HUD 4060.1 Mortgagee Approval Handbook - CDFI Fund PDF

Preview HUD 4060.1 Mortgagee Approval Handbook - CDFI Fund

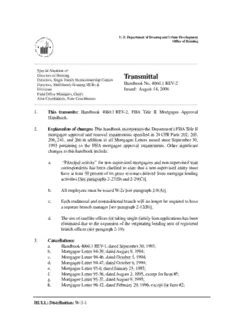

U. S. Department of Housing and Urban Development Office of Housing ______________________________________________________________________________________ Special Attention of: Directors of Housing Transmittal Directors, Single Family Homeownership Centers Handbook No. 4060.1 REV-2 Directors, Multifamily Housing HUBs & Divisions Issued: August 14, 2006 Field Office Managers, Chiefs Area Coordinators, State Coordinators ______________________________________________________________________________________ 1. This transmits: Handbook 4060.1 REV-2, FHA Title II Mortgagee Approval Handbook. 2. Explanation of changes: This handbook incorporates the Department's FHA Title II mortgagee approval and renewal requirements specified in 24 CFR Parts 202, 203, 206, 241, and 266 in addition to all Mortgagee Letters issued since September 30, 1993 pertaining to the FHA mortgagee approval requirements. Other significant changes to this handbook include: a. “Principal activity” for non-supervised mortgagees and non-supervised loan correspondents has been clarified to state that a non-supervised entity must have at least 50 percent of its gross revenues derived from mortgage lending activities [See paragraphs 2-27(D) and 2-29(C)]. b. All employees must be issued W-2s [see paragraph 2-9(A)]. c. Each traditional and nontraditional branch will no longer be required to have a separate branch manager [see paragraph 2-12(B)]. d. The use of satellite offices for taking single-family loan applications has been eliminated due to the expansion of the originating lending area of registered branch offices (see paragraph 2-19). 3. Cancellations: a. Handbook 4060.1 REV-1, dated September 30, 1993; b. Mortgagee Letter 94-39, dated August 9, 1994; c. Mortgagee Letter 94-46, dated October 5, 1994; d. Mortgagee Letter 94-47, dated October 6, 1994; e. Mortgagee Letter 95-6, dated January 25, 1995; f. Mortgagee Letter 95-36, dated August 2, 1995, except for Item #5; g. Mortgagee Letter 95-37, dated August 9, 1995; h. Mortgagee Letter 96-12, dated February 29, 1996, except for Item #2; HULL: Distribution: W-3-1 i. Mortgagee Letter 96-64, dated November 21, 1996; j. Mortgagee Letter 99-17, dated May 14, 1999; k. Mortgagee Letter 00-15, dated May 1, 2000; l. Mortgagee Letter 00-40, dated November 3, 2000; m. Mortgagee Letter 01-01, dated January 5, 2001, paragraph 6 only; n. Mortgagee Letter 03-03, dated February 25, 2003; o. Mortgagee Letter 04-06, Dated June 30, 2004; p. Mortgagee Letter 04-19, dated April 30, 2004; q. Mortgagee Letter 05-24, dated May 17, 2005; r. Mortgagee Letter 05-37, dated September 28, 2005; s. Mortgagee Letter 05-40, dated October 29, 2005; 4. Filing Requirements: Remove: Insert: Handbook 4060.1 REV-1, Handbook 4060.1 REV-2, dated September 30, 1993 dated: August 14, 2006 ___________________________ Brian D. Montgomery Assistant Secretary for Housing -- Federal Housing Commissioner HULL: Distribution: W-3-1 Handbook 4060.1 REV-2 U.S. Department of Housing and Urban Development Office of Housing ________________________________________________________________________________________________ Program Participants and Departmental Staff ________________________________________________________________________________________________ FHA Title II Mortgagee Approval Handbook August 14, 2006 HULL: Distribution: W-3-1 4060.1 REV-2 FOREWORD Scope. This Handbook covers the Department's requirements and policies for FHA approval and annual renewal of mortgagees for participation in the FHA Title II mortgage insurance programs. It provides information to HUD staff and participating mortgagees on procedures for obtaining and retaining FHA approval as a mortgagee. The Handbook also provides basic information on the Department's program for monitoring the loan origination and servicing performance of mortgagees, the Mortgagee Review Board, and civil money penalties. Enabling Legislation. The U.S. Department of Housing and Urban Development is authorized by legislation to approve mortgage lenders to participate in FHA mortgage insurance programs, and to regulate those lenders. This authority is contained in the National Housing Act (12 U.S.C. 1701 et seq.) and the Department of Housing and Urban Development Act (42 U.S.C. 3531 et seq.). Regulations. This Handbook incorporates the provisions of the Department's mortgagee approval regulations as set forth in 24 CFR Parts 202, 203, 206, 241, and 266. Handbook Organization: • Chapter 1: Overview • Chapter 2: Requirements for initial and continued FHA approval • Chapter 3: Applying for approval, appealing denials and being approved • Chapter 4: Annual renewal of FHA approval • Chapter 5: Branches, lending areas for single family originations, principal- authorized agents, and loan correspondent-sponsors • Chapter 6: Changes subsequent to FHA approval • Chapter 7: Quality Control Plan • Chapter 8: Monitoring, Administrative Sanctions, Credit Watch and Neighborhood Watch 08/06 i 4060.1 REV-2 REFERENCES 1. 5 U.S.C. App. 3 Inspector General Act of 1978 2. 12 U.S.C. §1701 et seq. National Housing Act 3. 12 U.S.C. §2601 et seq. Real Estate Settlement Procedures Act of 1974 4. 12 U.S.C. §2801 et seq. Home Mortgage Disclosure Act of 1975 5. 15 U.S.C. §1601 et seq. Federal Truth in Lending Act 6. 15 U.S.C. §1691 et seq. Equal Credit Opportunity Act 7. 18 U.S.C. §709 False advertising or misuse of names to indicate Federal agency 8. 31 U.S.C. §7501 et seq. The Single Audit Act of 1984, as amended 9. 42 U.S.C. §3601 et seq. Fair Housing Act 10. 42 U.S.C. §3531 et seq. Department of Housing and Urban Development Act 11. 24 CFR Part 24 Government Suspension and Debarment 12. 24 CFR Part 25 Mortgagee Review Board 13. 24 CFR Part 30 Civil Money Penalties 14. 24 CFR Part 202 Approval of Lending Institutions and Mortgagees 15. 24 CFR Part 203 Single Family Mortgage Insurance 16. 24 CFR Part 206 Home Equity Conversion Mortgage Insurance 17. 24 CFR Part 241 Supplementary Financing for Insured Project Mortgages 18. 24 CFR Part 266 Housing Finance Agency Risk-Sharing Programs for insured Affordable Multifamily Project Loans 19. 24 CFR Part 3500 Real Estate Settlement Procedures Act Regulations 20. GAO “Yellow Book,” Government Auditing Standards 21. HUD IG Handbook 2000.04, Consolidated Audit Guide for Audits of HUD Program 22. HUD Handbook 4000.2, Mortgagees' Handbook, Application Through Insurance (Single Family) 23. HUD Handbook 4000.4, Single Family Direct Endorsement Program 24. HUD Handbook 4060.2, Mortgagee Review Board 25. HUD Handbook 4155.1, Mortgage Credit Analysis for Mortgage Insurance on One- to Four-Family Properties 26. HUD Handbook 4330.1, Administration of Insured Home Mortgages 27. HUD Handbook 4350.4, Insured Multifamily Mortgagee and Field Office Remote Monitoring 28. HUD Handbook 4430.1, Initial Closing Requirements for Project Mortgage Insurance Download Locations for Most Recent Version of References Statutes: http://www.gpoaccess.gov/index.html. HUD Regulations and handbooks: http://www.hudclips.org/cgi/index.cgi. GAO “Yellow Book”: http://www.gao.gov/govaud/ybk01.htm ii 08/06 4060.1 REV-2 ACRONYMS AAFB...................Area Approved for Business CAIVRS...............Credit Alert Interactive Voice Response System CPA......................Certified Public Accountant DAS......................Deputy Assistant Secretary DBA (or dba)........Doing Business As DCF......................Data Collection Form DE........................Direct Endorsement Fannie Mae...........Federal National Mortgage Association FDIC....................Federal Deposit Insurance Corporation FDT......................Financial Data Templates FHA......................Federal Housing Administration Freddie Mac.........Federal Home Loan Mortgage Corporation GAAP...................Generally Accepted Accounting Principles GAAS...................Generally Accepted Auditing Standards GAGAS................Generally Accepted Government Auditing Standards GAO.....................General Accountability Office Ginnie Mae...........Government National Mortgage Association HECM..................Home Equity Conversion Mortgage (Reverse Mortgage) HMDA.................Home Mortgage Disclosure Act HOC.....................FHA Single Family Homeownership Center HUD.....................Department of Housing and Urban Development IG.........................Inspector General for HUD LASS....................Lender Assessment Sub-system LDP......................Limited Denial of Participation LLC......................Limited Liability Company MRB.....................Mortgagee Review Board NCUA..................National Credit Union Administration P&U Division.......Processing and Underwriting Division in a HOC QAD.....................Quality Assurance Division QC Plan................Quality Control Plan RESPA.................Real Estate Settlement Procedures Act RMCR..................Residential Mortgage Credit Reports SAS......................Statement of Auditing Standards SSN......................Social Security Number V-form..................Annual Verification Report Yellow Book........Government Auditing Standards issued by GAO 08/06 iii 4060.1 REV-2 TABLE OF CONTENTS CHAPTER 1. OVERVIEW Paragraph Page 1-1 Approval..............................................................................................................1-1 1-2 Types of Approved Mortgagees.........................................................................1-2 1-3 Renewal of FHA Approval.................................................................................1-3 1-4 HUD’s Lender Web Page...................................................................................1-3 1-5 FHA Connection.................................................................................................1-3 1-6 HUDCLIPS.........................................................................................................1-3 1-7 HUD Handbooks.................................................................................................1-4 1-8 Frequently Asked Questions..............................................................................1-4 1-9 FHA Lender List on HUD’s Web Site...............................................................1-4 1-10 Performance Requirements...............................................................................1-4 1-11 Reports and Examinations.................................................................................1-4 1-12 Home Mortgage Disclosure Act of 1974 (HMDA)...........................................1-4 1-13 Administrative Actions, Administrative Sanctions, and Civil Money Penalties.......................................................................................1-4 1-14 Reporting Fraud, Illegal Acts, and Unethical Practices to HUD...................1-5 1-15 Mortgagee’s Address for Communication........................................................1-5 1-16 Contacting the Department...............................................................................1-5 1-17 OMB Approval of Information Collections......................................................1-5 CHAPTER 2. MORTGAGEE REQUIREMENTS FOR INITIAL AND CONTINUING APPROVAL Part A. Requirements for all Mortgagees 2-1 Introduction........................................................................................................2-1 2-2 Business Form.....................................................................................................2-1 2-3 State Licensing Requirements...........................................................................2-2 2-4 Mortgagee Name.................................................................................................2-3 2-5 Net Worth Requirements ..................................................................................2-3 2-6 Liquid Assets.......................................................................................................2-5 2-7 Application Fees..................................................................................................2-5 2-8 Operating Expenses............................................................................................2-6 2-9 Employees and Officers.....................................................................................2-6 2-10 Ineligible Participants........................................................................................2-8 2-11 Office Facilities...................................................................................................2-8 2-12 Staffing Requirements......................................................................................2-10 2-13 Outsourcing.......................................................................................................2-10 2-14 Prohibited Branch Arrangement....................................................................2-11 2-15 Communications Capability and Responsibility............................................2-12 2-16 Fair Housing and Other Federal Laws...........................................................2-13 2-17 Misrepresentative Advertising.........................................................................2-13 2-18 Loan Origination Requirement.......................................................................2-14 2-19 Geographic Restrictions for Loan Origination and Underwriting..............2-14 iv 08/06 4060.1 REV-2 2-20 Loan Servicing Responsibility.........................................................................2-15 2-21 Escrow Funds....................................................................................................2-15 2-22 Prohibited and Permissible Payments............................................................2-16 2-23 Quality Control.................................................................................................2-17 2-24 Requirement to Notify HUD of Changes Subsequent to Approval..............2-17 Part B. Additional Requirements for Specific Mortgagee Types 2-25 Introduction......................................................................................................2-18 2-26 Supervised Mortgagees....................................................................................2-18 2-27 Non-supervised Mortgagees............................................................................2-18 2-28 Supervised Loan Correspondents...................................................................2-19 2-29 Non-supervised Loan Correspondents...........................................................2-20 2-30 Investing Mortgagees.......................................................................................2-21 2-31 Governmental Institutions...............................................................................2-22 CHAPTER 3. MORTGAGEE APPROVAL PACKAGE AND PROCEDURES Part A. Submission of Application 3-1 Introduction........................................................................................................3-1 3-2 Required Documentation...................................................................................3-1 3-3 Documentation for Specific Business Forms....................................................3-7 Part B. Processing of Application 3-4 Introduction........................................................................................................3-8 3-5 Requests for Additional Information................................................................3-8 3-6 Mortgagee Approval Processing.......................................................................3-8 3-7 Approval Notifications.....................................................................................3-10 3-8 Disapproval.......................................................................................................3-10 Part C. Appeals of Disapproval 3-9 INITIAL APPEAL..................................................................................................3-11 3-10 Final Appeal .....................................................................................................3-11 Part D. Newly Approved Mortgagees 3-11 Introduction......................................................................................................3-12 3-12 Immediately Upon Approval...........................................................................3-12 3-13 FHA Mortgage Insurance Premiums and Claims.........................................3-12 3-14 Direct Endorsement (DE)................................................................................3-12 CHAPTER 4. ANNUAL RENEWAL OF FHA APPROVAL 4-1 Requirement for Annual Renewal.....................................................................4-1 4-2 Yearly Verification Report.................................................................................4-1 4-3 Annual Renewal Fees.........................................................................................4-1 4-4 Annual Submission of Audited Financial Statements.....................................4-2 08/06 v 4060.1 REV-2 A. Required Reports by Type of Mortgagee For Electronic Submission.....4-3 B. Types of Mortgagee for Which Submission are Not Required................4-6 C. Extensions................................................................................................4-6 4-5 LASS Review Procedures..................................................................................4-6 A. Auditor's Report.......................................................................................4-7 B. Annual Submission..................................................................................4-7 4-6 Acceptance of LASS Submission.....................................................................4-11 4-7 Deficient LASS Submission.............................................................................4-11 4-8 Rejected LASS Submission..............................................................................4-12 4-9 Termination of FHA Mortgagee Approval.....................................................4-12 4-10 Requests for Information.................................................................................4-13 CHAPTER 5. BRANCH OFFICES, PRINCIPAL-AUTHORIZED AGENT RELATIONSHIPS AND ADDITIONAL SPONSORS Part A. Branch Offices 5-1 Introduction........................................................................................................5-1 5-2 Originating at Branch Offices...........................................................................5-1 5-3 Underwriting at Branch Offices........................................................................5-1 5-4 Servicing at Branch Offices...............................................................................5-1 5-5 Centralized Centers............................................................................................5-1 5-6 Mortgagees Permitted to Maintain Branch Offices........................................5-1 5-7 Registration of a New Branch...........................................................................5-1 5-8 Direct Lending Branch Office...........................................................................5-2 Part B. Principal-Authorized Agent Relationship 5-9 Introduction........................................................................................................5-4 5-10 Principal..............................................................................................................5-4 5-11 Authorized Agent................................................................................................5-4 5-12 Origination and Underwriting..........................................................................5-4 5-13 Mortgagee Name in Loan Closing.....................................................................5-5 5-14 Establishing the Relationship............................................................................5-5 5-15 Origination Fee...................................................................................................5-5 Part C. Additional Sponsors 5-16 Adding Sponsors for a Loan Correspondent...................................................5-5 5-17 Registration Procedure......................................................................................5-5 CHAPTER 6. CHANGES SUBSEQUENT TO APPROVAL 6-1 Reporting Business Changes.............................................................................6-1 6-2 Change of Home Office Location or Telephone...............................................6-2 A. Address Changes......................................................................................6-2 B. Telephone and Fax Numbers and Email Address....................................6-2 6-3 Change of Branch Office Location or Telephone Number.............................6-3 vi 08/06

Description: