DTIC ADA463020: The Budget and Economic Outlook: Fiscal Years 2008 to 2017 PDF

Preview DTIC ADA463020: The Budget and Economic Outlook: Fiscal Years 2008 to 2017

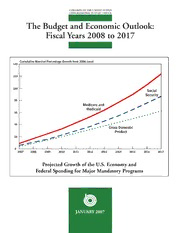

CONGRESS OF THE UNITED STATES CONGRESSIONAL BUDGET OFFICE The Budget and Economic Outlook: Fiscal Years 2008 to 2017 Cumulative Nominal Percentage Growth from 2006 Level 140 120 100 Social Security 80 Medicare and Medicaid 60 40 Gross Domestic Product 20 0 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Projected Growth of the U.S. Economy and Federal Spending for Major Mandatory Programs JANUARY 2007 Report Documentation Page Form Approved OMB No. 0704-0188 Public reporting burden for the collection of information is estimated to average 1 hour per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. Send comments regarding this burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, to Washington Headquarters Services, Directorate for Information Operations and Reports, 1215 Jefferson Davis Highway, Suite 1204, Arlington VA 22202-4302. Respondents should be aware that notwithstanding any other provision of law, no person shall be subject to a penalty for failing to comply with a collection of information if it does not display a currently valid OMB control number. 1. REPORT DATE 3. DATES COVERED JAN 2007 2. REPORT TYPE 00-00-2007 to 00-00-2007 4. TITLE AND SUBTITLE 5a. CONTRACT NUMBER The Budget and Economic Outlook: Fiscal Years 2008 to 2017 5b. GRANT NUMBER 5c. PROGRAM ELEMENT NUMBER 6. AUTHOR(S) 5d. PROJECT NUMBER 5e. TASK NUMBER 5f. WORK UNIT NUMBER 7. PERFORMING ORGANIZATION NAME(S) AND ADDRESS(ES) 8. PERFORMING ORGANIZATION Congressional Budget Office,Ford House Office Building, 4th REPORT NUMBER Floor,Second and D Streets SW,Washington,DC,20515-6925 9. SPONSORING/MONITORING AGENCY NAME(S) AND ADDRESS(ES) 10. SPONSOR/MONITOR’S ACRONYM(S) 11. SPONSOR/MONITOR’S REPORT NUMBER(S) 12. DISTRIBUTION/AVAILABILITY STATEMENT Approved for public release; distribution unlimited 13. SUPPLEMENTARY NOTES The original document contains color images. 14. ABSTRACT 15. SUBJECT TERMS 16. SECURITY CLASSIFICATION OF: 17. LIMITATION OF 18. NUMBER 19a. NAME OF ABSTRACT OF PAGES RESPONSIBLE PERSON a. REPORT b. ABSTRACT c. THIS PAGE 193 unclassified unclassified unclassified Standard Form 298 (Rev. 8-98) Prescribed by ANSI Std Z39-18 Pub. No. 2941 CBO The Budget and Economic Outlook: Fiscal Years 2008 to 2017 January 2007 The Congress of the United States O Congressional Budget Office Notes Unless otherwise indicated, all of the years referred to in describing the economic outlook are calendar years; other years referred to in this report are federal fiscal years (which run from October 1 to September 30). Numbers in the text and tables may not add up to totals because of rounding. Some of the figures in Chapter2 use shaded vertical bars to indicate periods of recession as well as dashed vertical lines to separate actual from projected data. (A recession extends from the peak of a business cycle to its trough.) Supplemental data for this analysis are available on the home page of the Congressional Budget Office’s Web site (www.cbo.gov) under “Current Budget Projections” and “Current Economic Projections.” Preface T his volume is one of a series of reports on the state of the budget and the economy that the Congressional Budget Office (CBO) issues each year. It satisfies the requirement of section 202(e) of the Congressional Budget Act of 1974 for CBO to submit to the Committees on the Budget periodic reports about fiscal policy and to furnish baseline projections of the federal budget. In accordance with CBO’s mandate to provide impartial analysis, the report makes no recommendations. The baseline spending projections were prepared by the staff of CBO’s Budget Analysis Division under the supervision of Robert Sunshine, Peter Fontaine, Janet Airis, Thomas Bradley, Kim Cawley, Paul Cullinan, Jeffrey Holland, and Sarah Jennings. The revenue estimates were prepared by the staff of the Tax Analysis Division under the supervision of Thomas Woodward, Mark Booth, and David Weiner, with assistance from the Joint Commit- tee on Taxation. (A detailed list of contributors to the revenue and spending projections appears in AppendixF.) The economic outlook presented in Chapter2 was prepared by the Macroeconomic Analysis Division under the direction of Robert Dennis, Kim Kowalewski, and John F. Peterson. Robert Arnold and Christopher Williams produced the economic forecast and projections. David Brauer, Ufuk Demiroglu, Richard Farmer (formerly of CBO), Naomi Griffin, Douglas Hamilton, Juann Hung, Kim Kowalewski, Mark Lasky, Angelo Mascaro, Ben Page, and Frank Russek contributed to the analysis. Andrew Gisselquist and Adam Weber provided research assistance. An early version of CBO’s economic forecast was discussed at a meeting of the agency’s Panel of Economic Advisers. At that time, members of the panel were Martin Baily, Richard Berner, Dan Crippen, J. Bradford DeLong, Martin Feldstein, Robert J. Gordon, Robert E. Hall, Douglas Holtz-Eakin, Ellen Hughes-Cromwick, Lawrence Katz, Allan H. Meltzer, Laurence H. Meyer,William D. Nordhaus, June E. O’Neill, Rudolph G. Penner, James Poterba, Robert Reischauer, Alice Rivlin, Nouriel Roubini, and Diane C. Swonk. Raj Chetty, Sherry Glied, Daniel Kessler, and David Zion attended the panel’s meeting as guests. Although CBO’s outside advisers provided considerable assistance, they are not responsible for the contents of this report. Jeffrey Holland wrote the summary. Barry Blom, with assistance from Mark Booth and Eric Schatten, wrote Chapter1 (David Newman compiled Box 1-1). John F. Peterson authored Chapter2. Christina Hawley Anthony wrote Chapter3, with assistance from Eric Rollins and Eric Schatten. Mark Booth authored Chapter4, with assistance from Barbara Edwards, Pamela Greene, Andrew Langan, and Emily Schlect. Ann Futrell, with assistance from Mark Booth, wrote AppendixA. Luis Serna wrote AppendixB (Frank Russek wrote the box) and AppendixC. Andrew Gisselquist and Adam Weber compiled AppendixD, and Ann Futrell prepared AppendixE. Mark Hadley and Eric Schatten produced the glossary. Christine Bogusz, Christian Howlett, Kate Kelly, Loretta Lettner, Leah Mazade, and John Skeen edited the report. Marion Curry, Denise Jordan-Williams, and Linda Lewis Harris assisted in its preparation. Maureen Costantino designed the cover and prepared the report for publication. Lenny Skutnik printed the initial copies, Linda Schimmel handled the print distribution, and Annette Kalicki and Simone Thomas handled the electronic distribution via CBO’s Web site (www.cbo.gov). Peter R. Orszag Director January 2007 Contents Summary xi 1 The Budget Outlook 1 A Review of 2006 3 The Concept Behind CBO’s Baseline Projections 5 CBO’s Baseline Projections for 2007 to 2017 5 The Long-Term Budget Outlook 10 Changes in CBO’s Baseline Since August 2006 11 Uncertainty and Budget Projections 14 The Outlook for Federal Debt 19 Trust Funds and the Budget 22 2 The Economic Outlook 25 The Rise in Interest Rates and the Decline in Housing Construction 27 The Continued Strength in Business Fixed Investment and Net Exports 32 The Slowdown in Consumer Spending 35 The Steady Growth in Government Purchases 36 The Easing of Core Inflation 37 The Outlook Through 2017 40 Projections of Income 42 Changes in the Outlook Since August 2006 44 How CBO’s Forecast Compares with Others 46 3 The Spending Outlook 49 Mandatory Spending 53 Discretionary Spending 65 VI THE BUDGET AND ECONOMIC OUTLOOK: FISCAL YEARS 2008 TO 2017 4 The Revenue Outlook 77 Revenues by Source 79 CBO’s Current Revenue Projections in Detail 80 Changes in CBO’s Revenue Projections Since August 2006 98 The Effects of Expiring Tax Provisions 99 A Changes in CBO’s Baseline Since August 2006 109 B How Changes in Economic Assumptions Can Affect Budget Projections 119 C Budget Resolution Targets and Actual Outcomes 125 D CBO’s Economic Projections for 2007 to 2017 135 E Historical Budget Data 139 F Contributors to the Revenue and Spending Projections 153 Glossary 157 CONTENTS VII Tables S-1. CBO’s Baseline Budget Outlook xii S-2. CBO’s Economic Projections for Calendar Years 2007 to 2017 xvi 1-1. Projected Deficits and Surpluses in CBO’s Baseline 2 1-2. Average Annual Growth Rates of Revenues and Outlays 4 1-3. CBO’s Baseline Budget Projections 8 1-4. Changes in CBO’s Baseline Projections of the Deficit or Surplus Since August 2006 13 1-5. The Budgetary Effects of Selected Policy Alternatives Not Included in CBO’s Baseline 16 1-6. CBO’s Baseline Projections of Federal Debt 20 1-7. CBO’s Baseline Projections of Trust Fund Surpluses or Deficits 23 2-1. CBO’s Economic Projections for Calendar Years 2007 to 2017 26 2-2. Key Assumptions in CBO’s Projection of Potential Output 41 2-3. CBO’s Current and Previous Economic Projections for Calendar Years 2006 to 2016 45 2-4. Comparison of Forecasts by CBO, the Administration, and the Blue Chip Consensus for Calendar Years 2007 to 2012 47 3-1. CBO’s Baseline Spending Projections 50 3-2. Average Annual Rates of Growth in Outlays Since 1995 and in CBO’s Baseline 51 3-3. CBO’s Baseline Projections of Mandatory Spending 55 3-4. Sources of Growth in Mandatory Spending 61 3-5. CBO’s Baseline Projections of Offsetting Receipts 64 3-6. Costs for Mandatory Programs That CBO’s Baseline Assumes Will Continue Beyond Their Current Expiration Dates 66 3-7. Defense and Nondefense Discretionary Outlays, 1985 to 2007 68 3-8. Growth in Discretionary Budget Authority, 2006 to 2007 69 3-9. Nondefense Discretionary Funding for 2007 70 3-10. CBO’s Projections of Discretionary Spending Under Selected Policy Alternatives 72 3-11. CBO’s Baseline Projections of Federal Interest Outlays 74 4-1. CBO’s Projections of Revenues, by Source 81 4-2. CBO’s Projections of Individual Income Tax Receipts and the NIPA Tax Base 83