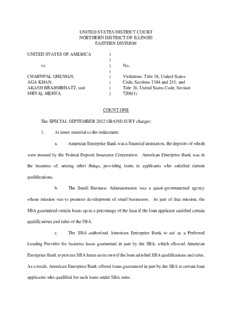

Ghuman et al Indictment PDF

Preview Ghuman et al Indictment

UNITED STATES DISTRICT COURT NORTHERN DISTRICT OF ILLINOIS EASTERN DIVISION UNITED STATES OF AMERICA ) ) vs. ) No. ) CHARNPAL GHUMAN, ) Violations: Title 18, United States AGA KHAN, ) Code, Sections 1344 and 215; and AKASH BRAHMBHATT, and ) Title 26, United States Code, Section SHITAL MEHTA ) 7206(1) COUNT ONE The SPECIAL SEPTEMBER 2012 GRAND JURY charges: 1. At times material to the indictment: a. American Enterprise Bank was a financial institution, the deposits of which were insured by the Federal Deposit Insurance Corporation. American Enterprise Bank was in the business of, among other things, providing loans to applicants who satisfied certain qualifications. b. The Small Business Administration was a quasi-governmental agency whose mission was to promote development of small businesses. As part of that mission, the SBA guaranteed certain loans up to a percentage of the loan if the loan applicant satisfied certain qualifications and rules of the SBA. c. The SBA authorized American Enterprise Bank to act as a Preferred Lending Provider for business loans guaranteed in part by the SBA, which allowed American Enterprise Bank to process SBA loans on its own if the loan satisfied SBA qualifications and rules. As a result, American Enterprise Bank offered loans guaranteed in part by the SBA to certain loan applicants who qualified for such loans under SBA rules. d. American Enterprise Bank and the SBA required applications for loans to provide truthful information, including the borrower’s name and other identifiers, employment background, income, assets and liabilities, which information was material to the approval, terms, and funding of loans. Specifically, the SBA loan application required a certification that all information in the application and exhibits was true and complete to the best of the borrower’s knowledge, and each loan form contained a warning against false statements. The Statement of Personal History form provided by the SBA for loan applications contained a warning against making false statements on the form, and cautioned that false statements violated federal law. The Personal Financial Statement form provided by the SBA for loan applications stated that the signature of the borrower certified that the statements contained in the document were true and accurate and that false statements may result in possible prosecution. e. The SBA also required that borrowers of SBA loans invest a reasonable amount of equity in the business, to be determined through the loan process, rather using an SBA loan to provide 100% financing of the business. f. CHARNPAL GHUMAN and AGA KHAN are individuals who, through various entities set forth below, all co-owned and controlled by GHUMAN and KHAN, sold and caused to be sold gas stations to purchasers financed by loans processed by American Enterprise Bank and guaranteed in part by the SBA. g. AKASH BRAHMBHATT was a loan officer at American Enterprise Bank who handled the applications and processing of SBA loans for purchasers of gas stations owned by entities controlled by GHUMAN and KHAN. h. SHITAL MEHTA was an accountant who was engaged in providing advice -2- and documents for a variety of accounting, tax and corporate functions, including the preparation and filling of incorporation documents, the preparation and filing of sales tax returns, and the preparation and filing of corporate and individual tax returns. 2. Beginning no later than in or about 2006 and continuing to at least in or about 2009, in the Northern District of Illinois, and elsewhere, CHARNPAL GHUMAN, AGA KHAN, AKASH BRAHMBHATT and SHITAL MEHTA, defendants herein, knowingly devised and participated in a scheme to defraud and to obtain money and funds owned by and under the custody and control of American Enterprise Bank, by means of materially false and fraudulent pretenses, representations and promises, which scheme is further described in the following paragraphs. 3. It was part of the scheme that GHUMAN and KHAN recruited purchasers for the gas stations that they jointly owned, and arranged for the purchasers to finance the deals, in total exceeding $l0,000,000 in SBA-guaranteed loans, from American Enterprise Bank through BRAHMBHATT, based on false representations, including false tax returns prepared by MEHTA. 4. It was further part of the scheme that, where a purchaser of a gas station did not have an acceptable credit record to qualify for all or part of the SBA loan, GHUMAN, KHAN and BRAHMBHATT arranged for the loans to be made in whole or in part in the name of the purchaser’s family member or friend who had acceptable credit records, even though GHUMAN, KHAN and BRAHMBHATT knew that the family member or friend was not the purchaser of the gas station, and did not intend to have any role in the gas station business or in repayment of the loan proceeds. As a result, American Enterprise Bank did not know the true extent of the actual -3- purchaser’s loan obligations, which was material to the approval, terms, and funding of loans. 5. It was further part of the scheme that GHUMAN, KHAN and BRAHMBHATT caused materially false and fictitious information and documents to be submitted to American Enterprise Bank on behalf of the purchasers of GHUMAN’s and KHAN’s gas stations, which information and documents were material to the approval, terms, and funding of loans, so that the loans would be approved and the loan proceeds would be paid to GHUMAN and KHAN. This false information and documentation included, among other things: a. false information about employment, income, assets and liabilities; b. false income tax returns; and c. false information about the purchasers’ contribution of equity, by making it appear that the purchasers had contributed equity to the purchase as required by the SBA, when in fact the purchasers had not contributed equity. 6. It was further part of the scheme that MEHTA prepared false tax returns for purchasers, showing income in an amount calculated to qualify for the loans, which MEHTA knew to be false, and which MEHTA submitted and caused to be submitted to BRAHMBHATT at American Enterprise Bank, for the purpose of becoming a material part of the loan application package. 7. It was further part of the scheme that GHUMAN, KHAN and BRAHMBHATT arranged for American Enterprise Bank to pay broker’s fees to KHAN’s brother, for work purportedly performed in connection with certain loans made by American Enterprise Bank to purchasers of gas stations owned by GHUMAN and KHAN, even though GHUMAN, KHAN and BRAHMBHATT knew that KHAN’s brother did not perform any work in connection with those -4- loans. 8. It was further part of the scheme that GHUMAN and KHAN gave, offered and promised things of value to BRAHMBHATT, including cars, with the intent to influence and reward BRAHMBHATT, as an employee and agent of American Enterprise Bank, for his assistance in processing the fraudulent loans. 9. It was further part of the scheme that GHUMAN, KHAN, BRAHMBHATT and MEHTA caused American Enterprise Bank to issue loans based on fraudulent applications in excess of $10,000,000. 10. It was further part of the scheme that the loan proceeds were paid to GHUMAN and KHAN as payment for gas stations owned by entities controlled by GHUMAN and KHAN, with loan proceeds frequently deposited into bank accounts jointly controlled by GHUMAN and KHAN. Ish Petroleum Loans 11. It was further part of the scheme that on or about April 19, 2007, GHUMAN and KHAN, acting as the principals of Infinite Gas Fifteen and Infinite Gas Sixteen, sold and caused to be sold to Individual A two gas stations located in Macomb, Illinois, and arranged for BRAHMBHATT to process SBA loans through American Enterprise Bank to fund Individual A’s purchase of the gas stations, even though GHUMAN, KHAN and BRAHMBHATT knew that Individual A did not qualify for SBA loans. GHUMAN, KHAN and BRAHMBHATT arranged for American Enterprise Bank to fund the purchase for the two gas stations through two loans, both made to an entity called Ish Petroleum, with both loans guaranteed by Individual A. 12. It was further part of the scheme that GHUMAN and BRAHMBHATT submitted -5- and caused to be submitted to the American Enterprise SBA loan file for Ish Petroleum a copy of two checks, in the amounts of $175,000 and $170,000, to falsely represent equity contributed by Individual A for the purchase of these two gas stations, knowing those checks were drawn by the sellers, the original checks were never provided to American Enterprise Bank or any other entity in connection with the purchase of the gas stations, and Individual A never tendered these checks or made any equity contribution to the purchase of the gas stations. 13. It was further part of the scheme that GHUMAN and BRAHMBHATT arranged for letters to be provided to American Enterprise Bank to document that Individual A had been provided funds as a gift for the purpose of paying the required equity contribution for the Ish Petroleum loans, when such documentation was false. 14. It was further part of the scheme that GHUMAN and BRAHMBHATT arranged for, created and submitted false application documents for the loans, knowing that such documents were false and intending for American Enterprise Bank to rely on such documents in approving and funding the loans. Such documents included false Personal Financial Statements for Individual A, which overstated the amount of cash available to Individual A, and false Statements of Personal History and false Management Resumes for Individual A, which overstated and misrepresented Individual A’s experience. 15. It was further part of the scheme that the loan proceeds, which exceeded $1,000,000, were used to pay for gas stations owned by entities controlled by GHUMAN and KHAN, and that the proceeds from the loans were deposited into bank accounts jointly controlled by GHUMAN and KHAN. -6- Z&S Loans 16. It was further part of the scheme that on or about September 20, 2007, GHUMAN and KHAN, acting as the principals of Infinite Oil, sold and caused to be sold to Individual B three gas stations, two located in Rock Island, Illinois and one located in Silvis, Illinois. GHUMAN arranged for BRAHMBHATT to process SBA loans through American Enterprise Bank to fund Individual B’s purchase of the gas stations, even though GHUMAN and BRAHMBHATT knew that Individual B did not qualify for SBA loans. 17. It was further part of the scheme that GHUMAN and BRAHMBHATT arranged for the purchase funds for the three gas stations to be provided by American Enterprise Bank in three loans, all made to an entity named Z&S Corp., with each of the loans guaranteed by Individuals B and C, even though GHUMAN and BRAHMBHATT knew that Individuals B and C did not qualify for the SBA loans, and that Individual C did not intend to have any role in the gas station or in repaying the loans. 18. It was further part of the scheme that GHUMAN and BRAHMBHATT arranged for, created and submitted false documents for the loans, knowing that such documents were false and intending for American Enterprise Bank to rely on such documents in approving and funding the loans. Such documents included false Personal Financial Statements, false Statements of Personal History and false Management Resumes, and false bank statements for Individual B and Individual C. These documents contained materially false statements made to American Enterprise Bank for the purpose of fraudulently obtaining three SBA loans for Individual B to purchase the three gas stations. 19. It was further part of the scheme that MEHTA, at the request of GHUMAN and -7- BRAHMBHATT, prepared tax returns containing false statements of income for Individual B and Individual C, and MEHTA submitted and caused to be submitted these false tax returns to American Enterprise Bank for the purpose of having the loans approved by American Enterprise Bank, knowing that the returns contained false statements and that such false statements were material to the approval, terms, and funding of loans by American Enterprise Bank. 20. It was further part of the scheme that GHUMAN and BRAHMBHATT submitted and caused to be submitted to the American Enterprise Bank SBA loan file for Z & S Corp. a copy of two checks, in the amounts of $150,000 and $250,000, to falsely represent equity contributed by Individual B and Individual C for the purchase of the three gas stations, knowing those checks were drawn by the sellers, the original checks were never provided to American Enterprise Bank or any other entity in connection with the purchase of the gas stations, and neither Individual B nor Individual C provided these checks or any equity for the purchase of the gas stations. 21. It was further part of the scheme that the loan proceeds, which exceeded approximately $1.8 million, were used to pay for gas stations owned by entities controlled by GHUMAN and KHAN, and that the proceeds from the loans were deposited into bank accounts jointly controlled by GHUMAN and KHAN. Elite Petroleum Loans 22. It was further part of the scheme that between in or about October 2007 and December 2007, defendants GHUMAN and KHAN, acting as the principals of Iowa Gas, sold and caused to be sold to Individual A eight gas stations located in Iowa, and that GHUMAN arranged for BRAHMBHATT to process SBA loans through American Enterprise Bank to fund Individual A’s purchase of the gas stations, even though GHUMAN and BRAHMBHATT knew that -8- Individual A did not qualify for SBA loans. GHUMAN and BRAHMBHATT arranged for the purchase funds for the eight gas stations to be provided by American Enterprise Bank in eight loans, made to entities named, sequentially, Elite Fuel One through Elite Fuel Eight. In order to hide that all eight loans were being made for the purchase of gas stations by Individual A, BRAHMBHATT and GHUMAN arranged for Individual A to act as the applicant for the loan to Elite Fuel One, and for Individual A’s relatives and friends to act as applicants for seven other loans, even though GHUMAN and BRAHMBHATT knew that the purpose of all eight loans was for Individual A to purchase the eight gas stations, the applicants for loans to Elite Fuel Two through Elite Fuel Eight were not actually purchasing the gas stations, and the applicants for loans to Elite Fuel Two through Elite Fuel Eight, like Individual A, were not qualified to obtain the loans, and would have no role in repaying the loans. 23. It was further part of the scheme that GHUMAN and BRAHMBHATT arranged for, created and submitted false application documents for the loans, knowing that such documents were false and intending for American Enterprise Bank to rely on such documents in approving and funding the loans. Such documents included false Personal Financial Statements, false Statements of Personal History and false Management Resumes for the Elite Fuel loan applicants. These documents contained materially false statements made to American Enterprise Bank for the purpose of fraudulently obtaining eight SBA loans for Individual A to purchase eight gas stations in Iowa from entities controlled by GHUMAN and KHAN. 24. It was further part of the scheme that MEHTA, at the request of GHUMAN and BRAHMBHATT, prepared tax returns containing false statements of income for Individual A and certain of Individual A’s relatives and friends who were acting as applicants for loans, and -9- MEHTA submitted and caused to be submitted these false tax returns to American Enterprise Bank for the purpose of having the loans approved by American Enterprise Bank, knowing that the returns contained false statements and that such false statements were material to the approval, terms, and funding of loans by American Enterprise Bank. 25. It was further part of the scheme that GHUMAN and BRAHMBHATT submitted and caused to be submitted false documentation of borrowers’ equity contributions for certain Elite Fuel loan applications, each of which was material to the approval and funding of the respective loan, as follows: a. GHUMAN and BRAHMBHATT submitted and caused to be submitted to the American Enterprise Bank SBA loan file for Elite Fuel One a copy of a check for $115,000, to falsely represent equity contributed by the borrower, knowing that check was drawn by the seller, the original check was never tendered to American Enterprise Bank or any other entity in connection with the purchase of the gas station, and the borrower never contributed any equity toward the purchase; b. GHUMAN and BRAHMBHATT submitted and caused to be submitted to the American Enterprise Bank SBA loan file for Elite Fuel Three a copy of a fake and altered check in the amount of $100,000, to falsely represent equity contributed by the borrower, knowing that check was drawn by the seller, the original check was never tendered to American Enterprise Bank or any other entity in connection with the purchase of the gas station, and the borrower never contributed any equity toward the purchase; c. GHUMAN and BRAHMBHATT submitted and caused to be submitted to the American Enterprise Bank SBA loan file for Elite Fuel Four a copy of a fake and altered check -10-

Description: