Proposed Senate Committee Substitute for House Bill 1030, 2016 Appropriations Act PDF

Preview Proposed Senate Committee Substitute for House Bill 1030, 2016 Appropriations Act

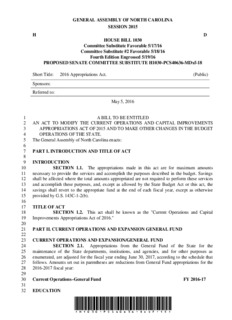

GENERAL ASSEMBLY OF NORTH CAROLINA SESSION 2015 H D HOUSE BILL 1030 Committee Substitute Favorable 5/17/16 Committee Substitute #2 Favorable 5/18/16 Fourth Edition Engrossed 5/19/16 PROPOSED SENATE COMMITTEE SUBSTITUTE H1030-PCS40636-MDxf-18 Short Title: 2016 Appropriations Act. (Public) Sponsors: Referred to: May 5, 2016 1 A BILL TO BE ENTITLED 2 AN ACT TO MODIFY THE CURRENT OPERATIONS AND CAPITAL IMPROVEMENTS 3 APPROPRIATIONS ACT OF 2015 AND TO MAKE OTHER CHANGES IN THE BUDGET 4 OPERATIONS OF THE STATE. 5 The General Assembly of North Carolina enacts: 6 7 PART I. INTRODUCTION AND TITLE OF ACT 8 9 INTRODUCTION 10 SECTION 1.1. The appropriations made in this act are for maximum amounts 11 necessary to provide the services and accomplish the purposes described in the budget. Savings 12 shall be affected where the total amounts appropriated are not required to perform these services 13 and accomplish these purposes, and, except as allowed by the State Budget Act or this act, the 14 savings shall revert to the appropriate fund at the end of each fiscal year, except as otherwise 15 provided by G.S. 143C-1-2(b). 16 17 TITLE OF ACT 18 SECTION 1.2. This act shall be known as the "Current Operations and Capital 19 Improvements Appropriations Act of 2016." 20 21 PART II. CURRENT OPERATIONS AND EXPANSION GENERAL FUND 22 23 CURRENT OPERATIONS AND EXPANSION/GENERAL FUND 24 SECTION 2.1. Appropriations from the General Fund of the State for the 25 maintenance of the State departments, institutions, and agencies, and for other purposes as 26 enumerated, are adjusted for the fiscal year ending June 30, 2017, according to the schedule that 27 follows. Amounts set out in parentheses are reductions from General Fund appropriations for the 28 2016-2017 fiscal year: 29 30 Current Operations–General Fund FY 2016-17 31 32 EDUCATION *H1030-PCS40636-MDxf-18* General Assembly Of North Carolina Session 2015 1 2 Community Colleges System Office $16,126,073 3 4 Department of Public Instruction 277,265,560 5 6 Appalachian State University 0 7 East Carolina University 8 Academic Affairs 0 9 Health Affairs 0 10 Elizabeth City State University 0 11 Fayetteville State University 0 12 NC A&T State University 0 13 NC Central University 0 14 NC State University 15 Academic Affairs 200,000 16 Agricultural Extension 0 17 Agricultural Research 0 18 UNC-Asheville 0 19 UNC-Chapel Hill 20 Academic Affairs 0 21 Health Affairs 3,000,000 22 AHEC 0 23 UNC-Charlotte 0 24 UNC-Greensboro 0 25 UNC-Pembroke 0 26 UNC-School of the Arts 0 27 UNC-Wilmington 0 28 Western Carolina University 0 29 Winston-Salem State University 0 30 General Administration 1,000,000 31 University Institutional Programs 81,806,684 32 Related Educational Programs 0 33 NC School of Science & Math 630,000 34 Aid to Private Institutions 34,472,500 35 36 Total University of North Carolina–Board of Governors 121,109,184 37 38 HEALTH AND HUMAN SERVICES 39 40 Department of Health and Human Services 41 Central Management and Support 5,984,592 42 Division of Aging & Adult Services 505,824 43 Division of Blind Services/Deaf/HH 8,200 44 Division of Child Development & Early Education (10,025,488) 45 Health Service Regulation 46,070 46 Division of Medical Assistance (313,267,938) 47 Division of Mental Health, Developmental Disabilities, & 48 Substance Abuse Services (2,909,413) 49 NC Health Choice 348,334 50 Division of Public Health 1,696,366 51 Division of Social Services 8,352,167 Page 2 House Bill 1030 H1030-PCS40636-MDxf-18 [v.64] General Assembly Of North Carolina Session 2015 1 Division of Vocational Rehabilitation 39,911 2 Total Health and Human Services (309,221,375) 3 4 NATURAL AND ECONOMIC RESOURCES 5 6 Department of Agriculture and Consumer Services 5,345,814 7 8 Department of Commerce 9 Commerce 7,022,856 10 Commerce State-Aid (2,100,000) 11 12 Wildlife Resources Commission 19,922 13 14 Department of Environmental Quality (2,542,284) 15 16 Department of Labor 275,186 17 18 Department of Natural and Cultural Resources 5,789,491 19 Department of Natural and Cultural Resources–Roanoke Island 0 20 21 22 JUSTICE AND PUBLIC SAFETY 23 24 Department of Public Safety 22,361,271 25 26 Judicial Department 16,893,600 27 28 Judicial Department–Indigent Defense 5,631,994 29 30 Department of Justice 4,339,117 31 32 33 GENERAL GOVERNMENT 34 35 Department of Administration 2,106,856 36 37 Office of Administrative Hearings 10,141 38 39 Department of State Auditor 240,714 40 41 Office of State Controller 35,443 42 43 State Board of Elections 11,488 44 45 General Assembly 6,664,500 46 47 Office of the Governor 10,560 48 49 Office of the Governor–Special Projects 0 50 51 Office of State Budget and Management H1030-PCS40636-MDxf-18 [v.64] House Bill 1030 Page 3 General Assembly Of North Carolina Session 2015 1 Office of State Budget and Management 294,160 2 OSBM – Reserve for Special Appropriations 5,050,000 3 4 Housing Finance Agency 0 5 6 Department of Insurance 7 Insurance 1,719,818 8 9 Office of Lieutenant Governor 11,535 10 11 Military and Veterans Affairs 220,146 12 13 Department of Revenue 501,372 14 15 Department of Secretary of State 656,755 16 17 Department of State Treasurer 18 State Treasurer (195,735) 19 State Treasurer – Retirement for Fire and Rescue Squad Workers 5,152,982 20 21 DEPARTMENT OF INFORMATION TECHNOLOGY 43,031,353 22 23 24 RESERVES, ADJUSTMENTS AND DEBT SERVICE 25 26 Compensation Increase Reserve–OSHR 77,000,000 27 Compensation Increase Reserve–State Agency Teachers 1,533,800 28 Information Technology Fund (21,681,854) 29 Information Technology Reserve (21,320,843) 30 Job Development Investment Grants (JDIG) (10,000,000) 31 Lottery Reserve 50,000,000 32 One North Carolina Fund (417,883) 33 OSHR Minimum of Market Reserve (7,000,000) 34 Pending Legislation Reserve 200,000 35 Public Schools Average Daily Membership (ADM) (107,000,000) 36 State Emergency Response and Disaster Relief Fund 10,000,000 37 UNC System Enrollment Growth Reserve (31,000,000) 38 Mental Health Reserve 10,000,000 39 Debt Service 40 General Debt Service 1,253,023 41 Federal Reimbursement 37,000,000 42 43 44 TOTAL CURRENT OPERATIONS–GENERAL FUND $222,404,740 45 46 GENERAL FUND AVAILABILITY STATEMENT 47 SECTION 2.2.(a) The General Fund availability statement set out in Section 2.2(a) of 48 S.L. 2015-241 applies to the 2015-2016 fiscal year only. The General Fund availability used in 49 adjusting the 2016-2017 budget is shown below: 50 51 FY 2016-17 Page 4 House Bill 1030 H1030-PCS40636-MDxf-18 [v.64] General Assembly Of North Carolina Session 2015 1 Unappropriated Balance 175,488,544 2 Over Collections FY 2015-16 330,200,000 3 Reversions FY 2015-16 358,439,524 4 Earmarkings of Year End Fund Balance: 5 Savings Reserve (583,888,541) 6 Repairs and Renovations (41,562,474) 7 Beginning Unreserved Fund Balance 238,677,053 8 9 Revenues Based on Existing Tax Structure 21,417,800,000 10 11 Non-tax Revenues 12 Investment Income 37,500,000 13 Judicial Fees 242,600,000 14 Disproportionate Share 147,000,000 15 Insurance 77,000,000 16 Master Settlement Agreement (MSA) 127,400,000 17 Other Non-Tax Revenues 178,700,000 18 Subtotal Non-tax Revenues 810,200,000 19 20 Adjustment for Medicaid Transformation Fund (S.L. 2015-241) (150,000,000) 21 22 Total General Fund Availability 22,316,677,053 23 24 Adjustments to Availability: 2016 Session 25 Increase the Zero Bracket (S.B. 818) (145,000,000) 26 Modification to Sales Tax Base Expansion (S.B. 870) 35,000,000 27 Limit Repair and Maintenance Tax on Airplanes and Boats (Direct Pay Option) (500,000) 28 Repeal Service Contracts (RMI Services) (3,500,000) 29 Elimination of State Contribution to Local Sales Tax Distribution 17,600,000 30 Adjustment for Transfer from Treasurer's Office 3,129 31 Adjustment for Transfer from Insurance Regulatory Fund 1,719,818 32 Adjustment for Transfer from NCGA Special Fund 3,000,000 33 Subtotal Adjustments to Availability: 2016 Session (91,677,053) 34 35 Revised General Fund Availability 22,225,000,000 36 37 Less General Fund Net Appropriation (22,225,000,000) 38 39 Unappropriated Balance Remaining 0 40 41 SECTION 2.2.(b) Notwithstanding the provisions of G.S. 143C-4-3(a), the State 42 Controller shall transfer a total of forty-one million five hundred sixty-two thousand four hundred 43 seventy-four dollars ($41,562,474) from the unreserved fund balance to the Repairs and 44 Renovations Reserve on June 30, 2016. This subsection becomes effective June 30, 2016. 45 SECTION 2.2.(c) Notwithstanding G.S. 143C-4-2, the State Controller shall transfer 46 a total of five hundred eighty-three million eight hundred eighty-eight thousand five hundred 47 forty-one dollars ($583,888,541) from the unreserved fund balance to the Savings Reserve 48 Account on June 30, 2016. This transfer is not an "appropriation made by law," as that phrase is 49 used in Section 7(1) of Article V of the North Carolina Constitution. This subsection becomes 50 effective June 30, 2016. H1030-PCS40636-MDxf-18 [v.64] House Bill 1030 Page 5 General Assembly Of North Carolina Session 2015 1 SECTION 2.2.(d) Notwithstanding any other provision of law to the contrary, 2 effective July 1, 2016, three million dollars ($3,000,000) from the Special Fund – Non-Interest 3 Bearing (Budget Code 21000) shall be transferred to the State Controller to be deposited in the 4 appropriate budget code as determined by the State Controller. These funds shall be used to 5 support the General Fund appropriations as specified in this act for the 2016-2017 fiscal year. 6 7 PART III. CURRENT OPERATIONS/HIGHWAY FUND 8 9 CURRENT OPERATIONS AND EXPANSION/HIGHWAY FUND 10 SECTION 3.1. Appropriations from the State Highway Fund for the maintenance and 11 operation of the Department of Transportation and for other purposes as enumerated are adjusted 12 for the fiscal year ending June 30, 2017, according to the following schedule. Amounts set out in 13 parentheses are reductions from Highway Fund Appropriations for the 2016-2017 fiscal year. 14 15 Current Operations – Highway Fund FY 2016-17 16 17 Department of Transportation 18 Administration $ 0 19 20 Division of Highways 21 Administration 0 22 Construction 2,500,000 23 Maintenance 19,340,000 24 Planning and Research 0 25 OSHA Program 0 26 27 State Aid to Municipalities 0 28 29 Intermodal Divisions 30 Ferry 0 31 Public Transportation 4,000,000 32 Aviation 14,817,417 33 Rail 13,750,000 34 Bicycle and Pedestrian 0 35 36 Governor's Highway Safety 0 37 38 Division of Motor Vehicles 4,973,177 39 40 Other State Agencies, Reserves, Transfers (71,743) 41 42 Capital Improvements 0 43 44 Total Highway Fund Appropriations $ 2,048,910,000 45 46 HIGHWAY FUND AVAILABILITY STATEMENT 47 SECTION 3.2. Section 3.2 of S.L. 2015-241 is repealed. The Highway Fund 48 availability used in adjusting the 2016-2017 fiscal year budget is shown below: 49 50 Highway Fund Availability Statement FY 2016-17 51 Page 6 House Bill 1030 H1030-PCS40636-MDxf-18 [v.64] General Assembly Of North Carolina Session 2015 1 Unreserved Fund Balance $ 0 2 Estimated Revenue 2,048,910,000 3 4 Total Highway Fund Availability $ 2,048,910,000 5 6 Unappropriated Balance $ 0 7 8 PART IV. HIGHWAY TRUST FUND APPROPRIATIONS 9 10 CURRENT OPERATIONS/HIGHWAY TRUST FUND 11 SECTION 4.1. Appropriations from the State Highway Trust Fund for the 12 maintenance and operation of the Department of Transportation and for other purposes as 13 enumerated are adjusted for the fiscal year ending June 30, 2017, according to the following 14 schedule. Amounts set out in parentheses are reductions from Highway Trust Fund Appropriations 15 for the 2016-2017 fiscal year. 16 17 Current Operations – Highway Trust Fund FY 2016-17 18 19 Program Administration $ 0 20 Turnpike Authority 0 21 Transfer to Highway Fund 0 22 Debt Service 0 23 Strategic Prioritization Funding Plan for Transportation Investments 32,045,000 24 25 Total Highway Trust Fund Appropriations $ 1,371,280,000 26 27 HIGHWAY TRUST FUND AVAILABILITY STATEMENT 28 SECTION 4.2. Section 4.2 of S.L. 2015-241 is repealed. The Highway Trust Fund 29 availability used in adjusting the 2016-2017 fiscal year budget is shown below: 30 31 Highway Trust Fund Availability Statement FY 2016-17 32 33 Unreserved Fund Balance $ 0 34 Estimated Revenue 1,370,080,000 35 Adjustment to Revenue Availability: 36 Title Fees (Mercury Switch Removal) 1,200,000 37 38 Total Highway Trust Fund Availability $ 1,371,280,000 39 40 Unappropriated Balance $ 0 41 42 PART V. OTHER APPROPRIATIONS 43 44 EDUCATION LOTTERY FUNDS & REVENUE ALLOCATIONS 45 SECTION 5.1.(a) Section 5.2 of S.L. 2015-241 reads as rewritten: 46 "SECTION 5.2.(a) The appropriations made from the Education Lottery Fund for the 47 2015-2017 fiscal biennium are as follows: 48 FY 2015-2016 FY 2016-2017 49 Noninstructional Support Personnel $ 310,455,157 $ 314,950,482$ 372,266,860 50 Transportation 50,000,000 51 Prekindergarten Program 78,252,110 78,252,110 H1030-PCS40636-MDxf-18 [v.64] House Bill 1030 Page 7 General Assembly Of North Carolina Session 2015 1 Public School Building Capital Fund 100,000,000 100,000,000 2 Scholarships for Needy Students 30,450,000 30,450,000 3 UNC Need-Based Financial Aid 10,744,733 10,744,733 4 TOTAL $ 529,902,000 $ 534,397,325$ 641,713,703 5 6 "SECTION 5.2.(b) Notwithstanding G.S. 18C-164, the Office of State Budget and 7 Management shall not transfer funds to the Education Lottery Reserve Fund for either year of the 8 2015-2017 fiscal biennium.G.S. 18C-164(b), the net revenues deposited in the Education Lottery 9 Fund from the 2015-2016 fiscal year that are in excess of the amounts appropriated in subsection 10 (a) of this section for the 2015-2016 fiscal year shall be transferred to the Lottery Reserve Fund. 11 ...." 12 SECTION 5.1.(b) G.S. 18C-162 reads as rewritten: 13 "§ 18C-162. Allocation of revenues. 14 (a) The Commission shall allocate revenues to the North Carolina State Lottery Fund in 15 order to increase and maximize the available revenues for education purposes, and to the extent 16 practicable, shall adhere to the following guidelines: 17 (1) At least fifty percent (50%) of the total annual revenues, as described in this 18 Chapter, shall be returned to the public in the form of prizes. 19 (2) At least thirty-five percent (35%) of the total annual revenues, as described in 20 this Chapter, shall be transferred as provided in G.S. 18C-164. 21 (3) No more than eight percent (8%) of the total annual revenues, as described in 22 this Chapter, shall be allocated for payment of expenses of the Lottery. 23 Advertising expenses shall not exceed one percent (1%) of the total annual 24 revenues. 25 (4) No more than seven percent (7%) of the face value of tickets or shares, as 26 described in this Chapter, shall be allocated for compensation paid to lottery 27 game retailers. 28 (a1) Advertising costs shall not exceed two percent (2%) of the total annual revenues, as 29 described in this Chapter. 30 ...." 31 SECTION 5.1.(c) G.S. 18C-163(b) reads as rewritten: 32 "(b) Expenses of the lottery shall also include a all of the following: 33 (1) A transfer of two million one hundred thousand dollars ($2,100,000) annually 34 to the Department of Public Safety, Alcohol Law Enforcement Branch, for 35 gambling enforcement activities. 36 (2) Advertising costs." 37 38 PART VI. GENERAL PROVISIONS 39 40 ESTABLISHING OR INCREASING FEES 41 SECTION 6.1.(a) Notwithstanding G.S. 12-3.1, an agency is not required to consult 42 with the Joint Legislative Commission on Governmental Operations prior to establishing or 43 increasing a fee to the level authorized or anticipated in this act. 44 SECTION 6.1.(b) Notwithstanding G.S. 150B-21.1A(a), an agency may adopt an 45 emergency rule in accordance with G.S. 150B-21.1A to establish or increase a fee as authorized by 46 this act if the adoption of a rule would otherwise be required under Article 2A of Chapter 150B of 47 the General Statutes. 48 49 EXPENDITURES OF FUNDS IN RESERVES LIMITED 50 SECTION 6.2. All funds appropriated by this act into reserves may be expended only 51 for the purposes for which the reserves were established. Page 8 House Bill 1030 H1030-PCS40636-MDxf-18 [v.64] General Assembly Of North Carolina Session 2015 1 2 BUDGET STABILITY AND CONTINUITY 3 SECTION 6.3.(a) G.S. 143C-5-4 reads as rewritten: 4 "§ 143C-5-4. Enactment deadline.deadline; procedures to be followed when the Current 5 Operations Appropriations Act does not become law prior to the end of certain 6 fiscal years. 7 (a) Enactment Deadline. – The General Assembly shall enact the Current Operations 8 Appropriations Act by June 15 of odd-numbered years and by June 30 of even-numbered years in 9 which a Current Operations Appropriations Act is enacted. 10 (b) Procedure for Budget Continuation. – If a fiscal year begins for which no Current 11 Operations Appropriations Act providing for current operations of State government during that 12 fiscal year has become law, then the following procedures shall be followed and the following 13 limitations shall apply: 14 (1) Authority. – Unless otherwise provided by law, the Director of the Budget may 15 continue to allocate funds from all funds for expenditure by State departments, 16 institutions, and agencies at a level not to exceed the level of recurring 17 expenditures from those funds for the prior fiscal year. If the Director of the 18 Budget finds that projected revenues for the fiscal year will not support 19 expenditures at the level of recurring expenditures for the prior fiscal year, the 20 Director of the Budget shall allot funds at a lower level. In making these 21 allocations, the Director of the Budget shall ensure the prompt payment of the 22 principal and interest on bonds and notes of the State according to their terms. 23 Except as otherwise provided by this section, the limitations and directions on 24 the expenditure of funds for the prior fiscal biennium shall remain in effect. 25 (2) Appropriation of funds necessary to implement. – There is appropriated from 26 the appropriate State funds, cash balances, federal receipts, and departmental 27 receipts sums sufficient to implement the authority described in this subsection 28 for the applicable fiscal year. 29 (3) Relation to Current Operations Appropriations Act. – The appropriations and 30 the authorizations to allocate and spend funds which are set out in this 31 subsection shall remain in effect until the Current Operations Appropriations 32 Act for the applicable fiscal year becomes law, at which time that act shall 33 become effective and shall govern appropriations and expenditures. When the 34 Current Operations Appropriations Act for that fiscal year becomes law, the 35 Director of the Budget shall adjust allotments to give effect to that act from July 36 1 of the fiscal year. 37 (4) Vacant positions. – If both houses of the General Assembly have passed their 38 respective versions of the Current Operations Appropriations Act on the third 39 reading and ordered them sent to the other chamber, then vacant positions 40 subject to proposed budget reductions in either or both versions of the bill shall 41 not be filled. 42 (5) State employee salaries. – The salary schedules and specific salaries established 43 for the prior fiscal year and in effect on June 30 of the prior fiscal year for 44 offices and positions shall remain in effect until the Current Operations 45 Appropriations Act for the current fiscal year becomes law. State employees 46 subject to G.S. 7A-102(c), 7A-171.1, 20-187.3, or any other statutory salary 47 schedule, shall not move up on salary schedules or receive automatic increases, 48 including automatic step increases, until authorized by the General Assembly. 49 State employees, including those exempt from the classification and 50 compensation rules established by the State Human Resources Commission, H1030-PCS40636-MDxf-18 [v.64] House Bill 1030 Page 9 General Assembly Of North Carolina Session 2015 1 shall not receive any automatic step increases, annual, performance, merit, 2 bonuses, or other increments until authorized by the General Assembly. 3 (6) School Employee Salaries. – Public school employees paid on the teacher 4 salary schedule, the school-based administrator salary schedule, or any other 5 salary schedule established by State law shall not move up on salary schedules 6 or receive automatic step increases until authorized by the General Assembly. 7 (7) State's employer contribution rate. – The State's employer contribution rates 8 budgeted for retirement and related benefits for the current fiscal year shall 9 remain the same as they are on June 30 of the prior fiscal year. These rates are 10 effective until the Current Operations Appropriations Act for the current fiscal 11 year becomes law and are subject to revision in that act. If that act modifies 12 those rates, the Director of the Budget shall further modify the rates set in that 13 act for the remainder of the fiscal year so as to compensate for the different 14 amount contributed between July 1 and the date the Current Operations 15 Appropriations Act becomes law so that the effective rates for the entire year 16 reflect the rates set in the Current Operations Appropriations Act. 17 (8) Statutory transfers to reserves. – Notwithstanding G.S. 143C-4-2 and 18 G.S. 143C-4-3, funds shall not be reserved to the Savings Reserve Account or 19 the Repairs and Renovations Reserve Account and the State Controller shall not 20 transfer funds from the unreserved credit balance to the those accounts on June 21 30 of the prior fiscal year. 22 (9) Federal block grant funds and other grant funds. – Notwithstanding 23 G.S. 143C-6-4, State agencies may, with approval of the Director of the 24 Budget, spend funds received from grants awarded during the current fiscal 25 year, including federal block grants, that are for less than two million five 26 hundred thousand dollars ($2,500,000), do not require State matching funds, 27 and will not be used for a capital project. State agencies shall report to the Joint 28 Legislative Commission on Governmental Operations within 30 days of receipt 29 of such funds. State agencies may spend all other funds from grants awarded 30 during the current fiscal year, including federal block grants, only with approval 31 of the Director of the Budget and after consultation with the Joint Legislative 32 Commission on Governmental Operations, except that consultation with the 33 Joint Legislative Commission on Governmental Operations shall not be 34 required prior to an expenditure to respond to an emergency, as that term is 35 defined in G.S. 166A-19.3(6). The Office of State Budget and Management 36 shall work with the recipient State agencies to budget grant awards according to 37 the annual program needs and within the parameters of the respective granting 38 entities. Depending on the nature of the award, additional State personnel may 39 be employed on a time-limited basis. Funds received from such grants are 40 hereby appropriated and shall be incorporated into the authorized budget of the 41 recipient State agency. Notwithstanding the provisions of this subdivision, no 42 State agency may accept a grant if acceptance of the grant would obligate the 43 State to make future expenditures relating to the program receiving the grant or 44 would otherwise result in a financial obligation as a consequence of accepting 45 the grant funds." 46 SECTION 6.3.(b) This section is effective when it becomes law. 47 48 SECTION 6.25 OF S.L. 2015-241 IS APPLICABLE TO BOTH FISCAL YEARS 49 SECTION 6.4. Section 6.25 of S.L. 2015-241 reads as rewritten: 50 "SECTION 6.25.(a) Elimination of Certain Vacant Positions. – Notwithstanding 51 G.S. 143C-6-4, and except as otherwise provided in subsection (c) of this section, for each fiscal Page 10 House Bill 1030 H1030-PCS40636-MDxf-18 [v.64]

Description: