Global Multi-Strategy Fund PDF

Preview Global Multi-Strategy Fund

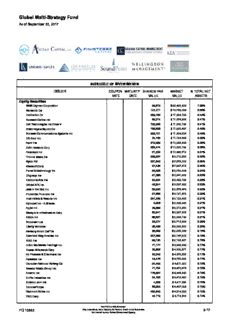

Global Multi-Strategy Fund As of September 30, 2017 SCHEDULE OF INVESTMENTS ISSUER COUPON MATURITY SHARES/ PAR MARKET % TOTAL NET RATE DATE VALUE VALUE ASSETS Equity Securities GMS Cayman Corporation 29,819 $ 28,486,686 1.00% Monsanto Co 156,811 $ 18,789,094 0.66% Halliburton Co 259,703 $ 11,954,129 0.42% Rockwell Collins Inc 89,314 $ 11,674,233 0.41% Dell Technologies Inc Class V 150,268 $ 11,602,192 0.41% Bristol-Myers Squibb Co 180,820 $ 11,525,467 0.40% Brocade Communications Systems Inc 950,151 $ 11,354,304 0.40% CR Bard Inc 34,725 $ 11,129,363 0.39% Alere Inc 215,609 $ 10,993,903 0.38% DISH Network Corp 202,474 $ 10,980,165 0.38% Facebook Inc 61,232 $ 10,462,712 0.37% Tribune Media Co 220,637 $ 9,015,228 0.32% Mylan NV 231,846 $ 7,273,009 0.25% Microsoft Corp 97,428 $ 7,257,412 0.25% Puma Biotechnology Inc 56,626 $ 6,780,964 0.24% Citigroup Inc 91,306 $ 6,641,598 0.23% Electronic Arts Inc 55,024 $ 6,496,133 0.23% Orbital ATK Inc 48,047 $ 6,397,939 0.22% Jack in the Box Inc 62,593 $ 6,379,479 0.22% Prudential Financial Inc 57,860 $ 6,151,675 0.22% Host Hotels & Resorts Inc 331,336 $ 6,126,403 0.21% Alphabet Inc - A Shares 6,258 $ 6,093,540 0.21% Apple Inc 39,000 $ 6,010,680 0.21% Macquarie Infrastructure Corp 82,541 $ 5,957,809 0.21% Altaba Inc 88,831 $ 5,884,165 0.21% Broadcom Ltd 23,577 $ 5,718,366 0.20% Liberty Ventures 98,408 $ 5,663,380 0.20% Advisory Board Co/The 98,500 $ 5,282,063 0.18% Extended Stay America Inc 257,360 $ 5,147,200 0.18% NIKE Inc 99,125 $ 5,139,631 0.18% Hilton Worldwide Holdings Inc 71,177 $ 4,943,243 0.17% Costco Wholesale Corp 29,858 $ 4,905,371 0.17% Air Products & Chemicals Inc 32,240 $ 4,875,333 0.17% Autodesk Inc 42,478 $ 4,768,580 0.17% Canadian National Railway Co 54,456 $ 4,511,850 0.16% Nexstar Media Group Inc 71,754 $ 4,470,274 0.16% Arconic Inc 178,587 $ 4,443,245 0.16% EnPro Industries Inc 54,793 $ 4,412,480 0.15% Amazon.com Inc 4,589 $ 4,411,635 0.15% ConocoPhillips 88,053 $ 4,407,053 0.15% Richmont Mines Inc 462,840 $ 4,314,029 0.15% FMC Corp 46,119 $ 4,118,888 0.14% Not FDIC or NCUA Insured PQ 10863 May Lose Value, Not a Deposit, No Bank or Credit Union Guarantee 9-17 Not Insured by any Federal Government Agency Global Multi-Strategy Fund As of September 30, 2017 SCHEDULE OF INVESTMENTS ISSUER COUPON MATURITY SHARES/ PAR MARKET % TOTAL NET RATE DATE VALUE VALUE ASSETS Gray Television Inc 261,892 $ 4,111,704 0.14% PNC Financial Services Group Inc/The 30,326 $ 4,087,035 0.14% Scripps Networks Interactive Inc 45,935 $ 3,945,357 0.14% QUALCOMM Inc 76,065 $ 3,943,210 0.14% Xylem Inc/NY 61,069 $ 3,824,751 0.13% TJX Cos Inc/The 51,639 $ 3,807,343 0.13% T-Mobile US Inc 60,913 $ 3,755,896 0.13% Verizon Communications Inc 75,825 $ 3,752,579 0.13% Bank of America Corp 147,286 $ 3,732,227 0.13% Bunge Ltd 53,192 $ 3,694,716 0.13% PTC Inc 65,647 $ 3,694,613 0.13% Mandatory Exchangeable Trust 5.75 06/03/2019 18,658 $ 3,659,207 0.13% Pinnacle Foods Inc 62,471 $ 3,571,467 0.12% Pinnacle Entertainment Inc 163,499 $ 3,484,164 0.12% Deere & Co 27,689 $ 3,477,462 0.12% Alstom SA 79,183 $ 3,364,319 0.12% Citrix Systems Inc 43,473 $ 3,339,596 0.12% Bayer AG 24,220 $ 3,308,514 0.12% Paychex Inc 54,767 $ 3,283,829 0.11% McDonald's Corp 20,789 $ 3,257,221 0.11% Kraft Heinz Co/The 41,921 $ 3,250,974 0.11% Workday Inc 30,508 $ 3,215,238 0.11% Marriott International Inc/MD 29,151 $ 3,214,189 0.11% Partners Group Holding AG 4,720 $ 3,204,399 0.11% Public Storage 14,939 $ 3,196,797 0.11% Ultra Petroleum Corp 368,014 $ 3,190,681 0.11% C&J Energy Services Inc 104,798 $ 3,140,796 0.11% New York REIT Inc 398,393 $ 3,127,385 0.11% Halcon Resources Corp 453,491 $ 3,083,739 0.11% Praxair Inc 21,961 $ 3,068,830 0.11% Allergan PLC 5.50 03/01/2018 4,075 $ 3,006,617 0.11% Ulta Beauty Inc 13,292 $ 3,004,790 0.11% Alphabet Inc - C Shares 3,130 $ 3,002,014 0.11% Lear Corp 17,265 $ 2,988,226 0.10% NVR Inc 1,043 $ 2,977,765 0.10% Baker Hughes a GE Co 81,153 $ 2,971,823 0.10% General Electric Co 122,593 $ 2,964,299 0.10% Conagra Brands Inc 87,241 $ 2,943,511 0.10% Markel Corp 2,749 $ 2,935,877 0.10% Knight-Swift Transportation Holdings Inc 70,629 $ 2,934,635 0.10% Everi Holdings Inc 381,216 $ 2,893,429 0.10% Welltower Inc 6.50 45,600 $ 2,892,408 0.10% M&T Bank Corp 17,942 $ 2,889,380 0.10% Not FDIC or NCUA Insured PQ 10863 May Lose Value, Not a Deposit, No Bank or Credit Union Guarantee 9-17 Not Insured by any Federal Government Agency Global Multi-Strategy Fund As of September 30, 2017 SCHEDULE OF INVESTMENTS ISSUER COUPON MATURITY SHARES/ PAR MARKET % TOTAL NET RATE DATE VALUE VALUE ASSETS Activision Blizzard Inc 44,494 $ 2,870,308 0.10% Visa Inc 26,863 $ 2,827,062 0.10% Parsley Energy Inc 107,054 $ 2,819,802 0.10% MetLife Inc 54,272 $ 2,819,430 0.10% Marsh & McLennan Cos Inc 33,403 $ 2,799,505 0.10% Motorola Solutions Inc 32,931 $ 2,794,854 0.10% Mohawk Industries Inc 11,231 $ 2,779,785 0.10% Edwards Lifesciences Corp 25,370 $ 2,773,195 0.10% Element Comm Aviation 280 $ 2,772,843 0.10% Sony Corp 73,600 $ 2,745,918 0.10% ACS Actividades de Construccion y Servicios SA 73,719 $ 2,734,783 0.10% ManpowerGroup Inc 23,208 $ 2,734,367 0.10% Sinclair Broadcast Group Inc 84,985 $ 2,723,769 0.10% XL Group Ltd 67,990 $ 2,682,206 0.09% Equity Residential 40,652 $ 2,680,186 0.09% International Paper Co 46,202 $ 2,625,198 0.09% Newfield Exploration Co 86,750 $ 2,573,873 0.09% Yum! Brands Inc 34,751 $ 2,558,021 0.09% Home Depot Inc/The 15,420 $ 2,522,095 0.09% Eaton Corp PLC 32,692 $ 2,510,419 0.09% Ross Stores Inc 38,876 $ 2,510,223 0.09% Tropicana Entertainment Inc 53,176 $ 2,499,272 0.09% Accenture PLC - Class A 18,352 $ 2,478,805 0.09% Baxter International Inc 39,449 $ 2,475,425 0.09% Huntsman Corp 89,418 $ 2,451,842 0.09% American International Group Inc 39,930 $ 2,451,303 0.09% Chubb Ltd 17,184 $ 2,449,579 0.09% Bank of New York Mellon Corp/The 46,080 $ 2,443,162 0.09% NXP Semiconductors NV 21,602 $ 2,442,970 0.09% Kimberly-Clark Corp 20,117 $ 2,367,369 0.08% Waste Connections Inc 33,798 $ 2,364,508 0.08% Las Vegas Sands Corp 36,694 $ 2,354,287 0.08% United Parcel Service Inc 19,551 $ 2,347,880 0.08% Cimarex Energy Co 20,514 $ 2,331,826 0.08% Applied Materials Inc 44,667 $ 2,326,704 0.08% Comcast Corp - Class A 59,761 $ 2,299,603 0.08% Songa Offshore 322,488 $ 2,299,453 0.08% Vestas Wind Systems A/S 25,464 $ 2,288,852 0.08% CoStar Group Inc 8,520 $ 2,285,490 0.08% Anthem Inc 5.25 05/01/2018 43,075 $ 2,252,392 0.08% Shin-Etsu Chemical Co Ltd 24,890 $ 2,227,654 0.08% Digital Realty Trust Inc 18,804 $ 2,225,077 0.08% McKesson Corp 14,434 $ 2,217,207 0.08% Not FDIC or NCUA Insured PQ 10863 May Lose Value, Not a Deposit, No Bank or Credit Union Guarantee 9-17 Not Insured by any Federal Government Agency Global Multi-Strategy Fund As of September 30, 2017 SCHEDULE OF INVESTMENTS ISSUER COUPON MATURITY SHARES/ PAR MARKET % TOTAL NET RATE DATE VALUE VALUE ASSETS Bemis Co Inc 48,490 $ 2,209,689 0.08% Athene Holding Ltd 40,920 $ 2,203,133 0.08% Coach Inc 54,597 $ 2,199,167 0.08% Allergan PLC 10,713 $ 2,195,629 0.08% UnitedHealth Group Inc 11,188 $ 2,191,170 0.08% Hershey Co/The 20,027 $ 2,186,348 0.08% Time Warner Inc 21,198 $ 2,171,735 0.08% Cummins Inc 12,885 $ 2,165,067 0.08% NRG Energy Inc 84,257 $ 2,156,137 0.08% Veresen Inc 143,421 $ 2,151,746 0.08% ServiceNow Inc 18,169 $ 2,135,403 0.07% Amgen Inc 11,441 $ 2,133,174 0.07% Biogen Inc 6,780 $ 2,122,954 0.07% Priceline Group Inc/The 1,145 $ 2,096,289 0.07% AMP Ltd 551,827 $ 2,095,437 0.07% Procter & Gamble Co/The 22,915 $ 2,084,807 0.07% Repsol SA 112,935 $ 2,084,133 0.07% American Express Co 23,009 $ 2,081,394 0.07% Humana Inc 8,494 $ 2,069,393 0.07% Midstates Petroleum Co Inc 132,976 $ 2,066,447 0.07% Aon PLC 14,102 $ 2,060,302 0.07% Mitsubishi UFJ Financial Group Inc 316,393 $ 2,057,136 0.07% Fortive Corp 28,607 $ 2,025,090 0.07% Engie SA 118,564 $ 2,013,372 0.07% Medtronic PLC 25,734 $ 2,001,333 0.07% Northrop Grumman Corp 6,915 $ 1,989,584 0.07% Adobe Systems Inc 13,311 $ 1,985,735 0.07% Lennox International Inc 10,967 $ 1,962,764 0.07% Shionogi & Co Ltd 35,800 $ 1,957,075 0.07% Volkswagen AG 11,559 $ 1,955,187 0.07% Luxottica Group SpA 34,733 $ 1,943,632 0.07% OMV AG 33,297 $ 1,941,212 0.07% Altria Group Inc 30,572 $ 1,938,876 0.07% Avery Dennison Corp 19,475 $ 1,915,172 0.07% Central Japan Railway Co 10,900 $ 1,912,838 0.07% Coty Inc 115,517 $ 1,909,496 0.07% Berry Global Group Inc 33,670 $ 1,907,406 0.07% CSX Corp 35,078 $ 1,903,332 0.07% Hologic Inc 51,700 $ 1,896,873 0.07% Franklin Resources Inc 42,543 $ 1,893,589 0.07% Wynn Resorts Ltd 12,696 $ 1,890,688 0.07% S&P Global Inc 12,047 $ 1,883,067 0.07% Diageo PLC 57,233 $ 1,882,133 0.07% Not FDIC or NCUA Insured PQ 10863 May Lose Value, Not a Deposit, No Bank or Credit Union Guarantee 9-17 Not Insured by any Federal Government Agency Global Multi-Strategy Fund As of September 30, 2017 SCHEDULE OF INVESTMENTS ISSUER COUPON MATURITY SHARES/ PAR MARKET % TOTAL NET RATE DATE VALUE VALUE ASSETS Loral Space & Communications Inc 37,911 $ 1,876,595 0.07% Fresenius Medical Care AG & Co KGaA 19,160 $ 1,873,193 0.07% Ocwen Financial Corp 540,649 $ 1,859,833 0.07% Rice Energy Inc 64,108 $ 1,855,286 0.06% Bank of the Ozarks 38,449 $ 1,847,474 0.06% SM Energy Co 104,125 $ 1,847,178 0.06% PayPal Holdings Inc 28,804 $ 1,844,320 0.06% Vantiv Inc 26,120 $ 1,840,676 0.06% Snam SpA 381,645 $ 1,839,157 0.06% UCB SA 25,733 $ 1,833,935 0.06% VWR Corp 55,354 $ 1,832,771 0.06% Secom Co Ltd 25,000 $ 1,820,614 0.06% Newmont Mining Corp 48,231 $ 1,809,145 0.06% Genesee & Wyoming Inc 24,371 $ 1,803,698 0.06% Fast Retailing Co Ltd 6,100 $ 1,799,225 0.06% Klepierre SA 45,260 $ 1,777,646 0.06% State Street Corp 18,581 $ 1,775,229 0.06% Tesco PLC 702,944 $ 1,762,808 0.06% UGI Corp 37,570 $ 1,760,530 0.06% IDEX Corp 14,443 $ 1,754,391 0.06% Novartis AG 20,415 $ 1,751,096 0.06% Amphenol Corp 20,657 $ 1,748,408 0.06% Stanley Black & Decker Inc 11,404 $ 1,721,662 0.06% Illinois Tool Works Inc 11,562 $ 1,710,714 0.06% Kamigumi Co Ltd 73,500 $ 1,702,824 0.06% AMETEK Inc 25,705 $ 1,697,558 0.06% SAP SE 15,463 $ 1,695,435 0.06% Colgate-Palmolive Co 23,178 $ 1,688,517 0.06% Fiat Chrysler Automobiles NV 93,255 $ 1,671,250 0.06% Whiting Petroleum Corp 301,798 $ 1,647,817 0.06% Cardinal Health Inc 24,464 $ 1,637,131 0.06% MS&AD Insurance Group Holdings Inc 50,800 $ 1,637,100 0.06% BlackRock Inc 3,622 $ 1,619,360 0.06% Cisco Systems Inc 47,970 $ 1,613,231 0.06% Union Pacific Corp 13,890 $ 1,610,823 0.06% Level 3 Communications Inc 30,187 $ 1,608,665 0.06% FANUC Corp 7,900 $ 1,601,754 0.06% AMERCO 4,252 $ 1,594,075 0.06% Recordati SpA 34,446 $ 1,589,562 0.06% Becton Dickinson and Co 8,111 $ 1,589,350 0.06% Cognizant Technology Solutions Corp 21,898 $ 1,588,481 0.06% Hang Lung Group Ltd 441,000 $ 1,588,085 0.06% Saputo Inc 45,800 $ 1,585,335 0.06% Not FDIC or NCUA Insured PQ 10863 May Lose Value, Not a Deposit, No Bank or Credit Union Guarantee 9-17 Not Insured by any Federal Government Agency Global Multi-Strategy Fund As of September 30, 2017 SCHEDULE OF INVESTMENTS ISSUER COUPON MATURITY SHARES/ PAR MARKET % TOTAL NET RATE DATE VALUE VALUE ASSETS Delphi Automotive PLC 16,103 $ 1,584,535 0.06% Xilinx Inc 22,325 $ 1,581,280 0.06% American Airlines Group Inc 33,100 $ 1,571,919 0.06% Boston Scientific Corp 53,846 $ 1,570,688 0.05% Garmin Ltd 29,083 $ 1,569,610 0.05% Danske Bank A/S 38,957 $ 1,561,147 0.05% 3i Group PLC 127,305 $ 1,558,608 0.05% SunTrust Banks Inc 25,707 $ 1,536,507 0.05% Brighthouse Financial Inc 25,218 $ 1,533,254 0.05% Texas Instruments Inc 17,098 $ 1,532,665 0.05% Micron Technology Inc 38,854 $ 1,528,128 0.05% Genting Singapore PLC 1,764,400 $ 1,525,700 0.05% Japan Airlines Co Ltd 45,000 $ 1,523,309 0.05% Vonovia SE 35,744 $ 1,522,248 0.05% Kite Pharma Inc 8,455 $ 1,520,294 0.05% XPO Logistics Inc 22,272 $ 1,509,596 0.05% Cintas Corp 10,459 $ 1,509,025 0.05% Hitachi Ltd 212,000 $ 1,494,781 0.05% Keyence Corp 2,800 $ 1,489,230 0.05% Tyson Foods Inc 20,938 $ 1,475,082 0.05% Astellas Pharma Inc 114,900 $ 1,462,395 0.05% AGL Energy Ltd 79,556 $ 1,460,858 0.05% Raytheon Co 7,725 $ 1,441,331 0.05% Jardine Matheson Holdings Ltd 22,700 $ 1,439,726 0.05% Martin Marietta Materials Inc 6,979 $ 1,439,279 0.05% AmerisourceBergen Corp 17,120 $ 1,416,680 0.05% Coca-Cola Co/The 31,462 $ 1,416,105 0.05% DNB ASA 69,565 $ 1,404,522 0.05% Nintendo Co Ltd 3,800 $ 1,401,187 0.05% AT&T Inc 35,768 $ 1,401,033 0.05% Telefonaktiebolaget LM Ericsson 241,933 $ 1,394,765 0.05% Miraca Holdings Inc 29,800 $ 1,387,308 0.05% Berkshire Hathaway Inc - Class B 7,565 $ 1,386,816 0.05% Moody's Corp 9,962 $ 1,386,810 0.05% ANSYS Inc 11,273 $ 1,383,535 0.05% Walgreens Boots Alliance Inc 17,806 $ 1,374,979 0.05% Constellation Software Inc/Canada 2,500 $ 1,363,935 0.05% NVIDIA Corp 7,604 $ 1,359,367 0.05% Choice Hotels International Inc 21,257 $ 1,358,322 0.05% Thomson Reuters Corp 29,600 $ 1,358,125 0.05% AGNC Investment Corp 62,637 $ 1,357,970 0.05% Ionis Pharmaceuticals Inc 26,728 $ 1,355,110 0.05% DXC Technology Co 15,633 $ 1,342,562 0.05% Not FDIC or NCUA Insured PQ 10863 May Lose Value, Not a Deposit, No Bank or Credit Union Guarantee 9-17 Not Insured by any Federal Government Agency Global Multi-Strategy Fund As of September 30, 2017 SCHEDULE OF INVESTMENTS ISSUER COUPON MATURITY SHARES/ PAR MARKET % TOTAL NET RATE DATE VALUE VALUE ASSETS Monster Beverage Corp 24,048 $ 1,328,652 0.05% WGL Holdings Inc 15,753 $ 1,326,403 0.05% Calumet Specialty Products Partners LP 157,951 $ 1,318,891 0.05% Asahi Group Holdings Ltd 32,500 $ 1,314,257 0.05% DowDuPont Inc 18,960 $ 1,312,601 0.05% Ste Industrielle d'Aviation Latecoere SA 190,517 $ 1,312,524 0.05% Atos SE 8,433 $ 1,308,018 0.05% Vulcan Materials Co 10,910 $ 1,304,836 0.05% Westar Energy Inc 26,295 $ 1,304,232 0.05% Porsche Automobil Holding SE 1.01 20,350 $ 1,302,023 0.05% Arista Networks Inc 6,860 $ 1,300,725 0.05% Progressive Corp/The 26,849 $ 1,300,029 0.05% Straumann Holding AG 2,019 $ 1,298,448 0.05% Alibaba Group Holding Ltd 7,516 $ 1,298,088 0.05% Platform Specialty Products Corp 116,292 $ 1,296,656 0.05% Sysco Corp 24,033 $ 1,296,580 0.05% PACCAR Inc 17,891 $ 1,294,235 0.05% American Tower Corp 9,415 $ 1,286,842 0.05% CNH Industrial NV 105,884 $ 1,271,166 0.04% Everest Re Group Ltd 5,529 $ 1,262,768 0.04% DENTSPLY SIRONA Inc 20,938 $ 1,252,302 0.04% Muenchener Rueckversicherungs-Gesellschaft AG in 5,833 $ 1,248,407 0.04% Muenchen Sompo Holdings Inc 32,000 $ 1,247,022 0.04% AerGen Aviation Finance Ltd 12,150 $ 1,246,419 0.04% Wolters Kluwer NV 26,931 $ 1,244,611 0.04% Randstad Holding NV 20,125 $ 1,243,792 0.04% Mizuho Financial Group Inc 708,600 $ 1,242,204 0.04% International Flavors & Fragrances Inc 8,670 $ 1,239,030 0.04% Laboratory Corp of America Holdings 8,198 $ 1,237,652 0.04% Akorn Inc 37,264 $ 1,236,792 0.04% Advanced Micro Devices Inc 96,957 $ 1,236,202 0.04% Lockheed Martin Corp 3,947 $ 1,224,715 0.04% Domino's Pizza Inc 6,163 $ 1,223,664 0.04% TechnipFMC PLC 43,656 $ 1,218,876 0.04% Legal & General Group PLC 347,489 $ 1,211,164 0.04% Western Digital Corp 13,947 $ 1,205,021 0.04% PAREXEL International Corp 13,657 $ 1,202,909 0.04% PPL Corp 31,530 $ 1,196,564 0.04% Microchip Technology Inc 13,316 $ 1,195,510 0.04% Subaru Corp 33,100 $ 1,193,823 0.04% London Stock Exchange Group PLC 23,156 $ 1,188,965 0.04% Seattle Genetics Inc 21,812 $ 1,186,791 0.04% Bank of Nova Scotia/The 18,400 $ 1,182,673 0.04% Not FDIC or NCUA Insured PQ 10863 May Lose Value, Not a Deposit, No Bank or Credit Union Guarantee 9-17 Not Insured by any Federal Government Agency Global Multi-Strategy Fund As of September 30, 2017 SCHEDULE OF INVESTMENTS ISSUER COUPON MATURITY SHARES/ PAR MARKET % TOTAL NET RATE DATE VALUE VALUE ASSETS Acacia Communications Inc 24,941 $ 1,174,721 0.04% Calpine Corp 79,229 $ 1,168,628 0.04% Wells Fargo & Co 21,122 $ 1,164,878 0.04% RioCan Real Estate Investment Trust 60,300 $ 1,156,465 0.04% Aflac Inc 14,103 $ 1,147,843 0.04% KLA-Tencor Corp 10,790 $ 1,143,740 0.04% ArcelorMittal 44,310 $ 1,143,027 0.04% Nitto Denko Corp 13,700 $ 1,142,735 0.04% FactSet Research Systems Inc 6,333 $ 1,140,637 0.04% Newcrest Mining Ltd 68,905 $ 1,134,160 0.04% Roche Holding AG 35,385 $ 1,132,320 0.04% Toyo Tire & Rubber Co Ltd 50,315 $ 1,132,179 0.04% Agnico Eagle Mines Ltd 24,900 $ 1,125,314 0.04% Fujitsu Ltd 150,880 $ 1,122,931 0.04% Sumitomo Rubber Industries Ltd 61,100 $ 1,121,438 0.04% Marathon Oil Corp 82,280 $ 1,115,717 0.04% TD Ameritrade Holding Corp 22,700 $ 1,107,760 0.04% Origin Energy Ltd 188,065 $ 1,107,563 0.04% Realogy Holdings Corp 33,530 $ 1,104,814 0.04% Avista Corp 21,234 $ 1,099,284 0.04% Southwest Airlines Co 19,631 $ 1,098,943 0.04% Mixi Inc 22,600 $ 1,091,489 0.04% ABB Ltd 43,842 $ 1,084,125 0.04% Tokyo Electron Ltd 7,000 $ 1,077,644 0.04% Forest City Realty Trust Inc 41,974 $ 1,070,757 0.04% Skyworks Solutions Inc 10,493 $ 1,069,237 0.04% Intercontinental Exchange Inc 15,560 $ 1,068,972 0.04% Zillow Group Inc - C Shares 26,537 $ 1,067,053 0.04% Orion Oyj 22,922 $ 1,064,312 0.04% Danaher Corp 12,406 $ 1,064,187 0.04% Toronto-Dominion Bank/The 18,900 $ 1,064,095 0.04% Credit Acceptance Corp 3,794 $ 1,062,965 0.04% Vertex Pharmaceuticals Inc 6,976 $ 1,060,631 0.04% Adidas AG 4,681 $ 1,060,086 0.04% Sherwin-Williams Co/The 2,953 $ 1,057,292 0.04% Nippon Telegraph & Telephone Corp 23,011 $ 1,054,381 0.04% Fairfax Financial Holdings Ltd 2,023 $ 1,052,771 0.04% eBay Inc 27,342 $ 1,051,573 0.04% First Republic Bank/CA 10,062 $ 1,051,077 0.04% GCP Applied Technologies Inc 34,117 $ 1,047,392 0.04% Tokio Marine Holdings Inc 26,752 $ 1,047,004 0.04% Samsung Electronics Co Ltd 462 $ 1,039,603 0.04% Starbucks Corp 19,344 $ 1,038,966 0.04% Not FDIC or NCUA Insured PQ 10863 May Lose Value, Not a Deposit, No Bank or Credit Union Guarantee 9-17 Not Insured by any Federal Government Agency Global Multi-Strategy Fund As of September 30, 2017 SCHEDULE OF INVESTMENTS ISSUER COUPON MATURITY SHARES/ PAR MARKET % TOTAL NET RATE DATE VALUE VALUE ASSETS Dollar Tree Inc 11,936 $ 1,036,284 0.04% Axis Capital Holdings Ltd 17,968 $ 1,029,746 0.04% Agilent Technologies Inc 16,015 $ 1,028,163 0.04% Chipotle Mexican Grill Inc 3,300 $ 1,015,839 0.04% Tableau Software Inc 13,523 $ 1,012,737 0.04% Aisin Seiki Co Ltd 19,200 $ 1,012,276 0.04% Masco Corp 25,752 $ 1,004,586 0.04% Tate & Lyle PLC 115,187 $ 1,000,190 0.03% Japan Post Bank Co Ltd 80,900 $ 999,797 0.03% Regions Financial Corp 65,584 $ 998,844 0.03% LVMH Moet Hennessy Louis Vuitton SE 3,600 $ 995,168 0.03% SEI Investments Co 16,254 $ 992,469 0.03% Boliden AB 29,199 $ 990,411 0.03% Wayfair Inc 14,675 $ 989,095 0.03% Osaka Gas Co Ltd 53,200 $ 988,799 0.03% Mastercard Inc 6,982 $ 985,858 0.03% Unicharm Corp 42,900 $ 982,641 0.03% RWE AG 43,153 $ 981,723 0.03% Diamondback Energy Inc 10,005 $ 980,090 0.03% Telefonica SA 90,083 $ 978,933 0.03% Symantec Corp 29,662 $ 973,210 0.03% Mitsubishi Corp 41,000 $ 953,899 0.03% T Rowe Price Group Inc 10,467 $ 948,834 0.03% ASML Holding NV 5,538 $ 946,315 0.03% Hirose Electric Co Ltd 6,700 $ 943,415 0.03% Nissan Chemical Industries Ltd 26,700 $ 939,622 0.03% Merck & Co Inc 14,654 $ 938,296 0.03% Analog Devices Inc 10,888 $ 938,219 0.03% Denso Corp 18,500 $ 936,292 0.03% Yandex NV 28,382 $ 935,187 0.03% LyondellBasell Industries NV 9,421 $ 933,150 0.03% Franco-Nevada Corp 12,000 $ 929,609 0.03% Fluor Corp 22,008 $ 926,537 0.03% Camden Property Trust 10,120 $ 925,474 0.03% Toho Gas Co Ltd 31,600 $ 925,459 0.03% Arch Capital Group Ltd 9,294 $ 915,459 0.03% Adecco Group AG 11,746 $ 915,067 0.03% Fastenal Co 20,072 $ 914,882 0.03% DexCom Inc 18,661 $ 912,989 0.03% Tiffany & Co 9,821 $ 901,371 0.03% Shimamura Co Ltd 7,500 $ 899,661 0.03% Netflix Inc 4,940 $ 895,869 0.03% GoDaddy Inc 20,576 $ 895,262 0.03% Not FDIC or NCUA Insured PQ 10863 May Lose Value, Not a Deposit, No Bank or Credit Union Guarantee 9-17 Not Insured by any Federal Government Agency Global Multi-Strategy Fund As of September 30, 2017 SCHEDULE OF INVESTMENTS ISSUER COUPON MATURITY SHARES/ PAR MARKET % TOTAL NET RATE DATE VALUE VALUE ASSETS Toyo Suisan Kaisha Ltd 24,300 $ 892,749 0.03% EXOR NV 14,051 $ 891,740 0.03% Banco Bilbao Vizcaya Argentaria SA 99,360 $ 888,313 0.03% Viacom Inc - B Shares 31,881 $ 887,567 0.03% Express Scripts Holding Co 13,959 $ 883,884 0.03% T-Mobile US Inc 5.50 12/15/2017 8,825 $ 881,706 0.03% Fortinet Inc 24,598 $ 881,592 0.03% LafargeHolcim Ltd 15,006 $ 878,525 0.03% Hitachi High-Technologies Corp 24,152 $ 877,172 0.03% Zodiac Aerospace 30,234 $ 874,101 0.03% USS Co Ltd 43,300 $ 873,923 0.03% General Motors Co 21,619 $ 872,975 0.03% Pandora A/S 8,789 $ 868,988 0.03% Allison Transmission Holdings Inc 23,045 $ 864,879 0.03% Anadarko Petroleum Corp 17,671 $ 863,228 0.03% Hitachi Chemical Co Ltd 31,400 $ 861,636 0.03% CME Group Inc 6,342 $ 860,483 0.03% Hess Corp 18,340 $ 859,963 0.03% Bandai Namco Holdings Inc 25,000 $ 858,871 0.03% Cenovus Energy Inc 85,000 $ 852,214 0.03% CIMIC Group Ltd 24,453 $ 849,784 0.03% TransUnion 17,973 $ 849,404 0.03% Harley-Davidson Inc 17,556 $ 846,375 0.03% Globalstar Inc 519,068 $ 846,081 0.03% Maruichi Steel Tube Ltd 28,900 $ 841,381 0.03% Honda Motor Co Ltd 28,320 $ 836,588 0.03% Oracle Corp 17,277 $ 835,343 0.03% Unilever NV 14,066 $ 831,450 0.03% Koito Manufacturing Co Ltd 13,100 $ 822,617 0.03% Ball Corp 19,843 $ 819,516 0.03% Melco Resorts & Entertainment Ltd 33,661 $ 811,903 0.03% Omron Corp 15,900 $ 810,780 0.03% White Mountains Insurance Group Ltd 946 $ 810,722 0.03% Santos Ltd 255,625 $ 810,616 0.03% Willis Towers Watson PLC 5,254 $ 810,324 0.03% WestRock Co 14,244 $ 808,062 0.03% CF Industries Holdings Inc 22,954 $ 807,063 0.03% Envision Healthcare Corp 17,944 $ 806,583 0.03% Mediobanca SpA 75,022 $ 806,214 0.03% Insulet Corp 14,560 $ 801,965 0.03% Westlake Chemical Corp 9,638 $ 800,821 0.03% EOG Resources Inc 8,269 $ 799,943 0.03% Mettler-Toledo International Inc 1,271 $ 795,849 0.03% Not FDIC or NCUA Insured PQ 10863 May Lose Value, Not a Deposit, No Bank or Credit Union Guarantee 9-17 Not Insured by any Federal Government Agency

Description: