Podium Minerals Limited* ACN 009 200 079 Prospectus PDF

Preview Podium Minerals Limited* ACN 009 200 079 Prospectus

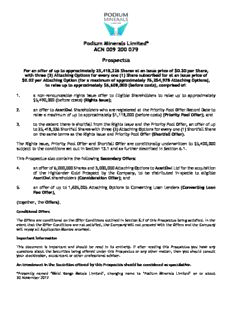

Podium Minerals Limited* ACN 009 200 079 Prospectus For an offer of up to approximately 25,418,326 Shares at an issue price of $0.20 per Share, with three (3) Attaching Options for every one (1) Share subscribed for at an issue price of $0.02 per Attaching Option (for a maximum of approximately 76,254,978 Attaching Options), to raise up to approximately $6,608,000 (before costs), comprised of: 1. a non-renounceable rights issue offer to Eligible Shareholders to raise up to approximately $5,490,000 (before costs) (Rights Issue); 2. an offer to AssetOwl Shareholders who are registered at the Priority Pool Offer Record Date to raise a maximum of up to approximately $1,118,000 (before costs) (Priority Pool Offer); and 3. to the extent there is shortfall from the Rights Issue and the Priority Pool Offer, an offer of up to 25,418,326 Shortfall Shares with three (3) Attaching Options for every one (1) Shortfall Share on the same terms as the Rights Issue and Priority Pool Offer (Shortfall Offer). The Rights Issue, Priority Pool Offer and Shortfall Offer are conditionally underwritten to $5,400,000 subject to the conditions set out in Section 13.1 and as further described in Section 6.1. This Prospectus also contains the following Secondary Offers: 4. an offer of 6,000,000 Shares and 3,000,000 Attaching Options to AssetOwl Ltd for the acquisition of the Highlander Gold Prospect by the Company, to be distributed in-specie to eligible AssetOwl shareholders (Consideration Offer); and 5. an offer of up to 1,625,005 Attaching Options to Converting Loan Lenders (Converting Loan Fee Offer), (together, the Offers). Conditional Offers The Offers are conditional on the Offer Conditions outlined in Section 6.7 of this Prospectus being satisfied. In the event that the Offer Conditions are not satisfied, the Company will not proceed with the Offers and the Company will repay all Application Monies received. Important Information This document is important and should be read in its entirety. If after reading this Prospectus you have any questions about the Securities being offered under this Prospectus or any other matter, then you should consult your stockbroker, accountant or other professional adviser. An investment in the Securities offered by this Prospectus should be considered as speculative. *Presently named ‘Weld Range Metals Limited’, changing name to ‘Podium Minerals Limited’ on or about 30 November 2017 Table of Contents Section Page No 1. Important Information ................................................................. 1 1.1 Important Notice ................................................................................. 1 1.2 Web Site – Electronic Prospectus .............................................................. 1 1.3 Overseas Applicants .............................................................................. 2 1.4 Forward looking statements .................................................................... 3 1.6 Disclosure to AssetOwl Shareholders .......................................................... 4 1.7 Definitions ......................................................................................... 4 2. Corporate Directory .................................................................... 5 3. Key Information and Indicative Timetable ........................................ 6 4. Investment Overview .................................................................. 8 4.1 Introduction ....................................................................................... 8 4.2 Key strengths .................................................................................... 13 4.3 Key risks .......................................................................................... 14 4.4 Proposed use of funds and other key terms of the Offers ................................. 18 4.5 Board and Management ........................................................................ 20 4.6 Miscellaneous .................................................................................... 21 5. Chairman’s Letter ..................................................................... 22 6. Details of the Offers .................................................................. 24 6.1 The Offers ........................................................................................ 24 6.2 Minimum Subscription .......................................................................... 25 6.3 Rights Issue ....................................................................................... 26 6.4 Priority Pool Offer ............................................................................... 26 6.5 Shortfall Offer ................................................................................... 27 6.6 Secondary Offers ................................................................................ 27 6.7 Conditions of Offers ............................................................................. 28 6.8 ASX Listing ........................................................................................ 29 6.9 Purpose of the Offers ........................................................................... 29 6.10 Use of Funds ..................................................................................... 30 6.11 Capital Structure ................................................................................ 31 6.12 Restricted Securities ............................................................................ 33 6.13 Dividend Policy .................................................................................. 34 6.14 Applications under the Offers ................................................................. 34 6.15 Application Monies to be held on Trust ...................................................... 36 6.16 Allocation of Securities ......................................................................... 36 6.17 Applicants outside of Australia ................................................................ 36 6.18 Underwriter ...................................................................................... 37 6.19 Potential effect on Control .................................................................... 37 6.20 CHESS and Issuer Sponsorship ................................................................. 39 6.21 Risks ............................................................................................... 39 6.22 Forecast Financial Information ................................................................ 39 6.23 Privacy Statement ............................................................................... 40 6.24 Taxation .......................................................................................... 40 6.25 Enquiries .......................................................................................... 40 7. Company Overview .................................................................... 41 7.1 Background ....................................................................................... 41 7.2 Location .......................................................................................... 44 7.3 WRC Geology ..................................................................................... 45 179693_14 Page i Table of Contents Section Page No 7.4 WRC PGM Project ............................................................................... 48 7.5 WRC Nickel-Copper Sulphides Project........................................................ 48 7.6 Highlander Gold Prospect ...................................................................... 49 7.7 Proposed Exploration Programs ............................................................... 49 7.8 Proposed Budget ................................................................................ 50 7.9 Financial Information ........................................................................... 52 8. Directors, Key Management and Corporate Governance ...................... 53 8.1 Director Profiles ................................................................................. 53 8.2 Management Profiles ........................................................................... 54 8.3 Director’s Interests ............................................................................. 54 8.4 Directors’ Security Holdings ................................................................... 55 8.5 Remuneration of Directors ..................................................................... 56 8.6 Key Terms of Agreements with Directors, Management or Related Parties ............ 57 8.7 Corporate Governance .......................................................................... 61 9. Independent Geologist’s Report .................................................... 75 10. Solicitor’s Report .................................................................... 148 11. Investigating Accountant’s Report ............................................... 193 12. Risk Factors ........................................................................... 211 12.1 General ......................................................................................... 211 12.2 Risks relating to the Company’s Operations ............................................... 211 12.3 General Risks................................................................................... 218 12.4 Investment Speculative ....................................................................... 219 13. Material Contracts ................................................................... 220 13.1 Underwriting Agreement ..................................................................... 220 13.2 Sub-underwriting and loan arrangements ................................................. 226 13.3 Oxide Mining Rights Acquisition Agreement ............................................... 227 13.4 Mining Rights Deed ............................................................................ 228 13.5 Native Title Mining Agreement .............................................................. 228 13.6 Highlander Gold Prospect Binding Terms Sheet .......................................... 228 14. Additional Information ............................................................. 229 14.1 Rights Attaching to Shares ................................................................... 229 14.2 Terms and Conditions of Attaching Options ............................................... 231 14.3 Terms and Conditions of Performance Rights ............................................. 233 14.4 Substantial Shareholders ..................................................................... 234 14.5 Employee Incentive Plan ..................................................................... 235 14.6 Company Structure ............................................................................ 237 14.7 Fees and Benefits ............................................................................. 237 14.8 Consents ........................................................................................ 238 14.9 Litigation ....................................................................................... 239 14.10 ASX Waivers .................................................................................... 239 14.11 Expenses of the Offers ....................................................................... 239 15. Director’s Authorisations .......................................................... 241 16. Glossary ............................................................................... 242 179693_14 Page ii 1. Important Information 1.1 Important Notice This Prospectus is dated 30 November 2017 and was lodged with the ASIC on that date. ASX, ASIC and its officers take no responsibility for the contents of this Prospectus or the merits of the investment to which the Prospectus relates. The expiry date of this Prospectus is that date which is 13 months after the date this Prospectus was lodged with the ASIC. No Securities may be issued on the basis of this Prospectus after that date. It is important that investors read this Prospectus in its entirety and seek professional advice where necessary before deciding whether to invest. The Securities that are the subject of this Prospectus should be considered speculative. Please refer to Section 12 for details relating to risk factors that could affect the financial performance and assets of the Company. This Prospectus will be circulated during the Exposure Period. The purpose of the Exposure Period is to enable this Prospectus to be examined by market participants prior to the raising of funds. You should be aware that this examination may result in the identification of deficiencies in this Prospectus and, in those circumstances, any application that has been received may need to be dealt with in accordance with section 724 of the Corporations Act. Applications for Securities under this Prospectus will not be processed by the Company until after the expiry of the Exposure Period. No preference will be conferred on applications lodged prior to the expiry of the Exposure Period. Application will be made to ASX within seven days after the date of this Prospectus for Official Quotation of the Shares and Attaching Options the subject of this Prospectus. Persons wishing to apply for Securities pursuant to the Offers must do so using the applicable Application Form as provided with a copy of this Prospectus. The Corporations Act prohibits any person passing onto another person an Application Form unless it is attached to a hard copy of this Prospectus or it accompanies the complete and unaltered version of this Prospectus. No person is authorised to give any information or to make any representation in relation to the Offers which is not contained in this Prospectus. Any information or representation not so contained may not be relied upon as having been authorised by the Company or the Directors in relation to the Offers. You should only rely on information in this Prospectus. 1.2 Web Site – Electronic Prospectus A copy of this Prospectus can be downloaded from the website of the Company at www.podiumminerals.com Any person accessing the electronic version of this Prospectus for the purpose of making an investment in the Company must only access this Prospectus from within Australia. The Corporations Act prohibits any person passing onto another person an Application Form unless it is attached to, or accompanied by, the complete unaltered version of the Prospectus. If you have received this Prospectus as an electronic Prospectus, please ensure that you have received the entire Prospectus accompanied by the relevant Application Forms. If you have not, please contact the Share Registry by telephone (within Australia): 1300 850 505 or (outside Australia): +61 3 9415 4000 between 9.00am and 5.00pm (WST) Monday to Friday and they will send you, at no 179693_14 Page 1 cost, either a hard copy or a further electronic copy of the Prospectus or both. Alternatively, you may obtain a copy of the Prospectus from the Company’s website at www.podiumminerals.com. The Company reserves the right not to accept an Application Form from a person if it has reason to believe that when that person was given access to the electronic Application Form, it was not provided together with the electronic Prospectus and any relevant supplementary or replacement prospectus or any of those documents were incomplete or altered. 1.3 Overseas Applicants The Offers of Securities made pursuant to this Prospectus are not made to persons to whom, or places in which, it would be unlawful to make such Offers of Securities. No action has been taken to register or qualify the Offers under this Prospectus or otherwise permit the Offers to be made in any jurisdiction outside of Australia. The distribution of this Prospectus in jurisdictions outside Australia may be restricted by law in those jurisdictions and therefore persons who come into possession of this Prospectus should seek legal advice on, and observe any of those restrictions. Failure to comply with these restrictions may violate securities laws. It is the responsibility of any overseas Applicant to ensure compliance with all laws of any country relevant to their Application. The return of a duly completed Application Form will be taken by the Company to constitute a representation and warranty that there has been no breach of such law and that all necessary approvals and consents have been obtained. This Prospectus may not be distributed to any person, and the Shares may not be offered or sold, in any country outside Australia, except to the extent permitted below. Hong Kong WARNING: This document has not been, and will not be, registered as a prospectus under the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32) of Hong Kong, nor has it been authorised by the Securities and Futures Commission in Hong Kong pursuant to the Securities and Futures Ordinance (Cap. 571) of the Laws of Hong Kong (SFO). No action has been taken in Hong Kong to authorise or register this document or to permit the distribution of this document or any documents issued in connection with it. Accordingly, the Securities have not been and will not be offered or sold in Hong Kong other than to “professional investors” (as defined in the SFO). No advertisement, invitation or document relating to the Securities has been or will be issued, or has been or will be in the possession of any person for the purpose of issue, in Hong Kong or elsewhere that is directed at, or the contents of which are likely to be accessed or read by, the public of Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to Securities that are or are intended to be disposed of only to persons outside Hong Kong or only to professional investors (as defined in the SFO and any rules made under that ordinance). No person allotted Securities may sell, or offer to sell, such securities in circumstances that amount to an offer to the public in Hong Kong within six months following the date of issue of such securities. The contents of this document have not been reviewed by any Hong Kong regulatory authority. You are advised to exercise caution in relation to the Offers. If you are in doubt about any contents of this document, you should obtain independent professional advice. 179693_14 Page 2 Switzerland The Securities may not be publicly offered in Switzerland and will not be listed on the SIX Swiss Exchange (SIX) or on any other stock exchange or regulated trading facility in Switzerland. This Prospectus has been prepared without regard to the disclosure standards for issuance prospectuses under art. 652a or art. 1156 of the Swiss Code of Obligations or the disclosure standards for listing prospectuses under the SIX Listing Rules or the listing rules of any other stock exchange or regulated trading facility in Switzerland. Neither this Prospectus nor any other offering or marketing material relating to the Securities under the Offers may be publicly distributed or otherwise made publicly available in Switzerland. The Securities will only be offered to regulated financial intermediaries such as banks, securities dealers, insurance institutions and fund management companies as well as institutional investors with professional treasury operations. Neither this Prospectus nor any other offering or marketing material relating to the Securities have been or will be filed with or approved by any Swiss regulatory authority. In particular, this Prospectus will not be filed with, and the offer of Securities will not be supervised by, the Swiss Financial Market Supervisory Authority. This Prospectus is personal to the recipient only and not for general circulation in Switzerland. United Kingdom Neither the information in this Prospectus nor any other document relating to the Offers has been delivered for approval to the Financial Conduct Authority in the United Kingdom and no prospectus (within the meaning of section 85 of the Financial Services and Markets Act 2000, as amended (FSMA)) has been published or is intended to be published in respect of the Securities. This Prospectus is issued on a confidential basis to fewer than 150 persons (other than "qualified investors" (within the meaning of section 86(7) of the FSMA)) in the United Kingdom, and the Securities may not be offered or sold in the United Kingdom by means of this Prospectus, any accompanying letter or any other document, except in circumstances which do not require the publication of a prospectus pursuant to section 86(1) of the FSMA. This Prospectus should not be distributed, published or reproduced, in whole or in part, nor may its contents be disclosed by recipients to any other person in the United Kingdom. Any invitation or inducement to engage in investment activity (within the meaning of section 21 of the FSMA) received in connection with the issue or sale of the Securities has only been communicated or caused to be communicated and will only be communicated or caused to be communicated in the United Kingdom in circumstances in which section 21(1) of the FSMA does not apply to the Company. 1.4 Forward looking statements This Prospectus may contain forward-looking statements which are identified by words such as ‘may’, ‘should’, ‘will’, ‘expect’, ‘anticipate’, ‘believes’, ‘estimate’, ‘intend’, ‘scheduled’ or ‘continue’ or other similar words. Such statements and information are subject to risks and uncertainties and a number of assumptions, which may cause the actual results or events to differ materially from the expectations described in the forward looking statements or information. Whilst the Company considers the expectations reflected in any forward looking statements or information in this Prospectus are reasonable, no assurance can be given 179693_14 Page 3 that such expectations will prove to be correct. The risk factors outlined in Section 12, as well as other matters not yet known to the Company or not currently considered material to the Company, may cause actual events to be materially different from those expressed, implied or projected in any forward looking statements or information. Any forward looking statement or information contained in this Prospectus is qualified by this cautionary statement. 1.5 Competent Persons Statement The information in this Prospectus that relates to Exploration Results is based on and fairly represents information and supporting documentation prepared by Mr Jeremy Peters who is a Fellow of the Australasian Institute of Mining and Metallurgy and Chartered Professional Mining Engineer and Geologist of that organisation. Mr Peters is a full time employee of Snowden Mining Industry Consultants Pty Ltd. Mr Peters has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity that he is undertaking to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Minerals Resources and Ore Reserves'. Mr Peters consents to the inclusion in this Prospectus of the matters based on his information in the form and context in which it appears. 1.6 Disclosure to AssetOwl Shareholders Securities issued pursuant to the Consideration Offer are to be distributed in-specie to eligible AssetOwl shareholders if the proposed In-specie Distribution is approved. A copy of this Prospectus is to accompany the notice of general meeting which AssetOwl proposes to issue in November 2017 to seek approval of its shareholders of resolutions to permit the In-Specie Distribution (AssetOwl Meeting). This Prospectus provides disclosure of material information in relation to the Company and the rights and liabilities associated with the Shares and Attaching Options for consideration by AssetOwl Shareholders relevant to their voting decision in respect of the resolutions to be considered at the AssetOwl Meeting. 1.7 Definitions A number of defined terms are used in this Prospectus. Unless the contrary intention appears, the context requires otherwise or words are defined in Section 16, words and phrases in this Prospectus have the same meaning and interpretation as in the Corporations Act or ASX Listing Rules. 179693_14 Page 4 2. Corporate Directory Directors Mr Clayton Dodd Non-Executive Chairman Mr Russell Thomson Executive Director and Chief Financial Officer Mr Roberto Castro Non-Executive Director Mr Peter Gilmour Non-Executive Director Mr Grant Osborne Non-Executive Director Chief Executive Officer Mr Thomas (Tom) Stynes Company Secretary Lawyers Mr Russell Thomson Bellanhouse Level 19, Alluvion 58 Mounts Bay Road PERTH WA 6000 Registered Office Share Registry* Level 9, 256 Adelaide Terrace Computershare Investor Services Pty Limited PERTH WA 6000 Level 11, 172 St Georges Terrace PERTH WA 6000 Phone: +61 8 9218 8878 Email: [email protected] Phone (within Australia): 1300 850 505 Phone (outside Australia): +61 3 9415 4000 Lead Manager and Underwriter Auditor* Patersons Securities Limited Greenwich & Co Audit Pty Ltd Level 23, Exchange Tower 35 Outram Street 2 The Esplanade WEST PERTH WA 6005 PERTH WA 6000 AFSL 239 052 Investigating Accountant Proposed ASX Code Greenwich & Co Audit Pty Ltd POD Level 2, 35 Outram Street WEST PERTH WA 6005 Independent Geologist Company Website Snowden Mining Industry Consultants Pty Ltd www.podiumminerals.com 6/130 Stirling St PERTH WA 6000 * These entities are included for information purposes only. They have not been involved in the preparation of this Prospectus. 179693_14 Page 5 3. Key Information and Indicative Timetable Description Minimum Maximum Subscription Subscription Issue price per Share under the Rights Issue, Priority Pool $0.20 $0.20 Offer and Shortfall Offer Issue Price per Attaching Option under the Rights Issue, $0.02 $0.02 Priority Pool Offer and Shortfall Offer Total subscription price for one Share and three $0.26 $0.26 Attaching Options offered under the Rights Issue, Priority Pool Offer and Shortfall Offer Total Shares offered under the Rights Issue, Priority Pool 20,769,231 25,418,326 Offer and Shortfall Offer Amount to be raised under the Rights Issue, Priority Pool $5,400,000 $6,608,765 Offer and Shortfall Offer (before costs) Approximate Shares on issue before completion of the 63,354,979 63,354,979 Offers1 Approximate total Shares on issue on completion of the 94,124,210 98,773,305 Offers Approximate market capitalisation on listing at $0.20 per $18.8 million $19.75 million Share Options on issue before completion of the Offers Nil Nil Options offered under the Rights Issue, Priority Pool Offer 62,307,693 76,254,978 and Shortfall Offer Total Options on issue on completion of the Offers 77,932,698 91,879,983 Note: Refer to Section 6.11 for further details relating to the proposed capital structure of the Company. 1. Existing Shares on issue quoted on a post-Consolidation basis. 179693_14 Page 6 Indicative timetable Date Lodgement of this Prospectus with ASIC Thursday, 30 November 2017 Priority Pool Offer Record Date 5pm WST, Monday, 4 December 2017 Record Date for Rights Issue Tuesday, 5 December 2017 Prospectus sent to Rights Issue Eligible Monday, 11 December 2017 Shareholders Opening Date of Offers Friday, 15 December 2017 Closing Date for the Consideration Offer Friday, 29 December 2017 Closing Date for the Rights Issue and Priority Pool Friday, 12 January 2018 Offer Closing Date for the Shortfall Offer Friday, 12 January 2018 Issue of Securities under the Rights Issue, Priority Thursday, 25 January 2018 Offer and Shortfall Offer Dispatch of holding statements Thursday, 25 January 2018 Completion of In-specie Distribution Monday, 29 January 2018 Expected date for Official Quotation on ASX Week commencing 29 January 2018 The above dates are indicative only and may change without notice. The Company reserves the right to extend the Closing Dates or close the Offers early without notice. 179693_14 Page 7

Description: