Proposed Committee Substitute for Senate Bill 257, Appropriations Act of 2017 PDF

Preview Proposed Committee Substitute for Senate Bill 257, Appropriations Act of 2017

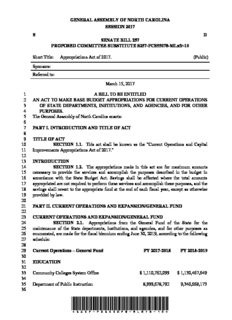

GENERAL ASSEMBLY OF NORTH CAROLINA SESSION 2017 S D SENATE BILL 257 PROPOSED COMMITTEE SUBSTITUTE S257-PCS55078-MLxfr-10 Short Title: Appropriations Act of 2017. (Public) Sponsors: Referred to: March 15, 2017 1 A BILL TO BE ENTITLED 2 AN ACT TO MAKE BASE BUDGET APPROPRIATIONS FOR CURRENT OPERATIONS 3 OF STATE DEPARTMENTS, INSTITUTIONS, AND AGENCIES, AND FOR OTHER 4 PURPOSES. 5 The General Assembly of North Carolina enacts: 6 7 PART I. INTRODUCTION AND TITLE OF ACT 8 9 TITLE OF ACT 10 SECTION 1.1. This act shall be known as the "Current Operations and Capital 11 Improvements Appropriations Act of 2017." 12 13 INTRODUCTION 14 SECTION 1.2. The appropriations made in this act are for maximum amounts 15 necessary to provide the services and accomplish the purposes described in the budget in 16 accordance with the State Budget Act. Savings shall be effected where the total amounts 17 appropriated are not required to perform these services and accomplish these purposes, and the 18 savings shall revert to the appropriate fund at the end of each fiscal year, except as otherwise 19 provided by law. 20 21 PART II. CURRENT OPERATIONS AND EXPANSION/GENERAL FUND 22 23 CURRENT OPERATIONS AND EXPANSION/GENERAL FUND 24 SECTION 2.1. Appropriations from the General Fund of the State for the 25 maintenance of the State departments, institutions, and agencies, and for other purposes as 26 enumerated, are made for the fiscal biennium ending June 30, 2019, according to the following 27 schedule: 28 29 Current Operations – General Fund FY 2017-2018 FY 2018-2019 30 31 EDUCATION 32 33 Community Colleges System Office $ 1,110,762,099 $ 1,130,467,649 34 35 Department of Public Instruction 8,999,678,792 9,340,668,173 36 *S257-PCS55078-MLxfr-10* General Assembly Of North Carolina Session 2017 1 Appalachian State University 134,672,993 134,672,993 2 East Carolina University 3 Academic Affairs 214,598,809 214,598,809 4 Health Affairs 74,373,798 75,014,745 5 Elizabeth City State University 31,964,712 31,154,712 6 Fayetteville State University 52,116,162 52,116,162 7 NC A&T State University 91,203,482 91,203,482 8 NC Central University 83,243,559 83,243,559 9 NC State University 10 Academic Affairs 409,648,050 407,648,050 11 Agricultural Extension 41,895,231 41,895,231 12 Agricultural Research 52,636,905 52,636,905 13 UNC-Asheville 38,750,625 38,750,625 14 UNC-Chapel Hill 15 Academic Affairs 248,309,119 248,309,119 16 Health Affairs 189,665,032 189,665,032 17 AHEC 56,783,693 62,183,693 18 UNC-Charlotte 226,376,692 226,376,692 19 UNC-Greensboro 150,156,774 150,156,774 20 UNC-Pembroke 53,711,549 53,715,428 21 UNC-School of the Arts 30,424,499 30,424,499 22 UNC-Wilmington 120,327,946 120,327,946 23 Western Carolina University 89,729,461 89,730,641 24 Winston-Salem State University 64,717,512 64,717,512 25 General Administration 42,172,369 42,172,369 26 University Institutional Programs 102,624,192 152,976,706 27 Related Educational Programs 110,268,501 110,768,501 28 NC School of Science & Math 20,958,012 20,959,212 29 Aid to Private Institutions 155,169,754 165,719,754 30 31 Total University of North Carolina – Board of Governors 2,886,499,431 2,951,139,151 32 33 HEALTH AND HUMAN SERVICES 34 35 Department of Health and Human Services 36 Central Management and Support 124,254,579 138,439,922 37 Division of Aging & Adult Services 45,106,213 45,139,285 38 Division of Blind Services/Deaf/HH 8,418,832 8,478,672 39 Division of Child Development & Early Education 268,984,429 272,511,265 40 Division of Health Service Regulation 18,438,099 19,052,444 41 Division of Medical Assistance 3,688,012,697 3,802,858,741 42 Division of Mental Health, Developmental Disabilities, 43 & Substance Abuse Services 684,418,672 655,413,652 44 NC Health Choice 459,077 396,238 45 Division of Health Benefits 9,742,662 9,786,700 46 Division of Public Health 151,257,798 149,748,494 47 Division of Social Services 197,255,967 203,399,766 48 Division of Vocational Rehabilitation 38,711,023 38,932,726 49 Total Health and Human Services 5,235,060,048 5,344,157,905 50 51 NATURAL AND ECONOMIC RESOURCES Page 2 Senate Bill 257 S257-PCS55078-MLxfr-10 [v.5] General Assembly Of North Carolina Session 2017 1 2 Department of Agriculture and Consumer Services 127,483,175 125,111,877 3 4 Department of Commerce 5 Commerce 140,647,735 134,736,660 6 Commerce State-Aid 15,275,793 15,175,793 7 8 Wildlife Resources Commission 10,678,051 10,792,605 9 10 Department of Environmental Quality 70,669,650 71,154,583 11 12 Department of Labor 17,531,715 17,736,687 13 14 Department of Natural and Cultural Resources 175,344,439 173,625,934 15 Department of Natural and Cultural 16 Resources – Roanoke Island 555,571 555,571 17 18 JUSTICE AND PUBLIC SAFETY 19 20 Department of Public Safety 1,977,021,279 1,996,753,751 21 22 Judicial Department 516,549,931 523,749,357 23 24 Judicial Department – Indigent Defense 120,413,821 121,363,932 25 26 Department of Justice 55,904,112 56,445,076 27 28 29 GENERAL GOVERNMENT 30 31 Department of Administration 62,265,447 62,596,178 32 33 Office of Administrative Hearings 5,906,579 6,004,787 34 35 Department of State Auditor 13,585,122 13,737,445 36 37 Office of State Controller 23,579,858 23,949,466 38 39 State Board of Elections 6,600,070 6,662,401 40 41 General Assembly 65,126,273 65,531,379 42 43 Office of the Governor 5,887,379 5,945,252 44 45 Office of the Governor – Special Projects 2,001,625 2,001,625 46 47 Office of State Budget and Management 48 Office of State Budget and Management 8,009,843 8,084,541 49 OSBM – Reserve for Special Appropriations 2,000,000 2,000,000 50 51 Housing Finance Agency 10,660,000 10,660,000 S257-PCS55078-MLxfr-10 [v.5] Senate Bill 257 Page 3 General Assembly Of North Carolina Session 2017 1 2 Department of Insurance 40,450,888 40,849,376 3 4 Office of Lieutenant Governor 793,477 771,266 5 6 Military and Veterans Affairs 10,302,913 8,372,298 7 8 Department of Revenue 84,702,526 85,540,885 9 10 Department of Secretary of State 13,070,985 13,281,617 11 12 Department of State Treasurer 13 State Treasurer 4,802,959 4,821,416 14 State Treasurer – Retirement for Fire 15 and Rescue Squad Workers 27,645,361 27,995,361 16 17 DEPARTMENT OF INFORMATION TECHNOLOGY 51,515,580 51,661,844 18 19 20 RESERVES, ADJUSTMENTS, AND DEBT SERVICE 21 22 Contingency & Emergency Fund 5,000,000 5,000,000 23 Other Operating Reserves 500,000 500,000 24 Classification and Compensation System 3,900,000 7,800,000 25 Statutory Pay Plan Reserve 20,365,642 21,503,791 26 Workers' Compensation Settlement Reserve 2,000,000 0 27 Salary Adjustment Fund 5,000,000 5,000,000 28 University System Enrollment Reserve 46,571,112 94,734,518 29 Film and Entertainment Grant Fund 15,000,000 15,000,000 30 Supplement Disaster Recovery Act 70,000,000 0 31 Matching Funds for Disaster Recovery 80,000,000 0 32 Enterprise Resource Planning 3,000,000 10,000,000 33 NC Promise Tuition Plan 0 11,000,000 34 Public Schools Average Daily Membership Reserve 0 48,410,289 35 36 Debt Service 37 General Debt Service 727,166,339 770,458,736 38 Federal Reimbursement 1,616,380 1,616,380 39 40 TOTAL CURRENT OPERATIONS – 41 GENERAL FUND $ 22,879,102,000 $ 23,445,125,555 42 43 GENERAL FUND AVAILABILITY STATEMENT 44 SECTION 2.2.(a) The General Fund availability used in developing the 2017-2019 45 fiscal biennial budget is shown below: 46 47 FY 2017-2018 FY 2018-2019 48 Unappropriated Balance $ 208,607,416 $ 306,975,383 49 Disaster Recovery Appropriations (S.L. 2016-124) (200,928,370) 0 50 Transfer From Savings Reserve 100,928,370 0 51 Revised Unappropriated Balance 108,607,416 0 Page 4 Senate Bill 257 S257-PCS55078-MLxfr-10 [v.5] General Assembly Of North Carolina Session 2017 1 Over Collections FY 2016-17 580,600,000 0 2 Reversions FY 2016-17 271,000,000 0 3 Replenish Savings Reserve (S.L. 2016-124) (100,928,370) 0 4 Earmarkings of Year End Fund Balance: 5 Savings Reserve (263,000,000) 0 6 Repairs and Renovations (120,000,000) 0 7 Beginning Unreserved Fund Balance 476,279,046 306,975,383 8 9 Revenues Based on Existing Tax Structure 22,303,700,000 23,299,200,000 10 11 Non-tax Revenues 12 Investment Income 60,100,000 60,600,000 13 Judicial Fees 240,900,000 240,500,000 14 Disproportionate Share 164,700,000 149,600,000 15 Insurance 75,500,000 75,500,000 16 Master Settlement Agreement (MSA) 127,200,000 127,200,000 17 Other Non-Tax Revenues 180,600,000 182,900,000 18 Subtotal Non-tax Revenues 849,000,000 836,300,000 19 20 21 Total General Fund Availability 23,628,979,046 24,442,475,383 22 23 Adjustments to Availability: 2017 Session 24 Tax Law Changes (323,700,000) (709,500,000) 25 Diversion of Taxes From Short-Term Lease 26 or Rental of Motor Vehicles to Highway Fund (10,000,000) (10,000,000) 27 Diversion to Savings Reserve (S.L. 2017-5) 0 (91,455,000) 28 Divert Additional MSA funds to Golden Leaf (10,000,000) (10,000,000) 29 Transfer from Federal Insurance Contributions Act (FICA) 1,500,000 0 30 Transfer to Medicaid Transformation Fund (75,000,000) (75,000,000) 31 Transfer from Department of Insurance 660,204 1,056,527 32 Transfer from the Department of the State Treasurer (5,463,867) (5,445,410) 33 34 Subtotal Adjustments to Availability: 2017 Session (422,003,663) (900,343,883) 35 36 Revised General Fund Availability $ 23,206,975,383 $ 23,542,131,500 37 38 Less General Fund Net Appropriation (22,900,000,000) (23,445,125,555) 39 40 Unappropriated Balance Remaining $ 306,975,383 $ 97,005,945 41 42 SECTION 2.2.(b) Notwithstanding the provisions of G.S. 143C-4-3(a), the State 43 Controller shall transfer a total of one hundred twenty million dollars ($120,000,000) from the 44 unreserved fund balance to the Repairs and Renovations Reserve on June 30, 2017. This 45 subsection becomes effective June 30, 2017. Funds transferred under this section to the Repairs 46 and Renovations Reserve are appropriated for the 2017-2018 fiscal year and shall be used in 47 accordance with Section 36.5 of this act. 48 SECTION 2.2.(c) Notwithstanding G.S. 143C-4-2, the State Controller shall 49 transfer a total of three hundred sixty-three million nine hundred twenty-eight thousand three 50 hundred seventy dollars ($363,928,370) from the unreserved fund balance to the Savings 51 Reserve Account on June 30, 2017. This transfer is not an "appropriation made by law," as that S257-PCS55078-MLxfr-10 [v.5] Senate Bill 257 Page 5 General Assembly Of North Carolina Session 2017 1 phrase is used in Section 7(1) of Article V of the North Carolina Constitution. This subsection 2 becomes effective June 30, 2017. 3 SECTION 2.2.(d) Notwithstanding any other provision of law to the contrary, 4 effective June 30, 2017, one million five hundred thousand dollars ($1,500,000) from the NC 5 FICA Account (Budget Code 24160/Fund Code 2000) shall be transferred to the State 6 Controller to be deposited in the appropriate budget code as determined by the State Controller. 7 These funds shall be used to support the General Fund appropriations as specified in this act for 8 the 2017-2018 fiscal year. 9 SECTION 2.2.(e) The State Controller shall reserve from funds available in the 10 General Fund the sum of seventy-five million dollars ($75,000,000) in nonrecurring funds for 11 the 2017-2018 fiscal year and the sum of seventy-five million dollars ($75,000,000) in 12 nonrecurring funds for the 2018-2019 fiscal year. The funds reserved in this subsection shall be 13 transferred and deposited in the Medicaid Transformation Fund established in Section 12H.29 14 of S.L. 2015-241. Funds deposited in the Medicaid Transformation Fund do not constitute an 15 "appropriation made by law," as that phrase is used in Section 7(1) of Article V of the North 16 Carolina Constitution. 17 SECTION 2.2.(f) Funds reserved in the Medicaid Contingency Reserve established 18 in Section 12H.38 of S.L. 2014-100 do not constitute an "appropriation made by law," as that 19 phrase is used in Section 7(1) of Article V of the North Carolina Constitution. 20 SECTION 2.2.(g) G.S. 105-187.9(a) reads as rewritten: 21 "(a) Distribution. – Taxes Of the taxes collected under this Article at the rate of eight 22 percent (8%) (8%), the sum of ten million dollars ($10,000,000) shall be credited annually to 23 the Highway Fund, and the remainder shall be credited to the General Fund. Taxes collected 24 under this Article at the rate of three percent (3%) shall be credited to the North Carolina 25 Highway Trust Fund." 26 SECTION 2.2.(h) Subsection (g) of this section is effective when this act becomes 27 law and applies to taxes collected on or after that date. 28 29 PART III. CURRENT OPERATIONS/HIGHWAY FUND 30 31 CURRENT OPERATIONS AND EXPANSION/HIGHWAY FUND 32 SECTION 3.1. Appropriations from the State Highway Fund for the maintenance 33 and operation of the Department of Transportation and for other purposes as enumerated are 34 made for the fiscal biennium ending June 30, 2019, according to the following schedule: 35 36 Current Operations – Highway Fund FY 2017-2018 FY 2018-2019 37 38 Department of Transportation 39 Administration $ 96,416,366 $ 94,370,410 40 41 Division of Highways 42 Administration 34,782,224 34,782,224 43 Construction 76,100,000 76,100,000 44 Maintenance 1,389,482,939 1,440,670,935 45 Planning and Research 0 0 46 OSHA Program 358,030 358,030 47 48 State Aid to Municipalities 147,500,000 147,500,000 49 50 Intermodal Divisions 51 Ferry 44,983,375 44,983,375 Page 6 Senate Bill 257 S257-PCS55078-MLxfr-10 [v.5] General Assembly Of North Carolina Session 2017 1 Public Transportation 92,527,592 92,527,592 2 Aviation 94,312,773 104,012,773 3 Rail 43,659,362 43,850,362 4 Bicycle and Pedestrian 724,032 724,032 5 6 Governor's Highway Safety 255,367 255,367 7 Division of Motor Vehicles 127,257,318 124,525,997 8 9 Other State Agencies, Reserves, Transfers 33,270,363 38,801,934 10 11 Capital Improvements 9,616,700 8,600,000 12 13 Total Highway Fund Appropriations $ 2,191,246,441 $ 2,252,063,031 14 15 HIGHWAY FUND AVAILABILITY STATEMENT 16 SECTION 3.2. The Highway Fund availability used in developing the 2017-2019 17 fiscal biennial budget is shown below: 18 19 Highway Fund Availability Statement FY 2017-2018 FY 2018-2019 20 Unreserved Fund Balance $ 0 $ 0 21 Estimated Revenue 2,179,096,441 2,237,763,031 22 Adjustment to Revenue Availability: 23 Division of Motor Vehicles Hearing Fees 2,150,000 4,300,000 24 Highway Use Tax Lease Proceeds 10,000,000 10,000,000 25 26 Total Highway Fund Availability $ 2,191,246,441 $ 2,252,063,031 27 28 Unappropriated Balance $ 0 $ 0 29 30 PART IV. HIGHWAY TRUST FUND APPROPRIATIONS 31 32 HIGHWAY TRUST FUND APPROPRIATIONS 33 SECTION 4.1. Appropriations from the State Highway Trust Fund for the 34 maintenance and operation of the Department of Transportation and for other purposes as 35 enumerated are made for the fiscal biennium ending June 30, 2019, according to the following 36 schedule: 37 38 Current Operations – Highway Trust Fund FY 2017-2018 FY 2018-2019 39 40 Program Administration $ 35,156,560 $ 35,156,560 41 Debt Service 52,160,868 50,036,452 42 Turnpike Authority 49,000,000 49,000,000 43 State Ports Authority 45,000,000 45,000,000 44 Transfer to Highway Fund 400,000 400,000 45 FHWA State Match 4,640,000 4,640,000 46 Strategic Prioritization Funding Plan for 47 Transportation Investments 1,361,257,401 1,402,087,304 48 49 Total Highway Trust Fund Appropriations $ 1,547,614,829 $ 1,586,320,316 50 51 HIGHWAY TRUST FUND AVAILABILITY STATEMENT S257-PCS55078-MLxfr-10 [v.5] Senate Bill 257 Page 7 General Assembly Of North Carolina Session 2017 1 SECTION 4.2. The Highway Trust Fund availability used in developing the 2 2017-2019 fiscal biennial budget is shown below: 3 4 Highway Trust Fund Availability FY 2017-2018 FY 2018-2019 5 Unreserved Fund Balance $ 0 $ 0 6 Estimated Revenue 1,547,614,829 1,586,320,316 7 Adjustment to Revenue Availability 0 0 8 9 Total Highway Trust Fund Availability $ 1,547,614,829 $ 1,586,320,316 10 11 Unappropriated Balance $ 0 $ 0 12 13 PART V. OTHER APPROPRIATIONS 14 15 CASH BALANCES AND OTHER APPROPRIATIONS 16 SECTION 5.1.(a) Cash balances, federal funds, departmental receipts, grants, and 17 gifts from the General Fund, revenue funds, enterprise funds, and internal service funds are 18 appropriated for the 2017-2019 fiscal biennium as follows: 19 (1) For all budget codes listed in the Governor's Recommended Budget for the 20 2017-2019 fiscal biennium, dated March 2017, and in the Budget Support 21 Document, fund balances and receipts are appropriated up to the amounts 22 specified, as adjusted by the General Assembly, for the 2017-2018 fiscal 23 year and the 2018-2019 fiscal year. Funds may be expended only for the 24 programs, purposes, objects, and line items or as otherwise authorized by the 25 General Assembly. Expansion budget funds listed in those documents are 26 appropriated only as otherwise provided in this act. 27 (2) Notwithstanding the provisions of subdivision (1) of this subsection: 28 a. Any receipts that are required to be used to pay debt service 29 requirements for various outstanding bond issues and certificates of 30 participation are appropriated up to the actual amounts received for 31 the 2017-2018 fiscal year and the 2018-2019 fiscal year and shall be 32 used only to pay debt service requirements. 33 b. Other funds, cash balances, and receipts of funds that meet the 34 definition issued by the Governmental Accounting Standards Board 35 of a trust or agency fund are appropriated for and in the amounts 36 required to meet the legal requirements of the trust agreement for the 37 2017-2018 fiscal year and the 2018-2019 fiscal year. 38 SECTION 5.1.(b) Receipts collected in a fiscal year in excess of the amounts 39 appropriated by this section shall remain unexpended and unencumbered until appropriated by 40 the General Assembly, unless the expenditure of overrealized receipts in the fiscal year in 41 which the receipts were collected is authorized by the State Budget Act. Overrealized receipts 42 are appropriated in the amounts necessary to implement this subsection. 43 SECTION 5.1.(c) Notwithstanding subsections (a) and (b) of this section, there is 44 appropriated from the Reserve for Reimbursements to Local Governments and Shared Tax 45 Revenues for each fiscal year an amount equal to the amount of the distributions required by 46 law to be made from that reserve for that fiscal year. 47 48 OTHER RECEIPTS FROM PENDING GRANT AWARDS 49 SECTION 5.2.(a) Notwithstanding G.S. 143C-6-4, State agencies may, with 50 approval of the Director of the Budget, spend funds received from grants awarded subsequent 51 to the enactment of this act for grant awards that are for less than two million five hundred Page 8 Senate Bill 257 S257-PCS55078-MLxfr-10 [v.5] General Assembly Of North Carolina Session 2017 1 thousand dollars ($2,500,000), do not require State matching funds, and will not be used for a 2 capital project. State agencies shall report to the Joint Legislative Commission on 3 Governmental Operations within 30 days of receipt of such funds. 4 State agencies may spend all other funds from grants awarded after the enactment of 5 this act only with approval of the Director of the Budget and after consultation with the Joint 6 Legislative Commission on Governmental Operations. 7 SECTION 5.2.(b) The Office of State Budget and Management shall work with 8 the recipient State agencies to budget grant awards according to the annual program needs and 9 within the parameters of the respective granting entities. Depending on the nature of the award, 10 additional State personnel may be employed on a time-limited basis. Funds received from such 11 grants are hereby appropriated and shall be incorporated into the authorized budget of the 12 recipient State agency. 13 SECTION 5.2.(c) Notwithstanding the provisions of this section, no State agency 14 may accept a grant not anticipated in this act if acceptance of the grant would obligate the State 15 to make future expenditures relating to the program receiving the grant or would otherwise 16 result in a financial obligation as a consequence of accepting the grant funds. 17 18 EDUCATION LOTTERY FUNDS/CHANGES TO REVENUE 19 ALLOCATIONS/NEEDS-BASED CAPITAL FUND 20 SECTION 5.3.(a) The appropriations made from the Education Lottery Fund for 21 the 2017-2019 fiscal biennium are as follows: 22 FY 2017-2018 FY 2018-2019 23 24 Noninstructional Support Personnel $372,266,860 $372,266,860 25 Prekindergarten Program 78,252,110 78,252,110 26 Public School Building Capital Fund 100,000,000 100,000,000 27 Needs-Based School Capital Fund 75,000,000 75,000,000 28 Scholarships for Needy Students 30,450,000 30,450,000 29 UNC Need-Based Financial Aid 10,744,733 10,744,733 30 School-Based Administrator Compensation 28,004,257 33,668,556 31 32 TOTAL APPROPRIATION $694,717,960 $700,382,259 33 34 SECTION 5.3.(b) G.S. 18C-162 reads as rewritten: 35 "§ 18C-162. Allocation of revenues. 36 (a) The Commission shall allocate revenues to the North Carolina State Lottery Fund in 37 order to increase and maximize the available revenues for education purposes, and to the extent 38 practicable, shall adhere to the following guidelines: 39 (1) At least fifty percent (50%) of the total annual revenues, as described in this 40 Chapter, shall be returned to the public in the form of prizes. 41 (2) At least thirty-five percent (35%) of the total annual revenues, as described 42 in this Chapter, shall be transferred as provided in G.S. 18C-164. 43 (3) No more than eight percent (8%) of the total annual revenues, as described 44 in this Chapter, shall be allocated for payment of expenses of the Lottery. 45 Advertising expenses shall not exceed one percent (1%) of the total annual 46 revenues. 47 (4) No more than seven percent (7%) of the face value of tickets or shares, as 48 described in this Chapter, shall be allocated for compensation paid to lottery 49 game retailers. 50 (a1) Advertising costs shall not exceed two percent (2%) of the total annual revenues, as 51 described in this Chapter. S257-PCS55078-MLxfr-10 [v.5] Senate Bill 257 Page 9 General Assembly Of North Carolina Session 2017 1 ...." 2 SECTION 5.3.(c) G.S. 18C-163(b) reads as rewritten: 3 "(b) Expenses of the lottery shall also include a all of the following: 4 (1) A transfer of two million one hundred thousand dollars ($2,100,000) 5 annually to the Department of Public Safety, Alcohol Law Enforcement 6 Branch, for gambling enforcement activities. 7 (2) Advertising costs." 8 SECTION 5.3.(d) G.S. 18C-164 reads as rewritten: 9 "§ 18C-164. Transfer of net revenues. 10 … 11 (b) From the Education Lottery Fund, theThe Office of State Budget and Management 12 shall transfer any a sum equal to five percent (5%) of the net revenue in excess of the amount 13 appropriated from the Education Lottery Fund in a fiscal of the prior year to the Education 14 Lottery Reserve Fund. A special revenue fund for this purpose shall be established in the State 15 treasury to be known as the Education Lottery Reserve Fund, and that fund shall be capped 16 atmaintain a minimum balance of fifty million dollars ($50,000,000). Monies in the Education 17 Lottery Reserve Fund may be appropriated only as provided in subsection (e) of this section. 18 … 19 (e) If Notwithstanding the minimum balance requirement contained in subsection (b) of 20 this section, if the actual net revenues are less than the appropriation for that given year, then 21 the Governor may shall transfer from the Education Lottery Reserve Fund an amount sufficient 22 to equal the appropriation by the General Assembly. To the extent that the funds described in 23 this subsection are required to be appropriated, they are hereby appropriated for the purpose set 24 forth in this subsection. 25 (f) Actual net revenues in excess of the amounts appropriated in a fiscal year shall 26 remain in the Education Lottery Fund." 27 SECTION 5.3.(e) There is created the Needs-Based Public School Capital Fund to 28 be administered by the Superintendent of Public Instruction. The Fund shall be used to award 29 grants to counties designated as development tier one or development tier two, as defined by 30 G.S. 143B-437.08, to assist with their critical public school building capital needs. The 31 Superintendent of Public Instruction shall award grants to counties in accordance with the 32 following priorities: 33 (1) Counties designated as development tier one areas. 34 (2) Counties with greater need and less ability to generate sales tax and property 35 tax revenue. 36 (3) Counties with a high debt-to-tax revenue ratio. 37 (4) The extent to which a project will address critical deficiencies in adequately 38 serving the current and future student population. 39 SECTION 5.3.(f) Grant funds awarded under this section shall be subject to a 40 matching requirement from the recipient county as follows: 41 (1) For a county designated as a development tier one area, the grant shall not 42 exceed two dollars ($2.00) in grant funds for every one dollar ($1.00) 43 provided by the county. 44 (2) For a county designated as a development tier two area, the grant shall not 45 exceed one dollar ($1.00) for every one dollar ($1.00) provided by the 46 county. 47 The total amount awarded to a single county in a fiscal year shall not exceed ten 48 million dollars ($10,000,000). The total aggregate amount awarded from the Fund in a fiscal 49 year shall not exceed one hundred million dollars ($100,000,000). Grant funds shall be used for 50 new capital projects only. Grant funds shall not be used for real property acquisition or for 51 operational lease agreements. Page 10 Senate Bill 257 S257-PCS55078-MLxfr-10 [v.5]

Description: