Return rganization Exempt From some Tax PDF

Preview Return rganization Exempt From some Tax

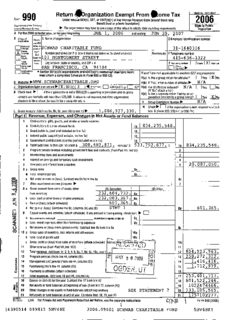

990 Return rganization Exempt From some Tax OMBNo 1545-0047 2006 Form Undersectiun501(c),527, or4947(a)(1)ofthe Internal RevenueCode(exceptblack lung benefittrustorprivate foundation) DepartmentoftheTreasury InternalRevenueService ► The organization mayhavetouseacopyofthis return tosatisfystate reporting requirements A Forthe2006 calendaryear, ortaxyearbeginning JUL 1 2006 and end JUN 30, 2007 B Checkif C Nameoforganization DEmployer identification number Please applicable useIRS OchAcadhadnnregses lppannbnnetltoorrSCHWAB CHARITABLE FUND 31-1640316 DchNaamnge type Numberandstreet(orP0 boxifmailisnotdelivered tostreetaddress) Room/sude ETelephone number Jreetum spsecific 101 MONTGOMERY STREET 415-636-3322 Final Instruc- =retum lions Cityortown,stateorcountry,andZIP +4 F Accountingmethod El Cash a Accrual =retAruemtreurnnnded SAN FRANCISCO, CA 94104 Ostheearfy)► =Applpiencdaitnigon •Section 501(c)(3) organizations and 4947(a)(1) nonexempt charitable trusts Hand Iarenotapplicable tosection527organizations must attach a completed ScheduleA (Form990 or990-EZ) H(a) Isthisagroup returnforaffiliates? =Yes EK]No G Website: SCHWABCHARITTAABBLLE H(b) If'Yes;enternumberofaffiliates► N/A J Organization type (checkonlyone)► 0 501(c) ( 3 )I [insertno) a 4947(a)(1) or 0 H(c) Areallaffiliates included? N/A =Yes ONo (if"No,*attacha list ) K Checkhere ► ifthe organization is nota509(a)(3)supporting organization and its gross H(d) Isthisaseparate returnfiled byan or- receipts are normally notmorethan $25,000 A return is notrequired,butifthe organization ganization covered byagroup ruling? ElYes [X]No choosestofile a return, besure tofile acomplete return I Group Exemption Number► N/A M Check ► El ifthe organization is not required toattach L Gross receipts Add lines6b,8b, 9b,and 10btoline 12 ► 1 086 92 7 330 . Sch B (Form 990,990-EZ, or990-PF) Part 1 Revenue. Exaenses. and Chances in Net Assets or Fund Balances 1 Contributions,gifts, grants,and similaramounts received a Contributions todonoradvisedfunds la 834,235,548. b Direct publicsupport (notincluded on line 1a) 1b c Indirectpublicsupport (notincluded on line 1a) 1c d Governmentcontributions (grants)(notincluded on line la) 1d e Total (addlineslathrough 1d)(cash $ 300, 482, 871. noncash $ 533, 752, 677. ) 1e 834, 235, 548. 2 Program service revenue including governmentfeesandcontracts (from PartVII, line 93) _ 2 3 Membershipduesand assessments 3 4 Interestonsavings and temporarycash investments 4 5 Dividends and interestfromsecurities 5 20,087,050. 6 a Gross rents 6a b Less rentalexpenses 6b c Net rental income or(loss) Subtractline6bfromline6a 6c 7 Otherinvestmentincome(describe ► 7 8 a Grossamountfromsales ofassets other (A) Securities (B) Other than inventory 232,604,732. 8a z b Less costorotherbasisand salesexpenses 232,003,367. 8b Z) c Gain or(loss)(attach schedule) 601 , 365. 8c d Netgain or(loss) Combine line8c,columns (A)and (B) STMT 1 8d 601,365. .U 9 Specialeventsand activities (attach schedule) Ifanyamountisfromgaming,check here ► 0 Z a Grossrevenue(notmcludnoS ofcontnbubomreportedonline1b) 9a Z b Less directexpenses otherthan fundraising expenses 9b L) c Netincomeor(loss)fromspecialevents Subtract line 9bfromline9a 9c I) 10 a Grosssalesofinventory,less returnsandallowances 10a b Less costofgoodssold (^ _ 10b c Gross profitor(loss)fromsales ofinventory (attachschedule) Subtractlfifre10bfrom'hn "10a 10c 11 Otherrevenue(fromPartVII,line 103) 11 12 Totalrevenue.Add lines le, 2 3 4 5 6c 7 8d 9c 10c and 1 12 854, 923, 963 . 0 13 Programservices (fromline 44,column (B)) qtyAY 2 0 2ryag_jO I 13 250, 272 , 322 . y 14 Managementandgeneral (fromline 44,column (C)) Ch 14 1 , 416 , 416 . C 15 Fundraising (from line 44,column (D)) ) - 15 1 , 712 , 979 . W 16 Payments toaffiliates (attachschedule) o^® b^, U I 16 17 Totalexpenses. Add lines 16and44,column (A) 17 253, 401 , 717 . 18 Excess or(deficit)fortheyear Subtract line 17fromline 12 18 601, 522 , 246 . mm 19 Netassetsorfund balancesatbeginning ofyear(fromline73,column(A)) 19 1022474466 . ZQ 20 Otherchangesin netassetsorfundbalances (attachexplanation) SEE STATEMENT_ 2 20 133 105 , 565. 21 Netassets orfund balancesatendofyear Combine lines 18, 19,and 20 21 1757102277 . 01'18-o7 LHA For PrivacyActand Paperwork ReductionActNotice,seetheseparate instructions Form990(2006) 1 16390514 099815 5HV48E 2006.09001 SCHWAB CHARITABLE FUND 5HV48E1 Form990 (2006) SCHWAB SARITABLE FUND 31-1640316 Page2 LF2!111J Statement of Allorganizationsmustcomplete column (A) Columns (B),(C), and (D)are requiredforsection 501(c)(3) Functional Expenses and (4)organizationsandsection 4947(a)(1)nonexemptcharitabletrusts butoptional forothers Donotincludeamountsreportedonline (A)Total (B) Program (C) Management (D) Fundraising 6b, 8b, 9b, 10b, or 16ofPartI services and general 22a Grants paidfromdonoradvised funds STATEMENT 3 (attach schedule) 246, 876,049 . noncash$ 0, ► 0 2a 46, 876, 049 . 6, 876 , 049 . Itthisamountincludesforeigngrants,checkhere 22b Othergrants andallocations (attach schedule (cash $ 0 • noncash$ 0 Ifthisamountincludesforeigngrants,checkhere ► a 22b 23 Specific assistancetoindividuals (attach schedule) 23 24 Benefits paidtoorformembers (attach schedule) 24 25a Compensation ofcurrentofficers,directors, key employees,etc listedin PartV-A 25a 751,425. 187,856. 374,426. 189,143. b Compensation offormerofficers, directors, key employees,etc listed in PartV-B 25b 0. 0. 0. 0. c Compensation andotherdistributions,notincluded above,todisqualified persons (asdefined under section 4958(f)(1))and personsdescribed in section 4958(c)(3)(B) 5c 26 Salaries andwages ofemployees not included on lines25a, b,andc 26 1, 776, 876. 699, 196. 258, 353. 819,327. 27 Pension plan contributions not includedon lines25a,b,andc 27 50,565. 17,886. 12,286. 20,393. 28 Employee benefits not includedon lines 25a-27 28 283 , 238. 99,133. 70,810. 113,295. 29 Payroll taxes 29 163, 265. 57,143. 40,816. 65,306. 30 Professional fundraisingfees 30 31 Accountingfees 31 86,075. 86,075. 32 Legal fees 32 176, 753. 104, 784. 71,969. 33 Supplies 33 93 ,436. 74,749. 18,687. 34 Telephone STMT 13 34 35 Postage and shipping 35 5, 311. 4,249. 1,062. 36 Occupancy STMT 13 35 37 Equipment rentaland maintenance 37 38 Puntingand publications 38 39 Travel 39 52 ,177. 52,177. 40 Conferences, conventions, and meetings 40 81 , 724 . 81,724 . 41 Interest . STMT 12 316,203. 316 , 203 . 42 Depreciation,depletion, etc (alSTM f 6, 3 16. 6,306. 43 Otherexpenses notcoveredabove (itemize): a FUNDRAISING AND I43a b OUTREACH 43b 423 ,791. 423,791. c PROFESSIONAL SERVICES 43c 135,384. 91,775. 43,609• d OFFICE EXPENSE 43d 242 ,586. 194,070. 48,516. e TECHNOLOGY INITIATIVES 43e 75 ,606. 60,485. 15,121. i COMMISSIONS AND FEES 43f 1,804,947. 1,804,947. g 43 44 Totalfunctional expenses.Add lines 22a through 43g (Organizationscompletingcolumns (B)-(D), carrythesetotals tolines 13-15) u 253,401,717. 250,272,322. 1,416,416. 1,712,979. JointCosts. Check ► Q ifyou arefollowing SOP 98.2. Areanyjointcostsfromacombined educationalcampaignandfundraisingsolicitation reported in (B) Programservices9 ► Yes No It'Yes,"enter(1) theaggregateamountofthese jointcosts $ N/A ,(ii) theamountallocated toProgramservices$ N/A (iil)theamountallocatedtoManagementand general $ N/A ,and (iv) theamountallocatedtoFundraising$ N/A 01-2°3-07 Form990(2006) 2 16390514 099815 5HV48E 2006.09001 SCHWAB CHARITABLE FUND 5HV48E1 Form990 SCHWAB WARITABLE FUND 31-1640316 Page3 ! PanIII I Statement of Program Service Accomplishments (See theInstructions) Form990 isavailableforpublic inspection and,forsomepeople, serves astheprimaryorsolesourceofinformation about aparticularorganization. Howthepublic perceives an organization insuch cases may bedetermined bytheinformation presented on its return Therefore, please makesurethe return iscomplete and accurate andfullydescribes, in Part III, theorganization's programs and accomplishments. What istheorganization's primary exempt purpose? ► SEE STATEMENT 4 Program Service Expenses (Requiredfor501(c)(3) All organizations must describe theirexempt purposeachievements in aclearand concise manner. Statethe numberof and (4) orgs ,and clientsserved, publications issued,etc. Discuss achievements thatarenot measurable. (Section 501(c)(3) and (4) 4947(a)(1)trusts,but organizations and 4947(a)(1) nonexemptcharitabletrusts must alsoentertheamount ofgrantsandallocations toothers) optionalforothers ) a THE SCHWAB CHARITABLE FUND DISTRIBUTED MORE THAN $246,000,000 TO VARIOUS CHARITIES. SINCE INCEPTION, AN AVERAGE OF 23% OF THE FUND'S ASSETS EACH YEAR HAVE BEEN DISTRIBUTED TO SUPPORT CHARITABLE CAUSES. (Grantsandallocations $ 246, 876, 049 . Ifthis amount includes foreign grants, checkhere ► LI 250, 272, 322. b Grants and allocations $ Ifthisamount includes foreign grants,checkhere ► Q C Grants and allocations $ Ifthisamount includes foreigngrants, check here ► d Grantsandallocations $ Ifthisamount includes foreign rants check here ► Q e Otherprogram services (attach schedule) Grants andallocations $ Ifthisamount includes foreign grants,check here ► Q f Total ofProgram Service Expenses (should equal line44,column (B), Programservices) ► 250,272,322. Form 990(2006) 623021 01-18-07 3 16390514 099815 5HV48E 2006.09001 SCHWAB CHARITABLE FUND 5HV48E1 Form 990 (2006) SCHWAB WARITABLE FUND 31-1640316 I PartIV I Balance Sheets (See theinstructions) Note: Whererequired, attachedschedules andamounts within thedescription column (A) (B) shouldbeforend-of-yearamountsonly. Beginning ofyear End ofyear 45 Cash-non-interest-bearing 105,655. 45 644,368. 46 Savings andtemporary cash investments 4,939, 818. 46 260,957. 47 a Accounts receivable 47a 1, 329,000. b Less:allowancefordoubtful accounts 47b 746,676. 47c 1 ,329,000. 48 a Pledges receivable 48a b Less- allowancefordoubtfulaccounts 48b 48c 49 Grants receivable 49 50 a Receivables fromcurrent andformerofficers,directors, trustees, and keyemployees 50a b Receivables fromotherdisqualified persons (asdefined undersection 4958(0(1)) and persons described in section 4958(c)(3 (B) 50b 51 a Othernotes and loans receivable 51a a b Less allowance fordoubtfulaccounts 51b 51c 52 Inventoriesforsaleoruse 52 53 Prepaidexpenses anddeferredcharges 18,907. 53 22 , 196. 54 a Investments -publicly-traded securities STMT 0 Cost MI FMV 987,629,691. 54a 1587433946. b Investments -othersecurities ► 0 Cost FMV 54b 55 a Investments -land, buildings, and equipment:basis 55a b Less:accumulated depreciation 55b 55c 56 Investments -other SEE STATEMENT 5 41,879,853. 56 178,189,015. 57 a Land, buildings,and equipment: basis 57a 27,758. b Less:accumulated depreciationSTMT 6 57b 26,050. 8,014. 57c 1,708. 58 Otherassets,including program-related investments (describe ► ) 58 59 Totalassets must equal line 74 Add lines 45through 58 1035328614. 59 1767821190. 60 Accounts payableand accrued expenses 1,524 ,509. 60 1,351,957. 61 Grants payable 2, 579, 639. 61 716, 956. 62 Deferred revenue 62 d 63 Loansfromofficers, directors, trustees,andkeyemployees 63 64 a Tax-exempt bond liabilities 64a b Mortgagesand othernotes payable STMT 7 8,750,000. 64b 8 ,650,000. 65 Otherliabilities (describe ► ) 65 66 Total liabilities.Add lines 60through 65 12 , 854 , 148. 66 10 , 718 , 913. OrganizationsthatfollowSFAS 117,check here ► andcomplete lines 67through 69 and lines 73 and 74. 67 Unrestricted 1022474466. 67 1757102277. 68 Temporarilyrestricted 68 co 69 Permanently restricted 69 Organizationsthatdo notfollowSFAS 117, check here ► ED and complete lines 70through 74. ° 70 Capital stock,trust principal,orcurrent funds 70 71 Paid-in orcapital surplus,orland, building, and equipment fund 71 Q 72 Retainedearnings,endowment,accumulated income,orotherfunds 72 Z 73 Totalnetassets orfund balances.Add lines67through 69orlines70through72 (Column (A)mustequalline 19andcolumn (B)mustequalline 21) 1022474466. 73 1757102277. 74 Total liabilitiesandnetassets/fundbalances.Add lines66and73 1035328614. 74 1767821190. Form990(2006) 623031 01-20-07 16390514 099815 5HV48E 2006.09001 SCHWAB CHARITABLE FUND 5HV48E1 Form990 (2006) SCHWAB ARITABLE FUND 31-1640316 5 PartIV-A Reconciliation of Revenue per Audited Financ nue per Return (See the Instructions) a Total revenue,gains, andothersupport peraudited financial statements a 989148224. b Amountsincluded on linea but not on Part I, line 12 1 Net unrealized gains on investments b1 133105565. 2 Donated services and use offacilities b2 1 , 118,696. 3 Recoveries ofprioryeargrants _ b3 4 Other (specify): b4 Add lines b1l through b4 b 134224261. 854923963. c Subtract linebfrom linea c d Amounts includedon Part I, line 12, but not on linea: 1 Investment expenses not includedon Part I, line6b d1 2 Other(specify): d2 Add lines d1 and d2 d 0 . e Total revenue Part I line 12).Add linesc and d ► e 85492 3963. Part IV-B Reconciliation of Expenses per Audited Financial Statements With Expenses per Return a Totalexpensesand losses perauditedfinancial statements _ a 254520413. b Amounts included on line a but not on Part I, line 17- 1 Donated servicesand useoffacilities b1 1,118,696. 2 Prioryearadjustments reportedon Part I, line20 b2 3 Losses reported on Part I, line20 b3 4 Other(specify): b4 Add lines b1 through b4 b 1,118,696. c Subtract line bfrom linea c 253401717. d Amounts included on Part I, line 17, but not on linea: 1 Investmentexpenses not includedon Part I, line6b d1 2 Other(specify): d2 Add lines d1 andd2 d 0 . e Total expenses Part I line 17).Add linesc andd ► e 253401717. PartV-A Current Officers, Directors, Trustees, and Key Employees (List each person whowas an officer,director, trustee, orkeyemployee at anytime dunna theyeareven ifthey were not compensated.)(See theinstructions) (B)Titleand average hours (C)Compensation (D)contnbubonsto (E) Expense (A)Nameandaddress perweekdevoted to (Ifnotpaid, enter employeebenefit accountand position -0-. copmlpaennss8atdieofnerprleadns otherallowances KIMBERLY WRIGHT-VIOLICH RESIDENT 1--0-1--OMN--TGO---ME-RST--R----Y--EET-------------- --------------------------------- SAN FRANCISCO CA 94104 40.00 320 046. 29,216. 1 , 950. NICHOLAS HODGES _ - _ _ _ _ _ _ ICE PRESIDE ------------------ ------- 101 MONTGOMERY STREET ------------------------------- SAN FRANCISCO CA 94104 40.00 192 228. 6 , 604. 0. SUSAN HELDMAN ___________________ VICE PRESIDE 101 MONTGOMERY STREET ------------------------------- SAN FRANCISCO CA 94104 40.00 175 695. 25 , 686. 0. CHARLES R__SCHWAB DIRECTOR 101 MONTGOMERY STRE-E-T--------------- --------------------------------- SAN FRANCISCO , CA 94104 0.25 0. 0. 0. SANFORD R. ROBERTSON DIRECTOR 101 MONTGOMERY STREET ------------------------------- SAN FRANCISCO CA 94104 0.25 0. 0. 0. BROOKS WALKER, JR. DIRECTOR -- -- - -- ---- - ----- -- -------------- 10 1 MONTGOMERY STREET --------------------------- SAN FRANCISCO CA 94104 0.25 0. 0. 0. CHARLENE HARVEY ___________________ DIRECTOR ---------- 101 MONTGOMERY STREET -------------------------------- SAN FRANCISCO CA 94104 0.25 0. 0. 0. ELIZABETH SAWI DIRECTOR 101 MONTGOMERY STREET SAN FRANCISCO CA 94104 0.25 0. 0. 0. Form990(2006) 623041 01-18-07 5 16390514 099815 5HV48E 2006.09001 SCHWAB CHARITABLE FUND 5HV48E1 Form990 (2006) SCHWAB•ARITABLE FUND • 31-1640316 Page6 PartV-A Current Officers, Directors, Trustees, and Key Employees (continued) Yes No 75 a Enterthetotalnumberofofficers, directors, andtrustees permitted tovoteon organization business at board meetings ► 5 b Are any officers, directors, trustees,orkeyemployees listed in Form 990, Part V-A,orhighest compensatedemployees listed in Schedule A, Part I,orhighest compensated professional and otherindependent contractors listed in ScheduleA, Part II-Aor II-B, relatedtoeach otherthrough family orbusiness relationships'? If 'Yes,' attach astatement that identifies theindividualsand explainsthe relationship(s) 75b X c Doanyofficers,directors, trustees, or key employees listed in Form990, Part V-A,orhighest compensated employees listedin Schedule A, Part I,orhighest compensated professional and otherindependent contractors listed in ScheduleA, Part Il-Aor II-B, receive compensation from anyotherorganizations, whethertaxexempt ortaxable,that arerelatedtothe organization? Seetheinstructions forthedefinition of "related organization ' 75c X If 'Yes,' attach astatement that includestheinformation described in the instructions. d Doestheorganization have awritten conflict ofinterest olio '? 75d X PartV-B Former Officers, Directors, Trustees, and Key Employees That Received Compensation or Other Benefits (Ifanyformerofficer, director, trustee, orkeyemployee received compensation orother benefits (described below) during theyear, listthat person belowandentertheamountofcompensation orotherbenefits in theappropriatecolumn. Seethe instructions) (C) Compensation (D)Contnbutionsto (E) Expense (A)Nameand address (B) LoansandAdvances (ifnotpaid, employeebenefit accountand NONE enter-0-) coPmlanesnssaLiioonnretdags otherallowances --------------------------------- --------------------------------- --------------------------------- --------------------------------- --------------------------------- --------------------------------- --------------------------------- --------------------------------- --------------------------------- --------------------------------- --------------------------------- --------------------------------- --------------------------------- --------------------------------- --------------------------------- --------------------------------- Part Vl Other Information (See theinstructions) Yes No 76 Didtheorganization makeachange in itsactivitiesormethods ofconducting activities? If 'Yes,' attach adetailed statement ofeach change SEE STATEMENT 9 76 X 77 Wereanychanges madein theorganizing orgoverning documents but not reported tothe IRS 77 X If 'Yes,' attach aconformedcopyofthechanges. 78 a Didtheorganization haveunrelated businessgrossincomeof$1,000 ormoreduring theyearcovered bythis return? 78a X b If 'Yes,' hasitfiledataxreturn on Form990-Tforthisyear? 78b X 79 Wastherealiquidation,dissolution, termination,orsubstantialcontraction during theyear? If 'Yes,' attach astatement 79 X 80 a Istheorganization related(otherthan byassociation with astatewideornationwide organization) through common membership, governing bodies, trustees, officers, etc.,toanyotherexempt ornonexempt organization'? 80a X b If 'Yes,' enterthe nameoftheorganization0- N/A and checkwhetherit is 0 exemptor 0 nonexempt 81 a Enterdirectorindirect politicalexpenditures. (See line81 instructions.) 81a 0 b Didtheorganization fileForm 1120-POLforthisyear? 1 1b X Form990(2006) 623161/01-18-07 6 17510514 099815 5HV48E 2006.09001 SCHWAB CHARITABLE FUND 5HV48E1 Form990 2006 SCHWABWARITABLE FUND 31-1640316 Page 7 p Vl Other Information (continued) Yes No 82 a Did theorganization receive donated servicesortheuseofmaterials, equipment,orfacilities at nochargeoratsubstantially lessthan fairrental value? 82a X b If 'Yes,' you may indicatethevalue ofthese itemshere. Donot includethis amount asrevenuein Part I orasan expensein Part II. (See instructions in Part III.) 82b 1,118,696. 83 a Did theorganization comply withthe public inspection requirements forreturns and exemption applications? 83a X b Did theorganization comply withthedisclosure requirements relating toquid proquocontributions? 83b X 84 a Did theorganization solicit anycontributions orgifts that were not taxdeductible? N/A 84a b If 'Yes,' didtheorganization include with everysolicitation an express statement that such contributions orgifts were not taxdeductible? N/A 84b 85 501(c)(4), (5), or(6) organizations aWeresubstantially allduesnondeductible by members? N/A 85a b Didtheorganization makeonlyin-house lobbying expenditures of$2,000orless? N/A 85b If 'Yes' wasanswered toeither85aor85b,do notcomplete85c through 85h below unlesstheorganization receiveda waiverforproxytaxowedfortheprioryear. c Dues, assessments,and similaramounts from members 85c N/A d Section 162(e) lobbying and political expenditures 85d N/A e Aggregatenondeductible amount ofsection 6033(e)(1)(A) duesnotices 85e N/A t Taxable amount oflobbying and political expenditures (line85d less 85e) 85f N/A g Doestheorganization electtopaythe section 6033(e) taxontheamount on line85f? N/A 85 h Ifsection 6033(e)(1)(A) duesnotices weresent, doestheorganization agree toaddtheamount on line 85f toitsreasonableestimate ofdues allocable tonondeductible lobbying and political expendituresforthe following taxyear? N/A 85h 86 501(c)(7) organizations. Enter: a Initiation fees andcapital contributions included on line 12 86a N/A b Gross receipts, includedon line 12,forpublic useofclubfacilities 86b N/A 87 501(c)(12) organizations. Enter: a Gross incomefrom members orshareholders 87a N/A b Gross incomefromothersources (Do not net amountsdueorpaidtoothersources against amountsdueorreceivedfrom them.) 87b N/A 88 a Atanytimeduring theyear, didtheorganization own a50% orgreaterinterest in ataxable corporation orpartnership, oran entity disregarded asseparate from theorganization under Regulationssections301.7701.2and301.7701.3" If 'Yes,' complete Part IX 88a X b At anytimeduring theyear, didtheorganization, directlyorindirectly, own acontrolled entitywithin the meaning of section 512(b)(13)" If 'Yes,' complete Part XI ► 88b X 89 a 501(c)(3)organizations. Enter:Amount oftaximposed on theorganization duringtheyearunder: section 4911100, 0 . ,section 4912 ► 0 . ,section 4955 ► 0. b 501(c)(3) and501(c)(4) organizations. Did theorganization engage in anysection 4958 excess benefit transaction duringtheyearordid it become aware ofan excess benefit transaction from aprioryear'? If 'Yes,' attach astatement explaining each transaction 89b X C Enter:Amount oftaximposed on theorganization managers ordisqualified personsduringtheyearunder sections4912, 4955,and4958 ► 0. d Enter: Amount oftaxon line89c, above, reimbursed bytheorganization ► 0. e Allorganizations. At anytimeduringthetaxyear,wastheorganization apartytoaprohibitedtaxsheltertransaction? 89e X f Allorganizations. Didtheorganization acquire adirectorindirect interest in any applicable insurancecontract? 89f X g Forsupporting organizationsandsponsoring organizations maintainingdonoradvisedfunds. Didthesupporting organization, orafund maintained byasponsoring organization, haveexcess business holdings at anytimeduringtheyear? 89 X 90 a Listthestates with which acopyofthisreturn isfiled ► SEE STATEMENT 10 b Numberofemployees employed inthe pay period that includes March 12,2006 1 90b 1 21 91 a Thebooksareincareof ► MS . SUSAN H . HELDMAN Telephone no ► 415-636-3322 Located at ► 101 MONTGOMERY STREET, SAN FRANCISCO CA ZIP+4 ► 94104 b At any timeduring thecalendaryear,did theorganization havean interest in orasignatureorotherauthority over Yes No afinancial account in aforeign country (such asabankaccount,securitiesaccount,orotherfinancial account) . 91b X If 'Yes,' enterthenameoftheforeign country ► N/A Seethe instructions forexceptions and filing requirements forForm TD F90-22.1, Report of Foreign Bank Form990(2006) 623162/01-18-07 7 16390514 099815 5HV48E 2006.09001 SCHWAB CHARITABLE FUND 5HV48E1 Form 990 2006 SCHWAB•ARITABLE FUND • 31-1640316 Page8 partVI Other Information (continued) Yes No c At anytimeduringthecalendaryear,didtheorganization maintain an office outsideofthe United States" 91C X If 'Yes,' enterthe name oftheforeign country ► N/A 92 Section 4947(a)(1)nonexemptchartable trustsfilingForm990inlieu ofForm 1041-Check here ► 0 and entertheamount oftax-exempt interest received oraccruedduring thetaxyear ► 92 N/A TartV11 Analysis of Income-Producing Activities (Seetheinstructions.) Noti Entergrossamounts unlessotherwise Unrelated business income Excludedbysection512,513,or514 (E) Indicsted. (A) (B) (C)_ (D) Related orexempt t Business Amount sion Amount 93 I rogram servicerevenue: code function income a b c d e flAedicare/Medicaid payments g1:eesandcontractsfromgovernment agencies 94 IAembershipduesandassessments 95 Interest onsavings andtemporary cash investments 96 I)ividends and interestfromsecurities 14 20,087,050. 97 IJet rental income or(loss)from realestate. a Iebt-financed property bilotdebt-financed property 98 IJet rental incomeor(loss) from personal property 99 )therinvestment income 100 gain or (loss) from salesofassets otherthan inventory 18 601 ,365. 101 Net incomeor(loss) fromspecial events 102 Grossprofit or(loss)from salesofinventory 103 Otherrevenue: a b c d e 104 Subtotal (addcolumns (B), (D), and (E)) 0.1 20 , 688 , 415. 0.- 105 Total (add line 104,columns (B), (D), and (E) ► 20,688,415. Note: Line 105plusline le, PartI, shouldequaltheamountonline 12, Part PartVIII Relationship of Activities to the Accomplishment of Exempt Purposes (Seetheinstructions.) Line No. Explain howeachactivityforwhich incomeis reported incolumn (E)ofPartVIIcontributed importantlytotheaccomplishment ofthe organization's ♦ exemptpurposes (otherthan byproviding fundsforsuch purposes) I PartIX I Information Reaardina Taxable Subsidiaries and Disregarded Entities(Seetheinstructions) Name,address,and EIN ofcorporation, Percentage of partnership,ordisregarded entity vnershipinterest SEE STATEMENT 11 >artX Information Regarding Transfers Associated (a) Didthe organization,duringtheyear,receive anyfunds,directly orindirectly, (b) Didtheorganization,duringtheyear,paypremiums,directly orindirectly, on Note:If"Yes" to(b),fileForm 8870andForm4720(seeinstructions). 623163 01-18-07 16390514 099815 5HV48E 2006.09001 990 SCHWABJARITABLE FUND 31-1640316 Page9 PartX1 Information Regarding Transfers To and From Controlled Entities. Completeonlyiftheorganization isa controllingorganizationasdefinedinsection 512(b)(13) N/A Yes No 106 Didthereporting organization makeanytransfers toacontrolled entity asdefined in section 512(b)(13)oftheCode? If 'Yes,' completetheschedule belowforeach controlled entity (A) (B) (C) (D) Name,address, ofeach Employer Description of Amount of Identification controlled entity transfer transfer Number --------------------------------- a --------------------------------- --------------------------------- b - -------------------------------- --------------------------------- c - -------------------------------- Totals Yes No 107 Didthereporting organization receive anytransfersfrom acontrolled entity asdefined in section 512(b)(13) oftheCode'? If 'Yes,' completetheschedule belowforeach controlled entity (A) (B) (C) (D) Name, address, ofeach Employer Description of Amountof Identification controlled entity transfer transfer Number --------------------------------- a --------------------------------- --------------------------------- b - -------------------------------- --------------------------------- c - -------------------------------- Totals Yes No 108 Didtheorganization haveabinding written contract in effecton August 17,2006,covering the interest, rents, royalties,and annurtlesdescribed in question 107 above? Underpenaltiesofperjury,IdeclarethatIhaveexaminedthisreturn,includingaccompanyingschedulesandstatements,andtothebestofmyknowledgeandbelief,itistrue,correct, andcomplete Declarationofpreparer(otherthanofficer)isbasedonallinformationofwhichpreparerhasanyknowledge Please Sign =Signa ffic7er Here AIL Prepa rS Date CheckIf PreparersSSNorPTIN(SeeGen Inst)Q Paid slgnat ai,oA eemployed ► 0 Prepare.. UseOnly sFeilrfme'mspnlaomyeed()or 'DELOITTE AX LLP EIN ► 50 FREMO T STREET address, SAN FRANCISCO, CA 94105 Phoneno ► 415-783-4000 Form990(2006) 623164/01-26-07 9 16390514 099815 5HV48E 2006.09001 SCHWAB CHARITABLE FUND 5HV48E1 SCHEDULE A Orgaaation Exempt Under Sectioo01(c)(3) OMBNo 1545-0047 (Form 990or990-EZ) (ExceptPrivate Foundation)and Section 501(e),501(f),501(k), 2006 501(n), or4947(a)(1)NonexemptCharitableTrust DepartmentoftheTreasury Supplementary Information-(See separate instructions.) InternalRevenueService ► MUST be completed bythe aboveorganizations and attached totheir Form990or990-EZ Nameofthe organization Employer identification number SCHWAB CHARITABLE FUND 31 1640316 Part1 Compensation of the Five Highest Paid Employees Other Than Officers, Directors, and Trustees (Seepage 2 ofthe instructions Listeach one Ifthere arenone,enter None ) (a)Nameandaddress ofeach employee paid (b)pTietrlewaenedkadveevroatgeedhtoours (c)Compensation (dConntributt>ieonnesfitto acc(oeu)ntExapnednsoether morethan $50,000 position_ pcloamnspe&nsdaetfeirorned allowances MARGAE DIAMOND US. DEV. DIRECTOR ------- --------- -- 101 MONTGOMERY ST, SAN FRANCISCO, CA 40.00 153,641. 16,259. 0. MICHAEL SMITHWICK VP OF MARKETING 101 MONTGOMERY ST,_ SAN FRANCIO, CA- 40.00 150,022. 34,706. 0. CHRISTOPHER YAROS ___ DIRECTOR OF O ERATIO -------------- A___SC__ 101 MONTGOMERY ST,_ SAN FRNCIO, CA 40.00 111,470. 4,265. 0. CHRISTOPHER GEISON _ _ ______SC__ _ DIRECTOR OF MARKETIN -------------- 101 MONTGOMERY ST, SAN FRANCIO, A- 40.00 102,101. 9,857. 0. ANDREW TROMBLEY DIRECTOR OF FINANCE 101 MONTGOMERY ST, SAN FRANCIO-, A- 40.00 75,661. 2,086. 0. Total numberofotheremployees paid over$50,000 ► 6 PartIl-A Compensation of the Five Highest Paid Independent Contractors for Professional Services (See page 2 ofthe instructions Listeach one (whether individuals orfirms) Iftherearenone,enter*None ') (a)Nameand address ofeach independentcontractorpaid morethan$50,000 (b)Type ofservice (c)Compensation BAKER STREET ADVISORS LLC -------------------------------------------- 455 MARKET STREET, STE 620, SAN FRANCISCO, CA 941ASSET MANAGEMENT 378,354. CALIBRE ADVISORY SERVICES -------------------------------------------- 930 WINTER STREET, STE 1500, WALTHAM, MA 02451 ASSET MANAGEMENT 219,604. GREYCOURT & CO. -------------------------------------------- 607 COLLEGE STREET PITTSBURGH, PA 15232-1700 ASSET MANAGEMENT 172,078. SACKETT DESIGN ASSOCIATES MARKETING ------------------------------------------- 1069 HOWARD STREET, SAN FRANCISCO CA 94103 SERVICES 118,845. MORGAN, LEWIS & BOCKIUS LLP -------------------------------------------- 1111 PENNSYLVANIA AVENUE, NW, WASHINGTON, DC 2000LEGAL SERVICES 112,542. Totalnumberofothers receiving over $50,000forprofessional services ► 5 Part Il-B Compensation of the Five Highest Paid Independent Contractors for Other Services (Listeachcontractorwhoperformed services otherthan professional services,whetherindividuals or firms Iftherearenone, enter None Seepage2ofthe instructions ) (a)Nameandaddress ofeach independentcontractorpaid morethan$50,000 (b)Typeofservice (c) Compensation CHARLES SCHWAB & CO, INC. BROKERAGE -------------------------------------------- 101 MONTGOMERY STREET, SAN FRANCISCO, CA 94104 SERVICES 266,510. -------------------------------------------- -------------------------------------------- -------------------------------------------- -------------------------------------------- Totalnumberofothercontractors receiving over $50,000forotherservices ► 0 623101/01-18-07 LHA ForPaperwork ReductionActNotice,seethe InstructionsforForm990and Form990-EZ. ScheduleA(Form990or990-EZ)2006

Description: