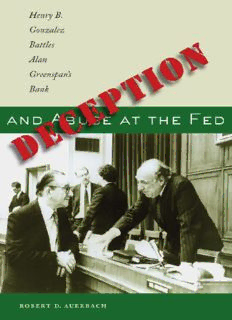

Deception and Abuse at the Fed: Henry B. Gonzalez Battles Alan Greenspan's Bank PDF

Preview Deception and Abuse at the Fed: Henry B. Gonzalez Battles Alan Greenspan's Bank

Deception anD abuse at the FeD THIS PAGE INTENTIONALLY LEFT BLANK Robert D. Auerbach Deception and Abuse at the Fed Henry B. Gonzalez Battles Alan Greenspan’s Bank University of Texas Press Austin The publication of this book was made possible in part by a University Cooperative Society Subvention Grant awarded by the University of Texas at Austin. Copyright © 2008 by the University of Texas Press All rights reserved Printed in the United States of America First edition, 2008 Requests for permission to reproduce material from this work should be sent to: Permissions University of Texas Press P.O. Box 7819 Austin, TX 78713-7819 www.utexas.edu/utpress/about/bpermission.html ♾ The paper used in this book meets the minimum requirements of Ansi/nisO Z39.48-1992 (R1997) (Permanence of Paper). LibRARy Of COngRess CAtALOging-in-PubLiCAtiOn DAtA Auerbach, Robert D. Deception and abuse at the Fed : Henry B. Gonzalez battles Alan Greenspan’s Bank / by Robert D. Auerbach. p. cm. Includes bibliographical references and index. isbn 978-0-292-71785-5 (cl. : alk. paper) 1. Board of Governors of the Federal Reserve System (U.S.) 2. Governmental investigations—United States—Case studies. 3. Greenspan, Alan, 1926– 4. Gonzalez, Henry B. (Henry Barbosa), 1916–2000. I. Title. Hg2563.A94 2008 332.1 ′10973—dc22 2007051720 Contents vii Acknowledgments 1 CHAPteR 1 Hitting a Tank with a Stick CHAPteR 2 The Burns Fed: Price Controls, Inflation, and the Watergate Cover-up with a 12 Distinguished Professor at the Helm 32 CHAPteR 3 The Master of Garblements 55 CHAPteR 4 Spinning Mountains into Molehills CHAPteR 5 Valuable Secrets and the Return of 74 Greenspan’s “Prophetic Touch” 87 CHAPteR 6 The Seventeen-Year Lie 106 CHAPteR 7 Corrupted Airplanes and Computer Mice 122 CHAPteR 8 Standing in the Door against Civil Rights 135 CHAPteR 9 When Five Hundred Economists Are Not Enough 148 CHAPteR 10 The Myth of Political Virginity CHAPteR 11 Pricking the Stock Market Bubble and 166 Other Greenspan Policies 182 CHAPteR 12 Bring the Fed into the Democracy APPenDix Excerpts from Waste and Abuse in the 195 Federal Reserve’s Payment System 201 Notes 251 Glossary 255 Bibliography 261 Index THIS PAGE INTENTIONALLY LEFT BLANK Acknowledgments Both the United States and the account presented in this book benefited from the legislators who carried out their oversight responsibilities for the U.S. central bank during their service on the House of Representa- tives Banking Committee. (The committee, formerly called the Bank- ing, Finance and Urban Affairs Committee, is now known as the Finan- cial Services Committee; as was the custom in the House, I will refer to it as House Banking or the Banking Committee.) They include the late House Banking Committee chairmen Henry S. Reuss (D-Wi; chair- man, 1975–1980) and Henry B. Gonzalez (D-tx; chairman, 1989–1994; ranking member to 1998) as well as other members who served on the Banking Committee, including Representatives Barney Frank (D-MA, ranking member in 2003, chairman in 2007), Maurice Hinchey (D-ny), Jessie Jackson, Jr. (D-iL), Joseph P. Kennedy II (D-MA), Carolyn Maloney (D-ny), Maxine Waters (D-CA), and Melvin L. Watt (D-nC). Former congressman James Leach (R-iA; chairman, 1995–2000) was always ac- cessible and knowledgeable, and provided funds for the Gonzalez inves- tigation, in which I participated, of the airplane fleet contracted by the Federal Reserve System (the Fed). I was privileged to work with these members during the eleven years I served as a staff economist on the committee. I also benefited from my service as a staff adviser on monetary policy and the Federal Reserve to Beryl Sprinkel, undersecretary of the treasury for monetary affairs, during the first year of Ronald Reagan’s administration. I am indebted to Nobel laureate Milton Friedman, my professor and dissertation chairman, who drew my attention to central banking and continued to provide me with suggestions and encouragement until his � viii DeCePtiOn AnD Abuse At tHe feD death in 2006. Insightful suggestions from several of his letters to me ap- pear in the book. He said he was looking forward to reading the book and liked the section of it I sent him in 2006, on whether it is important (or not) for Fed officials to be able to explain their actions (Chapter 9). Milton phoned me several times when I was working on congressional investiga- tions of the Fed. He called once to say that someone had asked for his help in stopping me. Milton wanted me to know that he strongly objected to this call and that I should continue my efforts. In another call, we talked about the exemption given to the Fed by some “conservative” think tank members who were critical of the untethered powers of other governmen- tal bureaucracies. I have always remembered his terse comment about this inconsistency of the conservative think tankers: “They aren’t perfect.” My thanks also go to Anna Schwartz, at the National Bureau of Eco- nomic Research, who coauthored with Friedman three classic books, one of which, A Monetary History of the United States, 1867–1960, encompasses the early history of the Federal Reserve. I was honored that she agreed to be a discussant of a paper I presented at a meeting of the Western Eco- nomic Association in 2000, detailing the deceitful manner in which the Fed concealed transcripts of its meetings for seventeen years and misled Congress. She thought such actions were outrageous. She testified before the House Banking Committee on October 19, 1993, about numerous leaks of inside information from the Fed. She was one of Congressman Gonzalez’s favorite witnesses. Two other witnesses at that same hearing also provided valuable testimony: James Meigs, an expert money-and- banking economist, and Robert Craven, an experienced broker who re- vealed some of the effects that leaks of inside information from the Fed have on securities markets (see Chapter 6). Three days after Anna Schwartz testified, when the Fed was discussing in a secret meeting what actions it would take with regard to the Gonzalez investigation and hearings, a governor of the Fed, apparently displaying his historical perspective, paid an unintended tribute to a wonderful scholar. He suggested to the Federal Open Market Committee that it not disclose the transcripts of any of its meetings from before 1981, since “the very deep history first of all is less interesting, except to the Anna Schwartzes of the world perhaps” (fOMC transcript, October 22, 1993, 7). I am especially indebted to Jake Lewis, who provided substantial expert knowledge and assistance. He has vast experience, going all the way back to 1958, when, as a reporter in Texas, he covered Gonzalez’s unsuccessful gubernatorial campaign. Jake served on the House Banking Committee � ix Acknowledgments staff for twenty-seven years (1965–1992). He was a superb adviser and the go-to expert for the staff during the tenure of four Banking Commit- tee chairmen, beginning with Wright Patman. He worked in the public interest on innumerable investigations and hearings as a primary force behind the scenes. He is the author of “Monster Banks: The Political and Economic Costs of Banking and Financial Consolidation” (Multinational Monitor, January–February 2005). I was very fortunate to work with many other excellent House Bank- ing Committee staff members, including Kelsay Meek, who served with Congressman Gonzalez for many years. He was staff director of the com- mittee until 1994, then minority staff director until Gonzalez left Con- gress, in 1998. Kelsay used his outstanding writing ability to assist in the preparation of many speeches and played a constructive leadership role in Banking Committee oversight and investigations. Other valuable staff members include the late Paul Nelson, who served as staff director under House Banking chairmen Wright Patman, Henry Reuss, and Fernand St. Germain; Stefanie Mullin, who was the innovative and hard-working press secretary for the committee; and Armando Falcon, who served as a committee lawyer under Gonzalez and performed spectacularly during his five-year tenure as director of the Office of Federal Housing Enter- prise Oversight (1999–2005), uncovering severe problems in government- sponsored enterprises operating in the mortgage market. Dennis Kane, an expert investigator, played a major role in assisting Gonzalez with an in- quiry into $5.5 billion in loans extended to Saddam Hussein’s Iraq govern- ment through an Atlanta banking operation (Chapter 4). Michael Crider served on the committee staff and participated in an investigation of Fed transcripts. During the 1970s, I worked on hearings and oversight actions related to the Federal Reserve System, efforts that in 1980 produced legislation regulating the Fed. During those years I worked closely with three econo- mists: Louis Gasper, of the House Banking Committee’s Republican staff; the late Robert Weintraub, of the committee’s Democratic staff; and James K. Galbraith, also of the Democratic staff. Galbraith, with whom I shared a small staff office in the 1970s and who is now my colleague at the LbJ School of Public Affairs, has been a very valuable source for discussing economic issues. I benefited also from discussions with David Meiselman, who wrote a classic book on interest rates and coauthored a famous study with Milton Friedman. I gratefully acknowledge the Fed employees who publicly assisted the

Description: