Graham & Doddsville - Columbia Business School PDF

Preview Graham & Doddsville - Columbia Business School

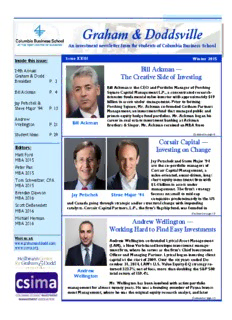

Graham & Doddsville An investment newsletter from the students of Columbia Business School Issue XXIII Winter 2015 Inside this issue: Bill Ackman — 24th Annual Graham & Dodd The Creative Side of Investing Breakfast P. 3 Bill Ackman is the CEO and Portfolio Manager of Pershing Bill Ackman P. 4 Square Capital Management L.P., a concentrated research- intensive fundamental value investor with approximately $19 Jay Petschek & billion in assets under management. Prior to forming Pershing Square, Mr. Ackman co-founded Gotham Partners Steve Major ’94 P. 13 Management, an investment fund that managed public and private equity hedge fund portfolios. Mr. Ackman began his Andrew career in real estate investment banking at Ackman Bill Ackman Wellington P. 21 Brothers & Singer. Mr. Ackman received an MBA from Student Ideas P. 29 (Continued on page 4) Corsair Capital — Editors: Investing on Change Matt Ford MBA 2015 Jay Petschek and Steve Major ’94 are the co-portfolio managers of Peter Pan Corsair Capital Management, a MBA 2015 value-oriented, event-driven, long/ Tom Schweitzer, CFA short equity investment firm with MBA 2015 $1.4 billion in assets under management. The firm’s strategy Brendan Dawson Jay Petschek Steve Major ’94 focuses on small to mid-cap MBA 2016 companies predominantly in the US and Canada going through strategic and/or structural change with impending Scott DeBenedett catalysts. Corsair Capital Partners, L.P., the firm’s flagship fund, was founded in MBA 2016 (Continued on page 13) Michael Herman Andrew Wellington — MBA 2016 Working Hard to Find Easy Investments Visit us at: Andrew Wellington co-founded Lyrical Asset Management www.grahamanddodd.com (LAM), a New York-based boutique investment manage- www.csima.org ment firm, where he serves as the firm’s Chief Investment Officer and Managing Partner. Lyrical began investing client capital at the start of 2009. Over the six years ended De- cember 31, 2014, LAM’s U.S. Value Equity-EQ strategy re- turned 323.7%, net of fees, more than doubling the S&P 500 Andrew total return of 159.4%. Wellington Mr. Wellington has been involved with active portfolio management for almost twenty years. He was a founding member of Pzena Invest- ment Management, where he was the original equity research analyst, and later (Continued on page 21) Page 2 Welcome to Graham & Doddsville It is our pleasure to bring you Andrew Wellington, found- Lastly, we are proud to once the 23rd edition of Graham & er of Lyrical Asset Management again highlight pitches from Doddsville. This student-led discusses his approach to port- four CBS Applied Value Invest- investment publication of folio construction, and shares ing students selected as the Columbia Business School (CBS) insight into several investments finalists for the 2015 Amici is co-sponsored by the Heil- which convey his thought pro- Capital Prize Competition to brunn Center for Graham & cess as an investor. be held in February. Formerly Dodd Investing and the Colum- known as the Moon Lee Prize, bia Student Investment Manage- This issue also highlights pho- the Amici Capital Prize is given ment Association (CSIMA). tos from the 24th Annual Gra- in memoriam of Alex Porter, ham & Dodd Breakfast, held on Founder and Managing Member In this issue, we are fortunate to October 24th, 2014 at the of Amici Capital, and Moon present four investors from Pierre Hotel in New York. This Lee, a dedicated value investor Louisa Serene Schneider three firms representing differ- Breakfast brings together alum- with Porter Orlin, LLC and ’06, the Heilbrunn Center ent investing approaches, but ni, students, scholars, and prac- friend of the Amici Capital Director. Louisa skillfully each reflecting the common titioners for a forum on cur- team. leads the Center, cultivating underlying tenets of value invest- rent insights and approaches to strong relationships with ing. investing. This year’s featured This year’s finalists include some of the world’s most panelists included Bruce Berko- fellow classmates: Kirill Ale- experienced value inves- Bill Ackman recounts his early witz of Fairholme Capital, Mar- ksandrov ’15 - First Solar tors, and creating numer- influencers as an investor, de- io Gabelli ’67 of Gamco Inves- (FSLR), Short; Harry Garcia ’15 ous learning opportunities scribes the traits he values in a tors, Jonathan Salinas ’08 of - JetBlue Airways (JBLU), Long; for students interested in CEO, and discusses recent in- Plymouth Lane Capital, and Luke Tashie ’15- Schibsted value investing. The classes vestments, including Herbalife, Professor Bruce Greenwald of Media Group (SCH: NO), sponsored by the Heil- Allergan, and Zoetis. Mr. Ack- Columbia Business School. Long; and Brian Waterhouse brunn Center are among man also sheds light on the cul- ’15 - CDK Global (CDK), Long. the most heavily demanded ture of Pershing Square Capital. We are proud to announce Summaries of these pitches can and highly rated classes at multiple strong showings from be found on pages 29-36. Columbia Business School. Jay Petschek and Steve Ma- CBS teams during the Fall’s jor ’94, co-PMs of Corsair Cap- cross-MBA stock pitch compe- As always, we thank our ital, share examples where Cor- titions, with 1st place finishes at interviewees for contributing sair’s approach led to variant the Darden @ Virginia Invest- their time and insights not only perceptions in key investments. ing Challenge and the UNC to us, but to the investment Mr. Petschek and Mr. Major ’94 Alpha Challenge, and a 2nd community as a whole, and we also discuss the importance of place finish at the Michigan thank you for reading. investing in companies whose Stock Pitch Competition. The - G&Dsville Editors management team’s interests teams’ respective pitches can are aligned with shareholders. be found on pages 37-42. Professor Bruce Greenwald, the Faculty Director of the Heilbrunn Center. The Cen- ter sponsors the Value In- vesting Program, a rigorous academic curriculum for particularly committed stu- dents that is taught by some of the industry’s best practi- tioners. Professor Bruce Greenwald and Louisa Jon Salinas ’08, Founder and Managing Serene Schneider ’06 at the October, Member of Plymouth Lane Capital, served 2014 Graham & Dodd Breakfast. as a panelist during this year’s Graham & Dodd Breakfast. Volume I, Issue 2 PPaaggee 33 24th Annual Graham & Dodd Breakfast— October 24, 2014 at The Pierre Hotel Panelists included Professor Bruce Greenwald, Mario Tom Russo of Gardner Russo & Gardner speaking with Gabelli ’67, Bruce Berkowitz, and Jon Salinas ’08. Dean Glenn Hubbard. Henry Arnhold with Jean-Marie Eveillard of First Eagle. The panelists speaking with Dean Hubbard. Page 4 Bill Ackman (Continued from page 1) Harvard Business School BA: I had very few actual think about mentorship within and a Bachelor of Arts mentors in this business Pershing and about developing magna cum laude from because I didn't really know your team on the investment Harvard College. anyone. I bought Seth side over time? Klarman's book, Margin of Graham & Doddsville Safety, which was published my BA: I don't think we have any (G&D): If we were to go back first year of business school. I particular programmatic way to the period before launching called him up and said, "Hey, to develop people. The Gotham, how did you get your I’m a business school student Goldman Sachs' of the world start in investing? and bought a copy of your have real training programs. At book.” He said, "You bought a Pershing, people on the Bill Ackman (BA): I started copy of my book?!" I don't investment team side are Bill Ackman investing in business school. A think many people had done pretty good investment friend recommended that I that. analysts by the time they get read Ben Graham's The here. They've already spent Intelligent Investor and it three or four years training at resonated with me. I decided investment banks and private to go to Harvard Business “...if you can find a equity firms. Some may even School and learn how to have finance experience from great business, and if become an investor. their undergraduate programs. you can switch out a I got to HBS and unfortunately The rest is just working as part there were no classes really mediocre management of a ten-person team. Our focused on investing. The first analysts work very closely with year is a set program – it didn't team for a great one, me and other members of the have much in the way of team. We learn from each choice. I thought the best way you can create a lot of other; not just the older to learn is by doing, so I people teaching the younger value. That was an started investing on my own. I people, but the younger people found that it fit with what I like teaching the older people. It evolution over 22 to do. The first stock I bought just sort of happens. We learn went up. I think if it had gone years.” new things every day. down I would have become a real estate developer or G&D: How would you something. Then, six months In a sense, he was a mentor describe the evolution of your later, I roped in a classmate, because he had graduated from investing philosophy from David Berkowitz, who was in Harvard Business School ten Gotham to Pershing Square? my section – it was a little years earlier and started a lonely going back to the dorm hedge fund right out of school. BA: Gotham was not set up to room on my own to do this That's what made it seem be an activist hedge fund – it kind of thing. The two of us possible. I don't know if he was just sort of happened. I don't started looking at investments a mentor per se – a mentor is remember the moment we together toward the end of my someone you have more decided to intervene in a first year and the beginning of interaction with, but he was company. There were a couple my second year. At a certain certainly someone that I of different cases where it point in time, I said, "What if looked up to. Of course, seemed obvious what should we did this as a real business?" Buffett was a mentor in a happen. The basic evolution I figured the worst case, if we sense. He didn't know me. You was this: Version 1.0 was failed, is we'd have a lot of very can still learn a lot from people classic value investing, which good experiences. And if we're without ever meeting them. entailed investing in statistically successful, great. cheap securities. Version 2.0 G&D: There have been a was recognizing the difference G&D: Did you have any number of analysts at Pershing between businesses of mentors back then? Square that have gone on to different quality. I think over great success. How do you time we developed more of an (Continued on page 5) Page 5 Bill Ackman appreciation for the value of a We size things based on how position. quality business. Version 3.0 much we think we can make was understanding the impact versus how much we think we The biggest investment we of activism. More recently, can lose. We'll probably be ever made was Allergan Version 4.0 is understanding willing to lose 5-6% of our (AGN), which, at cost, was that if you can find a great capital in any one investment. approximately 27% of our business, and if you can switch With Fannie (FNMA) and capital. There we were out a mediocre management Freddie (FMCC), you have partnering with a strategic team for a great one, you can highly leveraged companies acquirer and it had an create a lot of value. That was where the government is immediate catalyst to unlock an evolution over 22 years. effectively taking 100% of the value. It was a very high quality profits forever. There's legal business. We felt it was hard G&D: You manage a risk and political risk, and an for us to lose a lot of money, concentrated portfolio and enormous of amount of so the position could be quite there are some inherent risks uncertainty. We could large. Could we lose 20% of to that. Broadly speaking, how realistically lose our entire our capital? Sure, it was do you think about investment. That's a 2-2.5% possible, but very unlikely. So constructing the portfolio position at today's market in some sense, we think about today and how has that price. losing 20% on 27% as risking 5- changed over time? 6% of our capital. BA: I'm a big believer in “We look at G&D: You mentioned concentration. But it's not just companies failing to achieve management the analysis that protects you, it's their true earnings potential as the nature of the things you possible opportunities. How same way we judge invest in. If you invest in super do you evaluate management high quality, durable, simple, people we want to teams and what metrics do predictable, free cash flow you consider? generating businesses, that hire for Pershing should protect you as well. BA: We look at management Square. We're looking the same way we judge people If you pay a fair to cheap price we want to hire for Pershing for character, for businesses of that quality, I Square. We're looking for think it's hard to lose a lot of character, intelligence, and intelligence, and money. The key is you have to energy, but we're also looking be a good analyst in order to energy, but we're also for relevant experience. If you determine whether it truly is a look at Seifi Ghasemi at Air great business. You have to looking for relevant Products (APD), he knows the really understand what the industrial gas business very moats are. You have to experience.” well. He spent nearly 20 years understand the risk of with The BOC Group and technological entrants – the In our other investments, it is spent the last 13 years at two guys in a California garage very hard to lose money. We specialty chemical company working on the next new like to own businesses with Rockwood Holdings (ROC). thing. Buffett would always dominant competitive So he had both disciplines – write about the newspaper positions, such as railroads, the qualitative characteristics business being one of the great industrial gases, and specialty and the experience. He had businesses, but print has been pharmaceuticals. Some of our been a public company CEO disintermediated as a result of investments also benefit from for a meaningful period of changes in technology. So undermanaged operations or time. It was very easy to we're concentrated, but we try reported earnings that support him as CEO of the to invest in businesses where understate true economic company. it's very hard to lose money, earnings. When we pay a fair particularly at the price we price for those situations, we We helped recruit Hunter pay. can make it a significant Harrison to Canadian Pacific (Continued on page 6) Page 6 Bill Ackman Railway (CP). He had turned the launch of a public entity BA: Probably not. If Carl Icahn around two other railroads and a fair amount of internal had not come in and bought 17 including a Canadian capital, we're devoting million shares of stock, this competitor. If you meet him, effectively all of our resources would have played out very you'll understand his leadership to active investments. If you're differently. What made this go qualities. It's easy if you're going to be active in a a slightly different direction backing someone who's situation, it's very helpful to than we had expected was Professor Tano Santos already done it before. It’s have it be geographically Carl went first in a big way, listening to the panelists at more difficult when you are proximate, operating in the and that attracted a lot of the 2014 Graham & Dodd Breakfast. taking someone who has not same language, under the same other participants who viewed been successful before and law, where you're well known this as a trading opportunity to betting on their success. and you know the players. make money on a short squeeze. G&D: Do you have examples of bringing in successful CEOs I don't think it affected the who did not previously have ultimate outcome, and I think relevant experience? “We’ve yet to hear we'll make more money as a result, so maybe we were BA: We focus on candidates one fact from investors compensated for the extra with previous experience. You time by being able to buy a that own the stock or can meaningfully reduce the bigger notional short position. risk if you can find someone We bought a lot of put options any bull case that who's done it before. We have in the stock in the $70s and an affection for older CEOs in $80s that we could not have caused us to think some sense. With both Seifi economically purchased when and Hunter, they have 50 years Herbalife was a stock we first established the of experience. Someone at position. that stage of their career that you should buy as has been successful is not G&D: I'm sure you've heard opposed to one you really driven by financial an opposing thesis from any considerations. It's more about number of smart investors. Is should sell.” legacy and the fun they have. there any compelling piece of That's why we think old CEOs evidence that has made you are best. question your conclusions on HLF? G&D: Why hasn’t Pershing With a strategy where we're invested in more businesses doing two things a year, maybe BA: No. We've yet to hear outside the US? Certainly three, we don't need to go one fact from investors that there are legal considerations outside the U.S. or Canada. own the stock or any bull case from an activist perspective, We would be open to that caused us to think but even among the passive something international at Herbalife (HLF) was a stock holdings, there does not some point, but it would have you should buy as opposed to appear to have been many to be extremely compelling. one you should sell. The purely international focused We feel like we've got plenty quality of work done by the businesses in the portfolio. of things to do here. people that own this stock is really poor. If they continue to BA: Passive investments have G&D: Let’s talk about a own it, they will lose 100% of been placeholders until we find couple of ideas. One that their investment. 13-Fs are the next activist investment. people love to ask you about is coming out on Monday for this They've also been a way for us Herbalife (HLF). Do you think name (Editors’ Note: this to have more liquid the return has been worth it interview was conducted in investments in case we get relative to the amount of time November 2014). I will be redemptions from investors. and effort you've had to amazed. I'm always looking As our capital base has expend on this investment? forward to find out who become more permanent with bought it. There seems to be a (Continued on page 7) Page 7 Bill Ackman new victim each quarter. your Herbalife thesis? Americans find it a fancy thing Statistically, it screens really that you don't do at home. cheap. It's trading at 7-8x BA: Why was Bernie Madoff in They think there must be earnings. That sounds cheap, business for 37 years? I don't something shady about it. but it’s based on projected know, it seems so obvious. earnings. We think earnings Herbalife's been around for 34 G&D: You mentioned you projections are going to come years. It's on the New York only invested in two new down meaningfully and they've Stock Exchange. It has a positions this year. Can you already begun to. Ultimately, market cap of $8 billion. Yet if tell us about an idea that you we think earnings will go you go to L.A. and ask people spent a lot of time on, but negative. about Herbalife, they go, "Oh, ultimately decided to pass? that pyramid scheme?" They've G&D: Do you have a set had that thought for 20 years. I BA: We did a lot of work on process to keep yourself think the company has done a McGraw-Hill (MHFI) a few intellectually honest in terms very good job at creating the years ago. It is a conglomerate of assessing the counterview perception of legitimacy by with several businesses and to what your thesis is? products. One of them is the S&P franchise, which we think BA: We're always open to a is one of the best businesses in “We're always open to contrary point of view, the world. Capital IQ is particularly if it's someone another McGraw-Hill product a contrary point of who's smart with a good that we use and like. It’s a record that's on the other side great and valuable asset. The view, particularly if it's of something we own or company on the whole looked something we're short. We someone who's smart undervalued and interesting. want to hear it and we're going to listen to it. With Valeant with a good record Ultimately, we couldn't get (VRX), there are some well- comfortable with the potential that's on the other side known short sellers, Jim liability associated with being in Chanos in particular. I don't the bond rating business. We of something we own know if he's still involved, but had a pretty negative view on he was publicly short the how the ratings agencies had or something we're stock. I wanted to hear all of managed the crisis. We had big his arguments. I called him, and short. We want to hear short positions in bond he was very charitable in insurers that had AAA ratings. sharing them. I appreciated him it and we're going to I met with the ratings agencies doing that. many times to try to convince listen to it.” them that their ratings were One of the best ways to get just ridiculous to no avail. confidence in an idea is to find a smart person who has the surrounding themselves with We felt that MHFI had real opposing view and listen to all legitimate people. Madeleine liability and the potential losses of their arguments. If they have Albright is a consultant to the they may face from litigation a case that you haven't company. They have a Nobel were unknowable considering considered, then you should Laureate on their scientific the amount of bonds that were get out. But they can also help advisory board. They brought purchased and the amount of give you more conviction. If on the former surgeon general money that was lost relying on what I've heard are the best in the last year. They sponsor those ratings. With our arguments that can be made soccer stars, such as David strategy, we must be willing to against being short Herbalife, Beckham, and the L.A. Galaxy. put 15-20% of capital into a then I want to be short more. It's a brilliant scheme. particular idea. We can’t invest in a security where it is G&D: Why do you think it's Also, the general public is just possible that you wake up been so difficult for the market not interested or comfortable tomorrow and it's worth 50% to wrap their head around with short selling. Most or 80% less than what you (Continued on page 8) Page 8 Bill Ackman paid. So that was something way to think about that story with respect to each of we passed on even though we business. our failed retail investments. thought it was unlikely that And there are retail there would be a claim that G&D: One area that's been investments where we made a wipes out the value of the difficult for Pershing in the past lot of money – Sears (SHLD) company. has been retail. What has in 2004, Sears Canada (SCC), made that sector so difficult and food retail businesses We saw this as different from relative to some of your other would be examples. But I think Fannie (FNMA) and Freddie areas of focus? retail is a very difficult (FMCC) because we thought business, particularly fashion MHFI was a potential double, retail. That's a tough category. while we think we can make 25x our money in Fannie and G&D: Are there other “Fundamentally what Freddie. A small investment in industries that you'd say are Fannie and Freddie can still be you're looking for is too challenging? very material in terms of profits for the firm, yet if how much cash the BA: We have generally something happens and we avoided technology as well as lose our entire investment, we business can generate commodity-sensitive won't really notice. For MHFI businesses. With commodity on a recurring basis to be a meaningful contributor, businesses, it's very difficult to it would have to be a big predict the future price of the over a very long period investment. commodity – this year being a of time. That's what good example. If you asked G&D: Buffett uses the people at the beginning of the concept of owner earnings. we do.” year, I don't know how many Are there any particular would say that WTI would be metrics you find helpful? below $76. So we avoid a few sectors, but we try to stay BA: I think the job of the BA: I think retail has become open-minded. For example, security analyst is to take the much more difficult. A big part healthcare was something I reported GAAP earnings of a of that is Jeff Bezos and would have put on that list a business and translate them Amazon (AMZN), a large year ago. Right now, we have into what Buffett calls owner company that does nearly $75 two healthcare investments earnings. I call them economic billion in revenue growing comprising 40% of the earnings. The next step is to faster than 25% annually. They portfolio. In every sector there assess and understand the are reinvesting 100%, maybe are businesses that can meet durability of those earnings. more, of their profits to our standard, but most won't, Fundamentally, what you're improve the customer and that's why we haven't looking for is how much cash experience, expand their spent a lot of time looking in the business can generate on a reach, and so on. I think it’s an some of these areas. recurring basis over a very incredibly formidable long period of time. That's competitor that gets stronger G&D: Would you be willing to what we do. GAAP accounting every year. When you grow at share your thesis on Zoetis is an imprecise, imperfect those rates, that revenue is (ZTS) and what the playbook is language that works for very coming from somewhere. He's going to be there? simple businesses. For a widget got a better mousetrap. He's company that grows 10% a got the support from his BA: I think it's a great year, GAAP earnings are really investors to invest a huge business. It has a dominant good at approximating amount of capital in the position as the largest economic earnings. For Valeant business. That's a very difficult company in animal health. Pharmaceuticals (VRX), for competitor for the retail There are very good trends example, a company that's industry. supporting the growth of the been very acquisitive, GAAP company. Rising income levels accounting is not a very good Aside from that, there is a and increasing demand for (Continued on page 9) Page 9 Bill Ackman protein in people's diets a super high quality business which these vehicles were out benefit the company. The you can buy for a discount of favor in the investment companion animal health where there's an opportunity community. Our Allergan segment of their business for optimization? activist campaign was should also benefit from rising somewhat unprecedented as incomes. With more affluent G&D: Many respected well. cultures, people have more investors have publicly praised William von Mueffling ’95 of Cantillon Capital pets, but also care for them your investment creativity. It I don't think it's as much Management speaks with more. It meets our standard seems to be one of the creativity as it is a willingness Columbia Business School for a high quality business. It's defining qualities of Pershing to consider opportunities that Senior Associate Dean Lisa also a spinoff, which can create Square. How do you cultivate are unconventional and outside Yeh at the 2014 Graham & interesting opportunities. I that creativity? Is there a way the box. What's required is Dodd Breakfast. don’t think we are ready for for someone to develop that that you have to have a basic comment beyond that. ability? understanding of what's right, what's legal, and what's G&D: How do you typically possible, and not limit the source ideas? Is there one universe to things that no one method in particular that's had “What's required is else has done before. a lot of success? that you have a basic We are absolutely going to BA: Interestingly, Allergan consider things that haven't understanding of (AGN) and Air Products been done before. We don't (APD) were brought to us. what's right, what's need a precedent. We're just That's a good way to get ideas. interested in things that create We have a reputation for being legal, and what's value and we're going to look a good, proactive investor. at them objectively. To Canadian Pacific (CP) came possible, and not limit execute the strategy, you have from an unhappy CP to be willing to do things the universe to things shareholder. Air Products without caring what other came from a happy CP people think. You need thick that no one else has shareholder who made a lot of skin. In this strategy, not money with us and said, "Hey, done before.” everyone's beloved, this is the other dog in my particularly on the activist portfolio, maybe you can help." short side. You're not going to Allergan came to us through make many friends in that Valeant because they were BA: Someone once pointed business except for the first looking for someone who out that almost everything person who took your advice could help increase the we've done has been and got out. probability of their success. unprecedented. We shorted a company and announced to G&D: Given that we're in this We're looking for big things. the entire world that it is a "golden age of activism," there Today we have $19 billion in pyramid scheme. With General are lots of investors and capital capital. We want to put 10% Growth Properties (GGP), we focused on activism. Have you or more in an investment so bought 25% of the equity of a found it more difficult to find we prefer companies with company on the brink of ideas to add to your portfolio market caps above $25 or bankruptcy, convinced them to as a result? even $50 billion. We are file for bankruptcy, and helped looking for high business them restructure. We started BA: No. First of all, it depends quality and opportunities to a company from scratch with on what you count. In terms of make the business much more Howard Hughes (HHC). That dedicated activist funds, there valuable. Some of our sourcing was a collection of assets we is something like $150 billion. comes from reading the spun out of GGP and replaced That's a still a small number in newspaper and just looking for the management team. We’ve the context of the size of the companies that meet that very had two successful investments market. We are one of the simple model. Where is there in SPACs during a period in largest at $19 billion. We are (Continued on page 10) Page 10 Bill Ackman also one of the most lot of CDS outstanding, I recognize that the stability of concentrated activists. A would be much more inclined your capital base has a huge combination of concentration to do that than having to impact on your returns over and scale means we're doing borrow stock to go short and time. The Buffett Partnership very big investments and these risk the stock price rising. had no corporate level tax. At are very big companies. Every Berkshire Hathaway he had to company we've invested in, we G&D: What are you trying to work for $100,000 a year with were the first activist who accomplish with the creation no stock options, and pay bought a stake. of Pershing Square Holdings corporate level tax. This tells (PSH)? me that he viewed the Generally this is fertile ground. permanency of the capital base I would say there's more as much more material than activism happening in small and these other features. mid-cap companies, so I don't “I do think companies think it has affected us. I do That's basically what inspired think companies are trying to are trying to fix us to create a public entity. fix themselves before an We didn't want to pay themselves before an activist shows up, and that's a corporate level tax so we threat. As businesses become didn't want to merge with a activist shows up...as better managed and boards of corporation. While PSH is directors replace weak CEOs, businesses become structured as an offshore there's less for us to do. closed-end fund, we think of it better managed and like an investment holding G&D: You mentioned some of company. We have these the benefits of having boards of directors subsidiary companies which we permanent capital on your have a lot of influence over. replace weak CEOs, ability to do more activism on We’re often on the board of the long side. Are you going to directors and we own them there’s less for us to spend less time on shorts as for years. We add one or two that shift continues? do” new businesses each year. Our goal is to compound at a high BA: After the MBIA (MBI) rate of return over a long short where we made our period of time. This is different thesis public, I was asked by from Berkshire Hathaway. our investors if we were going BA: In 1957, Buffett formed Buffett is not an activist to do this again. I told them it the Buffett Partnership. Eleven anymore. His past investments was going to be a long time years later, after buying with Dempster Mill before I did another one of control of Berkshire Hathaway Manufacturing and Sanborn these big public shorts. It was (BRK), he gave investors a Maps had an activist bent five years between MBIA and choice of cash if they wanted though. Herbalife (HLF). Although, if to exit the partnership, or this in fact goes to zero, stock if they wanted to merge The key for us was how do we perhaps all we need to do the their shares into Berkshire get to permanent capital in a next time is just say, "We're Hathaway. Buffett gave up the way that's investor-friendly so short company XYZ" and it advantage of $100 million and we can do it in scale? We have will go straight to zero and we the right to collect 25% of the what I think is a closed-end won't even have to make a profits. He left that to be CEO fund with the biggest market presentation. We hope it for $100,000 a year with a value – it's $6.6 billion. Why works that way. public textile company which I did we do that instead of think had a market cap of $30- reinsurance? Because I don't Short selling is inherently less $40 million. know anything about rewarding. We like shorting reinsurance, and I didn't want credit as opposed to shorting Why would he do that? I think to mix investment risk with equities. If we could find a big the answer is that if you are a property casualty risk. It's too leveraged company that had a control-oriented investor, you complicated. (Continued on page 11)

Description: