MassMutual Artistry Variable Annuity PDF

Preview MassMutual Artistry Variable Annuity

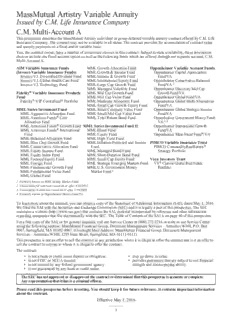

MassMutual Artistry Variable Annuity Issued by C.M. Life Insurance Company C.M. Multi-Account A ThisprospectusdescribestheMassMutualArtistryindividualorgroupdeferredvariableannuitycontractofferedbyC.M.Life InsuranceCompany.Wenolongersellthecontract.However,wecontinuetoadministerexistingcontracts.Thecontractprovidesfor accumulationofcontractvalueandannuitypaymentsonafixedand/orvariablebasis. You,thecontractowner,haveanumberofinvestmentchoicesinthecontract.Subjecttostateavailability,theseinvestment choicesincludeonefixedaccountoptionaswellasthefollowingfundswhichareofferedthroughourseparateaccount,C.M. Multi-AccountA. AIMVariableInsuranceFunds MMLGrowthAllocationFund OppenheimerVariableAccountFunds (InvescoVariableInsuranceFunds) MMLGrowth&IncomeFund OppenheimerCapitalAppreciation InvescoV.I.DiversifiedDividendFund MMLIncome&GrowthFund Fund/VA InvescoV.I.HealthCareFund1 MMLInternationalEquityFund OppenheimerConservativeBalanced InvescoV.I.TechnologyFund MMLLargeCapGrowthFund Fund/VA2 MMLManagedVolatilityFund OppenheimerDiscoveryMidCap Fidelity®VariableInsuranceProducts MMLMidCapGrowthFund GrowthFund/VA Fund MMLMidCapValueFund OppenheimerGlobalFund/VA Fidelity®VIPContrafund®Portfolio MMLModerateAllocationFund OppenheimerGlobalMulti-Alternatives MMLSmallCapGrowthEquityFund Fund/VA MMLSeriesInvestmentFund MMLSmallCompanyValueFund OppenheimerGlobalStrategicIncome MMLAggressiveAllocationFund MMLSmall/MidCapValueFund Fund/VA MMLAmericanFundsCore MMLTotalReturnBondFund OppenheimerGovernmentMoneyFund/ AllocationFund VA3 MMLAmericanFunds®GrowthFund MMLSeriesInvestmentFundII OppenheimerInternationalGrowth MMLAmericanFunds®International MMLBlendFund Fund/VA Fund MMLEquityFund OppenheimerMainStreetFund®/VA MMLBalancedAllocationFund MMLHighYieldFund MMLBlueChipGrowthFund MMLInflation-ProtectedandIncome PIMCOVariableInsuranceTrust MMLConservativeAllocationFund Fund PIMCOCommodityRealReturn® MMLEquityIncomeFund MMLManagedBondFund StrategyPortfolio MMLEquityIndexFund MMLShort-DurationBondFund MMLFocusedEquityFund MMLSmallCapEquityFund VoyaInvestorsTrust MMLForeignFund MMLStrategicEmergingMarketsFund VY®ClarionGlobalRealEstate MMLFundamentalGrowthFund MMLU.S.GovernmentMoney Portfolio MMLFundamentalValueFund MarketFund MMLGlobalFund 1 FormerlyknownasInvescoV.I.GlobalHealthCareFund. 2 Unavailableforcontractsissuedonorafter4/30/2012. 3 Unavailableincontractsissuedonorafter1/19/2008. Tolearnmoreaboutthecontract,youcanobtainacopyoftheStatementofAdditionalInformation(SAI),datedMay1,2018. WefiledtheSAIwiththeSecuritiesandExchangeCommission(SEC)anditislegallyapartofthisprospectus.TheSEC maintainsawebsite(http://www.sec.gov)thatcontainstheSAI,materialincorporatedbyreferenceandotherinformation regardingcompaniesthatfileelectronicallywiththeSEC.TheTableofContentsoftheSAIisonpage39ofthisprospectus. ForafreecopyoftheSAI,orforgeneralinquiries,callourServiceCenterat(800)272-2216orwritetoourServiceCenter usingthefollowingaddress:MassMutual,DocumentManagementServices–AnnuitiesW360,P.O.Box9067,Springfield, MA01102-9067.(OvernightMailAddress:MassMutual,DocumentManagementServices–AnnuitiesW360,1295State Street,Springfield,MA01111-0111) Thisprospectusisnotanoffertosellthecontractinanyjurisdictionwhereitisillegaltoofferthecontractnorisitanofferto sellthecontracttoanyonetowhomitisillegaltoofferthecontract. Thecontract: ‰ isnotabankorcredituniondepositorobligation. ‰ maygodowninvalue. ‰ isnotFDICorNCUAinsured. ‰ providesguaranteesthataresubjecttoourfinancial ‰ isnotinsuredbyanyfederalgovernmentagency. strengthandclaims-payingability. ‰ isnotguaranteedbyanybankorcreditunion. TheSEChasnotapprovedordisapprovedthecontractordeterminedthatthisprospectusisaccurateorcomplete. Anyrepresentationthatithasisacriminaloffense. Pleasereadthisprospectusbeforeinvesting.Youshouldkeepitforfuturereference.Itcontainsimportantinformation aboutthecontract. EffectiveMay1,2018 1 Table of Contents Index of Special Terms 3 Withdrawals 20 RighttoTakeLoans 21 Contacting the Company 4 Expenses 22 Overview 4 InsuranceCharges 23 MortalityandExpenseRiskCharge 23 Table of Fees and Expenses 6 AdministrativeCharge 23 AnnualContractMaintenanceCharge 23 The Company 8 ContingentDeferredSalesCharge(CDSC) 23 FreeWithdrawals 24 Ownership of the Contract 8 PremiumTaxes 25 Owner 8 TransferFee 25 Annuitant 8 IncomeTaxes 25 Beneficiary 8 FundExpenses 25 BeneficiaryIRA 8 The Income Phase 25 Age 9 AnnuityOptions 27 HowWeDetermineAgeofAnnuitant,Owner andBeneficiary 9 Death Benefit 28 Additional Purchase Payments 9 Taxes 31 AllocationofPurchasePayments 10 Other Information 36 Replacement of Life Insurance or TerminalIllnessBenefit 36 Annuities 10 Distribution 36 Assignment 37 Right to Cancel Your Contract 11 UnclaimedProperty 37 VotingRights 37 Investment Choices 11 ChangestotheContract 38 TheSeparateAccount 11 SuspensionofPaymentsorTransfers 38 TheFunds 11 TerminationofContract 38 Addition,Removal,ClosureorSubstitution Anti-MoneyLaundering 38 ofFunds 15 OurAbilitytoMakePaymentsUnderthe CompensationWeReceivefromFunds,Advisers Contract 38 andSub-Advisers 15 OurFinancialStatements 39 TheFixedAccount 16 ComputerSystemFailuresandCybersecurity 39 Contract Value 16 LegalProceedings 39 BusinessDaysandNon-BusinessDays 16 Table of Contents of the Statement of Sending Request in Good Order 17 Additional Information 39 Transfers and Transfer Programs 17 Appendix A 43 GeneralOverview 17 CondensedFinancialInformation 43 TransfersDuringtheAccumulationPhase 17 LimitsonFrequentTradingandMarketTiming Activity 18 TransfersDuringtheIncomePhase 19 TransferPrograms 19 2 Index of Special Terms Wehavetriedtomakethisprospectusasreadableandunderstandableforyouaspossible.Bytheverynatureofthecontract, however,certaintechnicalwordsortermsareunavoidable.Wehaveidentifiedthefollowingassomeofthesewordsorterms. Thepagethatisindicatedhereiswherewebelieveyouwillfindthebestexplanationforthewordorterm. Page AccumulationPhase 4 AccumulationUnit 16 Annuitant 8 AnnuityDate 25 AnnuityOptions 27 AnnuityPayments 25 AnnuityUnitValue 26 Claims-PayingAbility 38 ContractYear 18 FreeWithdrawals 24 GoodOrder 17 IncomePhase 25 PurchasePayment 9 QualifiedContract 31 SeparateAccount 11 ServiceCenter 4 Sub-Account 11 TaxDeferral 5 Tax-ShelteredAnnuity 29 3 Contacting the Company YoumaycontactusbycallingtheMassMutualCustomerServiceCenter(ourServiceCenter)at(800)272-2216Monday throughFridaybetween8a.m.and8p.m.EasternTime.Youmayalsocontactusbyvisitingwww.massmutual.com/contact-us. Additionally,youmaywritetoourServiceCenterusingthefollowingaddress:MassMutual,DocumentManagementServices– AnnuitiesW360,P.O.Box9067,Springfield,MA01102-9067ortoourovernightmailaddressatMassMutual,Document ManagementServices–AnnuitiesW360,1295StateStreet,Springfield,MA01111-0111. Overview Thefollowingisintendedasasummary.Pleasereadeachsectionofthisprospectusforadditionaldetail. WenolongerselltheMassMutualArtistryvariableannuitycontract.However,wecontinuetoadministerexistingcontractsand wecontinuetoacceptpurchasepaymentstoexistingcontracts,subjecttocertainrestrictions.See“AdditionalPurchase Payments.” Thisannuityisacontractbetween“you,”theowner,and“us,”C.M.LifeInsuranceCompany(“C.M.Life”orthe“Company”). Thecontractisintendedforretirementsavingsorotherlong-terminvestmentpurposes.Thecontractisdesignedprimarilyfor useinannuitypurchaseplansadoptedbypublicschoolsystemsandcertaintax-exemptorganizationspursuanttoSection403(b) oftheInternalRevenueCodeof1986,asamended(IRC).Theseplansaresometimescalled“tax-shelteredannuities”or “TSAs.”Subjecttostateavailability,thecontractwasalsosoldtogovernmentalentitiespursuanttoIRCSection457(b). Inexchangeforyourpurchasepayments,weagreetopayyouanincomewhenyouchoosetoreceiveit.Youdesignatethe dateonwhichtheincomeperiodbegins.Thatdatemustbeatleast30daysfromwhenyoupurchasethecontract.Thecontract hastwophases– theaccumulationphaseandtheincomephase.Yourcontractisintheaccumulationphaseuntilyoudecideto beginreceivingannuitypayments.Duringtheaccumulationphaseweprovideadeathbenefit.Onceyoubeginreceiving annuitypayments,yourcontractenterstheincomephase. ContractType Thecontractdescribedinthisprospectusisanindividualorgroupdeferredvariableannuity. Thecontractprovidesforaccumulationofcontractvalueandannuitypaymentsonafixed and/orvariablebasis. TheProspectusandthe TheprospectusandSAIdescribeallmaterialtermsandfeaturesofyourcontract.Certain Contract non-materialprovisionsofyourcontractmaybedifferentthanthegeneraldescriptioninthe prospectusandtheSAI,andcertainridersmaynotbeavailablebecauseoflegalrequirements inyourstate.Seeyourcontractforspecificvariationssinceanysuchstatevariationwillbe includedinyourcontractorinridersorendorsementsattachedtoyourcontract. AnnuityOptions Wemakeannuitypaymentsbasedontheannuityoptionyouelect.Whenyouelectanannuity optionyoualsoelectamonganumberoffeatures,including,butnotlimitedto:duration, numberofpayees,paymentstobeneficiaries,andwhetherpaymentswillbevariableand/or fixedpayments.See“TheIncomePhase.” InvestmentChoices Youcanchoosetoallocateyourpurchasepaymentsamongvariousinvestmentchoices. Subjecttostateavailability,yourchoicesincludetheunderlyingfundsandonefixedaccount. See“InvestmentChoices.” Withdrawals Subjecttocertainrestrictions,youmayperiodicallymakepartialwithdrawalsofyour contractvalue.Ifyoumakeafullwithdrawalofyourcontractvalue,allyourrightsunderthe contractwillbeterminated.Incometaxes,taxpenaltiesandacontingentdeferredsales charge(CDSC)mayapplytoanywithdrawalyourequest.See“Withdrawals,”“Expenses– ContingentDeferredSalesCharge”and“Taxes.” Transfers Subjecttocertainrestrictions,youmayperiodicallytransfercontractvalueamongavailable investmentchoices.See“TransfersandTransferPrograms.” DeathBenefit Abeneficiarymayreceiveabenefitintheeventofyourdeathpriortotheincomephase. Oncetheincomephasecommences,paymentsupondeathmaybeavailabletobeneficiaries dependingontheannuityoptionelected.See“DeathBenefit”and“TheIncomePhase.” 4 Fees Yourcontractvaluewillbesubjecttocertainfees.Thesechargeswillbereflectedinyour contractvalueandmaybereflectedinanyannuitypaymentsyouchoosetoreceivefromthe contract.See“Expenses”and“TableofFeesandExpenses.” Taxation TheInternalRevenueCodeof1986,asamended(IRC),hascertainrulesthatapplytothe contract.Thesetaxtreatmentsapplytoearningsfromthecontract,withdrawals,death benefitsandannuityoptions.See“Taxes.” TaxDeferral Youaregenerallynottaxedoncontractearningsuntilyoutakemoneyfromyourcontract. Thisisknownastaxdeferral.Taxdeferralisautomaticallyprovidedbytax-qualified retirementplans.Thereisnoadditionaltaxdeferralprovidedwhenavariableannuity contractisusedtofundatax-qualifiedretirementplan.Investorsshouldonlyconsiderbuying avariableannuitytofundaqualifiedplanfortheannuity’sadditionalfeaturessuchas lifetimeincomepaymentsanddeathbenefitprotection. GroupContracts Wemayissuethecontractasanindividualorgroupvariableannuitycontract.Inthosestates whereweissueagroupcontract,weissuecertificatestoindividuals,andtheseindividualsare consideredparticipants.Thecertificateissubjecttothetermsofthegroupcontractunder whichweissuethecertificate.Youmaybecomeaparticipantunderthegroupcontractby completinganapplicationandhavingitforwardedtousalongwithaninitialpayment. Thecertificateweissueindicatestheparticipant’srightsandbenefitsunderthegroup contract.Termsofthegroupcontractarecontrolling. Theparticipant,asanowner,mayexerciseallrightsandbenefitsofthecertificatewithoutthe consentofthegroupcontractowner.Unlesswestateotherwise,theownerofthecertificate underagroupcontractandtheownerofanindividualcontracthavethesamerightsand benefits.Asaresult,theterm“contract”meanseitheranindividualdeferredvariableannuity oracertificateissuedunderthegroupdeferredvariableannuity. RighttoCancelYour Youhavearighttoexamineyourcontract.Ifyouchangeyourmindaboutowningyour Contract contract,youcangenerallycancelitwithintencalendardaysafterreceivingit.However,this timeperiodmayvarybystate.See“RighttoCancelYourContract.” OurClaims-Paying Anyguaranteeswemakeunderthecontractaresubjecttoourfinancialstrengthandclaims- Ability payingability.See“OtherInformation–OurAbilitytoMakePaymentsUndertheContract.” 5 Table of Fees and Expenses Thefollowingtablesdescribethefeesandexpensesyoupaywhenbuying,owning,andsurrenderingthecontract.Inaddition tootherfeesandexpensesshownbelow,premiumtaxesmayalsoapply,butarenotreflectedbelow. I. Thefirsttabledescribesthefeesandexpensesthatyouwillpayatthetimethatyoutransferthevaluebetween investmentchoices,orsurrenderthecontract.Wedonotdeductasaleschargewhenwereceiveapurchasepayment, butwemayassessacontingentdeferredsaleschargeasnotedbelow. OwnerTransactionExpenses Current Maximum TransferFee $0 Thelesserof $20or2%ofthe amount transferred. LoanOriginationFee $01 $351 ContingentDeferredSalesCharge (asapercentageofamountwithdrawnorappliedtocertainannuityoptions2) 8% 8% ContingentDeferredSalesChargeSchedule ContractYear 1 2 3 4 5 6 7 8 9 10andlater Percentage 8% 8% 7% 6% 5% 4% 3% 2% 1% 0% 1 Currently,wedonotdeductachargefromyourcontractifyoutakealoanunderyourcontract.However,wereservetherighttodeductachargenotto exceed$35fromyourcontractvalueasaloanoriginationfeeshoulditbecomenecessaryforustoseekreimbursementforexpensesrelatedtothe administrationofcontractloans. 2 SeeAnnuityOptionsEandFin“TheIncomePhase–AnnuityOptions.” II. Thenexttabledescribesfeesandexpensesyouwillpayperiodicallyduringthetimeyouownthecontract,not includingunderlyingfundfeesandexpenses. PeriodicContractCharges Current Maximum AnnualContractMaintenanceCharge $ 0 $ 60 SeparateAccountAnnualExpenses (asapercentageofaverageaccountvalueintheseparateaccountonanannualizedbasis) MortalityandExpenseRiskCharge 1.03% 1.25% AdministrativeCharge 0.15% 0.25% TotalSeparateAccountAnnualExpenses 1.18% 1.50% AnnualFundOperating Expenses Whileyouownthecontract,ifyourassetsareinvestedinanyofthesub-accounts,youwillbesubjecttothefeesandexpenses chargedbythefundinwhichthatsub-accountinvests.Thetablebelowshowstheminimumandmaximumtotaloperating expenseschargedbyanyofthefunds,expressedasapercentageofaveragenetassets,fortheyearendedDecember31,2017 (beforeanywaiversorreimbursements)1.Moredetailconcerningeachfund’sfeesandexpensesthatyoumayperiodicallybe chargedduringthetimethatyouownthecontractiscontainedineachfundprospectus.Currentandfutureexpensesmaybe higherorlowerthanthoseshown. Charge Minimum Maximum TotalAnnualFundOperatingExpensesthataredeductedfromfundassets,includingmanagementfees, 0.43% 1.75% distribution,and/or12b-1fees,andotherexpenses. 1 Thefundexpensesusedtopreparethistablewereprovidedtousbythefunds.Wehavenotindependentlyverifiedsuchinformationprovidedtousbyfunds thatarenotaffiliatedwithus. Theinformationabovedescribesthefeesandexpensesyoupayrelatedtothecontract.Forinformationoncompensationwe mayreceivefromthefundsandtheiradvisersandsub-advisers,see“InvestmentChoices–CompensationWeReceivefrom Funds,AdvisersandSub-Advisers.”Forinformationoncompensationwepaytobroker-dealerssellingthecontract,see “OtherInformation–Distribution.” 6 ExamplesUsingCurrent andMaximum Expenses TheseExamplesareintendedtohelpyoucomparethecostofinvestinginthecontractwiththecostofinvestinginother variableannuitycontracts.Thesecostsincludecontractownertransactionexpenses,contractfees,separateaccountannual expenses,andfundfeesandexpenses.TheExamplesassumethatnoloanhasbeentaken. ExampleIassumesthatyouwithdrawallyourcontractvalueattheendofeachyearshown. ExampleIIassumesyoudonotwithdrawanyofyourcontractvalueattheendofeachyearshown,orthatyoudecidetobegin theincomephaseattheendofeachyearshownandwedonotdeductacontingentdeferredsalescharge.(Currentlythe incomephaseisnotavailableuntil30daysafteryoupurchaseyourcontract). BothExampleIandExampleIIassume: ‰ thatyouinvest$10,000inthecontractforthetimeperiodsindicated, ‰ thatyouallocateittoasub-accountthathasa5%grossreturneachyear, ‰ thateitherthecurrentormaximumfeesandexpensesinthe“TableofFeesandExpenses”apply,and ‰ thatyouselectedoneoftwosub-accounts: 1)theonethatinvestsinthefundwiththemaximumtotaloperatingexpenses,or 2)theonethatinvestsinthefundwiththeminimumtotaloperatingexpenses. ExamplesUsingCurrentExpenses. Basedontheaboveassumptions,yourcostswouldbeasshowninthefollowingtable. Youractualcostsmaybehigherorlower. ExampleI ExampleII Years 1 3 5 10 1 3 5 10 Sub-Accountwithmaximumtotaloperatingexpenses $1,030 $1,569 $2,027 $3,219 $293 $897 $1,527 $3,219 Sub-Accountwithminimumtotaloperatingexpenses $ 908 $1,198 $1,395 $1,879 $161 $500 $ 861 $1,879 ExamplesUsingMaximumExpenses. Basedontheaboveassumptions,yourcostswouldbeasshowninthefollowing table.Youractualcostsmaybehigherorlower. ExampleI ExampleII Years 1 3 5 10 1 3 5 10 Sub-Accountwithmaximumtotaloperatingexpenses $1,074 $1,703 $2,250 $3,670 $342 $1,041 $1,763 $3,670 Sub-Accountwithminimumtotaloperatingexpenses $ 953 $1,336 $1,631 $2,392 $210 $ 647 $1,111 $2,392 Theexamplesusingcurrentexpensesdonotreflectanannualcontractmaintenancecharge.Theexamplesusingmaximum expensesreflecttheannualcontractmaintenancechargeof$60asanannualchargeof0.17%. Theexamplesdonotreflectanypremiumtaxes.However,premiumtaxesmayapply. Theexamplesshouldnotbeconsideredarepresentationofpastorfutureexpenses.Youractualexpensesmaybehigheror lowerthanthoseshownintheexamples.Theassumed5%annualrateofreturnishypothetical.Actualreturnsmaybegreater orlessthantheassumedhypotheticalreturn. Thereisanaccumulationunitvaluehistoryin“AppendixA–CondensedFinancialInformation.” Thereisinformationconcerningcompensationpaymentswemaketosalesrepresentativesinconnectionwiththesaleofthe contractsin“OtherInformation–Distribution.” 7 The Company Inthisprospectus,the“Company,”“we,”“us,”and“our”refertoC.M.LifeInsuranceCompany(C.M.Life).C.M.Lifeisa whollyownedstocklifeinsurancesubsidiaryofMassachusettsMutualLifeInsuranceCompany(MassMutual).C.M.Life provideslifeinsuranceandannuitiestoindividualsandgrouplifeinsurancetoinstitutions.MassMutualanditssubsidiaries provideindividualandgrouplifeinsurance,disabilityinsurance,individualandgroupannuitiesandguaranteedinterest contractstoindividualandinstitutionalcustomersinall50statesoftheU.S.,theDistrictofColumbiaandPuertoRico. ProductsandservicesareofferedprimarilythroughMassMutual’sdistributionchannels:MassMutualFinancialAdvisors, DirecttoConsumer,InstitutionalSolutionsandWorkplaceSolutions. MassMutualisamutuallifeinsurancecompanydomiciledintheCommonwealthofMassachusetts.C.M.Life’shomeofficeis locatedat100BrightMeadowBoulevard,Enfield,Connecticut06082-1981. Ownership of the Contract Owner Inthisprospectus,“you”and“your”refertotheowner.Theownerisnamedattimeofapplication.Theownermustbean individual,unlessthecontractisissuedunderIRCSection457(b),inwhichcasetheownermustbeanon-naturalentity.We willnotissueacontracttoyouifyouhavepassedage85asofthedateweproposedtoissuethecontract.Themaximumissue ageforthecontractandcertainofitsridersmaybereducedinconnectionwiththeofferofthecontractthroughcertain broker-dealers.Youshoulddiscussthiswithyourregisteredrepresentative. Astheownerofthecontract,youexerciseallrightsunderthecontract.Theownernamesthebeneficiary. Ifyoupurchasedthecontractasatax-qualifiedcontract,yourrightsinthecontractmaybesubjecttorestrictionsunderthe plandocuments. Contractsunderqualifiedplans,includingsection457deferredcompensationplans,generallymustbeheldbytheplan sponsororplantrustee.ExceptforTSAsandIRAs,anindividualcannotbetheownerofacontractheldtofundaqualified plan.Therefore,theindividualscoveredbythequalifiedplanhavenoownershiprights. Annuitant Theannuitantisthepersononwhoselifewebaseannuitypayments.Youdesignatetheannuitantatthetimeofapplication. Wewillnotissueacontracttoyouiftheproposedannuitanthaspassedage85asofthedateweproposedtoissuethecontract. Inorderforthecontracttoqualifyasatax-shelteredannuityoranindividualretirementannuity,youmustbenamedasowner andannuitant.Wewillusetheageoftheannuitanttodetermineallapplicablebenefitsunderacontractownedbyanon- naturalperson. Beneficiary Thebeneficiaryistheperson(s)orentityyounametoreceiveanydeathbenefit.Younamethebeneficiaryatthetimeof application.Youmaychangethebeneficiaryatanytimebeforeyoudie.Tochangeanirrevocablebeneficiary,wemust receivewrittenauthorizationonourformingoodorderatourServiceCenterfromtheirrevocablebeneficiary. IfyouaremarriedandyourcontractisissuedunderanERISAplan,yourabilitytonameaprimarybeneficiaryotherthanyour spouseisrestricted. Beneficiary IRA Beneficiary,Inherited,Legacyor“Stretch”IRAsarealltermsusedtodescribeanIRAthatisusedexclusivelytodistribute deathproceedsofanIRAorotherqualifiedinvestmenttothebeneficiaryoverthatbeneficiary’slifeexpectancyinorderto meettherequiredminimumdistribution(RMD)rules.Uponthecontractowner’sdeathunderanIRAorotherqualified contract,abeneficiary(ies)maygenerallyestablishaBeneficiaryIRAbyeitherpurchasinganewannuitycontractorinsome circumstances,byelectingtheBeneficiaryIRApayoutoptionunderthecurrentcontract.Untilwithdrawn,amountsina BeneficiaryIRAorotherqualifiedcontractcontinuetobetaxdeferred.Amountswithdrawneachyear,includingamountsthat arerequiredtobewithdrawnundertheRMDrules,aresubjecttotax.Foralistoftheeligibilityrequirements/restrictions,see “DeathBenefit–BeneficiaryIRAElection.” 8 Age HowWe Determine Age of Annuitant,Owner andBeneficiary Inthisprospectustheterm“age,”exceptwhendiscussedinregardstospecifictaxprovisions,isdefinedas“insuranceage,” whichisaperson’sageonhis/herbirthdaynearestthedateforwhichtheageisbeingdetermined.Thismeanswecalculate youragebasedonyournearestbirthday,whichcouldbeeitheryourlastbirthdayoryournext.Forexample,age80is generallytheperiodoftimebetweenage79years,6monthsand1dayandage80and6months. Additional Purchase Payments WenolongerselltheMassMutualArtistryvariableannuitycontract.However,wedocontinuetoadministerexisting contracts,andyoumaycontinuemakingadditionalpurchasepaymentstoyourcontract,subjecttothelimitsdescribedinthis section. Theminimumamountweacceptedforaninitialpurchasepaymentwas: ‰ $200bythefirstcontractanniversarydate,foracontractpurchasedwithsalaryreductionpayments;or ‰ $2,000foracontractpurchasedthroughadirectassettransferfromanotherfinancialinstitutionoroneofouraffiliates orthroughnon-salaryreductionpayments. Additionalpurchasepaymentscanbemadetothecontract.However,additionalpurchasepaymentsoflessthan$25are subjecttoourapproval. ForcontractsissuedonorafterMay1,2010,themaximumamountofcumulativepurchasepaymentsweacceptwithoutour priorapprovalis$1.5million. ForcontractsissuedpriortoMay1,2010,themaximumamountofcumulativepurchasepaymentsweacceptwithoutourprior approvalisbasedonyouragewhenweissuedthecontract.Themaximumamountis: ‰ $1.5millionuptoage75;or ‰ $500,000ifolderthanage75oriftheownerisanon-naturalperson. Ageisasofthenearestbirthday.Forexample,age80isgenerallytheperiodoftimebetweenage79years,6monthsand 1dayandage80and6months.See“Age.” ForcontractsissuedinNewJersey,themaximumamountofcumulativepurchasepaymentsweacceptwithoutourprior approvalis$1.5million. Youcanmakeadditionalpurchasepayments: ‰ bymailingacheck,thatclearlyindicatesyournameandcontractnumber,toourlockbox: FirstClassMail OvernightMail MassMutualArtistry MassMutualArtistry AnnuityPaymentServices AnnuityPaymentServices MassMutualP.O.Box74908 350NorthOrleansStreet Chicago,IL60675-4908 Receipt&Dispatch,8thFloor Suite4908 Chicago,IL60654 ‰ byWireTransfer JPMorganChaseBank NewYork,NewYork ABA#021000021 C.M.LifeInsuranceCo.Account#323956297 Ref:AnnuityContract# Name:(YourName) 9 YoumayalsosendpurchasepaymentstoourServiceCenter.Wehavetherighttorejectanyapplicationorpurchasepayment. Allocation of Purchase Payments Whenyoupurchasedyourcontract,weappliedyourpurchasepaymentamongtheinvestmentchoicesaccordingtothe allocationinstructionsyouprovided.Ifyoumakeadditionalpurchasepaymentsanddonotprovidenewallocation instructions,wewillapplyeachaccordingtotheallocationinstructionswehaveonrecord.Unlessweareinstructedotherwise, wewillapplypurchasepaymentsmadebyyouremployerinaccordancewithyourpurchasepaymentallocationinstructionsin effectatthetimewereceiveyouremployer’spurchasepayment. Currently,thereisnolimittothenumberofinvestmentchoicesthatyoumayinvestinatanyonetime.However,wereservethe righttolimitthenumberofinvestmentchoicesthatyoumayinvestintoamaximumof18investmentchoices(includingthe fixedaccount)atanyonetimeintheeventadministrativeburdensrequiresuchalimitation. OncewereceiveyourinitialpurchasepaymentandthenecessaryinformationingoodorderatourServiceCenterorlockbox, wewillissueyourcontractandapplyyourinitialpurchasepaymentwithintwobusinessdays.Ifyoudonotgiveusallofthe informationweneed,wewillnotifyyou.Whenwereceiveallofthenecessaryinformation,wewillthenapplyyourinitial purchasepaymentwithintwobusinessdays.Ifforsomereasonweareunabletocompletethisprocesswithinfivebusiness days,wewilleithersendbackyourmoneyorgetyourpermissiontokeepituntilwereceiveallofthenecessaryinformation. Ifadditionalpurchasepaymentsaremadetoyourcontract,wewillcredittheseamountstoyourcontractonthebusinessday wereceivethemandallnecessaryinformationingoodorderatourServiceCenterorlockbox.Ifwereceiveyourpurchase paymentatourServiceCenterorlockboxonanon-businessdayorafterthebusinessdaycloses,wewillcredittheamountto yourcontracteffectivethenextbusinessday.OurbusinessdaycloseswhentheNewYorkStockExchange(NYSE)closes, usually4:00p.m.EasternTime. Replacement of Life Insurance or Annuities A“replacement”occurswhenanewpolicyorcontractispurchasedand,inconnectionwiththesale,anexistingpolicyor contractissurrendered,lapsed,forfeited,assignedtothereplacinginsurer,otherwiseterminated,orusedinafinanced purchase.A“financedpurchase”occurswhenthepurchaseofanewlifeinsurancepolicyorannuitycontractinvolvestheuseof fundsobtainedfromthevaluesofanexistinglifeinsurancepolicyorannuitycontractthroughwithdrawal,surrenderorloan. Therearecircumstancesinwhichreplacingyourexistinglifeinsurancepolicyorannuitycontractcanbenefityou.Asa generalrule,however,replacementisnotinyourbestinterest.Accordingly,youshouldmakeacarefulcomparisonofthe costsandbenefitsofyourexistingpolicyorcontractandtheproposedpolicyorcontracttodeterminewhetherreplacementis inyourbestinterest.Youshouldbeawarethatthepersonsellingyouthenewpolicyorcontractwillgenerallyearna commissionifyoubuythenewpolicyorcontractthroughareplacement.Rememberthatifyoureplaceapolicyorcontract withanotherpolicyorcontract,youmighthavetopayasurrenderchargeonthereplacedpolicyorcontract,andtheremaybe anewsurrenderchargeperiodforthenewpolicyorcontract.Inaddition,otherchargesmaybehigher(orlower)andthe benefitsmaybedifferent. Ifyoupurchasethecontractdescribedinthisprospectusinexchangeforanexistingpolicyorcontractfromanothercompany, wemaynotreceiveyourinitialpurchasepaymentfromtheothercompanyforasubstantialperiodoftimeafterwereceive yoursignedapplication. Youshouldalsonotethatonceyouhavereplacedyourvariablelifeinsurancepolicyorannuitycontract,yougenerallycannot reinstateitevenifyouchoosenottoacceptyournewvariablelifeinsurancepolicyorannuitycontractduringyour“freelook” period.Theonlyexceptiontothisrulewouldbeifyourpreviouslyissuedcontractwasissuedinastatethatrequiresthe insurertoreinstatethepreviouslysurrenderedpolicyorcontractiftheownerchoosestorejecttheirnewvariablelifeinsurance policyorannuitycontractduringthe“freelook”period. 10

Description: