Table Of ContentFORMATIO

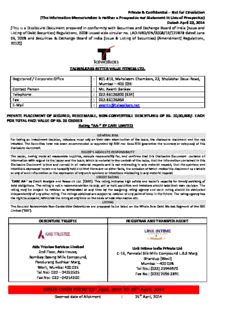

Private & Confidential – Not for Circulation

(The Information Memorandum is neither a Prospectus nor Statement in Lieu of Prospectus)

Dated: April 23, 2014

(This is a Disclosure Document prepared in conformity with Securities and Exchange Board of India (Issue and

Listing of Debt Securities) Regulations, 2008 issued vide circular no. LAD‐NRO/GN/2008/13/127878 dated June

06, 2008 and Securities & Exchange Board of India (Issue & Listing of Securities) (Amendment) Regulations,

2012))

TALWALKARS BETTER VALUE FITNESS LTD.

Registered / Corporate Office : 801‐813, Mahalaxmi Chambers, 22, Bhulabhai Desai Road,

Mumbai – 400 026

Contact Person : Ms. Avanti Sankav

Telephone : 022‐66126300 (324)

Fax : 022‐66126363

E‐Mail : [email protected]

PRIVATE PLACEMENT OF SECURED, REDEEMABLE, NON‐CONVERTIBLE DEBENTURES OF RS. 10,00,000/‐ EACH

FOR TOTAL FACE VALUE OF RS. 25 CRORES

Rating “AA‐” BY CARE LIMITED

GENERAL RISK

For taking an investment decision, investors must rely on their own examination of the issue, the disclosure document and the risk

involved. The Securities have not been recommended or approved by SEBI nor does SEBI guarantee the accuracy or adequacy of this

disclosure document.

ISSUER’S ABSOLUTE RESPONSIBILITY

The Issuer, having made all reasonable inquiries, accepts responsibility for, and confirms that this Disclosure Document contains all

information with regard to the Issuer and the Issue, which is material in the context of the Issue, that the information contained in this

Disclosure Document is true and correct in all material respects and is not misleading in any material respect, that the opinions and

intentions expressed herein are honestly held and that there are no other facts, the omission of which makes this document as a whole

or any of such information or the expression of any such opinions or intentions misleading in any material respect.

CREDIT RATING

‘CARE AA‐’ by Credit Analysis and Research Ltd. (CARE). This rating indicates high safety and issuer’s capacity for timely servicing of

debt obligations. The rating is not a recommendation to buy, sell or hold securities and investors should take their own decision. The

rating may be subject to revision or withdrawal at any time by the assigning rating agency and each rating should be evaluated

independently of any other rating. The ratings obtained are subject to revision at any point of time in the future. The rating agency has

the right to suspend, withdraw the rating at any time on the basis of new information etc.

LISTING

The Secured Redeemable Non‐Convertible Debentures are proposed to be listed on the Whole Sale Debt Market Segment of the BSE

Limited (‘BSE’).

DEBENTURE TRUSTEE REGISTRAR AND TRANSFER AGENT

Axis Trustee Services Limited

Link Intime India Private Ltd

2nd Floor, Axis House,

C‐13, Pannalal Silk Mills Compound L.B.S Marg

Bombay Dyeing Mills Compound,

Bhandup (West)

Pandurang Budhkar Marg, Mumbai – 400 078

Worli, Mumbai 400 025

Tel No.: (022) 25946970

Tel No:‐ 022 – 24252525

Fax No.: (022) 2596 2691

Fax No:‐ 022 –24254200

ISSUE OPEN FROM 23rd April, 2014 TO 25th April, 2014

Deemed date of Allotment : 25th April, 2014

TABLE OF CONTENTS

INDEX TITLE Page No.

I. DEFINITIONS/ ABBREVIATIONS 3

II. DISCLAIMER 4

III. NAME AND ADDRESS OF REGISTERED/ HEAD OFFICE OF THE ISSUER 6

IV. NAMES AND ADDRESSES OF THE DIRECTORS OF THE ISSUER 7

V. BRIEF SUMMARY OF BUSINESS/ ACTIVITIES OF ISSUER AND ITS LINE OF BUSINESS 8

BRIEF HISTORY OF ISSUER SINCE INCORPORATION, DETAILS OF ACTIVITIES INCLUDING 13

VI ANY REORGANIZATION, RECONSTRUCTION OR AMALGAMATION, CHANGES IN CAPITAL

STRUCTURE, (AUTHORIZED, ISSUED AND SUBSCRIBED) AND BORROWINGS

VII. SUMMARY TERM SHEET 31

TERMS OF OFFER (DETAILS OF DEBT SECURITIES PROPOSED TO BE ISSUED, MODE OF 33

ISSUANCE, ISSUE SIZE, UTILIZATION OF ISSUE PROCEEDS, STOCK EXCHANGES WHERE

VIII. SECURITIES ARE PROPOSED TO BE LISTED, REDEMPTION AMOUNT, PERIOD OF

MATURITY, YIELD ON REDEMPTION, DISCOUNT AT WHICH OFFER IS MADE AND

EFFECTIVE YIELD FOR INVESTOR)

IX. CREDIT RATING & RATIONALE THEREOF 44

X. NAME OF DEBENTURE TRUSTEE 44

XI. STOCK EXCHANGE WHERE SECURITIES ARE PROPOSED TO BE LISTED 44

DETAILS OF OTHER BORROWINGS (DETAILS DEBT SECURITIES ISSUED IN THE PAST, 45

PARTICULARS OF DEBT SECURITIES ISSUED FOR CONSIDERATION OTHER THAN CASH OR

XII.

AT A PREMIUM OR DISCOUNT OR IN PURSUANCE OF AN OPTION, HIGHEST TEN

HOLDERS OF EACH CLASS OR KIND OF SECURITIES, DEBT EQUITY RATIO)

XIII. SERVICING BEHAVIOR ON EXISTING DEBT SECURITIES AND OTHER BORROWINGS 47

XIV. UNDERTAKING REGARDING COMMON FORM OF TRANSFER 47

XV. MATERIAL EVENT, DEVELOPMENT OR CHANGE AT THE TIME OF ISSUE 47

XVI. PERMISSION / CONSENT FROM PRIOR CREDITORS 47

MATERIAL CONTRACTS & AGREEMENTS INVOLVING FINANCIAL OBLIGATIONS OF THE 47

XVII.

ISSUER

XVIII. DECLARATION 48

XIX. ANNEXURES

A. CREDIT RATING LETTER FROM CARE 49

B. RATING RATIONALE FROM CARE 52

C. CONSENT LETTER FROM AXIS TRUSTEE SERVICES LTD 63

D. APPLICATION FORM 64

E. INSTRUCTIONS 66

Page 2

I. DEFINITIONS/ ABBREVIATIONS

Act The Companies Act, 1956 as amended from time to time till date

Application Form The form in terms of which the investors shall apply for the Secured Taxable Redeemable

Non‐Convertible Debentures of the Company.

Board Board of Directors of Talwalkars Better Value Fitness Ltd.

Bondholder(s) The holder(s) of the NCDs

BSE Bombay Stock Exchange

NCDs Secured Taxable Redeemable Non‐Convertible NCDs issued under the terms of this

Disclosure Document

CBDT Central Board of Direct Taxes

CDSL Central Depository Services (India) Ltd.

Debt Securities Non‐Convertible debt securities which create or acknowledge indebtedness and include

debenture, NCDs and such other securities of the Issuer, whether constituting a charge

on the assets of the Issuer or not, but excludes security receipts and securitized debt

instruments

DDA Deemed Date of Allotment

EPS Earnings Per Share

FIs Financial Institutions

FIIs Foreign Institutional Investors

FY Financial Year

GOI Government of India

Issuer Company/ Talwalkars Better Value Fitness Ltd., a company incorporated under the Companies Act,

the Company/ 1956 and having its Registered Office at 801‐813, Mahalaxmi Chambers, 22, Bhulabhai

TBVFL Desai Road, Mumbai – 400 026

IT Act Income Tax Act, 1961 as amended from time to time till date

IST Indian Standard Time (Greenwich Mean Time + 0530 hours)

Lead Arranger Centrum Capital Limited

MFs Mutual Funds

NCDs Secured Taxable Redeemable Non‐Convertible Debentures

NRIs Non Resident Indians

NSDL National Securities Depository Ltd.

OCBs Overseas Corporate Bodies

Offer / Issue Private Placement of NCDs of TBVFL in terms of this Disclosure Document

The Disclosure Document dated April 23, 2014 for issue of Secured, Taxable,

Disclosure

Redeemable, Non‐Convertible Debentures of Rs. 10,00,000/‐ each for total face value of

Document

Rs. 25 crores to be issued by Talwalkars Better Value Fitness Ltd

RBI Reserve Bank of India

Registrars to the Link Intime India Private Ltd

issue

RTGS Real Time Gross Settlement

SEBI Securities and Exchange Board of India

SEBI Act Securities and Exchange Board of India Act, 1992, as amended from time to time

SEBI Regulations Securities and Exchange Board of India (Issue and Listing of Debt Securities) Regulations,

2008 issued vide Circular No. LAD‐NRO/GN/2008/13/127878 dated June 06, 2008 and

Securities & Exchange Board of India (Issue & Listing of Securities) (Amendment)

Regulations, 2012)

Trustee for the Axis Trustee Services Limited

Bondholders

YTM Yield to Maturity

Page 3

II. DISCLAIMER

GENERAL DISCLAIMER

This Disclosure Document is neither a Prospectus nor a Statement in Lieu of Prospectus and is prepared in

accordance with Securities and Exchange Board of India (Issue and Listing of Debt Securities) Regulations, 2008

issued vide Circular No. LAD‐NRO/GN/2008/13/127878 dated June 06, 2008 and Securities & Exchange Board

of India (Issue & Listing of Securities) (Amendment) Regulations, 2012). This document does not constitute an

offer to the public generally to subscribe for or otherwise acquire the NCDs to be issued by Talwalkars Better

Value Fitness Ltd (the “Issuer”/ “TBVFL”). The document is for the exclusive use of the Institutions to whom it is

delivered and it should not be circulated or distributed to third party(ies). TBVFL certifies that the disclosures

made in this document are generally adequate and are in conformity with the captioned SEBI Regulations. This

requirement is to facilitate investors to take an informed decision for making investment in the proposed Issue.

This Issue is being made strictly on a private placement basis and nothing in this Disclosure Document shall

constitute and/or deem to constitute an offer or an invitation to an offer to the Indian public or any section

thereof to subscribe for or otherwise acquire the NCDs. This Disclosure Document should not be construed to

be a prospectus or a statement in lieu of prospectus under the Companies Act.

This Disclosure Document and the contents hereof are restricted for only the intended recipient(s) who have

been addressed directly and specifically through a communication by the Issuer and only such recipients are

eligible to apply for the NCDs. All investors are required to comply with the relevant regulations/guidelines

applicable to them for investing in this Issue.

Therefore, as per the applicable provisions, a copy of this Disclosure Document has not been filed or submitted

to the SEBI for its review and/or approval. Further, since this Issue is being made on a private placement basis,

the provisions of Section 60 of the Companies Act shall not be applicable and accordingly, a copy of this

Disclosure Document has not been filed with the RoC or the SEBI.

DISCLAIMER OF THE SECURITIES & EXCHANGE BOARD OF INDIA

This Disclosure Document has not been filed with Securities & Exchange Board of India (SEBI). The Securities

have not been recommended or approved by SEBI nor does SEBI guarantee the accuracy or adequacy of this

document. It is to be distinctly understood that this document should not, in any way, be deemed or construed

that the same has been cleared or vetted by SEBI. SEBI does not take any responsibility either for the financial

soundness of any scheme or the project for which the Issue is proposed to be made, or for the correctness of

the statements made or opinions expressed in this document. The issue of NCDs being made on private

placement basis, filing of this document is not required with SEBI, however SEBI reserves the right to take up at

any point of time, with the Issuer, any irregularities or lapses in this document.

DISCLAIMER OF THE LEAD ARRANGER

It is advised that the Issuer has exercised self due‐diligence to ensure complete compliance of prescribed

disclosure norms etc in this Disclosure Document. The role of the Lead Arrangers in the assignment is confined

to marketing and placement of the NCDs on the basis of this Disclosure Document as prepared by the Issuer.

The Lead Arrangers has neither scrutinized/ vetted nor have they done any due‐diligence for verification of the

contents of this Disclosure Document. The Lead Arrangers shall use this document for the purpose of soliciting

subscription from qualified institutional investors in the NCDs to be issued by the Issuer on private placement

basis It is to be distinctly understood that the aforesaid use of this document by the Lead Arrangers should not

in any way be deemed or construed that the document has been prepared, cleared, approved or vetted by the

Lead Arrangers; nor do they in any manner warrant, certify or endorse the correctness or completeness of any

of the contents of this document; nor do they take responsibility for the financial or other soundness of this

Issuer, its promoters or its management. The Lead Arrangers or any of its directors, employees, affiliates or

representatives do not accept any responsibility and/or liability for any loss or damage arising of whatever

nature and extent in connection with the use of any of the information contained in this document.

DISCLAIMER OF THE ISSUER

Page 4

The Issuer certifies that the disclosures made in this Disclosure Document are generally adequate and in

conformity with the SEBI/ RBI regulations and directions. Further, the Issuer accepts no responsibility for

statements made otherwise than in this Disclosure Document or any other material issued by or at the

instance of the Issuer and anyone placing reliance on any source of information other than this Disclosure

Document would be doing so at his own risk. Further, the Issuer and its directors have not been prohibited

from accessing the capital market under any order or directions passed by SEBI.

DISCLAIMER OF THE STOCK EXCHANGE

As required, a copy of this Disclosure Document has been submitted to the Bombay Stock Exchange (BSE)for

hosting the same on its website. It is to be distinctly understood that such submission of the document with BSE

or hosting the same on its website should not in any way be deemed or construed that the document has been

cleared or approved by BSE; nor does it in any manner warrant, certify or endorse the correctness or

completeness of any of the contents of this document; nor does it warrant that this Issuer’s securities will be

listed or continue to be listed on the Exchange; nor does it take responsibility for the financial or other

soundness of this Issuer, its promoters, its management or any scheme or project of the Issuer. Every person

who desires to apply for or otherwise acquire any securities of this Issuer may do so pursuant to independent

inquiry, investigation and analysis and shall not have any claim against the Exchange whatsoever by reason of

any loss which may be suffered by such person consequent to or in connection with such subscription/

acquisition whether by reason of anything stated or omitted to be stated herein or any other reason

whatsoever.

Page 5

III. NAME AND ADDRESS OF REGISTERED/ HEAD OFFICE OF THE ISSUER

Name of the Issuer : Talwalkars Better Value Fitness Ltd.

Registered Office : 801‐813, Mahalaxmi Chambers,

22, Bhulabhai Desai Road,

Mumbai – 400 026

Tel. No. : +91‐022‐66126300 (324)

Fax No. : +91‐022‐66126363

E‐mail : [email protected]

Website : www.talwalkars.net

Compliance Officer of the issuer : Ms. Avanti Sankav

Chief Financial Officer of the Issuer : Mr. Anant Gawande

Auditors of the issuer : M. K. Dandeker & Co., Chartered Accountants.

(Since Annual General Meeting of the Company held on 12th

August, 2012, earlier Statutory Auditors ‐ Saraf Gurkar &

Associates, Chartered Accountants.)

Arrangers of the Issue : Centrum Capital Limited

Centrum House,

Vidya Nagari Marg,

Near Mumbai University,

Kalina, Santacruz (East),

Mumbai 400 098

Tel no : (022)42159841 Fax No : (022) 42159633

Contact Person : Gaurav Bhandari

Email : [email protected]

Trustee of the issue : Axis Trustee Services Limited

2nd Floor, Axis House, Bombay Dyeing Mills Compound,

Pandurang Budhkar Marg, Worli, Mumbai ‐ 400 025

Tel: 022‐24252525 ; Fax:022‐24254200

Contact Person : Mr Neelesh Baheti

Email : [email protected]

Registrar of the issue : Link Intime India Private Limited

C‐13, Pannalal Silk Mills Compound

LBS Marg, Bhandup (West), Mumbai ‐ 400 078

Tel No:‐ 022 – 25963838 Fax No:‐ 022 ‐ 2594 6979

Contact Person : Mr Ganesh Jadhav

Email : [email protected]

Credit Rating Agency of the issue : Credit Analysis & Research Ltd.

4th Floor, Godrej Coliseum, Somaiya Hospital Road,

Off Eastern Express Highway, Sion (East), Mumbai – 400 022

Tel No:‐ 022 – 67543429 ; Fax No:‐ 022 – 67543457

Email: [email protected]

Contact Person : Ms Rashmi Narvankar

Page 6

IV. NAME & ADDRESSES OF THE DIRECTORS OF THE ISSUER

The composition of the Board of Directors of the TBVFL as on date of this Disclosure Document is as under:

Sr. Name Designation Address

No.

1. Mr. Madhukar Vishnu Executive Chairman C‐37/40, Pandurang Society, Dr. A. B. Nair Road,

Talwalkar Juhu, Mumbai 400 049.

Mr. Prashant Sudhakar Managing Director & 26, Sheesh Mahal, D’Monte Park Road,

2. Talwalkar CEO Bandra (West), Mumbai 400 050.

3. Mr. Vinayak Ratnakar Whole‐time Director E‐6, Prathamesh CHS, Twin Tower Lane,

Gawande Off. Veer Savarkar Marg, Prabhadevi,

Mumbai 400 025.

4. Mr. Girish Madhukar Whole‐time Director D‐22, New Juhu, Park Co‐operative Housing

Talwalkar Society, 3rd floor, Opp. ISKON Temple, Juhu,

Mumbai 400 049.

5. Mr. Harsha Ramdas Whole‐time Director N‐5, Prathamesh CHS, Off. Veer Savarkar Road,

Bhatkal Prabhadevi, Mumbai‐ 400 025.

6. Mr. Anant Ratnakar Whole‐time Director A/173, Twin Tower, Twin Tower Lane, Off. Veer

Gawande & CFO Savarkar Marg, Prabhadevi,

Mumbai‐ 400 025, Maharashtra

7. Mr. Manohar Gopal Bhide Independent Director A/5, Bageshree, Shankar GhanekarMarg,

Prabhadevi, Mumbai‐ 400 025.

8. Mr. Raman Hirji Maroo Independent Director 21/A, Woodland, 67 Dr. G. DeshmukhMarg,

Mumbai 400 026.

9. Mr. Mohan Motiram Independent Director 12, Makani Manor, Peddar Road,

Jayakar Mumbai‐ 400 026.

10 Dr. Avinash Achyut Phadke Independent Director A‐Flat No. 41, 4th Floor, The Shrieesh CHS, 187,

V.S. Marg, Mahim, Mumbai – 400016.

11 Mr. Abhijeet Rajaram Patil Independent Director 3rd Floor, 214, Sweet Home, L.J Road,

Mahim (West), Mumbai 400 016.

12 Mr. Dinesh Kishanrao Independent Director P‐11, 5 Buena Vista, General Jagannath

Afzulpurkar BhosaleMarg, Mumbai – 400021.

Changes in the Management of the Company in last three Years

Reason for change in the Directorship: Resignation Reason for change in the Directorship: Appointment

Name of the Director resigning: Mr. Glenn Saldanha Name of the Director appointed: Mr. Dinesh Afzulpurkar

Designation of the Director: Independent Director Designation of the Director: Independent Director

Date of Resignation: 22nd November, 2011. Date of Appointment: 19th May, 2012.

Page 7

V. BRIEF SUMMARY OF BUSINESS/ ACTIVITIES OF THE ISSUER AND ITS LINE OF BUSINESS

Indian Wellness Industry

In India, wellness is a concept which has been in vogue since ancient times. Traditional medicinal and health

practices like Ayurveda and Yoga have propounded the concept of mental and bodily wellness. Most of the

ancient wellness concepts have largely focused on the basic needs of an individual within the need hierarchy,

namely a focus on health, nutrition and relaxation. With the progress of time, wellness as a concept has taken

up a multi‐dimensional definition, encompassing the individual’s desire for social acceptance, exclusivity and

collective welfare. Chiefly influenced by changes in society and in the lifestyles of individuals, this change has

also been accelerated by extraneous factors like globalization and a great awareness of the need for wellness

among individuals.

The Indian wellness industry is divided into the following segments:

Beauty services and cosmetic products – Salons and beauty centers, Cosmetic treatments (invasive and

non‐invasive)

Fitness Centers – Gyms, Health Clubs and Slimming centers

Nutrition – Health and wellness foods, Organic food etc.

Alternate therapy ‐ Ayurveda, Homeopathy, Unani, Naturopathy etc.

Rejuvenation – Spas, Foot reflexology etc.

Indian Fitness Market

The fitness and slimming market in India is ` 60 billion of which, 50% is the fitness services sector. The fitness

services sector in India continues to be fragmented with a large number of players. Most leading fitness chains

have grown aggressively and have doubled their number of centers. Expansion has been mostly driven by entry

into Tier 2 and Tier 3 cities and towns. In order to attract new customers and retain interest levels, organized

fitness service providers are looking beyond plain‐ vanilla services and adding new service offerings like pilates,

spinning, and power yoga to boost revenues.

Presently, the fitness industry is in its nascent stages. The industry is very fragmented with majority of the

market being dominated by a large number of mom‐and‐pop gyms. Every club offers similar basic gym facilities

and there is complete lack of product differentiation. The market also appears to have a shortage of talent,

since qualified personal trainers, nutrition consultants and professional managers are scarce, which also

contributes to the lack of differentiation. This high degree of fragmentation, lack of product differentiation,

and customer price sensitivity result in prevalent price competition and low margins. Yet, on the other hand,

awareness about fitness and a healthy lifestyle is growing; along with higher disposable incomes and a growing

young population. This is largely under penetrated market with less than 5% penetration of the urban

population. Organized players focus on below the line marketing to increase awareness about fitness among

consumers.

Source: PWC FICCI Wellness Report, September 2011; PWC FICCI Winds of change, August 2012, PWC FICCI

Imperatives for growth August 2013

Growth Drivers for Fitness Industry in India:

Change in demographic profile

India has a population of around a billion which is growing at a rate of about 1.7%. In general, more people

between the ages of 18‐54 exercise. However, in India age group 20‐44 can be mainly identified as prime

market for fitness clubs. The proportion of people in the age group of 20‐44 is projected to go up. The

rising youth population becomes the prime users of the health clubs in India. Increase in young and

working population coupled with increase in disposable income will have a positive effect on the industry

with larger number of people enrolling for health related services and products. The desire to be fit,

backed by increase in disposable income, will create more demand for niche fitness services like personal

training, massage, spinning, aerobics etc.

Page 8

Indian youth (in the age group 15 to 34 years) comprises over

34% of the total population. This is expected to cross over 400mn

by 2015 and forms the core target group for wellness products

and services.

Source: PWC FICCI Wellness Report, September 2011

Increasing incidence of lifestyle diseases

Significant changes in lifestyle related to lack of physical activity and increased consumption of fast foods

among both affluent and working class population has led to the greater need for healthy lifestyles

through sports, fitness centers and counseling on dietary habits.

According to International Diabetic Federation (IDF)’s latest report released at the 20th annual World

Diabetes Congress in Oct 2009, India leads the world in the number of people suffering from diabetes and

by 2030 nearly 9 per cent of the country's population is likely to be affected from the disease. About 50.8

million people are now suffering from the looming epidemic of diabetes, followed by China with 43.2

million. IDF estimates that Type 2 diabetes constitutes about 85% to 95% of all diabetes cases in developed

countries and accounts for an even higher percentage in developing countries. There is a huge emphasis on

regular exercise to prevent obesity and diabetes. IDF estimates that up to 80% of type 2 diabetes is

preventable by adopting a healthy diet and increased physical activity.

As per PWC FICCI Wellness Report the incidence of coronary heart disease in India by 2015 is expected to

rise by 46% as compared to 2010 while cases for diabetes is expected to grow 32% as compared to 2010.

Health clubs can play a vital role in taking preventive measures towards lifestyle diseases.

Source: PWC FICCI Wellness Report, September 2011

Growing realization of a need for healthy lifestyle

Awareness in the country on diseases like diabetes is increasing. According to AC Nielsen’s Global Online

Consumer Survey findings released in Feb 2009, 54 percent Indian respondents think they have issues with

their weight. About 80% people said they exercise at least once a week. Going to a gym is second most

preferred option for exercise after walking.

Forms of exercise preferred by Indians Frequency of exercise

Walking 22% 20%

Never

14%

35% Gym

16% 22% 1‐2days a week

Yoga/Pilates

36% 3‐6days a week

17% Running/Jogging

18% Daily

Others

Source:Nielsen survey Feb 2009 Source:Nielsen survey Feb 2009

The findings of the survey are very encouraging. Indians are adopting various actions to reduce their

weight. 79 percent respondents plan to exercise more, the second highest percentage for a country

globally after New Zealand (86), that is planning to exercise more to lose weight. 69 percent of Indians are

changing their diet plans to lose weight.

Increased awareness among the masses has opened a huge vista for the industry to expand. The demand

for fitness related products and services will increase tremendously with more and more people becoming

sensitive towards their health.

Page 9

Higher disposable income

India’s growing middle‐class is fuelling demand for fitness.

Source: PWC FICCI Wellness Report, September 2011

Increase in discretionary spends is positive for the industry.

• Rising incomes are resulting in increasing discretionary expenditures.

• Aspirational products and services are finding many takers.

Source: PWC FICCI Wellness Report, September 2011

This rapid increase in wealth can also be visibly seen in the several posh residential complexes that have

emerged in the top few Indian cities like Mumbai, NCR, Chennai, Kolkata, Hyderabad, Bangalore and Pune.

This segment of population provides an upscale market for fitness centers to offer not just the basic gym

facility but also advanced value added activities like spas, steam/sauna bath, nutrition centers, aerobics,

spinning studios and personal training program.

Growing urbanisation is resulting in higher awareness levels.

o The urban population constituted 28% of total population in 2001, this is expected to increase to 37%

in 2025.

o Increasing urbanisation has the dual impact of higher availability and awareness of wellness products

as well as higher incidence of stress‐related disorders and lifestyle diseases.

o This is driving growth in products and services in the enhancement and curative segments.

Source: PWC FICCI Wellness Report, September 2011

The urbanization, industrialization and economic liberalization have led to a rapid rise in the middle and

upper class in Indian population. The steep rise in urban population will leave limited scope for open area

physical activities leading to a sedentary lifestyle. Along with urbanization there has been regional

development with smaller towns becoming mini‐metro of India, which has led to an increased demand for

fitness services.

400 377

Urban population in Million

350

300

250 Tier 2, Tier 3 cities offers a huge

187

200 opportunity due to urbanization, rising

150 income and awareness in these cities

90

100 70

30

50

0

Tier 1 Tier 2 Tier 3 Other Total

Urban Urban

Source: PWC FICCI Wellness Report, August, 2012

Page 10

Description:GENERAL RISK. For taking an investment decision, investors must rely on their own examination of the issue, the disclosure document and the risk Body Sculpting / Body Shaping scheduled Commercial Banks are open for Business in the State of Maharashtra), then the payment due shall be