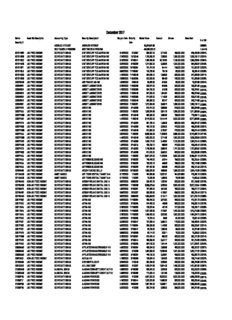

Florida Combined Holdings SP December 2017 Website PDF

Preview Florida Combined Holdings SP December 2017 Website