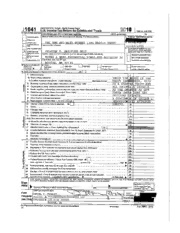

The Ann and Mitt Romney 1995 Family Trust 2010 1041 tax form PDF

Preview The Ann and Mitt Romney 1995 Family Trust 2010 1041 tax form

EAO41 _GStinsing Fett Forests and Trusts 2010 Sa eT eee poe ee ater oe een taeeeity 2 Sansone vepop seen) Tecan Pps Serer fines ow ‘Staessen fa y. a Sead “¢E —— Loa ——— [A\ss bral Jor Erin The To le ain so, 2004 Ame ert snes a 4 es ner 0 KITT nom 2908 MTGE FT a RB. MALT; ROPES & GRAY, LP; PRUDENTIAL TONER, 800 BOYLSTON STREET ‘BOSTON, "MA 02159 EitiSitomsos Sonn Garan Cone fing Fame Tom, Toc roan) — re ES = —, SS = = = a er a= Tn Seas = neers oO oO SO a Ra a aT {5 eaten tr ony 201 ort yr ner J Tiere” Tirana nsonrewnime commas ms 1 tac Sin a ert yma neta wig acre SSE cecee cenit Sea Snr Con eae “ll hare essen: Do coe ra Ope Ta pode A [sos «MeN vat niduer ag ERPE: FEF Serceiston np “Roane THE RAW AND MTT ROWREY 1995 FAMILY FROST ROPES & GRAY, PRUDENTIAL TOWER, 800 BOYLSTON ST Boszom, MA 02199. BELMONT RA 02478 seme 0170172010 ‘pone 12/31/2010 1.8. GOVERNMENT INTEREST (ENTER OW FORM 1040, Live @Aj (OPHER INTEREST INCOKE se ranevanerenenevexeuse 503,510. (exten OW FORE 1060, Lise @aj FOREIGN INTEREST INCOME «-.- peesevovssevserveesse¥ 31,756. (evten ow rome 1000, iiie’ da’ Foi iiié) ‘QUALIFIED... TOTAL FOR YEAR (Givren On roisi' 1040; ‘ORDINARY DIVIDENDS. QUALIFIED sv ne cesses eee (See. Pom’ i045" TisEROCTTONS|” (eran ow roi 1046) ithe’ da} FOREIGN DIVIDENDS, ‘QUALIFIED. (SEE Pom i046" niaTRACETONS) ‘TOTAL FOR YEAR eraserentaeriecneverraisresa 63,770. (ENTER On Scibbuie By paRE Ti) “bine S"W' onic 1116) PARINERSHI?, TROST/ESTATE, AND S CORP GAIN OR LOSS .. (ENTER Ow SCHEDULE b, LINE 5, COLUMN F) OnieR EAPITAL GAIN-OR LOSS’. csreeesscoceses (EvreR OW SCHEDULE D, PARE i, Lite’ i} SECTION 1256 GAIN OR LOSS. 70, 142, NSEE SCHEDULE D, LIne @”iStROCTiONS} 741,407. + 1,460,803. 62,509. 209,213 ceseeses 130,526. 8,258. ape honours hed how nye 2010 saxvesn Tae ay dtm gamete Yu. The "GRANTOR TAX RFORURTION LETTER, CONTRORTION (aurea on scuEDULE 0, LINE 13, couOMN F) PARINERSHIP, TRUST/ESTATE, AND S'CORP GAIN OR Loss TOTAL FOR YEAR. vecssesseessteaseresenteseees 4,898, 662. (ane OW’ SciueDULE' Lies" 12)" Cound #) 208 RATE ss . or (enbek’ oi Lise’ ("ob WoaRSAbEY' BOR SciBb'D; “Line 18) (ENTER ON FORM 4997, “PART i, \Couma 6) UWRECAPTORED SECTION 1250 GAIN’ (PARTNERSEIP5/S CORE) ... 2,088 (GNTER ON LIWE 11. OF WORKSHEET FOR SCAED D, LINE 15) (onmeR CAPITAL GAIN OR LOSS sess 7179, 609. TOTAL FOR YEAR scr -se+ seeeeeeenee 2,849,003, (Evzer on scaeviz'b; iii stcnzoy 1256 earR OR Loss + 108,233. (Ste ScmeoULE D, LINE 1i TwsTRiCEION3} ROYALTY INCOME. a . 402. (aNTER ON SciRDULE i, “PARE i} (OPHER TAKABLE. INCOME. creamer 320,947. KENTER ON FORY 1040, LiWe”2i} REWE/ROYALTY INCOME FROM ACEIVE/PASSIVE ACTIVITIES ....e0eee4 “281,872 (ENTER ON SCHEDULE E, PAR? 1) PARTNERSHIP INCOME FROM ACTIVE/PASSIVE ACTIVITIES 763,651. (ENTER OW SCHEDULE , PART II) INVESTMENT INTEREST EXPENSE oo. csesescscceseseae 13,784. (ENTER THE ABOVE OW SCHEDULE A, 1 APPLICABLE) CHARITABLE DEDUCTION vsscscecsesntsceseerersnsesticesscesesses 4s. (GNTER THE ABOVE of SCHRbULE Ay" 1F ABPLICARLE] ora DEDUCTIONS SUBJECT 0 24 AGE . sgvevienser 357, 495 (GNTER TAE ABOVE O8 SCHEDULE A, IF APPLICABLE) MISCELLANEOUS INFORMATION. "(ENTER ON FORM 1040," Lis” 83} ° (Wo ALLOCATION AGAINST FEES OR CoMMTssIONS HAS BEEN MADE WITH YOUR TAX-EXEMPT INCOME) ep hemou feed show nye 2010 sre Tes may payments eit ened you The ferns ry ceased be ocatnof wana noone, ur ass pn tng tae sence ‘itcenjurinate yarn te so Fyouhe Paces chr scat spp ew Sw [ai TRON TETTER CONTR TAX _PRErERENce rrens” TAX PREFERENCE ACCELERATED DEPRECIATION... 1,148. ADJUSTED GAIN OR LOSS ss s-sseerees eases 6s! vax caEpits FOREIGN TAX CREDIT INFORMATION (ENTER THE FOLLOWING OM FORM 1116 OR SCR. A IF AFPLICABLE) fcounsay __ FOREIGN suCoME _ EXPENSES. aK DATE PAID rantous 1,374,857. 453,574. 177. zysi/0 7ARIOUS $15,312 6,851. 0. RAID INFORMATION LINE 168: $12,325,151 LINE i6c: $8,319,141 LIME 1G: $303,083, LIME 16H: $3,915, 857 GUALIPTED FOREIGN DIVIDENDS: $770,670 SECTION 1250 GAIM/ (LOSS): $2, 088 SECTION 1231 GAIN/(1088): $(98) LINE ISN - CREDIT FOR EMPLOYER TAXES PAID: $300 LINE 15P - US WITAMOLDING TAK: 697 LINE 27a: 61,148 LINE 278: §(4,633) LIne 20: $1, 655 LIne ime: $1,696 LIne ite: $346 ape ance above enjou___tkihen. Thee may tet prs acy id The ‘SCHEDULE E ‘Supplemental income and Loss joss ssem Lan mre ean rte 2010 = > so orem roe ts baseharwins ttn fom we |S ty Ut cme os Fe Resta Rel xine Royates Tay anes ee Sunt ur ssage £3. yu on nal gt am ns es fom it Soar — lesen ine ayoucr fas ay aE SED STL etchant reenoet al yy fa day ree tar n rH > Gnu wt meron Bhat oy L ‘reson coer) |a » — ps k 12 Income pete ants Show a8 be 22 Banot ser ay eae Pa 494 1B Lome Aadays ono 22 nal nnn Ym ne 2 ace 4 Tot roa rea eat and oy ncome wf os). Cane Wm 24 2 Ee ast ne Pa Wendie ope? oa apoyo yao wen ara oF 040, wT, Tem 10M ts Ye Coerwan tele ht anne tas on ef one a 402 Ferre asin eee. our ain ‘aE Fo oe TE AOL AD Mic goer aes ena couse __| lll aa Symmes Li Sam peter cree ae ia ease Seen ee pega Lh nas atwmaenen ce Cle Ce Swoon nnpatraowaengemae te aaa paar aa etek oe ed Norton = 7 Aileen Ese 2 aomperadrese : r rom 3 cmamenans [saefiss penne eee al ous ia a a aa ee x AI 2 tieaane ~ “he ee a ea t ina Soe