ARTISAN PARTNERS FUNDS, INC. - RightProspectus PDF

Preview ARTISAN PARTNERS FUNDS, INC. - RightProspectus

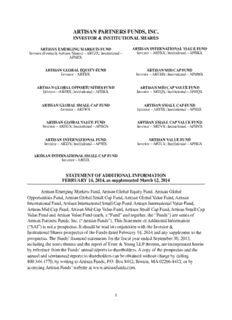

STATEMENT OF 2022 ADDITIONAL INFORMATION 1February2022, asrevised 7November2022 Artisan Partners Funds ShareClass Investor Advisor Institutional ArtisanDevelopingWorldFund ARTYX APDYX APHYX ArtisanFloatingRateFund ARTUX APDUX APHUX ArtisanFocusFund ARTTX APDTX APHTX ArtisanGlobalDiscoveryFund APFDX APDDX APHDX ArtisanGlobalEquityFund ARTHX APDHX APHHX ArtisanGlobalOpportunitiesFund ARTRX APDRX APHRX ArtisanGlobalValueFund ARTGX APDGX APHGX ArtisanHighIncomeFund ARTFX APDFX APHFX ArtisanInternationalFund ARTIX APDIX APHIX ArtisanInternationalSmall-MidFund ARTJX APDJX APHJX ArtisanInternationalValueFund ARTKX APDKX APHKX ArtisanMidCapFund ARTMX APDMX APHMX ArtisanMidCapValueFund ARTQX APDQX APHQX ArtisanSelectEquityFund ARTNX APDNX APHNX ArtisanSmallCapFund ARTSX APDSX APHSX ArtisanSustainableEmergingMarketsFund ARTZX — APHEX ArtisanValueFund ARTLX APDLX APHLX StatementofAdditionalInformation 1February2022,asrevised7November2022 Artisan Developing World Fund, Artisan Floating Rate Fund, Artisan Focus Fund, Artisan Global DiscoveryFund,ArtisanGlobalEquityFund,ArtisanGlobalOpportunitiesFund,ArtisanGlobalValue Fund,ArtisanHighIncomeFund,ArtisanInternationalFund,ArtisanInternationalSmall-MidFund, ArtisanInternationalValueFund,ArtisanMidCapFund,ArtisanMidCapValueFund,ArtisanSelect EquityFund,ArtisanSmallCapFund,ArtisanSustainableEmergingMarketsFundandArtisanValue Fund (each, a “Fund” and, together, the “Funds”) are series of Artisan Partners Funds, Inc. (“Artisan Partners Funds”). This Statement of Additional Information (“SAI”) is not a prospectus. It shouldbereadinconjunctionwiththeprospectusoftheFundsdated1February2022,asrevised7 November 2022 and any supplement or amendment to the prospectus. The Funds’ financial statementsforthefiscalyearended30September2021,includingthenotestheretoandthereport ofErnst&YoungLLPthereon,areincorporatedhereinbyreferencefromtheFunds’annualreportsto shareholders.Acopyoftheprospectusandtheannualandsemiannualreportstoshareholderscan be obtained without charge by calling 800.344.1770, by writing to Artisan Partners Funds, P.O. Box 219322, Kansas City, MO 64121-9322, or by accessing Artisan Partners Funds’website at www.artisanpartners.com. TableofContents InformationabouttheFundsandArtisanPartners ............................................... 2 InvestmentObjectivesandPolicies.............................................................. 2 InvestmentTechniquesandRisks................................................................ 2 InvestmentRestrictions .........................................................................27 Organization....................................................................................29 DirectorsandOfficers...........................................................................29 PortfolioManagers..............................................................................37 PotentialConflictsofInterest....................................................................40 ControlPersonsandPrincipalShareholders......................................................44 InvestmentAdvisoryServices....................................................................49 CodeofEthics ..................................................................................52 Distributor......................................................................................52 PortfolioTransactions ...........................................................................53 ProxyVoting....................................................................................56 DisclosureofPortfolioHoldings .................................................................58 Purchasing,ExchangingandRedeemingShares .................................................59 AdditionalFederalIncomeTaxInformation ......................................................61 Custodians......................................................................................67 TransferAgent..................................................................................68 LegalCounsel...................................................................................68 IndependentRegisteredPublicAccountingFirm.................................................68 FinancialStatements............................................................................68 StatementofAdditionalInformation—ArtisanPartnersFunds InformationabouttheFundsandArtisanPartners EachFundisaseriesofArtisanPartnersFunds.ArtisanPartnersLimitedPartnership(“ArtisanPartners”)providesinvestmentadvisoryservices totheFunds. ThediscussionbelowsupplementsthedescriptionintheprospectusofeachFund’sinvestmentobjectives,policiesandrestrictions. InvestmentObjectivesandPolicies TheinvestmentobjectiveofeachFundmaybechangedbytheboardofdirectorswithouttheapprovalofshareholders.However,investors inaFundwillreceiveatleast30days’priorwrittennoticeofimplementationofanychangeinaFund’sinvestmentobjective. InvestmentTechniquesandRisks ForeignSecurities EachFundcaninvestinsecuritiesofnon-UScompanies.ArtisanMidCapValueFundandArtisanSmallCapFundcanonlyinvestinsecurities of non-US companies that trade in the US. For the purposes of testing compliance with each Fund’s investment restrictions related to investing in non-US companies, Artisan Partners generally considers an issuer to be from a particular country as designated by ArtisanPartners’securitiesinformationvendors,whichmaychangefromtimetotime.However,eachinvestmentteam,initsownjudgment, mayconsideranissuertobefromacountryotherthanthecountrydesignatedbythesecuritiesinformationvendors.Therefore,classifications maydifferbyFundandinvestmentteam.Indeterminingthecountrydesignationsofissuers,eachinvestmentteamand/orArtisanPartners’ vendorsmayusearangeofcriteria,includingtheidentityofthejurisdictionoftheissuer’sincorporation,themainequitytradingmarketfor theissuer’ssecurities,thegeographicaldistributionoftheissuer’soperations,thelocationoftheissuer’sheadquartersorothercriteria,such as the source of a company’s revenues. Over time, country designations may change. As a result of this classification, a Fund may hold securitiesofissuersclassifiedasUS,butwhichareorganizedoutsidetheUSor,viceversa,aFundmayholdsecuritiesofissuersclassifiedas non-US,butwhichareorganizedintheUSand/ortradeintheUS.Inaddition,thecountryandregionalclassificationsshownintheFunds’ shareholderreports,financialstatementsandotherreportsmaydifferfromtheclassificationsusedforpurposesoftestingcompliancewitha Fund’sinvestmentrestrictions. Securities of non-US companies include American Depositary Receipts (“ADRs”), NewYork Shares, European Depositary Receipts (“EDRs”), ContinentalDepositaryReceipts(“CDRs”),GlobalDepositaryReceipts(“GDRs”),orothersecuritiesrepresentingunderlyingsharesofforeign issuers. ADRs, New York Shares, EDRs, CDRs and GDRs are receipts, typically issued by a financial institution (a“depositary”), evidencing ownershipinterestsinasecurityorpoolofsecuritiesissuedbyanissueranddepositedwiththedepositary.ADRs,EDRs,CDRsandGDRsmay be available for investment through“sponsored”or“unsponsored”facilities. A sponsored facility is established jointly by the issuer of the securityunderlyingthereceiptandadepositary,whereasanunsponsoredfacilitymaybeestablishedbyadepositarywithoutparticipationby theissuerofthereceipt’sunderlyingsecurity.TheFundsmayinvestinsponsoredorunsponsoredADRs,EDRs,CDRs,GDRsorotherformsof depositaryreceipts,certainofwhichmayincludevotingrightswithrespecttotheunderlyingforeignshares,andcertainofwhichmaynot. With respect to portfolio securities that are issued by foreign issuers or denominated in foreign currencies (including, among others, participationcertificatesanddepositaryreceipts),aFund’sinvestmentperformanceisaffectedbythestrengthorweaknessoftheUSdollar againstthesecurrencies.Forexample,ifthedollarfallsinvaluerelativetotheJapaneseyen,thedollarvalueofayen-denominatedstockheld intheportfoliowillriseeventhoughthepriceofthestockremainsunchanged.Conversely,ifthedollarrisesinvaluerelativetotheyen,the dollarvalueoftheyen-denominatedstockwillfall.(Seediscussionoftransactionhedgingandportfoliohedgingunder“ManagingInvestment Exposure.”) Investors should understand and consider carefully the risks involved in foreign investing, including the risks of transacting on foreign exchangesorwithforeignclearinghouses.Investinginforeignsecurities(includingthroughpositionsdenominatedinforeigncurrenciesor dollar-denominatedsecuritiesorotherinstrumentsthatexposetheFundtoforeignsecuritiesorcurrencies)andutilizationofforwardforeign currencyexchangecontractsinvolvecertainconsiderationscomprisingbothrisksandopportunitiesnottypicallyassociatedwithinvestingin US securities.These considerations include fluctuations in exchange rates of foreign currencies; possible imposition of exchange control regulationorcurrencyrestrictionsthatwouldpreventcashfrombeingbroughtbacktotheUS;lesspublicinformationwithrespecttoissuers of securities; less governmental supervision of stock exchanges, securities brokers and issuers of securities; lack of uniform accounting, auditing,financialreportinganddisclosurestandards;lackofuniformsettlementperiodsandtradingpractices;lessliquidityandfrequently greaterpricevolatilityinforeignmarketsthanintheUS;possibleimpositionofforeigntaxes;andsometimeslessadvantageousoruncertain legal,operationalandfinancialprotectionsapplicabletoforeignsub-custodialarrangementsandinvestmentsthroughcomplexstructures thatmaylacktransparency. There is the possibility of expropriation or confiscatory taxation, seizure or nationalization of foreign bank deposits or other assets, establishment of exchange controls, the adoption of foreign government restrictions, or other adverse political, social or diplomatic developmentsthatcouldaffectinternationalinvestments.Forexample,continuinguncertaintyastothestatusoftheEuroandtheEuropean MonetaryUnion(“EMU”)andthepotentialforcertaincountriestowithdrawfromtheinstitutionhascreatedvolatilityincurrencyandfinancial markets.TheUnitedKingdomapprovedareferendumtowithdrawfromtheEU(commonlyreferredtoas“Brexit”)inJune2016.InMarch2017, theBritishgovernmentformallynotifiedtheEUofthecountry’sintentiontowithdrawfromtheEU.Thewithdrawalagreementbetweenthe StatementofAdditionalInformation—ArtisanPartnersFunds 2 UnitedKingdomandtheEUtookeffecton31January2020,atwhichtimetheUnitedKingdomceasedtobeamemberoftheEU.On1 January2021,theEU-UKTradeandCooperationAgreement,abilateraltradeandcooperationdealgoverningthefuturerelationshipbetween theUnitedKingdomandtheEU,provisionallywentintoeffect.TheUnitedKingdom'sParliamenthasalreadyratifiedtheagreement,butthe agreementwillcontinuetobeappliedprovisionallyuntilitisformallyratifiedbytheEUParliament.TheUnitedKingdom’sdeparturefromthe EUmayresultinasustainedperiodofmarketuncertainty,asnewtradeandotheragreementsbetweentheUnitedKingdomandtheEUtake effect.TheUnitedKingdom’sdeparturefromtheEUmayalsodestabilizesomeoralloftheotherEUmembercountriesand/ortheEurozone. ThesedevelopmentscouldresultinlossestoaFund,astheremaybenegativeeffectsonthevalueoftheFund’sinvestmentsand/oronthe Fund’sabilitytoenterintocertaintransactionsorvaluecertaininvestments,andthesedevelopmentsmaymakeitmoredifficultforaFundto exit certain investments at an advantageous time or price. As a further example, certain investments by a Fund that involve a business connectedwithorrelatedtonationalsecurity(including,withoutlimitation,criticaltechnology,criticalinfrastructure,orsensitivedata)may besubjecttoreviewandapprovalbytheCommitteeonForeignInvestmentintheUnitedStates(“CFIUS”)and/ornon-USnationalsecurity/ investment clearance regulators. In the event that CFIUS or another regulator reviews one or more of a Fund's proposed or existing investments,itispossiblethatCFIUSoranotherregulatorwillseektodirectlyorindirectlyimposelimitationsonorprohibitoneormoreofthe Fund'sinvestmentsorunwindatransaction.SuchlimitationsorrestrictionsmaypreventaFundfrompursuingcertaininvestments,cause delays with respect to consummating such investments, or require the Fund to consummate an investment on terms that are less advantageousthanwouldbethecaseabsentsuchrestrictions.WhereaFundisrequiredtounwindatransaction,inadditiontoincurring additionallegal,administrative,andothercosts,theFundmayhavetodisposeoftheinvestmentatapricethatislessthanitwouldhave received had the Fund exited at a different time or under different circumstances. Any of these outcomes could adversely affect a Fund's performance. Income, gains and proceeds from non-US securities held by a Fund could be reduced by taxes withheld from that income, gains and proceeds,orothertaxesthatmaybeimposedbythecountriesinwhichtheFundinvests.Thenetassetvalue(“NAV”)ofaFundalsomaybe affectedbychangesintheratesormethodsoftaxationapplicabletotheFundortoentitiesinwhichtheFundhasinvested. Emerging, Less Developed and Developing Markets. Each Fund may invest in securities of companies in emerging, less developed and developing markets, including companies domiciled in frontier markets. Artisan Partners considers emerging and less developed markets (“emergingmarkets”)tobethosemarketsinanycountryotherthanCanada,Luxembourg,theUSandthecountriescomprisingtheMSCIEAFE Index(currently,Australia,Austria,Belgium,Denmark,Finland,France,Germany,HongKong,Ireland,Israel,Italy,Japan,theNetherlands,New Zealand,Norway,Portugal,Singapore,Spain,Sweden,SwitzerlandandtheUnitedKingdom).“Frontiermarkets”areasubsetofemergingand lessdevelopedmarketsthat,generally,havesmallereconomiesandlessmaturecapitalmarkets.ArtisanDevelopingWorldFund’sinvestment teamgenerallyconsidersdevelopingworldtoincludecountriesthatareincludedinanyoneoftheMSCIemergingorfrontiermarketsindices, or that are classified under a similar corresponding classification, by organizations such as the World Bank, United Nations, International Finance Corporation or the International Monetary Fund. For purposes of the Fund’s investments, a determination that an issuer is economicallytiedtooneormoremarketsinthedevelopingworldisbasedonfactorsincluding,butnotlimitedto,geographiclocationofits primary trading markets, location of its assets, its domicile or its principal offices, the source of its revenues and/or whether the issuer is indirectlyexposedtotherisksoreconomicfortunesofadevelopingmarket. Investments in emerging and developing markets’securities involve special risks in addition to those generally associated with foreign investing.Manyinvestmentsinemerginganddevelopingmarketscanbeconsideredspeculative,andthevalueofthoseinvestmentscanbe more volatile than investments in more developed foreign markets. This difference reflects the greater uncertainties of investing in less establishedmarketsandeconomies.Costsassociatedwithtransactionsinemerginganddevelopingmarkets’securitiestypicallyarehigher thancostsassociatedwithtransactionsinUSsecurities.Suchtransactionsalsomayinvolveadditionalcostsforthepurchaseorsaleofforeign currency. Investinginemerginganddevelopingmarketcountriesinvolvessubstantialriskdueto,amongotherreasons,limitedinformation;higher brokeragecosts;differentaccounting,auditingandfinancialreportingstandards;lessdevelopedlegalsystemsandthinnertradingmarketsas comparedtothoseindevelopedcountries;andcurrencyblockagesortransferrestrictions.Incertainfrontierandemergingmarkets,fraud and corruption may be more prevalent than in developed market countries. In addition, securities markets of emerging and developing marketcountriesmaybesubstantiallysmaller,lessdeveloped,lessliquidandmorevolatilethanthemajorsecuritiesmarketsintheUSand other developed nations. The limited size of many securities markets in emerging and developing market countries and limited trading volumeinissuerscomparedtothevolumeinUSsecuritiesorsecuritiesofissuersinotherdevelopedcountriescouldcausepricestobeerratic forreasonsotherthanfactorsthataffectthequalityofthesecurities.Inaddition,emerginganddevelopingmarketcountries’exchangesand broker-dealersmaygenerallybesubjecttolessregulationthantheircounterpartsindevelopedcountries.Suchrisksmaybegreaterinfrontier markets.Brokeragecommissionsanddealermark-ups,custodialexpensesandothertransactioncostsaregenerallyhigherinemergingand developingmarketcountriesthanindevelopedcountries,allofwhichcanincreasefundoperatingexpensesand/orcreateadragonfund performance. EmerginganddevelopingmarketcountriesmayhavedifferentclearanceandsettlementproceduresthanintheUS,andincertainmarkets there may be times when settlements fail to keep pace with the volume of securities transactions, making it difficult to conduct such transactions.Further,satisfactorycustodialservicesforinvestmentsecuritiesmaynotbeavailableinsomeemerginganddevelopingmarket countries, which may result in additional costs and delays in trading and settlement. The inability of a Fund to make intended security StatementofAdditionalInformation—ArtisanPartnersFunds 3 purchasesduetosettlementproblemsortheriskofintermediaryorcounterpartyfailurescouldcauseaFundtomissattractiveinvestment opportunities. The inability to dispose of a portfolio security due to settlement problems could result either in losses to a Fund due to subsequentdeclinesinthevalueofsuchportfoliosecurityor,iftheFundhasenteredintoacontracttosellthesecurity,inpossibleliabilityto thepurchaser. The Funds may invest in some emerging and developing markets through trading structures or protocols that subject them to the risks describedabove(suchasrisksassociatedwithilliquidity,custodyingassets,differentsettlementandclearanceprocedures,assertinglegaltitle underadevelopinglegalandregulatoryregimeandotherrisks)toagreaterdegreethanindevelopedmarketsoreveninotheremergingand developing markets. For example, some of the markets in which a Fund may invest do not provide for settlement on a delivery versus paymentbasisandtheriskinrelationtosuchsettlementsarebornebytheFund. Certain foreign markets (including certain emerging and developing markets) may require governmental approval for the repatriation of investmentincome,capitalortheproceedsofsalesofsecuritiesbyforeigninvestors.AFundcouldbeadverselyaffectedbydelaysin,ora refusaltogrant,requiredgovernmentalapprovalforrepatriationofcapital,aswellasbytheapplicationtotheFundofanyrestrictionson investments. Manyemerginganddevelopingmarketshaveexperiencedsubstantialratesofinflationforextendedperiods.Inflationandrapidfluctuations in inflation rates have had and may continue to have adverse effects on the economies and securities markets of certain emerging and developingmarketcountries.Inanattempttocontrolinflation,certainemerginganddevelopingmarketcountrieshaveimposedwageand pricecontrols.Someofthosecountries,inrecentyears,havebeguntocontrolinflationthrougheconomicpolicies. Governmentsofmanyemerginganddevelopingmarketcountrieshaveexercisedandcontinuetoexercisesubstantialinfluenceovermany aspects of the private sector through ownership or control of many companies. The future actions of those governments could have a significanteffectoneconomicconditionsinemerginganddevelopingmarkets,whichinturn,mayadverselyaffectcompaniesintheprivate sector,generalmarketconditionsandpricesandyieldsofcertainofthesecuritiesinaFund’sportfolio.Expropriation,confiscatorytaxation, nationalization and political, economic and social instability have occurred throughout the history of certain emerging and developing marketcountriesandcouldadverselyaffectFundassetsshouldanyofthoseconditionsrecur.Inaddition,highlevelsofnationaldebttendto makeemerginganddevelopingmarketsheavilyreliantonforeigncapitaland,therefore,vulnerabletocapitalflight. China-RelatedInvestments.TheFundsmayinvestincertaineligibleChinesesecurities(“ChinaAShares”)listedandtradedontheShanghai StockExchange(“SSE”)andShenzhenStockExchangethroughstockconnectprograms(each,a“StockConnect”).TheStockConnectsare securitiestradingandclearingprogramsfortheestablishmentofmutualmarketaccessbetweenmarkets.TheStockConnectsaresubjectto regulationspromulgatedbyregulatoryauthoritiesforeachmarketandfurtherregulationsorrestrictions,suchastradingsuspensions,may adverselyaffecttheStockConnectsandthevalueoftheChinaASharesheldbytheFunds.Thereisnoguaranteethatthesystemsrequiredto operate a Stock Connect will function properly or that exchanges will continue to support Stock Connects in the future.While the Stock Connects may not currently be subject to individual investment quotas, daily and aggregate investment quotas generally apply to all participantsonStockConnectsona“netbuy”basis,whichmayrestrictorprecludeaFund’sabilitytoinvestinsecuritiestradedthroughthe StockConnectsonatimelybasisoratallonanygivenday.Inaddition,suchsecuritiesgenerallymaynotbesold,purchasedorotherwise transferredotherthanthroughtheapplicableStockConnectinaccordancewiththeprogram’srules,whichmayfurthersubjecttheFundsto liquidityriskwithrespecttoChinaAShares.AFundmayberestrictedinitsabilitytodisposeofitsChinaASharespurchasedthroughStock Connectinatimelymanner.Asanexample,theStockConnectsaregenerallyavailableonlyonbusinessdayswhenbothmarketsareopen. Wheneithermarketisclosed,aFundwillnotbeabletotradesecuritiesonthatStockConnectatatimethatmayotherwisebebeneficialto trade.BecauseofthewayinwhichChinaASharesareheldinaStockConnect,aFundmaynotbeabletoexercisetherightsofashareholder andmaybelimitedinitsabilitytopursueclaimsagainsttheissuerofasecurity,andmaysufferlossesintheeventthedepositoryoftheStock Connectbecomesinsolvent.ThelimitationsandrisksdescribedabovewithrespecttotheStockConnectsarespecifictothoseprograms; however, these and other risks may exist to varying degrees in connection with the Funds’investments through other trading structures, protocolsandplatformsinotheremerginganddevelopingmarkets. InadditiontoinvestingthroughaStockConnect,theFundsmayalsoinvestinChinaASharesthroughaQualifiedForeignInvestor(“QFI”) arrangement.ArtisanPartnershasappliedforandreceivedaQFIlicensefromtheChinaSecuritiesRegulatoryCommission.ArtisanPartnersis permittedtoinvestdirectlyinChinaASharesdenominatedinChineserenminbiorothercurrencies,onbehalfofclientswhoseportfolios Artisan Partners manages, including the Funds. Under Chinese law, Artisan Partners, as holder of the QFI license, is required to maintain custodyofChinaAShareassetsheldaspartoftheQFIlicensewithalocalcustodianinArtisanPartners’nameforthebenefitoftheapplicable Fund,andtheFundbearsthecostsofmaintainingitssub-accountonthebooksandrecordsoftheChinesecustodian.ArtisanPartners'ability toinvestinChinaASharesthroughaQFIarrangementonbehalfoftheFundsissubjecttotheapplicableChineselaws,rulesandregulations, includingrelatingto,withoutlimitation,restrictionsoninvestmentandrepatriationofprincipalandprofits.Theinvestmentregulationsunder which the Funds would invest in the China A Shares market are relatively new. In addition, the application and interpretation of these regulationsisoftenunclearandthereisnocertaintyastohowtheywillbeapplied. CertainoftheFundsmayinvestinonshoreChinabondsthroughaChinaInterbankBondMarket("CIBM")registration.CIBMisanover-the- counter market outside the two main stock exchanges in China through which institutional investors (including domestic institutional investorsbutalsoQFIs,aswellasotheroffshoreinstitutionalinvestors,subjecttoauthorization)tradecertaindebtinstrumentsonaone-to- StatementofAdditionalInformation—ArtisanPartnersFunds 4 onequote-drivenbasis.MarketvolatilityandpotentiallackofliquidityduetolowtradingvolumeofcertaindebtsecuritiesinCIBMmayresult inpricesofcertaindebtsecuritiestradedonsuchmarketfluctuatingsignificantly.Thebidandofferspreadsofthepricesofsuchsecurities may be large, and the fund may therefore incur significant trading, settlement and realization costs and may face counterparty default, liquidity,andvolatilityrisks,resultinginsignificantlossesforthefundsandtheirinvestors. TotheextentaFundinvestsinsecuritiesofChineseissuers,itmayalsobesubjecttocertainrisksandconsiderationsnottypicallyassociated withinvestinginsecuritiesofUSissuersandpotentiallytoagreaterextentthaninvestmentsincertainothernon-USissuers,including,among others,morefrequenttradingsuspensions,limitsontheuseofbrokersandonforeignownership,variableinterestentities(“VIEs”)risks(see below),higherdependenceonexportsandinternationaltradeandpotentialforincreasedtradetariffs,embargoesandothertradelimitations. USorforeigngovernmentsanctionsorothergovernmentsinterventionscouldprecludeaFundfrommakingcertaininvestmentsinChinaor resultinaFundsellinginvestmentsinChinaatdisadvantageoustimesorprices.SignificantportionsoftheChinesesecuritiesmarketsmay becomerapidlyilliquid,asChineseissuershavetheabilitytosuspendthetradingoftheirequitysecurities,andhaveshownawillingnessto exercisethatoptioninresponsetomarketvolatilityandotherevents. InChina,foreignownershipofChinesecompaniesincertainsectors(includingbyUSpersonsandentities,inclusiveofUSmutualfunds)is prohibited.Inordertofacilitateforeigninvestment,manyChinesecompanieshaveestablishedshellcompaniesthatenterintocontractual arrangementswithChineseVIEsthatallowforeigninvestors,suchascertainoftheFunds,throughtheuseofcontractualarrangements,to both exert a degree of influence and to obtain substantially all of the economic benefits arising from a company without formal legal ownership. Although VIEs are a longstanding industry practice and well known to Chinese officials and regulators, they are not formally recognizedunderChineselaw.IftheChinesecompanies(ortheirofficers,directors,orChineseequityholders)breachedtheircontractsorif Chineseofficialsand/orregulatorswithdrawtheirimplicitacceptanceoftheVIEstructureorifnewlaws,rulesorregulationsrelatingtoVIE structuresareadopted,USinvestors,includingFundsthatinvestdirectlyorindirectlyinVIEs,couldsuffersubstantial,detrimental,andpossibly permanentlosseswithlittleornorecourseavailable.Insuchcases,aFund’snetassetvalueand/orreturnsmaybenegativelyaffected.In addition,totheextentthataFundinvestsdirectlyorindirectlyinVIEs,itonlyhasspecificrightsprovidedforintheagreementscreatingthe VIEstructure,theabilitytoinfluencetheactivitiesoftheChinesecompanyarelimitedandtheChinesecompanymayengageinactivitiesthat negatively impact investment value.VIE structures do not offer the same level of investor protections as direct ownership. Investors may experiencelossesifVIEstructuresarealteredordisputesemergeovercontroloftheVIE. Privatizations.Somegovernmentshavebeenengagedinprogramsofsellingpartoralloftheirinterestsingovernmentownedorcontrolled enterprises(“Privatizations”).EachFundthatmayinvestinfixedincomesecuritiesmayinvestinPrivatizations.Incertaincountries,theability ofaUSentitysuchasaFundtoparticipateinPrivatizationsmaybelimitedbylocallaw,and/orthetermsonwhichaFundmaybepermitted toparticipatemaybelessadvantageousthanthoseaffordedlocalinvestors.Therecanbenoassurancethatgovernmentswillcontinuetosell theirinterestsincompaniescurrentlyownedorcontrolledbythemorthatPrivatizationprogramswillbesuccessful. RussianConflictRisk.Russia’smilitaryinvasionofUkraineinFebruary2022,theresultingresponsesbytheUSandothercountries,andthe potential for wider conflict could increase volatility and uncertainty in global financial markets and adversely affect regional and global economies.The US and other countries have imposed broad-ranging economic sanctions on Russia, certain Russian individuals, banking entitiesandcorporations,andBelarusasaresponsetoRussia’sinvasionofUkraine,andmayimposesanctionsonothercountriesthatprovide militaryoreconomicsupporttoRussia.Thesesanctionsmaycause,amongotherthings,thecontinueddevaluationoftheruble,adowngrade inthecountry'screditrating,and/oradeclineinthevalueandliquidityofRussiansecurities,propertyorinterests.Thesesanctionscouldalso resultintheimmediatefreezeofRussiansecuritiesand/orfundsinvestedinprohibitedassets,andmayimpairtheabilityofaFundtobuy,sell, receiveordeliverthosesecuritiesand/orassets. The extent and duration of Russia’s military actions and the repercussions of such actions (including any retaliatory actions or countermeasures that may be taken by those subject to sanctions, including cyber attacks) are impossible to predict, but could result in significantmarketdisruptions,includingincertainindustriesorsectors,suchastheoilandnaturalgasmarkets,andmaynegativelyaffect globalsupplychains,inflationandglobalgrowth.InadditionthepriceandliquidityoffuturesinwhichaFundinvestsmayfluctuatewidelyas aresultoftheconflictandrelatedevents.Theseandanyrelatedeventscouldadverselyaffectglobalfinancialandenergymarketsandthereby negativelyaffectthevalueofaFund'sinvestmentsbeyondanydirectexposuretoRussianissuersorissuersinothercountriesdirectlyaffected bytheinvasion. ForeignSovereignDebt.EachFundthatmayinvestinfixedincomesecuritiesmayinvestinsovereigndebtsecurities,whichareissuedor guaranteedbyforeigngovernmentalentities.Investmentinsovereigndebtcaninvolveahighdegreeofrisk.Thegovernmentalentitythat controlstherepaymentofsovereigndebtmaynotbeableorwillingtorepaytheprincipaland/orinterestwhendueinaccordancewiththe termsofsuchdebt.Agovernmentalentity’swillingnessorabilitytorepayprincipalandinterestdueinatimelymannermaybeaffectedby, among other factors, its cash flow situation, the extent of its foreign reserves, the availability of sufficient foreign exchange on the date a payment is due, the relative size of the debt service burden to the economy as a whole, the governmental entity’s policy towards the InternationalMonetaryFund,andthepoliticalconstraintstowhichagovernmentalentitymaybesubject.Governmentalentitiesmayalsobe dependentonexpecteddisbursementsfromforeigngovernments,multilateralagenciesandothersabroadtoreduceprincipalandinterest arrearages on their debt.The commitment on the part of these governments, agencies and others to make such disbursements may be conditionedonagovernmentalentity’simplementationofeconomicreformsand/oreconomicperformanceandthetimelyserviceofsuch debtor’sobligations.Failuretoimplementsuchreforms,achievesuchlevelsofeconomicperformanceorrepayprincipalorinterestwhendue StatementofAdditionalInformation—ArtisanPartnersFunds 5 mayresultinthecancellationofsuchthirdparties’commitmentstolendfundstothegovernmentalentity,whichmayfurtherimpairsuch debtor’sabilityorwillingnesstoserviceitsdebtsinatimelymanner.Consequently,governmentalentitiesmaydefaultontheirsovereigndebt. Holdersofsovereigndebtmayberequestedtoparticipateinthereschedulingofsuchdebtandtoextendfurtherloanstogovernmental entities.Thereisnobankruptcyproceedingbywhichsovereigndebtonwhichgovernmentalentitieshavedefaultedmaybecollectedin wholeorinpart. ParticipationCertificates Each Fund, except Artisan Mid Cap Value Fund and Artisan Small Cap Fund, may invest in equity-linked securities (called“participation certificates”inthisSAIbutmaybecalleddifferentnamesbyissuers).Inatypicaltransaction,aFundwouldbuyaparticipationcertificatefrom abankorbroker-dealer(“counterparty”)thatwouldentitlethatFundtoareturnmeasuredbythechangeinvalueofanidentifiedunderlying security.1Thepurchasepriceoftheparticipationcertificateisbasedonthemarketpriceoftheunderlyingsecurityatthetimeofpurchase convertedintoUSdollars,plustransactioncosts.Thecounterpartymay,butisnotrequiredto,purchasethesharesoftheunderlyingsecurity tohedgeitsobligation.WhentheparticipationcertificateexpiresoraFundexercisestheparticipationcertificateandclosesitsposition,that Fund receives a payment that is based upon the then-current value of the underlying security converted into US dollars (less transaction costs). Theprice,performanceandliquidityoftheparticipationcertificatearealllinkeddirectlytotheunderlyingsecurity.AFund’sabilitytoredeem or exercise a participation certificate generally is dependent on the liquidity in the local trading market for the security underlying the participation certificate. Participation certificates are typically privately placed securities that have not been registered for sale under the Securities Act of 1933, as amended (the“1933 Act”). Pursuant to Rule 144A under the 1933 Act, participation certificates are eligible for purchaseorsaletocertainqualifiedinstitutionalbuyersbutarenottypicallytraded. There are additional risks associated with participation certificates. If a Fund invests in a participation certificate, it will bear the full counterpartyriskwithrespecttotheissuingcounterparty.Counterpartyriskinthiscontextistheriskthattheissuingcounterpartywillnot fulfillitscontractualobligationtotimelypayaFundtheamountowedundertheparticipationcertificate.AFundattemptstomitigatethatrisk bypurchasingonlyfromissuerswithinvestmentgradecreditratings.Aparticipationcertificateisageneralunsecuredcontractualobligation oftheissuingcounterparty.AFundtypicallyhasnorightsunderaparticipationcertificateagainsttheissuerofthesecuritiesunderlyingthe participationcertificateandisthereforetypicallyunabletoexerciseanyrightswithrespecttotheissuer(including,withoutlimitation,voting rightsandfraudorbankruptcyclaims).Thereisalsonoassurancethattherewillbeasecondarytradingmarketforaparticipationcertificate orthatthetradingpriceofaparticipationcertificatewillequalthevalueoftheunderlyingsecurity.Participationcertificatesalsomayhavea longersettlementperiodthantheunderlyingsharesandduringthattimeaFund’sassetscouldnotbedeployedelsewhere.Theissuersof participation certificates may be deemed to be broker-dealers or engaged in the business of underwriting as defined in the Investment Company Act of 1940, as amended (the“1940 Act”). As a result, a Fund’s investment in participation certificates issued by a particular institutionmaybelimitedbycertaininvestmentrestrictionscontainedinthe1940Act.Forthepurposesofdeterminingcompliancewitha Fund’slimitationsoninvestingincertainmarkets,regions,securitiesorindustries,eachFundlooksthroughtheparticipationcertificatetothe issueroftheunderlyingsecurity. FixedIncomeSecurities Artisan DevelopingWorld Fund, Artisan Focus Fund, Artisan GlobalValue Fund, Artisan International Small-Mid Fund, Artisan International Value Fund, Artisan Select Equity Fund and Artisan Value Fund may invest in corporate bonds, notes and debentures of long and short maturitiesandofvariouscreditqualities,includingunratedsecurities.ArtisanFloatingRateFundandArtisanHighIncomeFundmayinvestin abroadrangeoffixedincomesecurities,includinghighyieldcorporatebonds,loansandothercorporatefixedincomeinstrumentsofvarying maturities, including fixed-, variable- and floating-rate bonds, debentures, notes, commercial paper and other types of corporate debt instrumentsacrossthecreditqualityspectrum,suchasconvertibledebtsecuritiesandstressedanddistresseddebtsecurities,aswellascredit defaultswapsandotherderivativesrelatedto,referencingorwithsimilareconomiccharacteristicstocorporatefixedincomesecurities.The Fundsnotedabovemayinvestinfixedincomesecuritiesacrossthecreditqualityspectrum,includinghighyieldfixedincomesecurities(i.e., “junk”bonds)(see“JunkBondSecurities”below).Fixedincomesecuritiesincludeabroadarrayofshort-,medium-,andlong-termobligations issuedbytheUSorforeigngovernments,governmentorinternationalagenciesandinstrumentalities,andcorporateandprivateissuersof varioustypes.Thematuritydateisthedateonwhichafixedincomesecuritymatures.Thisisthedateonwhichtheborrowermustpayback theborrowedamount,whichisknownastheprincipal.Somefixedincomesecuritiesrepresentuncollateralizedobligationsoftheirissuers;in othercases,thesecuritiesmaybebackedbyspecificassets(suchasmortgagesorotherreceivables)thathavebeensetasideascollateralfor theissuer’sobligation.Fixedincomesecuritiesgenerallyinvolveanobligationoftheissuertopayinterestordividendsoneitheracurrent basisoratthematurityofthesecurity,aswellastheobligationtorepaytheprincipalamountofthesecurityatmaturity.Therateofinterest onfixedincomesecuritiesmaybefixed,floatingorvariable.Somesecuritiespayahigherinterestratethanthecurrentmarketrate.Aninvestor mayhavetopaymorethanthesecurity’sprincipaltocompensatethesellerforthevalueofthehigherinterestrate.Thisadditionalpayment isapremium. Fixedincomesecuritiesaresubjecttocreditrisk,marketriskandinterestraterisk.Excepttotheextentvaluesareaffectedbyotherfactors, suchasdevelopmentsrelatingtoaspecificissuer,industry,sectororregion,generallythevalueofafixedincomesecuritycanbeexpectedto 1 AFundmayalsoinvestinaparticipationcertificateinwhichabasketofequitysecuritiesservesastheunderlyingreferencesecurityfordeterminingthevalueoftheparticipationcertificate. StatementofAdditionalInformation—ArtisanPartnersFunds 6 risewheninterestratesdeclineand,conversely,fallwheninterestratesrise.Somefixedincomesecuritiesalsoinvolveprepaymentorcallrisk. ThisistheriskthattheissuerwillrepayaFundtheprincipalonthesecuritybeforeitisdue,thusdeprivingtheFundofafavorablestreamof futureinterestordividendpayments.AFundcouldbuyanothersecurity,butthatothersecuritymightpayalowerinterestrate.Inaddition, manyfixedincomesecuritiescontaincallorbuy-backfeaturesthatpermittheirissuerstocallorrepurchasethesecuritiesfromtheirholders. Suchsecuritiesmaypresentrisksbasedonpaymentexpectations.AlthoughaFundwouldtypicallyreceiveapremiumifanissuerwereto redeemasecurity,ifanissuerweretoexerciseacalloptionandredeemthesecurityduringtimesofdeclininginterestrates,theFundmay realizeacapitallossonitsinvestmentifthesecuritywaspurchasedatapremiumandtheFundmaybeforcedtoreplacethecalledsecurity withaloweryieldingsecurity. Changesbynationallyrecognizedsecuritiesratingorganizations(“NRSROs”)intheirratingsofanyfixedincomesecurityortheissuerofafixed incomesecurityandchangesintheactualorperceivedabilityofanissuertomakepaymentsofinterestandprincipalmayalsoaffectthe valueoftheseinvestments.Changesinthevalueofportfoliosecuritiesgenerallywillnotaffectincomederivedfromthesesecurities,butwill affectaFund’sNAV. Because interest rates vary, it is impossible to predict the income, if any, for any particular period for a Fund that invests in fixed income securities.FluctuationsinthevalueofaFund’sinvestmentsinfixedincomesecuritieswillcausetheNAVofeachshareclassoftheFundto fluctuatealso. Durationisanestimateofhowmuchabondfund’ssharepricewillfluctuateinresponsetoachangeininterestrates.Forexample,ifinterest ratesrisebyonepercentagepoint,thesharepriceofaportfolioofdebtsecuritieswithanaveragedurationoffiveyearswouldbeexpected todeclinebyabout5%.Ifratesdecreasebyapercentagepoint,thesharepriceofaportfolioofdebtsecuritieswithanaveragedurationoffive years would be expected to rise by about 5%.The greater the duration of a bond, the greater its percentage price volatility. Only a pure discountbond–thatis,onewithnocouponorsinking-fundpayments–hasadurationequaltotheremainingmaturityofthebond,because onlyinthiscasedoesthepresentvalueofthefinalredemptionpaymentrepresenttheentiretyofthepresentvalueofthebond.Forallother bonds,durationislessthanmaturity. AFundmayinvestinvariable-orfloating-ratesecurities,whichbearinterestatratessubjecttoperiodicadjustmentorprovideforperiodic recoveryofprincipalondemand.ThevalueofaFund’sinvestmentincertainofthesesecuritiesmaydependontheFund’srighttodemand thataspecifiedbank,broker-dealer,orotherfinancialinstitutioneitherpurchasesuchsecuritiesfromtheFundatparormakepaymenton shortnoticetotheFundofunpaidprincipaland/orinterestonthesecurities.Thesesecuritiesaresubjectto,amongothers,interestraterisk andcreditrisk. AFundmayinvestinfixedincomesecuritiesthatareissuedbyspecialpurposeentitiesandthatdirectlyorindirectlyrepresentaninterestin, oraresecuredbyandarepayablefrom,astreamofpaymentsgeneratedfromparticularassets,suchasoperatingcontractsand/orintellectual property.Suchsecuritiesaresubjecttotherisksassociatedwithfixedincomesecuritiesgenerally,andmaybesubjecttoadditionalrisks.The additionalrisksmayinclude,amongothers,risksassociatedwithserviceprovidersmanagingthecollateralheldbythespecialpurposeentity and/oradministeringthesecurity,theextentandnatureofanyinternalorexternalcreditsupport,andsubordinationtoothersecuritiesissued bythespecialpurposeentity. Generally, the Funds use the terms debt security, debt obligation, bond, loan, fixed income security and fixed income instrument interchangeably, and regard them to mean a security or instrument having one or more of the following characteristics: a fixed income security,asecurityorinstrumentissuedatadiscounttoitsfacevalue,asecurityorinstrumentthatpaysinterestatafixed,floatingorvariable rateorasecurityorinstrumentwithastatedprincipalamountthatrequiresrepaymentofsomeorallofthatprincipalamounttotheholder ofthesecurity.Thetermsdebtsecurity,debtobligation,bond,fixedincomesecurityandfixedincomeinstrumentareinterpretedbroadlyby Artisan Partners as an instrument or security evidencing what is commonly referred to as an IOU rather than evidencing the corporate ownershipofequityunlessthatequityrepresentsanindirectorderivativeinterestinoneormoredebtsecurities.Forthispurpose,theterms alsoincludeinstrumentsthatareintendedtoprovideoneormoreofthecharacteristicsofadirectinvestmentinoneormoredebtsecurities. Asnewfixedincomeinstrumentsaredeveloped,aFundmayinvestinthoseopportunitiesaswell. JunkBondSecurities.EachFundthatmayinvestinfixedincomesecuritiesmayinvestinsecuritiesthatarerated,atthetimeofpurchase, belowinvestmentgrade(belowBBB-byStandard&Poor’sFinancialServicesLLC,adivisionofMcGraw-HillFinancial,Inc.,orFitchRatingsInc. orbelowBaa3byMoody’sInvestorsService,Inc.orcomparablyratedbyanotherNRSROorunratedbutaredeterminedbyArtisanPartnersto beofcomparablequality,whichareoftenreferredtoas“junkbonds”).Whileofferingagreaterpotentialopportunityforcapitalappreciation andhigheryieldscomparedtohigher-ratedfixedincomesecurities,junkbondstypicallyentailgreaterpotentialpricevolatilityandmaybe less liquid than higher-rated securities. Junk bonds may be regarded as predominately speculative with respect to the issuer’s continuing abilitytomeetprincipalandinterestpayments.Theymayalsobemoresusceptibletorealorperceivedadverseeconomicandcompetitive industryconditionsthanhigher-ratedsecurities.Issuersofsecuritiesindefaultmayfailtoresumeprincipalorinterestpayments,inwhichcase aFundmayloseitsentireinvestment. ThelowerratingsofcertainsecuritiesheldbyaFundreflectagreaterpossibilitythatadversechangesinthefinancialconditionoftheissuer, oringeneraleconomicconditions,orboth,oranunanticipatedriseininterestrates,mayimpairtheabilityoftheissuertomakepaymentsof interestandprincipal.Theinability(orperceivedinability)ofissuerstomaketimelypaymentofinterestandprincipalwouldlikelymakethe valuesofsecuritiesheldbyaFundmorevolatileandcouldlimitaFund’sabilitytosellitssecuritiesatpricesapproximatingthevaluestheFund StatementofAdditionalInformation—ArtisanPartnersFunds 7 hadplacedonsuchsecurities.Intheabsenceofaliquidtradingmarketforsecuritiesheldbyit,theFundmaybeunableattimestoestablish thefairmarketvalueofsuchsecurities.Theratingassignedtoasecuritydoesnotreflectanassessmentofthevolatilityofthesecurity’smarket valueoroftheliquidityofaninvestmentinthesecurity. Like those of other fixed income securities, the values of lower-rated securities fluctuate in response to changes in interest rates.Thus, a decreaseininterestratesgenerallywillresultinanincreaseinthevalueofaFund’sfixedincomesecurities.Conversely,duringperiodsofrising interestrates,thevalueofaFund’sfixedincomesecuritiesgenerallywilldecline.Inaddition,thevaluesofsuchsecuritiesarealsoaffectedby changes in general economic conditions and business conditions affecting the specific industries of their issuers. Changes by recognized ratingservicesintheirratingsofanyfixedincomesecurityandintheabilityofanissuertomakepaymentsofinterestandprincipalmayalso affectthevalueoftheseinvestments.Changesinthevaluesofportfoliosecuritiesgenerallywillnotaffectcashincomederivedfromsuch securities,butwillaffectaFund’sNAV. Issuersoflower-ratedsecuritiesareoftenhighlyleveraged,sothattheirabilitytoservicetheirdebtobligationsduringaneconomicdownturn or during sustained periods of rising interest rates may be impaired. In addition, such issuers may not have more traditional methods of financingavailabletothemandmaybeunabletorepaydebtatmaturitybyrefinancing.Theriskoflossduetodefaultinpaymentofinterest orprincipalbysuchissuersissignificantlygreaterbecausesuchsecuritiesfrequentlyareunsecuredandsubordinatedtothepriorpaymentof senior indebtedness. Certain of the lower-rated securities in which a Fund may invest are issued to raise funds in connection with the acquisitionofacompany,inso-calledleveragedbuy-outtransactions.Thehighlyleveragedcapitalstructureofsuchissuersmaymakethem especiallyvulnerabletoadversechangesineconomicconditions. Underadversemarketoreconomicconditionsorintheeventofadversechangesinthefinancialconditionoftheissuer,aFundcouldfindit moredifficulttoselllower-ratedsecuritieswhenArtisanPartnersbelievesitadvisabletodosoormaybeabletosellsuchsecuritiesonlyat prices lower than might otherwise be available. In many cases, lower-rated securities may be purchased in private placements and, accordingly,willbesubjecttorestrictionsonresaleasamatterofcontractorundersecuritieslaws.Undersuchcircumstances,itmayalsobe moredifficulttodeterminethefairvalueofsuchsecuritiesforpurposesofcomputingaFund’sNAV.Inordertoenforceitsrightsintheevent ofadefaultunderlower-ratedsecurities,aFundmayberequiredtotakepossessionofandmanageassetssecuringtheissuer’sobligationson suchsecurities,whichmayincreasetheFund’soperatingexpensesandadverselyaffecttheFund’sNAV.AFundmayalsobelimitedinitsability toenforceitsrightsandmayincurgreatercostsinenforcingitsrightsintheeventanissuerbecomesthesubjectofbankruptcyproceedings. In addition, a Fund’s intention to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”)maylimittheextenttowhichtheFundmayexerciseitsrightsbytakingpossessionofsuchassets. CertainsecuritiesheldbyaFundmaypermittheissueratitsoptiontocall,orredeem,itssecurities.Ifanissuerweretoredeemsecuritiesheld bytheFundduringatimeofdeclininginterestrates,theFundmaynotbeabletoreinvesttheproceedsinsecuritiesprovidingthesame investmentreturnasthesecuritiesredeemed. Lower-rated securities may be subject to certain risks not typically associated with investment grade securities, such as the following: (1) reliable and objective information about the value of lower rated obligations may be difficult to obtain because the market for such securitiesmaybethinnerandlessactivethanthatforinvestmentgradeobligations;(2)adversepublicityandinvestorperceptions,whether or not based on fundamental analysis, may decrease the values and liquidity of lower than investment grade obligations, and, in turn, adverselyaffecttheirmarket;(3)companiesthatissuelowerratedobligationsmaybeinthegrowthstageoftheirdevelopment,ormaybe financially troubled or highly leveraged, so they may not have more traditional methods of financing available to them; (4) when other institutionalinvestorsdisposeoftheirholdingsoflowerrateddebtsecurities,thegeneralmarketandthepricesforsuchsecuritiescouldbe adverselyaffected;and(5)themarketforlowerratedsecuritiescouldbeimpairediflegislativeproposalstolimittheiruseinconnectionwith corporatereorganizationsortolimittheirtaxandotheradvantagesareenacted. UnratedSecurities.AFundmaypurchaseunratedsecurities(whicharenotratedbyaratingagency)ifArtisanPartnersdeterminesthatthe securitiesareofcomparablequalitytoratedsecuritiesthattheFundmaypurchase.Unratedsecuritiesmaybelessliquidthancomparable ratedsecuritiesandinvolvetheriskthatArtisanPartnersmaynotaccuratelyevaluatethesecurity’scomparativecreditworthiness.Analysisof creditworthinessofissuersofhighyieldsecuritiesmaybemorecomplexthanforissuersofhigher-qualityfixedincomesecurities. FloatingandVariableRateInvestments.ThecouponsonvariableandfloatingrateinvestmentsinwhichaFundmayinvestarenotfixedand mayfluctuatebaseduponchangesinmarketrates.Thecoupononafloatingrateinvestmentisgenerallybasedonaninterestratesuchasa money-marketindex,SecuredOvernightFundingRate(“SOFR”),LondonInterbankOfferedRate(“LIBOR”)oraTreasurybillrate.Variableand floatingrateinvestmentsaresubjecttointerestrateriskandmayfluctuateinvalueinresponsetointerestratechangesifthereisadelay between changes in market interest rates and the interest reset date for the obligation, or for other reasons. US Government and related obligations and other types of debt instruments may be structured as floating- and variable-rate obligations. As short-term interest rates decline,thecouponsonvariableandfloatingrateinvestmentstypicallyshoulddecrease.Alternatively,duringperiodsofrisinginterestrates, changesinthecouponsofvariableandfloatingrateinvestmentsmaylagbehindchangesinmarketratesormayhavelimitsonthemaximum increasesinthecouponrates.Thevalueofvariableandfloatingrateinvestmentsmaydeclineiftheircouponsdonotriseasmuch,oras quickly, as interest rates in general. Conversely, variable and floating rate investments will not generally increase in value if interest rates decline.Variableandfloatingrateinvestmentsarelesseffectivethanfixedrateinvestmentsatlookinginaparticularyieldandmaybesubject tocreditrisk.Certaintypesoffloatingrateinstrumentsmayalsobesubjecttogreaterliquidityriskthanotherdebtinvestments. StatementofAdditionalInformation—ArtisanPartnersFunds 8 Certainfloatingandvariablerateobligationshaveaninterestratefloorfeature,whichpreventstheinterestratepayablebythesecurityfrom droppingbelowaspecifiedlevelascomparedtoareferenceinterestrate(the“referencerate”),suchasLIBOR.SuchafloorprotectstheFund fromlossesresultingfromadecreaseinthereferenceratebelowthespecifiedlevel.However,ifthereferencerateisbelowthefloor,therewill bealagbetweenariseinthereferencerateandariseintheinterestratepayablebytheobligation,andtheFundmaynotbenefitfrom increasinginterestratesforasignificantamountoftime. In 2017, the United Kingdom’s Financial Conduct Authority warned that LIBOR may cease to be available, or appropriate for use, by 2021. However,onNovember30,2020,LIBOR’sadministrator,theICEBenchmarkAdministration,signaledthatLIBORmaycontinuetobepublished andavailableforuseuntilJune30,2023.TheunavailabilityorreplacementofLIBORmayaffectthevalue,liquidityorreturnoncertainFund investmentsandmayresultincostsincurredinconnectionwithclosingoutpositionsandenteringintonewtrades.Regulatorsandmarket participants are working together to identify or develop a replacement rate. For instance, the US Federal Reserve, based on the recommendations of the New York Federal Reserve’s Alternative Reference Rate Committee (comprised of major derivative market participantsandtheirregulators),hasbegunpublishingSOFRthatisintendedtoreplaceUSdollarLIBOR.Anypricingadjustmentstothe Fund’s investments resulting from a substitute reference rate including but not limited to SOFR, may also adversely affect the Fund’s performanceand/orNAV.ThereremainsuncertaintyregardingthefutureutilizationofLIBORandthenatureofanyreplacementrate.Assuch, thepotentialeffectofatransitionawayfromLIBORonaFundorthefinancialinstrumentsinwhichaFundinvestscannotyetbedetermined andmayvarydependingonfactorsthatinclude,butarenotlimitedto,existingfallbackorterminationprovisionsinindividualcontracts. Loans,AssignmentsandParticipations.ArtisanFloatingRateFundandArtisanHighIncomeFundmayinvestdirectlyinsecuredorunsecured loansorinvestinloanassignmentsorparticipationswithrespecttoborrowersoperatinginanyindustryand/orgeographicalregion.The Funds may acquire some or all of the interest of a bank or other lending institution in a loan to a particular borrower, by means of an assignmentoraparticipation.Inanassignment,theFundsassumesalloftherightsofalendinginstitutioninaloan,includingtherightto receivepaymentsofprincipalandinterestandotheramountsdirectlyfromtheborrowerandtoenforceitsrightsasalenderdirectlyagainst theborrower.TheFundsassumesthepositionofaco-lenderwithothersyndicatemembers.Asanalternative,theFundsmaypurchasea participatinginterestinaportionoftherightsofalendinginstitutioninaloan.Insuchcase,theFundswillgenerallybeentitledtoreceive fromthelendinginstitutionamountsequaltothepaymentsofprincipal,interestandpremium,ifany,ontheloanreceivedbytheinstitution, butwillnotgenerallybeentitledtoenforceitsrightsdirectlyagainsttheagentbankortheborrower,andmustrelyforthatpurposeonthe lendinginstitution.Inthecaseofaparticipation,thevalueoftheFund’sloaninvestmentwilldependatleastinpartonthecreditstandingof theparticipatinginstitution. TheloansinwhichtheFundsmayinvestincludethosethatpayfixedratesofinterestandthosethatpayfloatingrates–i.e.,ratesthatadjust periodicallybasedonaknownlendingrate,suchasabank’sprimerate.Investmentsinloansmaybeofanyquality,including“distressed” loans.The Funds also may gain exposure to loans and related investments through the use of total return swaps and/or other derivative instruments and through private funds and other pooled investment vehicles, including some which may be sponsored or advised by ArtisanPartners. Manyloansaremadebyasyndicateofbanks,representedbyanagentbank(the“Agent”)whichhasnegotiatedandstructuredtheloanand whichisresponsiblegenerallyforcollectinginterest,principalandotheramountsfromtheborroweronitsownbehalfandonbehalfofthe otherlendinginstitutionsinthesyndicate(the“Lenders”),andforenforcingitsandtheirotherrightsagainsttheborrower.Eachofthelending institutions,whichmayincludetheAgent,lendstotheborroweraportionofthetotalamountoftheloan,andretainsthecorresponding interestintheloan.Unless,underthetermsoftheloanorotherindebtedness,eachFundhasdirectrecourseagainsttheborrower,theFund mayhavetorelyontheAgentorotherfinancialintermediarytoapplyappropriatecreditremediesagainstaborrower. The Fund’s ability to receive payments of principal and interest and other amounts in connection with loan participations held by it will dependprimarilyonthefinancialconditionoftheborrower(and,insomecases,thelendinginstitutionfromwhichitpurchasestheloan).The valueofcollateral,ifany,securingaloancandecline,ormaybeinsufficienttomeettheborrower’sobligationsormaybedifficulttoliquidate. In addition, each Fund’s access to collateral may be limited by bankruptcy or other insolvency laws. The failure by the Funds to receive scheduledinterestorprincipalpaymentsonaloanwouldadverselyaffecttheincome,gainsandproceedsoftheFundsandwouldlikely reducethevalueofitsassets,whichwouldbereflectedinareductionineachFund’sNAV.LoansthatarefullysecuredoffertheFundsmore protectionthananunsecuredloanintheeventofnon-paymentofscheduledinterestorprincipal.However,thereisnoassurancethatthe liquidation of collateral from a secured loan would satisfy the corporate borrower’s obligation, or that the collateral can be liquidated. Indebtedness of companies whose creditworthiness is poor involves substantially greater risks and may be highly speculative. Some companiesmayneverpayofftheirindebtedness,ormaypayonlyasmallfractionoftheamountowed.Consequently,wheninvestingin indebtednessofcompanieswithpoorcredit,eachFundbearsasubstantialriskoflosingtheentireamountinvested. Unsecuredloansareloansthatarenotcollateralized.Theclaimsofholdersofunsecuredloansmaybesubordinated,andthuslowerinpriority, toclaimsofcreditorsholdingsecuredindebtednessandpossiblyotherclassesofcreditorsholdingunsecureddebt.Sincetheywillnotafford theFundsrecoursetocollateral,unsecuredloansaresubjecttogreaterriskofnonpaymentintheeventofdefaultthansecuredloans. Banksandotherlendinginstitutionsgenerallyperformacreditanalysisoftheborrowerbeforeoriginatingaloanorparticipatinginalending syndicate.InselectingtheloansinwhichtheFundswillinvest,however,ArtisanPartnerswillnotrelysolelyonthatcreditanalysis,butwill performitsowninvestmentanalysisoftheborrowers.ArtisanPartners’analysismayincludeconsiderationoftheborrower’sfinancialstrength StatementofAdditionalInformation—ArtisanPartnersFunds 9

Description: