NW Á{aa r PDF

Preview NW Á{aa r

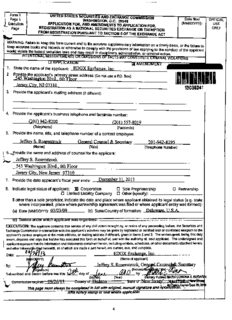

Form 1 UNITED STATES SECURITIESAND EXCHANGE COMMISSION Date filed OFFICIAL D.C. Page1 WASHINGTON, 20549 (MM/DD/YY): USE Execution APPLICATION FOR,AND AMENDMENTS TOAPPLICATION FOR, ONLY Pay REGISTRATION ASANATIONAL SECURITIES EXCHANGEOR EXEMPTION FROM REGISTRATION PURSUANT TO SECTION 5OFTHEEXCHANGE ACT WARNING:Failureto keep thisformcurrent and tofile accurate supplementary information onatimely basis, orthe failureto keep accurate books andrecords or otherwise to comply with the provisions of law applying to the conduct of the applicant would violatethe federal securities lawsand mayresult indisciplinary, administrative, orcriminal action. INTENTIONAL MISSTATEMENTS OR OMISSIONS OFFACTS MAYCONSTITUTE CRIMINAL VIOLATIONS O APPLICAllON DilAMENDMENT 1. State the nameofthe applicant: ED(iX Exchange,Inc. 2. Provide the applicant's orimarv street address (Donot useaRO.Box): 545Washington Blvd..6thTloor NW Jersey City, NJ07310 13035241 3. Provide the applicant's mailing address (if different): 4. Provide the applicant's business telephone and facsimile number: (201) 557-8019 (Telephone) (Facsimile) 5. Providethe name,title, and telephone number of acontact employee: S. Jeffrey Rosenstrock GeneralCounsel& Secretary 201-942-8295 (Name) (Title) (Telephone Number) 6 Providethe name and address of counsel for the applicant: Jeffrey S.Rosenstrock 545Washington Blvd.,6th Floor JerseyCity, NewJersey 07310 7. Provide the date applicant's fiscal year ends: December31,2013 8. Indicate legalstatus ofapplicant: liD Corporation D SoleProprietorship 0 Partnership O Limited Liability Company 0 Other (specify): Ifother than asole proprietor, indicate the date and place whereapplicant obtained its legalstatus (e.g.state whereincorporated, place where partnership agreement was filed or where applicant entity was formed): (a) Date (MM/DD/YY): 03/03/09 (b) State/Country of formation: Delaware, U.S.A. (c) Statute under which applicant was organized: EXECUTION: Theapplicant consents that service ofany civil action brought by,or notice of any proceeding before, the Securities and Exchange Commission in connection with the applicant's activities maybegivenbyregistered or certified mail orconfirmed telegram to the applicant's contactemployee at the mainaddress, ormailing addressifdifferent,given inItems2and 3.The undersigned, being first duly sworn,deposesandsaysthat he/she has executed this form on behalf of, andwith theauthority of,said applicant. The undersigned and applicantrepresentthat the information and statements contained herein,including exhibits, schedules, orotherdocuments attached hereto, and otherInformat nfil herewith, allof which aremadeaparthereof, arecurrent,true,andcomplete. Il Date: EDGX Exchange,Inc. By: Jeffrey S RosN etr k l Cons etary Á{a $0 Subscribed and sworn before me this day of(Montn)a r , (Ye,ar) by (NotaryP MARIACORONAS.BelGARN Guiliniissiuti eAvlica 09/20/13 uuilty us IIutlaun Grate uf NC," -Elasy' enna ruum.uiview Tema: This page must always be completed in fuHwith original, manual slgnature and Uta res'SeptizBj203 Aikx notarystamp or seal where applicable. 4 o c FY Form 1 UNITED STATES SECURITIES AND EXCHANQECOMMISSION Date filed OFFICIAL Page1 WASHINGTON, D.C.20540 (MM/DD/YY): USE Execution APPLICATION FOR, AhlDAMENDMENTS TOAW9tjCATION FOR, ONLY Page REGISTRATION ASA NATIONAL SECURITIES EXCHÅlŠEOREXEMPTION FROM REGISTRATION PURSUANT TO SECTION 5OFTHE EXCHANGEACT WARNING:Failureto keep thisformcurrent and to file accurate supplementary information on atimely basis, orthe failure to keepaccurate books andrecords or otherwise to comply with the provisions of lawapplying to the conduct ofthe applicant would violate the federal securitieslawsand mayresultindisciplinary, administrative, orcriminal action. INTENTIONAL MISSTATEMENTS OROMISSIONSOFFACTSMAYCONSTITUTE CRIMINALVIOLATIONS Ll APPLIGAllON DiAMENDME.NI 1. State the nameof the applicant: EDGX Exchange,Inc. 2. Providethe applicant's primary street address (Donot useaRO.Box): 545Washington Blvd., 6th Floor JerseyCity,NJ07310 3. Provide the applicant's mailing address (ifdifferent): 4. Provide the applicant's business telephone and facsimile number: (201) 942-8200 (201) 557-8019 (Telephone) (Facsimile) 5. Provide the name,title, and telephone number of a contact empioyee: Jeffrey S,Roseristrock GeneralCounsel& Secretary 201-942-8295 (Name) (Title) (Telephone Number) 6. Provide the nameand address ofcounsel for the applicant: Jeffrey S.Rosenstrock 545Washington Blvd.,6th Floor Jersey City,New Jersey 07310 7. Provide the date applicant's fiscal year ends: December 31,2013 8. Indicate legal status of applicant: XI Corporation D Sole Proprietorship 0 Partnership D Limited Liability Company 0 Other (specify): Ifother than a sole proprietor, indicate the date and place where applicant obtained its legal status (e.g.state whereincorporated, place where partnership agreement was filed or where applicant entity wasformed): (a) Date (MM/DD/YY): 03/03/09 (b) State/Country of formation: Delaware, U.S.A. (c) Statute under which applicant was organized: EXECUTION:Theapplicant consents that service ofany civilaction brought by,ornotice of any proceeding before, the Securities and ExchangeCommissioninconnection with the applicant's activities maybegiven byregistered orcertified mailorconfirmed telegram to the applicant's contact employee at the mainaddress, ormailing address ifdifferent, giveninitems 2and 3. Theundersigned, being first duly sworn, deposes and saysthat he/she has executed this formon behalf of, and with the authority of, said applicant. The undersigned and applicant represent that the information and statements contained herein,including exhibits,schedules, orother documents attached hereto, and otherinformat nfil dherewith, allof which aremade apart hereof, arecurrent,true,and compiete. Date: a& lb EDGX Exchange,Inc. ( Y) (Nameofapplicant) By: faus Jeffrey S. Rosenstrock, Gen 1Couns Secretary , ure) (Printe le) Subscribed andswornbefore me this day of pg r, ,O by (M th) (Year) ( otary Public) MARIACORONAS.BUGARii lvly Cuiumission expises 09/26/l3 Coulay of IIudoun ,Mme ui Now Joisey Nuny Fublit.ufNewJemes Thispage must always be completed in fuHwith original, manual signature and notaNzcafomExpiresSept.26,203 Alhx notary stamp or seal where apphcable. 4 DirectEdge June 28,2013 Mr. Christopher Grobbel U.S. Securities and Exchange Commission Division of Trading and Markets Securities and Exchange Commission 100F Street, NE Washington, DC 20549 Dear Mr. Grobbel: Enclosed please find anamendment to the EDGX Exchange,Inc.("EDGX" or the "Exchange") Form 1for registration asa national securities exchange. Pursuant to Rule 6a-2 of the Securities Exchange Act of 1934("the Act"), the Exchange is filing the following: Form 1Execution Page • • Annual Amendment to Form 1including Exhibits D,I,J,K,M and N Tri-Annual Amendment to Form 1including Exhibits A,B and C • The Exhibits supplement materials filed in connection with EDGA's Form 1application for exchange registration, which the Securities and Exchange Commission approved in March 2010,1 and its Form 1update filed on April 19,2013. Very truly yours, Jeffrey Rosenstrock, Esq. General Counsel Enclosures: Original and two (2)copies of the above amendments to the Exchange'sForm 1 cc: Freedom of Information Act Officer (U.S.Securities andExchange Commission) i Re Securities Exchange Act Release No.61698,74FR 13151(March 18,2010). Direct Edge, 545 Washington Boulevard, 6*Fl.,Jersey City,NJ 07310 Tel.201.942.8200 Fax201.557.8019 www.directedge.com C O PY DirectEdge June 28,2013 Mr. Christopher Grobbel U.S.Securities and Exchange Commission Division of Trading and Markets Securities and Exchange Commission 100F Street, NE Washington, DC 20549 Re: FOIA CONFIDENTIAL TREATMENT REQUEST Dear Mr. Grobbel: Pursuant to 17C.F.RSection 200.83,EDGX Exchange, Inc. (the "Exchange") requests confidential treatment for the enclosed documents and all the information contained therein. This confidential treatment request is basedupon, among other things, exemptions 4,7 and 8of the Freedom of Information Act, 5U.S.C.552(b)(4). The enclosed documents contain or relate to: privileged and confidential trade secrets and commercial and financial information relating to the Exchanges and other persons; information relating to techniques andprocedures for law enforcement investigations andprosecutions; and examination, operating or condition reports prepared by the Exchanges which, asregistered national securities exchanges, are responsible for the regulation and supervision of financial institutions. The Exchanges further submit that, to the extent the information provided relates to individuals, disclosure could affect those individuals' rights under the Privacy Act of 1974,5U.S.C.552a. Please contact me at(201) 942-8295 upon receipt of any requests for copies of the any of the enclosed documents, pursuant to 17C.F.R.Section 200.83. Sincerely, Jeffrey Rosenstrock General Counsel cc: Freedom of Information Act Officer (U.S.Securities and Exchange Commission) Direct Edge, 545Washington Boulevard, 6*Fl.,Jersey City, NJ07310 Tel. 201.942.8200 Fax 201.557.8019 www.directedge.com DirectEdge EDGX Exchange, Inc. Annual Amendment to Form 1 Exhibit D Exhibit Request: For each subsidiary or affiliate of the exchange, provide unconsolidated financial statements for the latest fiscal year.Such financial statements shall consist, ataminimum, of abalance sheet and anincome statement with such footnotes and other disclosures asarenecessary to avoid rendering the financial statements misleading. If any affiliate or subsidiary is required by another Commission rule to submit annual financial statements, astatement to that effect with a citation to the other Commission rule, may beprovided in lieu of the financial statements required here. Response: 1. The financials of Deutsche Börse AG are submitted in response to this Exhibit D. 2. Direct Edge Holdings LLC filed financial statements for the year ended December 31, 2012 with the Commission pursuant to Rule 17a-5 under the Securities Exchange Act of 1934which include the financials for the entities listed below. They are submitted again asareference in response to Exhibit D. The financials of DECN d/b/a/ DE Route are submitted in response to Exhibit D. • The financials of EDGA Exchange,Inc. are submitted in responseto Exhibit D. • • The financials of EDGX Exchange, Inc. are submitted in response to Exhibit D. 3. The financials of Eurex Global Derivatives AG, Zrich are submitted in responseto this Exhibit D. 4. The financials of Eurex Frankfurt AG are submitted in responseto Exhibit D. 5. The financials of Eurex Zrich AG are submitted in response to Exhibit D. 6. The financials of International Securities Exchange Holdings, Inc. are submitted in response to Exhibit D. 7. The financials of International Securities Exchange, LLC are submitted in response to Exhibit D. 8. The financials of U.S.Exchange Holdings, Inc. are submitted in response to Exhibit D. 9. There areno financials available for U.S.Exchange, LLC asthe entity was dormant for the fiscal year ending December 31,2012. Exhibit D 1.Deutsche Börse AG DeutSche BörSe AktiengeSellSChaft, Frankfurt/Main Balance Sheet aSat 31 December 2012 ets 31/12/2012 31/12/2011 Shareholders Equity and Liabilities 31/12/2012 31/12/2011 € € (thousand) acqPueirrevdalufeororeftsirheamreesnt Sbuebfosrceribreedtirecmaepnittal € € (thousand) NCURRENT ASSETS SHAREHOLDERS EQUITY € C ansesandssseimtsilai rightsfordata processing andsoftware 13.058.459,00 9.15Ó Subscribed Capital 193.000.000,00 -8.921.326,00 184.078.674,00 183.400 opdawymillents 4425.9.02050,0,000 4615 Capital Reserve 1.286.328.955,19 1.284.329 6.384,00 9.624 Retained Earnings Otherprofit reserves 431.144.371,32 138.156 iguirbelesoAnsstheitrsd partyland 23.174.252,00 24.224 431.144.371,32 138.156 erassets, furniture andoffice equipment 54.604.766,94 53.769 ancialAssets 77.779.018,94 77.993 Unappropriated Surpius 400.000.000,00 650.000 TotalShareholders Equity 2.301.552.000,51 2,255.885 resinaffiliated companies 3.086.328.369,45 2 496.172 nstoaffiliated companies 996.934.322,01 942.765 Provisions istments 34.408.837,03 34.651 Provisions forpensions andsimilar obiigations 16.463.524,92 26.142 nstocompanies inwhich thecompany hasaparticipating interest 77.187,98 549 Provisionsfor deferred taxes 130,838.773,33 114.995 g-Term securities 12.636.498,14 10.669 Otherprovisions 131.788.565,28 145.822 arloans 4.130.435.5708.85,7941,30 3.484.8126 Totalprovisions 279.090.863.53 286.959 alNoncu ntAssets 4.221.721.191,85 3.572.428 LIABILITIES Bonds 1.746.387.690,66 1.463.106 2RENTASSETS Liabilities frombank loans andoverdraft 96.148,45 527 unts Receivable andOther Assets Tradeaccounts payable 21.589.616.21 29.944 leaccounts receivable 118.807.282,50 119.887 Amounts owed toaffiliated companies 557.352.867,42 440.423 eivablesfrom affiliated companies 253.331.809,10 210.284 Amounts owed tocompanies in which thecompany hasaparticipating interest 13.260.012,84 12.988 eivablesfrom companies in which the company hasaparticipating interest 1.438.448,48 3.402 Otherliabilities 51.268.160,69 62.163 thereof withresidual termover 1year € 13.976.760,02 (previous year€ 15.671 (thousand)) trcurrent assets 78.061.601,38 37.467 Total Liabilities 2.389.954.496,27 2.009.152 451.639.141,46 371.040 DEFERRED INCOMEAND ACCRUED EXPENSES 907.288,40 2.367 iandBank Balances 281.081 01 6Ï)15 ICurrent Assets 732.720.157,29 967.053 ERREDEXPENSES ANDACCRUED INCOME 17.063.299,57 14.881 iAssets 4.971.504.648,71 4.554.362 TotalShareholders Equity andLiabilities 4.971.504.648,71 4.554.362 Deutsche Börse Aktiengesellschaft, Frankfurt/Main Profit and LossAccount for the period 1 January to 31 December 2012 2012 2011 € € €(thousand) €(thousand) SalesRevenue 1.110.263.852,97 1.280.677 OtherOperating income 109.182.724,08 118.786 thereof fromcurrency transiation € 13.485.097,00 (previousyear € 6.469 (thousand)) PersonnelExpenses WagesandSalaries -120.307.535,19 -119.487 Sociatlhesreecoufritiepse,nsipoennssi6on5s,9a5n8d.7o6th5e,9r8ben(epfritesviousyear€ 15.245 (thousand)) -17.668.253,18 -27,034 -146.521 Depreciation ofintangible andtangible assets -32.526.864,49 -28.439 OtherOperating Expenses -522.140.871,83 -566.278 thereof fromcurrency transiation € 4.567.676 62 (previousyear € 14.615 (thousand)) incomefromParticipating Interests 79.772.463,08 39.489 thereof fromaffiliated companies € 72.200.950,71 (previousyear € 37.195 (thousand)) incomefromProfitandLossAgreements 215.420.834,70 173.436 income fromFinancial Assets: Long-Term SecuritiesandLoans 27.018.291,41 16.754 thereof fromaffiliated companies € 15.000.000,00 (previousyear € 15.286 (thousand)) Interest andSimilar income 1.094,474,84 4.492 thereof fromaffiliated companies € 22.290,64 (previous € 36 (thousand)) Depretchieatrieonof toofaCffiulirarteendtAcsosmetps:aniFeisna€nc0ia,0l0As(speretsviaonudsSyeecaurrit€iesÖ(thousarid)) -2.662.724,18 -25.876 Interest andSimilarCharges -121.143.275,18 -106.376 thereof toaffiliated companies € 1.147.005,48 (previousyear € 3.033 (thousand)) thereof fromaddition ofdiscounted interest € 10.608.388,48 (previous year€ 8.408 (thousand)) Profit beforeTaxfrom Ordinary Activities 726.303.117,03 760.145 Extraordinary income 0,00 60.261 Extraordinaryexpense 0,00 -118 Extraordinary earnings 0,00 60.143 TaxonProfit -120.639.985,13 -155.891 Other Taxes 29.868,10 15.289 Net income forthe Financial Year 605.693.000,00 679.685 Withdrawal fromother profit reserves 0,00 0 Allocations toother profit reserve -205.693.000,00 -29.685 Unappropriated Surplus 400.000.000,00 650.000 Deutsche Börse Aktiengesellschaft, Frankfurt/Main Statement ofChangesin Noncurrent Assets asat 31 December 2012 Acquistion and Production COsts Depreciation and Amortization BOOk Value Changedueto Changedueto Balanceasat mergers Additions Disposals Balanceasat Balance asat mergers Depreciation Release Disposals Balanceasat iJan. 2012 2012 2012 2012 31Dec.2012 1Jan. 2012 2012 2012 2012 2012 31Dec.2012 31Dec.2012 31Dec2011 tangible Assets € € € € € e 0 e O e e e ansesandsimilarrightsfordataprocessingandsonware 249.922.912.74 0.00 8.944.151,26 33.266.214,75 225.600849,25 240.765172.74 0.00 5.043.432,26 0,00 33.266.214.75 212.542.390.25 13.058.459,00 9.157740.( odwill 484.734,10 0.00 29.416,26 0,00 514 150,36 23270,10 0.00 47.955,26 0,00 0.00 71.225,36 442.925,00 461 464,( payments onaccount andconstruction inprogress 5.000.00 0,00 0,00 0,00 5000,00 0.00 0.00 0,00 0,00 0,00 0,00 5.000,00 5000,( ngible Assets 250.412.646,84 0,00 8.973.567,52 33.266.214.75 226 119 999,61 240.788.442.84 0.00 5.091.387,52 0,00 33.266.214,75 212.613.615,61 13.506.384,00 9.624 204,( Ures onthird partyland 35.679.888.13 0.00 861 683,99 332.851,01 36208 721,11 11.456.178,13 0,00 1.911.141,99 0.00 332.851,01 13.034.469.11 23.174.252,00 24.223.710,( erassets,furnitures andofficeequipment 244.834.941.06 0,00 26.523.426,97 25.344.322,61 246 014 045,42 191.066.093,11 0,00 25.524.334,98 0,00 25.181.149,61 191.409.278,48 54.604.766.94 53.768.847,5 iancial Assets 280.514 829,19 0.00 27.385 110,96 25.677.173.62 282.222 766,53 202.522.271.24 0,00 27.435.476,97 0.00 25.514.000.62 204.443.747,59 77.779.018.94 77.992.557.5 ires inaffiliated companies 2.506.972 213,78 0,00 590.156 155,67 0.00 3.097.128.369,45 10.800.000,00 0,00 0,00 D,00 0.00 10,800 000,00 3.086,328,369,45 2.496.172.213, nstoalfiliatedcompanies 1.778.856095,21 0,00 0,00 2.530.000.00 1.776.326.095,21 836.091.375,14 0.00 0,00 -56.699.601,94 0.00 779.391773,20 996.934.322,01 942.764.720.( astments 56.897 133,12 0,00 1.241 745,63 1.484.009.52 56.654 869,23 22.246.032,20 0.00 0,00 0,00 0,00 22.246 032.20 34.408.837,03 34.651.100, nstocompaniesinwhichthecompanyhasaparticipatinginterest 3.465829.16 0,00 2.191083.00 0.00 5.656.912,16 2.917.000,00 0.00 2.662.724,18 0,00 0.00 5.579.724,18 77.187,98 548.829. gtermsecurities 11.970399,08 0,00 5.017042,65 3.970.400.00 13.017.041,73 1.301.859,65 0.00 0,00 -921.316,06 0,00 380543,59 12.636.498,14 10.668.539, loans 6274,96 0.00 44.299.34 0,00 50.574,30 0,00 0.00 0.00 0.00 0.00 0,00 50.574.30 6.274, 4.358.167 945,31 0,00 598.650,326,29 7,984.409.52 4.948.833.862,08 873.356.266,99 0,00 2.662.724,18 -57.620.918.00 0,00 818.398 073,17 4.130.435.788,91 3.484.811.678, 4.889.095 421.34 0,00 635.009.004.77 66.927.797,89 5.457.176.628.22 1.316.666.981,07 0,00 35.189.588,67 -57.620.918,00 58.780.215.37 1.235.455.436.37 4.221.721.191,85 3.572.428.440,

Description: