ILLINOIS INCOME TAX ACT AS AMENDED THROUGH PUBLIC ACT 99-0423 PDF

Preview ILLINOIS INCOME TAX ACT AS AMENDED THROUGH PUBLIC ACT 99-0423

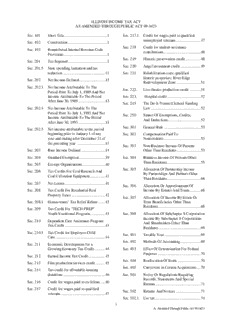

AS AMENDED THROUGH PUBLIC ACT 100-555 Sec. 101. Short Title. .................................... 1 Sec. 217. Credit for wages paid to qualified veterans. ....................... 47 Sec. 102. Construction. ................................. 1 Sec. 217.1. Credit for wages paid to Sec. 103. Renumbered Internal Revenue qualified unemployed veterans. .. 47 Code Provisions. ........................... 1 Sec. 218. Credit for student-assistance Sec. 201. Tax Imposed. ................................. 1 contributions. .............................. 48 Sec. 201.5. State spending limitation and Sec. 219. Historic preservation credit. ........ 48 tax reduction. ............................... 11 Sec. 220. Angel investment credit. ............. 48 Sec. 202. Net Income Defined. ................... 13 Sec. 221. Rehabilitation costs; qualified Sec. 202.3. Net Income Attributable To historic properties; River Edge The Period Prior To July 1, Redevelopment Zone. ................. 52 1989 And Net Income Attributable To The Period Sec. 222. Live theater production credit. .... 52 After June 30, 1989. .................... 13 Sec. 223. Hospital credit. ............................ 53 Sec. 202.4. Net Income Attributable To Sec. 224. Invest in Kids credit. ................... 53 The Period Prior To July 1, 1993 And Net Income Sec. 225. Credit for instructional Attributable To The Period materials and supplies. ................ 53 After June 30, 1993. .................... 13 Sec. 226. Natural disaster credit. ................ 54 Sec. 202.5. Net income attributable to the Sec. 250. Sunset Of Exemptions, Credits, period beginning prior to the And Deductions. ......................... 54 first day of a month and ending after the last day of the Sec. 301. General Rule. .............................. 55 preceding month. ......................... 13 Sec. 302. Compensation Paid To Sec. 203. Base income defined. .................. 14 Nonresidents. .............................. 55 Sec. 204. Standard Exemption. ................... 39 Sec. 303. Non-Business Income Of Persons Other Than Residents. ... 55 Sec. 205. Exempt organizations. ................. 40 Sec. 304. Business income of persons Sec. 206. Tax Credits For Coal Research other than residents. .................... 57 And Coal Utilization Equipment. .................................. 41 Sec. 305. Allocation Of Partnership Income By Partnerships And Sec. 207. Net Losses. .................................. 41 Partners Other Than Residents. ... 69 Sec. 208. Tax Credit For Residential Real Sec. 306. Allocation Or Apportionment Property Taxes. ........................... 42 Of Income By Estates And Trusts. Sec. 208.1. Homeowners’ Tax Relief Rebate. .................................................... 70 .................................................... 42 Sec. 307. Allocation Of Income By Estate Sec. 209. Tax Credit for "TECH-PREP" Or Trust Beneficiaries Other youth vocational programs. ......... 43 Than Residents. ........................... 70 Sec. 210. Dependent Care Assistance Sec. 308. Allocation Of Subchapter S Program Tax Credit. .................... 43 Corporation Income By Subchapter S Corporations Sec. 210.5. Tax credit for employee child care. And Shareholders Other Than .................................................... 43 Residents. .................................... 70 Sec. 211. Economic Development for a Sec. 401. Taxable Year. .............................. 71 Growing Economy Tax Credit. ... 44 Sec. 402. Methods Of Accounting. ............. 71 Sec. 212. Earned income tax credit. ............ 45 Sec. 403. Effect Of Determination For Sec. 213. Film production services credit. .. 45 Federal Purposes. ........................ 71 Sec. 214. Tax credit for affordable Sec. 404. Reallocation Of Items. ................ 71 housing donations. ...................... 45 Sec. 405 Carryovers in Certain Acquisitions. Sec. 216. Credit for wages paid to ex-felons. .................................................... 72 .................................................... 46 i As Amended Through Public Act 100-555 Sec. 501. Notice Or Regulations Sec. 507R. Mental Health Research Fund Requiring Records, Statements Checkoff. ..................................... 81 And Special Returns.................... 72 Sec. 507S. Children’s Cancer Fund Checkoff. Sec. 502. Returns and notices. .................... 73 .................................................... 81 Sec. 502.1. Use tax. ....................................... 76 Sec. 507T. American Diabetes Association Checkoff. ..................................... 82 Sec. 503. Signing Of Returns And Notices. ....................................... 76 Sec. 507U. Prostate Cancer Research Fund checkoff....................................... 82 Sec. 504. Verification. ................................ 77 Sec. 507V. National World War II Sec. 505. Time And Place For Filing Returns. Memorial Fund checkoff. ............ 82 .................................................... 77 Sec. 507W. Korean War Veterans National Sec. 506. Federal Returns. .......................... 78 Museum and Library Fund Sec. 506.5. Returns Based On Substitute checkoff....................................... 82 W-2 Forms. ................................. 78 Sec. 507X. The Multiple Sclerosis Sec. 507. Child Abuse Prevention Fund Assistance Fund checkoff. .......... 82 Checkoff. ..................................... 78 Sec. 507Y. The Illinois Military Family Sec. 507A. Community Health Center Care Relief checkoff. ........................... 82 Fund Checkoff. ........................... 79 Sec. 507Z. World War II Illinois Veterans Sec. 507B. Child Care Expansion Program Memorial Fund checkoff. ............ 83 Fund Checkoff. ........................... 79 Sec. 507AA. The Lou Gehrig's Disease Sec. 507C. Youth Drug Abuse Prevention (ALS) Research Fund checkoff. Fund Checkoff. ........................... 79 (PA 93-0036) .............................. 83 Sec. 507E. Assistive Technology For Sec. 507BB. Asthma and Lung Research Persons With Disabilities Fund checkoff. (PA 93-0292) ............... 83 Checkoff. ..................................... 79 Sec. 507CC. The Leukemia Treatment and Sec. 507F. Domestic Violence Shelter And Education checkoff. (PA 93-0324) Service Fund Checkoff. ............... 79 .................................................... 83 Sec. 507G. United States Olympians Sec. 507DD. The Illinois Veterans' Homes Assistance Fund Checkoff........... 79 Fund checkoff. ............................ 83 Sec. 507H. Persian Gulf Conflict Veterans Sec. 507EE. Pet Population Control Fund Fund Checkoff. ........................... 80 checkoff....................................... 83 Sec. 507I. Literacy Advancement Fund Sec. 507FF. Epilepsy Treatment and Checkoff. ..................................... 80 Education Grants-in-Aid Fund checkoff....................................... 84 Sec. 507J. Ryan White Pediatric And Adult AIDS Fund Checkoff. ....... 80 Sec. 507GG. Diabetes Research Checkoff Fund checkoff. ............................ 84 Sec. 507K. Illinois Special Olympics Checkoff. .................................................... 80 Sec. 507HH. Sarcoidosis Research Fund checkoff....................................... 84 Sec. 507L. Penny Severns Breast, Cervical, and Ovarian Cancer Research Sec. 507II. The Vince Demuzio Memorial Fund Checkoff. ........................... 80 Colon Cancer Fund checkoff. ..... 84 Sec. 507M. Meals On Wheels Fund Checkoff. Sec. 507JJ. The Autism Research Checkoff .................................................... 80 Fund checkoff. ............................ 84 Sec. 507N. Korean War Memorial Fund Sec. 507KK. Blindness Prevention Fund Checkoff. ..................................... 81 checkoff....................................... 85 Sec. 507O. Heart Disease Treatment And Sec. 507LL. The Illinois Brain Tumor Prevention Fund Checkoff. ......... 81 Research checkoff. ...................... 85 Sec. 507P. Hemophilia Treatment Fund Sec. 507MM. Supplemental Low-Income Checkoff. ..................................... 81 Energy Assistance Fund checkoff. .................................................... 85 Sec. 507Q. Women In Military Service Memorial Fund Checkoff. ........... 81 Sec. 507NN. The Heartsaver AED Fund checkoff. (P.A. 94-876) ............... 85 -ii- As Amended Through Public Act 100-0047 Sec. 507PP. The lung cancer research Sec. 603. Credit Of Overpayments For checkoff. (Public Act 95-434) ..... 85 Taxpayers That Are Members Of A Unitary Business Group. .... 92 Sec. 507QQ. The autoimmune disease research checkoff. (Public Act Sec. 604. Payments Not Payable To 95-435) ........................................ 85 Department. ................................. 92 Sec. 507RR. The Healthy Smiles Fund checkoff. Sec. 605. Payments By Credit Card. ........... 92 .................................................... 86 Sec. 606. EDGE payment. .......................... 92 Sec. 507SS. The hunger relief checkoff. ......... 86 Sec. 701. Requirement and Amount of Sec. 507TT. The crisis nursery checkoff. ........ 86 Withholding. ............................... 92 Sec. 507UU. The Illinois Route 66 checkoff. ... 86 Sec. 702. Amount Exempt From Withholding. ............................... 93 Sec. 507VV. Habitat for Humanity Fund checkoff....................................... 86 Sec. 703. Information Statement. ................ 93 Sec. 507WW. The State parks checkoff. ............ 86 Sec. 704. Employer's Return and Payment of Tax Withheld. ......................... 93 Sec. 507XX. The property tax relief checkoff for veterans with disabilities. ...... 86 Sec. 704A. Employer's return and payment of tax withheld. ........................... 94 Sec. 507YY. Crime Stoppers checkoff. ............ 87 Sec. 705. Employer's Liability For Sec. 507ZZ. After-School Rescue Fund Withheld Taxes. .......................... 96 checkoff....................................... 87 Sec. 706. Employer's Failure To Sec. 507AAA. The Childhood Cancer Withhold. .................................... 96 Research Fund checkoff. ............. 87 Sec. 707. Governmental Employers............ 96 Sec. 507BBB. The Children's Wellness Charities Fund checkoff. ............................ 87 Sec. 709.5. Withholding by partnerships, Subchapter S corporations, and Sec. 507CCC. The Housing for Families Fund trusts. ........................................... 96 checkoff....................................... 87 Sec. 710. Withholding From Lottery Sec. 507DDD. Special Olympics Illinois and Winnings. .................................... 97 Special Children's Checkoff. ....... 87 Sec. 711. Payor's Return and Payment of Sec. 507EEE. U.S.S. Illinois Commissioning Tax Withheld. ............................. 98 Fund checkoff. ............................ 88 Sec. 712. Payor's Liability For Withheld Sec. 507FFF. Autism Care Fund checkoff. ....... 88 Taxes. .......................................... 98 Sec. 507GGG. Thriving Youth checkoff. ............ 88 Sec. 713. Payor's Failure To Withhold. ...... 98 Sec. 507HHH. Illinois Police Memorial checkoff. Sec. 803. Payment Of Estimated Tax. ........ 98 .................................................... 88 Sec. 804. Failure To Pay Estimated Tax. .... 99 Sec. 508. Transfer Of Checkoff Funds. ...... 89 Sec. 806. Exemption from penalty ............ 101 Sec. 509. Tax checkoff explanations. ......... 89 Sec. 807. EDGE payment. ........................ 101 Sec. 509.1. Removal of excess tax checkoff funds. ............................ 89 Sec. 901. Collection Authority. ................ 101 Sec. 510. Determination of amounts Sec. 902. Notice And Demand.................. 105 contributed. ................................. 89 Sec. 903. Assessment. ............................... 106 Sec. 511. Refunds. ...................................... 89 Sec. 904. Deficiencies And Overpayments. Sec. 512. School District Information......... 90 .................................................. 106 Sec. 516. Assistance To The Homeless Fund. Sec. 905. Limitations on Notices of .................................................... 90 Deficiency. ................................ 107 Sec. 601. Payment on Due Date of Sec. 906. Further Notices Of Deficiency Return. ......................................... 90 Restricted. ................................. 109 Sec. 601.1. Payment by electronic funds Sec. 907. Waiver Of Restrictions On transfer. ....................................... 91 Assessment. ............................... 109 Sec. 602. Tentative Payments. .................... 92 Sec. 908. Procedure On Protest. ............... 110 Sec. 909. Credits And Refunds. ................ 110 -iii- As Amended Through Public Act 100-0047 Sec. 910. Procedure On Denial Of Claim Sec. 1110. Redemption By State. ............... 127 For Refund. ............................... 111 Sec. 1201. Administrative Review Law Sec. 911. Limitations on Claims for Refund. Illinois Independent Tax .................................................. 112 Tribunal Act of 2012. ................ 127 Sec. 911.1 114 Sec. 1202. Venue. ....................................... 127 Sec. 911.2. Refunds withheld; tax claims Sec. 1203. Service, Certification And of other states. ........................... 114 Dismissal. .................................. 127 Sec. 911.3. Refunds withheld; order of Sec. 1204. Modification Of Assessment. .... 128 honoring requests. ..................... 115 Sec. 1301. Willful And Fraudulent Acts. .... 128 Sec. 912. Recovery Of Erroneous Refund. Sec. 1302. Willful Failure To Pay Over. .... 128 .................................................. 116 Sec. 1401. Promulgation Of Rules And Sec. 913. Access To Books And Records. 116 Regulations. .............................. 128 Sec. 914. Conduct Of Investigations Sec. 1402. Notice. ....................................... 129 And Hearings. ........................... 116 Sec. 1403. Substitution Of Parties. ............. 129 Sec. 915. Immunity Of Witnesses. ........... 116 Sec. 1404. Appointment Of Secretary Of Sec. 916. Production Of Witnesses And State As Agent For Service Of Records. .................................... 116 Process. ..................................... 129 Sec. 917. Confidentiality and Sec. 1405. Transferees. ............................... 129 information sharing. .................. 117 Sec. 1405.1. Information Reports: ................. 129 Sec. 918. Place Of Hearings. .................... 118 Sec. 1405.2. Information Reports For Sec. 1001. Failure to File Tax Returns. ...... 119 Payments Made Under Sec. 1002. Failure To Pay Tax. ................... 119 Contracts For Personal Services: .................................................. 130 Sec. 1003. Interest On Deficiencies. ........... 120 Sec. 1405.3. Information Reports For Sec. 1004. Failure To File Withholding Payments Made For Prizes Returns Or Annual Transmittal And Awards. ............................. 131 Forms For Wage And Tax Statements. ................................ 120 Sec. 1405.4. Tax Refund Inquiries; Response. .................................................. 131 Sec. 1005. Penalty For Underpayment Of Tax. .................................................. 120 Sec. 1405.5. Registration of tax shelters. ....... 131 Sec. 1006. Frivolous Returns. ..................... 122 Sec. 1405.6. Investor lists. ............................. 132 Sec. 1007. Failure to register tax shelter Sec. 1406. Identifying Numbers. ................ 132 or maintain list. ......................... 123 Sec. 1407. Amounts Less Than $1. ............ 132 Sec. 1008. Promoting tax shelters. .............. 123 Sec. 1408. Administrative Procedure Sec. 1101. Lien For Tax. ............................ 123 Act - Application. ...................... 132 Sec. 1102. Jeopardy Assessments. .............. 124 Sec. 1501. Definitions................................. 133 Sec. 1103. Filing and Priority of Liens. ...... 124 Sec. 1502. Arrangement And Captions....... 140 Sec. 1104. Duration Of Lien. ...................... 125 Sec. 1601. Severability. .............................. 140 Sec. 1105. Release of Liens. ....................... 125 Sec. 1701. Effective Date. .......................... 140 Sec. 1106. Nonliability For Costs. .............. 125 Sec. 1107. Claim To Property. .................... 125 Sec. 1108. Foreclosure On Real Property. .. 126 Sec. 1109. Demand And Seizure. ............... 126 -iv- As Amended Through Public Act 100-0047 AN ACT to impose a tax on the privilege of earning (1) In the case of an individual, trust or or receiving income in or as a resident of the State estate, for taxable years ending prior to July 1, 1989, of Illinois. an amount equal to 2 1/2% of the taxpayer's net income for the taxable year. (35 ILCS 5/101 et seq.) (from Ch. 120, par. 1-101 et seq.) (2) In the case of an individual, trust or estate, for taxable years beginning prior to July 1, 1989 and ending after June 30, 1989, an amount Cite: 35 ILCS 5/101 et seq. From: Ch. 120, par. 1- equal to the sum of (i) 2 1/2% of the taxpayer's net 101 et seq. Source: P.A. 76-261. Date: Approved income for the period prior to July 1, 1989, as July 1, 1969. Short title: Illinois Income Tax Act. calculated under Section 202.3, and (ii) 3% of the taxpayer's net income for the period after June 30, ARTICLE 1. SHORT TITLE AND 1989, as calculated under Section 202.3. CONSTRUCTION. (3) In the case of an individual, trust or Sec. 101. Short Title. estate, for taxable years beginning after June 30, This Act shall be known and may be cited 1989, and ending prior to January 1, 2011, an as the "Illinois Income Tax Act." (Source: P.A. 76- amount equal to 3% of the taxpayer's net income for 261.) the taxable year. Sec. 102. Construction. (4) In the case of an individual, trust, or estate, for taxable years beginning prior to January Except as otherwise expressly provided or 1, 2011, and ending after December 31, 2010, an clearly appearing from the context, any term used in amount equal to the sum of (i) 3% of the taxpayer's this Act shall have the same meaning as when used net income for the period prior to January 1, 2011, in a comparable context in the United States Internal as calculated under Section 202.5, and (ii) 5% of the Revenue Code of 1954 or any successor law or laws taxpayer's net income for the period after December relating to federal income taxes and other provisions 31, 2010, as calculated under Section 202.5. of the statutes of the United States relating to federal income taxes as such Code, laws and statutes are in (5) In the case of an individual, trust, or effect for the taxable year. (Source: P.A. 77-726.) estate, for taxable years beginning on or after January 1, 2011, and ending prior to January 1, Sec. 103. Renumbered Internal Revenue 2015, an amount equal to 5% of the taxpayer's net Code Provisions. income for the taxable year. If a provision of the United States Internal (5.1) In the case of an individual, trust, or Revenue Code is specifically mentioned by number estate, for taxable years beginning prior to January in a provision of this Act and if after the effective 1, 2015, and ending after December 31, 2014, an date of the legislation that established such reference amount equal to the sum of (i) 5% of the taxpayer's the Internal Revenue Code provision thus referred to net income for the period prior to January 1, 2015, is, by amendment, renumbered without any other as calculated under Section 202.5, and (ii) 3.75% of change whatever being made to it, then the provision the taxpayer's net income for the period after of this Act containing such reference shall be December 31, 2014, as calculated under Section construed as though the renumbering of the 202.5. provision of the United States Internal Revenue Code had not occurred. (Source: P.A. 86-678.) (5.2) In the case of an individual, trust, or estate, for taxable years beginning on or after ARTICLE 2. TAX IMPOSED January 1, 2015, and ending prior to July 1, 2017, an Sec. 201. Tax Imposed. amount equal to 3.75% of the taxpayer's net income for the taxable year. (a) In general. A tax measured by net income is hereby imposed on every individual, (5.3) In the case of an individual, trust, or corporation, trust and estate for each taxable year estate, for taxable years beginning prior to July 1, ending after July 31, 1969 on the privilege of 2017, and ending after June 30, 2017, an amount earning or receiving income in or as a resident of equal to the sum of (i) 3.75% of the taxpayer's net this State. Such tax shall be in addition to all other income for the period prior to July 1, 2017, as occupation or privilege taxes imposed by this State calculated under Section 202.5, and (ii) 4.95% of the or by any municipal corporation or political taxpayer's net income for the period after June 30, subdivision thereof. 2017, as calculated under Section 202.5. (b) Rates. The tax imposed by subsection (5.4) In the case of an individual, trust, or (a) of this Section shall be determined as follows, estate, for taxable years beginning on or after July 1, except as adjusted by subsection (d-1): 2017, an amount equal to 4.95% of the taxpayer's net income for the taxable year. 1 As Amended Through Public Act 100-555 (6) In the case of a corporation, for taxable amount equal to 7% of the taxpayer's net income for years ending prior to July 1, 1989, an amount equal the taxable year. to 4% of the taxpayer's net income for the taxable The rates under this subsection (b) are year. subject to the provisions of Section 201.5. (7) In the case of a corporation, for taxable (c) Personal Property Tax Replacement years beginning prior to July 1, 1989 and ending Income Tax. Beginning on July 1, 1979 and after June 30, 1989, an amount equal to the sum of thereafter, in addition to such income tax, there is (i) 4% of the taxpayer's net income for the period also hereby imposed the Personal Property Tax prior to July 1, 1989, as calculated under Section Replacement Income Tax measured by net income 202.3, and (ii) 4.8% of the taxpayer's net income for on every corporation (including Subchapter S the period after June 30, 1989, as calculated under corporations), partnership and trust, for each taxable Section 202.3. year ending after June 30, 1979. Such taxes are (8) In the case of a corporation, for taxable imposed on the privilege of earning or receiving years beginning after June 30, 1989, and ending income in or as a resident of this State. The Personal prior to January 1, 2011, an amount equal to 4.8% Property Tax Replacement Income Tax shall be in of the taxpayer's net income for the taxable year. addition to the income tax imposed by subsections (a) and (b) of this Section and in addition to all other (9) In the case of a corporation, for taxable occupation or privilege taxes imposed by this State years beginning prior to January 1, 2011, and ending or by any municipal corporation or political after December 31, 2010, an amount equal to the subdivision thereof. sum of (i) 4.8% of the taxpayer's net income for the period prior to January 1, 2011, as calculated under (d) Additional Personal Property Tax Section 202.5, and (ii) 7% of the taxpayer's net Replacement Income Tax Rates. The personal income for the period after December 31, 2010, as property tax replacement income tax imposed by calculated under Section 202.5. this subsection and subsection (c) of this Section in the case of a corporation, other than a Subchapter S (10) In the case of a corporation, for corporation and except as adjusted by subsection (d- taxable years beginning on or after January 1, 2011, 1), shall be an additional amount equal to 2.85% of and ending prior to January 1, 2015, an amount such taxpayer's net income for the taxable year, equal to 7% of the taxpayer's net income for the except that beginning on January 1, 1981, and taxable year. thereafter, the rate of 2.85% specified in this (11) In the case of a corporation, for subsection shall be reduced to 2.5%, and in the case taxable years beginning prior to January 1, 2015, of a partnership, trust or a Subchapter S corporation and ending after December 31, 2014, an amount shall be an additional amount equal to 1.5% of such equal to the sum of (i) 7% of the taxpayer's net taxpayer's net income for the taxable year. income for the period prior to January 1, 2015, as (d-1) Rate reduction for certain foreign calculated under Section 202.5, and (ii) 5.25% of the insurers. In the case of a foreign insurer, as defined taxpayer's net income for the period after December by Section 35A-5 of the Illinois Insurance Code, 31, 2014, as calculated under Section 202.5. whose state or country of domicile imposes on (12) In the case of a corporation, for insurers domiciled in Illinois a retaliatory tax taxable years beginning on or after January 1, 2015, (excluding any insurer whose premiums from and ending prior to July 1, 2017, an amount equal to reinsurance assumed are 50% or more of its total 5.25% of the taxpayer's net income for the taxable insurance premiums as determined under paragraph year. (2) of subsection (b) of Section 304, except that for purposes of this determination premiums from (13) In the case of a corporation, for reinsurance do not include premiums from inter- taxable years beginning prior to July 1, 2017, and affiliate reinsurance arrangements), beginning with ending after June 30, 2017, an amount equal to the taxable years ending on or after December 31, 1999, sum of (i) 5.25% of the taxpayer's net income for the the sum of the rates of tax imposed by subsections period prior to July 1, 2017, as calculated under (b) and (d) shall be reduced (but not increased) to Section 202.5, and (ii) 7% of the taxpayer's net the rate at which the total amount of tax imposed income for the period after June 30, 2017, as under this Act, net of all credits allowed under this calculated under Section 202.5. Act, shall equal (i) the total amount of tax that would (14) In the case of a corporation, for be imposed on the foreign insurer's net income taxable years beginning on or after July 1, 2017, an allocable to Illinois for the taxable year by such 2 As Amended Through Public Act 100-555 foreign insurer's state or country of domicile if that as determined by the taxpayer's employment records net income were subject to all income taxes and filed with the Illinois Department of Employment taxes measured by net income imposed by such Security. Taxpayers who are new to Illinois shall be foreign insurer's state or country of domicile, net of deemed to have met the 1% growth in base all credits allowed or (ii) a rate of zero if no such tax employment for the first year in which they file is imposed on such income by the foreign insurer's employment records with the Illinois Department of state of domicile. For the purposes of this subsection Employment Security. The provisions added to this (d-1), an inter-affiliate includes a mutual insurer Section by Public Act 85-1200 (and restored by under common management. Public Act 87-895) shall be construed as declaratory of existing law and not as a new enactment. If, in (1) For the purposes of subsection (d-1), in any year, the increase in base employment within no event shall the sum of the rates of tax imposed by Illinois over the preceding year is less than 1%, the subsections (b) and (d) be reduced below the rate at additional credit shall be limited to that percentage which the sum of: times a fraction, the numerator of which is .5% and (A) the total amount of tax imposed on the denominator of which is 1%, but shall not such foreign insurer under this Act for a taxable exceed .5%. The investment credit shall not be year, net of all credits allowed under this Act, plus allowed to the extent that it would reduce a taxpayer's liability in any tax year below zero, nor (B) the privilege tax imposed by Section may any credit for qualified property be allowed for 409 of the Illinois Insurance Code, the fire insurance any year other than the year in which the property company tax imposed by Section 12 of the Fire was placed in service in Illinois. For tax years Investigation Act, and the fire department taxes ending on or after December 31, 1987, and on or imposed under Section 11-10-1 of the Illinois before December 31, 1988, the credit shall be Municipal Code, equals 1.25% for taxable years allowed for the tax year in which the property is ending prior to December 31, 2003, or 1.75% for placed in service, or, if the amount of the credit taxable years ending on or after December 31, 2003, exceeds the tax liability for that year, whether it of the net taxable premiums written for the taxable exceeds the original liability or the liability as later year, as described by subsection (1) of Section 409 amended, such excess may be carried forward and of the Illinois Insurance Code. This paragraph will applied to the tax liability of the 5 taxable years in no event increase the rates imposed under following the excess credit years if the taxpayer (i) subsections (b) and (d). makes investments which cause the creation of a (2) Any reduction in the rates of tax minimum of 2,000 full-time equivalent jobs in imposed by this subsection shall be applied first Illinois, (ii) is located in an enterprise zone against the rates imposed by subsection (b) and only established pursuant to the Illinois Enterprise Zone after the tax imposed by subsection (a) net of all Act and (iii) is certified by the Department of credits allowed under this Section other than the Commerce and Community Affairs (now credit allowed under subsection (i) has been reduced Department of Commerce and Economic to zero, against the rates imposed by subsection (d). Opportunity) as complying with the requirements specified in clause (i) and (ii) by July 1, 1986. The This subsection (d-1) is exempt from the Department of Commerce and Community Affairs provisions of Section 250. (now Department of Commerce and Economic (e) Investment credit. A taxpayer shall be Opportunity) shall notify the Department of allowed a credit against the Personal Property Tax Revenue of all such certifications immediately. For Replacement Income Tax for investment in tax years ending after December 31, 1988, the credit qualified property. shall be allowed for the tax year in which the property is placed in service, or, if the amount of the (1) A taxpayer shall be allowed a credit credit exceeds the tax liability for that year, whether equal to .5% of the basis of qualified property placed it exceeds the original liability or the liability as later in service during the taxable year, provided such amended, such excess may be carried forward and property is placed in service on or after July 1, 1984. applied to the tax liability of the 5 taxable years There shall be allowed an additional credit equal to following the excess credit years. The credit shall be .5% of the basis of qualified property placed in applied to the earliest year for which there is a service during the taxable year, provided such liability. If there is credit from more than one tax property is placed in service on or after July 1, 1986, year that is available to offset a liability, earlier and the taxpayer's base employment within Illinois credit shall be applied first. has increased by 1% or more over the preceding year 3 As Amended Through Public Act 100-555 (2) The term "qualified property" means it has been placed in service in Illinois by the property which: taxpayer, the amount of such increase shall be deemed property placed in service on the date of (A) is tangible, whether new or used, such increase in basis. including buildings and structural components of buildings and signs that are real property, but not (6) The term "placed in service" shall have including land or improvements to real property that the same meaning as under Section 46 of the Internal are not a structural component of a building such as Revenue Code. landscaping, sewer lines, local access roads, (7) If during any taxable year, any property fencing, parking lots, and other appurtenances; ceases to be qualified property in the hands of the (B) is depreciable pursuant to Section 167 taxpayer within 48 months after being placed in of the Internal Revenue Code, except that "3-year service, or the situs of any qualified property is property" as defined in Section 168(c)(2)(A) of that moved outside Illinois within 48 months after being Code is not eligible for the credit provided by this placed in service, the Personal Property Tax subsection (e); Replacement Income Tax for such taxable year shall be increased. Such increase shall be determined by (C) is acquired by purchase as defined in (i) recomputing the investment credit which would Section 179(d) of the Internal Revenue Code; have been allowed for the year in which credit for (D) is used in Illinois by a taxpayer who is such property was originally allowed by eliminating primarily engaged in manufacturing, or in mining such property from such computation and, (ii) coal or fluorite, or in retailing, or was placed in subtracting such recomputed credit from the amount service on or after July 1, 2006 in a River Edge of credit previously allowed. For the purposes of this Redevelopment Zone established pursuant to the paragraph (7), a reduction of the basis of qualified River Edge Redevelopment Zone Act; and property resulting from a redetermination of the purchase price shall be deemed a disposition of (E) has not previously been used in Illinois qualified property to the extent of such reduction. in such a manner and by such a person as would qualify for the credit provided by this subsection (e) (8) Unless the investment credit is or subsection (f). extended by law, the basis of qualified property shall not include costs incurred after December 31, 2018, (3) For purposes of this subsection (e), except for costs incurred pursuant to a binding "manufacturing" means the material staging and contract entered into on or before December 31, production of tangible personal property by 2018. procedures commonly regarded as manufacturing, processing, fabrication, or assembling which (9) Each taxable year ending before changes some existing material into new shapes, December 31, 2000, a partnership may elect to pass new qualities, or new combinations. For purposes of through to its partners the credits to which the this subsection (e) the term "mining" shall have the partnership is entitled under this subsection (e) for same meaning as the term "mining" in Section the taxable year. A partner may use the credit 613(c) of the Internal Revenue Code. For purposes allocated to him or her under this paragraph only of this subsection (e), the term "retailing" means the against the tax imposed in subsections (c) and (d) of sale of tangible personal property for use or this Section. If the partnership makes that election, consumption and not for resale, or services rendered those credits shall be allocated among the partners in conjunction with the sale of tangible personal in the partnership in accordance with the rules set property for use or consumption and not for resale. forth in Section 704(b) of the Internal Revenue For purposes of this subsection (e), "tangible Code, and the rules promulgated under that Section, personal property" has the same meaning as when and the allocated amount of the credits shall be that term is used in the Retailers' Occupation Tax allowed to the partners for that taxable year. The Act, and, for taxable years ending after December partnership shall make this election on its Personal 31, 2008, does not include the generation, Property Tax Replacement Income Tax return for transmission, or distribution of electricity. that taxable year. The election to pass through the credits shall be irrevocable. (4) The basis of qualified property shall be the basis used to compute the depreciation deduction For taxable years ending on or after for federal income tax purposes. December 31, 2000, a partner that qualifies its partnership for a subtraction under subparagraph (I) (5) If the basis of the property for federal of paragraph (2) of subsection (d) of Section 203 or income tax depreciation purposes is increased after 4 As Amended Through Public Act 100-555 a shareholder that qualifies a Subchapter S (A) is tangible, whether new or used, corporation for a subtraction under subparagraph (S) including buildings and structural components of of paragraph (2) of subsection (b) of Section 203 buildings; shall be allowed a credit under this subsection (e) (B) is depreciable pursuant to Section 167 equal to its share of the credit earned under this of the Internal Revenue Code, except that "3-year subsection (e) during the taxable year by the property" as defined in Section 168(c)(2)(A) of that partnership or Subchapter S corporation, determined Code is not eligible for the credit provided by this in accordance with the determination of income and subsection (f); distributive share of income under Sections 702 and 704 and Subchapter S of the Internal Revenue Code. (C) is acquired by purchase as defined in This paragraph is exempt from the provisions of Section 179(d) of the Internal Revenue Code; Section 250. (D) is used in the Enterprise Zone or River (f) Investment credit; Enterprise Zone; Edge Redevelopment Zone by the taxpayer; and River Edge Redevelopment Zone. (E) has not been previously used in Illinois (1) A taxpayer shall be allowed a credit in such a manner and by such a person as would against the tax imposed by subsections (a) and (b) of qualify for the credit provided by this subsection (f) this Section for investment in qualified property or subsection (e). which is placed in service in an Enterprise Zone (3) The basis of qualified property shall be created pursuant to the Illinois Enterprise Zone Act the basis used to compute the depreciation deduction or, for property placed in service on or after July 1, for federal income tax purposes. 2006, a River Edge Redevelopment Zone established pursuant to the River Edge (4) If the basis of the property for federal Redevelopment Zone Act. For partners, income tax depreciation purposes is increased after shareholders of Subchapter S corporations, and it has been placed in service in the Enterprise Zone owners of limited liability companies, if the liability or River Edge Redevelopment Zone by the taxpayer, company is treated as a partnership for purposes of the amount of such increase shall be deemed federal and State income taxation, there shall be property placed in service on the date of such allowed a credit under this subsection (f) to be increase in basis. determined in accordance with the determination of (5) The term "placed in service" shall have income and distributive share of income under the same meaning as under Section 46 of the Internal Sections 702 and 704 and Subchapter S of the Revenue Code. Internal Revenue Code. The credit shall be .5% of the basis for such property. The credit shall be (6) If during any taxable year, any property available only in the taxable year in which the ceases to be qualified property in the hands of the property is placed in service in the Enterprise Zone taxpayer within 48 months after being placed in or River Edge Redevelopment Zone and shall not be service, or the situs of any qualified property is allowed to the extent that it would reduce a moved outside the Enterprise Zone or River Edge taxpayer's liability for the tax imposed by Redevelopment Zone within 48 months after being subsections (a) and (b) of this Section to below zero. placed in service, the tax imposed under subsections For tax years ending on or after December 31, 1985, (a) and (b) of this Section for such taxable year shall the credit shall be allowed for the tax year in which be increased. Such increase shall be determined by the property is placed in service, or, if the amount of (i) recomputing the investment credit which would the credit exceeds the tax liability for that year, have been allowed for the year in which credit for whether it exceeds the original liability or the such property was originally allowed by eliminating liability as later amended, such excess may be such property from such computation, and (ii) carried forward and applied to the tax liability of the subtracting such recomputed credit from the amount 5 taxable years following the excess credit year. The of credit previously allowed. For the purposes of this credit shall be applied to the earliest year for which paragraph (6), a reduction of the basis of qualified there is a liability. If there is credit from more than property resulting from a redetermination of the one tax year that is available to offset a liability, the purchase price shall be deemed a disposition of credit accruing first in time shall be applied first. qualified property to the extent of such reduction. (2) The term qualified property means (7) There shall be allowed an additional property which: credit equal to 0.5% of the basis of qualified property placed in service during the taxable year in 5 As Amended Through Public Act 100-555 a River Edge Redevelopment Zone, provided such tax liability for that year, whether it exceeds the property is placed in service on or after July 1, 2006, original liability or the liability as later amended, and the taxpayer's base employment within Illinois such excess may be carried forward and applied to has increased by 1% or more over the preceding year the tax liability of the 5 taxable years following the as determined by the taxpayer's employment records excess credit year. The credit shall be applied to the filed with the Illinois Department of Employment earliest year for which there is a liability. If there is Security. Taxpayers who are new to Illinois shall be credit from more than one tax year that is available deemed to have met the 1% growth in base to offset a liability, the credit accruing first in time employment for the first year in which they file shall be applied first. employment records with the Illinois Department of Changes made in this subdivision (h)(1) by Employment Security. If, in any year, the increase Public Act 88-670 restore changes made by Public in base employment within Illinois over the Act 85-1182 and reflect existing law. preceding year is less than 1%, the additional credit shall be limited to that percentage times a fraction, (2) The term qualified property means the numerator of which is 0.5% and the denominator property which: of which is 1%, but shall not exceed 0.5%. (A) is tangible, whether new or used, (g) (Blank) including buildings and structural components of buildings; (h) Investment credit; High Impact Business. (B) is depreciable pursuant to Section 167 of the Internal Revenue Code, except that "3-year (1) Subject to subsections (b) and (b-5) of property" as defined in Section 168(c)(2)(A) of that Section 5.5 of the Illinois Enterprise Zone Act, a Code is not eligible for the credit provided by this taxpayer shall be allowed a credit against the tax subsection (h); imposed by subsections (a) and (b) of this Section for investment in qualified property which is placed (C) is acquired by purchase as defined in in service by a Department of Commerce and Section 179(d) of the Internal Revenue Code; and Economic Opportunity designated High Impact (D) is not eligible for the Enterprise Zone Business. The credit shall be .5% of the basis for Investment Credit provided by subsection (f) of this such property. The credit shall not be available (i) Section. until the minimum investments in qualified property set forth in subdivision (a)(3)(A) of Section 5.5 of (3) The basis of qualified property shall be the Illinois Enterprise Zone Act have been satisfied the basis used to compute the depreciation deduction or (ii) until the time authorized in subsection (b-5) for federal income tax purposes. of the Illinois Enterprise Zone Act for entities (4) If the basis of the property for federal designated as High Impact Businesses under income tax depreciation purposes is increased after subdivisions (a)(3)(B), (a)(3)(C), and (a)(3)(D) of it has been placed in service in a federally Section 5.5 of the Illinois Enterprise Zone Act, and designated Foreign Trade Zone or Sub-Zone located shall not be allowed to the extent that it would in Illinois by the taxpayer, the amount of such reduce a taxpayer's liability for the tax imposed by increase shall be deemed property placed in service subsections (a) and (b) of this Section to below zero. on the date of such increase in basis. The credit applicable to such investments shall be taken in the taxable year in which such investments (5) The term "placed in service" shall have have been completed. The credit for additional the same meaning as under Section 46 of the Internal investments beyond the minimum investment by a Revenue Code. designated high impact business authorized under (6) If during any taxable year ending on or subdivision (a)(3)(A) of Section 5.5 of the Illinois before December 31, 1996, any property ceases to Enterprise Zone Act shall be available only in the be qualified property in the hands of the taxpayer taxable year in which the property is placed in within 48 months after being placed in service, or service and shall not be allowed to the extent that it the situs of any qualified property is moved outside would reduce a taxpayer's liability for the tax Illinois within 48 months after being placed in imposed by subsections (a) and (b) of this Section to service, the tax imposed under subsections (a) and below zero. For tax years ending on or after (b) of this Section for such taxable year shall be December 31, 1987, the credit shall be allowed for increased. Such increase shall be determined by (i) the tax year in which the property is placed in recomputing the investment credit which would service, or, if the amount of the credit exceeds the have been allowed for the year in which credit for 6 As Amended Through Public Act 100-555

Description: