The Journal of Taxation 1992: Vol 77 Index PDF

Preview The Journal of Taxation 1992: Vol 77 Index

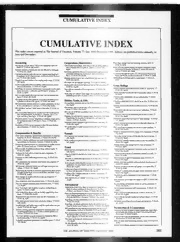

CUMULATIVE INDEX CUMULATIVE INDEX This index covers material in The Journal of Taxation, Volume 77, July 1992-D 192. Indexes are published twice annually, in June and December. Accounting Corporations, Shareholders Pr »p. Regs. change rules for allocating interest to BCI, 77 Advertising, at least, doesn't have to be capitalized under /N Consolidated return Regs. duck many STAX 52, Jul92 DOPCO, 77 STAX 258, Nov92 tion of Section 304, by Lynne A. Schewe ‘. affecting passive foreign investment companies ensure Amount realized on foreclosure sale not affected by mortgage. Sep92 “ cleration of income, by Wayne E. Smith and James N 77 STAX 201, Oct92 Defending against the Service's renewe a 77 JTAX 242, Oct92 Calculation options under the interest capitalization cumulated earnings tax, by David A. H roadmap through the maze: U.S. International Taxation by Regulations, by W. Eugene Seago and Frederick M. Richard. Barce, 77 STAX 324, Dec92 Kuntz and Peroni, by Steven Auderieth, 77 JTAX $1, Jul92 son, 77 TAX 300, Nov92 Holding period of stock was suspended t Withholding on alimony paid to nonresidents, 77 JTAX 51, Change to accrual method of accounting made easier, 77 JTAX JTAX 329, Dec92 jul92 194, Oct92 IRS backs off on corporate reporting Excteisons tno onCrOeDco uirnsceo mdee,b t 77i s Ja TlAiXab il6it7y, uAnudge9r2 insolvency excep- IssJuiTnAgX ca8s1h, wAiutgh9 2s tock for debt is no bar Letter Rulings Finiasls uRese,g s.by oLne selcieo nJo.m ic Scphneeridfeorr maanndc eM ircehqaueilr eFm e.nSt o loremsoonl,v e 77m ost NewD ecr9u2le s on valuation of loss corporation \ltIerTeAdX co3l7l8a,t erDael c9o2n installment note results in “payments,” 77 JTAX 12, Jul92 Wide range of “options” may trigge: de SAc ts Jsuall9e2 followed election out of partnership status, 77 JTAX How to report market discount currently, and on constant rate affiliated group rules, by John C. Ha basis, 77 JTAX 195, Oct92 Cafeteria plan contributions are not compensation, 77 JTAX IRS adopts inconsistent positions on nonrecourse debt in loan 250, Oct92 workouts, by Richard M. Lipton, 77 ITAX 196, Oct92 Estates, Trusts, & Gifts hanging partnership to LLC should be tax free, 77 JTAX 316, IRS determines asbestos removal is capital expenditure, by Eric Accumulation provision did not bar QTIF Nov92 R. Fox and Michael F .S olomon, 77 TAX 202, Oct92 183, Sep92 Delayed interspousal transfer incident to divorce, 77 JTAX 379, IRSJ ulr9e2d efines “activity” under passive loss rules, 77 JTAX 16, Faihro umsaer,k et7 7 vJaTluAeX of2 5a9r,t iNnocvl9ud2e s 10% com DepDreecc9i2a tion and start-up issues for new subsidiary, 77 JTAX New accounting statement for income taxes has broad implica- IRA was not QTIP due to potential for n 78, Dec92 tions for practitioners, by Michael A. Henning, Alex T. Ar- 182, Sep92 Disclaimer effective for substantial part of joint account, 77 cady, and Mary Ann Sigler, 77 JTAX 142, Sep92 Planning for split-interest transfers under th ITAX 173, Sep92 Proposed passive “activity” Regulations substitute rough justice Regulations, by Jonathan G. Blattmach document request does not result in “issue pending,” 77 JTAX for mechanical tests, by Michael J. Grace, 77 JTAX 68, Painter, 77 TAX 18, Jul92 417, Nov92 Aug92 Redeemed shares disposed of prior to alter donor's retained possession no bar to charitable deduction, 77 Treatment of COD income updated in three Revenue Rulings JTAX 183, Sep92 ITAX 173, Sep92 and a Procedure, 77 JTAX 322, Dec92 Tc agytiee below-market interest rules t EPA compliance extensions are tax free to pool members, 77 182, Sep92 ITAX 316, Nov92 tate tax deferral not lost by change to S corporation, 77 JTAX Compensation & Benefits Exempt 252, Oct92 Basis issues complicate qualified plan distributions of employer New guidance on arbitrage rebate is not th vorable change to buy-sell sidesteps Section 83 income, 77 securities, by Kirk F. Maldonado, 77 JTAX 334, Dec92 186, Sep92 ITAX 252, Oct92 Benefits to former employees can avoid nondiscrimination test- Rules modified for gift premiums to contrib Financing” transfer resulted in gain on sale and penalties, 77 ing problems, by Dennis R. Coleman, 77 JTAX 36, Jul92 187, Sep92 JTAX 125, Aug92 Computing Geduction limits for contributions to welfare benefit reign insurer was engaged in U.S. trade or business, 77 plans, by Vincent Amoroso, 77 JTAX 168, Sep92 Fraud ITAX 55, Jul92 EffJeTctAiXve 2d1a8t,e Oocft 9no2n discrimination Regs. delayed again, 77 Beli34e8f, thDaetc 9l2a w is invalid did not bar fraud 5 HeaIlTtAh X ben31e6f,i tsN ovfo9r2 employee's domestic partner not taxed, 77 GuiJdTaAnXce 99f,o r Afuiegl9d2 offices on pension plan compliance, 77 Directors> liable for payroll taxes under stat naIdTvAeXrt en5t6, eJluelc9t2i on out of installment method revocable, 77 GuiDdeacn9c2e on 20% withholding/rollover rules, 77 JTAX 323, IRS1 94s,e ekOsc t9to2 standardize application of per IRSI TAcoXn ti1n7u4,e s Setop 9a2p prove partnership status for LLCs, 77 IRAJ TAamXe n9d8m,e nAtusg 92f or minimum distribution rules required, 77 Is tghuei dperleipnaerse?r, ubyn dJeurlsetsa tReimtehnotlz paenndal tByr yainr j scleaArX pl3a79n,t lDoescs 92av ailable without physical abandonment, 77 IRS provides rabbi trust model and will begin issuing private JTAX 104, Aug92 P ments to cancel warrants and options were deductible, 77 rulings, 77 JTAX 131, Sep92 Is there any statute of limitations on the ITAX 54, Jul92 Maximizing the bencfits of deferred compensation plans funded by BruceM . Reynolds, 77 JTAX 342, De Producer” exception does not apply where contractors used, 77 t7h7 roSuTgAhX se9c0u,l aAr ugtr9u2st s, by Deborah Walker and Sallie Olson, LiaIbiTlAitXy o1f0 6K,- 1A upgr9e2p arer depends on returr IrTcAhaXs e 12b6y, suAbu gi9n 2 redemption of sole shareholder, 77 JTAX MorJeT AcXh an3g3e9,s Dteo cn9o2n discr tules are prop d,77 MorAeu gl9i2be ral view of “willful” in civil tax ile of Julla9n2d by social club was subject to UBIT, 77 JTAX 250. New compliance rules for qualified plans, 77 JTAX 39, Jul92 Oct92 New law changes retirement plan distribution rules, 77 JTAX Tax accounting and inventory issues for service providers, 77 171, Sep92 International ITAX 378, Dec92 Newpo si“tlso,o k7 7 baJcTkA”X ru3l,e Jsuilm9p2l ifies employer withholding de- Applliikcelayt itoon croefa t4e8 2p rPorbolp.e msR,e gsb.y Mtoa rtkr ansMf. erLse Sep9m2i tations applied to AMT determination, 77 JTAX 172, O’ Haveandr J,ame s P. Clancy, 77 TAX NewR egsw.i,t hh77o ldJiTnAgX de2p5o9s,i tN orvul9e2s are further simplified in final Finrael ncayn d hePdrgoipnogs edop pRoretguunliattiieosn,s bey xpBarnucde aHv.a ila IriftT’s AX in1t2e5r,e stA uign9c2o me did not bar worthless stock loss, 77 Payment from state insurance fund was IRA distribution, 77 Driscoll, and Peter J.C onnors, 77 TAX c of both accrual and installment methods okayed, 77 JTAX JTAX 38, Jul92 Final Regs. on dual consolidated losses are 56, Jui92 Plan could provide limited early retirement window, 77 JTAX JTAX 375, Dec92 Worthless stock deducted even though sub carried on, 77 JTAX 340, Dec92 Final Regs. on interest allocation clarify the 251, Oct92 Qualified plas safe harbor rules would be eased under new pro- Paul M. Bodner and Thomas A. Bryan posals, 77 JTAX 66, Aug92 IRS guidelines for cost sharing arrangement Partnerships & S Corporations Service's closing agreement program for employee plans can cient certainty,b y Peter A. Glicklich, 77 STA Adjusting the basis of assets in tiered partnerships under IRS's Aasvhotiodn ,d is7q7u aTliAfiXc ati2o1n2,, Obyc tC9.2 Frederick Reish and Bruce L Newfo r ifntoerreeisgtn ebxapneknss,e bya llPoectaetri oJn. ruCloensno rsp,o se Brprua Pyousetslteiwoaniatbel,e 7n7e wJ TRAuXl in4g,, Jbuyl 92J ohn S. Pennell and Philip F Tax Court upholds actuarial assumptions rejected by IRS in Paul S. Epstein, 77 JTAX 368, Dec92 Disguised sale rules for partnerships contain some additional small plan audits, 77 JTAX 131, Sep92 New rules on foreign tax credit separate arifications, 77 JTAX 258, Nov92 Voluntary compliance procedures for qualified plans, 77 JTAX 118, Aug92 t of entity items becoming nonentity items, 77 JTAX 210, 323, Dec92 No 482 allocation where foreign law prohibit Oct92 JTAX 50, Jul92 Exghth Circuit affirms taxation on receipt of partnership interest THE JOURNAL OF TAXATION 383 CUMULATIVE INDEX for services, 77 JTAX 130, Sep92 Settlement agreement was binding despite alterations to IRS ad- AUTHOR INDEX Final SCOS Regul contain Ad | clarifications, 77 justment schedule, 77 JTAX 66, Aug92 Vincent Amoroso JTAX 2, Jul92 When will IRS remedies be exhausted?, 77 JTAX 58, Jul92 Alex T. Arcady FPAA to bankrupt tax matters partner did not toll S/L, 77 JTAX 9, Jul92 Bruce L. Ashton Potential innocent spouse claim is not “affected item,” 77 JTAX Real Estate Steven Auderieth 10, Jul92 Broad scope of taxable mortgage pool rule may result in unex- John C. Barce PowJeTrA Xt o a10c,c uJmuull92a te did not preclude qualified S trust, 77 pBuetccthe,d c7o7 rpJoTrAatXe 3t6ax0,, bDye cS9t2e ven D. Conlon and Mary Sue Bruce E. Blanco Prodpiostsreidb utRieognss., pbryo vBirduec e soNm. e Lefmleoxnisbi liatnyd tRo iSc hcaorrdp s.D . inB leaaur,n in7g7 s CorJpToAraXt io2n6 6,w aNso vn9o2t agent of its joint venturer owners, 77 RJiocnhaathradn D.G . BlBalua ttmachr JTAX 132, Sep92 Effect of real estate tax refund on co-op shareholders, 77 JTAX Paul M. Bodner Prop. Regs. on S corporation basis adjustments increase plan- 267, Nov92 Gregory K. Brown Bnlianug, op7p7o rJtTunAiXt ie2s0,4 ,b yO cBtr9u2c e N. Lemons and Richard D Is ainnyc lupdaarbt leo f ian nboansrise?c,o ubrys e Mamrotirnt gaBge. C ogwraeant,l y 7e7 xcJeTeAdXi ng2 60F,M V Thomas A. Bryan Prop. Regs. provide more assurance on limited partnership clas- Nov92 Mary Sue Butch sification, 77 JTAX 131, Sep92 Rent based on lessee earnings okay under REIT income rules, James N. Calvin The single-class-of-stock rules, round three: The final Regula- 77 STAX 366, Dec92 James P. Clancy t1i3o8n,s , Sbeyp 9R2i chard M. Lipton and Michael C. Fondo, 77 JTAX Return Preparation Dennis R. Coleman Some partners will find that abandonment of partnership inter- Electronic filing capability continues to be featured in return Steven D. Conlon ests accelerates gain, by M. Celeste Pickron, 77 JTAX 268, preparation software, by Robert E. Nelson and Joseph W Peter J.C onnors Nov92 Langer, 77 JTAX 276, Nov92 Martin B. Cowan Personal Praicntdiitviiodnuearlss , rebvyi ewth e 2E6d ittaox riparle paSrtaatfiofon f tshoef tJwoaurren alp acokf aTgaexsa tifoonr , John E. Curtis 77 JTAX 220, Oct92 Thomas J. Driscoll Basis apportioned in bargain sale despite lack of deduction, 77 JTAX 31, Jul92 Paul S. Epstein Challenge to dual representation upheld as prejudicial to inno- Michael C. Fondo cent spouse defense, 77 JTAX 3, Jul92 Shop Talk Eric R. Fox Cost of preparing Schedule C is business deduction, 77 JTAX Actuaries can rely on IRS speeches—are tax advisors next?, 77 Peter A. Glicklich 30, Jul92 JTAX 319, Nov92 Michael J.G race Disposing of a closely held business through a tax-deferred sale Challenge Revenue Rulings? Pay negligence penalty! 77 JTAX to an ESOP, by Gregory K. Brown and John E. Curtis, 77 62, Jul92 David A. Haist ITAX 236, Oct92 Incorporation of pro athletes—is IRS a bad sport?,...While TC JohnC . Hart Exchange of annuity contract of troubled insurer was tax free, applies 6661 penalty to incorporated broker,...And IRS disre- Richard T. Helleloid 77 JTAX 87, Aug92 gards doctor's corporation!, 77 JTAX 254, Oct92 Walter Hellerstein Extended business trip expenses were deductible, 77 JTAX 159, IRS cites TAM to defend Regulation’s validity, 77 JTAX 127, Sep92 Aug92 Michael A. Henning Extended rollover period allowed due to partition suit, 77 JTAX IRS inaction on loan guarantee letter ruling is perplexing, 77 Bobbe Hirsh 241, Oct92 JTAX 190, Sep92 Joseph W. Langer Has the scope of the personal injury exclusion been changed by More on asset sale following election out of Subchapter K, 77 Alan S. Lederman Sth.eW . SuMparttesmoen , Co7u7r t?J,T AbXy R8i2c, haArudg 92T. Helleloid and Lucretia MorJeT AoXn r3e1l9i,a nNceo v9on2 IRS speeches, Where have all the audits Bruce N. Lemons IRS cleans up safe-harbor rules for mortgage points, 77 JTAX (and auditors) gone?,...And will Compliance 2000 lead to Marc M. Levey 159, Sep92 criminal cases?, 77 JTAX 380, Dec92 Richard M. Lipton IRS draws map for exclusion of outplacement services as work- More on S corp. payment of life insurance premiums, 77 JTAX Kirk F. Maldonado ing condition fringe, by Robert J.Werner, 77 JTAX 350, 381, Dec92 Lucretia S.W. Mattson Dec92 Passive loss planning issues, 77 JTAX 191, Sep92 Is a midstream abandonment of property by a bankruptcy Section 1124(a) of TRA °86 allows ten-year averaging, 77 Robert E. Nelson trustee taxable to the estate?, by Mark S. Wallace, 77 JTAX JTAX 192, Sep92 R. RusO’ Hsave r 26, Jul92 Some Form 1041 filers should seek refunds, 77 JTAX 127, Sallie Olson New rules on transportation fringe benefits, 77 JTAX 355, Aug92 Andrew D. Painter ReiDmebcu9r2s ements from tax advisors for errors may be income to Une1x9p1,e cSteepd9 2r esults from AMT NOL carryforwards, 77 JTAX John S. Pennell clients, 77 JTAX 130, Sep92 WWII art theft creates tax issues, 77 JTAX 63, jul92 M. Celeste Pickron Supreme Court rules on taxing mail-order sales and discrimina- Philip F. Postlewaite tion back pay, 77 JTAX 2, Jul92 C. Frederick Reish Treatment of excess adjustable rate mortgage interest, 77 JTAX Special Industries Bruce M. Reynolds 356, Dec92 Energy Act raises revenues to pay for expanded benefits, 77 U.S. tax residency rules broadened in final, Regulations, by Alan JTAX 322, Dec92 Frederick M. Richardson S. Lederman and Bobbe Hirsh, 77 TAX 152, Sep92 Wholly owned insurance sub can deduct reserves on policies is- Jules Ritholz sued to parent, 77 JTAX 195, Oct92 Lynne A. Schewe Procedure Leslie J.S chneider State & Local Challenge to dual representation upheld as prejudicial to inno- W. Eugene Seago cent spouse defense, 77 JTAX 3, Jul92 Cali1f8o0,r niSae p9u2ph olds unitary method of apportionment, 77 JTAX Mary Ann Sigler Fewteiorn errse,s tr7i7c tiJoTnAs Xo n 25a9d,v erNtoivs9i2ng and solicitation by IRS practi- GaiJnT AwXa s 1n8o0t, uSneipta9r2y income subject to state apportionment, 77 BWrayyanne C.E . SSkamriltaht os Is shareholder assessment barred by expired S corp. S/L? Stay State tax issues address the unitary method, dividends, and so- Michael F. Solomon tuned..., 77 JTAX 66, Aug92 licitation of orders, 77 JTAX 67, Aug92 Deborah Walker No lopwrsi viSleegceo nedx cCeiprtciuoitn, t7o7 caJsThA Xre po3r,t Jiungl:9 2 Eleventh Circuit fol- Suptiroen meb acCko urptay , ru7l7e s JoTnA Xt axi2,n gJ umla92i l-order sales and discrimina- Mark S. Wallace Private rulings are on sale (buy one, get one free. almost), 77 Supreme Court says no state use tax imposed on mail-order sell- Bruce H. Weinrib JTAX 323, Dec92 ers... for now, by Walter Hellerstein, 77 JTAX 120, Aug92 Robert J.W erner THE JOURNAL OF TAXATION / December 1992