Texas All-Lines Adjuster License training, plus exam PDF

Preview Texas All-Lines Adjuster License training, plus exam

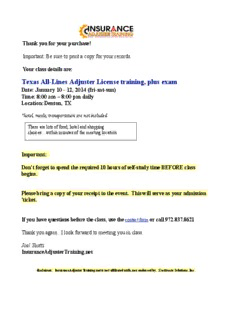

Thank you for your purchase! Important: Be sure to print a copy for your records. Your class details are: Texas All-Lines Adjuster License training, plus exam Date: January 10 - 12, 2014 (fri-sat-sun) Time: 8:00 am – 8:00 pm daily Location:Denton, TX *hotel, meals, transportation are not included There are lots of food, hotel and shopping choices…within minutes of the meeting location. Important: Don’t forget to spend the required 10 hours of self-study time BEFORE class begins. Please bring a copy of your receipt to the event. This will serve as your admission 'ticket. If you have questions before the class, use the contact form or call 972.837.8621 Thank you again...I look forward to meeting you in class. Joel Yeatts InsuranceAdjusterTraining.net disclaimer: InsuranceAdjusterTraining.net is not affiliated with, nor endorsed by, Xactimate Solutions, Inc. Texas Adjuster All lines Pre-licensing Course Part 2 – 30 Hours Classroom Requirement presented by InsuranceAdjusterTraining.net 1816 S. FM 51 Decatur, TX 76234 855-892-3587 Classroom Outline with associated hours of per topic Part 1 Classroom Study - Terminology and foundational concepts -- 10 Hours sect1 - a. commonly used adjuster terminology - 1.5 hours b. the basis of marketing terminology - .5 hours sect2 - a. Terminology and how to interpret policy laguage - 1.5 hours sect 3 - a. Terminology and how to interpret policy laguage - 1.5 hours b. standard fire policy terminology --.5 hours sect 4 - a. workers compensation concept and terminology - .5 b. Auto policy language - .5 hours sect 5 - a. Commercial policies concepts and terminology - 1.5 sect 6 - a. Inland marine terminology - .5 hours b. Ocean marine terminology - . 25 hours c . Bond language - .25 Part 2 Licensing Regulations -- 1.75 hours a. Licensing requirements -- .75 hous b. TDI regulations -- .5 hours c. Renewal and CE requirements -- .5 hours Part 3 Adjuster Practices and Responsibilities -- 1.5 hours a. adjuster role in claim handling - .5 hours b. knowledge factors - .5 hours c. Good Faith and bad faith - .5 hours Part 4 Marketing Practices -- 1.75 hours a. the business of insurance, the who when and where. -- .25 hrs b. Unfair claims settlement - rules not to violate -- .75 hours c Claim handling and payment time frames -- .75 hours Part 5 HO-A, HO-B, HO-C, ISO forms, Personal Lines Coverages -- 4.5 hours A. Reading a policy --------------------------------------------------- .3 hours B. Interpreting the language ------------------------------------------- .3 hours C. typical policy formats - Broad, Basic, Special, HO and DP -- . 4 hours D. perils and the HO-A, B and C -------------------------------------- .5 hours E. Deductibles - which to use and how to calculate --------------- . 3 hours F. Coverage A, B, C, D, E -------------------------------------------- . 4 hours G. Limits of Liability and how they affect the claim --------------- . 3 hours H. Duties after a loss - Policy holder and Insurer ----------------- . 3 hours I. Loss settlement provision ------------------------------------------ . 4 hours J. Co-insurance and how to calculate ------------------------------- .3 hours K. Liability sections ---------------------------------------------------- .3 hours L. adjuster application of policies ---------------------------------------.3 hours M. policy differences ------------------------------------------------------ .4 hours Part 6 Extensions, exclusions, and additional coverages -- 1.75 hours A. Extensions of coverage ------- .30 B. Exclusions ---------------------- .75 C. Additional coverages --------- . 30 Part 7 Standard Fire Policy -- 1 hrs A. DP VS. HO ---. 5 hours B. the four sections -- . 5 hours Part 8 Basic Workers Compensation -- 1 hours A. employers rights and responsibilities B. employees rights and responsibilities Part 9 Auto Liability -- 1.5 Hours A. Liability insurance -.4 hours B. Collision - .4 hours C. Comprehensive - . 4 hours D. Other types of coverage - . 3 hours Part 10 Commercial and Commercial General Liability -- 2.5 hours A. types of policies and examples ------------------------ .75 B. commercial property coverage's ----------------------- .75 C. Commercial Liability ----------------------------------- 1 hour Part 11 Inland Marine -- 1 hrs A. What is covered --------------- .75 B. Conformity and the lack thereof -- .25 Part 12 Ocean Marine -- 1 hrs A. Main Policy types ------ . 5 B. Other insurable items -- . 5 Part 13 Bonds -- .75 A. Fidelity -- .25 B. Surety --- .25 C. Parties too -- .25 Total Classroom Hours: 30 classroom time Total Self study Hours : 10 to be completed by students Total Hours: 40 Texas Adjuster All-Lines License Pre-Licensing SELF STUDY MATERIALS Foundational Terminology and Concepts – 10 hours (Part 1 of 40 required hours) presented by InsuranceAdjusterTraining.net 1816 S. FM 51 Decatur, TX 76234 972.837.8621 855-892-3587 [email protected] How to Get Maximum Benefit From Your Training The material presented in this self-study manual will lay the foundation for the 30 hours of classroom training that will follow. While we don't expect you to memorize this manual completely, it is extremely important that you spend the required ten hours (or more) studying the concepts and reviewing the related materials. Along with the definitions and related concept materials that follow, there are also several policies included. Read all of the policies completely – they are considered part of your mandatory 10-hour self study. Much of the information may not yet make sense, but read all of it before class begins. You may be surprised to learn that your most valuable new skill has nothing to do with accurately measuring a roof or writing good scope notes; rather, it is your ability to read and understand the various insurance policy forms. You'll need to know what is covered – what is not – and why. Do yourself a favor and keep this in mind as you complete your ten hours of self- study. Build your foundation with care...and your 30 hours of classroom time will be much easier. Thank you for choosing our company . We know that you had many options and we're honored that you ultimately chose to train with us. Our staff looks forward to serving you. We wish you great success in your new insurance career! 1 What is Insurance? Insurance is a means of transferring risk. Insurance companies, in exchange for a specified payment (premium), guarantee an amount of compensation for certain kinds of covered losses. Examples of losses: property damage, illness, injury and death. What is Risk? Risk is the potential that a chosen action or activity (including the choice of inaction) will lead to a loss (an undesirable outcome). (source: wikipedia.org) For the purposes of insurance, risk applies only to events that are not “certain or predictable”. Examples would be theft, weather damage and illness. How is Risk Addressed? Avoidance: (example) A company avoids potential flood risk by not building or buying property in a known flood plain. Reduction: (example) An individual reduces the risk of bodily harm by not engaging in skydiving. Transfer: (example) The cost of the known risk is transferred to another party; this may be accomplished by purchasing an insurance policy to cover one or more known risks. Acceptance: That is, accept the known risk and accept any losses or consequences of it. What is an Insurance Policy? An insurance policy is a legally-binding contract between an insurance company (insurer) and an individual, company or party (the policyholder); the agreement (insurance policy) specifies the types of claims which the Insurer is legally obligated to pay, in exchange for payment (also known as 'premium'). 2 What Does A Typical Insurance Policy Contain? • Declarations – names the insured, the insuring company and the losses covered. • Definitions – explanations of the important policy terms. • Insuring Agreement – a summary of the policy and the underlying coverages. • Exclusions – describes perils, hazards, property and losses not covered. • Conditions – rules, duties and obligations; if these are not met, the claim is denied. • Endorsements – additional forms attached to the policy, which modify it. • Policy Riders – specifies changes and amendments to the policy. Perils vs. Hazards Peril: something that is the direct cause of a loss. For example: lightning, hail, windstorm or fire. A peril might also be something 'man-made', such as theft or vandalism. Put simply, 'perils' are a defined group of damage-causing things that may, or may not, be covered by the insurance policy. Hazards: things or conditions that are known to increase the chances for a loss to occur. Examples of hazards: ice on a walkway, an overloaded electrical outlet, ice dams on a roof. What is an Insurance Adjuster? An Insurance Claims Adjuster is person who works for, or acting on behalf of, an insurance company for the purpose of documenting, investigating and evaluating claims for settlement. The adjuster's role is to determine: • what caused the loss • if the loss is covered by the insured's policy • the dollar amount of the loss • the dollar amount that the policy will pay for the loss Duties of an Insurance Agent Insurance agents are involved in the insurance policy process in the following ways: 3 1. Sales of policies to policyholders. 2. Reviews and signs each policy. 3. Provides premium quotes to current and potential policyholders. 4. ‘Field Underwriting’ – this is done by applying a set of criteria to the policyholder’s needs and making determinations about risk levels that must be addressed. 5. After the Sale – agents are responsible for servicing the policyholder, making sure that changes are recorded properly; coverages should be reviewed yearly, to ensure that coverages are appropriate and correct. Policy Provisions: Policy Period and Non-Renewal The policy period (policy term) is the time between the 'effective date' and the 'expiration date'. Some types of policies have terms of six months, others may be one year or multiple years. If the policy is not renewed by the policyholder, the coverage typically ends at 12:01 am (just after midnight) on the date of expiration. In order for coverage to be uninterrupted, coverage of the new (or continuing) policy must fall on the same day as the expiration date of the expiring policy. Named Insured The person, company or entity (policyholder) with whom an insurance policy (contract) has been made, and whose interests are covered by the insurance policy. First Named Insured This insured party has special rights and privileges, above all other named insureds. This person or entity is listed first on the policy declarations section. Among their specific privileges: • They are responsible for payment of the premiums; • They are responsible for communications with the insurance agent; • They have the right to make policy changes, including cancellation of the policy; • They have the right to make decisions on behalf of all other named insureds on the policy. 4 Additional Insured These are other entities or individuals with some type of coverage benefit extended by the policy; they are typically listed in the endorsements or declarations portion of the policy. Policy Limits ( Limit of Insurance, Limit of Coverage or Limit of Liability) This is the maximum defined monetary amount that the policy (contract) will indemnify (pay out) in the event of a covered loss. Understanding the Insurance Policy Deductible The amount of money that the policyholder (insured) must pay out of pocket, before the insurance company (insurer) pays the remaining balance, is known as the deductible. What is Subrogation? Subrogation rights are sometimes exercised by the insurer to obtain monetary compensation from one or more third parties who were responsible for the covered loss. Personal Insurance Contract This type of policy is issued on the insured person, rather than on the insured person's property. Unilateral Insurance Contract A unilateral contract is one-sided; this means that if a covered loss occurs, the insurer is obligated to pay out on the claim, pursuant to the insurance contract. However, if the policyholder (insured) wishes to discontinue the contract, he or she can do so by no longer making payments. In this way, the insured 'opts out' of the contract. 5 Utmost Good Faith Contract This refers to a contract that is two-sided, where both parties are relying on the mutual integrity of the other party. The duty of Utmost Good Faith means that both parties are honest and forthcoming with one another; for example, the insurance company acting in good faith will pay claims in a timely fashion and will not misrepresent coverages and exclusions – and the insured acting in good faith will be honest about claimed losses and cooperate with the insurer's investigations. Cancellation of an Insurance Policy Termination of the policy (contract) during the policy period; the termination may be initiated by the insured or the insurer. Insurers must provide a written notice of cancellation to the policyholder (insured). Unearned premiums are returned to the policyholder on a short rate basis or pro-rata basis. Why/When an Insurance Company Can Void a Policy Voiding a policy is different than outright 'cancellation'; an insurer may choose to void a policy in the event of: • fraudulent information or actions • misrepresentation of facts by the policyholder • concealment of facts by the policyholder(s) Fair Credit Reporting Act This federal law provides consumers the right to request and obtain a copy of their credit report, upon request, if their application for insurance is denied. Property Insurance vs. Casualty Insurance Property insurance provides coverage for physical property, along with income that it may be used to produce; Casualty insurance is 'non-property' insurance, such as liability, workers compensation, surety, fidelity and crime. 6

Description: