Table Of ContentDOCUMENT RESUME

CE 067 040

ED 373 206

Financing the Business. Unit 11. Level 1. Instructor

TITLE

Guide. PACE: Program for Acquiring Competence in

Entrepreneurship. Third Edition. Research &

Development Series No. 301-11.

Ohio State Univ., Columbus. Center on Education and

INSTITUTION

Training for Employment.

PUB DATE

94

29p.; For the complete set, i.e., 21 units, each done

NOTE

at three levels, see CE 067 029-092. Supported by the

International Consortium for Entrepreneurship

Education, the Coleman Foundation, and the Center for

Entrepreneurial Leadership Inc.

Center on Education and Training for Employment, 1900

AVAILABLE FROM

Kenny Road, Columbus, OH 43210-1090 (order no.

RD301-11 IG, instructor guide $4.50; RD301-11 M,

student module, $3; student module sets, level

1--RD301M, level 2--RD302M, level 3--RD303M, $45

each; instructor guide sets, level 1--RD301G, level

2--RD302G, level 3--RD303G, $75 each; 3 levels and

resource guide, RD300G, $175).

Teaching Guides (For

Classroom Use

PUB TYPE

Guides

Classroom Use

Guides

Teacher)

(052)

Instructional Materials (For Learner)

(051)

MF01/PCO2 Plus Postage.

EDRS PRICE

Behavioral Objectives; *Business Education;

DESCRIPTORS

*Competency Based Education; *Credit (Finance);

*Entrepreneurship; Financial Needs; Learning

Activities; Loan Default; Money Management;

Postsecondary Education; Secondary Education; *Small

Businesses; Student Evaluation; Teaching Guides

*Business Finance; *Program for Acquiring Competence

IDENTIFIERS

Entrepreneurship

ABSTRACT

This instructor guide for a unit on business

financing in the PACE (Program for Acquiring Competence in

Entrepreneurship) curriculum includes the full text of the student

module and lesson plans, instructional suggestions, and other teacher

into this module

resources. The competencies that are incorporated

of learning--understanding the creation and operation

are at Level

1

of a business. Included in the instructor's guide are the following:

unit objectives, guidelines for using PACE, lists of teaching

suggestions for each unit objective/subobjective, model assessment

The

responses, and overview of the three levels of the PACE program.

following materials are contained in the student's guide: activities

to be completed in preparation for the unit, unit objectives, student

reading materials, individual and group learning activities, case

study, discussion questions, assessment questions, and references.

Among the topics discussed in the unit are the following: the

importance of financing to a new business' success, reasons financing

is needed, personal risks involved in financing businesses, sources

of equity financing, sources for borrowing money, financial

statements included in business plans, the importance of a good

(MN)

credit rating, and ways lenders evaluate loan applications.

r

I

UNIT 11

LEVEL 1

Unit 11

Financing the Business

Level 1

HOW TO USE PACE

If a student

Use the objectives as a pretest.

is able to meet the objectives, ask him or

her to read and respond to the assessment

PACE

questions in the back of the module.

Progratin for Acquiring

Competence in

Entrepreneurship

Duplicate the glossary from the

.THIRD EDITION

Resource

to use as a handout.

Guide

,A1M),

CENTER ON EDUCATOR

\ '''l

AND TIUJIING FOR EMPLOYMENT

COLLEGE OF EDUCATOR

`,44.:4

II., 1,;)n

It

ttttt

h

nar do, STMT[ umn/Fa,r,

Use the teaching outlines provided in the

for assistance in focusing

Instructor Guide

left side of

your teaching delivery.

Objectives:

each outline page lists objectives with the

corresponding headings (margin questions)

from the unit. Space is provided for you to

Discuss the personal risks involved in financing the

add your own suggestions. Try to increase

business.

student involvement in as many ways as

foster an interactive learning

possible tc

process.

Explain the difference between operating expenses and

When your students are ready to do the

start-up costs.

assist them in selecting those

Activities,

that you feel would be the most beneficial

to their growth in entrepreneurship.

Describe methods of financing a new business.

Assess your students on the unit content

when they indicate they are ready.

You

may choose written or verbal assessments

Model re-

the situation.

according

to

sponses are provided for each module of

Discuss the importance of having a good credit rating.

While these are suggested

each

unit.

US DEPARTMENT OF EDUCATION

PERMISSION TO REPRODUCE THIS

tOt

ATiOtiiAl. RESOURCES INFORMATION

responses, others may be equally valid.

MATERIAL HAS BEEN GRANTED BY

CT NTER ERIC.

/T

his document lt,is teen

received Irom the peri,on nr modnizittin

(

originating if

I !

U Minor clianues 11,151 teen made in

improve reproduction dibtl ly

2

F.D! F

PEST C.rry

Fro,tr., of view or opinions slated in itiis

TO THE EDUCATIONAL RESOURCES

dui ornpnt do not nocostemly lepresent

INFORMATION CENTER (ERIC).

official OERI prniition of policy

Teaching Suggestions

Objectives

1. DISCUSS THE PERSONAL

RISKS INVOLVED IN

FINANCING THE BUSINESS

Emphasize the

Introduce the concept of business financing.

How important is financing to the

importance of planning for financing to ensure successful busi-

success of a new business?

ness operations.

Invite a local entrepreneur to speak about personal risks involved

What personal risks are involved

in financing his/her business.

in financing the business?

2. EXPLAIN THE DIFFERENCE

BETWEEN OPERATING

EXPENSES AND START-UP

COSTS

Define start-up costs and operating expenses. Use a chalkboard

What do you need the money for?

or an overhead to show examples of each. Help students under-

stand what personal expenses are and explain why entrepreneurs

need to evaluate these expenses prior to starting a business.

3. DESCRIBE METHODS OF

FINANCING A NEW BUSINESS

Define the concepts of equity financing and debt financing.

Where do you get the money for

IT tart the discussion by reminding students of the fundamental

financing a new business?

equality underlying the balance sheet (i.e., Assets = Liabilities +

Owner's Equity). Use a simplified approach to explain debt fi-

nancing and equity financing based on this equation (e.g., to pur-

chase assets, the business "uses up" its debt or equity).

Review the new concepts introduced in this unit. Show a chart

What are the sources of equity fi-

with methods of equity financing. Keep your explanations sim-

nancing?

ple to help students understand the meaning of the terms.

If

students have difficulties in grasping the meanings of the con-

cepts, reuse the fundamental equation mentioned above to sim-

plify your explanations.

Invite a local hanker to speak about ways used by banks to ap-

What are the sources for borrow-

prove loans. Encourage the hanker to speak about other sources

ing money?

In addition, the

of financing banks compete with in the market.

banker should explain what loans banks offer to businesses com-

pared to what other financing companies offer.

Teaching Suggestions

Objectives

Use a chart to explain franchises, trade credit, and factors as

Are there other sources of financ-

Explain the differences among

additional sources of financing.

ing?

these sources by using simple examples. Use a chart to show

what financial information should be included in the business

plan (i.e., balance sheet, income statement, cashflow statement,

ee this money

start-up costs, etc.). Explain why lenders need tc

before approving loans.

Define income statement in simple terms and review how it

What is an income statement?

Explain what kind of information the in-

should be developed.

come statement provides lenders.

Use the income statement developed previously to explain how

What is a cashflow statement?

cashflow statement is derived (i.e., cash disbursements are sub-

Make sure students under-

tracted from sources of cash, etc.).

stand how the cumulative cashflow is computed (i.e., Pre-operat-

ing cashflow = Sources of cash + Cash on hand

Start-up costs;

Monthly cumulative cashflow = Previous month cashflow +

cashflow generated in that month).

Explain the meaning of various ac-

What is the balance sheet?

Use the above approach.

counting entries in the balance sheet (e.g., current and fixed

assets, depreciation, etc.). Show how Equipment, Net of Depre-

ciation is computed (i.e., as the difference between Equipment &

Also, explain the equation Net

Fixtures and Depreciation).

Equity = Beginning Equity + Retained Earnings - Withdrawals).

4. DISCUSS THE IMPORTANCE

OF HAVING A GOOD CREDIT

RATING

important to have a

Why is

Have the hanker speak about the importance of having a good

it

good credit rating?

credit rating.

The banker should explain to stu-

How do lenders evaluate loan ap-

Use the above suggestion.

dents what criteria are used by banks to evaluate loan appli-

plications?

cations.

What are the six C's of credit

Use a chart to explain the six C's of credit evaluation.

evaluation?

4

MODEL ASSESSMENT RESPONSES

Personal risks involved in financing a business are (1) the inability of earning adequate funds from opera-

1.

tions to cover living expenses, (2) risks associated with pledging personal assets, such as savings, automo-

bile, home, etc. to obtain a loan (3) significant amount of stress due to potential family misunderstanding,

and (4) possible personal credit rating changes as a result of business failure.

Operating expenses are expenses associated with running a business. They include utilities, insurance, sal-

2.

aries, taxes, advertising, supplies, rent, and other expenses necessary to keep the business going. Start-up

costs are costs associated with starting a business. They include equipment, fixtures, starting inventory, real

estate, one-time advertising for grand opening, and other purchases entrepreneurs need to make to open the

doors of their businesses.

There are two basic forms of financing a business: equity and debt financing. Equity financing includes

3.

the personal savings of the owner, investments in the business made by family and friends, or funds ob-

Debt financing refers to venture capital or loans

tained from selling a part of the business to others.

obtained by entrepreneurs from private and public investors and lenders, including SBA. Examples of loans

include commercial and consumer loans, home equity loans, direct loans offered by SBA, revolving loans

(offered by communities), etc.

It is important to maintain a good credit rating to convince lending institutions to approve loans. Good

4.

credit ratings also help entrepreneurs who desire to invest in franchises. The franchisors accept only fran-

chisees with excellent credit rating. Moreover, suppliers and potential customers consider the credit rating

p

of the business before deciding to close deals.

Program for Acquiring

?CA

0.,4".;

Competence in

F.

,c;,):

-

:?7,

,5

Entrepreneurship

v,4

..........

Incorporates the needed competencies for creating and operating a small business at three levels of learning, with experiences and

outcomes becoming progressively more advanced.

Understanding the creation and operation of a business.

Level 1

Planning for a business in your future.

Level 2

Starting and managing your own business.

Level 3

Self-contained Student Modules include: specific objectives, questions supporting the objectives, complete content in form of answers

to the questions, case studies, individual activities, group activities, module assessment references. Instructor Guides include the full text

of each student module and lesson plans, instructional suggestions, and other resources. PACE,Third Edition, Resource Guide includes

teaching strategies, references, glossary of terms, and a directory of entrepreneurship assistance organizations.

For i cformation on PACE or to order, contact the Publications Department at the

Center on Education and Training for Employment, 19(X) Kenny Road, Columbus, Ohio

43210-1090

(614) 292-4353, (8(X)) 848-4815.

Support for PACE, Third Edition provided in whole or in part hy:

The Coleman Foundation

International Consortium for Entrepreneurship Education

and

International Enterprise Academy

Center for Entrepreneurial Leadership Inc.

Center on Education and Training for Employment

Ewing Marion Kauffman Foundation

The Ohio State University

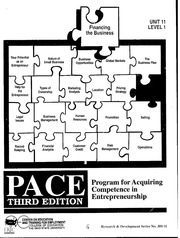

UNIT 11

Financing

LEVEL 1

the Business

Your Potential

Nature of

The

Business

Global Markets

as an

Small Business

Business Plan

Opportunities

Entrepreneur

Help for

Types of

Pricing

Marketing

Location

the

Analysis

Strategy

Ownership

Entrepreneur

Human

Business

Legal

Selling

Promotion

Resources

Management

Issues

Risk

Customer

Financial

Record

Operations

Management

Credit

Analysis

Keeping

Program for Acquiring

Competence in

111

Entrepreneurship

II

CENTER ON EDUCATION

AND TRAINING FOR EMPLOYMENT

COLLEGE OF EDUCATION

Research & Development Series No. 301-11

U

THE OHIO STATE UNIVERSITY

FINANCING THE BUSINESS

. . .

BEFORE YOU BEGIN

Consult the Resource Guide for instructions if this is your first PACE unit.

1.

If you think

on the following page.

Read What are the Objectives for this Unit

2.

your instructor.

you can meet these objectives now, consult

If you need help with the

this unit.

Look for these business terms as you read

3.

the PACE Glossary contained in the

meanings, ask your instructor for a copy of

Resource Guide.

Home equity loan (Second mortgage)

Balance sheet

Mortgage

Bank guaranteed loan

Operating expenses

Cashflow statement

Profit and loss statement

Commercial finance company

Projected cashflow statement

Commercial/Personal loan

Projected income statement

Consumer finance company

Revolving loan fund

Credit union

Savings and loan institutions

Debt financing

Spreadsheet program

Direct loan

Start-up costs

Equity financing

Trade credit

Factor

Venture capital

Financing

Franchise

7

Copyright © 1994, Center on Education and Training for Employment.

The Ohio State University. All rights reserved.

3

FINANCING THE BUSINESS

WHAT ARE THE OBJECTIVES FOR TILLS UNIT?

Upon completion of this unit you will be able to

discuss the personal risks involved in financing a business,

explain the difference between operating expenses and start-up costs,

describe methods of financing a new business, and

a good credit rating.

discuss the importance of having

HOW IMPORTANT IS

WHAT IS THIS UNIT ABOUT?

FINANCING TO THE

SUCCESS OF A NEW

This unit examines the financing necessary

BUSINESS?

Money is needed for

to start a business.

many different reasons. In this unit you will

discover the various expenses involved in

Financing

a new business means getting the

starting a business. Since many people don't

money necessary to start it and to keep it

have enough of their own money to get

Money is the fuel that powers the

going.

started, you will learn where you can go to

Just as a car won't run without

business.

borrow money and obtain other types of fi-

gasoline, neither will a business run without

nancing. People who lend or invest money

money.

will ask for a business plan, which helps

them decide whether it is safe to lend the

Besides the decision to start the business, the

Included in the

money for a new business.

next important decision is how to finance the

business plan is a projected profit-and-loss

business. Too many businesses fail because

statement, cashflow statement, and balance

of the lack of money to get them started and

sheet.

If you were planning a

keep them going.

2,000-mile trip in your car, would you start

out if you only had enough gas money for

the first 500 miles?

Probably not.

Yet,

4

many people do this when they start a busi-

Starting inventory

ness, thus limiting their chances for success.

Deposits for rent, utilities and insurance

If you are going to start a business, it is

coverages

important that you have enough money to

Financing is one of the

complete the trip.

Without it,

keys to a business's success.

Business licenses and permits

your chances of surviving and making a pro-

fit are poor.

Certain legal and accounting fees

Advertising for the grand opening

WHAT DO YOU NEED

THE MONEY FOR?

For example, if you were opening a restaur-

ant, you would have many start-up costs.

You would have to buy tables and chairs for

The first step in financing your business is

your customers to sit on, ovens and fryers to

to determine the need for money. There are

cook your food, all the ingredients to make

many costs and expenses to consider. If you

the items on the menu, and plates, knives,

don't consider all your money needs, then

forks, and spoons. You would also have to

you will start your business without enough

buy or rent a building, pay for a business

Therefore, think very carefully

money.

license and restaurant permit, and get your

about all of the things for which you will

menu printed. And, these are just a few ex-

need money.

penses. Think of all the other start-up costs

you would have.

Three groups of costs and expenses are iden-

tified below to help you think about your

Operating Expenses

money needs. The first group is called start-

up costs. The next group consists of operat-

Operating expenses come after the business

ing expenses. And the third group is called

has been started. They are necessary to get

personal expenses.

the business on its feet and to keep the busi-

ness operating on a daily, weekly, and

Sta -t-up Costs

monthly basis. Many businesses take a few

months to a year or longer to begin to pay

Start-up costs are generally expenses that

for operating expenses and to show a profit.

occur just once when getting the business off

Until there is enough income/revenue from

the ground. Once your business is started,

sales to keep the business running, money

you may not have these expenses again.

be needed for operating expenses.

will

Some examples of start-up costs are the

Some examples of operating expenses are

following:

these:

Furniture, fixtures and equipment

Inventory

5

Repairs to equipment

Food

Supplies

Utilities

Insurance

Transportation

Advertising

Medical bills

Monthly rent

Insurance

Payroll

Entertainment

Many new businesses will not be profitable

Utilities

right away. Sometimes it takes one to three

years for a business to become profitable.

Taxes

The owner of a new business may not make

That is, once your restaurant is open, you

enough from the business to cover personal

will have regular operating expenses. You

living expenses. These expenses should be

will have to buy food, pay the cooks and

included among your money needs. Some-

waitresses, pay sales tax, make monthly rent

times people start a new business while

payments, and much more on a c ,ntinual

working another job, or their spouse earns

is important to determi.ie how

basis.

It

This helps to

money from an outside job.

much money is needed each month to ope-

limit the money needed to cover personal

rate the business.

expenses, thereby reducing the amount of

money for financing the business.

Personal Expenses

Personal expenses are those costs that are

WHAT PERSONAL

necessary for you to live.

When you are

RISKS ARE INVOLVED

employed, the wages you earn would be for

IN FINANCING THE

The money you

your personal expenses.

BUSINESS?

need to start and operate the business is

However, don't overlook the

important.

money you need for personal or living

If

expenses. Here are some examples:

your business is not as successful as you

expect, you may face the following risks.

Rent or mortgage payment

You may not earn adequate living ex-

penses from business operations.

Clothing