capital appreciation limited circular to capprec shareholders PDF

Preview capital appreciation limited circular to capprec shareholders

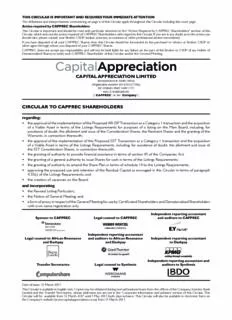

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION The definitions and interpretations commencing on page 6 of this Circular apply throughout this Circular including this cover page. Action required by CAPPREC Shareholders This Circular is important and should be read with particular attention to the “Action Required by CAPPREC Shareholders” section of this Circular, which sets out the action required of CAPPREC Shareholders with regard to this Circular. If you are in any doubt as to the action you should take, please consult your Broker, CSDP, banker, attorney, accountant or other professional adviser immediately. If you have disposed of all your CAPPREC Shares, then this Circular should be forwarded to the purchaser to whom, or Broker, CSDP or other agent through whom you disposed of your CAPPREC Shares. CAPPREC does not accept any responsibility and will not be held liable for any failure on the part of the Broker or CSDP of any holder of Dematerialised Shares to notify such CAPPREC Shareholder of this Circular and/or the General Meeting. CAPITAL APPRECIATION LIMITED (Incorporated in South Africa) (Registration number 2014/253277/06) JSE ordinary share code: CTA ISIN: ZAE000208245 (“CAPPREC” or the “Company”) CIRCULAR TO CAPPREC SHAREHOLDERS regarding: • the approval of the implementation of the Proposed AR-DP Transaction as a Category 1 transaction and the acquisition of a Viable Asset in terms of the Listings Requirements for purposes of a listing on the Main Board, including, for avoidance of doubt, the allotment and issue of the Consideration Shares, the Restraint Shares and the granting of the Warrants, in connection therewith; • the approval of the implementation of the Proposed SST Transaction as a Category 1 transaction and the acquisition of a Viable Asset in terms of the Listings Requirements, including, for avoidance of doubt, the allotment and issue of the SST Consideration Shares, in connection therewith; • the granting of authority to provide financial assistance in terms of section 45 of the Companies Act; • the granting of a general authority to issue Shares for cash in terms of the Listings Requirements; • the granting of authority to amend the Share Plan in terms of schedule 14 to the Listings Requirements; • approving the proposed use and retention of the Residual Capital as envisaged in this Circular in terms of paragraph 4.35(c) of the Listings Requirements; and • the creation of vacancies on the Board, and incorporating • the Revised Listing Particulars; • the Notice of General Meeting; and • a form of proxy in respect of the General Meeting for use by Certificated Shareholders and Dematerialised Shareholders with own-name registration only. Independent reporting accountant Sponsor to CAPPREC Legal counsel to CAPPREC and auditors to CAPPREC Independent reporting accountant Legal counsel to African Resonance and auditors to African Resonance Independent reporting accountant and Dashpay and Dashpay to Dashpay Independent reporting accountant and Transfer Secretaries Legal counsel to Synthesis auditors to Synthesis Date of issue: 31 March 2017 This Circular is available in English only. Copies may be obtained during normal business hours from the offices of the Company, Investec Bank Limited and the Transfer Secretaries, whose addresses are set out in the ‘Corporate information and advisers’ section of this Circular. This Circular will be available from 31 March 2017 until 5 May 2017, both days inclusive. This Circular will also be available in electronic form on the Company’s website (www.capitalappreciation.co.za) from 31 March 2017. CERTAIN FORWARD-LOOKING STATEMENTS This Circular contains statements about CAPPREC that are or may be forward-looking statements. All statements, other than statements of historical facts, are, or may be deemed to be, forward looking statements, including, without limitation, those concerning: strategy; the economic outlook and prospects for the payment systems, fin-tech and or financial industry; cash costs, revenues and other operating results; growth prospects and outlook for operations and future opportunities and pipelines, individually or in the aggregate; liquidity and capital resources and expenditure, the future regulatory environment expected to apply at the market and the effects of the Proposed Transactions on the CAPPREC Group and the expected timing of the Completion/s. These forward-looking statements are not based on historical facts, but rather reflect current expectations concerning future results and events and generally may be identified by the use of forward-looking words or phrases such as “believe”, “aim”, “expect”, “anticipate”, “intend”, “envisage”, “view”, “foresee”, “forecast”, “likely”, “should”, “planned”, “may”, “estimated”, “predict”, “project”, “potential” or similar words and phrases. Examples of forward-looking statements include statements regarding a future financial position or future profits, cash flows, corporate strategy, prospects, opportunities, market and/or industry projections, estimates of capital expenditures, acquisition strategy or future capital expenditure levels and other economic factors, such as, inter alia, growth, interest or exchange rates. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. CAPPREC cautions that forward-looking statements are not guarantees of future performance. Actual results, financial and operating conditions, liquidity and the developments within the industry in which CAPPREC operates (including as a result of a change to the regulatory environment, technology developments, competition in the industry and/or change in the political landscape) may differ materially from those made in, or suggested by, the forward-looking statements contained in this Circular. All these forward-looking statements are based on estimates and assumptions, all of which estimates and assumptions, although CAPPREC may believe them to be reasonable, are inherently uncertain. Such estimates, assumptions or statements may not eventuate. Many factors (including factors not yet known to CAPPREC, or not currently considered material), could cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied in those estimates, statements or assumptions. CAPPREC Shareholders should keep in mind that any forward-looking statement made in this Circular or elsewhere is applicable only at the date on which such forward-looking statement is made. New factors that could cause the business of the CAPPREC Group or other matters to which such forward-looking statements relate, not to develop as expected may emerge from time to time and it is not possible to predict all of them. Further, the extent to which any factor or combination of factors may cause actual results, performance or achievements to differ materially from those contained in any forward-looking statement are not known. CAPPREC has no duty to, and does not intend to, update or revise the forward-looking statements contained in this Circular after the date of this Circular (whether as a result of new information, future events, developments or otherwise), except as may be required by applicable law. CORPORATE INFORMATION AND ADVISERS The definitions and interpretations commencing on page 6 of this Circular apply throughout this Circular including this ‘Corporate information and advisers’ section. Registered office and business address of CAPPREC Company secretary 4th Floor, One Vdara Horwath Leveton Boner 41 Rivonia Road (Independent auditor registration number 93787) Sandhurst, 2196 3 Sandown Valley Crescent South Africa Sandown, 2196 South Africa Legal counsel to CAPPREC Legal counsel to African Resonance and Dashpay Webber Wentzel Hogan Lovells (South Africa) Inc. 90 Rivonia Road 22 Fredman Drive Sandton, 2196 Sandton, 2196 South Africa South Africa (PO Box 61771, Marshalltown, 2107, South Africa) (PO Box 78333, Sandton, 2146, South Africa) Legal counsel to Synthesis Sponsor Werksmans Inc. Investec Bank Limited 155 5th Street (Registration number 1969/004763/06) Sandton, 2196 100 Grayston Drive South Africa Sandton, 2196 (Private Bag 10015, Sandton, 2146, South Africa) South Africa (PO Box 785700, Sandton, 2146, South Africa) Independent reporting accountant and auditors Independent reporting accountant and auditors to CAPPREC to African Resonance and Dashpay Ernst & Young Incorporated Grant Thornton (Registration number 2005/002308/21) (Practice number 903485) 102 Rivonia Road Wanderers Office Park Sandton, 2196 52 Corlett Drive South Africa Johannesburg, 2196 (Private Bag X14, Sandton, 2146, South Africa) South Africa Independent reporting accountant and auditors Independent reporting accountant to Dashpay to Synthesis KPMG Inc. BDO South Africa Incorporated (Registration number: 1999/021543/21) (Registration number 1995/002310/21) 85 Empire Road 22 Wellington Road Parktown, 2193 Parktown South Africa Johannesburg, 2193 (Private Bag 9, Parkview, 2122) South Africa (Private Bag X60500, Houghton, 2041, South Africa) Transfer Secretaries Computershare Investor Services Proprietary Limited (Registration number 2004/003647/07) Rosebank Towers 15 Biermann Ave Rosebank Johannesburg, 2196 South Africa (PO Box 61051, Marshalltown, 2107, South Africa) Corporate Banker Corporate Banker Absa Bank Limited Investec Bank Limited (Registration number 1986/004794/06) (Registration number 1969/004763/06) 7th Floor, Barclays Towers West, 100 Grayston Drive 15 Troye Street Sandton, 2196 Johannesburg, 2001 South Africa South Africa (PO Box 785700, Sandton, 2146, South Africa) (PO Box 7735, Johannesburg, 2000, South Africa) Date of incorporation of CAPPREC: 3 December 2014 Place of incorporation of CAPPREC: South Africa 1 TABLE OF CONTENTS Page CORPORATE INFORMATION AND ADVISERS 1 ACTION REQUIRED BY CAPPREC SHAREHOLDERS 4 SALIENT DATES AND TIMES 5 DEFINITIONS AND INTERPRETATIONS 6 CIRCULAR TO SHAREHOLDERS 1. INTRODUCTION AND PURPOSE OF THIS CIRCULAR 15 2. ACQUISITION OF VIABLE ASSETS 16 3. AFRICAN RESONANCE AND DASHPAY (COMPRISING THE AR-DP TRANSACTION) 18 4. SYNTHESIS (SUBJECT OF THE SST TRANSACTION) 27 5. EXPANSION OPPORTUNITIES ACROSS AFRICA 28 6. RATIONALE FOR THE PROPOSED TRANSACTIONS 28 7. ACQUISITION OF AFRICAN RESONANCE 28 8. ACQUISITION OF RINWELL 30 9. ACQUISITION OF SYNTHESIS 31 10. VOTING ON THE PROPOSED TRANSACTIONS AT THE GENERAL MEETING 33 11. UNDERTAKINGS TO VOTE AT GENERAL MEETING 33 12. PROSPECTS 34 13. ADDITIONAL RESOLUTIONS 34 14. SHARE CAPITAL OF CAPPREC 34 15. FINANCIAL INFORMATION 34 16. GENERAL MEETING 36 17. ELECTRONIC PARTICIPATION IN THE GENERAL MEETING 36 18. DIRECTORS 36 19. OTHER MATERIAL MATTERS 36 20. WORKING CAPITAL STATEMENT 37 21. LITIGATION STATEMENT 37 22. EXPENSES 37 23. DIRECTORS’ RECOMMENDATION 37 24. ADVISERS’ CONSENTS 37 25. DIRECTORS’ RESPONSIBILITY STATEMENT 37 26. DOCUMENTS AVAILABLE FOR INSPECTION 38 27. EXCHANGE CONTROL APPROVAL 38 ANNEXURES Annexure 1 Pro forma financial information of CAPPREC 39 Annexure 2 Independent Reporting Accountants’ Report on the compilation of the pro forma financial information of the CAPPREC group 45 Annexure 3 Interim Financial Information of CAPPREC 47 Annexure 4 Independent Reporting Accountants’ Report on the interim financial information of CAPPREC 53 Annexure 5 Historical Financial Information of African Resonance 55 2 Page Annexure 6 Independent Reporting Accountants’ Report on the historical financial information of African Resonance 89 Annexure 7 Interim Financial Information of African Resonance 91 Annexure 8 Independent Reporting Accountants’ Report on the interim financial information of African Resonance 114 Annexure 9 Historical Financial Information of Rinwell for the seven month period ended 30 June 2016 115 Annexure 10 Independent Reporting Accountants’ Report on the historical financial information of Rinwell for the seven month period ended 30 June 2016 130 Annexure 11 Interim Financial Information of Rinwell 132 Annexure 12 Independent Reporting Accountants’ Report on the Interim Financial Information of Rinwell 133 Annexure 13 Historical Financial Information of Dashpay for the years ended 30 June 2016 and 30 June 2015 134 Annexure 14 Independent Reporting Accountants’ Report on the historical financial information of Dashpay for the years ended 30 June 2016 and 30 June 2015 153 Annexure 15 Report of Historical Financial Information of Dashpay for the year ended 30 June 2014 155 Annexure 16 Independent Reporting Accountants’ Report on the historical financial information of Dashpay for the year ended 30 June 2014 170 Annexure 17 Historical Financial Information of Synthesis 172 Annexure 18 Independent Reporting Accountants’ Report on the historical financial information of Synthesis 188 Annexure 19 Interim Financial Information of Synthesis 190 Annexure 20 Independent Reporting Accountants’ Report on the interim financial information of Synthesis 209 Annexure 21 Revised Listing Particulars 211 APPENDIXES TO ANNEXURE 21 Appendix 1 Other directorships 241 Appendix 2 Details of material contracts entered into by CAPPREC 244 Appendix 3 Details of material contracts entered into by African Resonance 246 Appendix 4 Details of material contracts entered into by Rinwell and its wholly-owned subsidiary Dashpay 247 Appendix 5 Details of material contracts entered into by Synthesis 248 Appendix 6 Extracts from the Memorandum of Incorporation of CAPPREC 249 Appendix 7 Extracts from the memorandum of incorporation of African Resonance 253 Appendix 8 Extracts from the memorandum of incorporation of Synthesis 254 Appendix 9 Ordinary Share trading history of CAPPREC 257 NOTICE OF GENERAL MEETING 258 FORM OF PROXY Attached 3 ACTION REQUIRED BY CAPPREC SHAREHOLDERS The definitions and interpretations commencing on page 6 of this Circular apply throughout this Circular including this “Action required by CAPPREC Shareholders” section. Please take careful note of the following provisions regarding the action required by CAPPREC Shareholders. If you have disposed of your CAPPREC Shares (in whole or in part), please forward this Circular to the purchaser of such CAPPREC Shares or to the Broker, CSDP, banker or other agent through which such disposal was effected. If you are in any doubt as to what action you should take, please consult your Broker, CSDP, accountant, banker, attorney, accountant or other professional adviser immediately. You should carefully read through this Circular and decide how you wish to vote on the resolutions to be proposed at the General Meeting. GENERAL MEETING Notice of General Meeting CAPPREC Shareholders are invited to attend the General Meeting, convened in terms of the Notice of General Meeting (which is annexed to and forms part of this Circular), to be held at the offices of CAPPREC on the 4th Floor, One Vdara, 41 Rivonia Road, Sandhurst, 2196 at 10:00 on Friday, 5 May 2017 in order to consider, and if deemed fit, approve and adopt the resolutions set out in the Notice of General Meeting forming part of this Circular. If you hold Dematerialised Shares: “Own-name” registration You are entitled to attend, or be represented by proxy, and may vote at the General Meeting. If you are unable to attend the General Meeting, but wish to be represented thereat, you must complete and return the attached form of proxy, in accordance with the instructions contained therein, to be received by the Transfer Secretaries, Computershare Investor Services Proprietary Limited, Rosebank Towers, 15 Biermann Ave, Rosebank, Johannesburg, 2196, South Africa (PO Box 61051, Marshalltown, 2107, South Africa) by no later than 10:00 on Wednesday, 3 May 2017. Other than “own-name” registration If your CSDP or Broker does not contact you, you are advised to contact your CSDP or Broker and provide them with your voting instructions. If your CSDP or Broker does not obtain instructions from you, they will be obliged to vote in accordance with the instructions contained in the custody agreement concluded between you and your CSDP or Broker. You must not complete the attached form of proxy. In accordance with the custody agreement between you and your CSDP or Broker you must advise your CSDP or Broker timeously if you wish to attend, or be represented at the General Meeting. Your CSDP or Broker will be required to issue the necessary Letter of Representation to you to enable you to attend, or to be represented at, the General Meeting. If you hold Certificated Shares You are entitled to attend, or be represented by proxy, and may vote at the General Meeting. If you are unable to attend the General Meeting, but wish to be represented thereat, you must complete and return the attached form of proxy, in accordance with the instructions contained therein, to be received by the Transfer Secretaries, Computershare Investor Services Proprietary Limited, Rosebank Towers, 15 Biermann Ave, Rosebank, Johannesburg, 2196, South Africa (PO Box 61051, Marshalltown, 2107, South Africa) by no later than 10:00 on Wednesday, 3 May 2017. 4 SALIENT DATES AND TIMES The definitions and interpretations commencing on page 6 of this Circular apply throughout this Circular including the following salient dates and times: Key action Posting Record Date to be eligible to receive the Circular Friday, 24 March 2017 Posting of Circular to CAPPREC Shareholders Friday, 31 March 2017 Last Day to Trade to participate in and vote at the General Meeting Monday, 24 April 2017 Voting Record Date to participate in and vote at the General Meeting Friday, 28 April 2017 Last day to lodge forms of proxy in respect of the General Meeting by 10:00 Wednesday, 3 May 2017 General Meeting to be held at 10:00 Friday, 5 May 2017 Results of General Meeting released on SENS Friday, 5 May 2017 Result of General Meeting published in the South African Press Monday, 8 May 2017 Notes: 1. The above dates and times are subject to amendment. Any such material amendment will be released on SENS and published in the South African Press. 2. All times quoted in this Circular are local times in South Africa on a 24-hour basis, unless specified otherwise. 3. No orders to dematerialise or rematerialise Shares will be processed from the Business Day following the Last Day to Trade up to and including the Voting Record Date, but such orders will again be processed from the first Business Day after the Voting Record Date. 4. The Certificated Register will be closed between the Last Day to Trade and the Voting Record Date. 5. CAPPREC Shareholders should note that, as transactions in securities (and thus CAPPREC Shares) are settled in the electronic settlement system operated by Strate, settlement of trade takes place three Business Days after such trade. Therefore, persons who acquire CAPPREC Shares after the Last Date to Trade as detailed in the table referred to above shall not be able to participate and vote at in the General Meeting. 6. If the General Meeting is adjourned or postponed, forms of proxy submitted for the General Meeting will remain valid in respect of any adjournment or postponement of the General Meeting unless the contrary is stated on such form of proxy. 5 DEFINITIONS AND INTERPRETATIONS In this Circular, unless the context indicates otherwise, references to the singular shall include the plural and vice versa; words denoting one gender include the others; words and expressions denoting natural persons include legal persons and associations of persons; and the following words and expressions have the meanings assigned to them below: “ Additional Committed African Rainbow Capital Proprietary Limited and the Student Support Investors” Programme as part of the Capital Appreciation 67 Scheme; “African Resonance” or “AR” African Resonance Business Solutions Proprietary Limited, registration number 1998/016632/07, a company incorporated in accordance with the laws of South Africa; “African Resonance Board” or the board of directors of African Resonance; “ African Resonance Directors” “ African Resonance Hanoch Neishlos, Wayne Fagan, Edmund Pieterse and Safika; Shareholders” “Alan Salomon” Alan Charles Salomon, a South African adult male with identity number 490107 5101 084; “AR Acquisition” the acquisition by CAPPREC of the AR Shares for the AR Consideration pursuant to the AR Agreement; “AR Agreement” the sale of shares agreement entered into by CAPPREC and the African Resonance Shareholders in terms of which CAPPREC shall purchase the AR Shares, dated 16 February 2017; “AR Conditions Precedent” the conditions precedent to which the AR Agreement is subject, a summary of which is set out in paragraph 7.3 of this Circular; “AR Consideration” the aggregate purchase consideration payable by CAPPREC for the AR Shares in terms of the AR Agreement, comprising an aggregate cash payment of R295 000 000 and the allotment and issue of the AR Consideration Shares; “AR Consideration Shares” 230 000 000 Ordinary Shares in aggregate; “AR Shares” 100% of the issued shares of African Resonance; “AUD” Australian Dollar, the lawful currency of Australia; “B-BBEE” broad-based black economic empowerment as contemplated in the B-BBEE Act; “B-BBEE Act” the Broad-Based Black Economic Empowerment Act, No 53 of 2003 and any regulations and codes of good practice published thereunder; “BDO” BDO South Africa Incorporated, registration number 1995/002310/21, registered auditors, a firm of chartered accountants (CA) and the independent reporting accountant to Synthesis; “Board” the board of directors of CAPPREC; “Bradley Sacks” Bradley Jonathan Sacks, an adult male with United States passport number 452079037; “Broker” any person registered as a broking member in equities in terms of the rules of the JSE in accordance with the provisions of the Financial Markets Act; “BSP” beneficiary service provider; “Business Day” any day other than a Saturday, Sunday or official public holiday in South Africa; “CAET” The Capital Appreciation Empowerment Trust, Master’s reference number IT2296/2015(G), a trust established in accordance with the laws of South Africa; 6 “CAPPREC Director” or a director of CAPPREC. Details of the current Directors are set out in “Director” paragraph 4.1.1 of the Revised Listing Particulars; “CAPPREC group” CAPPREC and its subsidiaries from time to time. As of the Last Practicable Date, CAPPREC did not have any subsidiaries; “CAPPREC Shareholder” a holder of a CAPPREC Share; “CAPPREC Shares” or “Shares” the Constituent Shares and the Ordinary Shares; “CAPPREC” or the “Company” Capital Appreciation Limited, registration number 2014/253277/06, a company incorporated in accordance with the laws of South Africa; “Castledash” Castledash Investment Holdings Limited, registration number HE 353446 and organisation number 501206, a company incorporated in accordance with the laws of the Republic of Cyprus, the entire issued share capital of which is owned by Eitan Neishlos; “Certificated Shareholders” CAPPREC Shareholders who hold Certificated Shares; “Certificated Shares” CAPPREC Shares which have not been dematerialised, title to which is represented by a share certificate or other Documents of Title; “CIPC” the Companies and Intellectual Property Commission, established in terms of the Companies Act; “Circular” this document, dated Friday, 31 March 2017, including the annexures and appendixes, the Revised Listing Particulars, the Notice of General Meeting and form of proxy; “Common Monetary Area” South Africa, the Republic of Namibia and the Kingdoms of Lesotho and Swaziland; “Companies Act” the South African Companies Act No. 71 of 2008, as amended or superseded from time to time; “Completed” with reference to the acquisition of a Viable Asset by CAPPREC, when such an acquisition has become unconditional and the assets have been transferred into the name of CAPPREC or a wholly-owned subsidiary of CAPPREC and “Complete” and “Completion” shall be construed accordingly; “Constituent Shares” ordinary shares of no par value in CAPPREC having the rights, preferences and limitations as set out in the MOI; “CSDP” a “participant” as such term is defined in section 1 of the Financial Markets Act; “Dashpay” Dashpay Proprietary Limited, registration number 2011/008978/07, a company incorporated in accordance with the laws of South Africa and a wholly owned subsidiary of Rinwell; “D ematerialised Shareholders” CAPPREC Shareholders who hold Dematerialised Shares; “Dematerialised Shares” CAPPREC Shares which have been incorporated into the Strate system and which are no longer evidenced by certificates or other physical Documents of Title; “Documents of Title” share certificates or any other documents of title to Certificated Shares acceptable to the Company; “Edmund Pieterse” Edmund Pieterse, an adult male with South African passport number 620801 5068 086; “EFTPOS” electronic funds transfer point of sale; “Eitan Neishlos” Eitan Neishlos, an adult male with Israeli passport number 12613733; 7 “Encumbrance” any mortgage, charge (fixed or floating), pledge, cession in security or out and out, lien, assignment, hypothecation, guarantee, trust arrangement, right of set-off, retention of title or other security interest, agreement or arrangement, or other third party right or interest including any reservation of title or other security interest of any kind, howsoever created or arising, or any agreement or arrangement (whether or not subject to any suspensive or resolutive condition) to create any of the above or that has a similar effect (including a sale, subscription and repurchase agreement), as well as any right to acquire, option, right of pre-emption or any similar right, and “Encumber” and “Encumbered” shall have corresponding meanings; “Escrow Agreement” the escrow agreement entered into between CAPPREC and Bowman Gilfillan Inc., dated 21 September 2015; “E xchange Control Regulations” Exchange Control Regulations, 1961, as amended, made in terms of section 9 of the Currency and Exchanges Act, No. 9 of 1933, as amended; “EY” Ernst & Young Incorporated, registration number 2005/002308/21, registered auditors, a firm of chartered accountants (CA) and the independent reporting accountant to CAPPREC; “Financial Markets Act” the Financial Markets Act, No. 19 of 2012, as amended or superseded from time to time; “Firefly” Firefly Investments 275 Proprietary Limited, registration number 2012/048286/07, a company incorporated in accordance with the laws of South Africa which is in the process of de-registration; “Founders” Michael Pimstein, Bradley Sacks, Motty Sacks, Alan Salomon, CAET and PIC; “Founders Agreement” the founders agreement entered into between the Founders and CAPPREC pursuant to the Listing, dated 18 September 2015; “GDP” gross domestic product; “General Meeting” the general meeting of CAPPREC Shareholders to be held at the offices of CAPPREC on the 4th Floor, One Vdara, 41 Rivonia Road, Sandhurst, 2196 at 10:00 on Friday, 5 May 2017, or any adjournment or postponement thereof, to consider and, if deemed appropriate, approve the resolutions set out in the Notice of General Meeting; “Grant Thornton” Grant Thornton, registration number 1989/006900/07, registered auditors, a firm of chartered accountants (CA) and the independent reporting accountant to African Resonance and the Rinwell group, respectively; “Hanoch Neishlos” Professor Hanoch Neishlos, a South African adult male with identity number 470730 5160 083; “HNS” HN Terminal Systems CC, registration number 2005/075094/23, a close corporation incorporated in accordance with the laws of South Africa; “IFRS” International Financial Reporting Standards, as issued by the International Accounting Standards Board; “Ingenico” as the context requires either Ingenico S.A., registration number 317218758, or any of its affiliates; “Jake Shepherd” Jake Damon Shepherd, a South African adult male with identity number 681103 5039 084; 8

Description: