Table Of ContentGurukripa’s Guideline Answers for May 2015 CA Inter (IPC) Group I Accounting

Gurukripa’s Guideline Answers to May 2015 Exam Questions

CA Inter (IPC) Group I Accounting

Question No.1 is compulsory (4 X 5 = 20 Marks).

Answer any five questions from the remaining six questions (16 X 5 = 80 Marks). [Answer any 4 out of 5 in Q.7]

Working Notes should form part of the answer.

Wherever necessary, suitable assumptions should be made and indicated in answer by the Candidates.

Note: All Page References given are from Padhuka’s Ready Referencer on Accounting – For CA Inter (IPC)

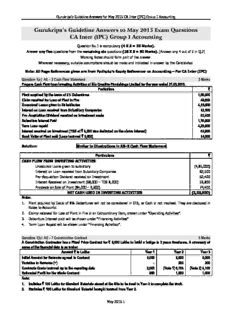

Question 1(a): AS – 3 Cash Flow Statement 5 Marks

Prepare Cash Flow from Investing Activities of M/s Creative Furnishings Limited for the year ended 31.03.2015.

Particulars `

Plant acquired by the issue of 8% Debentures 1,56,000

Claim received for Loss of Plant in Fire 49,600

Unsecured Loans given to Subsidiaries 4,85,000

Interest on Loan received from Subsidiary Companies 82,500

Pre–Acquisition Dividend received on Investment made 62,400

Debenture Interest Paid 1,16,000

Term Loan repaid 4,25,000

Interest received on Investment (TDS of ` 8,200 was deducted on the above Interest) 68,000

Book Value of Plant sold (Loss incurred ` 9,600) 84,000

Solution: Similar to Illustrations in AS–3 Cash Flow Statement

Particulars `

CASH FLOW FROM INVESTING ACTIVITIES

Unsecured Loans given to subsidiary (4,85,000)

Interest on Loan received from Subsidiary Companies 82,500

Pre–Acquisition Dividend received on Investment 62,400

Interest Received on Investment (68,000 – TDS 8,200) 59,800

Proceeds on Sale of Plant (84,000 – 9,600) 74,400

NET CASH USED IN INVESTING ACTIVITIES (2,05,900)

Note:

1. Plant acquired by Issue of 8% Debentures will not be considered in CFS, as Cash is not involved. They are disclosed in

Notes to Accounts.

2. Claims received for Loss of Plant in Fire is an Extraordinary Item, shown under “Operating Activities”.

3. Debenture Interest paid will be shown under “Financing Activities”

4. Term Loan Repaid will be shown under “Financing Activities”.

Question 1(b): AS – 7 Construction Contract 5 Marks

A Construction Contractor has a Fixed Price Contract for ` 9,000 Lakhs to build a bridge in 3 years timeframe. A summary of

some of the financial data is as under:

Amount ` in Lakhs Year 1 Year 2 Year 3

Initial Amount for Revenue agreed in Contract 9,000 9,000 9,000

Variation in Revenue (+) – 200 200

Contracts Costs incurred up to the reporting date 2,093 (Note 1) 6,168 (Note 2) 8,100

Estimated Profit for the whole Contract 950 1,000 1,000

Note:

1. Includes ` 100 Lakhs for Standard Materials stored at the Site to be used in Year 3 to complete the work.

2. Excludes ` 100 Lakhs for Standard Material brought forward from Year 2.

May 2015.1

Gurukripa’s Guideline Answers for May 2015 CA Inter (IPC) Group I Accounting

The variation in Cost and Revenue in Year 2 has been approved by the customer.

Compute year–wise amount of Revenue, Expenses, Contract Cost to complete and Profit or Loss to be recognised in the

Statement of Profit or Loss as per AS–7.

Solution: Similar to Page No.B.5.17, Q.No.49

Basic Calculations: (in ` Lakhs)

Particulars As at Year 1 As at Year 2 As at Year 3

Contract Price 9,000 9,000 9,000

Variations (Increase) Nil 200 200

(a) Total Contract Revenue 9,000 9,200 9,200

(b) Estimated Profit for whole Contract (given) 950 1,000 1,000

(c) Total Contract Costs = (a) – (b) 8,050 8,200 8,200

(d) Costs till date 2,093 6,168 – 100 = 6,068 8,100 + 100 = 8,200

Cost TillDate `2,093 `6,068 `8,200

(e) % of Completion = = 26% = 74% =100%

TotalContract Costs `8,050 `8,200 `8,200

The Contract Revenues, Costs & Profits recognised in each of the 3 years are given below – (in ` Lakhs)

Upto reporting date Already recognised Recognised during

Year Particulars

in previous years current year

1 Contract Revenue 9,000 × 26% = 2,340 Nil 2,340

Contract Costs 2,093 Nil 2,093

Contract Profits 247 Nil 247

2 Contract Revenue 9,200 × 74% = 6,808 2,340 4,468

Contract Costs 6,068 2,093 3,975

Contract Profits 740 247 493

3 Contract Revenue 9,200 × 100% = 9,200 6,808 2,392

Contract Costs 8,200 6,068 2,132

Contract Profits 1,000 740 260

Question 1(c): AS–2 Inventory Valuation 5 Marks

Mr. Mehul gives the following information relating to items forming part of Inventory as on 31.03.2015. His Factory produces

Product X using Raw Material A.

1. 600 units of Raw Material A (purchased at ` 120). Replacement Cost of Raw Material A as on 31.03.2015 is ` 90 per unit.

2. 500 units of Partly Finished Goods in the process of producing X and Cost incurred till date ` 260 per unit. These units can

be finished next year by incurring Additional Cost of ` 60 per unit.

3. 1,500 units of Finished Product X and Total Cost incurred ` 320 per unit.

Expected Selling Price of Product X is ` 300 per unit.

Determine how each item of inventory will be valued on 31.03.2015. Calculate the Value of Total Inventory as on 31.03.2015.

Solution: Similar to Page No.B.2.16, Q.No.51 [P (A/c) – RTP]

Item Valuation Principle Result

Raw Material Since the Finished Product using this Raw Material is expectable be sold below

600× ` 90 = ` 54,000

cost, Raw Material may be valued of NRV, i.e. Replacement Cost of ` 90.

• Cost ` 260

WIP • Estimated NRV = Sale Price ` 300 – Cost to complete ` 60 = ` 240. 500×` 240 = ` 1,20,000

• Hence, valued at least of the above, i.e. ` 240 p.u.

Finished Cost ` 320 or Net Realisable Value ` 300, whichever is lower. Hence valued at

1,500×` 300= ` 4,50,000

Goods ` 300 p.u.

Total ` 6,24,000

May 2015.2

Gurukripa’s Guideline Answers for May 2015 CA Inter (IPC) Group I Accounting

Question 1(d): AS–6 Depreciation 5 Marks

M/s. Laghu Udyog Limited has been charging depreciation on an item of Plant and Machinery on Straight line basis. The

Machine was purchased on 01.04.2012 at ` 3,25,000. It is expected to have a total useful life of 5 years from the date of

purchase and Residual Value of ` 25,000. Calculate the Book Value of the Machine as on 01.04.2015 and the Total Depreciation

charged till 31.03.2014 under SLM. The Company wants to change the method of depreciation and charge depreciation at 20%

on WDV from 2014–15.

Is it valid to change the method of depreciation? Explain the treatment required to be done in the books of accounts in the

context of AS – 6.

Ascertain the amount of Depreciation to be charged for 2014–15 and the Net Book Value of Machine as on 31.03.2015 after

giving effect of the above change.

Solution: Similar to Page No.B.4.6, Q.No.22,23 [P (A/c) – M 03, N 03, N 05, N 10, M 10, N 11, N 12]

Particulars Under Existing Method (SLM) Under New Method (WDV)

Cost on 01.04.2012 3,25,000 3,25,000

(–) Depreciation for 2012–2013 1/5th × (3,25,000 – 25,000) = 60,000 20% × 3,25,000 = 65,000

WDV on 01.04.2013 2,65,000 2,60,000

(–) Depreciation for 2013–2014 60,000 20%× 2,60,000= 52,000

WDV on 01.04.2014 2,05,000 2,08,000

1. Book Value of Plant & Machinery on 01.04.2014 (using SLM Depreciation) = ` 2,05,000

2. Total Depreciation charged till 31.03.2014 under SLM = 60,000 × 2 = ` 1,20,000

3. Change in Method of Depreciation is permissible only for –

(a) Compliance with Statutory Requirement, or

(b) Compliance with an Accounting Standard, or

(c) Consideration that the change would result in a more appropriate preparation or presentation of the Financilal

Statements of the enterprise.

4. Disclosure: A change in the method of charging depreciation is treated as a change in accounting policy and its effect is

quantified and disclosed.

5. Treatment in 2014–2015:

(a) Debit Asset & Credit P & L, by ` 3,000 (` 2,08,000 – 2,05,000) [Excess Depreciation to be reversed]

(b) Charge Depreciation at 20% on ` 2,08,000 = ` 41,600 (WDV basis)

(c) Net Book Value of Machine on 31–03–2015 after the above = ` 2,08,000 – ` 41,600 = ` 1,66,400

(d) The Company has to disclose that due to change in method of depreciation, there is a reversal of excess

depreciation of ` 3,000 and the Asset Value increased by ` 3,000 and Profits increased by ` 3,000. Such change will

have effect in future years also.

Question 2: Amalgamation 16 Marks

The financial position of two Companies Abhay Ltd and Asha Ltd as on 31.03.2015 is as follows –

Balance Sheet as on 31.03.2015

Particulars Abhay Ltd Asha Ltd

Sources of Funds

Share Capital – Issued and Subscribed: 15,000 Equity Shares at ` 100, fully paid 15,00,000

10,000 Equity Shares at ` 100, fully paid 10,00,000

General Reserve 2,75,000 1,25,000

Profit & Loss 75,000 25,000

Securities Premium 1,50,000 50,000

Contingency Reserve 45,000 30,000

12% Debentures, at ` 100 fully paid – 2,50,000

Sundry Creditors 55,000 35,000

Total 21,00,000 15,15,000

May 2015.3

Gurukripa’s Guideline Answers for May 2015 CA Inter (IPC) Group I Accounting

Particulars Abhay Ltd Asha Ltd

Application of Funds

Land and Buildings 8,50,000 5,75,000

Plant and Machinery 3,45,000 2,25,000

Goodwill – 1,45,000

Inventory 4,20,000 2,40,000

Sundry Debtors 3,05,000 2,85,000

Bank 1,80,000 45,000

Total 21,00,000 15,15,000

They decided to merge and form a New Company Abhilasha Ltd. as on 01.04.2015 on the following terms:

1. Goodwill to be valued at 2 years purchase of the Super Profits. The Normal Rate of Return is 10% of the Combined Share

Capital and General Reserve. All Other Reserves are to be ignored for the purpose of Goodwill. Average Profits of Abhay

Ltd is ` 2,75,000 and Asha Ltd is ` 1,75,000.

2. Land and Buildings, Plant and Machinery and Inventory of both Companies to be valued at 10% above Book Value and a

Provision of 10% to be provided on Sundry Debtors.

3. 12% Debentures to be redeemed by the issue of 12% Preference Shares of Abhilasha Ltd (Face Value of ` 100) at a

Premium of 10%

4. Sundry Creditors to be taken over at Book Value. There is an Unrecorded Liability of ` 15,500 of Asha Ltd as on 01.04.2015.

5. The Bank Balance of both Companies to be taken over by Abhilasha Ltd after deducting Liquidation Expenses of ` 60,000

to be borne by Abhay Ltd and Asha Ltd in the ratio of 2:1.

You are required to:

1. Compute the basis on which Shares of Abhilasha Ltd. are to be issued to the Shareholders of the Existing Company

assuming that the Nominal Value per Share of Abhilasha Ltd is ` 100.

2. Draw the Balance Sheet of Abhilasha Ltd as on 01.04.2015 after the amalgamation.

Solution: Similar to Page No.A.11.19, Q.No.9, N 97

The given question is an Amalgamation in the nature of Purchase.

1. Computation of Goodwill and Purchase Consideration

Particulars Abhay Ltd Asha Ltd

(a) Average Net Profits (Given) 2,75,000 1,75,000

Less: Normal Profits (10% on Combined Share 10% of (15,00,000 + 10% of (10,00,000 + 1,25,000)

Capital & General Reserve) 2,75,000) = (1,77,500) = (1,12,500)

(b) Super Profits 97,500 62,500

(c) Goodwill at 2 years’ Purchase of Super Profits 1,95,000 1,25,000

Add: Other Assets:

Land and Building 8,50,000 + 10% = 9,35,000 5,75,000 + 10% = 6,32,500

Plant and Machinery 3,45,000 + 10% = 3,79,500 2,25,000 + 10% = 2,47,500

Inventories 4,20,000 + 10% = 4,62,000 2,40,000 + 10% = 2,64,000

Debtors 3,05,000 2,85,000

Bank 1,80,000 – 40,000 = 1,40,000 45,000 – 20,000 = 25,000

Total Assets including Goodwill (A) 24,16,500 15,79,000

Less: Creditors & other Current Liabilities Given = (55,000) 35,000 + 15,500 = (50,500)

Provision for Doubtful Debts 3,05,000 × 10% = (30,500) 2,85,000 × 10% = (28,500)

Debentures (See Note) – 2,50,000 × 110% = (2,75,000)

Total Liabilities (B) (85,500) (3,54,000)

(d) Net Assets taken over=Purchase

23,31,000 12,25,000

Consideration (A) – (B)

(e) Number of Shares in Selling Company 15,000 10,000

(f) Intrinsic Value per Share (i.e. Book Value) ` 155.40 ` 125

(g) No. of Shares to be issued by Abhilasha Ltd 155.4 122.50

15,000 × = 23,310 10,000 × = 12,250

(FV=` 100) 100 100

May 2015.4

Gurukripa’s Guideline Answers for May 2015 CA Inter (IPC) Group I Accounting

Note: Computation of Preference Shares to be issued on Redemption of 12% Debentures

• Amount Due to Debenture Holders = ` 2,50,000 × 110% = ` 2,75,000

• Preference Shares to be issued on Redemption =2,75,000 ÷100 = 2,750 Preference Shares at ` 100 each.

• It is assumed that the Debentures are redeemed at a Premium of 10%. Alternatively, it can be assumed that Preference

Shares are issued at a Premium of 10%, i.e. ` 110 per Share for settling ` 2,50,000.

2. Balance Sheet of Abhilasha Limited as at 31st March (after Takeover)

Particulars as at 31st March Note This Year Prev. Yr

I EQUITY AND LIABILITIES:

(1) Shareholders’ Funds: Share Capital 1 38,31,000

(2) Current Liabilities:

Trade Payables Creditors (55,000+50,500) 1,05,500

Total 39,36,500

II ASSETS

(1) Non–Current Assets

(a) Fixed Assets:(i) Tangible Assets – Land (9,35,000 + 6,32,500) 15,67,500

– Plant (3,79,500 + 2,47,500) 6,27,000

(ii) Intangible Assets (Goodwill) (1,95,000 + 1,25,000) 3,20,000

(2) Current Assets:

(a) Inventories (4,62,000 + 2,64,000) 7,26,000

(b) Trade Receivables (Net of Provision) (2,74,500 + 2,56,500) 5,31,000

(c) Cash and Cash Equivalents (1,40,000 + 25,000) 1,65,000

Total 39,36,500

Note 1: Share Capital

Particulars This Year Prev. Yr

Authorised: ……. Equity Shares of ` …. Each

……. Preference Shares of `….. Each

Issued, Subscribed & Paid up: (23,310 + 12,250) Equity Shares of ` 100 each 35,56,000

2,750 Preference Shares at ` 100 each 2,75,000

Note: Above 35,560 Equity Shares of ` 100 each and 2,750 Preference Shares of `100 each are

issued for non – cash consideration, in the scheme of takeover of Abhay Ltd & Asha Ltd.

Total 38,31,000

Question 3(a): Profits Prior to Incorporation 10 Marks

The Partners Kamal and Vimal decided to convert their existing Partnership Business into a Private Limited Company called

KV Trading Private Ltd with effect from 01.07.2014.

The same books of accounts were continued by the Company which closed its account for the first term on 31.03.2015.

The summarized Profit and Loss Account for the year ended 31.03.2015 is below:

Particulars ` in Lakhs ` in Lakhs

Turnover 240.00

Interest on Investments 6.00

Total Income 246.00

Less: Cost of Goods Sold 102.00

Advertisement 3.00

Sales Commission 6.00

Salary 18.00

Managing Directors Remuneration 6.00

Interest on Debentures 2.00

Rent 5.50

Bad Debts 1.00

Underwriting Commission 2.00

May 2015.5

Gurukripa’s Guideline Answers for May 2015 CA Inter (IPC) Group I Accounting

Particulars ` in Lakhs ` in Lakhs

Audit Fees 2.00

Loss on Sale of Investment 1.00

Depreciation 4.00 152.50

Net Profit 93.50

The following additional information was provided:

1. The Average Monthly Sales doubled from 01.07.2014. GP Ratio was constant.

2. All Investments were sold on 31.05.2014.

3. Average Monthly Salary doubled from 01.10.2014.

4. The Company occupied additional space from 01.07.2014 for which rent of ` 20,000 per month was incurred.

5. Bad Debts Recovered amounting to ` 50,000 for a sale made in 2012, has been deducted from Bad Debts mentioned above.

6. Audit Fees pertains to the Company.

Prepare a Statement apportioning the Expenses between Pre and Post Incorporation Periods and calculate the Profit/ Loss for

such periods. Also suggest how the Pre–Incorporation Profits are to be dealt with.

Solution: Similar to Page No.A.9.12, Q.No.10 [N 11]

1. Computation of Time Ratio and Sales Ratio

Particulars Pre Inc. Period Post Inc. Period Total

(a) No. of Months = Time Ratio 01.04.2014 to 31.06.2014 01.07.2014 to 31.03.2015

= 3 months = 9 months 3 : 9 = 1 : 3

(b) Sales per Month Ratio (given) Say ` 1 × 3 Months ` 2 × 9

Overall Sales Ratio = 3 = 18 3 : 18= 1 : 6

(c) Rent for Addnl Premises (from 1st July) – 20,000 × 9 Months=` 1,80,000

(d) Balance Rent (` 5,50,000 – ` 1,80,000)

` 92,500 ` 2,77,500

distributed in 1 : 3 (Time Ratio)

Total Rent Expense (c) + (d) ` 92,500 ` 4,57,500

(e) Salary Ratio Say ` 1×3 Months = 3 (` 1×3 Months + ` 2×6) = 15 3: 15 = 1: 5

2. Statement showing calculation of Profit / Losses for Pre and Post Incorporation Periods

Total Ratio Post

Particulars Pre Incorpn.

Incorpn.

Turnover (Apportioned in Sales Ratio) 2,40,00,000 1:6 34,28,571 2,05,71,429

Add: Apportionment of Other Income

Interest on Investments 6,00,000 6,00,000 –

Bad Debts Recovered 50,000 50,000 –

A. Total Income 2,46,50,000 40,78,571 2,05,71,429

B. Apportionment of Expenses

Cost of Goods Sold 102,00,000 1:6 14,57,143 87,42,857

Advertisement Expenses 3,00,000 1:6 42,857 2,57,143

Sales Commission 6,00,000 1:6 85,714 5,14,286

Salary 18,00,000 1:5 3,00,000 15,00,000

Managing Directors Remuneration 6,00,000 Post – 6,00,000

Interest on Debentures 2,00,000 Post – 2,00,000

Rent (Note 1d) 5,50,000 92,500 4,57,500

Bad Debts 1,50,000 1:6 21,429 1,28,571

Underwriting Commission 2,00,000 Post – 2,00,000

Audit Fees 2,00,000 Post – 2,00,000

Loss on Sale of Investment 1,00,000 Pre 1,00,000 –

Depreciation 4,00,000 1:3 1,00,000 3,00,000

Total Expenses 1,53,00,000 21,99,643 1,31,00,357

C. Profit (A – B) 93,50,000 18,78,928 74,71,072

May 2015.6

Gurukripa’s Guideline Answers for May 2015 CA Inter (IPC) Group I Accounting

3. Accounting Treatment: Pre–Incorporation Profit is transferred to Capital Reserve A/c. Alternatively, the amount may

be set off against the Goodwill, if any, arising on acquisition of business.

Question 3(b): Insurance Claims – Loss of Profits – Computation of Policy Amount 6 Marks

M/s. Platinum Jewellers wants to take up a “Loss of Profit Policy” for the Year 2015. The Extract of the Profit and Loss Account

of the previous year ended 31.12.2014 is provided below:

Variable Expenses: Cost of Materials 18,60,000

Fixed Expenses: Wages for Skilled Craftsmen 1,60,000

Salaries 2,80,000

Audit Fees 40,000

Rent 64,000

Bank Charges 18,000

Interest Income 44,000

Net Profit 6,72,000

Turnover is expected to grow by 25% next year.

To meet the growing Working Capital needs, the Partners have decided to avail Overdraft Facilities from their Bankers @ 12%

p.a. interest. The Average Daily Overdraft Balance will be around ` 2 Lakhs. The Wages for the Skilled Craftsmen will increase

by 20% and Salaries by 10% in the current year. All other expenses will remain the same.

Determine the amount of policy to be taken up for the current year by M/s. Platinum Jewellers.

Solution: Similar to Page No.A.5.16, Q.No.22 [N 01]

1. Trading and Profit and Loss Account for Previous Year

Particulars ` Particulars `

To Variable Expenses 18,60,000 By Sales (balancing figure) 30,50,000

To Fixed Expenses 5,62,000 By Miscellaneous Income 44,000

To Net Profit 6,72,000

Total 30,94,000 Total 30,94,000

Note: Total Fixed Expenses = `1,60,000 + `2,80,000 + `40,000 + `64,000 + `18,000 = ` 5,62,000

2. Computation of Insurance Policy to be taken

Particulars `

Gross Profit (Sales ` 30,50,000 Less Variable Expenses ` 18,60,000) 11,90,000

Add: Additional GP at 25% of above 2,97,500

Add: Increasing Standing Charges

Wages @ 20% of 1,60,000 32,000

Salaries @ 10% of 2,80,000 28,000

Interest on Overdraft @ 12% of 2,00,000 24,000 84,000

Policy to be taken for Current Year 15,71,500

Question 4: Financial Statements from Incomplete Records 16 Marks

The following is the Balance Sheet of M/s Care Traders as on 01.04.2014:

Sources of Funds Amt in ` Application of Funds Amt in `

Share Capital 10,00,000 Machinery 8,25,500

Profit and Loss 1,47,800 Furniture 1,28,700

Unsecured Loan at 10% 1,75,000 Inventory 1,72.000

Trade Payables 45,800 Trade receivables 2,29,600

Bank balance 12,800

Total 13,68,600 13,68,600

A fire broke out in the premises on 31.03.2015 and destroyed the Books of Account. The Accountant could however provide the

following information:

May 2015.7

Gurukripa’s Guideline Answers for May 2015 CA Inter (IPC) Group I Accounting

1. Sales for the year ended 31.03.2014 was ` 18,60,000. Sales for the current year was 20% higher than the last year.

2. 25% Sales were made in cash and the balance was on credit.

3. Gross Profit on Sales is 30%

4. Terms of Credit: Debtors– 2 Months, Creditors – 1 month. All Creditors are paid by Cheque and all Sales are collected in

Cheque.

5. The Bank Pass Book has the following details (other than payment to Creditors and collection from Debtors)

Machinery purchased 1,14,000 Repairs 36,500

Rent paid 1,32,000 Sales of Furniture 9,500

Advertisement Expenses 80,000 Cash withdrawn for Petty Expenses 28,300

Travelling Expenses 78,400 Interest paid on Unsecured Loan 8,750

6. Machinery was purchased on 01.10.2014.

7. Rent was paid for 11 months only and 25% of the Advertisement Expenses relates to the next year.

8. Travelling Expenses of ` 7,800 for which Cheques were issued but not presented in bank.

9. Furniture was sold on 01.04.2014 at a loss of ` 2,900 on Book Value.

10. Physical Verification as on 31.03.2015 ascertained the Stock Position at ` 1,81,000 and Petty Cash Balance at Nil.

11. There was no change in Unsecured Loans during the year.

12. Depreciation is to be provided at 10% on Machinery and 20% on Furniture.

Prepare Bank A/c, Trading and Profit & Loss A/c for the year ended 31.03.2015, in the books of M/s. Care Traders and a Balance

Sheet as on that date. Make necessary assumptions wherever necessary.

Solution: Similar to Page No.A.3.59 Q.No.36, [N 02] and other Illustrations in this Chapter

1. Computation of Gross Profit

Particulars Computation `

(a) Sales for Current Year 18,60,000 + 20% 22,32,000

(b) Cash Sales 22,32,000 × 25% 5,58,000

(c) Hence, Credit Sales = Total Sales (–) Cash Sales 22,32,000 – 5,58,000 16,74,000

(d) Gross Profit = Sales × 30% 22,32,000 × 30% 6,69,600

2. Trading Account for the year ended 31st March

Particulars ` Particulars `

To Opening Stock 1,72,000 By Sales (WN 1) 22,32,000

To Purchases (balancing figure) 15,71,400 By Closing Stock 1,81,000

To Gross Profit (30%) 6,69,600

Total 24,13,000 Total 24,13,000

3. Computation of Debtors – Closing Balance

No. of Months O/S 2

Closing Debtors = Credit Sales × = ` 16,74,000 × = ` 2,79,000

12 12

4. Sundry Debtors Account (To find out Collections from Debtors)

Particulars ` Particulars `

To balance b/d 2,29,600 By Bank – Collection (balancing figure) 16,24,600

To Credit Sales (WN 1) 16,74,000 By balance c/d (WN 3) 2,79,000

Total 19,03,600 Total 19,03,600

5. Computation of Creditors – Closing Balance

No. of Months O/S 1

Closing Creditors = Credit Purchases × = ` 15,71,400 × = ` 1,30,950

12 12

(Assumed that the entire Purchases is on Credit)

May 2015.8

Gurukripa’s Guideline Answers for May 2015 CA Inter (IPC) Group I Accounting

6. Sundry Creditors Account (To find out Payments to Creditors)

Particulars ` Particulars `

To Bank – Payment (balancing figure) 14,86,250 By balance b/d 45,800

To balance c/d (WN 5) 1,30,950 By Purchases – Credit (WN 2) 15,71,400

Total 16,17,200 Total 16,17,200

7. Machinery Account

Particulars ` Particulars `

To balance b/d 8,25,500 By Depreciation (8,25,500 × 10%)+(1,14,000 × 10% × 6/12) 88,250

To Bank 1,14,000 By balance c/d 8,51,250

Total 9,39,500 Total 9,39,500

Note: Alternatively, Depreciation can be assumed at 10% on Book Value irrespective of date of addition.

8. Furniture Account

Particulars ` Particulars `

To balance b/d 1,28,700 By Bank (Sale Proceeds) 9,500

By Loss on Sale 2,900

By Depreciation (1,16,300 × 20%) (Note) 23,260

By balance c/d 93,040

Total 1,28,700 Total 1,28,700

Note: Depreciation = 20% on (1,28,700 – 9,500 – 2,900) = 23,260

9. Bank Account

Particulars ` Particulars `

To Balance b/d 12,800 By Creditors (WN 6) 14,86,250

To Debtors – Collections received (WN 4) 16,24,600 By Machinery 1,14,000

To Cash Sales (WN 1) 5,58,000 By Rent 1,32,000

To Furniture 9,500 By Advertisement 80,000

By Repairs 36,500

By Travelling (78,400 + 7,800) (Cheque issued) 86,200

By Petty Expenses 28,300

By Interest 8,750

By balance c/d (balancing figure) 2,32,900

Total 22,04,900 Total 22,04,900

10. Profit & Loss Account for the year ended 31.03.2015

Particulars ` Particulars `

1,32,000

To Rent ( × 12) 1,44,000 By Gross Profit 6,69,600

11

To Advertisement (80,000 × 75%) 60,000

To Travelling Expenses 86,200

To Loss on Sale of Furniture 2,900

To Depreciation (88,250 + 23,260) 1,11,510

To Repairs 36,500

To Petty Expenses 28,300

To Interest (1,75,000 × 10%) 17,500

To Net Profit (balancing figure) 1,82,690

Total 6,69,600 Total 6,69,600

By Opening Balance b/d 1,47,800

To Closing Balance c/d 3,30,490 By Net Profits for the year as above 1,82,690

Total 3,30,490 Total 3,30,490

May 2015.9

Gurukripa’s Guideline Answers for May 2015 CA Inter (IPC) Group I Accounting

11. Balance Sheet as at 31stMarch

Capital and Liabilities ` Properties and Assets `

Capital 10,00,000 Non–Current Assets:

Profit & Loss Account 3,30,490 Machinery (WN 7) 8,51,250

Non – Current Liabilities: Unsecured Loan 1,75,000 Furniture (WN 8) 93,040

Current Liabilities: Current Assets:

Sundry Creditors (WN 5) 1,30,950 Inventory 1,81,000

Rent Payable 12,000 Sundry Debtors (WN 3) 2,79,000

Interest Payable (17,500 – 8,750) 8,750 Bank 2,32,900

Advertisement Exp. paid in advance 20,000

Total 16,57,190 Total 16,57,190

Question 5(a): Hire Purchase Accounting – Cash Price, Repossession, Ledger A/cs 8 Marks

Lucky bought 2 tractors from Happy on 01.10.2011 on the following terms:

Description `

Down Payment 5,00,000

1st Installment at the end of First Year 2,65,000

2nd Installment at the end of Second Year 2,45,000

3rd Installment at the end of Third Year 2,75,000

Interest is charged at 10% p.a

Lucky provides Depreciation @ 20% on the Diminishing Balances.

On 30.09.2014, Lucky failed to pay the 3rd Installment upon which Happy repossessed 1 Tractor. Happy agreed to leave one

tractor with Lucky and adjusted the value of the Tractor against the amount due. The Tractor taken over was valued on the

basis of 30% depreciation annually on written down basis. The balance amount remaining in the Vendor’s Account after the

above adjustment was paid by Lucky after 3 Months with Interest @ 18% p.a.

You are required to:

1. Calculate the Cash Price of the Tractors and the Interest paid with each installment.

2. Prepare Tractor Account and Happy Account in the books of Lucky assuming that books are closed on 30th September

every year. Figures may be rounded off to the nearest Rupee.

Solution: Similar to Page A.5.73 Q.No.2 [N 12], and Page A.5.80 Q.No.14 [M 90]

1. Statement of Cash Price of the Asset acquired on HP

End of Balance due after Instalment Cumulative Interest at 10%

Paid for Principal

Instalment Instalment Amount Amount p.a

(4) = (2) + 10

(1) (2) (3) (5) = (4) × (6) = (3) – (5)

(3) 110

3 Nil 2,75,000 2,75,000 25,000 2,50,000

2 2,50,000 2,45,000 4,95,000 45,000 2,00,000

1 4,50,000 2,65,000 7,15,000 65,000 2,00,000

0 6,50,000 5,00,000 11,50,000 NIL (Down Payment) 5,00,000

12,85,000 1,35,000 11,50,000

Thus, Cash Price of the Asset = ` 11,50,000.

2.Tractor A/c

Date Particulars ` Date Particulars `

01.10.11 To Bank A/c(Down Payment) 5,00,000 30.09.12 By Depreciation (11,50,000× 20%) 2,30,000

01.10.11 To Happy A/c 6,50,000 30.09.12 By balance c/d 9,20,000

Total 11,50,000 Total 11,50,000

01.10.12 To balance b/d 9,20,000 30.09.13 By Depreciation (9,20,000× 20%) 1,84,000

30.09.13 By balance c/d 7,36,000

Total 9,20,000 Total 9,20,000

May 2015.10

Description:Prepare Cash Flow from Investing Activities of M/s Creative Furnishings . Draw the Balance Sheet of Abhilasha Ltd as on 01.04.2015 after the