Can anything beat a GARCH(1,1)? 2. Spurious regressions–non-sta PDF

Preview Can anything beat a GARCH(1,1)? 2. Spurious regressions–non-sta

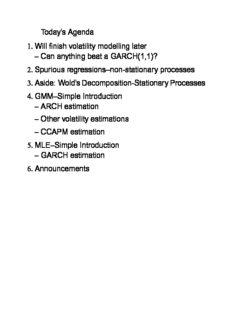

Today’s Agenda 1. Will (cid:2)nish volatility modelling later (cid:150) Can anything beat a GARCH(1,1)? 2. Spurious regressions(cid:150)non-stationary processes 3. Aside: Wold’s Decomposition-Stationary Processes 4. GMM(cid:150)Simple Introduction (cid:150) ARCH estimation (cid:150) Other volatility estimations (cid:150) CCAPM estimation 5. MLE(cid:150)Simple Introduction (cid:150) GARCH estimation 6. Announcements 1 Spurious Regressions and Non-Stationary Time Series Thus far, we have been looking at stationary time (cid:15) series. We have focused on r ; (cid:27)2; assuming t t that they are stationary. For some series, this assumption is more tenable than for others. But suppose you want to work with non-stationary (cid:15) time-series, i.e. prices, volume, number of investors in a particular fund, number of funds, etc. Those processes are inherently non-stationary. Let p be the log-price. We know that t (cid:15) p = p + " t t 1 t (cid:0) or p is an AR(1) process with an unit-root. t This process is non-stationary. We cannot apply (cid:15) the CLT. But we are still interested in testing the null (cid:30) = 1 (cid:15) versus (cid:30) < 1: Problem. Under the null, the process is non- (cid:15) stationary. Under the alternative, the process is stationary. (cid:15) It turns out that (Funtional CLT) (cid:15) t 1 1 p = " t s pT pT s=1 X [rT] 1 = " W (r) s pT ) s=1 X where W (r) is a Brownian motion on [0; 1] : I.e., W(r) N(0; r); 0 < r < 1: (cid:24) Note that this result is asymptotic. We don’t have (cid:15) to assume that the " s are normal (hence the 0 Functional CLT, or FCLT). Q: Can’t we standardize the non-stationary (cid:15) processes by a power of T in order for them to converge. A: Yes. (cid:15) Let’s get a (cid:147)(cid:3)avor(cid:148) of how things work: (cid:15) Recall that (cid:15) p p p ((cid:30)p + " ) ^ t t 1 t 1 t 1 t (cid:30) = = (cid:0) (cid:0) (cid:0) p2 p2 P t 1 P t 1 (cid:0) (cid:0) p " t 1 t = (cid:30)P+ P (cid:0) p2 P t 1 (cid:0) If (cid:30) < 1; we had P (cid:15) 1 " p ^ T t t 1 p (cid:30) = (cid:30) + (cid:30) (cid:0) 1 p2 ! TP t 1 (cid:0) pT (cid:30)^ (cid:30) N 0; (cid:27)2 P ^ (cid:0) (cid:24) (cid:30) (cid:16) (cid:17) (cid:16) (cid:17) But if (cid:30) = 1; the results do not hold. But (cid:15) " p ^ t t 1 (cid:30) = (cid:30) + (cid:0) p2 P t 1 (cid:0) ^ T (cid:30) (cid:30) O (1) p P (cid:0) ) (cid:16) (cid:17) ^ In other words, (cid:30) is super-consistent. (cid:15) ^ Q: But since we don’t know the distribution of (cid:30); (cid:15) can we use this result for testing? A: Yes, if we simulate the distribution. (cid:15) Dickey-Fuller (DF) Test: (cid:15) H : (cid:30) = 1 o H : (cid:30) < 1 a ^ (cid:30) 1 The test is: t = (cid:0) (^) (cid:15) se (cid:30) Suppose that " follows an AR(p) process. The t (cid:15) distribution of the DF test is in(cid:3)uenced by those parameters. Not good. To get rid of those parameters, we run the following (cid:15) regression: p = (cid:30)p + (cid:16) (cid:1)p + (cid:16) (cid:1)p + ::: + (cid:16) (cid:1)p + (cid:29) t t 1 1 t 1 2 t 2 k t=k t (cid:0) (cid:0) (cid:0) ^ (cid:30) 1 Then, t = : (cid:0) (^) (cid:15) se (cid:30) This is called the Augmented DF,or ADF test. (cid:15) Summary of ADF test(cid:150)Testing for a unit root: (cid:15) (cid:150) Regress p on p ; (cid:1)p ; (cid:1)p ; :::; (cid:1)p t t 1 t 1 t 2 t=k (cid:0) (cid:0) (cid:0) ^ (cid:30) 1 (cid:150) Form: t = (cid:0) (^) se (cid:30) (cid:150) Get the critical value from simulations. So, is working with non-stationary variables that (cid:15) easy? NO: (cid:15) Suppose p1 and p2 are the prices of the same asset t t (cid:15) traded on two markets. Then, it must be the case that 1 2 p = p t t Empirically, this is almost true. We (cid:2)nd (cid:15) 1 2 p p = " t t t (cid:0) where " is almost iid, and E (" ) = 0: t t How do we take advantage of this? (cid:15) Regress: (cid:15) 1 2 p = (cid:13)p + " t t t If (cid:15) " > 0 t 1 2 p > (cid:13)p t t The asset is (cid:147)too expensive(cid:148) in market 1. (cid:15) Easy, right? (cid:15) Wrong! (cid:15) Suppose we have two assets, with prices p and t (cid:15) q : One might be tempted to look for arbitrage t strategies as in p = (cid:13)q + " t t t If (cid:13) > 0; there is a relationship, and we can trade. (cid:15) No. (cid:15) Suppose (cid:15) p = p + u t t 1 t (cid:0) q = q + v t t 1 t (cid:0) cov (u v ) = 0 t t Note: The two log-prices represent two independent (cid:15) discrete Brownian motions. But: (cid:15) T T t t p q v u t=1 t t t=1 s=1 s s=1 s (cid:13)^ = = T q2 T t v 2 P t=1 t P (cid:0)Pt=1 s(cid:1)=(cid:0)1Ps (cid:1) 1 T t t v u TP2 t=1 s=1 s P s=(cid:0)P1 s (cid:1) = = O (1) p 2 1 T t v PT2 (cid:0)Pt=1 s(cid:1)=(cid:0)1Ps (cid:1) Similarly: P (cid:0)P (cid:1) (cid:15) (cid:13)^ t = se ((cid:13)^) is not consistent. The R2 does not converge to 0; as T : (cid:15) ! 1 Illustration: spurious.m (cid:15) Co-integration: Suppose that p and q are unit root (integrated) t t (cid:15) processes, but there is a linear combination of p t and q that is stationary. That is, there exists a t vector (cid:13) = 1 (cid:13) such that 1 (cid:0) p (cid:13)q = " t t t (cid:2) (cid:3) (cid:0) and " is a stationary process. Then, p and q are t t t said to be cointegrated. There are formal tests for cointegration, but they (cid:15) have low power against the alternative. Why? (Think spurious correlation). Cointegration is only between contemporaneous (cid:15) variables. I.e. p (cid:13)q is a cointegrating vector. t t (cid:0) But (cid:1)p is not. However, the latter is also a way of t stationarizing the process. Cointegration occurs (cid:147)naturally(cid:148) in economics. It is (cid:15) dictated by theory.

Description: