Medical marijuana. Mar 12:180. 12:578. Gains & Losses Medicare premiums. Sep 12:566. Foreign base company sales income. Mortgage interest deduction. Jan 12:54, Oct 12:653. Allocation of basis. Mar 12:182. May 12:300. Foreign earnings repatriation. Bad debts. Sep 12:581. Mortgage loan points. Nov 12:771. Mar 12:156. Cancellation of debt. Jun 12:390. Ordinary loss. Nov 12:727. Foreign estate and trust beneficiaries. Claim of right doctrine. Oct 12:659. Per diem rates. Dec 12:782. Dec 12:800. Cost basis. Apr 12:265. Ponzi schemes. Apr 12:262, Foreign financial assets. Jan 12:55, Debt modificationJ.u n 12:390. Oct 12:659. Feb 12:73, Apr 12:264. Debtor-to-creditor transfers. Pooled bonus arrangements. Foreign financial institution Jul 12:446. Apr 12:224. withholding. Apr 12:209. Derivatives contracts. Mar 12:182. Principal residence. Jan 12:55. Foreign Investment in Real Property Tax Financial blocker corporations. Purchasing distressed obligations. Act. Jul 12:433. Sep 12:581. Sep 12:608. Foreign partnerships. Feb 12:118. Hobby losses. Mar 12:180. Qualified residence interest. Foreign personal holding company Information reporting. Apr 12:265. May 12:354. incomeJ.u l 12:439. Installment obligationsJ.u l 12:452. Real estate taxes. Nov 12:770. Foreign R&D incentives. Aug 12:500. Like-kind exchanges. Mar 12:182, Repairs. Mar 12:150, 182, May 12:297, Foreign tax credits. May 12:301. Dec 12:819. Sep 12:575. Foreign tax credit splitter arrangements. LLC members. Feb 12:74. Residence acquisition costs. Apr 12:208, Sep 12:576. Loss limitations. Mar 12:180. Nov 12:770. Foreign taxation. Apr 12:225. Passive activity losses. Feb 12:74, Sec. 179. Mar 12:178. Homeland Security. Jul 12:428. Mar 12:180. THE TAX ADVISER | DECEMBER 2012 865 Subjectindex Gains & Losses, cont’d Estimated payments. Apr i12:250. LLCs & LLPs Filing status. Dec 12:787. Ponzi losses. Apr 12:262, Foster care payments. Mar 12:177. Limited partnership status. Apr 12:227. Oct 12:659. Head-of-household filing status. Material participation rules. Apr 12:227. Rental real estate. Mar 12:180. Mar 12:174. Passive losses. Apr 12:227. State tax credit sale. Mar 12:182. Hobby losses. Dec 12:814. Self-employment income. Mar 12:183. Theft loss. Mar 12:177. Innocent spouse relief. Mar 12:148, 184, Single-member LLCs. Dec 12:796. Timing of losses. Oct 12:660. Dec 12:820. Startup costs. Dec 12:796. Wash-sale rules. Mar 12:194. Interest. Dec 12:813. U.K. taxation of U.S. LLCs. Oct 12:684. Worthless securities. ep 12:585. Like-kind exchanges. Dec 12:819. Medical expenses. Nov 12:735, PARTNERS & PARTNERSHIPS Gross INCOME Dec 12:816. Medicare premiums. Nov 12:735. At-risk rules. Mar 12:160. Cancellation of debt income. Medicare tax on investment income. Cancellation of debt income. Jan 12:6 Mar 12:176, Jun 12:390, Aug 12:514. Capital interest. Mar 12:198. Dec 12:786. Mortgage interest. Mar 12:176. Debt-for-equity transfers. May 12:302. Capital gain. Dec 12:792. Mortgage loan points. Nov 12:771. Debt interest. Mar 12:199. Discharge of indebtedness. Moving expenses. Dec 12:818. Discharge of indebtedness income. Dec 12:790. Passive activity rules. May 12:327, Jan 12:6, May 12:302. Employee expense reimbursement Dec 12:818. Disguised sales. Feb 12:120. arrangements. Nov 12:718. Protective refund claims. Economic substance doctrine. Energy property grants. Jan 12:12. Dec 12:793. Feb 12:118. Form 1099-C. Dec 12:797. Qualified dividends. Aug 12:514. Electronic K-1s. Apr 12:206. Frequent flyer miles. Aug 12:511. Qualified scholarships. Mar 12:176. Equity interest. Mar 12:199. Interest subsidies. Mar 12:176. Real estate taxes. Nov 12:770. Family investment partnerships. Investment income. Reduced capital gains rates. Mar 12:157. Dec 12:792. Mar 12:174. Foreign partnerships. Feb 12:118. Ordinary income. Dec 12:792. Registered domestic partners. Limited partners. Apr 12:227, Promotional benefits Aug 12:511. Apr 12:24 Jun 12:368. Qualified dividend income. Mar 12:177 Residence acquisition costs. Loss limitations. Feb 12:121. Real property. Dec 12:792. Nov 12:770. Medicare premiums. Nov 12:735. Sec. 83(b) election. sep 12:567, Same-sex couples. Apr 12:244, Multistate reporting. Jun 12:366. Nov 12:733, 754. Dec 12:793. Multistate withholding. Jun 12:366. Substantial risk of forfeiture. Self-employment tax. Apr 12:248. Partners’ basis. Feb. 12:114, Nov 12:733, 754. Sole proprietors. Nov 12:735. Mar 12:160. Trade or business. Trade or business expenses. Partnership distributions. Feb 12:121. Dec 12:791. Dec 12:814. Partnership interests. May 12:302. Vacation home rentals. May 12:326. 0 © S corporation shareholders. Passive activity rules. Jun 12:368. Nov 12:735. Sec. 754 election. Feb 12:96. INDIVIDUALS Underpayment of estimated tax. Self-employment. Feb. 12:117. Dec 12:820. Statute of limitation. Feb 12:115. Alimony. Mar 12:176, Vacation home rentals. May 12:3~2~ = ) > Technical terminations. Oct 12:663. Dec 12:818. TEFRA proceedings. Feb 12:114. Capital expenditures. Dec 12:818. INTEREST INCOME & EXPENSE Capital gains. Aug 12:512. PERSONAL FINANCIAL PLANNING Charitable contribution. Dec 12:816. Convertible debt. Sep 12:589. Citizenship of dependents. Nov 12:734 Disqualified debt rules. Sep 12:589. Business succession planning. COD income. Dec 12:813. Dec 12:797. Community property. Apr 12:244. Capital gains. Feb 12:124. LEGISLATION Deductions. Nov 12:735. Capital loss limitation. Feb 12:123. Dependency exemption. Nov 12:734. Middle Class Tax Relief and Job Clawback of gift tax exemption. DOMA. Dec 12:793. Creation Act. May 12:285. Dec 12:847 Earned income credit. Dec 12:812. Three Percent Withholding Financial planning from tax return. Employer-provided educational benefits. Repeal and Job Creation Act. Sep 12:625. Aug 12:514. Feb 12:73. Investment. Jun 12:406. 866 THE TAX ADVISER | DECEMBER 2012 > IRAs. Feb 12:123. Identity theft. Oct 12:696, Examination process. Jan 12:56. Irrevocable life insurance trusts. Dec 12:842. Knowledge management strategy. Dec 12:825. Millennial generation. Mar 12:192. Oct 12:668. Life insurance. Dec 12:824. Privacy. Dec 12:842. Mailbox rule. Jun 12:360. Medical expense deduction. Dec 12:847. Professional development. Mar 12:193. Nonresident alien payees. Jun 12:369. Net investment income tax. Recruiting. Mar 12:193. Offer in compromise. Jul 12:474, Dec 12:846. Retention. Mar 12:193. Aug 12:491. Pension rescue. Dec 12:824. Tax preparation software. Aug 12:524. Option reporting. Jul 12:424. Qualified dividends. Dec 12:846. Work/life balance. Sep 12:622. Penalty relief for the unemployed. Retirement. Jun 12:406. May 12:283. Roth IRAs. Feb 12:123. Practitioner regulation. Apr 12:208. Procepure & ADMINISTRATION Savings bonds. Dec 12:847. Preparer compliance letters. Surviving spouses. Mar 12:188. Accuracy-related penalty. May 12:304. Jan 12:5. Tax-exempt investments. Circular 230. Jan 12:42, Feb 12:130, Preparer office visits. Jan 12:5. Dec 12:847. Apr 12:258. Preparer tax identification number. Wash-sale rules. Feb 12:124. Collections. Jul 12:425. Jan 12:42. Correspondence audits. Jun 12:361. Fees. Aug 12:490. Practice & PROCEDURES Debt instrument reporting. Jul 12:424. Requirements. Apr 12:208. Early referral program. Apr 12:229. Priority phone service. Jun 12:361. Check 21 Act. Jul 12:470. Earned income tax credit (EITC) due Registered tax return preparers. Circular 230. May 12:340, Nov 12:762. diligence. Jan 12:34, Mar 12:151. Jan 12:42, Apr 12:258. Compliance assurance process. EIN requirements. May 12:285. Retroactive relief. Nov 12:775. Jan 12:57. Electronic K-1s. Apr 12:206. Statistical sampling. Oct 12:702. Credit elect. Jul 12:468. Estimated tax payments. Mar 12:185. Statute of limitation, assessment of tax. Due diligence. May 12:340. Fast track mediation. Apr 12:230. Apr 12:228. Economic substance doctrine. Fast track settlement. Apr 12:230. Substantial understatement penalty. May 12:319. Filing false returns. May-12:355. Nov 12:719. EITC due diligence. Jan 12:34, Fingerprinting requirement. Jan 12:4. Tax evasion. May 12:355. May 12:340. Fraudulent returns. Nov 12:719. Tax return information disclosure. Errors and omissions. Aug 12:544. Fresh start program. May 12:283. Mar 12:199. Examinations. Jan 12:56. Frozen refundable credits. Nov 12:719. Tax return refund fraud. Nov 12:719, Filing. Nov 12:736. Global High Wealth Industry Group. Dec 12:783. Filing requirements, COD income. Jul 12:466. Taxpayer Advocate Service cases. Dec 12:797. Government contractor withholding. Nov 12:720. Form 1099-C. Dec 12:792. Feb 12:73. Tiered issue process. Oct 12:668. Identity theft. Oct 12:696, Dec 12:842. Health care individual mandate. Treasury regulations, deference to. Interest netting. Jan 12:67. Aug 12:493. ITINs. Sep 12:568, Oct 12:697. High-wealth audits. Jul 12:466. [reasury regulations, retroactivity of. Overpayment applied to estimated tax. HSA inflation adjustments. Jul 12:424. Apr 12:228. Jul 12:468. Identity theft. Oct 12:696, Nov 12:719, Uncertain tax position disclosure. Practitioner standards. Aug 12:544. Dec 12:784, 842. Oct 12:700. Quality examination process. Jan 12:57. Installment agreements. Jul 12:474. Valuation misstatement penalties. Statements on Standards for Tax International practice networks. Mar 12:163. Services. May 12:318, 340, Oct 12:668. Whistleblower claims. Dec. 12:856. Nov 12:762. IRS, alternative dispute resolution. Withholding. Jun 12:369. Substantiation. Jul 12:470. Apr 12:229. Worker misclassification. Jan 12:13, Substitute check. Jul 12:470. IRS Office of Professional Responsibility. Jan 12:50. Substitute for return. Nov 12:728. Apr 12:258. Wrongful levy. Jul 12:472. Tax practice quality control. IRS Return Preparer Office. Apr 12:258. Nov 12:762. Issue practice groups. Oct 12:668. REA Estate ITIN applications. Sep 12:568, PRACTICE MANAGEMENT Oct 12:697. Interest rate swaps. Jan 12:15. Labor Department data sharing. Personal use of rental property. CPA firms, startup. May 12:408. Jan 12:13. May 12:326. Cyber security. Dec 12:842. LB&I DivisionJ.an 12:56. REIT cash items. Sep 12:590. THE TAX ADVISER | DECEMBER 2012 867 Subjectindex Real Estate, cont'd Audit procedures. Jul 12:458. Asset acquisition agreements. Click-through nexus. Apr 12:253, May 12:305S. REITs. Jan 12:14. Jun 12:419. Average-cost-basis method. Rents from real property. Jan 12:14. Illinois. Jul 12:425. Mar 12:182. Cloud services. Sep 12:593. Commodity dealers. Jan 12:18. Commerce Clause. Apr 12:276. Corporate reorganizations. § CORPORATIONS Cost of performance. Nov 12:756. Nov 12:719. Asset acquisitions. Apr 12:231. Credits for tax paid. Sep 12:616. Cost-basis method. Mar 12:182. Basis. sep 12:569, Oct 12:679. “Deal of the day” instruments. Cost segregation. May 12:305. Built-in gains tax. Mar 12:166, Feb 12:100. Credit card fees. Feb 12:102. Oct 12:680. Discount vouchers. Feb 12:100. Customer loyalty programs. Jun 12:370, Change in capital structure. Ethics. Apr 12:232. Aug 12:518. Oct 12:678 Green energy incentives. Aug 12:497. Depreciation. May 12:305, Controlled corporations. Oct 12:679. Internet, sales tax on purchases. Jul 12:444. Earnings and profits. Oct 12:678. Apr 12:252. Doubtful accounts. Jan 12:16. Eligible shareholders. Oct 12:677 Market-based sourcing. Economic performance. Jun 12:375. Fringe benefits. Dec 12:850. Nov 12:737, 756. Energy contracts. Jan 12:18. IC-DISCs. Oct 12:682. Mobile Workforce State Income Tax FIN 48. May 12:307. Inadvertent terminations. Oct 12:663. Simplification Act. Dec 12:838. Mark-to-market rules. Jan 12:18. Information reporting. Oct 12:678. Model Mobile Workforce Statute. Nonaccrual-experience book safe- Lite insurance transactions. Dec 12:839. harbor method. Jun 12:372. Aug 12:516. Multistate Tax Compact. Nov 12:736. Notional principal contracts. Losses. Oct 12:679. New York Metropolitan Transportation Jan 12:21. One class of stock. Oct 12:677 Authority Tax. Dec 12:785. Premium coupons. Aug 12:520. QSubs. Apr 12:231, Aug 12:553. Nexus. Apr 12:253, 275, Jun 12:419, Purchase price allocations. Redemptions. Oct 12:664. Jul 12:425. May 12:30S. Reorganizations. Oct 12:680. Online retailers, sales tax. Apr 12:252. Recurring-item exception. Feb 12:72, Second class of stock sep 12:610, Physical presence requirement. Jun 12:375. Oct 12:664. Apr 12:276, Jun 12:419. Retail inventory method. Feb 12:101, S election. Apr 12:268. Ouill. jun 12:419. Apr 12:234. Self-employment tax. Oct 12:679. Remotely accessed software. Rewards programs. Aug 12:520. Sec. 132 fringe benefits. Dec 12:850. Sep 12:593. Sec. 168(i)(7) transactions. Jul 12:444. Sec. 351 transfer. Apr 12:231. R&D investment. Feb 12:98. Sec. 263A costs. Nov 12:720. Shareholder basis. Sep 12:569, Sales and use tax. Apr 12:252, 275, Sec. 1256. Jan 12:21. Oct 12:679. Jul 12:458. Success-based fees. Jan 12:19. Shareholder loans. Sep 12:569. Special apportionment formulas. Tax shelter. Sep 12:610 Oct 12:665. Tax EDUCATION 2% S corporation shareholders. State personal income taxes, Nov 12:735. nonresidents. Dec 12:838. Active learning. Aug 12:548. Wages. Oct 12:679. Successor tax liability. Sep 12:596. Circular 230. Feb 12:133. Tax incentives. Feb 12:98. International tax law. May 12:342. SPECIAL INDUSTRIES [rust taxation. Sep 12:616. Learning, reflection exercises in. UDITPA. Nov 12:736. Nov 12:766. Captive insurance companies. Use tax. Apr 12:232. Teaching corporate reorganization Sep 12:590. Withholding, state income tax. principles. Aug 12:548. Construction industry. Nov 12:723.> Dec 12:838. Crop insurance proceeds. Dec 12:798. Farming. Dec 12:791 Tax ACCOUNTING State & Locat TAxes Accounting method change. Jan 12:16, May 12:282, 306, Nov 12:719 Allocation and apportionment. Accrual method. Jan 12:16. Oct 12:665., Nov 12:737, 756. All-events test. Jun 12:375. Amazon laws. Apr 12:253, Allocation of Sec. 263A costs. Jun 12:419. Nov 12:720. 868 THE TAX ADVISER |