investor™s guide to angola PDF

Preview investor™s guide to angola

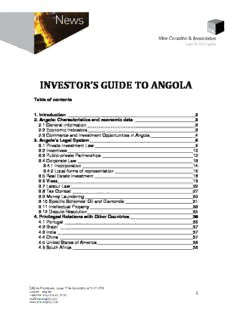

INVESTOR’S GUIDE TO ANGOLA Table of contents 1. Introduction ___________________________________________________2 2. Angola: Characteristics and economic data ________________________3 2.1 General information ___________________________________________3 2.2 Economic Indicators___________________________________________3 2.3 Commerce and Investment Opportunities in Angola__________________4 3. Angola’s Legal System__________________________________________5 3.1 Private Investment Law ________________________________________6 3.2 Incentives__________________________________________________10 3.3 Public-private Partnerships ____________________________________12 3.4 Corporate Law ______________________________________________13 3.4.1 Incorporation ____________________________________________14 3.4.2 Local forms of representation _______________________________16 3.5 Real Estate Investment _______________________________________18 3.6 Visas______________________________________________________19 3.7 Labour Law_________________________________________________22 3.8 Tax Context ________________________________________________27 3.9 Money Laundering___________________________________________30 3.10 Specific Schemes: Oil and Diamonds ___________________________31 3.11 Intellectual Property_________________________________________33 3.12 Dispute Resolution__________________________________________35 4. Privileged Relations with Other Countries_________________________36 4.1 Portugal ___________________________________________________36 4.2 Brazil _____________________________________________________37 4.3 India ______________________________________________________37 4.4 China _____________________________________________________37 4.5 United States of America______________________________________38 4.6 South Africa ________________________________________________38 1 1. Introduction Over the past few years, Angola has shown very attractive economic growth rates and is currently the greatest pole of concentration and attraction of investment in the African continent. Given the economic potential and the investment opportunities that the Angolan market offers in various sectors of activity, it becomes vital for those who decide to invest to know the country’s current legal framework. The main attraction of Angola for foreign investors is particularly focused on its existing riches such as oil and other natural resources, and infrastructure rehabilitation. To this extent, this Investor’s Guide is primarily intended to convey some general and summary information regarding the current legal environment in Angola, stress being laid to the areas of Private Investment, Commercial Law, Tax Law and Labour Law. The information conveyed in this Investor’s Guide does not dispense with the respective legal advice on each specific investment project. 2 2. Angola: Characteristics and economic data 2.1 General information Official Name: Republic of Angola Total area: 1,246,700 Km2 Population: 18.5 million inhabitants Official Language: Portuguese Capital: Luanda (5.5 million inhabitants) Other Important Cities: Cabinda, Huambo, Lubango, Lobito and Benguela Currency: Kwanza (KZ) Date of Independence: 11 November 1975 International Relations: African Union – since 1975 ONU – United Nations Organization – since 1976 IMF – International Monetary Fund – since 1976 World Bank – since 1989 WTO – World Trade Organization – since 1996 CPLP – Community of the Portuguese Speaking Countries (founding member) – since 1996 OPEC – Organization of Petroleum Exporting Countries – since 2007 2.2 Economic Indicators Angola is one of the economies with the greatest and fast-paced growth across the world, as it has become the largest oil producer in sub-Saharan Africa, implemented economic policies addressed to private investment, and benefitted from a privileged geographical location. To this extent, Angola is a fairly attractive market for investors. 3 The International Monetary Fund (IMF) expects that, in 2011, Angola will show a real economic growth of 7.5%, directly depending on the oil sector. This projection is justified by the average output level expected (which is an approximate indication of its maximum production capacity – 2 mbd). The non-oil sector is expected to grow by 8.8%. 2.3 Commerce and Investment Opportunities in Angola Angola is undeniably rich in oil and mineral reserves, particularly diamonds and iron ore. In order to boost the economy and promote employment, which are the key objectives of the Angolan government, the country needs to increase initiative and competitiveness of its private sector. Oil and diamonds account for nearly 99% of Angola’s exports. Nevertheless, the country has a huge potential to develop a diversified economy, namely regarding the production and export of agricultural products, industrial products and services. To this extent, the Angolan government recognizes the importance of attracting private investment, not only to contribute to diversify the economy, but also to reduce the Angolan economic dependence on volatile sectors such as oil and diamonds and has therefore implemented legislative measures towards creating a more attractive environment for investment. The sectors of activity which provide the best business opportunities are: a) Oil; b) Minerals; c) Civil construction and road, rail, port and airport infrastructure; d) Agriculture; e) Telecommunications; d) Banking; f) Tourism and g) Energy. 4 3. Angola’s Legal System The Angolan legal system is based upon the Portuguese civil law and customary law. For instance, it should be mentioned that the Angolan Civil Code corresponds to the original version of the Portuguese Civil Code of 1966. It is typically shaped by the Romano-Germanic law, whose legislation is mostly codified and legally established. Without direct correspondence to the Portuguese legal scheme, there are two extremely important diplomas in Angola: The Petroleum Act and the Diamond Act. The current Constitution of the Angolan Republic was published in the Official Journal of Angola on 5th February 2010. Compared to the previous version, significant amendments have been brought about, especially under the scope of the Fundamental Rights, as it has become wider by including free enterprise, private property, the right to environment and intellectual property. The judicial system includes municipal and provincial courts, which operate at the trial level, while the Supreme Court operates at the appellate level. The Constitutional Court deals exclusively with the examination of constitutionality matters. 5 3.1 Private Investment Law The new Private Investment Law (PIL), approved by Law No. 20/11, of 20th May, strategically redefines the principles regarding the already existing scheme and the procedures needed for access to the benefits and incentives granted by the State, namely in terms of profit and/or dividend repatriation. The purpose of the new diploma is to adapt more effectively the tax incentives granted to investors and the socio-economic impact of the investments made in the country and to adjust the system to the new constitutional reality of Angola and to the tax reform that has been underway. The new Law does not apply to investment projects approved under the previous legislation. It, however, applies to projects that are still outstanding from the date of entry into force of the diploma. This new law brings about significant changes to the private (internal and external) investment scheme, namely aiming at: - attracting larger investments (preferably in the structural sectors of the Angolan economy); - avoiding investments below USD 1,000,000.00 into the country, per project and per investor. To put a private investment into practice in Angola, it is necessary to obtain a priori authorization of the National Agency for Private Investment (ANIP), which is responsible for conducting the Angolan policy regarding private investments. 6 The new Private Investment Act has also introduced the concept of “External Reinvestment”, which consists in applying, within the Angolan territory, all or part of the income generated in virtue of an external investment previously made and already implemented under the framework of ANIP. This reinvestment may take advantage of new benefits, and the reinvestment commitment ab initio may help grant larger incentives to the initial investment. The main operations of foreign investment include: a) Transfer of funds from abroad; b) Investment of liquid assets in foreign currency bank accounts held by non- residents in Angola; c) Investment of funds under external reinvestment; d) Import of machinery, equipment, accessories and other tangible fixed assets; e) Incorporation of technologies and know-how. This new Law established a unique procedural mechanism for the implementation of private investments in Angola: the contractual regime. Thus, the a priori declaration regime was abolished. This new regime requires the existence of negotiations between the potential investor and the relevant authorities of the Angolan state, in any submitted draft investment proposal. Submission and Approval Stages: 1st) Submission of Proposal to ANIP The draft investment proposal to be submitted to ANIP should include: i) all supporting documents of legal, economic, financial and technical characterization of the investor and the investment (feasibility study, 7 evaluation of the suitability of access to incentives and aids, implementation schedule, among others); ii) environmental impact assessment study (if applicable). 2nd) ANIP sends notice for proposal rectification (possible) 3rd) Investor has 15 days to reply 4th) ANIP accepts offer 5th) Beginning of the general deadline of 45 days for negotiation (extendable for more 45 days) 6th) Beginning of the general deadline of 30 days to evaluate the proposals and negotiation with the Negotiation Committee for Aids and Incentives (known as CNFI) 7th) CNFI issues final opinion 8th) Delivery of final opinion to the approval body, by ANIP, within 5 days: a) Investments up to USD 10 million: approval, within 15 days, by the Board of ANIP (taking into account the binding opinion to be delivered by the Finance Ministry, as regards the tax incentives to be granted); b) Investments over USD 10 million: approval, within 30 days, by the Head of State (the President of the Republic of Angola, as head of Government), after a priori evaluation of the Council of Ministers; c) Investments over USD 50 million: the Head of State may set up and define the composition of an ad hoc CNFI in order to negotiate with the potential investor and then to deliver a final decision. 9th) Adoption or rejection of the proposal 10th) ANIP issues the Certificate for Registration of Private Investment (known as CRIP), within 15 days (if the proposal is approved). 8 For the purpose of granting incentives to investors, the projects must be carried out in priority sectors such as agriculture, manufacturing industry, transport infrastructure, telecommunications, fisheries, energy, water, social housing, health and education, as well as being located at development poles, special economic zones or off-shores, to be created by the Angolan government. The investors may have access to tax and customs incentives and/or benefits, namely: a) deductions to taxable income; b) accelerated depreciation and reincorporation; c) tax credit; d) exemption/reduction of rate of tax, contributions and other import duties. In this regard, the major innovation brought about by the new regime relies upon the exceptional character of incentive/benefit granting procedure, given that it is no longer automatic, indiscriminate and unlimited in time, now depending basically upon an analysis of each investment project. The decision-making power of granting tax benefits is also the Finance Minister’s responsibility, without prejudice to the ANIP competence in following up the whole process. The tax and customs benefits show specific features according to each Development Zone for the purposes of maximum time and value limits: a) ZONE A (Province of Luanda, the capital-municipalities of the Provinces of Benguela, Huíla, Cabinda and the Municipality ofLobito); Industrial Tax – from 1 to 5 years, max.; 9 Capital Gains Tax – from 1 to 3 years, max.; b) ZONE B (remaining Municipalities of the Provinces of Benguela, Cabinda and Huíla and Provinces of North Kwanza, South Kwanza, Malange, Namibe, Bengo and Uíge); Industrial Tax – from 1 to 8 years, max.; Capital Gains Tax – from 1 to 6 years, max.; c) ZONE C (Provinces of Huambo, Bié, Moxico, Kuando-Kubango, Cunene, Zaire, North Lunda and South Lunda); Industrial Tax – from 1 to 10 years, max.; Capital Gains Tax – from 1 to 9 years, max. 3.2 Incentives Among the various possible incentives, special attention should be paid to the exemption from or deduction of the Industrial Tax, up to 50%, regarding the profit arising from private investment, which varies according to the investment Development Zone. The tax benefits regarding the Real Estate Transfer Tax (Sisa) translate into the exemption from or percentage deduction of the payment of this tax, due to the acquisition of land and real property used in the project and that must be requested from the relevant tax service of the respective Development Zone. As regards the granting of investment incentives, the priority sectors are as follows: - Agriculture production; - Manufacturing industries; - Technology and modernization of the respective industry; 10

Description: