Malaysia IGB REIT The REIT-ail Giant PDF

Preview Malaysia IGB REIT The REIT-ail Giant

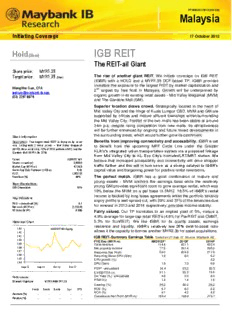

PP16832/01/2013 (031128) PP16832/01/2012 (029059) Malaysia Initiating Coverage 17 October 2012 17 October 2011 IGB REIT Hold (New) The REIT-ail Giant Share price: MYR1.39 Target price: MYR1.39 The rise of another giant REIT. We initiate coverage on IGB REIT (New) (IGBR) with a HOLD and a MYR1.39 DCF-based TP. IGBR provides investors the exposure to the largest REIT by market capitalization and Wong Wei Sum, CFA 2nd largest by free float in Malaysia. Growth will be underpinned by [email protected] organic growth in its existing retail assets - Mid Valley Megamall (MVM) (03) 2297 8679 and The Gardens Mall (GM). Superior location draws crowd. Strategically located in the heart of Mid Valley City and the fringe of Kuala Lumpur CBD, MVM and GM are supported by offices and mature affluent townships within/surrounding the Mid Valley City. Footfall of the two malls has been stable at around 34m p.a. despite rising competition from new malls. Its attractiveness will be further enhanced by ongoing and future mixed developments in the surrounding areas, which would further grow its catchment. Stock Information Description: The largest retail REIT in Malaysia by asset Benefits from improving connectivity and accessibility. IGBR is set size. Listing with 2 initial assets – Mid Valley Megamall to benefit from the upcoming MRT Circle Line under the Greater (MYR3.4b in asset size; 73% of 2011 proforma NPI) and the KL/KV‟s integrated urban transportation system via a proposed linkage Gardens Mall (MYR1.2b; 27%). from Mid Valley City to KL Eco City‟s Komuter/LRT/MRT station. We Ticker: IGBREIT MK believe that increased accessibility and connectivity will drive shopper Shares Issued (m): 3,400.0 traffic further and this will in turn serve as a strong catalyst to IGBR‟s Market Cap (MYR m): 4,726.0 3-mth Avg Daily Turnover (US$ m): 9.02 capital value and bargaining power for positive rental reversions. KLCI: 1,653.52 Free float (%): 49% The perfect match. IGBR has a good combination of mature and young assets - MVM anchors the earnings base while the relatively Major Shareholders: young GM provides significant room to grow average rental, which was IGB Corporation 51% 19% below the MVM on a psf basis in 5M12. 18.5% of IGBR‟s rental income is backed by long lease agreements whilst the portfolio tenancy Key Indicators expiry profile is well spread out, with 39% and 31% of the tenancies due ROE – annualised (%) 6.1 for renewal in 2013 and 2014 respectively; provides income stability. Net cash (MYR m): (1,155.4) NTA/shr (MYR): 0.996 Fairly valued. Our TP translates to an implied yield of 5%, versus a 4.9% average for large cap retail REITs (4.8% for PavREIT and CMMT, Historical Chart 5.3% for SunREIT). We like IGBR for its quality assets, earnings resilience and liquidity. IGBR‟s relatively low 26% debt-to-asset ratio 1.43 IGBREIT MK Equity allows it the capacity to borrow another MYR2.3b for asset acquisitions. 1.42 1.41 IGB REIT–Summary Earnings Table *Listed on 21 Sep 12 Source: Maybank KE 1.40 FYE Dec (MYR m) 4M2012F* 2013F 2014F 1.39 Total revenue 114.4 421.1 433.4 1.38 Net property income 77.5 287.4 295.6 1.37 Recurring Net Profit 54.0 204.3 211.9 1.36 Recurring Basic EPU (Sen) 1.6 6.0 6.2 1.35 EPU growth (%) - - 3.2 1.34 DPU (Sen) 1.8 7.0 6.8 Sep-12 Sep-12 Oct-12 Oct-12 PER^ -annualised 24.4 23.2 22.5 EV/EBITDA (x) 21.1 20.2 19.6 Div Yield (%) -annualised 4.8 5.0 4.9 Performance: P/NAV(x) 1.4 1.4 1.4 52-week High/Low MYR1.44/MYR1.25 Gearing (%) 26.2 26.2 26.2 1-mth 3-mth 6-mth 1-yr YTD ROE (%) 5.7 6.0 6.2 ROA (%) 4.1 4.3 4.5 Absolute (%) - - - - - Consensus Net Profit (MYR m) 184.4 198.8 216.1 Relative (%) - - - - - IGB REIT 17 October 2011 Contents Executive Summary P3 Key Investment Merits Merit 1 : MYR4.6b assets dwarves all listed REITs P5 Merit 2 : Superior location draws crowd P6 Merit 3 : Perfect match provides earnings growth and stability P10 Merit 4 : Ample headroom to grow P14 Merit 5 : Strong management team P15 Merit 6 : Favourable macro fundamentals P16 Risks and Concerns P18 Financials P19 Valuations P20 Income Statement & Balance Sheet P22 Property Profile – Mid Valley Megamall P23 Property Profile – The Gardens Mall P25 Appendix 1 – IGB REIT’s structure Appendix 2 – Who’s who in IGB REIT Appendix 3 – Background of the Sponsor Appendix 4 – Background of the Trustee Appendix 5 – Fee structure of IGB REIT Appendix 6 – Fee comparison among various M-REITs Appendix 7 – Accolades / awards Page 2 of 39 IGB REIT 17 October 2011 Executive Summary Highly sought after retail assets. IGB REIT (IGBR) is the largest domestic REIT by market capitalization at MYR4.7b and the 2nd largest REIT by asset size at MYR4.6b (based on appraised value). It comprises 2 properties: Mid Valley Megamall (MVM; MYR3.4b in asset size; 74.8% of total asset portfolio) and The Gardens Mall (GM; MYR1.2b; 25.2%). These properties form part of Mid Valley City – an integrated commercial development which includes 1,683 hotel rooms and serviced residences, seven blocks of commercial office buildings (2.67m sq.ft. NLA) and 228 residential units. Key investment merits. IGBR is a primarily retail-focused REIT and the REIT manager, IGB REIT Management S/B, will continue its focus on growing the retail-based assets through asset enhancement initiatives and mall acquisitions both locally and overseas. IGBR‟s key investment merits in our view include: (i) Its size as the largest retail-focused REIT by asset size and the largest REIT in Malaysia by market capitalization, thus providing an international appeal. (ii) Its superior location which provides long-term organic growth potential. The properties are strategically placed within Mid Valley City, one of the largest integrated developments in Malaysia, catering to locals, business travelers and tourists. Mid Valley City itself is located at the fringe of central Kuala Lumpur with proximity to various middle to high income suburbs. We believe that surrounding property developments (both current and in the future), the upcoming MRT Circle line and a proposed linkage to the existing Abdullah Hukum LRT station will further boost the footfall and shopper traffic at the malls. (iii) Its resilient earnings base, given that 18.5% of its gross rental income is from tenants with long lease agreements. Also, the malls have a diversified and sizeable tenant base of 663. No single tenant contributes to more than 6% of total gross rental income. Meanwhile, the portfolio tenancy expiry profile is well spread out with 38.7% (by gross rental income) and 31% of the tenancies due for renewal in 2013 and 2014 respectively, hence reducing earnings volatility. (iv) A perfect combination. In our opinion, the mature MVM, which has 13 years of successful operation, provides for a strong and stable earnings base while the relatively young GM (since 2007) has the potential for stronger rental growth and hence higher blended margins. (v) Room for inorganic growth. With a relatively low debt-to-asset ratio of 26%, IGBR has the ability to make yield accretive acquisitions for growth. It has a potential war chest of approximately MYR2.3b (at the 50% statutory limit) to fund new acquisitions without the need to raise fresh equity capital. IGBR has been granted the right of first refusal to acquire future retail properties in Malaysia and overseas from its sponsor, IGB Corporation. Page 3 of 39 IGB REIT 17 October 2011 In our opinion, working in favour of the REIT as well are the following factors: (i) Favourable macroeconomic fundamentals with (a) Malaysia‟s population base being one of the fastest growing in the world, (b) Malaysia‟s young population with a national median age of approximately 26 years, and (c) rising affluence among Malaysians, further spurred by the government‟s Economic Transformation Programme (ETP) which aims at transforming Malaysia into a high nation income by 2020 by doubling present GNI per capita to RM48,000. In addition, the ETP‟s Greater Kuala Lumpur / Klang Valley National Key Economic Area (NKEA) targets 10m population for Greater KL/KV by 2012 versus 6m in 2010 while tourism will remain an important income source to the Malaysian economy, being one of 12 NKEAs emphasized in the ETP blueprint. (ii) A very experienced management team. An added plus point for IGBR is the experienced, senior team at the REIT Manager, led by Anthony Patrick Barragry, who was involved in the development of Mid Valley City since Day 1. Valuation. We value IGBR at MYR1.39 based on a DCF approach as we believe it rigorously accounts for 10 years of cashflow and a terminal value, taking into consideration various assumptions on rental reversions, occupancy rates and others. Our MYR1.39 TP translates to an implied gross dividend yield of 5% (2013) which is marginally higher than Pavilion REIT (PavREIT)‟s 4.8% and CapitaMall Malaysia Trust‟s (CMMT) 4.8% but lower than Sunway REIT‟s (SunREIT) 5.3%. Table 1: Portfolio of properties in IGB REIT Mid Valley Megamall The Gardens Mall Type Retail Retail Appraised value as at 10 April 2012 (MYR`000) 3,440,000 1,160,000 Purchase consideration (MYR „000) 3,440,000 1,160,000 Subject properties weighting (by Appraised Value) (%) 74.8 25.2 NLA (sq ft) 1,718,951 817,053 GFA (sq ft) 6,107,103 3,379,510 Number of tenancies as at 31 Mar 2012 454 209 Occupancy rate as at 31 Mar 2012 (%) 99.8 99.7 Number of car park bays 6,092 4,128 Estimated footfall for 2011 („000) |--------------------------–––34,700 ----------------------------| Sources: IGB REIT, CBRE Page 4 of 39 IGB REIT 17 October 2011 Merit 1: MYR4.6b assets dwarves all listed REITs The retail giant. With MYR4.6b in asset size, IGBR will be the 2nd largest Malaysian REIT (M-REIT) after SunREIT‟s MYR4.9b (post- acquisition of Sunway Medical Centre) (see Chart 1). Correspondingly, IGBR will be the largest retail REIT in terms of appraised value and gross floor area based on current available data from CBRE. In comparison to its retail peers, it is 29% and 59% larger by asset size than the likes of PavREIT and CapitaMalls Malaysia Trust (CMMT) respectively and 4.6x larger than the small-cap Hektar REIT. The largest REIT by market capitalization. IGBR‟s market capitalization stood at MYR4.7b as at 15 Oct 2012. This compares against a market capitalization of MYR4.2b for PavREIT, MYR4.1b for SunREIT and MYR3.2b for CMMT. Chart 1: Asset sizes of Malaysian REITs Chart 2: Free float of Malaysian REITs MYR m (MYR m) Freefloat (LHS) Freefloat (RHS) (%) 5,000 Mixed Retail based 3,000 Retail 100 Mixed 4,500 based 90 2,500 4,000 80 3,500 70 2,000 3,000 60 2,500 1,500 50 2,000 40 1,500 1,000 30 1,000 20 500 500 10 0 0 0 muirtA rewoT lliuQ hanamA tieR AOU tsriFmA daetsuoB raqlAA- sixA llihratS TIERnuS ratkeH TMMC noillivaP BGI muirtA tieR AOU hanamA lliuQ rewoT tsriFmA llihratS raqlAA- daetsuoB sixA TIERnuS ratkeH noillivaP TMMC BGI Sources: Annual reports of entities listed, IGB REIT Sources: Annual reports of entities listed, Bloomberg, IGB REIT Sizeable in free float. IGBR‟s market capitalization of MYR4.7b and its sponsor‟s stake of 51% of IGBR post listing have made IGBR the 2nd largest Malaysian REIT in terms of free float – MYR2.3b, compared to SunREIT‟s MYR2.6b, PavREIT‟s MYR1.1b and CMMT‟s MYR2.1b. In our view, IGBR‟s huge free float is an attractive feature not only to domestic but also international investors. Page 5 of 39 IGB REIT 17 October 2011 Merit 2: Superior location draws crowd Strategic location. Size is not at the expense of quality. MVM and GM are strategically located at the fringe of Kuala Lumpur CBD and at the beginning of the Federal Highway which connects the city to the rest of Greater Kuala Lumpur. The malls‟ close proximity to some affluent suburbs such as Bangsar, Damansara Heights, Mont Kiara and Seputeh as well as mature townships like Taman Desa, Old Klang Road and Petaling Jaya provide for an immediate catchment area. Its catchment area spans the entire 6.7m population in the Klang Valley (source: CBRE). Chart 3: Major areas in Kuala Lumpur KualaLumpur Population (2010) 1,674,621 Batu Caves Gombak/ Setapak / Wangsa Maju Kepong / Segambut / Jinjang Sentul Damansara Heights / Golden Ampang Mont Kiara Triangle Kuala Lumpur CBD Pandan Jaya / Taman Maluri Mid Valley City KL Sentral / Bangsar Sungai Besi / Seputeh / Taman Salak Selatan Desa Old Klang Road / Kuchai Lama / Sri Petaling Cheras Sources: Google Maps, CBRE The “Mid Valley City” element. One of the features that distinguishes IGBR from other retail REITs (except for SunREIT) is that its malls are located in the mature and integrated Mid Valley City, developed by its sponsor IGB Corporation Berhad (“IGB Corporation”). Apart from MVM and GM, the entire Mid Valley City development also includes three hotels (1,484 hotel rooms and 199 suites), seven office buildings (2.67m sq.ft. in NLA) and 228 service apartments. Page 6 of 39 IGB REIT 17 October 2011 Figure1: Mid Valley City Sources: IGB REIT Support from self-contained Mid Valley City. In our opinion, the substantial commercial content of Mid Valley City has contributed steady shopper/tourist traffic to MVM and GM. The current office population in Mid Valley is estimated at around 14,547 workers. Including the office developments nearby, total office population is estimated at 117,365 workers, according to CBRE. This will be further boosted by IGB Corporation‟s last office development in Mid Valley City, i.e. Mid Valley City Southpoint, which we expect to add a further 5,000-6,000 workers (+4-5%) and 2,000 extra car park lots (+19.6%) from 2015. Growing catchment provides long-term organic growth potential. Ongoing projects such as KL Eco City, Bangsar South and KL Sentral are still developing, providing for a growing office/resident/hotelier catchment for IGBR‟s retail assets. For instance, we expect the MYR6b-7b KL Eco City, which comprises offices, service apartments and hotel rooms, to have an estimated population of 35,000 upon completion. Future developments include the 40-acre Setia Federal Hills which targets mid- to high-income residents. We believe its residential growth potential and income profile will continue to drive footfall at MVM and GM. Excellent accessibility and connectivity. IGBR‟s retail assets are easily accessible. Apart from a network of highways (Federal Highway, East-West Link Expressway, New Pantai Expressway and North-South Highway), major roads which connect to the malls‟ key catchment areas include Jalan Syed Putra, Jalan Klang Lama, Federal Highway, Jalan Maarof and Jalan Bangsar. Also, MVM and GM are directly linked to the Seremban/Rawang KTM Komuter railway line, which registered the second highest ridership of 2.2m in 2011 after KL Sentral Station (source: CBRE). Indirect beneficiary of ETP. Under the Greater Kuala Lumpur National Key Economic Areas (NKEA) initiative (under the ETP blueprint), new Mass Rapid Transit (MRT) lines, which include the MRT 2 Circle Line will be built to improve public transportation and connectivity between existing rail-based networks. The Circle Line, which is targeted to be completed by 2020, will link areas such as KL Eco City, Mont Kiara, Sentul Timur, Ampang and the MATRADE development. Higher capacity with the MRT. The new MRT line is designed with higher capacity in mind compared to the existing intra-city rail network. Page 7 of 39 IGB REIT 17 October 2011 And unlike the existing rail network, a portion of the new MRT line will pass through some of the more affluent neighborhoods in the Klang Valley (for e.g. Mont Kiara). Also, under the same plan, the KL Monorail will be extended to Taman Gembira in Old Klang Road and we expect this to benefit surrounding areas including Mid Valley City. More than just an MRT station. KL Eco City, a mixed development opposite Mid Valley City, will be an integrated rail transport hub accommodating the existing Abdullah Hukum Putra LRT, a new KTM commuter station along the Sentul-Port Klang route and a station on the MRT 2 Circle line. We understand that there will be a linkage connecting Mid Valley City to KL Eco City, enhancing connectivity and accessibility of MVM and GM (source: CBRE). Higher property value with superior transportation infrastructure. We believe shopper traffic to MVM and GM will improve further once the transport linkages are completed and the MRT Circle Line is fully operational, thus translating to better accessibility and connectivity. We believe that this will in turn translate into stronger bargaining power for rental reversions while eventually boosting the capital values of IGBR. Chart 4: Proposed MRT line Sg.Buloh Kg. Baru Sg.Buloh Kota Damansara Taman Industri Sg. Buloh PJU5 Sentul Dataran Sunway Matrade The Curve One Utama Pusat Bandar Warisan Pasar Rakyat TTDI Damansara KL Sentral Merdeka (KLIFD) Cochrane Seksyen 16 Semantan Pasar BukitBintang Maluri Seni Central Taman Bukit Ria Kampung Baru Taman Bukit Mewah Leisure Mall Plaza Pheonix KL Eco City Semantan Taman Suntex Taman Cuepacs Bandar Tun Hussein Onn Balakong Taman Koperasi Saujana Impian Bandar Kajang Kajang Source: Maybank KE, MRT Corp, KL Eco City websites Page 8 of 39 IGB REIT 17 October 2011 Chart 5: Existing transportation system Sources: Maybank KE, CBRE Page 9 of 39 IGB REIT 17 October 2011 Merit 3: Perfect match provides earnings growth and stability IGBR’s malls are a resilient asset class, we believe. It is our view that strategically located sub-urban malls in Klang Valley tends to be a more resilient asset class during an economic downturn compared to their peers in the KL City centre due to the residential catchment of the former. The footfall of MVM and GM are mainly supported by the office/residential population from Mid Valley City and surrounding townships. The malls‟ 34.7m shopper traffic in 2011 was spread between office workers and residents/tourists, hence lowering concentration risk. All under one roof. IGBR‟s MVM and GM complement each other with different niche and style; combined, they create a shopping paradise. MVM, one of the largest malls in Malaysia “for all kinds of everything” is served as a family, tourist and lifestyle destination for locals and tourists whilst GM is positioned as a premium fashion mall focused on the higher income segment. The complementary nature of IGBR‟s properties allows it to benefit from the diverse and ever-changing trends in consumer spending. Sustainable and diversified earnings base. 18.5% of IGBR‟s total gross rental income is backed by tenants with long lease agreements. These include reputable international department stores such as AEON, Carrefour, Isetan and Robinsons and other retailers such as Celebrity Fitness and and Golden Screen Cinema. As at May 2012, IGBR has a diversified and sizeable tenant base of 663 tenants. No single tenant contributes to more than 6% of gross rental income. Well spread-out lease expiry. IGBR‟s portfolio tenancy expiry profile is well spread out with 38.7% (by gross rental income) and 31.0% of the tenancies due for renewal in 2013 and 2014 respectively, hence reducing earnings volatility. MVM and GM typically have three-year lease terms. Chart 6: Tenancy expiry profile (by Chart 7: Tenancy expiry profile – Mid Chart 8: Tenancy expiry profile – The gross rental income)- IGBR Valley Megamall Gardens Mall 50 50 57.5 60 38.7 40 40 35.5 50 31 31 30 30 40 19 30 20 20 17.8 22.2 19.8 20 10 10 10 0 0 0 2012 2013 2014 2012 2013 2014 2012 2013 2014 Source: IGB REIT Source: IGB REIT Source: IGB REIT Page 10 of 39

Description: