MANAGEMENT ACCOUNTING - CPA Ireland PDF

Preview MANAGEMENT ACCOUNTING - CPA Ireland

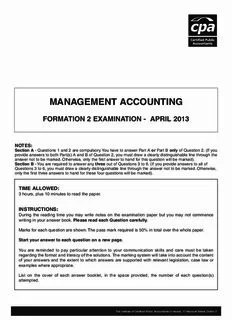

MANAGEMENT ACCOUNTING FORMATION 2 EXAMINATION - APRIL 2013 NOTES: Section A - Questions 1 and 2 are compulsory.You have to answer Part A or Part B only of Question 2.(If you provide answers to both Part(s) A and B of Question 2, you must draw a clearly distinguishable line through the answer not to be marked.Otherwise, only the first answer to hand for this question will be marked). Section B -You are required to answer any three out of Questions 3 to 6.(If you provide answers to all of Questions 3 to 6, you must draw a clearly distinguishable line through the answer not to be marked.Otherwise, only the first three answers to hand for these four questions will be marked). TIME ALLOWED: 3 hours, plus 10 minutes to read the paper. INSTRUCTIONS: During the reading time you may write notes on the examination paper but you may not commence writing in your answer book. Please read each Question carefully. Marks for each question are shown.The pass mark required is 50% in total over the whole paper. Start your answer to each question on a new page. You are reminded to pay particular attention to your communication skills and care must be taken regardingtheformatandliteracyofthesolutions.Themarkingsystemwilltakeintoaccountthecontent of your answers and the extent to which answers are supported with relevant legislation, case law or examples where appropriate. List on the cover of each answer booklet, in the space provided, the number of each question(s) attempted. TheInstituteofCertifiedPublicAccountantsinIreland,17HarcourtStreet,Dublin2. THEINSTITUTEOFCERTIFIEDPUBLICACCOUNTANTSINIRELAND MANAGEMENT ACCOUNTING FORMATION2EXAMINATION-APRIL2013 Timeallowed:3hours,plus10minutestoreadthepaper. SectionA:AnswerQuestion1andeitherPartAorPartBofQuestion2. SectionB:YouarerequiredtoansweranythreeoutofQuestions3to6. SECTION A - QUESTIONS 1 AND 2 ARE COMPULSORY 1. Apex Design Ltd manufactures an exclusive range of high quality office chairs. Using a modern, streamlined productionprocessthecompanyproducesthreetypesofluxurychairs:TheClassic,PrestigeandUltra. Thereare two main production departments, the forming department, which is highly mechanised and the finishing department,whichislabourintensive. Thecompanyhasbeeninoperationfortenyearsandeveryyearsaleshaveincreased. Inrecentyearsagreater choiceofdesignfeatureshasbeenofferedtocustomerssuchthatthefinishedchair,especiallytheUltra,ishighly bespoke. Thecurrentsellingpriceofthechairswasestablishedtwoyearsagobasedonamarkupofapproximately 30%onproductcost. For the first time since it commenced trading, profits last year were lower than expected and management were concerned that this may be a continuing trend. An initial investigation raised questions regarding the overhead costing system used by the company. Currently, the company uses a traditional overhead costing approach, absorbingoverheadsbasedoneithermachinehoursorlabourhoursasappropriate. Detailsrelatingtothecurrent yearareprovidedbelow: Classic Prestige Ultra Sellingpriceperchair €875 €1,050 €1,200 Directmaterialsperchair €225 €270 €315 Directlabourperchair €115 €138 €161 Directlabourhoursperchair 5 6 7 Machinehoursperchair 10 11 13 Totalchairsproduced 1,750 1,000 600 Forming Finishing Total € € € Productionoverheadcosts 828,729 400,982 1,229,711 In an attempt to curb the reduction in profits, the company is considering changing to an activity based costing approachforabsorbingoverheadsandhascompiledthefollowinginformation: CostDriverVolumes Activity CostDriver Cost€ Classic Prestige Ultra Total Purchasing No.ofrequisitions 125,175 240 225 285 750 Setupcosts No.ofsetups 512,120 150 300 350 800 Machining No.ofmachinehours 205,095 17,500 11,000 7,800 36,300 Qualitycontrol No.ofinspections 387,321 3,000 2,450 2,800 8,250 1,229,711 REQUIREMENT: (a) Calculatethetotalproductcostforeachofthethreetypesofofficechairusing: (i) ThecostingapproachcurrentlyusedbyApexDesignLtd; (8marks) (ii) Activitybasedcosting. (10marks) (b) Compareandcommentonyouranswersin(i)and(ii)above,providingrecommendationstoimprovetheprofitability ofApexDesignLtd. (7marks) [Total:25Marks] Page 1 ANSWER PART (A) OR PART (B) 2. AnswereitherPart(A)orPart(B)ofthisquestion.Eachpartisworth15marks. (A) You have been approached by the managing director of a small company that has recently been set up. The companyishopingtoobtainasignificantamountofbankfinancetosupportitsactivitiesandithasbeenaskedto supply various documentation as part of its funding application. The managing director has provided all of the requiredinformationexceptforthebudgetfortheforthcomingyear. Hehasexplainedtoyouthathereallydoesn’t understand why this has been requested and further confesses that he is unsure about how exactly a budget is prepared. REQUIREMENT: Prepareareportforthemanagingdirectorinwhichyou: (i) Explainthepurposesofbudgeting; (6marks) (ii) Describethestagesinthebudgetingprocess. (9marks) [Total:15Marks] OR (B) Oneofyourclientshascomplainedtoyouaboutthedifficultyofcostingproducts. Hiscompanymanufacturesone product using a simple production process that allows input costs to be specified for each unit of output. The costingsystemusedbythecompanycurrentlyfocusesonrecordingactualproductcostsastheyareincurredbut duetodelaysinreceivinginvoicesitisdifficulttomonitorexpensesandcalculateprofits. Yousuggesttotheclient thatastandardcostingsystemwouldbesuitableforthecompanybutbeforeagreeingwithyou,theclientasksyou toexplainhowsuchasystemwouldoperate. REQUIREMENT: Draftamemorandumforyourclientwhich: (i) Outlinesthepurposesofstandardcosting; (5marks) (ii) Describeshowastandardcostingsystemoperates. (10marks) [Total:15Marks] Page 2 SECTION B - ANSWER ANYTHREE QUESTIONS. 3. Attempteachofthesemultiple-choicequestions.Onlyoneoftheofferedsolutionsiscorrect.Eachquestion carriesequalmarks.Recordyouranswerstoeachsectionontheanswersheetprovided. 1) ThefollowinginformationrelatestotheoutputlevelsandcorrespondingoverheadcostsforCoxLtdforthepast4 months: Outputlevel Overheadcosts January 100,000 €175,000 February 75,000 €125,000 March 95,000 €181,000 April 50,000 €100,000 Usingthehigh-lowmethodofcostestimation,fixedmonthlyoverheadcostsareestimatedtobe: (a) €10,000 (b) €25,000 (c) €0 (d) €100,000 2) Whenthevolumeofunitssoldexceedsthevolumeofunitsproduced: (a) Profitsreportedundermarginalcostingarehigherthanunderabsorptioncosting. (b) Profitsreportedunderabsorptioncostingarehigherthanundermarginalcosting. (c) Profitsreportedarethesameundermarginalcostingandunderabsorptioncosting. (d) Profitsreportedundermarginalcostingarelowerthanunderabsorptioncosting. 3) BLtdhasdecidedtousetheEconomicOrderQuantity(EOQ)todeterminetheamountofstocktopurchase. The followingdetailshavebeenextractedfromthecompany’saccountingsystem: Demandpermonth = 6,050units Costofplacinganorder = €50 Costsofholdingoneunitinstock = €2permonth TheEOQiscalculated(tothenearestwholeunit)as: (a) 389units (b) 1905units (c) 550units (d) 159units 4) Whichofthefollowingstatementsistrue: (a) Semi-variablecostsvaryindirectproportiontothevolumeofoutput. (b) Semi-variablecostsarethesameasstep-fixedcosts. (c) Semi-variablecostsincludebothafixedandavariablecomponent. (d) Semi-variablecostsarealwaysirrelevant. 5) ActualfixedproductionoverheadsforCherryLtdforMarchwere€170,000andtherewasanunder-absorptionof overheadsof€11,240. Budgetedoverheadswere€180,000andthebudgetedproductionwas25,000units. The actualnumberofunitsproducedintheperiodwas: (a) 23,150units (b) 22,050units (c) 23,500units (d) 21,050units Page 3 6) Thefollowingprocessaccountrelatestothepreviousmonthandclosingworkinprogress(WIP)is40%complete. ProcessAccount Units € Units € OpeningWIP 271 12,000 Output 289 ? Periodcosts 33 2,455 ClosingWIP 15 ? 304 14,455 304 Thecompanyusestheweightedaverage(averagecost)methodofvaluation. Onthisbasis,thevalueoftheclosingworkinprogressfortheperiodis: (a) €441 (b) €294 (c) €735 (d) €285 Thefollowinginformationistobeusedinansweringquestions7)and8) Trax Ltd uses a standard absorption costing system and produces one product. The standard cost card is given below. ThevarianceanalysisreportforthemonthofMayrecordsasalesvolumevarianceof€4,000(A)andasales pricevarianceof€14,500(F).Thebudgetforeachmonthistomakeandsell3,000unitsatasellingpriceof€150 perunit. Standardcostcard € Directmaterials:2kg@€5perkg 10 Directlabour:3hours@€15perhour 45 Variableoverhead(absorbedbasedonlabourhrs) 15 Fixedproductionoverhead 40 110 7) ForTraxLtd,theactualsalesvolumeandactualsalespricewere: Salesvolume Salesprice (a) 2,900units €145 (b) 2,900units €155 (c) 3,100units €154 (d) 3,100units €145 8) ForTraxLtd,iftheactualnumberofunitsproducedandsoldinJunewas2,750,thenthefixedproductionoverhead volumevarianceforthemonthwas: (a) €10,000(A) (b) €3,750(A) (c) €3,750(F) (d) €10,000(F) [Total:20Marks] Page 4 4. TheRegencyisamediumsizedtheatre,withamaximumcapacityof500seats,offeringavarietyofmainlymusic events to its patrons. In the past, the events offered were low budget, featuring local and regional singers and musicians. This year, the theatre engaged the services of a music director who negotiated and booked two well knownartistsforeventsinMay. TheRegencyreceivessomefundingtopromoteitsactivitiesfromtheDepartment ofCultureandthisissufficienttopaybasicoperatingexpensessuchasinsurance,lightandheat,andstaffcosts. Whenaconcertoreventisstagedadditionalcostsariseandtheboardofmanagementofthetheatremustensure that all such costs are covered by ticket sales. While the artists that have been booked for May are nationally known, they charge higher fees to perform and the board of management are particularly concerned to ensure thattheticketpricechargedfortheeventissufficient. Thefollowingdetailshavebeenprovidedbytheboardofmanagement: Ticketprices Tickets for events are usually priced at €15 each but the board have stated that a higher price of €25 would be moresuitableforthewellknownartistsifcostsaretobecovered. TheRegencyemploysaticketbookingfacility that customers may use online or by telephone. The company providing the service charges the theatre 10% of theticketpriceforeachticketsold. Additionalstaff Foreveryeventthatisheldthetheatreemploystenpart-timestaffmembers. Onestaffmemberisrequiredforbox office ticket collection, four staff members are required to usher customers to their appointed seats and after the event has finished five workers are required to clean and arrange the theatre in preparation for the next event. Eachstaffmemberispaid€80forworkingattheevent. Wellknownartists • Onegroup,TheSols,agreedtoplayoneconcertforafixedfeeof€8,155. • Anothersinger/songwriter,JillMalsoagreedtoplayoneconcert. Shenegotiatedanarrangementwiththe musicdirectorwherebyshewouldbepaid€5,780plus20%oftheticketpriceforeveryticketsold. REQUIREMENT: (a) Foreachoftheeventsfeaturingwellknownartists: (i) Calculatethenumberofticketsthatmustbesoldtobreakeven. (ii) Assumingthemaximumnumberoftickets aresold,iftheboardofmanagementwouldliketoearnaprofit of€5,000ontheeventwhatticketpriceshouldbecharged? (10marks) (b) Assuming a ticket price of €25, at what level of ticket sales will the profit earned fromThe Sols equal the profit earnedfromJillM? (5marks) (c) OutlinethemainassumptionsonwhichtheCost-Volume-Profitmodelisbased. (5marks) [Total:20Marks] Page 5 5. PromoTees Ltd specialises in manufacturing good quality pure cotton t-shirts that are sold to two top retailers. The company has recently been approached by a conference organiser to provide a quotation for the supply of 5,000 t-shirts over the next three months. As PromoTees Ltd is currently working at 80% of its full production capacityitisseriouslyconsideringundertakingthisshorttermcontracttoboostitsprofits. Thefollowinginformation isavailable: 1. Theconferenceorganiserrequiresthet-shirtstobeinequalquantitiesofblackandwhitecotton.Tofulfillthe contract2,000metresofwhitecottonfabricand2,000metresofblackcottonfabricisrequired. 2. Currently, Promo Tees Ltd only manufactures white t-shirts and has plenty of fabric available which was purchasedinbulksixmonthsagoat€2.25permetre. Thecurrentpriceofthiscottonfabricis€2.40. 3. The company does not have any black cotton fabric in stock.However, it could buy some from an existing supplier for €2.60 per metre but must purchase a minimum of 2,500 metres. At present the company has nouseforanyunusedblackcottonfabric. 4. Whenmanufacturingt-shirts,onlywhitethreadmaybeusedtomakewhitet-shirtsandonlyblackthreadmay beusedtomakeblackt-shirts. 5. Foreach1,000t-shirtsproduced,200reelsofcottonthreadwouldberequired. Atpresentthereare2,000 reelsofwhitecottonthreadinstockwhichoriginallycost€1,800intotalsomemonthsago. Thepurchase pricehasnotincreasedsincethattime. 6. Asthecompanydoesnothaveanyblackcottonthreadinstockitwillhavetopurchasesomeandhasbeen quoted a price of €1.10 per reel. A regular supplier has offered PromoTees Ltd an end of batch box of 1,000reelsofblackcottonthreadatadiscountpriceof€450. Iftheblackthreadisnotusedforthiscontract itcannotbeusedforproducinganyotherproducts. 7. Tomeetthelabourrequirementsofthecontractsomeskilledandunskilledworkersarerequired. Thecost forskilledstafftoworkonthecontractamountsto€9,250. Thefactoryforemanhasstatedthatitwouldbe feasiblefortheexistingskilledstafftoworkonthecontractasthereissufficientidletime. Additionalunskilled staffwillhavetobeemployedonacasualbasis,asrequired,toworkonthecontractatacostof€15,000 intotal. 8. Machinerynotneededinthecurrentproductionsetupcouldbeusedforthiscontract.However,PromoTees Ltdhasbeenoffered€5,000touseitforthenextthreemonthsbyanotherclothingmanufacturer. 9. Depreciationonthemachinery,notedat8above,amountsto€24,000perannum. 10. The fixed production overhead applicable to the contract is €5,250. This has been calculated using an overheadabsorptionrateof€1.05pert-shirt. 11. Theconferenceorganiserrequiresalogotobeappliedtoeacht-shirt. Thelogoscost€0.25eachandthe companywouldhavetopurchasethese,inadvance,fromaspecificsupplier. Ifthelogosarenotusedon thecontracttheycanbereturnedtothesupplierforafullrefund. REQUIREMENT: (a) Brieflyexplainthefollowingterms: (i) Relevantcost (ii) Limitingfactor (4marks) (b) On the basis of the financial information provided above, calculate the lowest quotation that PromoTees Ltd can offerforthecontractwithoutincurringaloss. (12marks) (c) OutlineTWO qualitative factors that PromoTees Ltd should take into consideration before going ahead with the contract. (4marks) [Total:20Marks] Page 6 6. Top Glass Ltd provides toughened glass panels to customer order. The panels are used for both internal and externalpurposestoaddadecorativeeffectaswellasfulfillingapracticalpurpose. Anewcustomerhasplaced anordertoprovideglasspanelsforanewlibrarybuildinginCork. TheaccountantatTopGlassLtdhascodedthis orderasJobA134andprovidedthefollowingproductioninformation: DirectMaterials: TopGlassLtdusesaweightedaveragesystemforpricingissuestoproduction. Openingstockat1stApril: 20sizeLglasspanels@€40each 80typeBchromefittings@€2each Purchases: 1stApril: 50sizeLglasspanels@€37.76each 15thApril: 90typeBchromefittings@€2.17each Issuestoproduction(JobA134): 17thApril: 15sizeLglasspanels 19thApril: 90typeBchromefittings DirectLabour: Assembly: 42hours@€18perhour Finishing: 16hours@€16perhour AsthecustomerspecificallyrequestedthattheJobwasfinishedby20thApriltomeetconstructiondeadlinesfor the library, six of the hours worked in the assembly department were worked as overtime. The company pays overtimeatarateofoneandahalftimesthenormalhourlyrate. Overheads: Thecompanyabsorbsoverheadsusingatraditionalapproachbasedonlabourhours. Assembly Finishing Total Productionoverheads €336,105 €421,215 €757,320 Directlabourhours 64,000 102,000 166,000 Machinehours 500 100 600 Pricingpolicy: Itiscompanypolicytopriceallordersbasedonachievingaprofitmarginof25%onsalesprice. REQUIREMENT: (a) CalculatethetotalcostofJobA134. (14marks) (b) CalculatethepricechargedbyTopGlassLtdtothecustomer. (2marks) (c) Brieflyexplainthemaindifferencesbetweenjobcostingandprocesscosting. (4marks) [Total:20Marks] ENDOFPAPER Page 7 SUGGESTED SOLUTIONS THEINSTITUTEOFCERTIFIEDPUBLICACCOUNTANTSINIRELAND MANAGEMENT ACCOUNTING FORMATION2EXAMINATION-APRIL2013 SOLUTION1 (a) (i) Totalproductcostusingtraditionaloverheadcostingapproach W1Calculationoftotaldirectlabourhours Classic:1,750chairsX5hourseach 8,750 Prestige:1,000chairsX6hourseach 6,000 Ultra:600chairsX7hourseach 4,200 Totaldirectlabourhours 18,950 W2Calculationofproductionoverheadabsorptionrate Forming Finishing Totalproductionoverhead €828,729 €400,982 Overheadabsorptionbase -Machinehours 36,300 -Directlabourhours(W1) 18,950 Productionoverheadabsorptionrate(OAR) €22.83 €21.16 Permachine Perdirectlabour hour hour Calculationoftotalproductcost Classic Prestige Ultra € € € Directmaterials 225.00 270.00 315.00 Directlabour 115.00 138.00 161.00 Productionoverhead -Formingdept(machinehrsxOAR) 228.30 251.13 296.79 -Finishingdept(directlabourhrsxOAR) 105.80 126.96 148.12 Totalproductcost 674.10 786.09 920.91 (8marks) (ii) Totalproductcostusingtraditionaloverheadcostingapproach W3 Calculationofcostperdriver Activity Costdriver Cost Totalofdrivers Costperdriver € € Purchasing Requisitions 125,175 750 166.900 Setupcosts Setups 512,120 800 640.150 Machining Machinehours 205,095 36,300 5.650 Qualitycontrol Inspections 387,321 8,250 46.948 1,229,711 Page 8 W4Calculationoftotalandunitproductionoverheadcost Classic Prestige Ultra Total € € € € Purchasing 40,056.00 37,552.50 47,566.50 125,175.00 Setupcosts 96,022.50 192,045.00 224,052.50 512,120.00 Machining 98,875.00 62,150.00 44,070.00 205,095.00 Qualitycontrol 140,844.00 115,022.60 131,454.40 387,321.00 Totalproductionoverheadcost A 375,797.50 406,770.10 447,143.40 1,229,711.00 Unitsproduced B 1,750 1,000 6,00 Productionoverheadcostperunit A/B €214.74 €406.77 €745.24 Calculationoftotalproductcost Classic Prestige Ultra € € € Directmaterials 225.00 270.00 315.00 Directlabour 115.00 138.00 161.00 Productionoverhead 214.74 406.77 745.24 Totalproductcost 554.74 814.77 1221.24 (10marks) (b) ComparisonofProductcosts Productcostperchair Traditional/ ABCapproach Difference Sellingprice Existingapproach perchair € € € € -Classic 674.10 554.74 119.36 875.00 -Prestige 786.09 814.77 -28.68 1,050.00 -Ultra 920.91 1,221.24 -300.33 1,200.00 Comments&recommendations Comments ABC is a more accurate method of absorbing overheads onto products. In relation to the 3 chairs being produced: Classic The classic chair is currently overcosted by €119.36 - too much overhead is being absorbed as part of the productcost. This chair is produced in greater quantity than the others and under the existing costing system is being incorrectlyallocatedagreatershareofproduction overheads. It is subsidising the two other types of chairs whicharecreatingmorecostsforthecompany. Thecompanyischarging€875foreachchairsoldandisactuallygeneratingahighermarkupthanthe30% orsoexpected. Itisgeneratingalmost58%markuponcost(€320.26/€554.75). Prestige Fromtheanalysisabove,theprestigechairisbeingundercostedby€28.68,i.e.Undertheexistingoverhead costingsystemthereisnotenoughproductionoverheadbeingincludedaspartoftheproductcost. For the prestige chair the company is charging €1,050 and is generating approximately 29% mark up (€235.23/€814.77)ratherthanthe30%orsoexpectedmarkup. Page 9

Description: