Focus on Papua New Guinea • Chinese investment abroad • South East Asia map PDF

Preview Focus on Papua New Guinea • Chinese investment abroad • South East Asia map

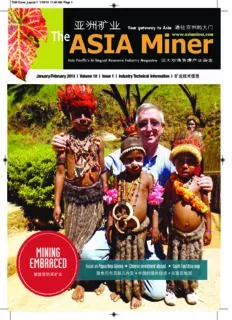

TAM Cover_Layout 1 1/10/13 11:40 AM Page 1 January/February 2013 | Volume 10 | Issue 1 | Industry Technical Information | 矿业技术信息 Focus on Papua New Guinea (cid:129) Chinese investment abroad (cid:129) South East Asia map 聚焦巴布亚新几内亚 (cid:129) 中国的境外投资 (cid:129) 东南亚地图 IFC_Layout 1 1/10/13 9:42 AM Page 1 TOC_Layout 1 1/10/13 9:50 AM Page 1 FEATURES South East Asia map This edition includes a special map produced by IntierraRMG showing the various mineral deposits of the South East Asian region. The map covers Indonesia, Malaysia, Thailand, Cambo- dia, Vietnam, Laos and other South East Asian countries. ..............................................................Insert. Chinese Investment Abroad China’s influence in global mining extends way beyond domestic demand for mineral resources with investment in various exploration, development and mining porjects right around the world as well as investment in infrastructure projects in developing countries. This special feature in- cludes news on Chinese investments in Australia, Canada, South America and Africa. ........................40 Mining in Ontario The province of Ontario is one of the world’s most mining friendly jurisdictions as indicated by this feature which follows a visit by The ASIA Miner editor John Miller to the Canadian region in October. ...........................................................................................................................................52 Blasting Technology Blasting plays a vital role in the mine development and mining processes and this feature examines some of the latest trends and technology. ................................................................58 LEADING DEVELOPMENTS Asian Intelligence First concentrate is expected to be produced at the Oyu Tolgoi Copper-Gold Project in southern Mongolia in late January with commercial production expected during the first half of the year. .....4 Papua New Guinea A pre-feasibility study has confirmed the Golpu deposit in the Wafi Golpu Gold- The communities around Marengo Mining’s Yandera Copper Project of Newcrest Mining and Harmony Gold as a world-class deposit Silvercorp. .................8 Copper-Molybdenum-Gold Project have been very Exploration Feasibility study drilling at Besra Gold’s Bau Gold Project in East Malaysia has substantially supportive of the company’s exploration efforts to date increased the resource at the Jugan Hill deposit. .................................................................................72 as indicated by this photo of Marengo’s managing di- rector Les Emery with local youngsters in traditional AROUND THE REGION dress. The project is reaching the next stage as Papua New Guinea Prime Minister Peter O’Neill has opened the Ramu Nickel Cobalt Project. ....................9 Marengo prepares for production. Data from recent successful infill drilling at Yandera will be included in China Silvercorp Metals continues to have drilling success at its producing silver, lead and zinc operations. ....20 mine planning being undertaken as part of a feasibil- Mongolia There has been an upgrade to measured category coal tonnes at Modun’s Nuurst project. ......22 ity study, which is nearing completion. Indonesia Realm Resources is on track to achieve first production at its Katingan Ria coal project in 2013. .24 Photo Marengo Mining Philippines Work on the new mill at Medusa’s Co-O project is on schedule for completion by mid-2013. .....26 DEPARTMENTS South Korea Woulfe Mining has secured land next to its Sangdong mine for a processing plant. .............28 Advertisers’ Index ......................................70 Malaysia Drilling at Monument Mining’s Selinsing Gold Project has defined a new ore pod. ................30 Calendar of Events ....................................69 Central Asia Slater Mining Corporation intends to purchase a gold project in Kazakhstan. .............................32 From the Editor ............................................2 Myanmar Centurion Minerals has raised funds for due diligence on a number of projects. ........................34 Product News ............................................66 Sri Lanka Bora Bora Resources intends acquiring tenements around a high-grade graphite mine. ......35 Subscription Form ......................................60 Supplier News ............................................70 Australia Flinders Mines has discovered nickel and copper sulphide mineralization in WA. ..................56 Lihir upgrade ramps up ....................................... 8 Sakari land acquisition ..........................................25 Golden Lake Shore future .................................... 54 January/February 2013 | ASIA Miner | 1 Editor's Page_Layout 1 1/10/13 9:51 AM Page 2 From The Editor It will be more of the same in 2013 2012 saw economic uncertainty around the world exacerbated by growing financial troubles in Europe and deliberate slowing of China’s growth. This WWW.ASIAMINER.COM uncertainty was reflected in the mining industry with resulting downward trends for most mineral prices and great difficulty in securing funds for ex- The ASIA Miner® ploration, mine development and expansions, which led to a concer ning Suite 9, 880 Canterbury Road, and increasing number of project postponements and cancellations. The Box Hill, Melbourne,Victoria, 3128 Australia overall downward trend in the mining industry and investment has not been Phone: +61 3 9899 2981Mobile: + 61 417 517 863 aided by an increasing amount of resource nationalism around the world. Unfortunately, 2013 looks like being little better, although there could By John Miller/Editor Editor —John Miller, [email protected] be signs of more certainty for the industry by the end of the yea.r The new Graphic Designer—Christine Hensley, [email protected] year will be pretty much the same as 2012 with minimizing risk again to the fore for investors, Editorial Director—Steve Fiscor, [email protected] meaning further difficult times for mining companies, particularly juniors, needing funds to ad- Europe—Simon Walker, [email protected] vance their exploration, mine development or mine expansion projects. In most cases this will North America—Russ Carter,[email protected] mean looking outside the square at innovative fund raising methods. Latin America—Oscar Martinez, [email protected] While these sentiments are of a general nature and intended to reflect the overall direction of South Africa—Antonio Ruffini,[email protected] the mining industry, there are some countries and regions that will do better than others in 2013, primarily due to the relative lack of resource nationalism and having proactive government and SALES industry support as well as being rich in the resources that are heavily in demand and boasting Publisher—Lanita Idrus, [email protected] strong existing infrastructure. Having spent a few weeks in Ontario, Canada, during 2012, I be- North America—Victor Matteucci, [email protected] lieve Canada is one country where the industry is well placed to weather the uncertainty. The global financial crisis of later 2008/2009 hit Canada quite har d whereas Australia’s mining in- Germany, Austria, Switzerland—Gerd Strasmann dustry enabled it to get through fairly well unscathed. This time it is the other way around with [email protected] Canada obviously having learnt some lessons from the GFC and Australia going down the path Rest of Europe—Colm Barry, [email protected] of increased taxes and fewer incentives with resulting troubled times for mining companies. Jeff Draycott, [email protected] At provincial and national level, governments in Canada are doing what they can to promote Japan—Masao Ishiguro, [email protected] growth in mining by cutting red tape and adopting positive tax policies. Geologically Canada has Indonesia—Dimas Abdillah, [email protected] vast resources with much of the large wilderness areas in the north largely unexplored and explo- ration efforts being widely supported by the governments as well as by the expertise provided by Mining Media International mining industry organizations and educational establishments. It also boasts large reserves of min- 8751 East Hampden Ave, Suite B-1 erals that are very much in demand and that appear to have very bright futures, including potash, Denver, Colorado 80231, U.S.A. diamonds, uranium, copper-gold and lithium. There are some infrastructure issues but, unlike other Phone: +1 303-283-0640Fax:+1 303-283-0641 parts of the world, these are being tackled with a united approach involving mining companies, min- ing contractors, communities, and local, provincial and national governments. Concerns expressed President—Peter Johnson, [email protected] about the exploration and mining processes are also being tackled in a co-ordinated manner with the Subscriptions: $120/year—Tanna Holzer, Ring of Fire region in Ontario being an perfect example owing to the proactive and unified approach [email protected] being taken by the provincial government in conjunction with communities. Accounting—Lorraine Mestas, [email protected] Chile in South America and parts of western and central Africa are also looking promising for mining in 2013 while in the Asia Pacific resource nationalism and political interference seem set The ASIA Miner®is published six times per year by Mining Media to continue into 2013, to the detriment of the mining industry. There are some bright spots, in- International. Every endeavour is made to ensure that the contents cluding New Zealand, where the government seems to be making the right noises, some South are correct at time of publication. The Publisher and Editors do not Pacific island nations, Malaysia where there are positive developments, Cambodia, South Korea, endorse the opinions expressed in the magazine. Editorial advice Myanmar and to some extent Papua New Guinea, where there have been some disturbing re- is non-specific and readers are advised to seek professional ad- cent resource nationalism influences. In Central Asia the future for the Kyrgyz Republic looks a vice for specific issues. Images and written material submitted for little brighter since the 2012 elections while Kazakhstan appears to be losing some of its appeal. publication are sent at the owners risk and while every car e is Indonesia and the Philippines still have plenty of potential, but this has been stated for many taken, The ASIA Miner®does not accept liability for loss or dam- years and, unfortunately, 2013 appears to be little better than previous years for both nations. age. The ASIA Miner®reserves the right to modify editorial and ad- It looks like being a difficult 12 months for investors and the mining industry in China owing to vertisement content. The contents may not be reproduced in whole increasing costs, in Mongolia where political forces are having a detrimental impact on invest- or in part without the written permission of the publisher. ment and Australia owing to global economic trends along with increased government interfer- Copyright 2013 Mining Media International Pty Ltd ence and lack of incentives. ISSN: 1832-7966 2 | ASIA Miner | January/February 2013 Editor's Page_Layout 1 1/10/13 9:51 AM Page 3 Asian Intelligence_Layout 1 1/10/13 9:58 AM Page 4 Asian Intelligence Oyu Tolgoi concentrator commissioned FIRST concentrate is expected to be produced dends from its 34% stake, the Government of vement of building the first phase of the project. at the Oyu Tolgoi Copper-Gold Project in sout- Mongolia will receive taxes and royalties. He says Oyu Tolgoi is committed to contribu- hern Mongolia in late January with commercial A ceremony to launch the Oyu Tolgoi concen- ting to a sustainable future for Mongolia. At least production expected during the first half of the trator and mark the first processing of ore was 9 out of 10 employees will be Mongolian once year. Oyu Tolgoi will be one of the largest and held at the mine site on December 27 attended the mine is in production and Oyu Tolgoi is in- highest-grade copper and gold mines in the by representatives of the Oyu Tolgoi investors, vesting US$58 million in training and education world. It is the largest project ever developed Board of Directors of Oyu Tolgoi LLC and Mon- and an additional US$27 million in the W ork- in Mongolia, requiring a capital investment for golian State and Government representatives force Employment Project designed to help ad- phase 1 of more than US$6 billion. headed by the Mining Minister D Gankhuyag. dress the general skills shortage in Mongolia. “Oyu Tolgoi’s key priorities are the health and safety of employees, best-practice envir on- mental management, contributing to sustaina- ble communities and always doing business with integrity, for the benefit of all the project’s shareholders and the people of Mongolia.” Rio Tinto says its vision in developing and operating Oyu Tolgoi is to safely deliver, on schedule and budget, and firmly aligned with Rio Tinto’s sustainable development strategy, The project is owned by Oyu T olgoi LLC, Oyu Tolgoi LLC president and CEO Cameron values and standards for excellence. Rio Mongolia’s largest copper and gold mining McRae says that stable partnership between Tinto Copper’s chief executive Andrew Har- company, and a strategic partnership between the Government of Mongolia and thir d- ding says, “We are on track to bring the first the Government of Mongolia (34% stake), Tur- neighbour investors as well as the contribution phase of the world-class Oyu Tolgoi mine into quoise Hill Resources (66%) and Rio Tinto. Rio of some 15,000 workers fr om 44 nations production in the first half of 2013. When fully Tinto is the major shareholder in Turquoise Hill around the world including hundreds of Mongo- developed it will be a top-five copper produ- and manager of the project. In addition to divi- lian supplier companies were important in achie- cer with significant gold production.” PDAC a convention, trade show and investor exchange WORDS like mammoth and monster have a national event into an international one. “We look forward to another tremendous been used to describe the size of the Pr o- “The convention has really hit its stride in event in 2013, with expanded programming, spectors & Developers Association of Cana- terms of its place in the global mineral industry,” an impressive list of speakers for our techni- da’s (PDAC) Convention, the mineral says Glenn Nolan. “In the early 90s, PDAC cal sessions, and innovative touches like our industry’s most popular annual networking began to build up an international reputation mobile convention guide,” says Ross Gallin- and educational event. It doesn’ t matter and the event went international. Since then, ger. “It’s not just about increasing our num- which descriptive words are used, the con- the convention has come to be known as the bers though - our goal is to maintain the vention’s size is impressive. global networking opportunity for the mineral quality of the technical program and the over- Held at the Metro Toronto Convention Centre exploration and development industry.” all convention experience.” and scheduled for March 3-6, 2013, the con- PDAC’s executive director Ross Gallinger The PDAC Convention is a convention, vention attracted a record of more than 30,000 experienced the convention from the inside trade show and investors exchange in one. delegates in 2012. “Early indicators show both for the first time in 2012. Having been part of It includes a technical program, presentati- Canadian and international interest is strong the mineral exploration industry for years and ons, short courses and workshops, a cor- again this year,” says PDAC president Glenn a regular convention delegate, Gallinger says porate social responsibility event series, an Nolan. “Trade show and investor exchange ex- the convention has become a massive focal Aboriginal program, student program, and hibits sold out early and we’re seeing many of point for the junior exploration sector. “The networking events. our 2012 sponsors returning.” convention fosters information-sharing and The Trade Show features 415 companies, Now in its 81st year, the convention attracts relationship-building that impacts the industry organizations and governments promoting investors, analysts, mining executives, geo- throughout the rest of the year. The networ- technology, products, services, and mining logists, prospectors and international govern- king that goes on during those four days re- jurisdictions worldwide. The Investors Ex- ment delegations from all over the globe. In sults in countless new r elationships and change, which is open to the public and free 2012, 25% of delegates were international, ideas, reinforces current partnerships and to attend, is the leading investment show de- reflecting the evolution of the convention from sets the stage for a great many deals. dicated solely to the mineral industry. 4 |ASIA Miner | January/February 2013 Asian Intelligence_Layout 1 1/10/13 9:58 AM Page 5 Asian Intelligence Myanmar’s mining Production Sharing Contracts By Edwin Vanderbruggen, of VDB Loi law firm’ AS Myanmar finds itself back in the global in- How is the contractor’s take calculated? importation of any equipment needed for the vestment community spotlight, international The Government receives a royalty and a pro- project. In practice, this happens by recom- mining companies are trying to determine duction share (which is negotiated). There is mending to the Myanmar Investment Com- whether the country’s vast mineral and metal normally no separate cost recovery. The Go- mission that such customs duty exemption resources pose an opportunity for them. My- vernment’s share may be above or below be included in the Investment Permit. Such anmar uses a Production Sharing Contract 30%, depending on the location of the site, the permit will typically provide for temporary im- (PSC) approach to the mining sector. Accor- product and its price, expected costs, and port duty exemptions. The 2012 Foreign In- dingly, when evaluating mining opportunities other factors. The contractor also pays land vestment Law has cr eated an additional in Myanmar, the key provisions of that PSC rent and forestry fees (if applicable) at fixed exemption period which has effect after the are of central importance. rates per square metre. Finally, the contractor initial period. In practice, the contractor will In this contribution, VDB Loi pr esents an is subject to the normal income tax rates in have to register as an importer with the Mini- overview of the salient features of Myanmar’s Myanmar, currently set at 25%. There are no stry of Commerce and obtain import licences Model Mining PSC of importance to foreign additional tax charges for paying out divi- for each good it wishes to import. investors. We also look ahead to a new law dends. Normally speaking, a five-year tax ho- on mining, which is being prepared. liday is awar ded to all for eign investors, Valuation and sale of extracted products including extractive industries. Other pay- Local prices or LME prices apply to the ex- Different licences ments, such as a signature bonus and guaran- tracted products, depending on the case. For According to the 1997 Mining Law, different tee fees may apply at the outset of the PSC. gold, which is currently not exported, local licences or permits apply to different stages prices apply. The PSC will state whether or of mining. For example, an exploration per- Is there a requirement for a local partner? not the contractor has the right to export the mit is necessary for the exploration phase Mining projects can be done as a joint ven- production. The current Mining Law prohibits (usually 1-3 years, including extensions), a ture with local shareholders, or as a 100% fo- export of raw ore. development permit for the development reign-owned company. Under the For eign phase, and finally a PSC for production. In Investment Law, foreign investors have the Does the PSC include an obligation to practice, mining companies approach the right to sell shares to locals or foreigners, so compensate local residents? Ministry of Mining (MoM) and lodge their in- an exit should be possible at any time. The The PSC will state that the contractor must terest for exploration of any of the deposits investment regulator and the MoM need to indemnify parties which incur damages or for which the MoM has indications. They are approve any transfer, which is typically not a costs as a result of the project. This can refer subdivided into four categories (P1, P2, P3 problem. The PSC will set out a minimum to local residents who may have to relocate and P4) based on the depth of the data the amount of capital for the contractor to deploy, their livelihood. There are currently few clear MoM has on hand. For example, P1 means and work commitments associated with that. rules on the calculation of such damages and there are just some indications of a deposit, costs, which is a concern to foreign investors. while P3 means that a deposit has definiti- Importation of equipment vely been identified. The PSC states that the MoM will facilitate How does the PSC address environmental issues? Myanmar’s PSC has only very basic rules on environmental protection but the Government is determined to strengthen its framework in the short term. Myanmar has a number of laws with rules that relate to the environment, such as the 1992 Forestry Law. The Govern- ment is moving in the direction of requiring comprehensive EMMPs. Termination of the PSC The Government has the right to terminate the PSC in a number of circumstances, including loss of and wrongful acts regarding resources, inefficient implementation of the project, viola- tion of the PSC terms, as well as if a force ma- jeure has occurred continuously for more than six months. The 2012 Foreign Investment Law contains a general prohibition against nationali- zation of foreign investors’ property. The rate of mining royalties imposed by the government in Myanmar. January/February 2013 | ASIA Miner | 5 Asian Intelligence_Layout 1 1/10/13 9:58 AM Page 6 Asian Intelligence 6 |ASIA Miner | January/February 2013 Asian Intelligence_Layout 1 1/10/13 9:58 AM Page 7 PNG_Layout 1 1/10/13 9:57 AM Page 8 Papua New Guinea PFS confirms Golpu deposit is world-class A PRE-FEASIBILITY study (PFS) has confirmed and 19.7 million ounces of silver. This is an and metal recoveries for development bey- the Golpu deposit in the Wafi Golpu Gold-Cop- increase of 11 million ounces of gold and 4.7 ond that assumed and already modelled, in- per Project of Newcrest Mining and Harmony million tonnes of copper compared with the cluding the potential for higher grade and Gold as a world-class deposit with an expec- previous estimate. The total indicated and in- recovery in lift 1, improved overall gold reco- ted mine life in excess of 25 years and projec- ferred resource estimate is 1 billion tonnes @ veries, accelerated production ramp-up and ted unit cash costs at the bottom of the 0.63 grams/tonne gold, 0.9% copper and 1.1 higher mining and processing rates, and the industry cost curve. The PFS and a significant grams/tonne silver for 20.3 million contained potential for an additional mining lift based on upgrade to the Golpu ore reserves form part of ounces of gold, 8.98 million tonnes of copper high grade drill intercepts recorded below the a technical report on the project which was re- and 35.7 million ounces of silver. existing ore reserve. leased in the final quarter of 2012. Block caving is the mining method proposed The joint venture participants are engaging The deposit forms part of the W afi-Golpu for Golpu, with two lifts to an aggregate depth with key stakeholders, including government project about 65km west of Lae in Mor obe of about 1.45km. Drilling beneath lift 2 has re- and landowner representatives, to ensure province. Newcrest and Harmony Gold each turned significant high grade intersections and alignment on the planned project develop- have a 50% interest in the project. The project mineralization remains open at depth below ment and key elements of the next phase of remains a highly prospective exploration area this drilling. The development capital costs and work, and anticipate commencing a feasibility and drilling on multiple targets continues. resulting preliminary valuations demonstrate a study in the first half of 2013. The updated ore reserve estimate for Golpu sound business case that supports the up- First production is forecast by 2019 subject shows 450 million probable tonnes @ 0.86 dated ore reserves estimate associated with to approvals and feasibility study. The PFS grams/tonne gold, 1.2% copper and 1.4 developing lifts 1 and 2. estimates mine life of 26 years with annual grams/tonne silver for 12.4 million contained The PFS also identified several factors with production up to about 550,000 ounces of ounces of gold, 5.4 million tonnes of copper the potential to improve production, grade gold and 330,000 tonnes of copper. Lihir gold plant upgrade ramps up THE Million Ounce Plant Upgrade (MOPU) completion of the conveying and grinding cir- a cash cost of Aus$632 per ounce. This at Newcrest Mining’s Lihir Gold Project on cuit, and the commissioning of the new oxygen compares with the pr evious quarter of Lihir Island was scheduled to be completed plant, autoclave, and grinding circuit. 163,059 ounces at a cash cost of Aus$571. during the December quarter of 2012 with Newcrest said the project cost continued Gold production was 21% lower than the commissioning almost complete and the to track in line with the budget of ar ound June 2012 quarter, primarily as a result of a plant now ramping up to full production ca- US$1.3 billion, though the contingency has production interruption associated with an pacity. The Lihir plant r efurbishment pro- been consumed, and the project remained electrical fault in the main oxygen plant. A gram also continues and will be completed on track to commence ramp-up of produc- temporary suspension of operations due to a during the 2014 financial year. tion in the December 2012 quarter. dispute involving the Lihir Mining Area Land- By the end of the September quarter MOPU During the September quarter the compa- owners Association also adversely impacted construction was around 97% complete and ny’s overall gold pr oduction was 460,425 production. Guidance for Lihir’s full year pro- commissioning activities about 75% complete. ounces, lower than the 587,310 ounces of duction for the 2013 financial year remains Construction of the autoclave was completed the previous quarter, while copper production unchanged at 700,000 to 900,000 ounces. during the September quarter. The key remai- was 18,598 tonnes, compar ed to 20,544 During the September quarter or e conti- ning activities for the pr oject which were all tonnes in June quarter. Lihir’s September nued to be sourced from stage 11 of the Lie- scheduled for the December quarter, were the quarter performance was 129,311 ounces at netz pit and stage 12 of the Minifie pit. Waste stripping of stages 9 and 12 of the Minifie pit continued. Unit cash costs were 11% higher than the previous quarter reflecting the lower gold production. Exploration continues at Lihir with further mineralization outside the existing resource shell in the Kapit North East target area being intersected. New results in- clude 168 metres @ 2.3 grams/tonne gold from 66 metr es, 98 metr es @ 3.4 grams/tonne from 250 metres and 60 metres @ 3.1 grams/tonne from 166 metres. The prospect remains open to the north and east. A gold pour at Newcrest Mining’s Lihir Gold Project. Gold dore from the Lihir project on Lihir Island. 8 |ASIA Miner | January/February 2013

Description: