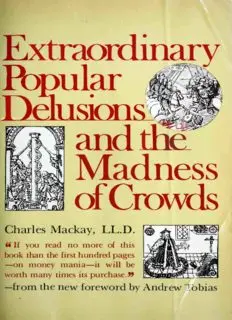

Extraordinary Popular Delusions and the Madness of Crowds PDF

Preview Extraordinary Popular Delusions and the Madness of Crowds

Extraordinary P.Ula�r . :-··� , Delusi··o ns J,PIIIIIU:·,� ¥./ and the� Madness ofCrowds CharMlaecsk aLyL,. D. "I fy our eando m oroef t his bootkh atnhf ei hrusntd praegde s -onm onemya niaw-iilbtle wormtahn tyi mietpssu rchase.,, -fomr thnee wf orewboyAr ndde rw�[ obias Extraordinary PopruD lealusions --andt he- MadnesofsCrowd s JOHN LAW (SePea g1e) Extraordinary PopuDleluasri ons -- andt he- MadnesofsCrowd s BYC HARLEMSA CKALYL,. D. With facsimile title pages and reproductions of original illustrations from the editions of 1841 and 1852 With a Foreword by ANDREW TOBIAS HARMONY BOOKS/NEW YORK This edition published in 1980 by Harmony Books, a division of Crown Publishers, Inc., 201 East 50th Street, New York, New York 10022. Member of the Crown Publishing Group. Foreword copyright © 1980 by Andrew Tobias AI I rights reserved. Manufactured in the United States of America Library of Congress Cataloging-in Publication Data Mackay, Charles, 1814-1889. Extraordinary popular delusions and the madness of crowds. Originally published in 1841 under title: Memoirs of extraordinary popular delusions. I. Impostors and imposture 2. Swindlers and swindling. 3. Hallucinations and illusions. 4. Social psychology. I Title. AZ999.M2 1980 001.9'6 79-24574 ISBN 0-517-54123-8 ISBN 0-517-53919-5 pbk 16 15 14 13 12 11 10 MEMOIRS OF EXTRAORDINARY DELUSIONS. POPULAR ·BY CHARLES MACKAY. AUTHOORF "THF. THAMF.SA ND ITST lllBUTARIE"ST,H"E HOPEO F THE WORLD,E"T C. "IeIs hto rnl ceo m,a\ietdsre cl ider re.,.1p rhintm aiCnh.a qpneel laps lefoesl ipet•u s oi>Um oingsr ossihes." MILLOT. VOL. I. LONDON: RICHABREDN TLENYE,WB URLINGSTTORNE ET. 13ubliin@s rbbeittn·�oa: e r�rpll jtifti?, 1841. MEMOIRS 01!' EXTRAORDINARY POPULAR DELUSIONS ANDT HE �a:bntss .of -Otr.orohs. BY CHARLES MACKAY, LL.D. AUTHOR OF" EGERJA," "THE SALAMANDRINE," ETC. ILLUSTRATED WITH NUMEROUS ENGRAVINGS. N'en deplaise aces fous nomm�s sages de Grece, En ce monde ii n'est point de parfaite sagesse; · 'I'ous Jes hommes sont fous, et malgre tous leurs soins Ne differeut entre eux qu� du plus ou du moins. BOILEAU. VOL. I. SECONDE DITION. LONDON: OFFICE OF THE NATIONAL ILLUSTRATED LIBRARY, 227 STRAND. 1852. FOREWORD I was doing a term paper on chain letters ( of all things) at the Harvard Business School. My faculty adviser-right off the top of his head-suggested I seek out a volume called Popular Delusions and the Madness of Krauts-published, he said, in 1841. My God, I was impressed. What esoterica! (I was also astonished by the title and surprised to learn that Germans, even back in 1841, were called Krauts-or that anyone would have called them that on a book jacket.) I subsequently learned that any business professor worth his salt would have had this book at tongue's tip; and that it had to do with the madness of crowds. But for each of us there has to be that first time we learn of this book, that first reading of it. Perhaps this is yours. If so, you will read of alchemists and crusaders, of witches and haunted houses, of stock speculations and fortune-tellers and, to my mind most wonderfully of all, of tulips. Tulips, in the_ fourth decade of the seventeenth century in Holland, be came the object of such insane and unreasoning desire that a single bulb-about the size and shape of an onion-could fetch a small fortune on any of the several exchanges that had sprung up to trade them. (Not entirely unlike the mania for certain tiny perforated squares of printed paper with stickum on their backs that exists today.) Not to be missed is Mackay's account of the unfortunate Dutch sailor who, having been sent down to a rich man's kitchen for breakfast, and having a particular taste for onions, actually consumed one of the priceless bulbs in error. XII FOREWORD X111 As with any true classic, once it is read it is hard to imagine not having known of it-and there is the compulsion to recom mend it to others. Thus did financier Bernard Baruch, who claimed his study of this book saved him millions, recommend it in his charming foreword of October 193 2. "'Have you ever seen,'" Baruch quoted an unnamed contem porary," 'in some wood, on a sunny quiet day, a cloud of flying midges-thousands of them-hovering, apparently motionless, in a sunbeam? ... Yes? ... Well, did you ever see the whole flight-each mite apparently preserving its distance from all others-suddenly move, say three feet, to one side or the other? Well, what made them do that? A breeze? I said a quiet day. But try to recall-did you ever see them move directly back again in the same unison? Well, what made them do that? Great human mass movements are slower of inception but much more effective.'" Suddenly, as I write this, everyone in New York and Cali fornia, with the rest of the country perhaps to follow, is on roller skates. I certainly would not call this a form of madness, having just purchased two pairs myself-nor, at least as of this writing, a "great human mass movement." But all of a sudden there they all are-on roller skates. Baruch quotes Schiller: "'A nyone taken as an individual is tolerably sensible and reasonable-as a member of a crowd, he at once becomes a blockhead.'" There are lynch mobs- and there are crusades; there are runs on banks and there are fires where, if only people hadn't panicked, they would all have es caped with their lives. There was "the hustle," not so long ago, where large groups of young people learned to dance in lemminglike unison. (I have never actually seen a lemming, but I suspect that when I do, I will see more than one.) And there was the mass suicide at Jones town. The month Baruch wrote his foreword, perhaps not coin cidentally, marked the absolute bottom of the stock market crash that had begun three years earlier, in 19 29. Wild specu lation had driven the Dow Jones Industrial Average to 381 in October of 1929 on the wings of what had been a panic of XIV FOREWORD greed. Three years later it had fallen not to 300 or 25 0 or 200 or 150 or even 75 but to 41. Unreasoning greed had turned in side out. It had become unreasoning fear. "I have always thought," Baruch reflected on this sorry state of affairs, "that if ... even in the very presence of dizzily spiralling [ stock lp rices, we had all continuously repeated, 'two and two still make four,' much of the evil might have been averted. Similarly, even in the general moment of gloom in which this foreword is written, when many begin to wonder if declines will never halt, the appropriate abracadabra may be: 'They always did.' " In the late 1960s, stock prices again began to spiral dizzily. Market mania. Synergy was the new magic word, and what it meant, in essence, as various corporate presidents and stock promoters explained over and over, was that two and two could, under astute management, equal five. It was alchemy of a sort-see pages 98-256-and enough to drive at least one stock, in two years, from $6 a share to $140. The talk of the town. Not much later it sold for $1. By late 1974, stocks generally had fallen, slumped, slid, and otherwise eroded in value to depression levels. The crowd had not just left the party-it was stoning the host. Yet had you had the courage, in December of 1974, to buck the crowd which in a way is what this book is all about-gains of 500 and 1,000 percent over the ensuing three to four years would have been common in your portfolio. Not that you must be a stock-trader to benefit from the perspective this book provides. Should the government balance its budget? Should the Fed loosen or tighten credit? Read in the very first chapter a tale of money printing and speculation in early eighteenth-century France that should give any deficit spender, any easy-money advocate, severe pause. (Read, too, of the hunchback who supposedly profited handily renting out his hump as a writing table, so frenzied had the speculation become.) Mackay describes Frenchmen "ruining themselves with frantic eagerness." And then in the second chapter the