Nokia Corporation PDF

Preview Nokia Corporation

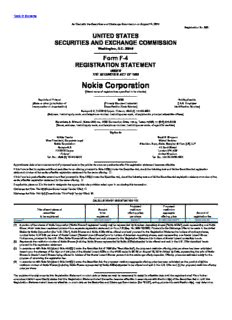

Table of Contents As filed with the Securities and Exchange Commission on August 14, 2015 Registration No. 333- UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form F-4 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 Nokia Corporation (Exact name of registrant as specified in its charter) Republic of Finland 3663 Not Applicable (State or other jurisdiction of (Primary Standard Industrial (I.R.S. Employer incorporation or organization) Classification Code Number) Identification Number) Karaportti 3, FI-02610 Espoo, Finland, +358 (0) 10-448-8000 (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) Genevieve A. Silveroli, Nokia USA Inc., 6000 Connection Drive, Irving, Texas 75039, +1 (972) 374-3000 (Name, address, including zip code, and telephone number, including area code, of agent for service) Copies to: Riikka Tieaho Scott V. Simpson Vice President, Corporate Legal Michal Berkner Nokia Corporation Skadden, Arps, Slate, Meagher & Flom (UK) LLP Karaportti 3 40 Bank Street FI-02610 Espoo London E14 5DS Finland United Kingdom Tel. No.: +358 (0) 10-448-8000 Tel. No.: +44 20-7519-7000 Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective. If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨ If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨ If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction: Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨ Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) x CALCULATION OF REGISTRATION FEE Proposed Proposed Title of each class of Amount maximum maximum securities to be offering price aggregate Amount of to be registered registered per share offering price registration fee Shares(1) 300 000 000(2) $6.60(3) $1 980 000 000(4) $230 076.00 (1) A portion of the shares of Nokia Corporation (“Nokia Shares”) registered hereby may be represented by American depositary shares (“Nokia ADSs”), each representing one Nokia Share, which have been registered pursuant to a separate registration statement on Form F-6 (Reg. No. 333-182900). Pursuant to the Exchange Offer to be made in the United States by Nokia Corporation (the “U.S. Offer”), Nokia Shares and Nokia ADSs will be offered and sold pursuant to this Registration Statement to holders of ordinary shares, nominal value EUR 0.05 per share of Alcatel Lucent (“Alcatel Lucent Shares”) and to holders of American depositary shares, each representing one Alcatel Lucent Share. Furthermore, pursuant to the U.S. Offer, Nokia Shares will be offered and sold pursuant to this Registration Statement to holders of Alcatel Lucent convertible bonds. (2) Represents the maximum number of Nokia Shares (including Nokia Shares represented by Nokia ADSs) expected to be offered and sold in the U.S. Offer described herein pursuant to this registration statement. (3) In accordance with Rule 457(c) and Rule 457(f)(1) under the Securities Act of 1933 (the “Securities Act”), the proposed maximum offering price per share has been calculated based upon the average of the high and low price of the Alcatel Lucent ADSs on the NYSE equal to $3.63 on August 10, 2015 divided by 0.55, representing the ratio of Nokia Shares to Alcatel Lucent Shares being offered to holders of the Alcatel Lucent Shares pursuant to this exchange offer/prospectus. Offering prices are estimated solely for the purpose of calculating the registration fee. (4) In accordance with Rule 457(c) and Rule 457(f)(1) under the Securities Act, the proposed maximum aggregate offering price has been calculated as the product of (a) the maximum number of Nokia Shares (including Nokia Shares represented by Nokia ADSs) expected to be offered and sold in the U.S. Offer and (b) the proposed maximum offering price per share. The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission (the “SEC”), acting pursuant to said Section 8(a), may determine. Table of Contents Preliminary Exchange Offer/Prospectus The U.S. Offer to exchange Alcatel Lucent Shares and OCEANEs set forth in this exchange offer/prospectus is not made to any person located in the European Economic Area and the U.S. Offer to exchange Alcatel Lucent ADSs set forth in this exchange offer/prospectus is only made to persons located in the European Economic Area pursuant to an exemption or exemptions from the Prospectus Directive (Directive 2003/71/EC, as amended). In addition, for the purposes of the proposed French Offer and Admission (both terms as defined below), this exchange offer/prospectus is not offer documentation or a prospectus and no such person should subscribe for or purchase any transferable securities referred to in this document except on the basis of information contained in the prospectus approved by the Finnish Financial Supervisory Authority and “passported” in France in accordance with the Prospectus Directive (the “Listing Prospectus”), and the separate French Offer documentation filed with the French stock market authority (Autorité des marchés financiers, or “AMF”) (the “French Offer Documentation”), which in each case are proposed to be published by Nokia in due course in connection with the proposed French Offer and the Admission of the Nokia Shares to Euronext Paris. A copy of the Listing Prospectus and the French Offer Documentation will, following publication, be available on Nokia’s website at www.nokia.com. None of the Listing Prospectus, the French Offer Documentation or the information on Nokia’s website forms a part of this exchange offer/prospectus, nor are such documents incorporated by reference herein. Table of Contents The information in this preliminary exchange offer/prospectus is not complete and may be changed. Nokia may not complete the Exchange Offer and issue its securities referred to below until the registration statement filed with the Securities and Exchange Commission becomes effective. This preliminary exchange offer/prospectus is not an offer to sell these securities and Nokia is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. Subject to Completion Dated August 14, 2015 U.S. Offer to Exchange All Ordinary Shares held by U.S. Holders American Depositary Shares OCEANEs held by U.S. Holders of ALCATEL LUCENT for 0.55 Nokia Share or 0.55 Nokia American Depositary Share per Alcatel Lucent Ordinary Share 0.55 Nokia American Depositary Share per Alcatel Lucent American Depositary Share Nokia Share per 2018 Alcatel Lucent OCEANE Nokia Share per 2019 Alcatel Lucent OCEANE Nokia Share per 2020 Alcatel Lucent OCEANE by NOKIA CORPORATION Nokia Corporation (“Nokia”), a Finnish corporation, is conducting, upon the terms and subject to the conditions set forth in this exchange offer/prospectus and the French Offer Documentation, an exchange offer comprised of two offers (separately, the “U.S. Offer” and the “French Offer” and collectively, the “Exchange Offer”). The U.S. Offer is being made pursuant to this exchange offer/prospectus to: • all U.S. holders (within the meaning of Rule 14d-1(d) under the U.S. Securities Exchange Act of 1934 (the “Exchange Act”)) of outstanding ordinary shares, nominal value EUR 0.05 per share (the “Alcatel Lucent Shares”) of Alcatel Lucent, a French société anonyme (“Alcatel Lucent”), • all holders of outstanding Alcatel Lucent American depositary shares, each representing one Alcatel Lucent Share (the “Alcatel Lucent ADSs”), wherever located, and • all U.S. holders of outstanding (i) EUR 628 946 424.00 Alcatel Lucent bonds convertible into new Alcatel Lucent Shares or exchangeable for existing Alcatel Lucent Shares due on July 1, 2018 (the “2018 OCEANEs”), (ii) EUR 688 425 000.00 Alcatel Lucent bonds convertible into new Alcatel Lucent Shares or exchangeable for existing Alcatel Lucent Shares due on January 30, 2019 (the “2019 OCEANEs”) and (iii) EUR 460 289 979.90 Alcatel Lucent bonds convertible into new Alcatel Lucent Shares or exchangeable for existing Alcatel Lucent Shares due on January 30, 2020 (the “2020 OCEANEs” and, together with the 2018 OCEANEs and the 2019 OCEANEs, the “OCEANEs” and, together with the Alcatel Lucent Shares and the Alcatel Lucent ADSs, the “Alcatel Lucent Securities”). Table of Contents Holders of Alcatel Lucent ADSs located outside of the United States may participate in the U.S. Offer only to the extent the local laws and regulations applicable to those holders permit them to participate in the U.S. Offer. For every Alcatel Lucent Share you validly tender into, and do not withdraw from, the U.S. Offer, you will receive, at your election, 0.55 share of Nokia (a “Nokia Share”) or 0.55 Nokia American depositary share (a “Nokia ADS”), each Nokia ADS representing one Nokia Share. For every Alcatel Lucent ADS you validly tender into, and do not withdraw from, the U.S. Offer, you will receive 0.55 Nokia ADS. For every 2018 OCEANE you validly tender into, and do not withdraw from, the U.S. Offer, you will receive Nokia Share, for every 2019 OCEANE you validly tender into, and do not withdraw from, the U.S. Offer, you will receive Nokia Share, and for every 2020 OCEANE you validly tender into, and do not withdraw from, the U.S. Offer, you will receive Nokia Share. The French Offer to exchange 0.55 Nokia Share for every Alcatel Lucent Share, Nokia Share for every 2018 OCEANE, Nokia Share for every 2019 OCEANE, and Nokia Share for every 2020 OCEANE, is being made pursuant to the French Offer Documentation available to holders of Alcatel Lucent Shares and OCEANEs located in France (holders of Alcatel Lucent Shares and OCEANEs located outside of France may not participate in the French Offer except if, pursuant to the local laws and regulations applicable to those holders, they are permitted to participate in the French Offer). No fractional Nokia Shares or fractional Nokia ADSs will be issued. Holders of Alcatel Lucent Securities tendering into the U.S. Offer or the French Offer will receive cash in lieu of any fractional Nokia Shares or Nokia ADSs to which such holders may otherwise be entitled, following the implementation of a mechanism to resell such fractional Nokia Shares or Nokia ADSs. Holders of options to acquire Alcatel Lucent Shares (“Alcatel Lucent Stock Options”) who wish to tender in the Exchange Offer or the subsequent offering period, if any, must exercise their Alcatel Lucent Stock Options, and Alcatel Lucent Shares must be issued to such holders prior to the Expiration Date (as defined below) or the expiration of the subsequent offering period, as applicable. Pursuant to the Memorandum of Understanding dated April 15, 2015 between Nokia and Alcatel Lucent (the “Memorandum of Understanding”), Alcatel Lucent agreed to accelerate or waive certain terms of the Alcatel Lucent Stock Options, subject to certain conditions. Restricted stock granted by Alcatel Lucent (“Performance Shares”) cannot be tendered in the Exchange Offer or the subsequent offering period, if any, unless such Performance Shares have vested and are transferable prior to the Expiration Date (as defined below) or the expiration of the subsequent offering period, as applicable. Pursuant to the Memorandum of Understanding, Nokia and Alcatel Lucent agreed to implement a mechanism with respect to unvested Performance Shares granted before April 15, 2015 pursuant to which the beneficiaries may waive their rights to receive Performance Shares in exchange for Alcatel Lucent Shares, subject to certain conditions. THE BOARD OF DIRECTORS OF ALCATEL LUCENT HAS DETERMINED THAT . The U.S. Offer is being made on the terms and subject to the conditions set forth in “The Exchange Offer” section of this exchange offer/prospectus beginning on page 60 and the related form of letter of transmittal. THE U.S. OFFER AND WITHDRAWAL RIGHTS FOR TENDERS OF ALCATEL LUCENT SHARES AND OCEANEs IN THE U.S. OFFER WILL EXPIRE AT 11:00 A.M., NEW YORK CITY TIME (5:00 P.M. PARIS TIME), ON (AS SUCH TIME AND DATE MAY BE EXTENDED, THE “EXPIRATION DATE”), UNLESS THE EXCHANGE OFFER IS EXTENDED. i Table of Contents THE DEADLINE FOR VALIDLY TENDERING AND WITHDRAWING ALCATEL LUCENT ADSs IN THE U.S. OFFER IS 5:00 P.M., NEW YORK CITY TIME ON THE U.S. BUSINESS DAY IMMEDIATELY PRECEDING THE EXPIRATION DATE, WHICH WILL BE (AS SUCH TIME AND DATE MAY BE EXTENDED, THE “ADS TENDER DEADLINE”), UNLESS THE U.S. OFFER IS EXTENDED. Nokia Shares are traded on NASDAQ OMX Helsinki Ltd. (the “Nasdaq Helsinki”) under the symbol “NOKIA” and Nokia ADSs are traded on the New York Stock Exchange (the “NYSE”) under the symbol “NOK.” On , the last trading day before the opening of the Exchange Offer, the closing price of Nokia Shares listed on the Nasdaq Helsinki was EUR (equivalent to USD based on the USD/EUR exchange rate on such date) and the closing price of Nokia ADSs on the NYSE was USD . Nokia has applied for the Nokia Shares (including the Nokia Shares to be issued in connection with the Exchange Offer) to be listed on Euronext Paris (the “Admission”). Nokia expects to request that Admission be approved to take effect following the completion of the Exchange Offer. In addition, Nokia will apply for listing of the Nokia Shares and Nokia ADSs to be issued in connection with the Exchange Offer on the Nasdaq Helsinki and the NYSE, respectively. Alcatel Lucent Shares are traded on Euronext Paris under the symbol “ALU” and Alcatel Lucent ADSs are traded on the NYSE under the symbol “ALU.” OCEANEs are traded on Euronext Paris, under the symbol “YALU” for the 2018 OCEANEs, “YALU1” for the 2019 OCEANEs and “YALU2” for the 2020 OCEANEs. On , the last trading day before the opening of the Exchange Offer, the closing price of Alcatel Lucent Shares on Euronext Paris was EUR (equivalent to USD based on the USD/EUR exchange rate on such date) and the closing price of Alcatel Lucent ADSs on the NYSE was USD and the latest reasonably available quotations for the OCEANEs was EUR (equivalent to USD ) for the 2018 OCEANEs, EUR (equivalent to USD ) for the 2019 OCEANEs and EUR (equivalent to USD ) for the 2020 OCEANEs. As promptly as practicable following completion of the Exchange Offer and subject to applicable law and Euronext Paris rules, Nokia intends to request Euronext Paris to delist the Alcatel Lucent Shares and OCEANEs from the regulated market of Euronext Paris. Nokia also intends, subject to applicable law, to cause Alcatel Lucent to terminate the deposit agreement in respect of the Alcatel Lucent ADSs (the “Alcatel Lucent deposit agreement”) and seek to delist the Alcatel Lucent ADSs from the NYSE and, when possible, to deregister the Alcatel Lucent Shares and Alcatel Lucent ADSs under the Exchange Act. SEE THE “RISK FACTORS” SECTION OF THIS EXCHANGE OFFER/PROSPECTUS BEGINNING ON PAGE 21 FOR A DISCUSSION OF IMPORTANT RISK FACTORS THAT YOU SHOULD CONSIDER BEFORE DECIDING WHETHER OR NOT TO TENDER YOUR ALCATEL LUCENT SECURITIES INTO THE U.S. OFFER. Nokia has not authorized any person to provide any information or to make any representation in connection with the U.S. Offer other than the information contained or incorporated by reference in this exchange offer/prospectus, and if any person provides any of this information or makes any representation of this kind, that information or representation must not be relied upon as having been authorized by Nokia. Nokia is not asking you for a proxy pursuant to this exchange offer/prospectus and you are requested not to send to Nokia a proxy in response hereto. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued in the transactions described in this exchange offer/prospectus or passed upon the adequacy or accuracy of this exchange offer/prospectus. Any representation to the contrary is a criminal offense. The date of this exchange offer/prospectus is , 2015. ii Table of Contents CERTAIN DEFINED TERMS Unless otherwise specified or if the context so requires in this exchange offer/prospectus: • “Admission” refers to Nokia’s application for the Nokia Shares (including the Nokia Shares to be issued in connection with the Exchange Offer) to be listed on Euronext Paris. • “ADS Tender Deadline” refers to the deadline for validly tendering and withdrawing Alcatel Lucent ADSs in the U.S. Offer, set for 5:00 P.M., New York City time on the U.S. business day immediately preceding the Expiration Date, which will be (as such time and date may be extended). • “Alcatel Lucent” refers to Alcatel Lucent, a French société anonyme. • “Alcatel Lucent ADSs” refer to American depositary shares each representing one Alcatel Lucent Share. • “Alcatel Lucent 2014 Form 20-F” refers to Alcatel Lucent’s Annual Report on Form 20-F for the year ended December 31, 2014 filed with the SEC on March 24, 2015. • “Alcatel Lucent Securities” refer to the Alcatel Lucent Shares, the Alcatel Lucent ADSs and the OCEANEs. • “Alcatel Lucent Shares” refer to ordinary shares, nominal value EUR 0.05 per share of Alcatel Lucent. • “Alcatel Lucent Stock Options” refer to options to acquire Alcatel Lucent Shares. • “AMF” refers to the French stock market authority (Autorité des marchés financiers). • “AMF General Regulation” refers to Article 236-3 of the General Regulation (Règlement général) published by the AMF. • “ATOP System” refers to the automated tender system of DTC. • “Completion of the Exchange Offer,” “completion of the U.S. Offer,” “completion of the French Offer” or “completion of the subsequent offering period” refer to settlement and delivery of the Nokia Shares to the holders of Alcatel Lucent Securities in accordance with the terms of the Exchange Offer and Conditions after announcement of the successful results of the French Offer by the AMF (taking into account the results of the U.S. Offer) or the results of the subsequent offering period, as applicable. • “Conditions” refer collectively to the Minimum Tender Condition and the Nokia Shareholder Approval. • “Convertible Bond” refers to Nokia’s EUR 750 million convertible bond issued in October 2012 and maturing in 2017. • “DTC” refers to The Depository Trust Company, the U.S. clearing and settlement system for equity securities. • “Exchange Offer” refers collectively to the U.S. Offer and the French Offer. • “Expiration Date” refers to the expiration date of the the U.S. Offer and withdrawal rights for tenders of Alcatel Lucent Shares and OCEANEs in the U.S. Offer, set for 11:00 A.M., New York City time (5:00 P.M. Paris time), on (as such time and date may be extended). • “French business day” refers to any day, other than a Saturday, Sunday or French public holiday. • “French Offer” refers to Nokia’s exchange offer in France to exchange 0.55 Nokia Share for every Alcatel Lucent Share, Nokia Share for every 2018 OCEANE, Nokia Share iii Table of Contents for every 2019 OCEANE and Nokia Share for every 2020 OCEANE, made pursuant to separate French Offer Documentation available to holders of Alcatel Lucent Shares and OCEANEs located in France (holders of Alcatel Lucent Shares and OCEANEs located outside of France may not participate in the French Offer except if, pursuant to the local laws and regulations applicable to those holders, they are permitted to participate in the French Offer). • “French trading day” refers to any day on which Euronext Paris is generally open for business. • “French Offer Documentation” refers to the French Offer documentation filed with the AMF. • “IFRS” refers to the International Financial Reporting Standards as issued by the International Accounting Standards Board. • “Mandatory Minimum Acceptance Threshold” refers to a number of Alcatel Lucent Shares representing more than 50% of the Alcatel Lucent share capital or voting rights, taking into account, if necessary, the Alcatel Lucent Shares resulting from the conversion of the OCEANEs validly tendered into the Exchange Offer. Refer to “Exchange Offer—Conditions to the Exchange Offer” for a description of how the Mandatory Minimum Acceptance Threshold is calculated. • “Memorandum of Understanding” refers to the Memorandum of Understanding dated April 15, 2015 between Nokia and Alcatel Lucent. • “Minimum Tender Condition” refers to the number of Alcatel Lucent Securities validly tendered in accordance with the terms of the Exchange Offer representing, on the date of announcement by the AMF of the results of the French Offer taking into account the results of the U.S. Offer, more than 50% of the Alcatel Lucent Shares on a fully diluted basis. • “MoU Business Day” refers to any day on which banking institutions are open for regular business in Finland, France and the United States which is not a Saturday, a Sunday or a public holiday. • “Nasdaq Helsinki” refers to NASDAQ OMX Helsinki Ltd. • “Nokia,” the “company,” “we,” “us” or “our” refers to Nokia Corporation, a Finnish corporation. • “Nokia ADSs” refer to American depositary shares each representing one Nokia Share. • “Nokia depositary” refers to Citibank, N.A., the depositary for the Nokia ADSs pursuant to a deposit agreement. • “Nokia 2014 Form 20-F” refers to Nokia’s Annual Report on Form 20-F for the year ended December 31, 2014 filed with the SEC on March 19, 2015. • “Nokia Shareholder Approval” refers to Nokia shareholders having approved the authorization for the Nokia board of directors to issue such number of new Nokia Shares as may be necessary for delivering the Nokia Shares offered in consideration for the Alcatel Lucent Securities tendered into the Exchange Offer and for the completion of the Exchange Offer. • “Nokia Shares” refer to shares of Nokia Corporation. • “NYSE” refers to the New York Stock Exchange. • “2018 OCEANEs” refer to EUR 628 946 424.00 Alcatel Lucent bonds convertible into new Alcatel Lucent Shares or exchangeable for existing Alcatel Lucent Shares due on July 1, 2018. • “2019 OCEANEs” refer to EUR 688 425 000.00 Alcatel Lucent bonds convertible into new Alcatel Lucent Shares or exchangeable for existing Alcatel Lucent Shares due on January 30, 2019. iv Table of Contents • “2020 OCEANEs” refer to EUR 460 289 979.90 Alcatel Lucent bonds convertible into new Alcatel Lucent Shares or exchangeable for existing Alcatel Lucent Shares due on January 30, 2020. • “OCEANEs” refer to the 2018 OCEANEs, the 2019 OCEANEs and the 2020 OCEANEs. • “Performance Shares” refer to restricted stock granted by Alcatel Lucent. • “Schedule TO” refers to the tender offer statement on Schedule TO. • “U.S. business day” refers to any day, other than a Saturday, Sunday or U.S. federal holiday or a day on which banking institutions are required or authorized by law or executive order to be closed in New York, New York. • “U.S. exchange agent” refers to Citibank, N.A. • “U.S. Offer” refers to the exchange offer to be made in the United States. v Table of Contents TABLE OF CONTENTS QUESTIONS AND ANSWERS ABOUT THE EXCHANGE OFFER x SUMMARY 1 The Companies 1 Summary of the Terms of the Exchange Offer 3 Treatment of Alcatel Lucent Stock Options and Performance Shares 6 Reasons for the Exchange Offer 6 Integration and Reorganization 8 Squeeze-Out 8 Reasons for the Alcatel Lucent Board of Directors’ View on the Exchange Offer 9 Opinion of the Financial Advisor to the Alcatel Lucent Board of Directors 9 Risk Factors 9 Nokia Shareholder Meeting 9 Trading in Alcatel Lucent Securities During and After the Exchange Offer Period 10 Accounting Treatment 10 No Appraisal Rights 10 Tax Considerations 10 Interests of Executive Officers and Directors of Alcatel Lucent in the Exchange Offer 11 Certain Relationships with Alcatel Lucent and Interests of Nokia in the Exchange Offer 11 Comparison of Rights of Holders of Nokia Shares and Alcatel Lucent Shares 11 Securities Prices 11 Regulatory Approvals for the Exchange Offer 12 No Solicitation of Alternate Proposals 12 Change in Alcatel Lucent Board Recommendation 12 Change in Nokia Board Recommendation 12 Termination of the Memorandum of Understanding 12 Termination Fees 13 COMPARATIVE DATA 14 SELECTED HISTORICAL CONSOLIDATED FINANCIAL INFORMATION 16 Selected Historical Consolidated Financial Information for Nokia 16 Selected Historical Consolidated Financial Information for Alcatel Lucent 17 SELECTED UNAUDITED PRO FORMA COMBINED FINANCIAL INFORMATION 19 RISK FACTORS 21 Risk Factors Relating to the Exchange Offer and the Squeeze-out 21 Risk Factors Relating to Nokia’s Business and Financing 30 Risk Factors Relating to Alcatel Lucent’s Business 30 Risk Factors Relating to the Proposed Sale of our HERE business 31 INDICATIVE TIMETABLE 32 THE TRANSACTION 33 Background of the Exchange Offer 33 Disclosure of Certain Information Relating to Alcatel Lucent 43 Reasons for the Exchange Offer 43 Reasons for the Alcatel Lucent Board of Directors’ View on the Exchange Offer 46 Opinion of the Financial Advisor to the Alcatel Lucent Board of Directors 46 Nokia Shareholder Meeting 46 Intentions of Nokia over the next twelve months 47 THE MEMORANDUM OF UNDERSTANDING 51 The Exchange Offer 51 Additional Exchange Mechanisms 51 Representations and Warranties 51 French Group Committee Consultation 52 vi Table of Contents Consents and Approvals 52 Conduct of the Business Pending the Exchange Offer 52 Nokia Shareholder Meeting 53 No Solicitation of Alternate Proposals 53 Change in Alcatel Lucent Board Recommendation 55 Nokia Board Recommendation 56 Change in Nokia Board Recommendation 56 Indemnification and D&O Insurance 57 Conditions to the Filing of the French Offer 57 Termination of the Memorandum of Understanding 58 Termination Fees 58 Standstill 59 Exchange Ratio Adjustment Mechanism 59 THE EXCHANGE OFFER 60 Terms of the Exchange Offer 60 Procedure for Tendering 66 Validity of Tenders 73 Announcement of Results 73 Settlement and Delivery of Securities 73 Treatment of Fractional Nokia Shares or Nokia ADSs 75 Share Issuance and Power of Attorney 76 Representations and Covenants of Tendering Holders 76 Certain Consequences of the Exchange Offer 79 Accounting Treatment 83 No Appraisal Rights 83 Fees and Expenses 83 Statutory Exemption from Certain U.S. Tender Offer Requirements 84 Matters Relevant for OCEANEs Holders 84 Legal Matters; Regulatory Approvals 87 Certain Relationships with Alcatel Lucent and Interests of Nokia in the Exchange Offer 89 Interests of Executive Officers and Directors of Alcatel Lucent in the Exchange Offer 91 Treatment of Alcatel Lucent Stock Options and Performance Shares 91 FINANCIAL ANALYSIS OF THE EXCHANGE OFFER 93 TAX CONSIDERATIONS 94 France Income Tax Consequences 94 United States Federal Income Tax Consequences 94 Finland 100 Finnish Income Tax Consequences of Ownership and Disposal of Nokia Securities 101 Finnish Transfer Tax 102 THE COMPANIES 103 Nokia 103 Alcatel Lucent 108 Organizational Structure 111 DESCRIPTION OF THE NOKIA SHARES AND ARTICLES OF ASSOCIATION 112 Shares and Share Capital of Nokia 112 Legislation Under Which Nokia Shares will be Issued 112 Summary of the Articles of Association of Nokia 112 Purchase Obligation 114 Overview of the Finnish Securities Market 116 The Finnish Book-Entry Securities System 117 DESCRIPTION OF THE NOKIA AMERICAN DEPOSITARY SHARES 120 Dividends and Distributions 121 vii

Description: