MP311 Victor Khanye AFS 2014-15 audited PDF

Preview MP311 Victor Khanye AFS 2014-15 audited

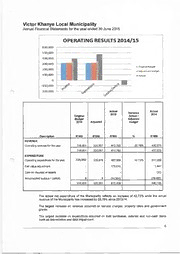

Victor Khanye Local Municipality Financial statements for the year ended 30 June 2015 Victor Khanye Local Municipality Financial Statements for the year ended 30 June 2015 General Information Legal form of entity Municipality Nature of business and principal activities Provision of municipal services Mayoral committee Executive Mayor Makhabane EN Councillors Ward 1 -Nhlapo MM Ward 2 -Yeko BD Ward 3 -Mlambo LN Ward 4 -Buda KV Ward 5 -Ngoma HM (Chief Whip) Ward 6 -Shabangu ET Ward 7 -Zulu ZJM Ward 8 -Bath DJ Ward 9 -Nkabinde SS Proportional -Mahlangu SH Proportional -Makhabane EN Proportional -Maluleka TM Proportional -Rautenbach M Proportional -Shabalala B Proportional -Nyathi BJ Proportional -Mokoena BN Proportional -Segone RK Grading of local authority Grade 3 Medium Capacity MP311 Accounting Officer Mashele F (Acting) Chief Finance Officer (CFO) Barnard C Registered office Municipal Building c/o Samuel and Van der Walt Street Delmas 2210 Business address Municipal Building c/o Samuel and Van der Walt Street Delmas 2210 Auditors Auditor General of South Africa Victor Khanye Local Municipality Financial Statements for the year ended 30 June 2015 Index The reports and statements set out below comprise the financial statements presented to the provincial legislature: Index Page Accounting Officer's Responsibilities and Approval 4 Accounting Officer's Report 5 Statement of Financial Position 15 Statement of Financial Performance 16 Statement of Changes in Net Assets 17 Cash Flow Statement 18 Appropriation Statement 19 -22 \ Accounting Policies 23 -47 Notes to the Financial Statements 48 -90 The following supplementary information does not form part of the financial statements and is unaudited: Appendixes: Appendix A: Schedule of External loans 91 Appendix B: Analysis of Property, Plant and Equipment 92 Appendix C: Segmental analysis of Property, Plant and Equipment 98 Appendix D: Segmental Statement of Financial Performance 99 Appendix E(1 ): Actual versus Budget (Revenue and Expenditure) 100 Appendix E(2): Actual versus Budget (Acquisition of Property, Plant and Equipment) 102 Appendix F: Disclosure of Grants and Subsidies in terms of the Municipal Finance 103 Management Act Appendix G(1 ): Budgeted Financial Performance (revenue and expenditure by standard 104 classification) Appendix G(2): Budgeted Financial Performance (revenue and expenditure by municipal vote) 106 Appendix G(3): Budgeted Financial Performance (revenue and expenditure) 107 Appendix G(4): Budgeted Capital Expenditure by vote, standard classification and funding 109 Appendix G(5): Budgeted Cash Flows 111 2 Victor Khanye Local Municipality Financial Statements for the year ended 30 June 2015 Index Abbreviations COID Compensation for Occupational Injuries and Diseases CRR Capital Replacement Reserve DBSA Development Bank of South Africa SA GAAP South African Statements of Generally Accepted Accounting Practice GRAP Generally Recognised Accounting Practice GA MAP Generally Accepted Municipal Accounting Practice HOF Housing Development Fund IAS International Accounting Standards ~ IMFO Institute of Municipal Finance Officers IPSAS International Public Sector Accounting Standards ME's Municipal Entities MEC Member of the Executive Council MFMA Municipal Finance Management Act MIG Municipal Infrastructure Grant (Previously CMIP) 3 Victor Khanye Local Municipality Financial Statements for the year ended 30 June 2015 Accounting Officer's Responsibilities and Approval The accounting officer is required by the Municipal Finance Management Act (Act 56 of 2003), to maintain adequate accounting records and is responsible for the content and integrity of the financial statements and related financial information included in this report. It is the responsibility of the accounting officer to ensure that the financial statements fairly present the state of affairs of the municipality as at the end of the financial year and the results of its operations and cash flows for the period then ended. The external auditors are engaged to express an independent opinion on the financial statements and was given unrestricted access to all financial records and related data. The financial statements have been prepared in accordance with Standards of Generally Recognised Accounting Practice (GRAP) including any interpretations, guidelines and directives issued by the Accounting Standards Board. The financial statements are based wpon appropriate accounting policies consistently applied and supported by reasonable and prudent judgements and estimates. The accounting officer acknowledges that he is ultimately responsible for the system of internal financial control established by the municipality and place considerable importance on maintaining a strong control environment. To enable the accounting officer to meet these responsibilities, the accounting officer sets standards for internal control aimed at reducing the risk of error or deficit in a cost effective manner. The standards include the proper delegation of responsibilities within a clearly ' defined framework, effective accounting procedures and adequate segregation of duties to ensure an acceptable level of risk. These controls are monitored throughout the municipality and all employees are required to maintain the highest ethical standards in ensuring the municipality's business is conducted in a manner that in all reasonable circumstances is above reproach. The focus of risk management in the municipality is on identifying, assessing, managing and monitoring all known forms of risk across the municipality. While operating risk cannot be fully eliminated, the municipality endeavours to minimise it by ensuring that appropriate infrastructure, controls, systems and ethical behaviour are applied and managed within predetermined procedures and constraints. The accounting officer is of the opinion, based on the information and explanations given by management, that the system of internal control provides reasonable assurance that the financial records may be relied on for the preparation of the financial statements. However, any system of internal financial control can provide only reasonable, and not absolute, assurance against material misstatement or deficit. The accounting officer has reviewed the municipality's cash flow forecast for the year to 30 June 2016 and, in the light of this review and the current financial position, he is satisfied that the municipality has or has access to adequate resources to continue in operational existence for the foreseeable future. Although the accounting officer are primarily responsible for the financial affairs of the municipality, they are supported by the municipality's external auditors. The external auditors are responsible for independently reviewing and reporting on the municipality's financial statements. The financial statements have been examined by the municipality's external auditors and their report is presented on page 5. The finan · s a em set out on pages 5 to 90, which have been prepared on the going concern basis, were approved by nting officer on O November 2015 and were signed on its behalf by: 4 Victor Khanye Local Municipality Annual Financial Statements for the year ended 30 June 2015 ACCOUNTING OFFICER'S REPORT 1. INTRODUCTION The 2014/15 financial year posed many challenges and obstacles which had to be addressed and accommodated by the limited financial and other resources. The budget and the IDP are aligned with the vision and imperatives of national government, which are to address service delivery backlogs and the following strategic areas, were focussed on during the 2014/15 budget: • The eradication of backlogs and investment in infrastructure for basic services and growth • Economic growth and development that is shared and creates sustainable jobs • Building safer, more secure and more sustainable communities • The deepening of democracy • Financial viability and management of resources • A caring and effective government • Institutional capacity and transformation To budget for improved service delivery and then subsequently realising operational efficiency while it is also ensured that the deliverables are attained in a sustainable manner, has been a huge challenge during the 2014/15 financial year. The challenge of addressing unlimited needs within the constraints of limited resources has necessitated a change in the way we do business to ensure that we stretch our resources to the maximum. 2. REVIEW OF OPERAT ING RES UL TS The 2014/15 budget of Victor Khanye was approved by Council on the 29th of May 2014. 2.1 General Details of the 2014/15 operating results and classification of revenue and expenditure are included in the Statement of Financial Performance. A graphical presentation of the operating results are shown in the graph below: The overall operating results for the year ending 30 June 2015 are as follows: 5 Victor Khanye Local Municipality Annual Financial Statements for the year ended 30 June 2015 OPERATING RESULTS 2014/15 600,000 500,000 400,000 300,000 • Original Budget 200,000 • Adjustment budget 100,000 • Actual 0 -100,000 i--~~-o~e~~~~~~--~~ '<:' e~ -200,000 Actual Actual Variance 2015 2014 Original Actual I Budget Adjusted 2015 Adjusted budget Description R'OOO R'OOO R'OOO % R'OOO REVENUE Operating revenue for the year 316,851 320,587 412,782 28.76% 430,670 316,851 320,587 412,782 437,670 EXPENDITURE Operating expenditure for the year 316,842 320,578 457,568 42.73% 517,259 Fair value adjustment - - 176,615 1,447 Gain on disposal of assets - - - (32) Accumulated surplus I (deficit) 9 9 (44,954) (78,490) 316,851 320,587 615,439 440,185 The actual net expenditure of the Municipality reflects an increase of 42, 73% while the actual revenue of the Municipality has increased by 28, 76% since 2013/14. The largest increase on revenue occurred on service charges, property rates and government grants. The largest increase on expenditure occurred on bulk purchases, salaries and non-cash items such as depreciation and debt impairment. 6 Victor Khanye Local Municipality Annual Financial Statements for the year ended 30 June 2015 2.2 Operating Revenue The following graph indicates a breakdown of the largest categories of revenue. OPERATING REVENUE 2014/15 • Property rates aservice charges • Rental Income a Interest received a Government grants a Other income 2.3 Operating expenditure The graph below indicates the break down per main expenditure group. OPERATING EXPENDITURE 2014/15 • Personnel 2% • Remuneration of councillors • Finance costs 36% • Impairment I impairment reversals 3% a Repairs and maintenance • Bulk purchases · Depreciation • 0th er expenses 7 Victor Khanye Local Municipality Annual Financial Statements for the year ended 30 June 2015 Remuneration The actual expenditure on remuneration expressed as a percentage of the total expenditure shows an increase from 20,71% in 2013/14 to 24,01% in 2014/15. The major cause of this increase was the increase in the employee costs of R 15,3 million. These figures have a large impact on the going concern capabilities of the municipality. The total remuneration cost and the allocation of individual items in a remuneration package differ from municipality to municipality for example; certain municipalities are more contract intensive whilst others might be more labour intensive. The target for remuneration as a percentage of expenditure is 30%. Description 2014/15 2013/14 R'OOO R'OOO Total operating expenditure 457,568 462,614 Total operating revenue 412,782 437,670 Employee remuneration 109,882 95,828 Ratio: % of total expenditure 24.01% 20.71% Ratio: % of total revenue 26.62% 21.89% % in/decrease in remuneration 14.67% 27.47% PERSONNEL COSTS vs OPERATING EXPENDITURE 600,000 500,000 400,000 300,000 • Salaries • Total expenses 200,000 100,000 2014/15 2013/14 8 Victor Khanye Local Municipality Annual Financial Statements for the year ended 30 June 2015 2.4 Government grants and subsidies The following table and graph show the amounts received in terms of grants, contributions and subsidies from the Central Government and the Mpumalanga Provincial Government, which have been included in the total revenue: Description 2014/15 2013/14 Equitable Share 59,142,000 53,533,000 Financial Management Grant 1,600,000 1,550,000 Integrated National Electrification programme 2,470,000 1,200,000 Municipal Infrastructure Grant 21,483,617 23,633,000 Municipal Systems Improvement Grant 934,000 890,000 EPWP Grant 1,823,000 2,135,960 MISA Grant 2,207,999 Grants from District Municipality 6,841,503 12,902,709 96,502,119 95,844,669 GOVERNMENT GRANTS & SUBSIDIES 2014/15 • Equitable Share • Financial Management Grant • Integrated National Electrification programme • Municipal Infrastructure Grant I 7% • Municipal Systems Improvement Grant 2% • EPWP Grant I 2% _M ISA Grant I I Grants from District Municipality 2%2% -Department of Human Settlements I L __ 9