Sharda Cropchem Ltd PDF

Preview Sharda Cropchem Ltd

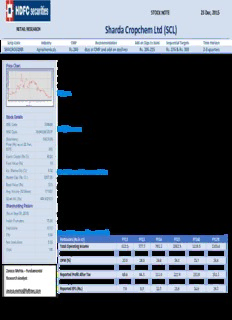

STOCK NOTE 23 Dec, 2015 Sharda Cropchem Ltd (SCL) REThAaILj RESEARCH Scrip Code Industry CMP Recommendation Add on Dips to band Sequential Targets Time Horizon SHACROEQNR Agrochemicals Rs.240 Buy at CMP and add on declines Rs. 205-215 Rs. 276 & Rs. 309 2-3 quarters Price Chart Sharda Cropchem Limited (SCL) is a fast growing global agrochemicals company with leadership position in the generic crop protection chemicals industry. It operates with an asset light business model focused on identifying generic molecules, preparing dossiers, seeking registrations, marketing and distributing formulations through third party distributors and/or own sales. Triggers Differentiated Business Model - Core competency acts as an entry barrier New registrations to drive growth Strong Balance Sheet Stock Details BSE Code 538666 Risks/Concerns NSE Code SHARDACROP Changes in the agricultural or other policies of Governments across the globe Bloomberg SHCR:IN Price (Rs) as on 22 Dec, Agrochemical business is subject to seasonal and weather factors 2015 240 Fluctuating foreign exchange rates Equity Capital (Rs Cr) 90.22 High investment in registrations – leads to lower ROE Face Value (Rs) 10 Eq. Shares O/s (Cr) 9.02 Conclusion and Recommendation Market Cap (Rs. Cr.) 2207.24 We believe that Sharda’s differentiated business model that leverages its registration expertise and wider participation in the Book Value (Rs) 72.5 growing crop protection agrochemicals industry is worth taking a bet on – especially after the recent weakness in the stock Avg. Volume (52 Week) 171307 based on currency turbulence, weather issues and agri commodity price deflation. At the current market price of Rs. 240, SCL 52 wk H/L (Rs) 408.9/215.3 is trading at 18.8x FY16E EPS of Rs 12.8 and at 14.3x FY17E EPS of Rs 16.7. Shareholding Pattern (As on Sept 30, 2015) We feel investors could buy the stock at CMP (Rs. 240) and add on dips in the range of Rs. 205-215 (12.3-12.9x FY17E EPS) for Indian Promoters 75.00 sequential targets of Rs. 276-309 (16.5-18.5x FY17E EPS) in next 2-3 quarters. Institutions 13.13 Financial Summary (Consolidated) FIIs 6.84 Particulars (Rs in Cr) FY12 FY13 FY14 FY15 FY16E FY17E Non Institutions 5.03 Total Operating Income 613.5 777.7 791.1 1062.5 1219.5 1335.4 Total 100 Operating Profit 122.5 140.0 155.0 172.9 191.1 221.7 OPM (%) 20.0 18.0 19.6 16.3 15.7 16.6 Other Income 6.6 14.9 32.1 27.3 33.8 39.8 Zececa Mehta – Fundamental Reported Pro fit After Tax 68.6 84.3 111.0 122.9 131.8 151.1 Research Analyst PATM (%) 11.2 10.8 14.0 11.6 10.8 11.3 Reported EPS (Rs.) 7.6 9.3 12.3 13.6 14.6 16.7 [email protected] (Source: Company, HDFCSec; E-Estimates) RETAIL RESEARCH Page | 1 Company Profile Sharda Cropchem Limited (SCL) is a fast growing global agrochemicals company with leadership position in the generic crop protection chemicals industry. It has made deep inroads in the highly developed European and US markets which are characterized as high entry barrier markets. It also has a significant presence in other regulated markets such as LATAM and Rest of the World. It operates with an asset light business model focused on identifying generic molecules, preparing dossiers, seeking registrations, marketing and distributing formulations through third party distributors and/or own sales. It outsources manufacturing of Active Ingredients and formulations. It has an extensive library of dossiers and registrations. As of September 30, 2015, SCL owned 1,336 registrations for formulations & 207 registrations for active ingredients (AIs) and filed 773 applications for registrations globally pending at different stages. It has strong geographical presence in more than 76 countries with an established global marketing & distribution network (more than 605 third-party distributors and over 109 direct sales force). SCL also runs a non-agrochemical business (revenues less than 1%) comprising of order-based procurement and supply of non-agrochemical products including conveyor belts and general chemicals, dyes and dyes intermediates. The company is capable of providing a wide bouquet of products to its customers. Its product portfolio in agrochemical business comprises of formulations and generic active ingredients in fungicide, herbicide and insecticide segments for protecting different kind of crops as well as serves turf and specialty markets and in biocide segment as disinfectants thereby allowing it to offer varied range of formulations and generic active ingredients. Business Verticals Agrochemicals Business SCL is primarily a crop protection chemical company engaged in the marketing and distribution of a wide range of formulations and generic active ingredients (AIs) globally. The product categories which SCL taps are Insecticides, Fungicides, Herbicides, Biocides and Plant Growth Regulator. Non-Chemicals Business The product portfolio in non-agrochemical business comprises of Belts, general chemicals, dyes and dye intermediates which enables the company to cater to varied demands. SCL also follows the asset light business model for the non-agrochemical operations and supply Belts, general chemicals, dyes and dye intermediates only on the basis of specific orders received from the distributors. It procures these non-agrochemical products, primarily, from the manufacturers in China or India which provides them the flexibility to cater to varied customer demands. Global Crop Protection Market Crop protection products are essential in safeguarding crops against various insects, diseases and pests. The crop protection chemicals market is segmented along three broader products: herbicides, insecticides, and fungicides. Increasing demand for agricultural products and decreasing arable land are driving the global crop protection market where farmers face the challenge to increase the productivity of crops. Other reasons for the growth of this market are the profitability margin in this segment, adoption of modern farming & protected agriculture, change in farming practices & technology, and high returns on investments. RETAIL RESEARCH Page | 2 According to Kleffmann Group estimates, as of 2014, the overall global market related to crop protection agrochemicals was worth $60.52 bn. This market has expanded at a Compound Annual Growth Rate (CAGR) of 5.40% over 2008 to 2014. NAFTA and EU have been early promoters and adopters of crop protection agrochemicals. Hence they dominate overall market of global agrochemical sales with share of 16.7% and 24.9% respectively. Asian region is now the biggest with a share of 28.0%, followed by LatAm with 26.0% and Rest of the World having 4.4% share. The LatAm market is the fastest growing region by far. Developed markets such as the US & EU have matured over the years and their future growth is likely to be marginal but stable. Agrochemicals are protected by patents to encourage innovation akin to the Pharmaceutical industry. Going ahead, many molecules are likely to go off patent throwing the market open for generic players. As per Nufarm, total likely available opportunity through patent expiry between 2011-16 stands at US$ 5.2 bn (2010 sales value). Share of generics have increased from 40% in 2006 to 52% in 2011.There has been visible drop in rate of introduction of new molecules for agrochemical / crop protection molecule over past 2 decade. RETAIL RESEARCH Page | 3 Sharda came out with Rs.351 cr Offer for sale in Sept 2014 and priced its shares at Rs.156. SCL has around 35 subsidiaries and one associate. Among the subsidiaries, about 12 are either non-operational or incur minor fixed expenses without generating revenue. These have been formed mainly for marketing/registration purposes. Below is the list of subsidiaries. Sr. No. Subsidiary Companies Associate Companies 1 Axis Crop Science Private Limited Sharda Private (Thailand) Limited, Thailand 2 Sharda International DMCC, U.A.E. 3 Sharda Cropchem Espana, S.L., Spain 4 Sharda Poland SP. ZO.O, Poland 5 Sharda Balkan Agrochemicals Limited, Greece 6 Sharda Chile SpA, Chile 7 Sharda Costa Rica SA, Costa Rica 8 Sharda Cropchem Tunisia SARL, Tunisia 9 Sharda De Guatemala, S.A., Guatemala 10 Sharda Del Ecuador CIA. Ltda., Ecuador 11 Sharda Do Brasil Comercio De Produtos Quimicos E Agroquimicos Ltda, Brazil 12 Sharda Hellas Agrochemicals Limited, Greece 13 Sharda Hungary Kft, Hungary 14 Sharda Italia SRL, Italy 15 Sharda Peru SAC, Peru 16 Sharda Polska SP. ZO.O., Poland 17 Sharda Spain, S.L., Spain RETAIL RESEARCH Page | 4 18 Sharda Swiss SARL, Switzerland 19 Sharda Taiwan Limited, Taiwan 20 Sharda Ukraine LLC, Ukraine 21 Sharda USA LLC, USA 22 Shardacan Limited, Canada 23 Shardarus LLC, Russia 24 Shardaserb DO.O., Serbia 25 Sharzam Limited, Zambia 26 Sharda Benelux BVBA, Belgium 27 Sharda Colombia S.A.S., Colombia 28 Sharda De Mexico S. De Rl De CV, Mexico 29 Sharda Europe BVBA, Belgium 30 Sharda International Africa (Pty) Limited, South Africa 31 Sharda Malaysia SDN BHD, Malaysia 32 Sharda Uruguay S.A., Uruguay 33 Sharpar S.A., Paraguay 34 Siddhivinayak International Limited, U.A.E. 35 Euroazijski Pesticidi d.o.o., Croatia Triggers: Differentiated Business Model SCL has a differentiated business model compared to its listed peers. Over the years, SCL has, primarily, grown organically and its core strength lies in identifying generic molecules, preparing dossiers, seeking registrations, marketing and distributing formulations or generic active ingredients in fungicide, herbicide and insecticide segments. It has also recently entered into the biocide segment and has acquired several registrations from the existing registration holders, primarily, in Europe. A typical agrochemical value chain consists of the following key activities: (a) basic and applied research, (b) identification of new product and registration opportunities, (c) seeking registrations, (d) manufacture of the active ingredient, (e) formulation and packaging, and (f) marketing and distribution. In this value chain, SCL has adopted an asset light business model whereby its focus is strongly on identification of generic molecules and registration opportunities, preparing dossiers and seeking registrations for formulations and generic active ingredients. SCL procures formulations and generic active ingredients in their finished form from third party manufacturers for onward sale. Company also procures generic active ingredients for preparation and sale of formulations wherein it outsources the process of preparation of formulations to third party formulators. This benefits company in terms of cost competitiveness and helps it to offer varied range of formulations as well as generic active ingredients. RETAIL RESEARCH Page | 5 Core competency acts as an entry barrier SCL’s core competency lies in identifying opportunities in generic molecules and corresponding formulations and generic active ingredients, preparing dossiers and seeking registrations in the relevant jurisdictions. Registering any product usually takes at least 5-6 years and involves a huge cost. For getting a molecule to be registered in a country, the company has to do various lab and field studies which usually takes 3-4 years. As a result of its focused efforts in seeking registrations in different countries and its investment of time and capital towards this objective, its library of dossiers and the number of registrations owned by it has increased progressively. Ability and experience to obtain registrations in such highly regulated markets with high entry barriers places SCL in an advantageous position. Its core competency in seeking registrations also enables it to enter into new markets in an efficient manner and helps in overcoming the critical entry barriers to a great extent. As of September 30, 2015 1,336 registrations for formulations & 207 registrations for generic active ingredients across Europe, North American Free Trade Agreement (NAFTA) nations, Latin America and the Rest of the World. As of September 30, 2015, SCL has filed 725 applications for registrations globally pending at different stages. Registrations as on Q2FY16 Q1FY16 Q4FY15 Q3FY15 Q2FY15 Registration Pipeline Q2FY16 Q1FY16 Q4FY15 Q3FY15 Q2FY15 Europe 725 683 623 545 545 Europe 353 335 342 309 239 NAFTA 79 77 74 68 68 NAFTA 111 104 92 92 86 LATAM 402 395 387 408 335 LATAM 176 164 164 136 147 RoW 337 333 325 313 307 RoW 133 123 131 64 103 Total Registrations 1543 1488 1409 1334 1255 Total Registration Pipeline 773 726 729 601 575 Global distribution network In the past, SCL was undertaking the distribution of formulations and generic active ingredients through third party distributors based in Europe, NAFTA, Latin America and Rest of the World. With an objective to increase its presence in the agrochemical value chain, it has set up its own sales force in various countries in Europe as well as in Mexico, Colombia, South Africa and India and other jurisdictions in addition to third party distributors. Relationship with the third party distributors and availability of its own sales force enables SCL to introduce new formulations and generic active ingredients in its existing market in a timely manner. It also supplies its non‐agrochemical products to its customers, primarily, distributors, across Australia, Asia, Africa, Europe, North America and Latin America based on their specific orders. As on September 30, 2015, SCL has a strong geographical presence in more than 76 countries with an established global marketing & distribution network (more than 605 third-party distributors and over 109 direct sales force). Strong Balance Sheet SCL has maintained a focus on capital efficiency (with healthy return ratios) and strives to maintain a conservative debt policy (as on FY15, D/E is 0.06 times). It has grown without incurring material indebtedness. SCL has the ability to leverage its balance sheet to take advantage of a favourable business cycle or market opportunity. It has also demonstrated a consistent track record of profitability in the last four years and has grown at a CAGR of 21.5%. Also its revenue has been growing at a CAGR of RETAIL RESEARCH Page | 6 20.1% during FY11-FY15. It has strong return on capital employed (RoCE) of 25.4% and return on equity (RoE) of 18.8% as on 31st March 2015. The net working capital days have also been improving from 123 days in FY13 to 108 days in FY15. This is mainly because of reduction in receivable days which was 185 days in FY14 falling in FY15 to 156 days. Pushing the young Biocides business SCL ventured into the biocide segment in 2012. Now, it is marketing and distributing biocides in various countries such as Spain, France, Italy, Hungary, Croatia, United Kingdom, Slovakia, Slovenia, Belgium, Bulgaria, Greece, Poland, Czech Republic. The company plans to increase its marketing and distribution activities for biocide products in other European countries also. As of 31st March, 2015, SCL owns over 148 registrations for biocides. Going forward, it intends to continue to increase the registrations for biocide products. New registrations to drive growth The company continues to focus on new registrations to drive revenue growth in the medium term. It aims to continue to invest Rs 75-80 crore every year for new product registration (and renewal of old registrations) with focus on increasing revenue share in the European markets. The company is working on 11-12 new molecules in the European continent where the overall market size pan Europe would be in the range of about $400-500 million. It is also working on about 3 new molecules in LATAM, about 8-10 odd molecules in the NAFTA region and about 5-7 molecules in the rest of the world region. The company currently has around 68 total molecules which it deals in of which around 50 molecules are the ones which have GLP accredited dossiers. China as Global Manufacturing Hub for Agrochemicals Sharda follows an asset-light business model that involves no investment in manufacturing assets. The company sources its entire production from third-party manufacturers. The management has 20 years of experience in sourcing agrochemicals from China. China has over 2,600 manufacturers of Active Substances (AS) and formulated products. The last 5 years has seen a large increase in the number of manufacturers. The large scale of manufacturing is evident from the fact that the top 10 Chinese companies have sales between $150mn - $300 mn per annum. There is also an excess of capacity for agrochemicals in China. For example, China now has 60 companies registered to manufacture imidacloprid with a total capacity of 25,000 tons of AS, however actual output in 2009 in the region of 12,000 tons with 8,000 tons exported for a world market of 18,000 tons. Also recently, China’s currency is getting weaker against dollar which would make exports from China cheaper than before. This will likely benefit SCL as it imports agrochemicals from China. Diversified business operations across the globe leads to reduced risk of adverse market and seasonal conditions. SCL owns 1,336 registrations for formulations & 207 registrations for active ingredients (AIs) and has filed 773 applications for registrations globally pending at different stages across Europe, NAFTA, Latin America and Rest of the World. The library of dossiers gives SCL a competitive edge and facilitates the company in seeking registrations in different countries in a time RETAIL RESEARCH Page | 7 efficient manner. This also fosters the ability to operate in and distribute diversified range of formulations and generic active ingredients globally including highly regulated markets, which would not be permitted without such registrations. As of FY2015, we have 729 applications for seeking registrations globally which are pending at different stages. It has strong geographical presence in more than 76 countries with an established global marketing & distribution network (more than 605 third-party distributors and over 109 direct sales force). Through this network, the company offers a diversified range of formulations in fungicide, herbicide, insecticide and biocide segments. SCL’s relationship with the third party distributors and availability of own sales force enables it to introduce new formulations into the existing market in a timely manner. This kind of diversification across countries leads to reduction of risk under adverse market conditions and seasonal variations because any changes in the political scenario of a country or currency depreciation or any such issue at the macro level can be camouflaged with growth in some other region. Financials RETAIL RESEARCH Page | 8 FY15 and Q2FY16 Review For FY15, the revenue grew by more than 34.25% as compared to last year, to reach Rs 1062.5 crore. The main drivers behind this growth were the strong organic and secular growth in existing markets across all the products. This was also supported by SCL’s early stage successes coming from new markets that it recently entered. Europe was the main contributor to the consolidated revenue of about 51%, followed by NAFTA (19.9%), LATAM (17.3%) and RoW (12.2%). Operating profit grew by 12% YoY to Rs 172.9 crore thus arriving at an OPM of 16.3%. EBITDA also improved by 7% YoY to Rs 200.3 crore compared to Rs 187.1 crore in FY14. However, EBITDA margin decreased by 480 basis points to 18.8%, primarily due to increase in business overheads and change in the product mix between formulations and active ingredients. Another reason was the depreciation of Euro currency during the financial year. But on a constant currency basis, as per the management, FY15 margins would be either flat or higher. The profit after tax improved by 11% to Rs 122.8 crore and PAT margin decreased by 247 bps to 11.6%, due to the foreign exchange loss of Rs 18.21 crore. For SCL, Q4 brings the highest revenues share, followed by Q1, Q2 and Q3. Q4 accounts for nearly 40% of annual sales. For Q2FY16, total revenues declined by 11.3% YoY to Rs. 236.3 crore primarily driven by volume growth of 6%, largely offset by unfavourable currency movement (majorly Euro-Dollar depreciation) leading to a decline of 4.3% and change in price, product & region mix leading to decline of 13%. Volume growth was low as the purchasing capacities of the distributors and the farmers in every country have got reduced because of the adverse foreign exchange (local purchase cost in some currencies were up 50% to 100% more due to that currency depreciating against the USD). The European revenue has declined due to adverse currency and price-product mix, though the volume growth was about 34.4%. In the NAFTA countries, growth was about 8.34%. However, NAFTA countries include Canada and Mexico and Canadian dollar has depreciated by 22% compared to the same period last year and Mexican currency has depreciated by even more may be about 30% to 35% which has affected the volume growth. In LATAM, volume de-grew by 34%. Also, the company has strategically reduced its exposure and controlled sales to LATAM region due to unfavourable economic environment. The rest of the world there has seen a good growth of 9.8%. In Q2FY16, Operating profit excluding foreign exchange impacts decreased by 14.9% YoY to Rs. 39.4 crore mainly due to lower revenues. OP Margins have declined by 74 bps to 16.6% mainly due to lower revenues and relatively stable fixed costs. PAT de- grew by 10% YoY to Rs. 24.2 crore with PAT margin at 10.2%. In Q2FY16, the company added 55 registrations (Europe – 42, NAFTA – 2, LATAM – 7 and RoW – 4. The capex incurred on registrations during H1FY16 stood at Rs. 36.3 crore. A point to be noted is in recent quarters, the company has been able to grow at a strong volume growth. However, this growth was sometimes marred by either currency impact or by lower realization or product mix. Revenue growth (%) Q2FY15 H1FY15 Q3FY15 9MFY15 Q4FY15 FY15 Q1FY16 Q2FY16 H1FY16 Volume Impact 34 21 61.5 32.6 31.5 32.3 14.1 6.0 10.2 Price/Product/Region Mix Impact 12.9 26.2 -32.2 12.5 -6.2 3.2 -5.3 -13.0 -9.3 RETAIL RESEARCH Page | 9 Currency Impact -3.6 2.7 -0.6 -1.3 -7.6 -1.3 -5.6 -4.3 -4.8 Overall growth 43.3 49.9 28.7 43.8 17.7 34.2 3.2 -11.3 -3.9 For FY16, the management expects the revenues from Latin American continent to be under pressure. For NAFTA, SCL has been able to crack upon some big multinationals like FMC, Arysta who have approved their products and can do some fairly big deals with them. SCL expects volume growth of about 15-20% for FY16. Valuation For FY16, we have assumed volume growth of about 11%, unfavourable currency movement (majorly Euro-Dollar depreciation) leading to decline of 3% and impact of price-product-region mix of -7% leading to an overall growth of 1% only. Thus the expected revenue is Rs. 1073.3 crore. The operating profit is expected to de-grow by 6% to Rs 166.9 crore with OPM to dip by 72 bps to 15.6%. With tax rate of about 32% we expect PAT to come in at Rs. 115.4 crore, down by 6% YoY. For FY17, we have assumed volume growth of about 12%, favourable currency movement (both Euro-Dollar and USD-INR depreciation) leading to marginal up tick of 2.5% and marginal pick up in realisations about 1% leading to an overall growth of 15.5%. Thus the expected revenue is Rs. 1239.7 crore. The operating profit is expected to grow by 28% to Rs 214.5 crore and OPM could grow by 175 bps to 17.3%. With tax rate of about 32% we expect PAT to come in at Rs 150.9 crore, up by 31% YoY considering a low base. Risks/Concerns Changes in the agricultural or other policies of the Government across the globe SCL’s formulations and generic active ingredients are marketed and distributed globally. Any changes in the government policies relating to the agriculture sector such as government expenditure in agriculture, changes in incentives and subsidy systems, import/export policy for crops, commodity pricing, ability of farmers to realize minimum support prices could also have an effect on the ability of the farmers to spend on agrochemical input products, which thereby could affect the market demand and the sales of its formulations and generic active ingredients. Agrochemical business is subject to seasonal and weather factors The agricultural sector on which SCL’s agrochemical business is dependent is subject to varying soil conditions, climatic conditions, rainfall, seasonal and weather factors, which makes the performance of the agricultural sector as a whole or the levels of production of a particular crop relatively unpredictable. Also, the occurrence of disease and the corresponding use of agrochemicals would depend primarily on these factors and would differ on a regional basis. Accordingly, the effect of the soil conditions, climatic conditions, rainfall, seasonal fluctuations, commodity crop price fluctuations and/or any of the above mentioned events on the agricultural sector and particularly the crops to which SCL’s products cater, drive the demand for the agrochemicals which makes the company’s operations relatively unpredictable and seasonal. RETAIL RESEARCH Page | 10

Description: