EVALUATION: Compressor Add-on PDF

Preview EVALUATION: Compressor Add-on

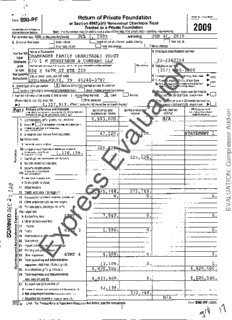

990-PF Return of Private Foundation OMBNo 1545-0052 Form or Section 4947(a)(1) Nonexempt Charitable Trust 2 9 Treated as a Private Foundation DepartmentoftheTreasury 00 InternalRevenueSi''.n Note. Thefoundation maybeabletouseacopyofthis return tosatisfy state reporting requirements Forcalendaryear2009, ortaxyearbeginning JUL 1, 2009 , and ending JUN 30, 2010 G Check allthatapply Initial return Initial return ofaformerpubliccharity 0 Final return Amended return 0 Addresschange Namechange Name offoundation A Employer identification number Usethe IRS CHAMPAGNE FAMILY CHARITABLE TRUST n label Otherwise, /O L M HENDERSON & COMPANY LLP 20-6262204 print Numberandstreet(orPO boxnumberifmailisnotdeliveredtostreetaddress) Roo sulte g Telephone number ortype. 450 E 96TH ST STE 200 31o7 566-1000 SeeSpecific Cityortown,state,and ZIPcode C Ifexemptionapplicationispending,checkhere Instructions. INDIANAPOLIS IN 46240-3797 01•iForeign organizations, check here 0 H Checktype oforganization W Section 501(c)(3)exemptprivatefoundation t2. cFohreecikgnheorregaannidzaattitoancshmcceooetmmippnugtatthieon85%test, ► O 0 Section 4947(a)(1)nonexemptcharitable trust E:J Othertaxableprivatefoundation aE Ifprivatefoundation status wasterminated I Fairmarketvalue ofallassets atend ofyear J Accounting method 0 Cash L] Accrual undersection 507(b)(1)(A), check here E::] (fromPartll, co! (c), line 16) = Other(specify) F Ifthefoundation is in a 60-monthtermination ► $ 4 357 9 11 . (Part1, column((mustbeoncashbasis) u undersection 507(b)(1 B check here ► ^sart i Analysis ofRevenue and Expenses (a) Revenue and (b)Netinvestment (c)Adjusted net (d)Disbursements n (nTehceestsotaanllyofeaqmuoaluntthseianmcooulnutmsnisn(cb)o,l(uc)m,na(nad))(d)maynot expenses perbooks income income forc(chaasnhtabbalseispuornlpyo)ses o 1 Contributions,gifts,grants,etc , received 6,503,000 . l NTA -d a d 2 Check► O ItthefoundationisnotrequiredtoattachSch B A 3 Interestonsavingsandtemporary cashinvestments 4 Dividendsand interestfrom securities 47,220 v. 47,220. STATEMENT 1 ro 5a Gross rents s s b Netrentalincomeor(loss) E e 325,528. d 6a Netgainor(loss)fromsaleofassetsnotonline10 rp 7 Grosssalespriceforall , ,156. b assetsonline6a 1 126 m 325,528. y 7 CapitalgainnetIncome(fromPartIV,line2) o 8 Netshort-term capital gain C 9 Income modifications s : Grosssaleslessreturns N 10a andallowances O b Less Costofgoodssold s I c Gross profit or(loss) IT 11 Otherincome A e 12 Total. Add lines 1 through 11 6 , 875 , 748. 372 , 748 . U 13 Compensationofofficers,directors, trustees,etc 0. 0. 0 L Cy A 14 Otheremployee salaries and wages r V t_U 15 Pension plans, employee benefits p E 16a Legalfees w b Accounting fees STMT 2 7,040. 0. 0. Ui Z W c Otherprofessional fees x 17 Interest 18 Taxes STMT 3 1,500. 0. .0. E 19 Depreciation and depletion E 20 Occupancy 4 21 Travel, conferences,and meetings 22 Printingand publications 23 Otherexpenses STMT 4 4 , 569. 0. 0. 0 24 Total operating and administrative at expenses. Add lines 13through 23 13,109. 0 . 0 . 0 25 Contributions,gifts, grants paid 6 , 820 , 500. 0. 26 Total expenses and disbursements Add lines 24 and 25 6 833 609• 0. 6 , 820 , 500. 27 Subtract line 26fromline 12 , 139 a Excessofrevenueoverexpensesanddisbursements 42 b Net investment incomeofnegative,enter-0-) 372,748.1 c Ad usted net income (ifnegative,enter-0- N/A 1 \f\ 0z02-10 LHA For PrivacyActand Paperwork Reduction ActNotice, seethe instructions Form990-Pi(2009) CHAMPAGNE FAMILY CHARITABLE TRUST Form 990-PF120091 CIO T, M HENDERSON & COMPANY LLP 20-6262204 Paoe2 Part li Balance Sheets cAtotlaucmhnedsshcohuelddubleefsoarnednda-moofu-nytesarianmtohuendtessconnlpybon B(eag)inBnoionkgVoaflyueear (b) BookValue End ofyea(rc)FairMarketValue 43,726. 33,334. 33,334. 1 Cash-non-Interest-bearing 2 Savingsandtemporarycash investments 3 Accounts receivable ► Less allowancefordoubtfulaccounts ► 4 Pledges receivable ► Less allowancefordoubtfulaccounts ► n 5 Grants receivable 6 Receivablesduefrom officers,directors,trustees,and other o disqualified persons 7 Othernobsandloansrecerable Less allowancefordoubtfulaccounts ► i 8 Inventoriesforsale oruse t as 9 Prepaid expenses and deferred charges a 10a Investments - U S and stategovernmentobligations b Investments -corporate stock c Investments -corporate bonds u 11 Imestnents-land,buildings,andequipmentbasis ► n o Less accumulateddepreciation ► l - 12 Investments -mortgage loans d a d 13 Investments -other A 14 Land, buildings,andequipment basis ► r Lessaccumulateddepreciation ► v o 15 Otherassets (describe► STATEMENT 5 5,896,662. 5,949,193. 4,324,577. s s E e 16 Total assets tobecompleted b allfilers 5 , 940 , 388. 5- r -98-2 , 527. -4 , 3-5-7 , 911. r p 17 Accounts payable andaccrued expenses m 18 Grants payable o v) 19 Deferred revenue C 20 Loansfromofficers,directors,trustees,andotherdisqualifiedpersonss : 21 Mortgages and othernotes payable N O 22 Other liabilities (describe ► s I T 23 Total liabilities (add lines 17throuQh 22) 0. 0. A e Foundationsthatfollow SFAS 117, checkhere ► U and complete lines24through26and lines 30 and 31 L A 24 Unrestricted r V 25 Temporarily restricted p E m 26 Permanently restricted Foundationsthatdo notfollowSFAS117, checkhere ► E LL and complete lines27thxrough31 ° 27 Capital stock,trust principal, orcurrentfunds 0. 0. 28 Paid-in orcapital surplus, orland, bldg ,and equipmentfund 0. 0. E a 29 Retained earnings, accumulated income,endowment,orotherfunds 5,940,388. 5,982,527. Z 30 Total net assets orfund balances 5,940,388. 5,982,527. 31 Total liabilities and netassets and balances 5 , 940 , 388.1 5 , 982 , 527.1 Part ljl Analysis of Changes in Net Assets or Fund Balances 1 Total netassets orfund balances atbeginning ofyear- Part II,column (a),line 30 (mustagree with end-of-yearfigure reported on prioryear's return) 1 5,940,388 . 2 Enteramountfrom Part I,line 27a 2 42 , 139 . 3 Otherincreases notincluded in line 2 (itemize) ► 3 0 . 4 Add lines 1, 2,and 3 4 5,982,527 . 5 Decreases notincluded in line 2(itemize) ► 5 0 6 Totalnetassets orfund balancesatend ofyear(line 4minus line5)- Part II,column (b),line 30 6 5 , 982 , 527 . Form990-PF(2009) 923511 02-02-10 2 CHAMPAGNE FAMILY CHARITABLE TRUST .f N Form990-PF(2009) C/O L M HENDERSON & COMPANY LLP 20-6262204 Page3 Part IV Capital Gains and Losses for Tax on Investment Income (a) Listand describethe kind(s) ofpropertysold (eg , realestate, (b Howacquired (c) Dateacquired (d) Datesold 2-storybuckwarehouse,orcommon stock, 200shs MLCCo) D-PDuorncathiaosne (mo,day,yr) (mo ,day,yr) la CALL 320 ITT EDUCATIONAL SER DUE 07/18/09 P 07/20/09 01/09/09 b 22 DNP SELECT INCOME FUND P 01/02/08 07/09/09 c CALL 130 ITT EDUCATIONAL SER P 04/19/10 09/09/09 d 10 DNP SELECT INCOME FUND P 01/02/08 05/07/10 e n (e)Gross sales price (t) Depreciation allowed (g)Cost orother basis (h)Gain or(loss) (orallowable) plusexpense ofsale (e)plus (f)minus (g) a 193,274. o 193,274. b 550,000. 550,432. -432. c 132,850. 132,850. i d 250,032. 250,196. -164. t e a Completeonlyforassets showing gain incolumn (h)and owned bythefoundation on 12/31/69 (I)Gains(Col (h)gain minus col (k), butnotlessthan -0-)or (j)Adjusted basis (k) Excess ofcol (1) (I) FMV as of12/31/69 as of 12/31/69 overcol (1),ifany u Losses (fromcol (h)) a 193,274. n b -432. o C l 132,850. - d d a -164. d A e r Ifgain, alsoenterin Part I,line7v o 2 Capital gain netincome or(netcapital loss) If(loss),enter-0-in PartI,line7 2 325 , 528. s s 3 Netshort-termcapitalgain or(loss)asdefined insections 1222(5)and (6) E e Ifgain,alsoenterin PartI,line8,column (c) r p If(loss),enter-0-in Part I,line8 3 N/A m Part Y ] Qualification Under Section 4940(e) for Reduced Tax on Net Investment Income o (Foroptional usebydomestic privatefoundations subjecttothe section 4940(a)tax on netinvestment income ) C s Ifsection4940(d)(2)applies,leavethis partblank :N Wasthefoundation liable forthesection 4942taxonthedistrsibutable amount ofanyyearinthebasepenod7 0 Yes 0 No O If"Yes°thefoundation does notqualifyundersection 4940(e) Do notcompletethis part IT 1 Entertheaoorooriate amount ineachcolumnforeachyear, see instructions before making anyentries A e U Base peraiod years (b) (c) Distribution ratio Calendaryear(ortaxyearbeginning in) qualifying distributions Netvalue ofnoncharitable-useassets (col (b)divided bycol (c)) L 2008 r 1,286,484. 4,766,779. .269885 A 2007 36,411. 3,534,367. .010302 V 2006 p 0. 753, 067. .000000 E 2005 0. 0. .000000 2004 0. 0. .000000 x 2 Total ofline 1,column (d) 2 .280187 E 3 Averagedistribution ratioforthe5-yearbaseperiod -dividethetotal on line 2by5,orbythe numberofyears thefoundation hasbeen in existenceiflessthan5years 3 . 056037 4 Enterthenetvalue ofnoncharitable-useassetsfor 2009from PartX,line 5 4 5,541,166. 5 Multiplyline4byline 3 5 310,510. 6 Enter 1% ofnetinvestmentincome (1% ofPart I,line 27b) 6 3 , 727 . 7 Add lines5and 6 7 314,237. 8 Enterqualifying distributions from PartXII,line4 8 6, 820,500. Ifline 8isequaltoorgreaterthan line7,checkthe boxin PartVI,line 1b,and completethatpartusing a 1%taxrate Seethe PartVI instructions 923521 02-02-10 Form990-PF (2009) CHAMPAGNE FAMILY CHARITABLE TRUST Form990-PF(2009) C/O L M HENDERSON & COMPANY LLP 20-6262204 Page4 Part V1 Excise Tax Based on Investment Income (Section 4940(a), 4940(b), 4940(e), or 4948 - see instructions) 1a Exemptoperating foundations described insection 4940(d)(2),checkhere ► 0 and enter'N/A'on line 1 Date ofruling ordetermination letter (attach copy ofletter ifnecessary-see instructions) b Domesticfoundations thatmeetthesection4940(e) requirements in PartV,check here ► OX and enter 1% 1 3,727. ofPart I,line27b c All otherdomesticfoundations enter2% ofline27b Exemptforeign organizations enter4% ofPart I,line 12,col (b) 2 Taxundersection 511 (domestic section 4947(a)(1)trusts andtaxablefoundationsonly Othersenter-0-) 2 0 3 Add lines 1 and 2 n3 3,727. 4 SubtitleA(income)tax(domesticsection4947(a)(1)trustsandtaxablefoundationsonly Othersenter-0-) 4 0 5 Taxbased on investment income Subtractline4fromline 3 Ifzeroorless,enter-0- 5 3, 727 . o 6 Credits/Payments a 2009 estimated taxpayments and 2008 overpaymentcreditedto2009 6a 1,083. b Exemptforeign organizations -taxwithheld atsource 6b i c Taxpaid with applicationforextension oftimetofile (Form8868) 6c t7,000. d Backupwithholdingerroneouslywithheld 6d a 7 Totalcredits and payments Add lines 6athrough6d 7 8,083. 8 Enteranypenaltyforunderpayment ofestimated tax Checkhere 0 ifForm 2220 isattached 8 8 9 Taxdue Ifthetotal oflines 5and 8is morethan line 7,enter amountowed u ► 9 10 Overpayment. Ifline7ismorethanthetotaloflines5and 8,enterthe amount overpaid ► 10 4,348. n 11 Entertheamountofline 10to be Credited to2010 estimated tax ► 4 34 8 . Refunded ► 11 0 o Part V11-A Statements Regarding Activities l -d la Duringthetaxyear,didthefoundation attemptto influence anynational, state, orlocal leagislation ordid itparticipate orintervene in Yes No d A anypolitical campaign? 1a X b Did itspend morethan $100duringtheyear(eitherdirectlyorindirectly)forpolitivcal purposes (see instructions fordefinition)? 1b X ro Iftheansweris "Yes" to1a orlb, attachadetaileddescription oftheactivitiesandcopiesofanymatenalspublishedor s s distributedbythefoundation in connection with theactivities E e c Didthefoundation file Form1120-POLforthisyear? 1c X r p d Entertheamount (ifany) oftaxon politicalexpenditures (section 4955)imposed duringtheyear m (1) Onthefoundation ► $ 0. (2) Onfoundation managers ► $ 0 o e Enterthe reimbursement (ifany) paid bythefoundation during theyearforpolitical expendituretax imposed onfoundation C managers ► $ 0 s : 2 Hasthefoundation engaged inanyactivitiesthat have notpreviously been reportedtothe IRS? 2 X N If "Yes,"attach adetaileddescnptionoftheactivisties O 3 Hasthefoundation madeanychanges,not previously reported tothe IRS,in itsgoverning instrument,articles ofincorporation, or IT bylaws,orothersimilarinstruments? If "Yes,"attach aconformedcopyofthechanges 3 X A e 4a Didthefoundation haveunrelated businessgross income of$1,000 ormoreduringtheyear? 4a X U b If'Yes'has itfiled ataxreturn on Form990-Tforthisyear? N/A 4b L A 5 Wastherea liquidation,termination,dissorlution, orsubstantialcontraction during theyear? 5 X V If "Yes,"attach thestatementrequiredbyGeneralInstruction T p E 6 Are the requirements ofsection508(e)(relatingtosections4941 through 4945)satisfied either • Bylanguage inthegoverning instrument, or • Bystate legislationthateffexctivelyamendsthegoverning instrument sothat nomandatorydirectionsthatconflictwiththe statelaw remain inthegoverning instrument? 5 X 7 Didthefoundation haveEatleast$5,000 inassetsatanytimeduringtheyear? 7 X If "Yes,"completePartll, col (c), andPartXV 8a Enterthestatestowhich thefoundation reports orwithwhich itis registered (see instructions) ► IN b Iftheansweris"Yes"to line 7,has thefoundation furnished acopyofForm990-PFtotheAttorneyGeneral (ordesignate) ofeach stateas required byGeneralInstruction G9If "No,"attach explanation Bb X 9 Isthefoundation claiming statusasa private operating foundation within themeaning ofsection4942(l)(3)or4942(j)(5)forcalendar year2009 orthetaxableyearbeginning in 2009 (seeinstructionsfor PartXIV)? If "Yes," complete PartXIV 9 X Form990-PF (2009) 923531 02-02-10 4 CHAMPAGNE FAMILY CHARITABLE TRUST Form 990-4 (2009) C/O L M HENDERSON & COMPANY LLP 20-6262204 Page 5 Part V11-A Statements Regarding Activities (continued) 11 Atanytimeduring theyear,didthefoundation,directlyorindirectly,ownacontrolled entitywithinthemeaning of section512(b)(13)' It'Yes,'attach schedule (seeinstructions) I 11 X 12 Didthefoundation acquireadirectorindirect interestinanyapplicable insurance contract before August 17,20089 12 X 13 Didthefoundation complywiththe public inspection requirementsforitsannual returns andexemption application? 13 X Website address ► NONE 14 Thebooksareincare of ► L M HENDERSON & COMPANY LLP Telephone no ►n( 317) 566-1000 Locatedat ► 450 E 96TH ST STE 200, INDIANAPOLIS, IN ZIP+4 ► 46240-3797 15 Section 4947(a)(1)nonexemptcharitabletrustsfiling Form990-PFin lieu ofForm1041 -Checkhere ► 0 o andentertheamount oftax-exemptinterest received oraccrued duringtheyear ► 15 N/A Part VU-B Statements Regarding Activities for Which Form 4720 May Be Required FileForm 4720 ifanyitem ischecked inthe "Yes" column, unless an exception applies. i Yes No- la Duringtheyeardidthefoundation (eitherdirectlyorindirectly) t (1) Engage inthesale orexchange,orleasing ofpropertywith adisqualified person? 0 Yes 0 No a (2) Borrow moneyfrom,lend moneyto,orotherwiseextend creditto (oracceptitfrom) adisqualified person? 0 Yes 0 No (3) Furnishgoods,services,orfacilitiesto (oracceptthemfrom)adisqualified person? u 0 Yes L1 No (4) Paycompensation to,orpayor reimbursetheexpenses of,adisqualified person' 0 Yes EXI No n (5) Transferanyincome orassetstoadisqualified person (ormakeanyofeitheravailable o l - forthebenefitoruseofadisqualified person)? LI Yes No d (5) Agreeto pay money orpropertytoagovernmentofficial? (Exception Check'No' a d A ifthefoundation agreedto make agranttoortoemploythe officialfora period after termination ofgovernmentservice,ifterminating within 90days ) v LI Yes 0 No ro b Ifanyansweris'Yes"to la(1)-(6),did anyoftheactsfadtoqualityundertheexceptionsdescribed in Regulations s section534941(d)-3 orinacurrent notice regarding disasterassistance (sEee page 20 ofthe instructions)? N/A 1b se Organizations relying onacurrent notice regarding disasterassistancecheck here ► LI r p c Didthefoundationengage in a prioryearin anyoftheactsdescribed in la,otherthan excepted acts,thatwere notcorrected m beforethefirstdayofthetaxyearbeginning in 2009' lc X o 2 Taxes onfailuretodistributeincome(section 4942) (does notapplyforyearsthefoundation was a private operatingfoundation C defined in section 4942(l)(3)or4942(l)(5)) s : a Attheend oftaxyear2009,didthefoundation haveanyundistributed income (lines 6dand6e, PartXIII)fortaxyear(s)beginning N before 2009' s LI Yes 0 No O If"Yes,"listtheyears ► IT b Arethereanyyears listed in 2aforwhichthefoundation isnotapplyingthe provisions ofsection 4942(a)(2) (relatingto incorrect A e valuation ofassets)totheyear's undistributed income? (Ifapplying section 4942(a)(2)to allyears listed,answer'No'andattach U statement -see instructions ) N/A 2b L A c Ifthe provisions ofsection 4942(a)(2)arerbeingappliedto anyoftheyears listed in 2a, listtheyears here V p E 3a Didthefoundation hold morethan a 2%directorindirect interest in any business enterpriseatanytime during theyear? 0 Yes No b If"Yes,did ithaveexcess busxiness holdings in 2009 asa result of(1)anypurchase bythefoundation ordisqualified persons after May26, 1969, (2)thelapse ofthe5-year period (orlongerperiod approved bythe Commissioner undersection 4943(c)(7))todispose ofholdingsacquired bygift orbequest,or(3)the lapse ofthe 10-, 15-, or20-yearfirstphase holding period?(UseScheduleC, E Form4720, to determineifthefoundation hadexcessbusiness holdingsin2009) N/A 3b 4a Didthefoundation investduringtheyearanyamount ina mannerthatwouldjeopardize itscharitable purposes? 4a X b Didthefoundation makeanyinvestment in a prioryear(butafter December31, 1969)thatcouldjeopardize itscharitable purposethat had notbeen removed fromjeopardy beforethefirstdayofthetaxyearbeginning in 2009' 4b X Form990-PF(2009) 923541 02-02-10 5 CHAMPAGNE FAMILY CHARITABLE TRUST Form 990-P 2009 C/O L M HENDERSON & COMPANY LLP 20-6262204 Pa e6 PartV!1-B Statements Regarding Activities for Which Form 4720 May Be Required (continued) 5a Duringtheyeardidthefoundation payorincuranyamountto (1) Carry on propaganda,orotherwise attempttoinfluence legislation (section4945(e))? Yes No (2) Influencetheoutcomeofanyspecificpublicelection (seesection4955),ortocarryon,directlyorindirectly, anyvoter registrationdrve? Yes No (3) Provide agranttoan individual fortravel,study,orothersimilarpurposes? Yes 0 No (4) Provide a granttoan organization otherthan a charitable, etc ,organizationdescribed insection 509(a)(1), (2), or(3), orsection 4940(d)(2)? O Yes No (5) Provideforanypurpose otherthan religious,chartable,scientific, literary,oreducational purposes, orfor n theprevention ofcrueltytochildren oranimals? 0 Yes No b Ifanyansweris'Yes'to5a(1)-(5),did any ofthetransactionsfailtoqualityundertheexceptionsdescribed in Regulations section534945orin acurrent notice regarding disasterassistance (see instructions)? o N/A 5b Organizations relying onacurrent notice regarding disasterassistance check here c Iftheansweris'Yes'toquestion 5a(4),doesthefoundation claimexemption fromthetaxbecause itmaintained i expenditure responsibility forthegrant? N/tA 0 Yes ED No If "Yes,"attach thestatementrequiredbyRegulationssection 534945-5(d) a 6a Didthefoundation,duringtheyear, receive anyfunds,directlyorindirectly,topaypremiumson a personal benefitcontract? El Yes FRI No b Didthefoundation,duringtheyear, paypremiums,directlyorindirectly, ona personalbenefitcontruact? 6b X If "Yes" to 6b, fileForm 8870 n 7a Atanytimeduring thetaxyear, was thefoundation a partytoa prohibitedtaxsheltertransaction? 0 Yes 0 No o b Ifyes,didthefoundation receiveanyproceeds orhaveanynet Incomeattributable tothetrlansaction? N/A 7b -d Information About Officers, Directors, Trustees, Foaundation Managers, Highly d Part VIII Paid Employees, and Contractors A 1 List allofficers, directors, trustees,foundation managers andtheircompensation. r v o a)Nameandaddress ho(ub)rsTiptleer,waenedkavdeervaogteed (c) CItonmoptenpsaaidti,on e(mdp)lCaonndtdnbeebtnueerbfrleolnlsatnos ac(ec)ouEnxt,peontsheer ss E toposition (enter-0-) compssatin allowances e RENE R CHAMPAGNE TRUSTEE r p 1809 S INLET DR m MARCO ISLAND, FL 34145-5984 0.00 0. 0. 0. o TERESA I CHAMPAGNE TRUSTEE C 1809 S INLET DR s : MARCO ISLAND, FL 34145-5984 0.00 0. 0. 0. N RANDY D CHAMPAGNE s TRUSTEE O 233 SYCAMORE DR I T WESTWOOD, MA 02090-3232 0.00 0. 0. 0. A e SCOTT A CHAMPAGNE TRUSTEE U 10487 GREENWAY DR L FISHERS , IN 46037-937r0 0.00 0. 0. 0. A V 2 Compensationoffive highest-paid employees (otherthanthoseincluded on line1). Ifnone, enter "NONE." p (b)Title,and average d)Conmbubonsto (e) Expense E (a) Name and address ofeach employee paid morethan $50,000 hours perweek (c)Compensation empadte17lans account, other devotedtoposition compensation allowances NONE x E Total numberofotheremployees paid over$50,000 10. 1 0 Form990-PF(2009) 923551 02-02-10 6 CHAMPAGNE FAMILY CHARITABLE TRUST _N 0 Form990-PF (2009) C/O L M HENDERSON & COMPANY LLP 20-6262204 Page 7 Information About Officers, Directors, Trustees, Foundation Managers, Highly Part V111 Paid Employees, and Contractors (continued) 3 Five highest-paidindependentcontractors forprofessional services. Ifnone, enter "NONE." (a)Name andaddressofeachperson paid morethan $50,000 (b)Typeofservice (c)Compensation NONE n o i t Total numberofothers receivin over$50,000forprofessional services ► 0 a Part IX-AI Summary of Direct Charitable Activities Listthefoundation'sfourlargestdirectcharitableactivitiesduringthetaxyear Include relevantstatisticalinformation such asthe Expenses number oforganizations and otherbeneficiariesserved,conferences convened, research papers produceud, etc i N/A n o l - d a d 2 A r v o 3 s s E e r p 4 m o C Part IX-B Summary of Program-Related Invsestments : Describethetwo largest program-related investments madebythefoundation duringthetaxyearon lines 1 and 2 Amount N 1 N/A s O I T A e 2 U L A r V Allotherprogram-related investments Seeinstructions p E 3 x Total. Add lines 1 through 3 ► 0 Form990-PF (2009) E 923561 02-02-10 7 CHAMPAGNE FAMILY CHARITABLE TRUST Form990-PF(2009) C/O L M HENDERSON & COMPANY LLP 20-6262204 Page8 RaltJ( Minimum Investment Return (All domestic foundations must complete this part. Foreign foundations, see instructions.) 1 Fairmarketvalue ofassets not used (orheldforuse)directlyin carrying outcharitable,etc ,purposes a Averagemonthlyfairmarketvalue ofsecurities 1a 4,629,299. b Averageofmonthlycash balances 1b 996,250. c Fairmarketvalue ofallotherassets 1c d Total (add lines la,b,andc) ld 5, 625,549 . e Reduction claimed forblockage orotherfactors reported on lines 1aand n tc(attach detailedexplanation) le 0 2 Acquisition indebtedness applicabletoline 1 assets 2 0 3 Subtractline 2fromline 1d o3 5,625,549 . 4 Cash deemed held forcharitableactivities Enter 1 1/2% ofline 3 (forgreateramount,seeinstructions) 4 84 , 383 . 5 Netvalue ofnoncharitable-use assets. Subtract line4fromline 3 Enterhereand on PartV,line4 i5 5,541,166 . 5 Minimum investment return. Enter5% ofline5 t 6 277 , 058 . Part x Distributable Amount (seeinstructions)(Section 4942(1)(3) and (1)(5) private operatingfoundations andcertain a foreign organizationscheck here ► 0 anddonotcompletethis part ) 1 Minimuminvestment return from PartX, line6 1 277,058. 2a Taxon investmentincomefor2009from PartVI, line5 2a u 3,727 . b Incometaxfor2009 (Thisdoes notincludethetaxfrom PartVI) 2b n c Add lines 2a and 2b 2c 3 , 727 . o 3 Distributable amountbefore adjustments Subtract line2cfromline 1 l 3 273 ,33 1 . -d 4 Recoveries ofamountstreated as qualifying distributions a 4 0 . d A 5 Add lines 3and 4 5 2 73, 331 . r 6 Deductionfromdistributableamount (seeinstructions) v 6 0 o 7 Distributable amountasadjusted Subtractline6from line5 Enterhereand on PartXIII line 1 7 273 , 331 . s s PartXII Qualifying Distributions (seeinstructions) E e r p 1 Amounts paid (including administrative expenses)toaccomplish charitable,etc ,purposes m a Expenses,contributions,gifts, etc -totalfrom PartI,column (d), l ine 26 la 6,820,500. o b Program-related investments -totalfrom PartIX-B 1b 0 C 2 Amounts paid toacquire assets used (orheldforuse)directlyisncarrying outcharitable,etc ,purposes 2 : 3 Amounts setasideforspecificcharitable projectsthat satisfythe N a Suitabilitytest(prior IRS approval required) s 3a O b Cashdistributiontest(attach the required schedule) 3b IT 4 Qualifying distributions.Add lines lathrough 3b Enterhereand on PartV,line8,and PartXIII, line4 4 6,820,500. A e 5 Foundations that qualityundersection 4940(e)forthe reduced rate oftaxon netinvestment U income Enter 1% ofPartI,line27b 5 3 , 727. L A 6 Adjusted qualifying distributions Subtracrtline5fromline4 6 6,816,773. V Note. Theamount on line6will be used in PartV,column (b),in subsequentyearswhen calculating whetherthefoundation qualifiesforthesection p E 4940(e) reduction oftaxinthoseyears Form990-PF(2009) x E 923571 02-02-10 8 CHAMPAGNE FAMILY CHARITABLE TRUST Form990-PF(2009) C/O L M HENDERSON & COMPANY LLP 20-6262204 Page9 Part Xl[I Undistributed Income (seeinstructions) (a) (b) (c) (d) Corpus Years priorto2008 2008 2009 1 Distributable amountfor2009from PartXI, 273,331. line7 2 Undistributed income, ifany,asoftheendof2009 a Enteramountfor2008only n0. bTotalforprioryears 0. o 3 Excess distributionscarryover, ifany,to2009 aFrom2004 bFrom2005 i c From2006 t dFrom2007 a eFrom2008 895 043. 895,043. f Totaloflines 3athrough e 4 Qualifying distributions for2009from u PartXll,line 4 6,820,500. n aApplied to 2008,butnotmorethan line 2a 0. o l - bApplied to undistributed income ofprior d years (Election required -see instructions) ... ..........a.... ... ...0..... ...... ................... . ... .... .... d A cTreated asdistributions outofcorpus (Election required -seeinstructions) 0. v ro 273,331. dApplied to 2009distributable amount s 6,547,169. s eRemaining amountdistributed outofcorpus 0.E 0. e 6 Excessdistributionscarryoverappliedto2009 r (itanamountappearsIncolumn(d),thesameamount p mustbeshownincolumn(a)) m 6 Enterthe nettotal ofeach column as o indicated below C aCorpus Addlines3f,4c,and4e Subtractline5 7,44s2,212. : bPrioryears' undistributed income Subtract N line4bfromline 2b s 0. O c Entertheamount ofprioryears' IT undistributed incomeforwhicha notice of A deficiency has been issued,oron which e U thesection 4942(a)taxhas been previously assessed 0. L A dSubtract line6cfrom line6b Taxable r 0. V amount -see instructions p E eUndistributed incomefor2008 Subtract line 0. 4afromline 2a Taxableamount -see instr f Undistributed incomefor2009xSubtract lines4d and 5fromline 1 This amount must 0. bedistributed in 2010 E 7 Amountstreated asdistributions outof corpustosatisfy requirements imposed by section 170(b)(1)(F) or4942(g)(3) 0. 8 Excess distributions carryoverfrom2004 notapplied on line5 orline7 0. 9 Excess distributions carryoverto2010 Subtract lines 7and 8fromline6a 7,442,212. 10 Analysis ofline 9 aExcessfrom2005 bExcessfrom2006 c Excess from2007 dExcess from2008 895,043. eExcess from2009 6,547,169. Form990-PF(2009) 923581 02-02-10 9 CHAMPAGNE FAMILY CHARITABLE TRUST Form990-PF 2009) C/O L M HENDERSON & COMPANY LLP 20-6262204 Page10 1 PartXFV Private Operating Foundations (seeinstructions and Part VII-A, question 9) N/A 1 a ifthefoundation has received a ruling ordetermination letterthatitisa private operating foundation, andthe ruling is effective for2009,enterthedate ofthe ruling 110- b Checkboxtoindicatewhetherthefoundation isaprivate operatingfoundation described in section 4942(1)(3) or El 4942(j)(5) 2 a Enterthelesseroftheadjusted net Taxyear Prior3years incomefrom PartI orthe minimum (a)2009 (b) 2008 (c)2007 (d) 2006 (e)Total investment returnfrom PartXfor eachyearlisted n b 85% ofline 2a c Qualifyingdistributionsfrom PartXII, o line4foreachyearlisted d Amounts included inline 2cnot used directlyforactiveconductof i exemptactivities t e Qualifyingdistributions madedirectly a foractiveconductofexemptactivities Subtract line 2dfrom line2c Complete 3a, b, orcforthe u alternativetestrelied upon a 'Assets'alternativetest-enter n (1) Valueofallassets o l - (2) Value ofassets qualifying d undersection4942(t)(3)(B)(i) a d A b 'Endowment"alternativetest-enter 2/3 ofminimuminvestment return r shown in PartX,line6foreach year v o listed s s c 'Support'alternativetest-enter E e (1) Totalsupport otherthan gross r p investmentincome (interest, m dividends, rents,payments on securitiesloans (section o 512(a)(5)), orroyalties) C (2) Supportfromgeneral public s and 5 ormoreexempt :N organizationsas provided in section4942(I)(3)(B)(ui) s O (3) Largestamount ofsupportfrom IT an exemptorganization A e (4) Gross investment income U Part XV Supplementary Information (Complete this part oonnlly ifthe foundation had $5,000 or more in assets L at any time during the year-see the instructions.) A r V 1 Information Regarding Foundation Managers: p E a Listanymanagers ofthefoundation who havecontributed morethan 2% ofthetotalcontributions received bythefoundation beforetheclose ofanytax year(butonlyiftheyhavecontributed morethan $5,000) (See section 507(d)(2) ) SEE STATEMENT 7 x b Listanymanagers ofthefoundation whoown 10% ormore ofthestock ofacorporation (oran equallylarge portion ofthe ownership ofa partnership or otherentity) ofwhich thefoundation hasa 10% orgreaterinterest E NONE 2 Information RegardingContribution, Grant, Gift, Loan,Scholarship, etc., Programs: Check here 0 ifthefoundation only makes contributions topreselected charitable organizationsand doesnotacceptunsolicited requestsforfunds If thefoundation makesgifts,grants, etc (see instructions) toindividuals ororganizationsunderotherconditions, complete items 2a,b,c,andd a The name,address,andtelephone numberofthe person towhomapplications should beaddressed b Theforminwhichapplicationsshould besubmitted and information and materials theyshould include c Anysubmission deadlines d Any restrictions orlimitations on awards, such as bygeographical areas,charitable fields, kinds ofinstitutions, orotherfactors 923601 02-02-10 Form990-PF(2009) 10

Description: