Form- 990 PDF

Preview Form- 990

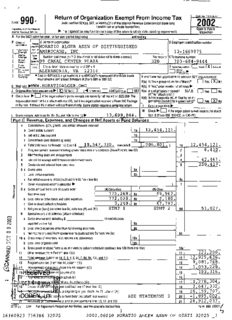

Return of Organization Exempt From Income Tax Form- 990 Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung benefit trust or private foundation) Deportment of the Treasury imemei Rwenue Serve " The organization may have to use a copy of this return to satisfy state reporting requirements A For the 2002 calen tax year period beginning and ending B capnplRikca nbl e Please C Name of organization D Employer Identification number se IFS ORATIO ALGER ASSN OF DISTINGUISHED O/pp Qs label, oo,r ERICANS INC 13-1669975 =Name . S~ Number and street (or P 0 box if mail is not delivered to street address) Room/suite ETelephone number D Irne tuarln SP VC,,fic99 CANAL CENTER PLAZA 320 703-684-9444 F,nei Insvuc ,at., ,.an. City or town state or country and ZIP a 4 F kcaironprrenod LJ Cash U ncoual =Ar lmlounm o eho ALEXANDRIA, VA 22314 L-j Acpepnicciantgi on 9 Section 501(c)(3) organizations and 4947(a)(1 ) nonexemill charitable trusts H and I are not applicable to section 527 organizations must attach a completed Schedule A (Form 990 or 990 EZ) N(a) Is this a group return for affiliates ~ Yes 0 No U Weusne 11111 "V " I +va~r~iiv~LVnI, . N(h) If 'Yes,' enter number of affiliates J Organizaliontype a+acrbivorcl " M 501(c) ( 3 )" (-n..nno) 0 4947(a)(1) or = 52 H(c) Are all affiliates include09 NBA ~ Yes ~ No (If'NO' attach a list ) K Check here " 1-1 if the organization's gross receipts are normally not more than E25,000 The HBO) Is this .a separate return filed by an or- organization need net file a return with the IRS, but d the organization received a Form 990 Package in the mail it should file a return without financial data Same states require a complete return M Check J it the organization is not required to attach Stn B (F 990 990-EZ.or990-PF) t Contributions gifts, grants and Similar amounts received a Direct public support 1a D Indirect public support tb c Government contributions (grants) 1c d Total (add iines is through to) (cash E 10,547,320 . noncash $ 1 , 12,454,121 . 2 Program service revenue including government tees and contracts (from Part VII, line 93) 6,410 . 3 Membership dues and assessments a Interest on savings and temporary cash investments 42,461 . 5 Dividends and interest from securities 250,417 . 6 a Gross reins 6a b Less rental expenses 6b c Net rental income or (loss) (subtract line 6b from line 6a) 7 Other investment income (describe L 7 c 8 a Gross amount loom sale of assets other ?A) Securities L u than inventory 775 268. Ba 5 h Less cost or other basis and sales expenses 772 , 02 8. Bb c Gain or (loss) (attach schedule) ~ 3,240. ec a Net gain of (loss) (combine line 8c, columns (A) and (B)) STMT 1 51,027. 9 Special events and activities (attach schedule) 0 a Gross revenue (not including $ of contributions 0 N reported on line 7a) 9a 6 Less direct expenses olherthan fundraising expenses 9b O c Net income or (loss) from special events (subtract line 9b from line 9a) H- 10 a Gross sales of inventory less returns and allowances 10a U h Less cost of goods sold 10G O c Gross profit or (loss) from sales of inventory (attach schedule) (subtract line 10b from line 10a) W 11 Other revenue (tmm Part fill (me 103) 13 Program services (from line 44, column (B)) 0 44 Management allot °ar`°a: from line 44 column (C)) 15 $ejdine 44 Column (D)) "TMn1%-tTTfttI13Mj( Ch Schedule) Excess or (i to "ear (subtract line 17 from line 12) s at beginning of year (from line 73 column (A)) 7 ~~pe~Fet ass is or tuna balances (attach explanation) SEE STATEMENT 3 e asse s o es at end of year (combine tines t8, 19 one 20) LHA For Paperwork Reduction Act Notice, see the separate Instructions Form 990 (2002) 1 16160923 756386 32025 2002 .06010 HORATIO ALGER ASSN OF DISTI 320251 HORATIO ALGER ASSN OF DISTINGUISHED 13-1669975 All must complete column (D) are required for section 501(c)(3) Page 2 ions and section 4947( lmsls but optional for others uo no6r6 in8c6i,u 9o6e, a m1o0ub.n tors 1r6e opfo nPaerot o1n yin? lad Totai (G) M,nadn aggpenm e,nit (0) Fundraising 22 Grants and allocations (attach schedule) cush s4580857 . ,:aa s 0,85 4,580,857 . 23 Specific assistance to individuals (attach schedule) 24 Benefits paid to or for members (attach schedule) 25 Compensation of officers directors, etc 26 Other salaries and wages 27 Pension plan contributions 28 Other employee benefits 29 Payroll (axes 30 Professional fundraising fees 31 Accounting fees 32 Legal fees 33 Supplies 34 Telephone 35 Postage and shipping 36 Occupancy 37 Equipment rental and maintenance 38 Printing and publications 39 Travel 40 Conferences conventions, and meetings 41 interest 42 Depreciation depletion, etc (attach schedule) 43 Other expenses not covered above (itemize) a b t 0 e SEE STATEMENT 4 Joint Costs Check " U d you are following SOP 98.2 Are any joint costs from a combined educational campaign and fundraising solicitation reported in (B) Program services ~ 0 Yes 0 No If Yes' enter (I) the aggregate amount of these Joint costs $ , (II) the amount allocated to Program services $ Part III AZaSemeni of rrogram 5ervlce Accompllsnmenis what is theorpanaaUOn'sprimary exempt ourpose, IN- SEE STATEMENT 5 Program Service Au oqan¢abom must aescnbe inasempt purpose sniwemente in a clear and wncss manner Slip Via numbx old,mm serves, puDnwhona issusC ew Dismiss (iiedulnp br501(cXJ)~na echibvements that are not measurable ($OCtion 501/L$3) and (d) oqenliai~ena and a9a7(y(1) nonexempt Cnentable ImsU must also enter the amount of pmnb end (Q) ergs ynd d947(e)(1) aIICfA4onst0oNq5I seats bYtOpLOn"Ibrounces ) a HORATIO ALGER AWARDS INDUCTION CEREMONY : THIS HONOR IS PRESENTED TO TEN AMERICANS EACH YEAR IN RECOGNITION OF THEIR OUTSTANDING CONTRIBUTIONS IN THEIR CHOSEN FIELDS . Grants andallocations S 1 533, 175 . b TELEVISION PRODUCTION: COVER PRODUCTION COSTS . IGrantsanaallocations 5 )~ 588,712 . c HORATIO ALGER SCHOLARS PROGRAM : SENIORS WHO HAVE OVERCOME ADVERSITY SO THEY MAY HIGHER EDUCATION. /frankandallncafmnsS 11083,583.1 1, 751.038 . d f Total of Program Service Expenses (Should equal line 44, column (B) Program services) " 9 , 0 81 , 76 B . a3 zz'oa Farm 990 f2002) 2 16160923 756386 32025 2002 .06010 HORATIO ALGER ASSN OF DISTI 320251 HORATZO ALGER ASSN OF DISTINGUISHED Form 99o(2002) AMERICANS, INC 13-1669975 Page 3 Part IV Balance Sheets Note Where required, attached schedules end amounts within the description column (A) (B) should be lorend-ol-yearamounts only Beginning of year End of year 45 Cash-non-interest-nearing 300 . 45 300 . 46 Savings and temporary cash investments 5 , 256 , 960 . 46 9 , 321, 939 . 47 a Accounts receivable 47a h Less allowance for doubtful accounts 47b 47c 48a Pledges receivable aBa 9 , 795 , 599 . h Less allowance for doubtful accounts 48b 553 , 195 . 9 122,847 . 4Bc 9 , 242 , 404 . 49 Giants receivable 49 50 Recervables tram natters, directors trustees and key employees 50 N ar 51 a Other notes and loans receivable 51a N a'" 6 Less allowance for doubtful accounts 5th 51s 52 Inventories for sale or use 52 53 Prepaid expenses anadeferred charges 362 156 . 53 380 437 . 54 investments-securities STMT 8 " = Cost OX FMV 15 596 198 . 5a 15 182 115 . 55a investments - land, buildings, and equipment basis 55a b Less accumulated depreciation SSh SSc 56 Investments - other 56 57a Wnd,bwldings,aneequipment basis 57a 541 951 . b Less accumulated depreciation 57h 271 874 . 332,299 . 57c 270 077 . 58 Other assets (describe b- - SEE STATEMENT 9 ~ 466 551 . 58 421 840 . 59 Total asters add tines 45 tnrou h 58 must equal dine 74 31 137 311 . 59 34 819 112 . 60 Accounts payable anaaccrued expenses 610 309 . 60 577 702 . 61 Giants payable 61 6z Deferred revenue 20,000 . 62 21 150 . N d 63 Loans from nutters, directors trustees and key employees 63 y 64 a Tax-exempt bond liabilities 64a b Mortgages and other notes payable bah 65 Other liabilities (describe NO- SEE STATEMENT 10 - ) 4 347 295 . 65 7 , 308, 223 . 66 Total liabilities aOdlines 60through 65 4 977 604 . 66 7,907 ,075 . Organlzatlons that follow SFAS 117, check here IN- EKI and complete lines 67 through 69 and lines 73 and 74 67 unrestricted 14 138t 188 . 67 13 934 326 . m 68 Temporarily restricted 11 307 229 . se 12,145 564 . m" 69 Permanently restricted 714 290 . 69 832 : 147 . Organizations that do not follow SFAS 117, check here ~ D and complete lines 70 through 74 °, 70 Capital stock trust Principal, or current funds 70 y 71 Paid-in or capital sur0lus, or land building and equipment fund 71 a 72 Retained earnings, endowment, accumulated income, or other funds 72 z°' 73 Total net assets or fund balances (add lines 67 through 69 or lines 70 through 72, column (a)must equal fine l9,column (B)must equal line 2t) 26 159 707 . 73 26 , 912 , 037 . ~ 74 iota uahlutt¢s and net assets l fund balances (add ones 66 and 73) ~ 31 , 13 7 , 31 1 . ~ 74 ~ 34,819,112 . Form 990 is available for public inspection and tar some people serves as the primary or sole source of information about a particular organization How the public perceives an organization in such cases may be determined by the information presented on its return Therefore. please make sure the return is complete and accurate and fully descries, in Part III, the organization s programs and accomplishments zzsoz, o, za oa 3 16160923 756386 32025 2002 .06010 HORATIO ALGER ASSN OF DISTI 320251 r HORATIO ALGER ASSN OF DISTINGUISHED AMERICANS INC 13-16 99 /-,) Page 4 ation of Revenue per Audited Pert N-B Reconciliation of Expenses F r Audited Statements with Revenue per Financial Statements with E) senses per a iota( revenue, gams ana other suppor a Iota] expenses and losses per Per audited financial statements a 12 ,925 , 636 .1 audited financial statements 2,173,306 . b Amounts included on line a but not on h Amounts included on line a but not on line 17, Form 990 line 12, Form 990 (1 ) Donated services (1) Net unrealized gains and use of facilities S on investments $ (2) Prior year adjustments (2) Donated services reporleA on line 20, and use of facilities $ Farm 990 S (3) Recovenes of prior (3) Losses reported on year grants $ line 20,Form 990 S 1,895,002 . (4) Other (specify) (4) Other (specify) f Add amounts on lines (1) through (4) b 0 . Add amounts on lines (1 ~ through (A) 1.895 .002 . s Line a minus line b c12 , 925 ,636 . c Line aminus line h G Amounts included an line 12, Form d Amounts included on line 17 Form 990 bud not on line a 990 but not on line a (1) Investment expenses (7) Investment expenses not included on not included on line 6b Form 990 $ line 6b, Form 990 S (2) Other (specify) (2) Other (specify) S S Add amounts on lines (1) and (2) d 0 . Add amounts on lines (1) and (2) 10. 0. e Total revenue per line 12 Form 990 e Total expenses per line 17 Form 990 (line c plus line 4) " e12,925,636 . (linetplus line dl Part V List of Officers. Din ployees (List each one even it no Title and average hours (C) Comp JA) Name and address per week Devoted to (If hat asrtion U? TERRENCE J. GIROUX ECUTIVE DI ^CTOR 99 CANAL CENTER PLAZA, SUITE 320 ALEXANDRIA, VA 22314 - - - - - - - - - - - - - 229, 707 .1121, 151 .1 0 FOR ALL OTHERS SEE ATTACHMENT 99 CANAL CENTER PLAZA, SUITE 320 ALEXANDRIA, VA 22314 0 .1 0 .1 0 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 75 Did! any atticer, director, trustee, or key employee receive aggregate compensation of more than $100,000 from your organization and all related organizations of which more than 310000 was provided by the related organizations? Ii 'Yes: attach schedule So. 0 Yes EKNo Farm 990 (20021 223031 01 22 03 4 16160923 756386 32025 2002 .06010 HORATIO ALGER ASSN OF DISTI 320251 r HORATIO ALGER ASSN OF DISTINGUISHED Form 990 AMERICANS . INC -1669975 Page 5 76 Did the organization engage in any activity not previously reported to the IRS If 'Yes,' attach a detailed description of each activity 76 X 77 Were any changes made in the organizing or governing documents but not reported to the IRS 77 X It 'Yes' attach a conformed copy of the changes 78 a Did the organization have unrelated business gross income of $1000 or more during the year covered by this relurn9 7Ba X D it 'Yes' has it tiled a tax return on Form 990-T for this years N/A 7Bb 79 Was there a liquidation, dissolution, termination, or substantial contraction during the years 79 X If 'Yes,* attach a statement 80 a Is the organization related (other than by association with a statewide or nationwide organization) through common membership, governing bodies trustees, officers, etc to any other exempt or nonexempt organization? Boa X b If 'Yes' enter (he name of the organization 01 and check whether it is 0 exempt or ~ nonexempt 81 a Enter direct or indirect political expenditures See line 81 instructions 181a ~ 0 h Die the organization file Farm 1120 POL for this year X 82 a Did the organization receive donated services or the use of materials equipment or facilities at no carpe or at substantially less than fair rental yalue9 h It *Yes you may indicate the value of these items hale Do not include this amount as revenue in Park I Or as an expense in Part II (See instructions in Part III ) I 82h 83 a Did the organization comply with the public inspection requirements for returns and exemption applications7 b Did the organization comply with the disclosure requirements relating to quid pro quo contributions9 84 a Did the organization solicit any contributions or gifts that were not lax deductibla9 h It 'Yes,' did the organization include with every solicitation an express statement that such contributions or gifts were not tax deductible? N/A 85 501(c)(a), (S), or (6) organizations a Were substantially all dues nondeductible by members? NIA h Did the organization make only in-house lobbying expenditures of $2,000 or less NBA If'Ves' was answered to either BSa or 85b do net complete B5c through BSh below unless the organization received a waiver for proxy tax owed for the prior year c Dues, assessments, and similar amounts from members 85c NBA d Section t62(e) lobbying and political expenditures 850 NBA e Aggregate nondeductible amount of section 6033(e)(1 )(A) dues notices 85e NBA I Taxable amount of lobbying and political expenditures (line BSd less BSe) L 851 ~ N/A q Does the organization elect to pay the section 6033(e) lax on the amount on line 85119 NBA h If section 6033(e)(1 )(A) dues notes were sent, does the organization agree to add the amount on line 85f to its reasonable estimate of dues allocable to nondeductible lobbying and political expenditures for the following tax years N/A 86 507(c)(7) organizations Enter a Initiation lees and capital contributions included on line 12 86a NBA b Gross receipts, included on line 12, for public use of club facilities B6h N/A 87 507(c)(12) organizations Enter a Gross income from members or shareholders 87a N/A h Gross income from other sources (DO not net amounts due or paid to other Sources against amounts due or received from them ) 87b NBA BB A1 any time during the year did the organization own a 50°k or greater interest in a taxable corporation or partnership or an entity disregarded as separate from the organization under Regulations sections 301 7701-2 and 307 7701-37 If 'Yes' complete Part IX X 89 a 507(c)(3) organizations Enter Amount of tax imposed on the organization during the year under section 49111111- 0 , section 4912 . 0 . section 4955 . 0 . b 501(c)(3) end 501(c)(4) organizations Did the organisation engage in any section 4958 excess benefit transaction during the year or did it become aware of an excess benefit transaction from a prior year It 'Yes' attach a statement explaining each transaction c Enter Amount of tax imposed on the organization managers or disqualified persons during the year under sections 4912, 4955 and 4958 . 0 . D Enter Amount of tax on line 89c above, reimbursed by the organization - 0 . 90 a list the states with which a copy of this return is idea " NEW YORK 6 Number of employees employed in the pay period that includes March 12, 2002 90U~ 10 9i rhebooksareincare ot 10-HALT, THRASHER & BUZAS, LTD. reiephoneno 1 703-836-1350 Locate0at 1 99 CANAL CENTER PLAZA, #230, ALEXANDRIA, VA ziP*4 " 22314 92 Section 49470(1) nonexempt Charitable trusts tiling Form 990 in lieu of Farm 1041- Check here N/A Farm 990(2002) 5 16160923 756386 32025 2002 .06010 HORATIO ALGER ASSN OF DISTI 32025-1 r HORATIO ALGER ASSN OF DISTINGUISHED Form 990(2002) AMERICANS, INC 13-1669975 Pace 6 Part VII Analysis off Income- Product ng Activitles (See page 31 of the instructions ) Note Enter gross amounts unless otherwise Unrelated business income Excwaea n s«uon siz sia or sia indicated Business Amount E~x_ls ~ Amount Related or exempt 93 Program service revenue code function income a VIDEO & BOOK SALES 6, 410. b c u e I Medicare/Medicaid payments q Fees and contracts from government agencies 94 Membership dues and assessments 95 interest on sarongs and temporary cash investments 14 42 , 461 . 96 Dividends and interest from secunhes 14 250 , 417 . 97 Net rental income or (loss) from real estate a debt-financed property h not debt-financed property 98 Net rental income or (loss) from personal property 99 Other investment income 700 Gain or (loss) from sales of assets other than inventory 18 51 , 027 . 101 Net income or (loss) from special events 102 Gross profit or (loss) from sales of inventory 103 Other revenue a OTHER REVENUE 011 121 200 . e c a e toe Subtotal (add columns (e), (D), and (e)) ~ 0 . 465,105 . 6,410o 105 rout (add line too, columns (e), (o) and (E)) " 471,515 . Note Line 105 plus line id, Part l, should equal the amount on line 12, Part 1 Part VIII Relationship of Activities to the Accomplishment of Exempt Purposes (See page 32 m the instructions ) Line Na Ex0lain haw each activity tar which income is reported in column (E) of Part VII contributed importantly to the accomplishment of the organization's exempt purposes (other than by providing funds tar such purposes) ON art IX Information Regarding Taxable Subsidiaries and Disregarded Entities (See gape 3 (A) (B) (C) (D) Name address and EIN o1 corporation Percentage of Nature of activities Total income (a) Did the organ n u p the year, receive any funds directly or indirec (b) e Did the D~ anuzalhon duri the year, pay premiums directly of indirectly, N of zes, to I t 8870~and FarrvVM ls~ instructions) Please Sign Here Preparers' V Paid signaturree Preparers F ,~o, H l T, THRASHER & BUZAS Use Only em'p~oYero) self '99 CANAL CENTER PLAZA, 3ZZ~ Press end ALEXANDRIA, VA 22314 16160923 756386 32025 2002 .0601 SCHEDULE A Organization Exempt Under Section 501(c)(3) OM9NO 15dSpp47 (Form 990 or 99d-En (Except Private Foundation) and Section 501(e), 501(1), 501(k), 501(n), or Section 4947(a)(1) Nonexempt Charitable Trust ' 0 0 ow.n~t of u,.r~un Supplementary Information-(See separate instructions.) L intemai aevenua semim 1 MUST be completed 6y the above arqanlzallons and attached to their Form 990 or 990-EZ Name oltneorganization HORATIO ALGER ASSN OF DISTINGUISHED loyerlUentllicatlonnumher Emir AMERICANS INC 13 1669975 Part I Compensation of the Five Highest Paid Employees Other Than Officers, Directors, and Trustees (See page 7 of the instructions List each one If there are none, enter 'None *) (a) Name and address of each employee paid (6) TAIa and average hours jai canmouuons to (e) Expense Der week devate0 to (c) Compensation =rd ~ ~' account and other more than E50 000 nn,ltlnn --- ~Ilnwan~cc H . KEVIN BYRNE . PIR PUB RELA 0 98,737 .125,763 . JULIE REAMES_-_-___-____ _-_______GR PROG S 99 CANAL CENTER PLAZA, ALEXANDRIA. V~40 54 .824 18 MARGARET SLIPEK GR EDIT . 99 CANAL CENTER PLAZA, ALEXANDRIA, VA140 MELODY MORRIS . .................... ~MGT MEMBR 5 6 --------------------------------- Total number of other employees paid Compensation of the Five Highest Paid Independent Contractors for Professional Services (See page 2 of the instructions List each one (whether individuals or firms) If there are none, enter 'None ') (a) Name and address of each independent contractor paid mare than $50 000 (6) Type of service (c) Compensation SIGNATURE- COMMUNICATIONS, -INC . PROGRAM 4250 HUNTING CREEK ROAD. HUNTINGTOWN, MD 20639 HALT, THRASHER & BUZAS, LTD- ------------------ 131,76 PETER -D.- HART 1724 CONNECTICUT AVENUE NW, WASHINGTON, DC 20009 C RELATIONS I 57 .018 . MILESTONE, LLC PO BOX 200, PORT TOBACCO, MD 20677 SULT 268,164 . -------------------------------------------- Total number of others receiving over $50 000 for professional serves " 1 0 zz3ioiA, zz m LHA For Paperwork Reduction Act Notice, see the Instructions for Farm 990 and Farm 990-E2 Schedule A (Form 990 or 990-EZ) 2002 7 16160923 756386 32025 2002 .06010 HORATIO ALGER ASSN OF DISTI 320251 HORATIO ALGER ASSN OF DISTINGUISHED Schedule A 990 or 990-EZ) 2002 2 Part III Statements About Activities (see page 2 of the instructions ) No 1 Doling the year has the organization attempted to influence national state, or local legislation including any attempt to influence public opinion on a legislative matter or referendums If 'Yes' enter the total expenses paid or incurred in connection with the lobbying activities " E E (Must equal amounts on Ilne 38, Part VI-A or line i of Part VI-8 ) Organizations that made an election under section 507(h) by tiling Form 5768 must complete Part VI-A Other organizations checking 'Yes' must complete Part VI-B AND attach a statement giving a detaAed description of the lobbying activities 2 During the year has the organization either directly or indirectly, engaged in any of the following acts with any substantial contributors trustees, directors officers creators, key employees, or members of then families, or with any taxable organization with which any such person is affiliated as an officer director, trustee, majority owner, or principal beneficiary (1l the answer to any question is "Yes," attach a detailed statement explaining the transactions) a Sale, exchange, or leasing of property b Lending of money or other extension of credit? I 2b I I X c Furnishing of goods services or tacilities7 2c ! X 0 Payment of compensation (or payment or reimbursement of expenses ii more than $1,000) SEE PART V , FORM 990 e Transfer of any part of its income or assets 2e X 3 Does the organization make grants tar scholarships, fellowships student loans, etc ? (See Note below ) 3 X 4 Do you have a section G03(0) annuity plan for your employees 4 X Note Attach a statement to explain how the organization determines that individuals or organizations receiving grants or loans from it in furtherance of it charitable programs 'quarry' to receive payments SEE STATEMENT 1 1 Part IV Reason for Non-Private Foundation Status (See pages 3 tnrauen 5of the instructions) The organization is not a private foundation because it is (Please check only ONE applicable box ) 5 0 A church convention of churches, or association of churches Section 170(lb)(1)(A)(I) 6 ~ A school Section 170(b)(1)(A)(u) (Also Complete Part V ) 7 ~ A hospital or a cooperative hospital service organization Section t70(b)(1)(A)(ni) B ~ A Federal, stale or local government or governmental unit Section t70(o)(1)(A)(v) 9 ~ A medical research organization operated in conjunction with a hospital Section 170(U)(1)(A)(ui) Enter the hospital's name, city, and state 10, 10 ~ An organization operated for the benefit of a college or university owned or operated by a governmental unit Section 170(b)(1)(A)(rv) (Also complete the Support Schedule in Part IV-A ) 11a ~X An organization that normally receives a substantial part of its support from a governmental unit or from tie general public Section 170(6)(1)(A)(vi) (Also complete the Support Schedule in Part IV-A 1113 0 A community trust Section 170(b)(1)(A)(vi) (Also complete the Support Schedule in Part IV-A 12 0 An organization that normaly receives (7) more than 33 7/3Y, of its support from contributions, membership tees, and gross receipts from activities related to its charitable, etc functions-subject to certain exceptions, and (2) no mare than 3310% of its support from gross investment income and unrelated business taxable income (less section 511 tax) from businesses acquired by the organization after June 30 1975 See section 509(a)(2) (Also Complete the Support Schedule in Part IV-A ) 13 CD An organization that is not controlled 6y any disqualified persons (other than foundation managers) and supports organisations described in (1) lines 5 throuan 12 above or (2) section 5011c1(4) (5) or (6) d they meet the lest of section 509(a)(2) (See section 5091a11311 Provide the following information about the supported organizations (See page 5 of the instructions (b) Line number (a) Name(s) of supported organization(s) from above aria operated to test for public safety Section 509(a)(4) (Sea page 5 of the instructions Schedule A (Form 990 or 990.EZ) 2002 223111 O i 77 0.7 8 16160923 756386 32025 2002 .06010 HORATIO ALGER ASSN OF DISTI 320251 HORATIO ALGER ASSN OF DISTINGUISHED A(FOrm990or990-EZ)2002 AMERICANS INC 13-1669975 Page 3 (y_A Support Schedule (Complete only if you checked a box on line 10, 11, or 12) Use cash method of accounting You ma use the worksheet in the instructions for convertin from the accn cash method o! accounhn year 00-1 (a) 2001 161 2000 Itl 1999 (E) 1998 (e) Total 15 unusual 18,949,463.1 6,7 6,966,016 . 29,054,850. 17 Gross receipts from admissions, merchandise sold or services performed, or furnishing of facilities in any activity that is related to tie organization 5 charitable, purpose 16, 956 . 17 , 334 . 7 , 068 . 17 ,( 15 . 18 Gross income from interest, dividends amounts received tom payments on securities loans (sec- lion 512(a)(5)) rents royalties, and unrelated business taxable income (less section 511 taxes) from businesses acquired by the organization atterJune 30,1975 408 694 . 422 133 . 322,865 . 313,F 7 19 Net income from unrelated business activities not included in line 18 20 Tax revenues levied for the organization s benefit and either paid to it or expended on its behalf 21 The value of services or facilities furnished to the organization by a governmental unit without charge Do not include the value of services or facilities generally furnished to the public without charge Z EE STATEMENT 12 Dohnul include gam ora(lossj I~om sale of capital assets 127 , 408 . 4 7 3 4 0 . 174, 748 . 23 Total ollines l5through 22 9,502 521 . 7 240 525 . 6, 715 , 586 . 7, 297 , 4 24 Line 23minus line 17 ~ 9,485,565 . 7,223,191 . 6,708,518 . 7,279,E 25 Enter 1% otline23 95,025 . 72,40567,156 . 72,5 26 Organizations described on lines 10 or 71 a Enter 2% 01 amount in column (e), line 24 1 h Prepare a list for your records to show the name of and amount contributed by each person (other than a governmental unit or publicly supported organization) whose total gifts for 1998 through 1001 exceeded the amount sown in line 26a Do not file this list with your return Enter the sum of all these excess amounts 1 7,7 c Total support for section 509(a)(1) test Enter line 24, column (e) d AdaAmounts from column (e)torlines 18 1,467,497 . i9 22 174,748 . 26n 6,067,709 . 7 9 e Public support (line 26c minus line 260 total) 1 t Public support percentage (line 26e (numerator) divided by line 26c (denominator)) 27 Organizations described on line 12 a For amounts included in lines 15 16, and 17 that were received from a'disqualitied person,' prepare a list for your records to show the name 01 and total amounts received in each year from each 'disqualified person' DO not life this list with your return Enter the sum of such amounts for each year N/A (2001) (2000) (1999) (7998) b For any amount included in line 17 that was received from each person (other than 'disqualified persons'), prepare a list for your records to show the name ot, and amount received for each year that was more khan the larger of (1) the amount on line 25 for the year or (2) $5,000 (Include in the list organizations described in lines 5 through 11. as well as individuals ) Do not the Ihis list with your return After computing the difference between the amount received and the larger amount described in (1) or (2), enter the sum of these differences (the excess amounts) for each year NBA (2001) (2000) (1999) (7998) c Add Amounts from column (e) for lines 15 16 17 20 21 " 27s N/A d Add Line 27a total and line 276 total " 27d N/A e Public support (line 27c total minus line 21d total) 1 27e NBA I Total support for section 509(a)(2) test Enter amount on line 23, column (e) " 271 N/A g Public support percentage (line 27e (numerator) divided by line 27( (denominator) 1111- p7 NBA h Investment income percentage (line 18, column (e) (numerator) divided by line 271 (denominator)) 1111~ ~ 27h ~ N/A 28 Unusual Grants For an organization descried in line 10 11, or 72 that received any unusual grants during 1998 through 2001 prepare a list for your records to show for each year, the name of the contributor the date and amount of the grant and a brief description of the nature of the gram Do not file flits list with your return Do not include these grants in line 15 223121 Ot 22 N NONE Scneoule A (Form 990 or 990 EZ 16160923 756386 32025 2002 .06010 HORATIO ALGER ASSN OF DISTI 320251 HORATIO ALGER ASSN OF DISTINGUISHED Schedule A(FOrm990or990-EZ)2002 AMERICANS INC 13-1669975 Px9e4 Part Y PrNate School Questionnaire (sea page 7 of the instructions) N/A (To be completed ONLY by schools that checked the box on line 6 in Part IV) Yes No 29 Does the organization have a racially nondiscriminatory policy toward students by statement in its charter, bylaws, other governing instrument, or in a resolution of its governing body 29 30 Does the organization include a statement of its racially nondiscriminatory policy toward students in all its brochures, catalogues and othei written communications with the public dealing with student admissions, programs, and scholarships? 30 37 Has tie organization publicized it racially nondiscriminatory policy through newspaper or broadcast media during the period of solicitation for students or during the registration period if it has no solicitation program, in a way that makes the policy known to ail parts of the general community it serves 31 It 'Yes,' please describe, it 'NO' please explain (II you need more space attach a separate statement ) 32 Does the organization maintain the following a Records indicating the racial composition of the student body, faculty, and administrative staff? h Records documenting that scholarships and other financial assistance are awarded on a racially nondiscriminatory basis c Copies of all catalogues, brochures, announcements and other written communications to the public dealing with student admissions programs, and scholarships d Copies of all material used by the organization or on its behalf to solicit conlri6utions9 It you answered 'No' to any of the above please explain (It you need more space, attach a separate statement ) 33 Does the organization discriminate by race in any way with respect to a Students' rights or privileges9 b Admissions policies c Employment of faculty or administrative staff? d Scholarships or other financial assistance9 e Educational policies I Use of facilities? g Athletic Orogiams~ h Other extracurricular activities? It you answered 'Yes'to any of the above, please explain (It you need more space, attach a separate statement ) 34 a Does the organization receive any financial aid or assistance from a governmental agency b Has the organization s nght to such aid ever been revoked or suspended If you answered 'Yes"to either 34a or b, please explain using an attached statement 35 Does the organization certify that it has complied with lie applicable requirements of sections 4 01 through 4 OS of Rev Proc 75-50, 1975-2 C B 587 covering racial nondiscrimination? It 'No.' attach an explanation Schedule A (Form 990 or 990-EZ) 2002 azaiai of sz 03 10 16160923 756386 32025 2002 .06010 HORATIO ALGER ASSN OF DISTI 320251

Description: