By Dr. RAJ K. AGARWAL DR. RAKESH GUPTA Nature of Search provisions Q1. After the possible ... PDF

Preview By Dr. RAJ K. AGARWAL DR. RAKESH GUPTA Nature of Search provisions Q1. After the possible ...

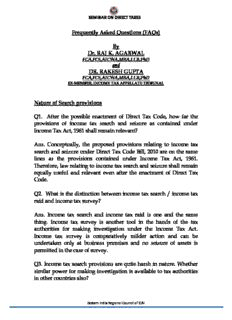

SEMINAR ON DIRECT TAXES Frequently Asked Questions (FAQs) By Dr. RAJ K. AGARWAL FCA,FCS,AICWA,MBA,LLB,PhD and DR. RAKESH GUPTA FCA,FCS,AICWA,MBA,LLB,PhD EX-MEMBER, INCOME TAX APPELLATE TRIBUNAL Nature of Search provisions Q1. After the possible enactment of Direct Tax Code, how far the provisions of income tax search and seizure as contained under Income Tax Act, 1961 shall remain relevant? Ans. Conceptually, the proposed provisions relating to income tax search and seizure under Direct Tax Code Bill, 2010 are on the same lines as the provisions contained under Income Tax Act, 1961. Therefore, law relating to income tax search and seizure shall remain equally useful and relevant even after the enactment of Direct Tax Code. Q2. What is the distinction between income tax search / income tax raid and income tax survey? Ans. Income tax search and income tax raid is one and the same thing. Income tax survey is another tool in the hands of the tax authorities for making investigation under the Income Tax Act. Income tax survey is comparatively milder action and can be undertaken only at business premises and no seizure of assets is permitted in the case of survey. Q3. Income tax search provisions are quite harsh in nature. Whether similar power for making investigation is available to tax authorities in other countries also? Eastern India Regional Council of ICAI SEMINAR ON DIRECT TAXES Ans. Yes. Powers of almost similar nature are available with the tax authorities for making investigation and un-earthing black money in other developed and developing countries. In other developed countries, such powers are more transparent, system driven and technology based than being discretionary in nature. Q4. The provisions of income tax search and seizure are quite harsh and it is often said that the powers given to tax authorities are draconian in nature. Are there any checks and balances established by the legislature so as to prevent misuse of such powers? Ans. Yes, there are in-built safeguards provided within the provisions of Section 132 itself so as to restrict misuse of the powers of search and seizure with the tax authorities. There is no power of arrest given to the income tax authorities in the case of search as is the case with respect to the enforcement of other economic laws such as excise duty, customs, enforcement directorate etc. Authorization of Search Q5. Whether non-compliance of summons issued by the Assistant Director of Investigation under section 131(1A) can form the basis for initiating search? Ans. This is a controversial issue and there is no direct authority available from any court on the above issue. As per literal interpretation of section 132(1), it seems that search action cannot be initiated for non-compliance of summons issued under section 131(1A) but if we go by purposive interpretation, such view is not free from doubt. Q6. Whether search can be initiated on the basis of information regarding investment in immovable properties particularly when existence of immovable property is a known fact and cannot be subject matter of seizure? Eastern India Regional Council of ICAI SEMINAR ON DIRECT TAXES Ans. To take a view that search action cannot be initiated on the basis of information regarding investment in immovable properties does not seem to be the correct view. The underlying asset maybe immovable property which is a visible asset and location of which maybe in the knowledge of the department, but the test would lie upon the fact that whether income representing such assets or the assets itself, have been disclosed to the department or not. Q7. Whether the identity of the informer, on the basis of whose information, search action was initiated, can be discovered by the person searched? Ans. It is very difficult to know the identity of the informer since such information is kept highly confidential in possession of senior officers only. However, in case the informer is a professional informer and claims reward from the Department at a later stage for information supplied by him, assessee may lay hand at such details of reward, though the same is also kept confidential. In case such professional informers approach court for seeking a direction to the tax department to give them the reward, their identity in that case becomes exposed. Q8. How much time does it take in preparing a case for taking search action by the income tax department? Ans. There is no time limit which can be prescribed for this purpose. It depends upon the nature of information regarding existence of undisclosed income and likelihood of seizure of assets, according to which case maybe prepared for taking action of search. However, in all cases search warrant by competent authority is required to be issued before taking action of search. In the case of property transaction, when there is information available with the department regarding exchange of huge unaccounted cash consideration, search maybe planned even in one day. In yet another case, unless the information received is reliable Eastern India Regional Council of ICAI SEMINAR ON DIRECT TAXES and verified, search action may not be planned and remain pending for months or sometimes years together. Q9. Under what circumstances an action of survey under section 133A maybe converted into search under section 132? Ans. It is not easy and is not at the whim and fancy of the survey team to convert survey into search, though in practice it has been observed that sometimes such pressure is exercised by the survey team. It maybe possible only on the fulfillment of either of the conditions prescribed under clauses (a), (b) or (c) of section 132(1) and after obtaining the search warrant from the competent authority. Survey is generally conducted by assessment wing of the department whereas competent authority to authorize search in such a case would normally be Commissioner of Income Tax. The Additional Commissioner of Income Tax, who may be heading the survey team, may not normally be the competent authority to authorize search and he will have to obtain search warrant from CIT. Q10. Whether assessee can get copy of search warrant authorizing search action against him? Ans. As per various judicial pronouncements, assessee does not have legal right to get the copy of search warrant authorizing search against him. Copy of search warrant is shown and signature of assessee on search warrant is obtained by the authorized officer before commencing action of search but the copy of search warrant is not supplied to the assessee. Q11. Whether assessee can get copy of reasons recorded by the competent authority authorizing search? Ans. The reasons recorded by the competent authority authorizing search are kept in confidential folder and the same are not shown to the assessee. The assessee cannot get the copy of the reasons; moreover, he cannot even read the contents of the reasons recorded. In a case when validity of search is challenged in writ petition before Eastern India Regional Council of ICAI SEMINAR ON DIRECT TAXES the high court and copy of reasons is summoned by the high court, the reasons recorded are seen and read by their lordships themselves and the contents are not made public or available to the assessee. In certain judicial cases reported, it has been seen that the reason for conducting search has been reproduced in the judicial orders. Q12. Whether authorized officer can enter and search any of the premises relating to the person searched in the course of search action on the basis of suspicion that some kind of incriminating material maybe available thereat? Ans. Any premises relating to the person searched maybe searched on the basis of suspicion but authorized officer is required to obtain search warrant from the competent authority to enter and search such premises. He cannot at his own enter and search any of the premises relating to the person searched. Q13. Whether consequential search warrant can be issued by the competent authority in the name of some other person, say consultant of the assessee, or employee of the assessee on the basis of suspicion? Ans. No search warrant can be issued by the competent authority in the name of some other person merely on the basis of suspicion. For issuing search warrant in the name of some other person, the competent authority has to record “reasons to believe” in consequence of information in his possession. Q14. Whether search warrant can be issued in the name of minor / non-resident Indian / foreign national residing in India / Legal heir of the deceased person? Ans. Yes, it is possible. Q15. Whether blank search warrant signed by the competent authority maybe filled and used by the authorized officer for covering some other premises during search? Eastern India Regional Council of ICAI SEMINAR ON DIRECT TAXES Ans. No, use of search warrant in this manner is illegal. Q16. Whether search can be conducted with respect to the person who is in joint occupation with the person searched? Ans. A person who is in joint occupation with the person searched may also be searched by the authorized officer to find out any incriminating material relating to the person searched available in his possession. However, in case the premises are independent, separate search warrant is required to enter and search such premises. Independence of the premises is a matter of fact and will depend upon particular case. Q17. Whether search warrant can be issued in joint name? Ans. Yes, search warrant can be issued in joint name and in such a situation, each person covered in the search warrant can be searched and would be liable to be assessed / re-assessed in accordance with the provisions of section 153A. However, in such a case, “reason to believe” is required to be recorded by the competent authority separately for each person before including his or her name in the search warrant. Q18. In case of a search with respect to group of companies, if search warrant is issued in the name of the employee of the company & consequently, search is conducted at his residential premises, whether legality of search can be challenged by such employee in the high court for the reason that search in his case is invalid? Ans. For conducting a valid search at the residential premises of the employee, “reason to believe” should be recorded by the competent authority with respect to such person in his individual capacity. “Reason to believe” recorded for the group as a whole may not be sufficient for issuing search warrant in his personal name & conducting search at his residential premises and in such a case search action maybe declared as invalid by the high court if it is Eastern India Regional Council of ICAI SEMINAR ON DIRECT TAXES found that reason to believe has not been recorded against him in his individual capacity. However, search warrant can be issued in the name of the company to conduct search at his residential premises in case, there is suspicion that incriminating material relating to the company is kept at his residential premises. Q19. The person searched is generally tempted to challenge the validity of search in the high court. Whether it is in his advantage to do so? Ans. It is not always advantageous to challenge the validity of the search in the high court. The decision is required to be taken keeping in view several factors and after weighing all the pros and cons. Q20. Whether incriminating material found and seized during search which is declared as illegal by the high court, maybe used by the department against the assessee? Ans. Yes, as per various judicial pronouncements, incriminating material found and seized even in an illegal search action maybe used by the income tax department against the assessee in appropriate proceedings. Q21. Whether validity of search can be challenged by the assessee during appellate proceedings before CIT(A) / ITAT? Ans. No, validity of search cannot be examined by CIT(A) / ITAT during appellate proceedings. The validity of search can be examined by high court in writ jurisdiction. Q22. Whether failure to file the return of income or return of wealth maybe a sufficient ground to issue search warrant? Ans. No, non-filing of return of income / wealth cannot be a sufficient ground for conducting search. Conduct of Search Eastern India Regional Council of ICAI SEMINAR ON DIRECT TAXES Q23. Whether action of search can be initiated in the night? Ans. There is no restriction provided under the Act with respect to the timings for initiating action for search. Search action can be initiated at any time depending upon the urgency of the matter. Q24. Whether search can be conducted at the premises found locked or at the premises where no person is available? Ans. Yes, the authorized officer has the power to break open the lock and enter the premises and make the search irrespective of whether the occupant / owner or some other person is available at the premises or not. The authorized officer may call upon two independent witnesses and in the presence of such witnesses; he may conduct the search proceedings. Q25. Whether search can be conducted with respect to a person at the premises not belonging to him but occupied by some other person? Ans. Yes, search can be conducted at any premises for which search warrant has been issued in consequence of information available with the authorities that incriminating material belonging to the target person is kept at such premises. Q26. Whether deleted data from the laptop maybe restored and be made use of by the department? Ans. Yes, there are soft-wares available to restore the deleted data and sometimes the department does make use of such technique. The assessee cannot disown such data. Q27. Whether a guest staying with the assessee may also be searched? Ans. Yes, any person staying in, coming out or going in the premises maybe made subject of personal search. Eastern India Regional Council of ICAI SEMINAR ON DIRECT TAXES Q28. Whether assessee is duty bound to disclose password / soft ware for operation of files in the computer? Ans. Yes, assessee is duty bound to disclose password / soft ware for operation of files in the computer. In case of non-cooperation in this regard, assessee maybe prosecuted. Q29. Whether the authorized officer has the power to break open the locker, almirah, box etc. or tear the sofa or dig the wall / floor etc.? Ans. Yes, in case of suspicion or non-cooperation from the assessee to make available the keys, the authorized officer has power to take such action. Q30. Whether search can be temporarily suspended? Ans. Search can be temporarily suspended by passing prohibitory orders as prescribed under section 132(3) of the Act. Q31. Whether it is mandatory to appoint two independent witnesses before commencing conduct of search? Ans. Yes, it is a mandatory requirement and the entire search proceedings are conducted in the presence of two independent witnesses. Q32. Whether witnesses of his choice may be selected by the assessee? Ans. No, it is not the right of the assessee to select witnesses of his choice. However, in practice, selection of witnesses is made by the authorized officer with the consent of the assessee so that whole proceedings may be carried out smoothly. Q33. Whether authorized officer can forcibly require any person to act as witness? Eastern India Regional Council of ICAI SEMINAR ON DIRECT TAXES Ans. No it is not possible to forcibly require any person to act as witness. However, a person refusing to act as witness without any justifiable cause, inspite of direction of the authorized officer may be prosecuted for his denial. Q34. Whether a person can ask for medical aid during the proceedings of search? Ans. Yes, a person under search can ask for medical aid in case he is not feeling well and he requires medical aid. He can call his family doctor to look after him and on the advice of doctor, if required he may be admitted to hospital. Q35. Whether assessee may insist for the presence of his counsel at the time of search operation? Ans. No, assessee does not have legal right to insist the presence of his counsel at the time of search operations. Search proceedings are the investigation proceedings and are conducted in the presence of two independent witnesses. Q36. Whether authorized officer has power to arrest or detain the person during search? Ans. No, income tax authorities in the course of income tax search and seizure operation do not have any power to arrest or detain any person. Q37. Whether assessee has right to get copy of panchnaama and copy of statement recorded during search? Ans. Assessee has right to get copy of panchnaama along with all annexures and generally it is handed over by the authorized officer to the assessee at the time of conclusion of search. But copy of statement recorded is not given to the assessee on the plea that the same shall be given at the time when it is to be used against the assessee. Eastern India Regional Council of ICAI

Description: