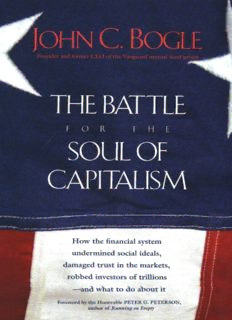

The Battle for the Soul of Capitalism PDF

Preview The Battle for the Soul of Capitalism

r $25.00/£15.95 THEB ATTLE F O R. T H E SOUOLF CAPllALISM JOHCN.B OCLE Theriesn oo neb ettqeura liftiote edlu ls aboutth ef ailuorfte hseA mericfianna ncial systeamn dt heg rotesqaubeu setsh ahta ve takepnl acien r ecenyte artsh anJ ohnC . Boglef,o undaenrd f ormecrh ieefx ecutive of theV anguarmdu tualfu nd group. Thisl egendamruyt uafuln d pionehears witnessed fitrhsteih nannedr mowsotr kings oft hef inanciinadlu stfroymr o ret hafnift y yearasn dh ass ett hes tandafrodrss ound investmsetnrta teagnides st ewardship. Boglep'rsu deandtv ocaocfty h er ights ofi ndiviidnuvaels tboergsa wni thhi 1s9 51 PrincetUonni verstihteys oins thefu nd industarnyd,h e continuteosc hampion ther estoratoifo inn tegriint iyn dustry practitcoedsa yAn. astutoeb server, he knowst hata trustworbtulisyi neasnsd financicaolm pleixse ssenttioAa mle rica's continulienagd ersihnti hpe w orladn dt o economaincd s ociparlo greasths o me. This botoekl mlusc hm oret han the story about whawtr onwge.Mn otr e importainttt ,e lwlhsy w e losotu rw ay andh ow we canr ighotu rc oursTeh.e specirfiecf ormBso glea dvancienst his booka rep ractiacnadle ssentaisaa lr,e hisr ecommendatifoonras s suritnhga t investroercse itvhee ifra isrh aroeffi nancial markerte turns. Praise for The Battle for the Soul of Capitalism “A great, readable, and important book. Jack Bogle gets it right in this hard-hitting and entertaining analysis of how corporate America nearly derailed American capitalism. There are few heroes in this book, but a wealth of common sense wisdom for investors to protect themselves and profit from Bogle’s very specific suggestions.” —Arthur Levitt, 25th Chairman of the U.S. Securities and Exchange Commission “This book is a gift to the reading and investing public that holds a lifetime’s wisdom. Bogle uniquely understands mutual funds and everyone needs to listen when he warns of the deceptions that have plagued the industry. Investors will profit if they follow his simple straightforward advice.” —Robert A. G. Monks, author of Corporate Governance “Jack Bogle says exactly what needs to be said, and he does it with gusto. He knows what he’s talking about, he loves capitalism, and he is eager to punch out those who would abuse the system. His tales and lessons should be required reading for any business leader, plus they offer great insights for smart investors.” —Walter Isaacson, President of the Aspen Institute “Over the past half century, American capitalism nearly lost its soul. One of the few who noticed was Jack Bogle. Now, for the first time, he tells the whole tale as only Jack Bogle can: just what happened, just how it happened, and just how to fix it. Written in his trademark compelling style, this is mandatory reading for anyone with a dollar to invest or an interest in the future of American capitalism.” —William Bernstein, author of The Birth of Plenty “Jack Bogle has written a brilliant and insightful book that highlights the many ways that our economy has suffered because managers have placed their own economic interests ahead of those of owners and investors. Bogle offers prescriptions that, if enacted, will help prevent a repeat of the scandals that we have witnessed over the past five years.” —Eliot Spitzer, Attorney General of New York “The low-cost revolution Jack Bogle has led, both vocationally and intellectually, has improved the lives of investors everywhere. Simply put, capitalism has too many characters and not enough men of character. When one of the few tells us that the system he loves is ailing, and how he’d fix it, we had best listen.” —Cliff Asness, Ph.D., Managing and Founding Principal, AQR Capital Management “John Bogle, whom I regard as the conscience of the mutual fund industry, has written an insightful book with great historical and contemporary perspective. His analysis of what has gone wrong and what needs to be done should be required reading for students, financial practitioners, and official policy makers.” —Henry Kaufman, President of Henry Kaufman and CompanyInc. “A wake-up call to policy makers. Anyone who cares about the future of America needs to read this book.” —Jack Treynor, President of Treynor Capital Management Inc. “This is a must-read book for anyone interested in how to restore badly needed integrity, and efficiency, to our capital markets.” —The Honorable Peter G. Peterson “Jack Bogle has done more to protect corporate shareholders from mounting abuses at the hands of greedy and negligent CEOs, directors, and money managers than anyone in America. The case he makes here is so powerful and well reasoned that our Washington politicians will be hard pressed to ignore it.” —Mario Cuomo, 52nd Governor, New York State “Jack Bogle’sThe Battle for the Soul of Capitalismis arguably the most important treatise on the bubble era. Policy makers, investment fiduciaries, and individual investors should read and act upon Bogle’s prescriptions. The stakes are high: our collective financial souls.” —Steve Galbraith, Limited Partner, Maverick Capital “This is an important book for the post-Enron era. In his characteristic hard-hitting style, one of the legends of the mutual fund industry presents an insider’s view of what’s wrong with corporate America and what can be done to improve it.” —Burton G. Malkiel, Princeton University “Bogle describes the continuous struggle for control of our capi- talistic system, the odds being heavily in favor of the managers. Individual investors and beneficiaries remain helpless, inter- mediaries are passive or conflicted, and Boards not yet effective. You owe it to yourself to read this book and reflect on his call for further Federal intervention to restore some balance.” —Ira Millstein, Senior Partner, Weil, Gotshal & Manges LLP “In this tour de force, Bogle subjects corporate America to a forceful critique.Keen insights, rich experience, and moral courage shine throughout.Anyone interested in our corporate system should read this book, and those who do will never see corporate America the same again.” —Lucian Bebchuk, Harvard University “The American wage earners’ pension and 401(k) savings are now a major source of capital. Incredibly, although the source of capital is democratized, wealth is more concentrated. Jack Bogle finds this contradiction unacceptable and in this book shows us how to democratize the rewards of capitalism.” —Ray Carey, author of Democratic Capitalism: The Way to a World of Peace and Plenty “John Bogle has done more to help ordinary investors than any other person in America today. He continues his battle on behalf of shareholders with this impassioned new book. Every investor and every policy maker should read his ideas for reform.” —Peter Fitzgerald, U.S. Senator for Illinois, 1999–2005 “Jack Bogle’s brilliant tour de force provides the first integrated view of how our system of investing often destroys more value than it creates. Bogle clearly understands how the system works and how perverse motivations are undermining value creation. Always a pragmatic, he offers workable and practical solutions of how to get back on track.” —William W. George, Former Chairman and CEO of Medtronic, Inc. “Once again Jack Bogle is the clearest and most courageous voice pointing out critical flaws in our governance and financial system but also showing, in constructive, brilliant ways, how to make the timely repairs. This book presents a rare blend of erudition, experience, and utility. It should be required reading for CEOs, public policy leaders, and MBA students—if not all informed investors.” —Jeffrey Sonnenfeld, Yale University “This superb book should be a required reading for every business student in college. Like a fine surgeon, Jack Bogle dissects what is wrong with the capital markets from an investor’s view, and at the same time provides a well-reasoned cure.” —Lynn Turner, Former Chief Accountant of the U.S. Securities and Exchange Commission “In his characteristic style, Bogle delivers strong medicine for what ails our capital markets and corporate governance framework. Not all will agree with everything that he has written, but they would be wise to take note, as his message is resounding and his proposals go to the heart of crucial debates about management, ownership, and value creation.” —Devin Wenig, President, Business Divisions, Reuters Group THE BATTLE FOR THE SOUL OF CAPITALISM J C. B OHN OGLE THE BATTLE F O R T H E SOUL OF CAPITALISM YALE UNIVERSITY PRESS / NEW HAVEN & LONDON Copyright © 2005by John C. Bogle. All rights reserved. This book may not be reproduced, in whole or in part, including illustrations, in any form (beyond that copying permitted by Sections 107and108ofthe U.S. Copyright Law and except by reviewers for the public press), without written permission from the publishers. Designed by Mary Valencia. Set in ITC Galliard type by Integrated Publishing Solutions. Printed in the United States ofAmerica. The Library ofCongress has cataloged the hardcover edition as follows: Bogle, John C. The battle for the soul ofcapitalism / John C. Bogle. p. cm. Includes bibliographical references and index. ISBN0-300-10990-3(alk. paper) 1. Capitalism—United States. 2.Corporations—United States. 3. Investments—United States. 4. Mutual funds—United States. I. Title. HB501.B6552005 330.12(cid:2)2(cid:2)0973—dc22 2005013193 A catalogue record for this book is available from the British Library. The paper in this book meets the guidelines for permanence and durability ofthe Committee on Production Guidelines for Book Longevity ofthe Council on Library Resources. ISBN-13:978-0-300-11971-8(pbk. : alk. paper) ISBN-10:0-300-11971-2(pbk. : alk. paper) 10 9 8 7 6 5 4 3 2 1 To my twelve grandchildren— Peter, David, Rebecca, Sarah, Christina, Ashley, Andrew, Molly, Christopher, John, Alex, and Blair— and to all the other fine young citizens of their generation. My generation has left America with much to be set right; you have the opportunity of a lifetime to fix what has been broken. Hold high your idealism and your values. Remember always that even one person can make a difference. And do your part “to begin the world anew.”

Description: