The Tax Adviser 2010: Vol 41 Index PDF

Preview The Tax Adviser 2010: Vol 41 Index

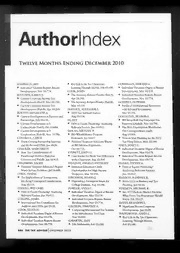

Authorindex TWELVE MONTHS ENDING DECEMBER 2010 AUERBACH, ART ® Reel Life in the Tax Classroom: GERSHMAN, EDWARD A. ® Individual Taxation Report: Recent Learning Through Movies. Feb 10:144. ® Individual Taxation: Digest of Recent Developments. Nov 10:774. COOK, JOHN Developments. Mar 10:178 BOUCHER, KAREN J. ® The Accuracy-Related Penalty (Part I). ® Individual Taxation Report: Recent ® Current Corporate Income Tax Apr 10:248. Developments. Nov 10:774. Developments (Part I). Mar 10:186. ® The Accuracy-Related Penalty (Part Il). GODFREY, HOWARD Current Corporate Income Tax May 10:338. ® Profile of Multinational Businesses Developments (Part II). Apr 10:260. DeFELICE, ALEXANDRA with Inbound Investments. RTON, HUGHLENE A. ® 2010 Tax Software Survey. Mar 10:196. Current Developments in Partners and Aug 10:536. GOLDSTEIN, BENSON S. Partnerships. Feb 10:116. DI, HUI ® IRS Set to Roll Out Uncertain Tax Current Developments in S ® Debt or Equity Financing? Analyzing Positions Schedule. Nov 10:798. Corporations (Part I). Oct 10:684. Relevant Factors. Jun 10:412. The IRS’s Examination Workhorse: Current Developments in S DOLAN, MICHAEL P. The Correspondence Audit. Corporations (Part Il). Nov 10:786. ® IRS Whistleblower Program Aug 10:566. CANTRELL, CAROI Evaluated. Jan 10:63. Time to Start Planning for the 2011 © Trusts Owning Partnership Interests National Taxpayer Advocate Warns Tax Filing Season. May 10:348. and the Revised UPIA. Jan 10:26. of IRS Mission Expansion. HAGY, JANET C. CHALKER, MARGARETE Oct 10:718. ® Individual Taxation: Digest of Recent ® State Tax Considerationso f EVERETT, JOHN O. Developments. Mar 10:178. Passthrough Entities: Potential ® Case Studies for Book-Tax Differences ® Individual Taxation Report: Recent Concerns and Pitfalls. Jun 10:418. in the Classroom. Aug 10:568. Developments. Nov 10:774. CHAMBERS, VALRIE FALGIANI, ANGELO ANTHONY HANKE, STEVEN A. ® National Taxpayer Advocate’s Report ® Improved Education Credit ® Debt or Equity Financing? Notes Serious Problems. Jul 10:488. Opportunities for High-Income Analyzing Relevant Factors. CHEN, YINING Taxpayers. Mar 10:194. Jun 10:412. ® Tax Implicationso f Transactions FERGUSON, SUSAN Q. HANSON, RANDALL K. Involving Contingent Consideration. ® Dependency Exemption Issues for ® Series LLCs in Business and Tax Aug 10:558. College Students. Aug 10:546. Planning. Jan 10:50. CHIANG, WEI-CHIH FOWLER, ANNA C. HARMON, MICHAEL R. ® Debt or Equity Financing? Analyzing ® Individual Taxation: Digest of Recent ® Sec. 475 Mark-to-Market Election: Relevant Factors. Jun 10:412. Developments. Mar 10:178. What Every Tax Practitioner Should COLLINS, JAMES ® Individual Taxation Report: Recent Know. Feb 10:125. ® International Tax Compliance for Developments. Nov 10:774. HAYES, BRANDON L. Auditors and CFOs. Jan 10:58. GAGNON, TIMOTHY A. ® Significant Recent Corporate COOK, ELLEN D. © Comparing International Tax Systems Developments. Jan 10:30. ® Individual Taxation: Digest of Recent in the Introductory Tax Class. HAZELWOOD, ANITA C. Developments. Mar 10:178. Nov 10:800. ® Reel Life in the Tax Classroom: ® Individual Taxation Report: Recent GAVARTIN, AMY Learning Through Movies. Developments. Nov 10:774. ® Life Settlements. Feb 10:140. Feb 10:144. 886 THE TAX ADVISER DECEMBER 2010 Authorindex TWELVE MONTHS ENDING DECEMBER 2010 AUERBACH, ART ® Reel Life in the Tax Classroom: GERSHMAN, EDWARD A. ® Individual Taxation Report: Recent Learning Through Movies. Feb 10:144. ® Individual Taxation: Digest of Recent Developments. Nov 10:774. COOK, JOHN Developments. Mar 10:178 BOUCHER, KAREN J. ® The Accuracy-Related Penalty (Part I). ® Individual Taxation Report: Recent ® Current Corporate Income Tax Apr 10:248. Developments. Nov 10:774. Developments (Part I). Mar 10:186. ® The Accuracy-Related Penalty (Part Il). GODFREY, HOWARD Current Corporate Income Tax May 10:338. ® Profile of Multinational Businesses Developments (Part II). Apr 10:260. DeFELICE, ALEXANDRA with Inbound Investments. RTON, HUGHLENE A. ® 2010 Tax Software Survey. Mar 10:196. Current Developments in Partners and Aug 10:536. GOLDSTEIN, BENSON S. Partnerships. Feb 10:116. DI, HUI ® IRS Set to Roll Out Uncertain Tax Current Developments in S ® Debt or Equity Financing? Analyzing Positions Schedule. Nov 10:798. Corporations (Part I). Oct 10:684. Relevant Factors. Jun 10:412. The IRS’s Examination Workhorse: Current Developments in S DOLAN, MICHAEL P. The Correspondence Audit. Corporations (Part Il). Nov 10:786. ® IRS Whistleblower Program Aug 10:566. CANTRELL, CAROI Evaluated. Jan 10:63. Time to Start Planning for the 2011 © Trusts Owning Partnership Interests National Taxpayer Advocate Warns Tax Filing Season. May 10:348. and the Revised UPIA. Jan 10:26. of IRS Mission Expansion. HAGY, JANET C. CHALKER, MARGARETE Oct 10:718. ® Individual Taxation: Digest of Recent ® State Tax Considerationso f EVERETT, JOHN O. Developments. Mar 10:178. Passthrough Entities: Potential ® Case Studies for Book-Tax Differences ® Individual Taxation Report: Recent Concerns and Pitfalls. Jun 10:418. in the Classroom. Aug 10:568. Developments. Nov 10:774. CHAMBERS, VALRIE FALGIANI, ANGELO ANTHONY HANKE, STEVEN A. ® National Taxpayer Advocate’s Report ® Improved Education Credit ® Debt or Equity Financing? Notes Serious Problems. Jul 10:488. Opportunities for High-Income Analyzing Relevant Factors. CHEN, YINING Taxpayers. Mar 10:194. Jun 10:412. ® Tax Implicationso f Transactions FERGUSON, SUSAN Q. HANSON, RANDALL K. Involving Contingent Consideration. ® Dependency Exemption Issues for ® Series LLCs in Business and Tax Aug 10:558. College Students. Aug 10:546. Planning. Jan 10:50. CHIANG, WEI-CHIH FOWLER, ANNA C. HARMON, MICHAEL R. ® Debt or Equity Financing? Analyzing ® Individual Taxation: Digest of Recent ® Sec. 475 Mark-to-Market Election: Relevant Factors. Jun 10:412. Developments. Mar 10:178. What Every Tax Practitioner Should COLLINS, JAMES ® Individual Taxation Report: Recent Know. Feb 10:125. ® International Tax Compliance for Developments. Nov 10:774. HAYES, BRANDON L. Auditors and CFOs. Jan 10:58. GAGNON, TIMOTHY A. ® Significant Recent Corporate COOK, ELLEN D. © Comparing International Tax Systems Developments. Jan 10:30. ® Individual Taxation: Digest of Recent in the Introductory Tax Class. HAZELWOOD, ANITA C. Developments. Mar 10:178. Nov 10:800. ® Reel Life in the Tax Classroom: ® Individual Taxation Report: Recent GAVARTIN, AMY Learning Through Movies. Developments. Nov 10:774. ® Life Settlements. Feb 10:140. Feb 10:144. 886 THE TAX ADVISER DECEMBER 2010 HENNIG, CHERIE J. MILFORD, DOUGLAS J]. PETRONCHAK, KATHY ® Case Studies for Book-Tax Differences ® Tax Return Due Diligence: Basic ® Assessment Period Remains Open in in the Classroom. Aug 10:568. Considerations. Oct 10:690. Partnership Case. Apr 10:273. HODES, ROCHELLE L. MOISE, ROBERT M. PLUCINSKI, KENNETH J. ® Sec. 6676: There’s a New Penalty in © Do We Really Have Privilege? ® Improved Education Credit Town. Jul 10:486. Oct 10:716. Opportunities for High-Income HORN, JONATHAN NAKAMURA, KAREN Taxpayers. Mar 10:194. ® Individual Taxation: Digest of Recent ® State Tax Considerations of POLLARD, WILLIAM B. Developments. Mar 10:178. Passthrough Entities: Potential ® Tax Treatment of Expenses Incurred ® Individual Taxation Report: Recent Concerns and Pitfalls. Jun 10:418. by Individuals Temporarily Out of Developments. Nov 10:774. NASH, CLAIRE Y. Work. Sep 10:622. JONES, LYNN COMER ® Taxation of LLC Members as General PONDA, SHONA © Tax Court Rules on Medical Partners. Sep 10:612. ® Current Corporate Income Tax Necessities. Oct 10:698. NELLEN, ANNETTI Developments (Part I). Mar 10:186. KARLINSKY, STEWART S. ® Individual Taxation: Digest of Recent ® Current Corporate Income Tax ® Current Developments in S Developments. Mar 10:178. Developments (Part II). Apr 10:260. Corporations (Part I). Oct 10:684. ® Individual Taxation Report: Recent RAABE, WILLIAM A. ® Current Developments in $ Developments. Nov 10:774. ® Case Studies for Book-Tax Differences Corporations (Part I). Nov 10:786. NEUSCH WANDER, DARREN L. in the Classroom. Aug 10:568. KELLEY, CLAUDIA L. ® Individual Taxation: Digest of Recent RANDALL, VANCE e Tax Treatment of Expenses Incurred by Developments. Mar 10:178. ® Obtaining a Power of Attorney Individuals Temporarily Out of Work. ® Individual Taxation Report: Recent Through IRS E-Services. Jan 10:64. Sep 10:622. Developments. Nov 10:774. RANSOME, JUSTIN KULSRUD, WILLIAM N. NEWMAN, DENNIS ® Back to the Basics: Common Gift Tax ® Sec. 475 Mark-to-Market Election: ® Individual Taxation: Digest of Recent Return Mistakes. Jul 10:471. What Every Tax Practitioner Should Developments. Mar 10:178. Significant Recent Developments in Know. Feb 10:125. NICHOLS, NANCY B. Estate Planning (Part I). Sep 10:630. LAGUN, JULIA ® Dependency Exemption Issues for Significant Recent Developments in ® Assessment Period Remains Open in College Students. Aug 10:546. Estate Planning (Part II). Oct 10:702. Partnership Case. Apr 10:273. OCHELTREE, ALAN J. ROLFE, RALPH E. LAU, CHRISTOPHER ® The Accuracy-Related Penalty (Part 1). ® Protecting the Elderly from Financial ® Renewable Energy Tax Incentives. Apr 10:248. Abuse. Apr 10:276. Jan 10:46. © The Accuracy-Related Penalty (Part II). ROWE, DANIEL LIPIN, ILYA A. May 10:338. ® §S Corporations: Facing the 15% ® A Practitioner’s Guide to the Taxation OH, HYUCK Sunset. Aug 10:555S. of Telecommuting. Feb 10:100. ® Current Developments in Employee RUPERT, TIMOTHY J. LUH, TROY Benefits and Pensions (Part I). © Comparing International Tax Systems ® The HIRE Act of 2010. Dec 10:850. Nov 10:758. in the Introductory Tax Class. McCASLIN, TOM ® Current Developments in Employee Nov 10:800. ® Classification as a Statutory Employee. Benefits and Pensions (Part Il). SCHAEFER, RENE Dec 10:856. Dec 10:838. ® Tax Professionals: Making the McGAHAN, SARAH OLIVEIRA, PAUL Difference. Dec 10:874. ® Current Trends in Sales and Use Tax: © Comparing International Tax Systems in SCHAFER, FRANCES Click-Through Nexus and Information- the Introductory Tax Class. Nov 10:800. ® Back to the Basics: Common Gift Tax Reporting Requirements. Dec 10:870. O’MEARA, WILLIAM Return MistakesJ.u l 10:471. McGOWAN, JOHN R. ® Net Operating Loss and the IRS. ® Significant Recent Developments in ® The HIRE Act of 2010. Dec 10:850. Apr 10:272. Estate Planning (Part I). Sep 10:630. McNAMARA, LAWRENCE H., JR. PARKER, JAMES ® Significant Recent Developments in ® Scope of Foreign Trust Provisions in ® Taxation of LLC Members as General Estate Planning (Part II). Oct 10:702. the HIRE Act. Nov 10:768. Partners. Sep 10:612. SCHREIBER, GERARD H., JR. MARCHBEINJ,O E PARKER, KENNETH M. ® Circular 230 Best Practices. Apr 10:270. © Request for Audit Reconsideration. ® CPA Conflicts of Interest. Sep 10:644. ® IRS Workforce Initiative. Jan 10:64. Jan 10:62. PARSHALL, GERALD H.., JR. SCHURRER, PHILLIPJ . ® Using an Offer in Compromise. ® Defending R&D Credits: IRS Strategies ® Sec. 199: Domestic Production Jul 10:487. and Recent Cases. May 10:328. Activities Deduction. May 10:322. THE TAX ADVISER |D ECEMBER 2010 887 Author|ndex SLATTEN, JOHN VANDEVEER, MARK A. Case Study ® Passive Activity Grouping Disclosure ® IRS Issues Interim Report on the ELLENTUCK, ALBERT B. (Editor) Statements. Apr 10:271. Colleges and Universities Compliance ® Jan 10:66. SPOOR, GORDON Project. Oct 10:719. Feb 10:146. ® Trusts Owning Partnership Interests WALBERG, GLENN Mar 10:210. and the Revised UPIA. Jan 10:26. ® Series LLCs in Business and Tax Apr 10:278. STALEY, BLAIR A. Planning. Jan 10:50. May 10:354. ® Applying the Material Participation WALKER, DEBORAH Jun 10:426. Standards to Nongrantor Trusts. ® Current Developments in Employee Jul 10:491. Jun 10:404. Benefits and Pensions (Part I). Aug 10:574. STAPLETON, NORA Nov 10:758. Sep 10:647. ® Individual Taxation: Digest of Recent ® Current Developments in Employee Oct 10:724. Developments. Mar 10:178. Benefits and Pensions (Part II). Nov 10:806. ® Individual Taxation Report: Recent Dec 10:838. Dec 10:877. Developments. Nov 10:774. WEINREB, ADAM STUART STOCK, TOBY ® Income Apportionment and Allocation DC Currents ® Tax Implicationso f Transactions After Mead. Sep 10:640. GOLDSTEIN, BENSON S. Involving Contingent Consideration. WIGGINS, CASPER ® IRS Set to Roll Out Uncertain Tax Aug 10:558. ® Profile of Multinational Businesses Positions Schedule. Nov 10:798. STROMSEM, WILLIAM R. with Inbound Investments. ® The IRS’s Examination Workhorse: @ AICPA Tax Standards Strengthened. Mar 10:196. The Correspondence Audit. Feb 10:137. WILLIAMSON, DONALD T. Aug 10:566. SULLIVAN, JEANNE ® Applying the Material Participation ® Time to Start Planning for the ®@ The Story of Basis. Jun 10:398. Standards to Nongrantor Trusts. 2011 Tax Filing Season. SWAILS, J. EDWARD Jun 10:404. May 10:348. ® Tax Return Due Diligence: Basic WOLBACH, KRISTINE R. STROMSEM, WILLIAM R. Considerations. Oct 10:690 ® IRS Auditing Through QuickBooks. @ AICPA Tax Standards Strengthened. SWIFT, KENTON D. Oct 10:717. Feb 10:137. ® Inclusion of Certain Trusts in a WRIGHT, GAIL E. Decedent’s Gross Estate Under Sec. ® Lessons from Federal Tax Court. News Notes 2036. Feb 10:108. May 10:350. NEVIUS, ALISTAIR M. TAUB, LEWIS YIN, RACHEI ® jan 10:4. ® Sec. 465 Traps for the Unsuspecting ® The New Health Care Law and the Feb 10:76. S Corporation Shareholder. Medicare Part D Retiree Drug Subsidy. Mar 10:156. jul 10:481. Sep 10:628. Apr 10:220. TRAUM, SYDNEY S. ® Tax Implications of the Five-Year NOL May 10:294. ® S Corporation Basis Reductions for Carryback. Jul 10:478. Jun 10:370. Nondeductible Expenses. ZIMMERMAJONH,N C. Jul 10:444. Apr 10:258. ® Classification as a Statutory Employee. Aug 10-508. ® §S Corporations with Earnings and Dec 10:856. Sep 10:586. Profits. Dec 10:864. ZOOK, JOHN D. Oct 10:662. TRUGMAN, LINDA B. ® Tax Benefits for Education. Jul 10:464. Nov 10:738. ® The Valuation of FLPs: What Does ZOOK, KRISTIN L. Dec 10:818. the Tax Practitioner Need to Know? ® Tax Benefits for Education. Jul 10:464. Jan 10:38. On the Bookshelf rYLKA, STAN Campus to Clients FINK, PHILIP R. ® The IRS Whistleblower Program. NELLEN, ANNETTE (Editor) ® Mar 10:209. Mar 10:204. ® Case Studies for Book-Tax Differences ® Jun 10:424. VALENTI, STEPHEN P. in the Classroom. Aug 10:568. ® The Smartphone: The Tax Comparing International Tax Systems in Personal Financial Planning Practitioner’s Portable Office. the Introductory Tax Class. Nov 10:800. SCHULMAN, MICHAEL DAVID Mar 10:206. Lessons from Federal Tax Court. (Editor) VANDENBURGH, WILLIAM M. May 10:350. ® Life Settlements. Feb 10:140. ® Dependency Exemption Issues for Reel Life in the Tax Classroom: ® Protecting the Elderly from College Students. Aug 10:546. Learning Through Movies. Feb 10:144. Financial Abuse. Apr 10:276. 888 THE TAX ADVISER DECEMBER 2010 State & Local Taxes National Taxpayer Advocate Warns CPA KWIATEK, HARLAN J. (Editor of IRS Mission Expansion ® Current Trends in Sales and Use Oct 10:718. Tax: Click-Through Nexus and National Taxpayer Advocate’s Report This tax season Information-Reporting Requirements. Notes Serious Problems. Jul 10:488. become an efficiency Dec 10:870. Net Operating Loss and the IRS. Apr expert with... Income Apportionment and Allocation 10:272. After Mead. Sep 10:640. Obtaining a Power of Attorney Managing State Tax Considerations of Through IRS E-Services. Jan 10:64. Your Tax Season Passthrough Entities: Potential Passive Activity Grouping Disclosure Concerns and Pitfalls. Jun 10:418. Statements. Apr 10:271. Request for Audit Reconsideration. Tax Clinic Jan 10:62. ALMERAS, JON (Editor) Sec. 6676: There’s a New Penalty in ® Mar 10:162. Town. Jul 10:486. ANDERSON, KEVIN D. (Editor) Using an Ofter in Compromise. ®@ May 10:298. Jul 10:487. APONTE, STEPHEN E. (Editor) © Oct 10:668. Tax Practice Management BAKALE, ANTHONY S. (Editor) GREEN, MARY CATHRYN (Editor ® Aug 10:510. HOLUB, STEVEN F. (Editor) COOK, MARK G. (Editor © CPA Conflicts of Interest. Sep 10:644. ® Nov 10:742. ® The Smartphone: The Tax FAIRBANKGSRE,G A. (Editor Practitioner’s Portable Office. @ Feb 10:80. Mar 10:206. KAUTTER, DAVID J. (Editor) Tax Professionals: Making the © Jan 10:8. Difference. Dec 10:874. Paperback 090560 KLAHSEN, RICK (Editor AICPA Member: $75.00 Tax Trends Nonmember: $93.75 KOPPEL, MICHAEL D. (Editor) BEAVERS, JAMES ® Dec 10:822. ® Jan 10:68. Improve your tax season O’CONNELL, FRANK J., JR. (Editor) Feb 10:148. workflow system with this © Sep 10:588. Mar 10:212. hands-on guide filled with SMITH, ANNETTE B. (Editor) Apr 10:280. checklists, sample letters ®@ jul 10:448. May 10:359. charts, Excel tax comparison VAN LEUVEN, MARY (Editor Jun 10:430. ® Jun 10:374. Jul 10:502. worksheets, best practices for Aug 10:578. return preparation and review, Tax Practice & Procedures Sep 10:654. and leveraging technology MILLER, JOHN L. (Editor) Oct 10:729. ® Assessment Period Remains Open Nov 10:810. Tax season management expert, in Partnership Case. Apr 10:273. Dec 10:880. Edward Mendlowitz, covers ® Circular 230 Best Practices. TTA everything you need to know to Apr 10:270. Write for The Tax Adviser! make the most of your staff's Do We Really Have Privilege? Oct 10:716. time and skills, and find out We welcome full-length articles IRS Auditing Through QuickBooks. and short, timely pieces that how to keep your clients happy Oct 10:717. cover current happenings in while effectively managing IRS Issues Interim Report on the the tax field. Please contact workflow during the busiest Colleges and Universities Compliance the editor to reserve a topic or time of your year Project. Oct 10:719. e-mail items for consideration: IRS Whistleblower Program Alistair M. Nevius, (919) 402-4052; [email protected]. EvaluatedJ.a n 10:63. (Articles are subject to peer cpa2biz.com IRS Workforce Initiative. review after submission.) Jan 10:64. 888.777.7077 Subjectindex TWELVE MONTHS ENDING DECEMBER 2010 F reorganizations. Apr 10:222 First-time homebuyers. Jan 10:4, ACCOUNTING MetuHops & Periops Gain recognition agreements. Jan 10:31. Mar 10:180, Jun 10:430, See “Tax Accounting” Hold constant principle. Sep 10:588. Sep 10:586, Nov 10:774. Inversion transactions. Jan 10:34, Government grants. Aug 10:510. BANKauptcy & INSOLVENCY May 10:298. Health insurance premium assistance. Legislative proposals. Jan 10:36. May 10:364, Nov 10:775. Bankruptcy plan used to avoid taxes. Qualified stock purchases. Apr 10:226. Hope scholarshipJ.u l 10:464, Aug 10:578. Reorganizations. Apr 10:226, Nov 10:774. Dec 10:823. Investment tax credit. May 10:360, CHARITABLE CONTRIBUTIONS D reorganizations. Mar 10:162. Aug 10:510. F reorganizations. Apr 10:222 Lifetime learningJ.u l 10:464. Credit card rebates. Dec 10:822. Reporting requirements. May 10:354. Making work pay credit. Estate valuation. Jan 10:68. Sec. 304 transactions. Apr 10:224. Jan 10:4. Inventory gifts. Jun 10:374. Sec. 382. Sep 10:588. Payroll tax credit for new hires. Partial disclaimers. Jan 10:68. Step-transaction doctrine. Apr 10:226. May 10:294, Jun 10:370, Stock basis recovery. Jan 10:33. Nov 10:767, Dec 10:850. CONSOLIDATED RETURNS Surrogate foreign corporations. Qualified expenses. May 10:328. Jan 10:30. Qualified therapeutic discovery project Sales between members of consolidated Tax attributes. Dec 10:823. credit. Aug 10:512. group. Nov 10:742. Research and development. Feb 10:82, May 10:328, Jun 10:376. Crepits AGAINST Tax Corporations & SHAREHOLDERS Retained workers. Dec 10:850. Agricultural chemical security credit. Small business health insurance. Anti-inversion rules. Jan 10:34, Mar 10:164. May 10:364, Jun 10:370, May 10:298. American opportunity tax credit. Jul 10:446, Oct 10:668, Basis recovery. Jan 10:33. Mar 10:194, Jul 10:464. Nov 10:738, 776. C corporation conversion to LLC. American Recovery and Reinvestment Substantiation. Apr 10:227. Jun 10:426. Act. Jun 10:430. Contributions to capital. Jun 10:388. Business credit carryback. Dec 10:819. Emptoyer Benerits & PENSIONS Corporate ownership change. Cellulosic biofuels Sep 10:588. Black liquor. May 10:362. Annuitization of portion of contract. D reorganizations. Mar 10:162. Crude tall oil. Dec 10:820. Dec 10:820. De facto liquidations. May 10:300. Child tax credit. Mar 10:179. Cafeteria plan nondiscrimination safe Debt vs. equity. Jun 10:412. Earned income credit. Mar 10:180, harbor. Nov 10:759. Estimated tax payments in 2014. Jun 10:431, Nov 10:774. Contributions of unused time off to May 10:364. Education credits. Mar 10:194. 401(k) plans. Jan 10:8. Expenses paid on behalf of subsidiary. Employee retention. May 10:294, Defined contribution plan Feb 10:80. Jun 10:370. diversification. Dec 10:847. 890 THE TAX ADVISER DECEMBER 2010 Dependent health coverage. Jul 10:445, Tool reimbursement plans. Oct 10:674. Hiring Incentives to Restore Nov 10:761. Employment (HIRE) Act. Employee stock purchase plan EMPLOYMENT TAXES Sep 10:630. Reporting. Jan 10:6, Dec 10:840. Indirect gifts. Sep 10:633. FICA student exception. Nov 10:766. Medicare contribution tax on net Marital deduction. Sep 10:590. Grandfathered health plans. investment income. May 10:360, Noncitizen spouse. Apr 10:23 May 10:359, Nov 10:760. Aug 10:510, Sep 10:600, Partnership interests. Jan 10:26. Group health plan claims procedures. Nov 10:783, Dec 10:824. Qualified domestic trust. Nov 10:764. Medicare hospital insurance tax. Apr 10:231. 773. Health care vouchers. Nov 10: May 10:360, sep 10:600, Dec Qualified terminable interest property Health insurance coverage mandate. 10:824, 850. (QTIP). Mar 10:212. May 10:360. Statutory employees. Dec 10:856. Required minimum distribution. Health plans. Nov 10:758. Sep 10:590. Lifetime and annual limits. Estates, TRusts & Girts *c. 529 plans. Jul 10:471. Nov 10:762. *c. 2035(b). Mar 10:212. W-2 reporting. Dec 10:818. Annual exclusion. Apr 10:234, . 2207A. Mar 10:212. Health savings accounts. Mar 10:210. Jul 10:471. Single-member LLCs. Apr 10:230. High-cost employer-sponsored health Carryover basis. May 10:301, Stepped-up basis. Oct 10:713. care. May 10:360. Oct. 10:713. [ransters in trust. Apr 10:220. Incentive stock options. Dec 10:842. Charitable lead annuity trusts (CLATs). Transfers with a retained life estate. Individual retirement accounts (IRAs). Feb 10:83, Oct 10:713. Feb 10:108. Jul 10:491. Charitable remainder trusts. Irustee fees. Aug 10:516, Nonqualified deferred compensation Feb 10:108. Oct 10:710. plans—Document failures. Charitable remainder unitrusts (CRUTs). [rusts owning partnership interests. Dec 10:839. Oct 10:712. Jan 10:26. Payroll tax exemption. May 10:244, Conversion to grantor trust. Uniform Principal and Income Act. Jun 10:370, Nov 10:765. Oct 10:710. Jan 10:26. Pension funding relief. Dec 10:845. Designated beneficiary. Sep 10:590. Valuation Plan amendments. Feb 10:76. Domestic asset protection trusts. Clauses. Sep 10:635. Preexisting conditions. Nov 10:762. Oct 10:711. Discounts. Apr 10:230. Preventive health service coverage. Estate planning. Aug 10:513. Family limited partnership interests. Nov 10:744, 764 Estate tax reform. Sep 10:631. Jan 10:38, Sep 10:632. Repriced discount options. Dec 10:844. Estate tax valuation. Oct 10:708. Gift. Jul 10:471, Sep 10:636. Retention credit. Nov 10:765. Family limited partnerships. Ownership interests. Jul 10:502. Roth IRAs. Jan 10:10. Jan 10:38, Sep 10:632, Oct 10:702. Conversion. Apr 10:228. Formula clauses. Sep 10:635. Excise TAXES Rollovers from employer plans. Generation-skipping transfer tax. Jan 10:10, Dec 10:820. Jul 10:471, Oct 10:708. High-cost employer-sponsored Salary advance program. Dec 10:845. Gift tax health care. May 10:360. Sec. 409A Exclusion. Sep 10:632. Medical devices. May 10:361. Document failure correction. Gift of partnership interest. Ozone-depleting chemicals. Mar 10:166, Dec 10:839. Apr 10:234. Jun 10:377J,u l 10:448. Salary advance program. Dec 10:845. Gift to spouse. Jul 10:471. Tanning services. May 10:361, Sec. 457 plan Roth contributions. Indirect gift. Sep 10:633. Aug 10:508. Dec 10:819. ReturnsJ.u l 10:471. Small business health insurance tax Valuation. Jul 10:471, Sep 10:636. Exempt ORGANIZATIONS credit. May 10:364, Jun 10:370, Valuation clause. Sep 10:635. Jul 10:446, Oct 10:668, Grantor charitable lead annuity trust. Activities outside the United States. Nov 10:738. Feb 10:83. Apr 10:235. Small employer workplace wellness Grantor retained annuity trusts Advertising. Dec 10:826. programs. Nov 10:759. (GRATs). Dec 10:826. Form 990. Apr 10:235. Statutory stock option reporting. Grantor retained income trusts (GRITs). Qualified sponsorships. Dec. 10:826. Jan 10:6. Feb 10:108. Schedule F. Apr 10:235. Substantially equal periodic payments. Health care reform legislation. Unrelated business taxable income. Jul 10:491. Sep 10:630. Dec 10:826. THE TAX ADVISER | DECEMBER 2010 891 Subjectindex Expenses & Depuctions Canadian treatment of LLCs. Aug 10:518. Cell phones as listed property. Controlled foreign corporations (CFCs). Dec 10:819. Apr 10:237, Jul 10:452. Charitable contributions. Nov 10:780. Corporate international tax compliance. Compensation deduction limits. Jan 10:58. Dec. 10:838. Dividend equivalent payments. aera Domestic production activities Jun 10:386. wPenaities deduction. Feb 10:85, May 10:322, Dual consolidated losses. Jul 10:453. Jun 10:382. Entity classification. Jul 10:451. Education. Sep 10:622. Equity awards. May 10:306. Employee medical reimbursement plan. Equity swaps. Jun 10:386. Nov 10:778. Extraterritorial income. Jun 10:384. Employment change. Sep 10:622. FBAR. Sep 10:595. Energy-efficient commercial property. Foreign Account Tax Compliance Act Jul 10:450. (FATCA). Oct 10:670, Nov 10:770, Energy tax incentives. Jan 10:46. Dec 10:850. Facilitative costs. Sep 10:592. Foreign controlled domestic Gender reassignment surgery. corporations. Mar 10:196. Corporate equity reduction transaction. Apr 10:221, Oct 10:698. Foreign corporation stock. Jan 10:10. Jul 10:478. Government contractors. Feb 10:85. Foreign sales corporation. Jun 10:384. Debt modification. Mar 10:169. Hypothetical investor test. Nov 10:745. Foreign tax credit limitations. Deemed dispositions. May 10:295. Job hunting. Sep 10:622. Oct 10:664. Depreciation recapture. Jan 10:12. Luxury automobile depreciation limits. Foreign trusts. Nov 10:769. Economic substance. Jan 10:69, Nov 10:781. Form 5472. Mar 10:196. May 10:361, Dec 10:818, 882. Medical expenses. Mar 10:184, Hiring Incentives to Restore Employment Energy Star rebates. Jun 10:431. Apr 10:221, May 10:362, Oct (HIRE) Act. May 10:294, Jun 10:386, Grouping activities. Apr 10:271, 10:698, Nov 10:776, 781. Dec 10:850. May 10:309, Dec 10:831. Oil spill expenses. Dec 10:830. Inbound investments. Mar 10:196. Hobby losses. Nov 10:781. Reasonable compensation. Nov 10:745. Multinational businesses. Mar 10:196. Lease in, lease out (LILO) transactions. Retiree prescription plan subsidies. Passive foreign investment companies. Jan 10:69. May 10:362. Jul 10:452. Like-kind exchanges—Bankrupt Sec. 179. May 10:294, Aug 10:508, Reporting requirements. Sep 10:595. qualified intermediary. May 10:295, Dec 10:819. Shelf company acquisitions. Aug 10:524. Sec. 179D. Jul 10:450. Jul 10:451. LLC interest. Jan 10:12. Sec. 199. Feb 10:85, 87. Software transactions. Apr 10:237. Mark-to-market election. Feb 10:125. Self-employed health insurance. Surrogate foreign corporations. Market discount bonds. Oct 10:671. Dec 10:819. Jan 10:10. Material participationJ.un 10:404. Sex reassignment surgery expenses. Swiss account information. Jun 10:371. Net operating losses. Jan 10:4, Apr 10:221, Oct 10:698. U.S.-Switzerland treaty protocol. Feb 10:76, 116, Jul 10:478, Startup expenses. Dec 10:819. Jun 10:371. Sep 10:597. State legislator living expenses. VAT. Aug 10:523. Nongrantor trusts. Jun 10:404. Jun 10:372. Withholdintgax . Nov 10:768. Original issue discount. Mar 10:169. Substantiation. Nov 10:779. Principal residence exclusion. Success-based fees. Jun 10:379, Gains & Losses Mar 10:182, Sep 10:654, Oct 10:673, Sep 10:592. Nov 10:746, Dec 10:833. Trade or business expenses. Alternative minimum tax net operating Publicly traded debt. Mar 10:169. Sep 10:622. losses. Sep 10:597. Qualified intermediaries. May 10:295, Transaction costs. May 10:304. Basis. Feb 10:77, Jun 10:398. Aug 10:524. Canadian emigrants—deemed Related parties. Jan 10:12. FOREIGN INCOME & TAXPAYERS dispositions. May 10:295. Rental real estate activities. Nov 10:806, Cancellation of debt income. Dec 10:831. Branch profits tax. Mar 10:196. Mar 10:169, Oct 10:666. Sale of principal residence. Canada-U.S. tax treaty. May 10:295. Casualty losses. Nov 10:780. Mar 10:182, Sep 10:654, Oct 10:673, Canadian emigrants. May 10:295. Controlled entities. Jan 10:12. Nov 10:746, Dec 10:833. 892 THE TAX ADVISER | DECEMBER 2010 Sec. 475. Feb 10:125. Exemptions. Mar 10:182. Health Care and Education *c. 1031. See “Like-kind exchanges” Fee on uninsured. May 10:359. Reconciliation Act of 2010. Sec. 1250. Jan 10:12. FICA taxes. Nov 10:783. May 10:359. -c. 9100 relief. Feb 10:125. First-time homebuyer credit. Jan 10:4, Hiring Incentives to Restore Separate return limitation year. Mar 10:180, Jun 10:430, Employment (HIRE) Act. Jul 10:478. Sep 10:586, Nov 10:774. May 10:294, Dec 10:850. Small business stock. Dec 10:819. Gross income. Mar 10:180, Nov 10:776. Patient Protection and Affordable Traders in securities. Feb 10:125. Health care legislation. May 10:359, Care Act. May 10:359. Nov 10:758. Pension Relief Act. Dec 10:845. Gross INCOME Hobby losses. Mar 10:183. Small Business Jobs Act. Dec 10:819. Home mortgage interest deduction. Compensation for injuries. Nov 10:777. Mar 10:179, 183. LLCs & LLPs Detense Department Housing Assistance Home office expenses. Mar 10:184, Program. Nov 10:782. Nov 10:781. Conversion of C corporation. Jun 10:426. Distribution of life insurance policy. Hope scholarship credit. Jul 10:464. Employer identification number. Apr 10:282. Innocent spouse relief. Mar 10:184, Jul 10:453. Employee stock purchase. Feb 10:89. Aug 10:579, Nov 10:784, 810. Gift of LLC interest. Feb 10:146. Energy Star rebates. Jun 10:431. Investment income Medicare tax. Material participation. Jul 10:457, Gambling winnings. Nov 10:776. May 10:360, Aug 10:510, Sep 10:612. General welfare exclusion. Nov 10:776. Dec 10:824. Self-employment tax. Jul 10:457. Indebtedness guarantees. Dec 10:820. Involuntary conversions. Nov 10:782. Passive activity losses. Sep 10:612. Life insurance. Apr 10:282. Lifetime learning credit. Jul 10:464. Series LLCs. Jan 10:50, Nov 10:739. Nonshareholder contributions to Like-kind exchanges. Mar 10:183, Tax treatment of members. Sep 10:612. capital. Jun 10:388. May 10:295, Nov 10:782. TerminationO.c t 10:724. Rental income reporting. Dec 10:820. Livestock replacement. Mar 10:184. Sec. 83. Feb 10:89. Medical expenses. Mar 10:184, MISCELLANEOUS Tool reimbursement plans. Oct 10:674. Apr 10:221, Oct 10:698, Nov 10:776, 781. High-wealth taxpayers group. Jan 10:5. Mileage allowances. Nov 10:781. INDIVIDUALS Place of abode. Mar 10:185. PARTNERS & PARTNERSHIPS Adoption expenses. Nov 10:775. Recent developments. Mar 10:178. Alternative minimum tax. Nov 10:776. Sale of principal residence. American Recovery and Reinvestment Foreign tax credit limitation. Mar 10:182, Sep 10:654, Act. Feb 10:116. Mar 10:180. Oct 10:673, Nov 10:746, Anti-abuse rule. Aug 10:509. American opportunity credit. Dec 10:833. Cancellation of debt income. Jul 10:464. Scholarships. Jul 10:464. Feb 10:116. Annuities. Mar 10:180. Self-employment income. Nov 10:783. Choiceo f entity. Apr 10:242. Cancellation of debt income. Taxpayer identification number. COD income. See “Cancellation Mar 10:181, Nov 10:777. Mar 10:178. of debt income” Capital gains and losses. Mar 10:184. Trade or business expenses. Contingent liabilities. Apr 10:239. Casualty losses. Nov 10:780. Mar 10:183, Nov 10:778. Distributions. Feb 10:123. Charitable contributions. Nov 10:780. Transfers incident to divorce. Economic substance doctrine. Child tax credit. Mar 10:179. Sep 10:655, Nov 10:782. Feb 10:122. COD income. See “Cancellation of Tuition deduction. Jul 10:464. Family limited partnerships. Jan 10:38, debt income” Feb 10:120. Compensation for injuries. Nov 10:777 INTEREST INCOME & EXPENSE Hot assets. Aug 10:529. Coverdell ESA. Jul 10:464. Income allocation. Feb 10:120. Dependency exemption. Mar 10:182, Applicable high-yield discount Investment partnership. Feb 10:120. Aug 10:546, Nov 10:778. obligation. Sep 10:599. Liability allocation. Feb 10:121. Dependents. Mar 10:182, Original issue discount. Sep 10:599. Loss deduction. Feb 10:116. Nov 10:778. Net operating loss carrybacks. Earned income credit. Mar 10:180, LEGISLATION Feb 10:116. Jun 10:431, Nov 10:774. Notice of deficiency. Feb 10:116. Education tax benefits. Mar 10:194, Foreign Account Tax Compliance Act Operations. Feb 10:116. Jul 10:464. (FATCA). Oct 10:670, Dec 10:850. Partnership adjustments. Feb 10:116. THE TAX ADVISER | DECEMBER 2010 893 Subject|index Partners & Partnerships, cont’d [ax professionals. Dec 10:874. Mixed service costs. Jan 10:16. Partnership redemptions. Aug 10:529. Tax software survey. Aug 10:536. National taxpayer advocate. Jul 10:488, Return filing penalty. Jan 10:4. Aug 10:566, Oct 10:718. Sale of partnership interest. Aug 10:529. Negligence. Apr 10:248. Procepure & ADMINISTRATION Sec. 704(c). Feb 10:121. Net operating loss carrybacks. Sec. 752 liabilities. Apr 10:239. Accounting method changes. Jan 10:21. Mar 10:173, Apr 10:272. Sec. 754 election. Feb 10:124. Accuracy-related penalty. Apr 10:248, Nonresident aliens. Jan 10:4. Statute of limitation. Apr 10:273, May 10:338. Offer in compromise. Jul 10:487. ful 10-503 Adequate disclosure. Apr 10:220. Omission from gross income. TEFRA. Feb 10:117. Advance pricing agreements. Jan 10:13. Valuation. Feb 10:116. Oct 10:679. Overpayment interest. Jul 10:459. Discounts. Jan 10:38. Assessable penalties. Mar 10:213. Paper coupons for tax payments. Family limited partnership interests. Circular 230. Apr 10:270, Jun 10:391. Nov 10:738. Jan 10:38 Compliance initiatives. Feb 10:93. Practitioner regulation. Mar 10:156, Contractual allowances as Tier II May 10:296, 310, 317, 348, PENSIONS issue. Jan 10:16. Jun 10:371, Oct 10:662. Correspondence audits. Aug 10:566. Preparer tax identification number. See “Employee Benefits & Pensions” Credit card reporting rules. Oct 10:664. Jun 10:371, Jul 10:444, Sep 10:587. Disclosure of tax return information. Reasonable cause. May 10:338. PERSONAL FINANCIAL PLANNING Mar 10:157. Refund claims. Jul 10:458. DOI income reporting. Jan 10:14. Medical residents—FICA. May Elder financial abuse. Apr 10:276. Earned income credit due diligence. 10:295, Nov 10:783. Life settlements. Feb 10:140. Jun 10:431. Reliance on advice. May 10:338. Economic substance doctrine codified. Rental income reporting. Dec 10:820. Practice & PROCEDURES May 10:361, Dec 10:818, 882. Repairs and maintenance costs. Employee stock purchase plan reporting. Jan 10:15, May 10:312. Circular 230 best practices. Apr 10:270. Feb 10:92, Dec 10:840. Reportable transactions. Cohan rule. Apr 10:227, May 10:328. Erroneous refund claim penalty. May 10:314, 338. College and university compliance Jul 10:486. Reporting uncertain tax positions. check. Oct 10:719. Federal contractor levies. Dec 10:820. Mar 10:159, May 10:294, 296, 313, Due diligence. Oct 10:690. FIN 48. Aug 10:530. 314, Jul 10:445, Aug 10:530, 531, E-services. Jan 10:64. Form 1099 reporting rules. Oct 10:665. Nov 10:798. Form 2848. Jan 10:64. Form 1099-C. Jan 10:14. Requests for audit reconsideration. Innocent spouse relief. Apr 10:280, Good-faith exception. May 10:338 Jan 10:62. Aug 10:579, Nov 10:784, 810. Gulf oil spill hotline. Sep 10:586. Return preparer registration. IRS mission. Oct 10:718. High-wealth taxpayer group. Mar 10:156, May 10:296, 310, 317, Mandatory e-filing. Jan 10:5, Jan 10:5. 348, Jun 10:371, Oct 10:662. Sep 10:586. Incentive stock option reporting. National Taxpayer Advocate. Feb 10:92. Pianining tox 20 xxx Aug 10:566, Oct 10:718. Independent contractors. Oct 10:678. Report. Jul 10:488. Information return penalties. Power of attorney. Jan 10:64. Dec 10:820. Privileged communications. Oct 10:716. Innocent spouse relief. May 10:184, QuickBooks auditing. Oct 10:717. Aug 10:579, Nov 10:784, 810. Reason to know of understatement. Installment payments. Feb 10:77. Apr 10:280. IRS workforce initiative. Jan 10:64. Statements on Standards for Tax Joint returns. Nov 10:751. Services. Jan 10:4, Feb 10:137. Large and Mid-Size Business Division Statute of limitation. Apr 10:273, (LMSB). Jan 10:15, Oct 10:664. Jul 10:503. Large Business and International Division. Oct 10:664. Practice MANAGEMENT Lien attachment. Sep 10:655. Mandatory e-filing. Jan 10:5, Sep 10:586. Conflicts of interest. Sep 10:644. Medical resident FICA refunds. Smartphones. Mar 10:206. May 10:295, Nov 10:783. 894 THE TAX ADVISER | DECEMBER 2010