Mitt and Ann Romney's 2010 federal income tax return PDF

Preview Mitt and Ann Romney's 2010 federal income tax return

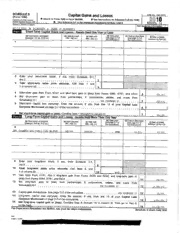

$10.40 rrzrentsite rom. ona Ree sees 7 18S Use Only Do not wre or stapein this space tne, { | Address,|n WILLARD M ROMNEY and SSN] 2st retum, spouse's ret name and iniiat | Lest name ber See separate | L Home address (pumbar and sroa) you have a P.O. box sce structs, Bot ne wrowctone, | E Make sr the SH) above a ace ‘ esas BEL aL ee Speen Election Campaign pe Chock here if you, or your spouse fling joint, want $3 to goto this fund Tor El vow fx ] spouse Filing Status * [| sesle + LT tient of rouse wth qualigng perc, See insracions) 2 [C] marie ing joint (oven i ony one had income) she auaivig poon Isa cis but not your dependent, ene ths Check onlyone 3 Married filing separately. Enter spouse's SSN above ‘child's name here. D> box and fullname here. p> 5 _Qualitying widow(er) with dependent child Exemptions ® [2] Yourset. 1 soméone can claim you asa dependent do net checkbox 6a vy snes 2 pik | suowe etter We otehiren © Dependents: = Dopendons | Waytcwamrany | Stein nea vaone | sollscotynon | eau) | Sheet eater seperation Fonte ieee tetctons pstontg Dependents on 82 ete pabanie Sos = — @_ Jol qurber of eemnpions cine, 21s Donen apa te abe be 7 Wages, salaries peo. Atach FomiWi2, Le incon 8a Taxable interest. Attach Schedule B if required . . . Leen ie 3,295, 727. ‘Atach Form(s) ‘Tax-exempt interest. Do not include on line@a..,...,,. Lab 557. Maateeae 9a Ordinary dividends. Attach Schedule B if required « eet Ss oe 4,923, 348. b Qualiied dividends... .,..,,,. STMT. 1. Lan] 3,327.67. 7 TOSO-R Ita 10 Taxable refunds, credits, oF offsets of slate andiecalincome toes... STMT, 3, [10 826, 064 Af Alinony e080 oss ses ce eee seas ec ellle 1" 12 Business income or (loss). Attach Schedule C or C-EZ.... wee teens 42 593,996. fetaw2 13 Capital gain or (oss) Attach Schedule D if required. tf not required, check here ® 12,573,249 ‘see page 20. 14 Other gains or (losses). Attach Form 4797 epee eee eect: 1,482. 452 imAdstrbutions,...., . [188 Tecable amount - 48a Pensions and annuites, - |. [16a Taxable amount | ence oy.do 17 Retial realestate, royates, partnerps, S corporations, tusis, ot. Ailch Schedule’ © =279, 884. ‘not attach, any 18 ~—- Farm income or (loss). Attach Schedule F eee, parmart AB®. 49 Unemployment compensation... « Eine Form ‘oso. 20a Social security benofts, . .. [20a Db Tacable amount | 24 Other income. List type and amount _, Sere G38. 22 _ Combine the amounts in the far right column for lines 7 through 21. This is your total income D> 21, 661, 344. ee - 23. Educalorepenses... . , Adjusted uy 24 Certain business expenses of reservists, performing ats, and Gross fee-basis government offeiels, Attach Form 2108 or 2106-62 . | 24 Income 25 Health savings account deduction. Attach Form 8869... ... . | 26 26 Moving expenses. Atach Form3603............./ | 26 27 One-half of seltemploymentiax Ach Scheawe Se... ..[-27| 14, 576. 28 Soltemployed SEP, SIMPLE, and quate plans... 0s sss «28 ' 29° Seltemployed heath insurance deduction... [ze 30 Panaly on early withdrawal of'savngs 1... ss. | 30 318 Alimony id. Recipients SSN > ata 32 IRAdeduction... 2. aes ~ 182 33° Student oan interest deduction. =. aceamn 34 Tutlon and foes, attach Form 8817. = Life 38 Domestic production activities deduction. Attach Form 8903 . L358: 61. 36 Add lines 23 through 31a and 32 through 35.2... eevee 14,837. 37__ Subtract line 36 from tine 22 This is your adjusted gross income |. 21, 646, 507. gy Disclosure, Privacy Act, and Paperwork Reduction Act Nolce, see separate instructions. Fem 1040 (2010) ervey ey GOLDMAN SACHS HEDGE FUND PARTNERS, LLC. ‘SCHEDULE K-1 SUPPORTING SCHEDULES BOX 15, CODE P- OTHER CREDITS U.S. WITHHOLDING TAX ‘TOTAL OTHER CREDITS. MALT TTEE THE ANN D ROPES & GRAY LLP. 8 | Scum guront soneouss Tara Meno AL TEE THE AWD ROPES BORA soeouneseurommcsoeouss RADFORD MALT TEE THE AN O ROPES GRATHAP BOX 15, CODE P - OTHER CREDITS U.S, WITHHOLDING TAX TOTAL OTHER CREDITS | GOLDMAN SACHS HEDGE FUND PARTNERS Ill, LLC SCHEDULE K-1 SUPPORTING SCHEDULES BOX 15, CODE P - OTHER CREDITS. U.S, WITHHOLDING TAX ‘TOTAL OTHER CREDITS PARNER a = R.BRADFORD MALT & ANN ROMNEY C/O R BRADFORD MALT | GOLDMAN SACHS HEDGE FUND PARTNERS, LLC SCHEDULE K:1 SUPPORTING SCHEDULES BOX 15, CODE P - OTHER CREDITS U.S. WITHHOLDING TAX TOTAL OTHER CREDITS | — BRADFORD MALT & ANN ROMNEY ROPES & GRAY LLP. Fom 1940 2010) WELD, IN_D ROMNEY a... Tax and 38 Amount from ine 97 (eclusted goss income)... .. «zrev TT ve ~+[ 98 | 21, 646, 507. Credits 39a check {{__| vou ware born before January 2, 1946, Blind | Tote boxes | it ‘Spouse wes born before January 2, 1946, Blind, checked =P 3: DI your spouse itemizes on a separate return or you were a duarstatus allen check hers Be 306, 40 ltemized deductions (from Schedule A) or your standard deduction (se: structions)... [40 4,519,140, 41° Subiract line 40tromine38 ~ i . -4tl 17, 127, 367. 42 Exemptions, Multiply $3,650 by the number ontine 6d, eee 11) ie g00- 43 Taxable mcome, Subtract ine 42 from ine 41 fling 42s moran the ont.” 43. 77,130, 067. 44 Tax (000 instructions). Check # any taxis trom: @ L_} Form(s) a5%4 | j444._2, 873,054, 45 Alternative minimum tax (see instructions). Attach Form 6251, , 145} _232, 989. 46 Addtines 4400045 ves sees esevcesee sere lel, [as 371067043. 47 Foreign tex cred Atiach Form 10ifrequied » s+ +++ «++ [SP 129, 697. 48 Credit for child and dependent care expenses, tach Fam 2441 . . . [48 49 Education credits from Form 8863, ine 23, , , on i 50 Retirement savings contributions credit. Attach Form 8880 ee 51 Chi tax credit (ooo instructions)... sv eee wee secs c J LSt 52 Residential energy credits. Atach Form 5608-0. sv. ss ss [52 53 omentstenton: al] 300 wll et01 el] 33 i 84 Add lines 47 through 59. These are your total cred... > ss veeeeeee. [Sef 329,698, | S$ Subtract line 54 from line 46. H line 64's more than line 46, enter -0- » aeiesse pl 55] 2,976, 345. Other 56. Sott-amploymenttax Atach ScheduleSE -+ e+ see saaevseveutnectersre e+] 56 29,151, Taxes 57 Unreported social securty and Medicare taxtrom Form: aL_] 4137 bL_lagta....... 87 38 Additional taxon IRAs, other qualiid rtrement plans, ec, Atach Form S329 reqied .» -. . | 58 59 al_Troems)w-2, vox b LX! scnecule H cL Form st05,tine16 ...... 2.88 4270 80 _Add lings 55 through 69. This is your fotal tax.+ ++ + + mgt eee sorsss pl eel 3,009, 766, Payments 61 Federal income tax withheld trom Forms W-2 and 1089... ....L64 112.| 82 2010 estimated tax paymants and amount appiled trom 2008 reurn . | 62 | 1, 369, 095. 83, Making werk pay credit. Altoch Schedule M ses v eves «| 62 64a Earned income credit(EIC) .--.. +... Sse. [_b Nontaxable combat pay election. . 5 Accitional child tax erect. Atach Ferm 8812. +.» 86 American opportunity erel from Form 8863, fre 14. 87 Fiestme homebuyer exe from Form 5405, line 10 - 68 Amount paid with request for exersiontofie sss. es 250,000. 60 Excess social security and tert RRTA taxwithheld | 70. Credit for fedora! exon fuss, tach For 4136.2 2 2112) Po 14 Creat irom Form: aL] 2:9 »L_] soso el] asoraL—l sees Lt 72 Addines 61, 62, 63, 4a, and 65 through 71. These er your ftal payments... 4,619, 207. Refund 73 fine 72 e more man tine 60, subtract ine 60 trom Ine 72. Tiss the amount you everpaid [78.11 60S aa Ta.a Armount of ine 73 you ded to you. It Form 6968 is attached, check here... L-] [Taw Direct depost? Bf Routing number iI bot} Checking ‘Savings So ams A Accont mde ET] T 75 Amount of ine 75 ya wantanpied te your 207 coumated x [7s] 17609, 241. Amount 76 Amount you owe. Subst line 72 from tne 60. For dotale en how to pay, ses nenatins --—p| 78 You Owe_77_Estimated tax penalty (eee instructions), vs. ss. wees tr7] ‘Third Party °° Yu want to sllow another person to alscuss this return wih te IRS (sea instructons)?L2i] es, Complete belon Designee Pury 2._.FERELEY hey are Vue, core, and corpwie, Dodarslon o proper (ohana it Be See page el (eed, Pini/ype preparers namo Paid Pojarer DANIEL 2. Use Only Fimsaiiess 125 HIGH STREET ras BOSTON MA 02710 ez 5.000 Form 1040 57} SCHEDULE A (Form 1040) arent of the Troan Inara venue ones 0) Itemized Deductions D> Attach to Form 1040, See instructions for Schedule A (Form 1040), (OME No, 1545-0074 Name(s) shown on Forrn 1040 WILLARD _M ROMNEY & ANN D ROMNEY Caution. Do not include epensesrembursd opal by oes. Belg Selene oe 5 2 Enteramount fom Fem oa Oa Dental ‘040, me 36 : Expenses 3 Motil ne 3 by7.5% (07 veeeeuee 3 at 4 Subtract line 3 from fine 1. If line 3 is more than ine 1, enter -0- as a: es 4 NONE ' State and focal (eheck only one box}: a g a Income taxes, or ae eens [8 672,444. | Taxes You —o L_|cenera sates tas Paid 6 Real estate taxes (see instructions)... 2... | 8 226,356. | | 7 New motor vehide tas fom tne 11, of ie werkshost o0 bas fr cea wl cone 250) kp youchedksebousb sens sa z 8 Other taxes. List ype and amount D_ u 146. 9_Addlines § through... 7 wie. 98,946. Interest 10 Homemorgage interest and point reported to you on Form 1098 You Paid 11 Hone morgage interest nt reported o you on Fem 1098. pad {o the person from whom you bought the home se insulins «and show thatpomons name, lentigo, and aress De Note. 7 Your mortgage Interest 12 Points not reported to you on Form 1086, Seo instructions deduction may forspeciaies 6... AR Bele (82 43 Mfrigage insurance premiums asinstucions) | [43 irettcOMe 44 invetent interest Aah Fom 4852 1 raquted. (ee Instwions) [44 51,444 STM 5 18 Add lines 10 through 14 = $1,444. | Gifts to 16 Git by cash or check. f you mad ! Charity more, see instructions . . SEE, STATEMENT, 5. {4 1,525,167. Ityeumadea 17 Other than by cash or check, I any gift of $250 or more, ait and got 9 00 instructions. You must attach Form 8289 if over $500. [17 1,458,807. STME 6 benest for t, 18 Carryover from prior year |... cre bl} fe Seelstructons. 49 Add lines 16 through 18...) |. ea caer err 2,983,974 Gasualty and Theft Losses 20 Casualty or thet loss(es)_Altach Form 4664, (See nstructons.) «ss sy eevee eee vJob Expenses 21 Unreimbursed employe persoe - job travel unlon duck, joo and Certain ‘education, oc. Attach Fom 2108 or 2106-2 if requied. (See Miscalaneous —iggtucione) Pecustcns 22 Tax preparation fees... , apes 23. Other epenses - invesment, see depost box ec. List typo and amount EE_STATEMENT. 1,017,706. 1,017, 106 / Maly tne 25 by 2% (02) Lag] __432, 930. | Subtract ine 26 from fine 24. ine 26 is more than ine 24, enter recente 584,776. ‘Other - from list in instructions. List ype anc emount > _ : | 26 Total 29 Add the amounts in the far right column for ines 4 trough 28, Also, entar Wis amount \ Hemized a 4,519,140. Deductions 39 it you elect to itemize deductions even though they ae fess than your standard ees j deduction, check here , oe Per pacer ara Fis = if For Paperwork Reduction Act Notice, see Form 1040 instructions. 188 dts00 2000 ey ‘Schedule A (Form 1040) 2040 SCHEDULE B (OMB No, 1545-0074 (Form 1040A of 1040) Interest and Ordinary Dividends 2010 ——— Attach to Form 10404 or 1040. > See instructions on back. ‘AStechment ‘aera Rocaanes Saence No, 08, Name(s) shows or rum Youzgocial secury number WILLARD Mf ROWNEY ¢ ANN D ROMNEY =—_—— Parti 1 List name of payer. If any interest is from a sellerfinanced Mortgage and the buyer used the property as a personal residence, see instructions on back and ist this interest first. Also, show that buyer's social security number and address (See instuctions = —~. ‘on back and the instructions for Form 1040A, ot Form 1040, line 8a.) SEE STATEMENT. 8 Interest Note, tfyou fecetved& Form 4098-17 Form 098-00, supsite Statement rom ' broxerage i, isttne tens name as he payer and ener he tte infer - Shownen'tiet’, 2 Add'the amounis oa 3,295, 727. : ues iran DQG) Seegnr tors farm 3 Excludable interest on series EE and 1 US. savings bonds issued after’ 1989. Attach Form 8815 4° Subtract line 3 from line 2. Enter the result ‘and on Form 1040A, ‘or Form 1040, fine 82... se ee yes ae seesseseee P14 | 3,295,727, Note. If line 4 is over $1,500, you must complete Part Il. ‘Amount Partil 5 Listname of payer 2 172. Ordinary 7 2,122. Dividends 2 572. (See instructions - 88. ‘on back and the - 1, 524, 581. instructions for 7 3770227. aie 3,008,710. line 8a) “| 5 5,715. RS FUND 1-8 LP. 7 4,154, Note. f you - received a Form 1099-D1V or S substitute - Statement from a brokerage frm, fist the rms - name as the z payor andenter the ordinary Svidends shown = ‘on that form, - 7 6 Add the amounis on line 8. Enter the total here ene sess. hl 6} 4,923,348, You must complete this part if you (a) had over $1,500 of taxable interest or ordinary dividends, (by had a Ves! N Part Ill foreign account; or (¢) received a distribution from, or were a grantor of, or a transferor to, aforeign trust, _ |S} No Foreign 7a At any time during 2010, did you have an interest in or a signature or other authority over @ z Ascaunts financial account in a foreign country, such as a bark account, securties account, or other and Trusts _‘financial account? See instructions on back for exceptions and filing requirements for Form TD F 9022.1 $5 Sacspsssepsnece (<0 bit"ve instructions on During 2010, did you receive a distribution from, or were you the grantor ef, or transferor to, Be back.) foreign trust? If "Yes," you may have to file Form 3520. See instructions on back... se xX For Paperwork Reduction Act Notice, see your tax return instructions. Schedule B (Form 040A or 1040) 2010 CES cateto 2000 * INCLUDES, 889 = OF a — OBLIGATION INT. FROM SCH K-1 SOUR SCHEDULE C Profit or Loss From Business (Form 1040) . {Sole Proprietorship) weriaaicl ts > Parinorships, joint ventures, oe gonerally must fle Form 1085 or 185-5, InfomatRaweue sues @o)| B Attach to Form 1040, 1040NR, or 1041. Soe Instructions for Schedule ¢ Form 1040, | SEAN, og Name of propor - WILLARD M ROMNEY ‘A Principal business or profecslan,Indiing product or sande Ges navuconsy INDEPENDENT ARTISTS, WRITERS. PERFORMER; © Business name, fro eeparao buses name, leave lank AUTHOR/SPEAKING FEES E Business address (including suite or room no.) p> City, town of post ofc, stat, and ZIP code F Accounting method: ¢1)[X] Cash (@)[_] Accrual (3) L_] Other (speci) » _ © Dia you "materially paricioae” in the operation ofthis business during 2010? IN" ee nations far nl oa bases Hf you startad or acquited his business during 2010, check hate Income 1 Gross reps or sales. Caution. So insrutlone and check tho box ‘This income was reported to you on Form We? andthe "Staluory employee"box REE STATEMENT 9 ‘on that form was checked, or ‘* ‘You aré a member of a qualified joint venture reporting only rental real estate" * ” a 4 528,871. income not subject fo self-employment tax. Also see mstructions for limit on losses. 2 Returns andalowancos eee eee . cece 3 Subtractiine 2from iinet le i Dt! 4 Cost of goods sold (rom line 42 cn page 2). |... eeeeees 5 Gross profit. Subtract line 4 from line 3, . speceiersianeions vatugetenm @ earincosn & Other income, including federal and stato gasoline o fuel txcret or rend (See insnicfons) | | | | 7. Gross income, Add lines § and6 , en Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising... LB. 9,000.]18 Officcemense .. Le] 9 Car ond truck expenses ooo 19 Pension and proft-sharng pans | | Instructions). . soe xe) 3 20 Rent or lease 662 instructions): 10 Commissions andfees.... . . | 410 39,756,| a Vehicles, machinery, and equipment 11. Contract labor (eee instructions)” [44 ‘Other business property, |, 42 Depletion 2... 2.2... [42 21 Repairs and maintenance | | | || 48 Depreciation and section 178 22 Supplies (not included in Pa iy” expense deduction (nol 23 Tawsandiicenses || included in Part Ml) (Gee 24 Travel, meals, and entertainment: ee instructions), . 2... LAS. a Travel nae wees [da 14 Employee benefit programs bb Deductible mess and (otnerthan on tine 18)... entertainment (see instructions), 2b. 415 Insurance (other than heath) | | 25 ules... a 25 16 interes: 26 Wages (less employment cred) 26 a Mortgage (peid to banks, etc.) - 27 Other expenses (fem ine 4 on botter 1b page2). 417 Legal and professional sornvices . ANP 7 28 Total expenses before expenses for business use of home, Add lines 8 through 27 29 Tentative profit or (loss). Subtract ine 28 from line 7, 30 Expenses for business use of your home. Attach Form 8829... 31 Net profit or loss). Subtract line 30 from fine 28, ¢ Ifa profit, enter on both Form 1040, line 12, and Schedule SE, line 2, or on Form 4040NR, line 13 (if you checked the box on line 4, see instructions). Estates and trusts, enter on Form 1044, line 3. © If aloss, you must go to line 32. 480,115. 32 MW you have a loss, check the box that deseribes your investment inthis activity (see instructions). * I'you checked 32a, enter the loss on both Fortn 1040, fine 12, and Schedule SE, line 2, or on Form 1040NR, line 13 (if you checked the box on line 1, see the fre 31 instructions). Estates and 32a |_| an investment is etch trusts, enter on Form 1044, line 3. 32b |_| Some invesiment's not + Ifyou checked 32b, you must attach Form 6188. Your loss may be limited att For Paperwork Reduction Act Notice, see your tax return instructions, ‘Schedule © (Form 1040) 2010 GXdr90 2.000 Schedule C (Form 1940)2010 WELLARD M_ROMNEY 33 Cost of Goods Sold (see instructions) Method(s) used to value closing inventory: a Cost b Lower of cost or market e ther (attach explanation) 34 Was there any change in determining quantities, costs, or valuations between epening and closing inventory? c "Yes\"attach eplanaton sss. Raeenandinn sevess Elves Dx] no 35 Inventory at beginning of year. If ferent from lst year's closing ventory, alach omienaton | 38. 36 Purchases less cost of items withdrawn for personaluse | A Lee roe 387 Gost of labor. Do not include any amounts paid to yourself |, a beceeee ee bt 38 Materias and supplies wee lees veeeeee ee [38 39 Other cos aoe : Ct con el 40 Add lines 35 through 39 | | sees a pee eee pees ++. [so 41 Inventory at end ofyear ve _ wieiniese <cneese aoe [ 42, Cost of goods sold. Subtract line 41 from line 40. Enter the reeuthere and on gege tylined ........ «| 43 Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562. 43 When did you place your vehicle in service for business purposes? (month, day, year) De 44 Of the totat number of miles you drove your vehicle during 2010, enter the number of miles you used your vehicle for: Business 1b Commuting (s00intrctons)_ _¢ Other _ 45 Was your vehicle available for personal use ding oftly hours? . 6 ceveeeee EC] ves [no 46 Do you (or your spouse) have ancther vehicle avalale for personal use? . , . . . beeen . Elves ne 474 Do you have evidence to support your deduction? .. . .. eee teveeeseee Ldves [Jno bf "Yes.is the evidence writen? » oe ‘Other Expenses. List below business expenses 48 Total other expenses. Enter here and on page i, line 27. ‘Schedule © (Form 4040) 2010 8A de0120 2.000