NAOS Emerging Opportunities Company Limited ACN PDF

Preview NAOS Emerging Opportunities Company Limited ACN

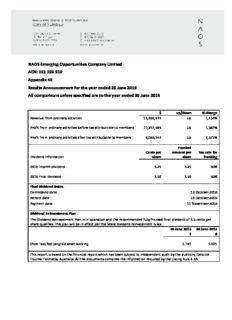

NAOS Emerging Opportunities Company Limited ACN: 161 106 510 Appendix 4E Results Announcement for the year ended 30 June 2016 All comparisons unless specified are to the year ended 30 June 2015 $ up/down % change Revenue from ordinary activities 13,000,673 Up 1,454% Profit from ordinary activities before tax attributable to members 11,237,685 Up 1,567% Profit from ordinary activities after tax attributable to members 8,063,747 Up 8,572% Franked Cents per amount per Tax rate for Dividend Information share share franking 2016 Interim dividend 3.25 3.25 30% 2016 Final dividend 3.50 3.50 30% Final Dividend Dates Ex-dividend date 19 October 2016 Record date 20 October 2016 Payment date 11 November 2016 Dividend Reinvestment Plan The Dividend Reinvestment Plan is in operation and the recommended fully franked final dividend of 3.5 cents per share qualifies. The plan will be in effect per the latest dividend reinvestment rules. 30 June 2016 30 June 2015 $ $ (Post Tax) Net tangible asset backing 1.181 1.071 This report is based on the financial report which has been subject to independent audit by the auditors, Deloitte Touche Tohmatsu Australia. All the documents comprise the information required by the Listing Rule 4.3A. NAOS EMERGING OPPORTUNITIES COMPANY LIMITED Annual Report 2016 ACN 161 106 510 CONTENTS Financial Record 02 Corporate Summary 03 Board of Directors 04 Chairman’s Letter 05 Investment Manager’s Review 06 Our Team 08 Corporate Governance Statement 09 Directors’ Report 11 Auditor’s Independence Declaration 16 Independent Auditor’s Report 17 Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2016 19 Statement of Financial Position as at 30 June 2016 20 Statement of Changes in Equity for the year ended 30 June 2016 21 Statement of Cash Flows for the year ended 30 June 2016 22 Notes to the Financial Statements 23 Directors’ Declaration 41 Additional Information 42 Corporate Information IBC Annual General Meeting AGM to be held at 11am (AEST) on Friday 18 November 2016 at Taylor Collison, Level 10, 167 Macquarie Street, Sydney NSW 2000 Our objective is to provide investors with genuine exposure to emerging companies with a long-term value focus regardless of market capitalisation and/or liquidity 01 FINANCIAL RECORD Net Tangible Assets 30 June 2016 30 June 2015 Undiluted NTA per share (pre-tax)*** $1.25 $1.07 Undiluted NTA per share (post-tax) $1.18 $1.07 Diluted NTA per share (pre-tax)* $1.25 $1.07 Diluted NTA per share (post-tax)* $1.18 $1.07 Share price $1.04 $1.00 Option price (expiring 1 February 2015) n/a n/a Option price (expiring 1 August 2015)** n/a $0.004 Dividend Dividend Information Cents per share Franked amount per share Tax rate for franking 2016 Interim dividend 3.25 3.25 30% 2016 Final dividend 3.50 3.50 30% Final Dividend Dates Ex-dividend date 19 October 2016 Record date 20 October 2016 Payment date 11 November 2016 Dividend Reinvestment Plan The Dividend Reinvestment Plan is in operation and the recommended fully franked final dividend of 3.5 cents per share qualifies. The plan will be in effect per the latest dividend reinvestment rules. * I n the calculation of diluted NTA per share, options expiring on 1 August 2015 are not considered to have a dilutive effect, as the average market price of ordinary shares of the Company during the year did not exceed the exercise price of the options. ** On 1 August 2015, all unexercised options expired. *** T he Net Tangible Assets backing of the Company’s shares is calculated, in accordance with ASX guidelines, by dividing the net tangible assets of the Company (net assets less tax assets and liabilities), at a particular date, by the number of shares on issue at that date. Portfolio Performance as at 30 June 2016 2 Years 3 Years Inception Inception 1 Month 6 Months 1 Year (p.a.) (p.a.) (p.a.) (nom.) NCC Investment Portfolio +2.97% +17.07% +24.77% +12.49% +18.51% +20.07% +84.22% Performance S&P/ASX Small Ordinaries –1.31% +6.94% +14.40% +7.19% +9.13% +2.33% +8.00% Accumulation Index (XSOAI) Outperformance Relative +4.28% +10.13% +10.37% +5.30% +9.38% +17.74% +76.22% to Benchmark Past performance is not an indicator of future returns. Performance shown is post all operating expenses but before fees and taxes. 02 NAOS Emerging Opportunities Company Limited Annual Report 2016 CORPORATE SUMMARY THE COMPANY BENCHMARK RISK NAOS Emerging Opportunities Company The Company compares its performance The Company invests in securities listed on Limited is a listed investment Company with the S&P/ASX Small Ordinaries the ASX and unlisted securities. The value and its shares are listed on the Australian Accumulation Index (XSOAI). of the shares and the income derived may securities Exchange (ASX: NCC). fall or rise depending on a range of factors. INVESTMENT MANAGER Refer to Section 4 of the Prospectus OBJECTIVE The Company has outsourced its of the Company and Note 17 of this The Company was established on investment management function to financial report. 6 November 2012 to invest primarily in NAOS Asset Management Limited a concentrated portfolio of listed entities (ACN 107 624 126) (Australian Financial MANAGEMENT AGREEMENT that are not included in the S&P/ASX 100 Services Licence Number 273529) (the The Company has an agreement with Accumulation Index with the objective to “Investment Manager”). NAOS Asset Management Limited for the provide investors with genuine exposure provision of management services, details to emerging companies with a long- CAPITAL STRUCTURE of which are contained at Note 16. term value focus regardless of market The Company’s capital structure capitalisation and/or liquidity, aiming to comprises Ordinary shares. provide a growing income stream franked to the maximum extent possible, and long-term capital growth to investors above the benchmark index, being the S&P/ASX Small Ordinaries Accumulation Index (ASX: XSOAI). 30 June 2016 30 June 2015 Total Assets and Net Tangible Assets (“NTA”) $ $ Total assets 60,322,421 54,707,585 Undiluted NTA per share (pre-tax) 1.25 1.07 Undiluted NTA per share (post-tax) 1.18 1.07 Diluted NTA per share (pre-tax) 1.25 1.07 Diluted NTA per share (post-tax) 1.18 1.07 Total shares on issue 46,918,297 46,918,297 INFORMATION ABOUT THE greatest opportunity for shareholders to NAOS believe there should always INVESTMENT MANAGER realise positive absolute returns in the form be a significant alignment of interests of capital growth and income generation between the managers of investments The Investment Manager of the over the long term. and shareholders. As such, in undertaking Company is NAOS Asset Management Limited (NAOS). All NAOS investment products have the implementation of the investment an absolute return focus. As such, strategy for the Company, the investment NAOS was established in 2005 and in implementing the strategy for the team seek only to invest in businesses focuses on providing investors with niche Company, the team place a primary focus that are led by proven management teams product offerings, in asset classes and on mitigating the risk of permanent loss with a clear alignment of interests to that sub-sectors where they often lack the of capital and assessing each investment of shareholders. Furthermore, NAOS time, resources or expertise to research opportunity on the basis of its potential Directors and employees are significant and invest in the products themselves. for long-term value add in the portfolio. investors in the vehicles they manage. NAOS adopts a high conviction, long- Given the approach adopted, it is unlikely Further information about NAOS can be term, value driven, long/short approach that the performance of the Company’s found at w w w.naos.com.au. to investing. The investment team look investment portfolio will present a to realise value over the medium to long high correlation to broader investment term by sourcing, selecting and combining market movements. investment opportunities that present the 03 BOARD OF DIRECTORS SEBASTIAN EVANS WARWICK EVANS DAVID RICKARDS Director Director Independent Chairman Sebastian Evans has been a Director of Warwick Evans has been a Director of the David has been a Director and Chairman of the Company since inception (6 November Company since inception (6 November the Company from 20 November 2012. 2012). He was appointed as Director on 2012). He was appointed as Director on David has over 25 years of equity market 6 November 2012. 6 November 2012. experience, most recently as an Executive Sebastian Evans is a Director of NAOS Warwick Evans has over 35 years of equity Director at Macquarie Group where David Absolute Opportunities Company markets experience, most notably as was head of equities research globally as Limited and the major shareholder and Managing Director for Macquarie Equities well as equity strategy since 1989 until Managing Director of the Investment (Globally) from 1991-2001 as well as he retired in mid-2013. David was also a Manager. He is also the Chief Investment being an Executive Director for Macquarie Consultant for the financial analysis firm Officer for both the NAOS Emerging Group. He is a Director of NAOS Absolute Barra International. Opportunities Company and the NAOS Opportunities Company Limited. He was He is a former Director and Treasurer at Absolute Opportunities Company. Prior also the founding Chairman and CEO of Bush Heritage Australia, a Director of to this he was an Investment Analyst at the Newcastle Stock Exchange (NSX). He NAOS Absolute Opportunities Company the Investment Manager, focusing on was also the Chairman of the Australian Limited and a Consultant emerging companies. Stockbrokers Association. Prior to these at Barra International. Sebastian holds a Masters of Applied positions he was an Executive Director at David holds a Masters of Business Finance majoring in Investment County NatWest. Administration majoring in Accounting Management, a Bachelor’s Degree Warwick holds a Bachelor’s degree in and Finance from the University of in Commerce, majoring in Finance Commerce majoring in Economics from Queensland as well as two Bachelor and International Business, and a the University of New South Wales. degrees, one in Engineering (Civil and Graduate Diploma in Management Structural) from the University of Sydney, from the Australian Graduate School of and a Bachelor’s degree in Science (Pure Management (AGSM). He also holds Mathematics and Geology). a Diploma in Financial Services and is RG146 Competent. 04 NAOS Emerging Opportunities Company Limited Annual Report 2016 CHAIRMAN’S LETTER Dear fellow Shareholders, Welcome to the 2016 Annual Report for the NAOS Emerging Opportunities Company Limited. For the financial year ended 30 June 2016, the Company recorded a record profit of $8.06 million, representing a significant increase on the prior period. The pre-tax NTA increased by 23.25c including the 6.25c of fully franked dividends paid over the same period. The strategy of offering a completely shareholders with a growing, predictable Fully Franked Dividend (CPS) benchmark unaware strategy whilst stream of dividends, franked to the providing concentrated exposure to maximum extent deemed appropriate by 9.0 emerging companies has continued to the Board of Directors. 8.0 provide excellent risk adjusted returns The Company continues to place to shareholders, well above that of the significant emphasis on providing quality 7.0 5 wider market. The Company continues to and value add communications to our 6.0 25 6.5 6.7 provide current and future shareholders shareholder base. The Directors believe 5.0 6. a Listed Investment Company that is true the monthly investment reports and to its investment philosophy of investing quarterly question and answer session 4.0 in emerging companies over a long term with the NAOS Chief Investment Officer 3.0 ifinvvee sytemaresn, tw hhoirlsizto mn aoinf tbaeintwinege tnh eth arebeil itayn d awrieth sionm thee t Lhies tmedo sInt vuessetfmule annt dC tormanpsapnayre nt 2.0 2.5 3.0 to hold a significant cash position of up space. To further improve our shareholder 1.0 to 100% in times where excellent risk communications, we will be holding 0.0 adjusted returns are not able to be sourced investor briefings in five of the capital FY13 FY14 FY15 FY16 by the Investment Manager. cities on a bi-annual basis. The Directors (part year) In its fourth year of operations the believe these briefings will allow both Fully Franked Dividend (CPS) Company continues to grow from the prospective and current shareholders perspective of both net assets and the the ability to meet with both the Board number of shareholders. The number of Directors and the wider team at the aligning our interests with those of all of shareholders that held equity in the Investment Manager, and allow them to shareholders of the Company. Company increased by 4% in FY16, and have answered any questions they may On behalf of the Board of Directors, notably this was without the assistance of have in regards to the Company and I would like to thank all staff of the any form of capital raisings, including the its operations. Investment Manager for their hard work issue of new shares through a Dividend As stated in previous years, the Board over the financial year. Reinvestment Plan. The net assets of the remains committed to managing the The Board is grateful for all shareholder business continue to increase with a post- capital base of the Company in a manner support through the year and we welcome tax net asset value of $55.40 million at the that provides the flexibility the Investment all new shareholders who joined the end of financial year 2016. Manager requires to maximise potential Company in the 2016 financial year. Dividends paid by the Company have shareholder returns over the long term. now grown for four consecutive years The Board continues in its commitment since listing in February 2013. For the to limit the size of the Company to financial year 2016 the Company will $150 million unless organic growth pay a fully franked dividend of $0.0675 increases the asset value over this amount. to shareholders. This represents an Importantly, all Directors of the Company increase of +3.85% over the previous year. were net acquirers of shares over the David Rickards The paramount focus of the Directors financial year, and the Directors hold a Chairman continues to be the ability to provide cumulative 3.44 million shares, further 25 August 2016 05 INVESTMENT MANAGER’S REVIEW Dear Fellow Shareholders, It is with great pleasure that I report to you after completion of the fourth year of operations for the NAOS Emerging Opportunities Company Limited (‘NCC’). The investment portfolio returned +24.77% for the year, which compared favourably to the Benchmark Small Ordinaries Accumulation Index (XSOAI) which returned +15.23%. This brings the performance of the investment portfolio to 84.22% since the Company’s inception in February 2013. “Pleasingly, almost all of Pleasingly, almost all of the nine number of well-known brands, such investments held at the beginning as ALDI, the Australian Federal the nine investments held of the financial year produced Government, and also worked with at the beginning of the positive absolute returns, and all Ebay in Europe on its social media of these investments remained in strategy. Moving forward it will be financial year produced the portfolio at the end of Financial key for EGG to manage the mix positive absolute returns” Year 2016. More importantly, the of potential acquisitions to help worst detractor to the portfolio expand existing brands as well as returned just –1.25%. continue to move the margin of the current businesses higher. If both of The major contributors to the these are successfully completed, portfolio performance through the EGG could increase its earnings financial year were Enero Group base significantly over the next (ASX: EGG), BSA Limited (ASX: 24 months. BSA) and Armidale Investments (ASX: AIK). Below is a short In 2016, BSA Group continued to summary of the progress these build on the success achieved in three companies have made FY2015. Over this financial year in FY2016 that has resulted in BSA moved from a turnaround this subsequent share price and recapitalisation project, appreciation, looking first at Enero to a business that has gained Group, which operates advertising further market share within and PR agencies in Australia, the telecommunication sector, Western Europe and the USA. specifically through the National Broadband Network (NBN), which As with many NCC investments has given the company an excellent Enero has reputable brands, a solid base to significantly grow its current balance sheet and an excellent revenue base over the next 2-3 management team. EGG has years. Due to the more technical been working towards increased nature of the telecommunications profitability through margin work recently won by BSA, we expansion to bring it in line with believe this will be higher margin levels achieved by many of its local than some of the work BSA was and global peers, i.e. 14-17% at previously completing. The key the EBITDA level. Pleasingly EGG for BSA has always been for it to was able to achieve an EBITDA lift its EBITDA margins as close margin of 11.64%, a significant to 5% as possible on the >$500 improvement on the sub <6% result million revenue base achieved in just two years ago. A degree of this FY16. When looking at comparable improvement can be attributed to companies such as Service Stream the revenue base which not only (SSM) EBITDA margins of >7% have stabilised but grew 3% year on year. been achieved, so we are confident A number of the Enero subsidiaries this can be achieved. won and completed work for a 06 NAOS Emerging Opportunities Company Limited Annual Report 2016 Finally, Armidale Investment Group CURRENT PORTFOLIO The portfolio at the end of the financial (ASX: AIK) made a significant amount of POSITIONING year was 98.5% invested across 10 progress over the year. Firstly, the small different holdings. The top-5 positions, It is the core of the NAOS philosophy to to medium business leasing unit called being BSA, AIK, EGG, My Net Fone (ASX: focus on the “controllable”. What we HAL finally secured a tier-1 bank funding MNF) and Lindsay Australia (ASX: LAU) mean by this, is that a NAOS investment arrangement after a number of years represented greater than 65% of the total should have characteristics that allow of persistence. This funding agreement portfolio, with the other five positions for a substantial share price re-rating will allow HAL to compete on larger making up the balance. The portfolio had to occur over the long term but with financing opportunities that are often 1.5% in cash and no active short positions. less company specific risk than most at lower rates than deals of <$100,000 investment opportunities. Such variables in value. Secondly AIK completed the The current portfolio positioning reflects include an existing revenue base, earnings acquisition of Platform Finance Group our belief that our core holdings remained growth through revenue and/or margin (PFG), a finance broker that mainly deals undervalued. Much of a company’s re- improvement, balance sheet flexibility, with the financing of automobiles with valuation does not come from earnings excellent management credibility and a small amount of equipment financing. growth but from the earnings multiple finally companies that are valued on This acquisition provides AIK the platform that investors are willing to pay for a today’s flat earnings profile and not the to focus on two strategic objectives, company’s earnings. growing earnings base that may eventuate namely scalability in the finance broking, in 3-5 years’ time. Posting what we As always, the NAOS investment team is and control over originators. Firstly the believed was a good result in FY2015, we looking to find potential new investments equipment financing industry completes asked our shareholder base to be patient that will form the foundation of our over $32 billion of financing every year. with the NCC portfolio at that time. All of portfolio in future years. Predictably, Yet unlike the mortgage broking and these companies are still in the portfolio given the current valuation backdrop new insurance broking industries, equipment today, many with significantly higher share investment ideas are potentially harder to financing is yet to go through the process prices. Ultimately these share prices have come by than at any time over the last 10 of disintermediation. This acquisition gives re-rated because management teams have years. In saying this, the team believes we AIK the platform to consolidate the finance executed and thus profitability has grown. are close to initiating on 2-3 new positions broking space and achieve the numerous Just because share prices have increased in the coming months and we look benefits that come with scale. Secondly, does not necessarily mean it’s time to forward to sharing the details with you the main factors that affect the growth sell. Many of the best performing stocks later in the new financial year. of a leasing business are funding and continue to be consistent performers origination. With the acquisition of PFG for quite a few years, such examples On behalf of all the NAOS team, I would and potentially further broking businesses include CSL, TPM, ALU, VOC, MNF, SRX like to thank shareholders for their in FY17, AIK will have control over the and MFG. Being extremely mindful of continued support. originators that feed business to HAL, company specific valuations and company which will thus allow the leasing book to specific risks, I believe that a majority grow significantly over time. of our current holdings still represent excellent risk adjusted return opportunities over a 12-36-month period. Sometimes it Sebastian Evans is your winners that you continue to hold Managing Director/Portfolio Manager that often represent your best investment NAOS Asset Management Limited decisions. SUMMARY OF MONTHLY PORTFOLIO RETURNS % 10 9 8 7 6 5 4 3 2 1 0 -1 -2 -3 -4 -5 -6 -7 -8 07

Description: