City and County of San Francisco general obligation bonds (branch library facilities improvement bonds, 2000) series 2001E PDF

Preview City and County of San Francisco general obligation bonds (branch library facilities improvement bonds, 2000) series 2001E

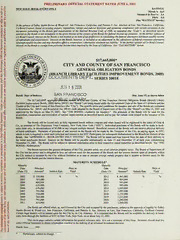

PRELIMINARY OFFICIAL STATEMENT DATEDJUNE6, 2001 NEWISSUE.BOOK-ENTRYONLY RATINGS: Moody's: Aa3 Standard& Poor's: AA AA Fitch: (See"RATINGS"herein.) IntheopinionofSidleyAustinBrown& WoodLLP, SanFrancisco, California, andPamelaS.Jue,AttorneyatLaw, SanFrancisco, California, Co-BondCounsel, basedonexistingstatutes, regulations, rulingsandjudicialdecisionsandassumingcompliancewithcertaincovenantsinthe documentspertainingto the Bonds andrequirements oftheInternalRevenue Code of1986, as amended (the "Code"), as describedherein, interestontheBondsisnotincludableinthegrossincomeoftheownersoftheBondsforfederalincometaxpurposes. Inthefurtheropinionof Co-BondCounsel, interestontheBondsisnottreatedasanitemoftaxpreferenceincalculatingthefederalalternativeminimumtaxableincome ofindividualsandcorporations. InterestontheBonds, however, isincludedasanadjustmentinthecalculationoffederalcorporatealternative minimumtaxableincomeandmaythereforeaffectacorporationsalternativeminimumtaxliability. InthefurtheropinionofCo-BondCounsel, interestontheBondsisexemptfrompersonalincometaxesimposedbytheStateofCalifornia. See "TAXMAITERS"herein. $17,665,000* CITY AND COUNTY OF SAN FRANCISCO GENERAL OBLIGATION BONDS (BRANCH LIBRARY FACILITIES IMPROVEMENT BONDS, 2000) DOCUMENTS DEPT. series 2001E JUN 9 2CG1 1 SAN FRANCISCO Dated: DateofDelivery Due:June15,asshownbelow The $17,665,000* aggregat^Iiiisipal/aLiSRARyVand County of San Francisco General Obligation Bonds (Branch Library FacilitiesImprovementBonds,2000)Series200IE(the"Bonds")arebeingissuedundertheGovernmentCodeoftheStateofCaliforniaandthe CharteroftheCityandCountyofSanFrancisco(the"City"). ThespecifictermsandconditionsforissuanceandsaleoftheBondsarecontained inResolutionNo. 389-01 andResolutionNo.390-01,bothadopt—edbytheBoardofSupervisorsoftheCity(the"Board")onMay14,2001 and approved by the Mayor on May25, 2001. See "THE BONDS Authority for Issuance." The proceeds ofthe Bonds will be used for the acquisition,constructionandrenovation ofvariousimprovementsasdescribedhereinandtopay forcertaincosts related tothe issuance ofthe Bonds. TheBondswillbeissuedonlyasfullyregisteredbondswithoutcouponsandwhenissuedwillberegisteredinthenameofCede & Co.,asnomineeofTheDepositoryTrustCompany,NewYork,NewYork("DTC"). IndividualpurchasesoftheBondswillbemadein book- entryformonly,indenominationsof$5,000oranyintegralmultiplethereof. BeneficialownersoftheBondswillnotreceivephysicaldelivery ofbondcertificates. Paymentsofprincipal ofandinterestonthe Bondswill bemadebytheTreasurerofthe City, aspaving agent, to DTC, whichinturnisrequiredtoremitsuchprincipalandinteresttotheDTCParticipantsforsubsequentdisbursementtotheBeneficialOwnersofthe Bonds. See"APPENDDCE—BOOK-ENTRYONLY SYSTEM." TheBondswillbedatedandbearinterestfromthedateoftheirdeliveryto the initial purchasers thereof. Interest on the Bonds will be payable semiannually on June 15 and December 15 ofeach year, commencing December 15,2001. TheBondswillbesubjecttooptionalredemptionpriortotheirrespectivestatedmaturitiesasdescribedherein. See"THE BONDS—Redemption." TheBondsrepresentthegeneralobligationoftheCity,payablesolelyoutofadvalorempropertytaxes. TheBoardofSupervisorsof theCityhasthepowerandisobligatedtolevyadvaloremtaxesforthepaymentoftheBondsandtheinterestthereonuponallpropertywithin theCity subjecttotaxationbythe City without limitationasto rate oramount(exceptcertain propertythatistaxable at limited rates) forthe paymentoftheBondsandtheinterestthereon. MATURITYSCHEDULE* Maturity Maturity Date Principal Priceor Date Principal Priceor (June 15) Amount* InterestRate Yield (June15) Amount* InterestRate Yield % % % % 2002 $ 530,000 2012 $ 865,000 2003 565,000 2013 905,000 2004 600,000 2014 945,000 2005 635,000 2015 995,000 2006 670,000 2016 1,045,000 2007 705,000 2017 1,095,000 2008 730,000 2018 1,155,000 2009 760,000 2019 1,215,000 2010 795,000 2020 1,280,000 2011 825,000 2021 1,350,000 TheBondsareofferedwhen,as,andifissuedbytheCityandacceptedbythepurchasers,subjecttotheapprovaloflegalitybySidley Austin Brown & Wood LLP, San Francisco, California, and Pamela S. Jue, Attorney at Law, San Francisco, California, Co-Bond Counsel. CertainlegalmatterswillbepasseduponfortheCitybyitsCityAttorney. Itisexpectedthatthe Bondswillbeavailablefordeliveryinbook- entryformthroughthefacilitiesofDTCinNewYork,NewYork,onoraboutJuly 12,2001. Thiscoverpagecontainscertaininformationforgeneralreferenceonly. Itisnotasummaryofthisissue. Investorsshouldreadthis entireOfficialStatementtoobtaininformationessentialtothemakingofaninformedinvestmentdecision. Dated:June 2001 , Preliminary,subjecttochange. No dealer, broker, salesperson or other person has been authorized by the City to give any information or to make any representations other than those contained herein and, ifgiven or made, such other information or representation must not be relied upon as having been authorized by the City. This Official Statement does not constitute an offer to sell or the solicitation ofan offer to buy nor shall there be any sale ofthe Bonds by any person in anyjurisdiction in which it is unlawful for suchperson to make such an offer, solicitation or sale. This Official Statement is notto be construedas a contract withthe purchaser orpurchasers ofthe Bonds. Statements contained in this Official Statement which involve estimates, forecasts or matters of opinion, whether or not expressly so described herein, are intended solely as such and are not to be construed as representations offacts. The information set forth herein has been obtained from sources which are believedto be reliable, but is not guaranteed as to accuracy or completeness. The information and expressions ofopinion herein are subject to change without notice and neither delivery of this Official Statement nor any sale made hereunder shall, under any circumstances, create any implication that there has been no change in the affairs ofthe City since the date hereof. E SANFRANCISCOPUBLICLIBRARY 3 1223 05851 9936 OFFICIAL NOTICE OF SALE $17,665,000* CITY AND COUNTY OF SAN FRANCISCO GENERAL OBLIGATION BONDS (BRANCH LIBRARY FACILITIES IMPROVEMENT BONDS, 2000) SERIES 2001E NOTICEISHEREBYGIVENthatsealed, facsimileandelectronicproposalswillbereceivedonbehalf ofthe City and County of San Francisco (the "City") at 1 Dr. Carlton B. Goodlett Place, Room 336, San Francisco, California 94102 on Wednesday, June 20, 2001 at 8:00 a.m. *$17,665,000* aggregateprincipalamountofCityandCountyofSan JUN 2 2 ami ;(BranchLibraryFacilitiesImprovementBonds,2000)Series2001 5/S onds"),moreparticularlydescribedhereinafter.See "TERMSOF orinformationregardingthetermsandconditionsunderwhich imile or electronic transmission. 3ne or cancel the saleprovidedthatnotice ofsuch change is given ovef ientinformationcenter* BloombergBusiness News (collectively, the "News Services"),as SAN FR.•ANCISCO PUBLIC LIBRARY then scheduled for the receipt of such proposals. If the sale is he place set forthabove onaweekdayon orbeforeFriday, July20, SAN FRANCISCO hall determine. Notice ofthe new date and time for receipt ofbids ofthe Bonds) shallbe giventhrough theNews Services as soon as PUBLIC LIBRARY ent. As an accommodation to bidders, telephone, electronic or lentand ofthe new saledatewillbe givento anybidderrequesting e and Associates, 3093 Citrus Circle, Suite 155, Walnut Creek, 156-9797, facsimile (925) 256-9795, Attention: Darlene Cimino- REFERENCE lerose.com)orfromCausewayFinancialConsulting, 150California BOOK :alifornia 941 1 1, telephone (415) 277-721 1, facsimile (415) 732- iail:Gobears@flashjiet). Montague DeRose and Associates and sometimes collectively referred to herein as the "Co-Financial : eceive such wire, telephonic, electronic ortelecopiednotice shall Nol (o be takenfrom the. Library uired notice or the legalityofthe sale. ereinareauthorizedtobeissuedpursuanttotheCharteroftheCity o. 389-01 adopted by the Board of Supervisors of the City (the ouaiu ; on lviay 14, zuui, ana Resolution No. 390-01 adopted by the Board on May 14, 2001 (the "Series 200IE Resolution" or the "Resolution"). The Bonds are more particularly described in the Resolution (which is incorporated herein by reference) and copies thereof will be furnished to any interestedbidderuponrequest.BiddersarereferredtothepreliminaryOfficial StatementdatedJune 6, 2001, for additional information regarding the City, the Bonds and the security therefor and other matters. See "Terms of Sale - Official Statement," hereinafter. TERMS RELATING TO THE BONDS The Bonds are generallydescribed as follows: Issue $17,665,000*aggregateprincipalamountofCityandCountyofSanFranciscoGeneralObligation Bonds (Branch LibraryFacilities ImprovementBonds, 2000) Series 200IE. The Bonds will be fully * Preliminary, subjectto change. No dealer, broker, salesperson or other person has been authorized by the City to give any information or to make any representations other than those contained herein and, ifgiven or made, such other information or representation must not be relied upon as having been authorized by the City. This Official Statement does not constitute an offer to sell or the solicitation ofan offer to buy nor shall there be any sale ofthe Bonds by anyperson in anyjurisdiction in which it is unlawful for suchperson to make such an offer, solicitation or sale. This Official Statement isnotto be construed as a contract withthe purchaser orpurchasers ofthe Bonds. Statements contained in this Official Statement which involve estimates, forecasts or matters of opinion, whether or not expressly so described herein, are intended solely as such and are not to be construed as representations offacts. The information set forthherein has been obtained from sources which art but is not guaranteed as to accuracy or completeness. The information and expre are subject to change without notice and neither delivery of this Official Stater hereunder shall, under any circumstances, create any implication that there has affairs ofthe City since the date hereof. E SANFRANCISCOPUBLIC ^ |j||||||jj||j|J 3 1223 05851 9936 OFFICIAL NOTICE OF SALE $17,665,000* CITY AND COUNTY OF SAN FRANCISCO GENERAL OBLIGATION BONDS (BRANCH LIBRARY FACILITIES IMPROVEMENT BONDS, 2000) SERIES 2001E NOTICEIS HEREBYGIVENthatsealed, facsimileandelectronicproposalswillbereceivedonbehalf ofthe City and County of San Francisco (the "City") at 1 Dr. Carlton B. Goodlett Place, Room 336, San Francisco, California 94102 on Wednesday, June 20, 2001 at 8:00 a.m. Californiatime, forthepurchaseof$17,665,000* aggregateprincipalamountofCityandCountyofSan FranciscoGeneralObligationBonds(BranchLibraryFacilitiesImprovementBonds,2000)Series2001 (the"Series2001EBonds"orthe"Bonds"),moreparticularlydescribedhereinafter.See "TERMSOF SALE-FormofBid"hereinafterforinformationregardingthetermsandconditionsunderwhich bids will be received through facsimile or electronic transmission. The Cityreserves the right to postpone or cancel the sale providedthatnotice ofsuch change is given through The Bond Buyer Wire and BloombergBusiness News (collectively, the "News Services"), as described herein, prior to the time then scheduled for the receipt of such proposals. If the sale is postponed,bids willbe receivedattheplace set forthabove onaweekdayon orbeforeFriday, July20, 2001, and at such time as the City shall determine. Notice ofthe new date and time for receipt ofbids (and any change in the terms ofsale ofthe Bonds) shallbe giventhrough the News Services as soon as practicable following a postponement. As an accommodation to bidders, telephone, electronic or telecopied notice ofsuchpostponementand ofthe new saledatewillbe givento anybidderrequesting such notice from Montague DeRose and Associates, 3093 Citrus Circle, Suite 155, Walnut Creek, California 94598, telephone (925) 256-9797, facsimile (925) 256-9795, Attention: Darlene Cimino- DeRose(e-mail:[email protected])orfromCausewayFinancialConsulting, 150California Street, Suite 2300, San Francisco, California 941 1 1, telephone (415) 277-721 1, facsimile (415) 732- 7740, Attention: Lisa Siemsen (e-mail:Gobears@flashjiet). Montague DeRose and Associates and Causeway Financial Consulting are sometimes collectively referred to herein as the "Co-Financial Advisors."Failureofany bidderto receive suchwire, telephonic, electronicortelecopiednotice shall not affect the sufficiency ofany required notice or the legalityofthe sale. The Series2001EBondsdescribedhereinareauthorizedtobe issuedpursuanttotheCharteroftheCity and the provisions of Resolution No. 389-01 adopted by the Board of Supervisors of the City (the "Board") on May 14, 2001, and Resolution No. 390-01 adopted by the Board on May 14, 2001 (the "Series 200IE Resolution" or the "Resolution"). The Bonds are more particularly described in the Resolution (which is incorporated herein by reference) and copies thereof will be furnished to any interestedbidderuponrequest.Biddersarereferredto thepreliminaryOfficial StatementdatedJune 6, 2001, for additional information regarding the City, the Bonds and the security therefor and other matters. See "Terms of Sale - Official Statement," hereinafter. TERMS RELATING TO THE BONDS The Bonds are generallydescribed as follows: Issue $17,665,000*aggregateprincipalamountofCityandCountyofSanFranciscoGeneralObligation Bonds (Branch LibraryFacilities ImprovementBonds, 2000) Series 200IE. The Bonds will be fully * Preliminary, subjectto change. registered bonds without coupons in book-entry form in denominations of $5,000 or any integral multiple thereof, as designated by the successful bidder (the "Purchaser"), all dated as ofthe date of deliveryofthe Bonds to the initial purchasersthereof. Book-Entry Only The Bonds will be registered in the name of Cede & Co., as nominee of The DepositoryTrust Company("DTC"),NewYork, NewYork. DTCwill act as securities depositoryfor the Bonds. Individual purchases will be made in book-entry form only, and the Purchaser will not receive bond certificates representing its interest in the Bonds purchased. As ofthe date ofaward of the Bonds, the Purchasermust either participate in DTC or must clear through ormaintaina custodial relationshipwith an entitythat participates in DTC. InterestRates The maximum interest rate bid shall not exceed twelve percent (12%) per annum, and interest on the Bonds shall be payable semiannually on June 15 and December 15 of each year, commencingDecember 15, 2001. Interest shall be calculated on the basis ofa 30-daymonth, 360-day yearfromthedateofthe Bonds. Biddersmustspecifytherateorrates ofinterestwhichthe Bonds shall bear; provided, that: (i) each interest rate specified in anybid mustbe a multipleofone-eighth or one- twentieth ofone percent (1/8 or 1/20 of 1%) per annum and a zero rate ofinterest cannot be named; (ii) no Bond shall bear more than one rate ofinterest; (iii) each Bond shall bear interest from its date to its statedmaturitydateatthe singlerateofinterest specifiedinthebid; (iv) all Bondsmaturingatany onetime shallbearthe same rateofinterest; and (v) the interestrate specified foranymaturityshallnot be more than three percent higher than the interest rate specified for any other maturity. PrincipalPayments TheBondsshallbeserialand ortermBonds, as specifiedbyeachbidder,maturing on June 15, inanyorallyears2002 through 2021,bothinclusive. No serial Bond shallmatureafterthe first mandatorysinking fund payment for any term Bond. The principal amount ofBonds maturing or subject to mandatory sinking fund redemption in any year shall be in integral multiples of $5,000. Subject to adjustment as hereinafter provided, the aggregateamount ofthe principal payment for the Bonds in each year is initially estimated as follows: Principal Series 2001E Payment Date Principal (June 15) Amount* 2002 S 530,000 2003 565,000 2004 600,000 2005 635,000 2006 670,000 2007 705,000 2008 730,000 2009 760.000 2010 795,000 2011 825.000 2012 865,000 2013 905,000 2014 945.000 2015 995,000 2016 1.045,000 2017 1.095.000 2018 1.155,000 2019 1.215,000 2020 1.280,000 2021 1,350,000 " Subject to adjustment in accordance with this OfficialNotice ofSale. 2 AdjustmentofPrincipalPaymentsTheprincipalamountssetforthinthisOfficialNoticeofSalereflect certain estimates ofthe Citywithrespectto the likelyinterestrates ofthe winningbid. In orderto size andstructuretheBondstoachieve substantiallyleveldebtserviceineachBondyearafterthe firstBond year, the Cityreserves the right to change the principal paymentschedule set forth hereinbeforeafter thedeterminationofthewinningbidder,byincreasingordecreasingtheprincipalamountofoneormore maturitiesinincrementsof$5,000,provided, however, thattheaggregateprincipalamountoftheBonds shall remainthe same. The purchaser may not withdraw its bid or change the interest rates bid as a result of any changes made to the principal payments of the Bonds in accordance with this Official Notice ofSale. The dollaramountofthe pricebid will be changed so that the percentage of net compensation to the successful bidder does not increase or decrease from what it would have been if no adjustment had been made to the principal amounts shown in the maturity schedule;provided, however, that the purchase price ofthe Bonds shall not be less than par. The mandatorysinking fund redemptionpayments (ifany),mustbe specifiedby each bidderin the spaces provided in the bid form. No mandatorysinking fund redemptionmay occurprior to June 15, 2009. OptionalRedemption The Bonds maturingon orbeforeJune 15, 2009, shallnotbe subjectto optional redemption prior to their fixed maturity dates. The Bonds maturing on and after June 15, 2010, are subject to optional redemption prior to their fixed maturitydates, at the option ofthe City and as the City shall determine, from any source ofavailable funds, as a whole or in part on any date (with the maturitiestoberedeemedtobedeterminedbythe Cityandbylotwithinamaturity) onorafterJune 15, 2009, at the following redemption prices (each expressed as a percentage ofthe principal amount of Bonds to be redeemed), togetherwith accrued interest to the date fixed for redemption: Redemption Dates RedemptionPrice June 15, 2009, through June 14, 2010 102% June 15, 2010, through June 14, 2011 101 June 15, 201 1, and thereafter 100 Mandatory Sinking Fund Redemption Term Bonds, if any, are further subject to mandatory redemptionprior to their stated maturitydates, on June 15 ofeach year on or after June 15, 2009, for which a mandatorysinking fund redemption is specified by the Purchaser, by lot within any maturity ifless than all ofthe Bonds ofsuchmaturityaretoberedeemed,uponpaymentoftheprincipal amount thereofand accrued interest thereon to the date fixed for redemption, without premium, but only in amounts equal to, and in accordance with, the schedule of the principal amounts of Bonds to be redeemed in each such year from mandatorysinking fund redemption. Payment Principal ofand interest on the Bonds are payable in lawful money ofthe United States of America. Principal ofthe Bonds is payable at the office ofthe Treasurer ofthe City and County of San Francisco (the "Treasurer"). Interest on the Bonds is payable by check mailed to the registered owner at such address as appears on the registration books ofthe Treasurer as ofthe last day ofthe calendar monthpreceding such interestpaymentdate, or, for holders ofat least $1,000,000 aggregate principal amount ofthe Bonds, by wire transfer within the continental limits ofthe United States of America, upon due notice to the Treasurer. As long as the Bonds are registeredinthe name ofCede & Co., as nominee ofDTC, principal and interest will be paidby wire transfer onlyto Cede & Co. AuthorityforIssue The Bondswereauthorizedbythevotesofatleasttwo-thirds(2/3) ofthequalified votersoftheCityvotingatanelectionfortheraisingofmoneyforlawfulmunicipalpurposes,indicated generallyin theirtitle. Security The Bonds represent the general obligation ofthe City, and the Board has the power and is obligated to levy ad valorem taxes for the payment of the Bonds and the interest thereon upon all property within the City subject to taxation by the City (except certain property which is taxable at limited rates) without limitation as to rate or amount. 3 Tax Exemption In the opinion ofSidley Austin Brown & Wood llp and Pamela S. Jue, Attorney at Law, Co-BondCounsel,underexistinglawandassumingcontinuedcompliancewithcertaincovenants inthe documentsrelatingto theBonds and certainprovisions ofthe Internal RevenueCodeof 1986, as amended, and certain provisions ofthe Treasury Regulations, interest on the Bonds is excluded from thegrossincome oftheownersthereofforfederalincome taxpurposesandwillnotbetreatedasanitem oftax preference in calculating alternative minimumtaxable income ofindividualsand corporations. However,interest on the Bonds willbe included as an adjustment in the calculation ofa corporation's alternative minimum taxable income. Interest on the Bonds will be exempt from State ofCalifornia personal income taxes. See "Tax Matters" in the Official Statement. LegalOpinion The legal opinionofSidleyAustinBrown & Woodllp and PamelaS. Jue, Attorneyat Law, Co-BondCounsel approvingthevalidityoftheBonds,willbe furnishedtothe Purchaserwithout charge. Copies ofsaid opinion will be filed with DTC and with the Treasurer. TERMS OF SALE Form ofBid All bidsmustbe forall, andnotless than all, ofthe Bonds herebyoffered forsale, andfor not less than the aggregateprincipal amountthereof,plus anypremium as maybe specified in the bid. Allbidsmustbeunconditionalandinwriting. Bidsdeliveredbyhandorbyfacsimiletransmissionmust be signedbythe bidder. Electronicbids mustconformwiththe procedures established byDalcomp, a division ofThomson Financial Municipals Group, Inc., BIDCOMPCompetitive Bidding System and ParityElectronicBidSubmissionSystem(the"BidService"),395 HudsonStreet,NewYork,NewYork 10014, telephone: (212) 806-8304,facsimile: (212) 989-9281. Eachbidmustbe deliveredbyfacsimile orelectronictransmission,ashereinafterdescribed, ormustbe enclosedinasealedenvelopeaddressed totheDirectorofPublicFinance, 1 Dr. CarltonB. GoodlettPlace,Room336, SanFrancisco,California 94102, and clearly marked "Proposal for $17,665,000* City and County of San Francisco General Obligation Bonds," and received by 8:00 a.m. California time on Wednesday, June 20, 2001, or such other date as is determined in accordance with this Official Notice of Sale, at the Mayor's Office of Public Finance, Attention: Karen Ribble (Facsimile: (415) 554-4864; Telephone (415) 554-6902). If the saleoftheBondsiscanceledorpostponed,allsealedbidsshallbereturnedunopened. Allbidsshall be deemed to incorporateall ofthe terms ofthis Official Notice ofSale. Solely as an accommodation to bidders, electronic bids will be received exclusivelythrough the Bid Service in accordance withthis Official Notice ofSale until 8:00 a.m. Californiatime, but no bid will be received after the time specified for receivingbids. To the extent any instructions or directions of the Bid Service conflictwiththis OfficialNoticeofSale, theterms ofthis Official Notice ofSale shall control. TheCityretainsabsolutediscretiontodeterminewhetheranybid,whetherhanddeliveredorsent by facsimile or electronic transmission, is timely, legible and complete. The City takes no responsibility for informing any bidder prior to the time for receiving bids that its bid is incomplete, illegible or not received. Warnings regarding facsimile bids: A bid submitted by facsimile transmission will not be considered timely unless, at the deadline for submission of bids, the entire bid form has been received by the receivingfax machine. The receivingfax machinewill be disabled atthe deadline for receipt of bids. Neither the City, the Co-Financial Advisors, nor Co-Bond Counsel shall be responsiblefor,andthebidderexpresslyassumestheriskof,anyincomplete,illegibleoruntimely bid submitted by facsimiletransmission by such bidder, including,without limitation, by reason 3 1223 05851 9936 Preliminary, subjectto change. 4 of garbled transmission, mechanical failure, engaged telephone or telecommunications lines, or any other cause arising from delivery by facsimile transmission rather than by hand. Warnings regarding electronic bids: The City will accept bids in electronic form solely through the Bid Service on the official bid form created for such purpose. Each bidder submitting an electronicbidunderstandsandagreesbydoingsothatitis solelyresponsibleforallarrangements with theBid Service,thattheCityneitherendorses norencouragesthe use oftheBid Service,and that the Bid Service is not acting as an agent ofthe City. Instructions and forms for submitting electronic bids must be obtained from the Bid Service, and the City has no responsibility for ensuring or verifying bidder compliance with the procedures ofthe Bid Service. The City shall assume that any bid received through the Bid Service has been made by a duly authorized agent ofthe bidder. TheCity,theCo-FinancialAdvisorsandCo-BondCounselassumenoresponsibilityforanyerror contained in any bid submitted electronically,orforfailureofanybidto be transmitted,received or opened at the official time for receipt of bids. The official time for receipt of bids will be determinedbytheCityatthe placeofbidopening,andthe Cityshallnotberequiredto acceptthe time kept by Bid Service as the official time. In the event ofa malfunction in the electronic bidding process, bidders should submittheir bids by facsimile or hand delivery on the official bid form attached hereto as ExhibitB. GoodFaith Deposit Each bid must be preceded or accompanied by a cashier's check in immediately availablefunds drawn on abankortrust companytransactingbusiness in the State ofCalifornia, orby a financial suretybond, ineach case inthe amountof$300,000payableto the orderofthe Treasurerof the CityandCountyofSan Francisco, to securethe Cityfromany loss resulting fromthe failureofthe bidder to complywith the terms ofits bid. Ifa financial suretybond is used, it mustbe from an insurance companylicensed to issue such a bond in the State ofCalifornia, whose claims-payingability is rated in the highest rating category(without regard to subcategories) by Moody's Investors Service and Standard & Poor's, A Division of The McGraw-HillCompanies. SuchfinancialsuretybondmustbereceivedbytheMayor'sOfficeofPublic Finance, 1 Dr. CarltonB. GoodlettPlace, Room336, SanFrancisco, California94102, telephone(415) 554-6902,facsimile(415) 554-4864,Attention: Karen Ribbleno laterthan 8:00 a.m. (Californiatime) on the date bids are to be received. The financial surety bond must identify each bidder whose good faith deposit is guaranteed by such financial surety bond, and the City has no responsibility for any failure ofa financial suretybond to list any bidder or to be received on a timelybasis as described in thepreceding sentence. Ifthe Bonds are awardedto abidderutilizing a financial suretybond, thenthe Purchasershall deliverits good faith depositto theTreasurerinthe formofacashier'scheck(meeting the requirementsset forth hereinbefore) orby wire transferno later than 12:00 noon (Californiatime) on the business day immediately following the award. The wire transfer is to be made to Bank of America, N.A., ABA 121000358, 555 Capitol Mall, Suite 1555, Northern California Government Banking, Unit 1436, Sacramento, California95814, to the creditofCityand CountyofSan Francisco, Account No. 00661-80050, for credit to the City and County ofSan Francisco with notice thereofto Karen Ribble, telephone (415) 554-6902, facsimile(415) 554-4864. Ifsuch depositis notreceivedby that time, the financial suretybond shall be drawn by the Cityto satisfythe depositrequirement. TheCitywillacceptafinancialsuretybondinlieuofacashier'scheckundertheterms describedherein solelyasanaccommodationtobidders,anditisunderstoodandagreedbyeachbidderusingsuchabond that the bidder must make its own arrangements with the provider of the bond. The City does not encourage or discourage the use ofa financial suretybond or any particular suretybond provider. No interestwillbe paiduponthe depositmadeby anybidder. Good faithdepositchecks ofall bidders (except the Purchaser) will be returned by the Citypromptlyfollowing the award ofthe Bonds to the Purchaser. The deposit of the Purchaser will, immediately upon acceptance of its bid, become the 5 propertyofthe Cityto be heldand investedfor the exclusive benefitofthe City. The principal amount ofsuch deposit shall be applied to the purchase price ofthe Bonds at the time ofdeliverythereof. Ifthe purchase price is not paid in full upon tender ofthe Bonds, the Purchaser shall have no right in orto the Bonds orto the recoveryofits deposit, orto any allowance orcreditbyreasonofsuchdeposit, unlessitshallappearthatthe BondswouldnotbevalidlyissuedifdeliveredtothePurchaserintheform and manner proposed. In the event of nonpayment by the Purchaser, the amount of the good faith depositshallberetainedbytheCityas andforliquidateddamagesforsuchfailurebythePurchaser,and suchretentionshallconstituteafullreleaseand discharge ofallclaims bytheCityagainstthePurchaser arising from such failure. The City's actual damages in such eventmaybe greaterormaybe less than the amount of the good faith deposit. Each bidder waives any right to claim that the City's actual damages are less than such amount. Basis ofAward Unless all bids are rejected, the Bonds will be awarded to the bidder whose bid representsthe lowesttrueinterestcost("TIC")totheCity. The TIC willbethatnominalannualinterest rate which, when compounded semiannually and used to discount to the dated date ofthe Bonds all payments ofprincipal and interest payable on the Bonds, results in an amount equal to the principal amount ofsuch Bonds plus the amount ofany premium, ifany. In the eventthat two or more bidders offer bids for the Bonds at the same lowest TIC, the City shall determine by lot which bidder shall be awarded such Bonds. Bid evaluations or rankings by the Bid Service are not binding on the City. EstimateofTrueInterestCost Eachbidderis requested, butnotrequired,to state initsbidthe amount of interest payable on the Bonds during the life of the issue and the percentage TIC to the City determinedas describedhereinbefore),which shallbe considered as informative onlyandnotbinding I on either the bidder or the City. Right ofRejection and Waiver ofIrregularity The Cityreserves the right, in its discretion, to reject any and all bids and to waive any irregularityor informalityin any bid. PromptAward The Controller ofthe City (the "Controller") will take action awarding the Bonds or rejecting all bids not later than twenty-six (26) hours afterthe expiration ofthe time hereinprescribed forthe receipt ofproposals, unless suchperiod forawardis waivedbythe Purchaser. Promptnotice of the award will be given to the Purchaser. Qualification for Sale; Blue Sky The City will furnish such information and take such action not inconsistentwithlaw as the Purchasermayrequest and the Cityshall deemnecessaryorappropriateto qualifythe Bonds for offer and saleunderthe Blue Sky or othersecurities laws and regulations ofsuch states and otherjurisdictions ofthe United States ofAmerica as may be designatedby the Purchaser; provided, however, that the City shall not execute a general or special consent to service ofprocess or qualifyto do business in connectionwith such qualification or determinationin anyjurisdiction. The successful bidderwill not offer to sell, or solicit any offerto buy, the Bonds in anyjurisdiction where it is unlawful for such successful bidder to make such offer, solicitation or sale, and the successful bidder shall comply with the Blue Sky and other securities laws and regulations of the states and jurisdictions in which the successful bidder sells the Bonds. Paymentofany fees forthe qualification ofthe Bonds is the sole responsibilityofthe Purchaser. Delivery andPayment Deliveryofthe Bonds, in the formofone certificatefor each maturityshall be made to the Purchaser through the facilities ofDTC inNewYork, New York, or at any other location mutuallyagreeableto both the City and the Purchaser, as soon as practicable. Paymentfor the Bonds (includinganypremium) mustbemadebywiretransferinfundsimmediatelyavailableinSanFrancisco. Any expense formakingpaymentin immediately availablefunds shallbe bornebythe Purchaser. The costs ofpreparing the Bonds will be borne by the City. Reoffering Price Certificate The Purchasermust submitto the City a certificate specifying for each maturitythe reoffering price at which at least ten percent ofthe Bonds ofsuch maturitywere sold (or 6