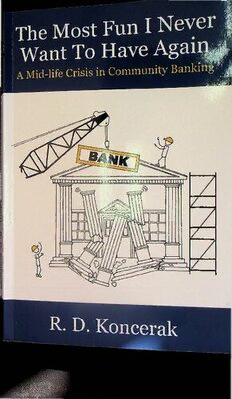

The Most Fun I Never Want To Have Again: A Mid-Life Crisis in Community Banking PDF

Preview The Most Fun I Never Want To Have Again: A Mid-Life Crisis in Community Banking

_____________- - • - - HB fe The Most Fun I Never 1 Jl^d M 1 i Want To Have AgaiM A Mid-life Crisis in Community Banki“®^JF & ■Ki R. D. Koncerak ^■r The Most Fun I Never Want To Have Again A Midlife Crisis in Community Banking Robert D. Koncerak Copyright 2013 BankForward Consulting, LLC All rights reserved. ISBN-10: 1481867954 ISBN-13: 9781481867955 Library of Congress Control Number: 2013900175 CreateSpace Independent Publishing Platform North Charleston, South Carolina Cover illustration by Laurkon Designs and The Cheeb To Bill For the most fun neither one of us ever wants to have again I The author and Bill Short at the opening of Touchmark National Bank’s Alpharetta, Georgia headquarters in October 2009. In color, our ties match the palate of the Touchmark company logo. Contents Introduction: What Was That All About?. vii Chapter 1 It’s All About Getting Chosen 1 Chapter 2 All In: A Brief History of Georgia’s Banking Boom 45 List 1 New Georgia Bank Charters 1997—2012 90 Chapter 3 Caveat Emptor 95 Chapter 4 Running (Up) The Bank 169 Chapter 5 Regulation, Controls and the ‘Chernobyl’ of Banking 193 Chapter 6 The Trend Is Not Your Friend: John Mauldin 211 Chapter 7 Strategic Plans and Avoiding the Exploding Hippo 221 Chapter 8 Dead Indians 239 List 2 Georgia Bank Failures 1997—2012 248 Chapter 9 Enablers of the Apocalypse and the Perils of Contemporary Banking 251 Chapter 10 The Downslide Of Creekside 283 Lists Time Line: Banking Crisis and Progress of Touchmark National Bank 317 Chapter 11 What Happens Now?: Karl Nelson 323 Epilogue What’s An Investor To Do? 329 I Index of Charts, Graphs and Data Chart Page Count of Georgia and US FDIC Insured Institutions: 1995 - June 2012 6 2 Georgia de novo Bank count, 1997-2007 7 3 Commercial and Savings Banks by Asset Size, 12-31-12 48 4 Graph of FDIC Institutions, 1996-2012 49 5 Growth of FDIC Atlanta Deposits, 1994-2007 50 6 Select US population trends 53 7 US Financial Institution Starts, 1997-2012 53 8 Graph of ADC loans at FDIC institutions, 1991-2010 63 9 Average Community Bank CRE charge-off rate, 2000-2010 64 10 Atlanta C&D concentrations, 1988, 1991, 1997 66 11 Southeast Community Bank Median Price/Book Transactions, 1Q2006 — 1Q2008 69 12 Southeast Community Bank Median P/E Transactions, 1Q2006 — 1Q2008 70 13 Assets/Deposits of Top 10 Bank Holding Companies, December 2012 88 »4 Comparative Asset Trends of Community’ vs. Non Community Banks, 1984-2011 89 15 Average Georgia Community Bank Start-Up Capital, 1997-2007 104 16 Total Georgia Invested Capital by Year 1997-2007 104 17 Listing of Total Invested Start-Up Capital In Georgia Banks 1997-2007 105 vi 18 Selected Chart of Touchmark Bancshares Capital Raise By Week 163 19 Graph of Prime rate, 1 month LIBOR and Fed Funds 1999- 2012 172 20 Target Fed Funds rate 2005-2008 176 21 Treasury-Agency spreads 2007-2012 177 22 TED spread, 3 mo. LIBOR vs. 3 mo. T-Bill 1996-2012 179 23 TMAK Selected Revenue Measures 181 24 Georgia Dept, of Banking New Institutions Applications Report, Oct 2007 185 25 Major Federal Reserve Policy Actions, August 2007 - March 2008 190 26 GDP Growth +/- Home Equity Mortgage Withdrawals (Mauldin) 216 27 Bank Return On Equity by Lending Concentration, 4Q12 224 28 TMAK SEC Balance Sheet, June 30, 2010 and December 31, 2009 245 29 Atlanta Housing Permit Trend, October 2008 - August 2012 254 30 Annualized Housing Starts, Jan 1993 — Feb 2013 255 31 Trend of Residential Housing Inventory 256 32 Trust Preferred Issuance 2000-2007 257 33 Creekside Organizers, 2005 288 34 Georgia Real Estate Write-Offs/Bank Capital 2008-2011 298 35 Graph of US Bank Closings by State 2007-2012 3*3 36 Graph of Georgia Bank Closures 2007-2012 313 37 Atlanta MSA Lending Limits, March 2013 335 vii